What is the Anthocyanin Food Colors Market Size?

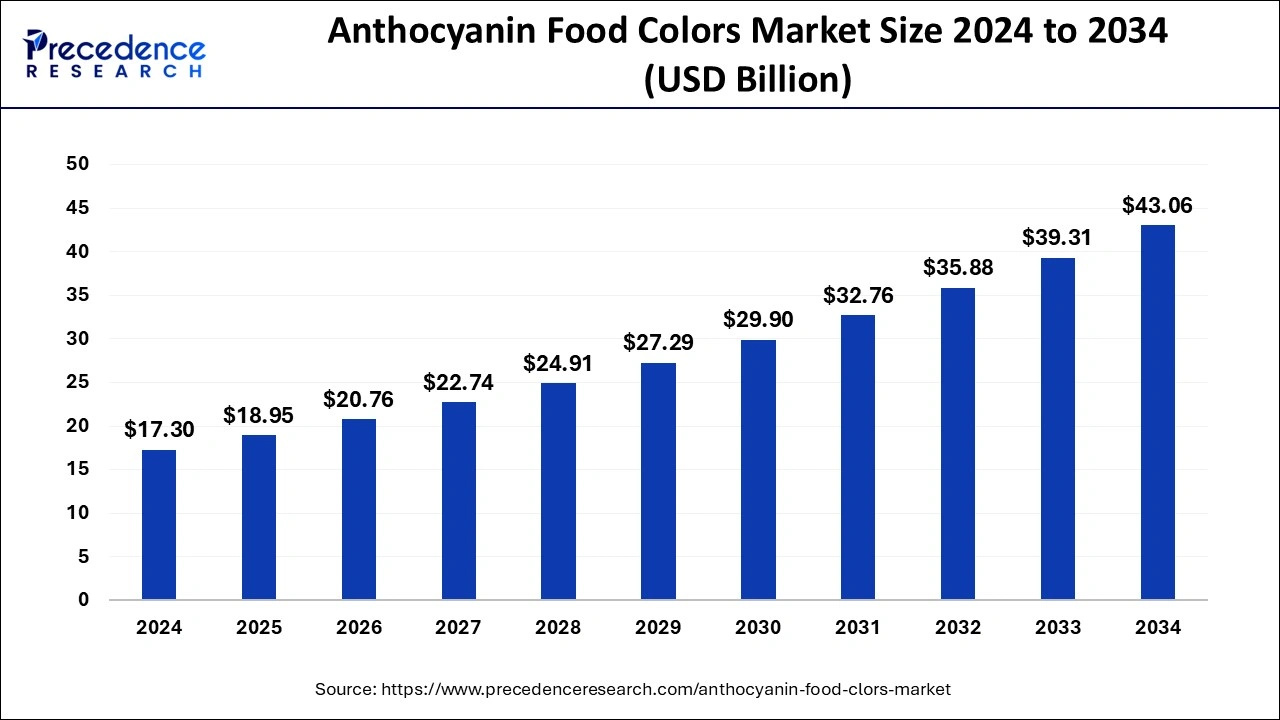

The global anthocyanin food colors market size is valued at USD 18.95 billion in 2025 and is predicted to increase from USD 20.76 billion in 2026 to approximately USD 43.06 billion by 2034, expanding at a CAGR of 9.55% from 2025 to 2034. The anthocyanin food colors market is on the rise because of the rising trends of natural and clean label colors, increasing attention toward healthy plant-based products, and the growing uses of anthocyanins in different food processing applications also significantly contribute to market expansion.

Anthocyanin Food Colors Market Key Takeaways

- North America accounted for the largest market share of the anthocyanin food colors market in 2024.

- Asia Pacific is anticipated to witness the fastest growth during the forecasted years.

- By type, the powder segment led the global market in 2024.

- By type, the liquid segment is projected to witness the fastest growth in the market during the forecast period.

- By source, the grapes segment noted the largest share of the market in 2024.

- By application, the beverage segment dominated the global market in 2024.

- By distribution channel, the supermarket segment contributed the largest share of the market in 2024.

Market Overview

Anthocyanin food colors are flavonoid pigments present in fruit, vegetables, and flowers, contributing red, blue, and or purple colors. The common sources are berries, red cabbage, grapes, hibiscus, black rice, and other plants. They are not only responsible for their color but also provide health benefits that anthocyanins are antioxidants. Opportunities for growing the anthocyanin food colors market due to the expanding food and beverage sector, developing new extraction and purification technologies, and exploring novel applications in cosmetics and pharmaceuticals.

The anthocyanin food colors market is growing due to rising customer awareness of the health benefits of antioxidants, increasing demand for natural colorants in the food and beverages industry, and a shift towards plant-based products. Major factors that fuel the growth of anthocyanin food color are the demand for natural and clean label colors, awareness of health benefits associated with anthocyanins, and trends towards plant-based foods and beverages.

Artificial Intelligence (AI) Integration in the Anthocyanin Food Colors Market

Artificial intelligence integration is promoting innovations and efficiency in the manufacture of anthocyanin food colors market and several other segments. The technologies available enhance the extraction process, reduce cost, and enhance sustainability. AI is also in the process of assisting with product formulation through the evaluation of the consumers' preferences and tendencies, thereby allowing food producers to create foods with anthocyanin-based colors. Further, AI helps to maintain quality since it maintains the intensity and safety of the products.

Market Outlook

- Industry Growth Overview: The anthocyanin food colors market is expected to grow at a rapid pace between 2025 and 2034. This growth is driven by rising consumer demand for clean-label natural colors, stricter regulations, and technological advances improving stability. The growing application of anthocyanins in beverages, confectionery, and bakery products is fueling innovation and supplier consolidation in the food-color industry, while cost and formulation challenges continue to drive sustainability efforts.

- Global Expansion: There is significant potential for market expansion around the world, driven by growing demand for clean-label ingredients, along with the expansion of the food & beverage sector. The rising demand for ready-to-eat bakery products, driven by urbanization in emerging regions, is propelling the market.

- Major investors:Major investors in the market include large specialty-ingredient firms such as Chr. Hansen Holding A/S, Sensient Technologies Corporation, GNT Group B.V., The Archer Daniels Midland Company, and Naturex S.A. (now part of Givaudan S.A.), each backing R&D, sustainable sourcing, and clean-label formulations in this rapidly expanding segment.

- Startup Ecosystem:The startup landscape in the market is characterized by innovative biotech companies leveraging precision fermentation and microbial engineering to create vibrant, clean-label pigments. Companies like Phytolon and Michroma are collaborating with larger platforms and raising funds to expand sustainable color solutions.

Anthocyanin Food Colors Market Growth

- Versatility in applications: Anthocyanins find application in all suitable food items, which include beverages, snacks, confectionery, dairy products, sauces, and several others, thus making anthocyanins versatile and acceptable to different markets.

- Sustainability focus: With increasing emphasis on sustainability, naturally occurring anthocyanin pigments fit the expanding class of environmentally friendly and sustainable foods.

- Health and wellness trends: The changing consumer trends in natural, plant, and clean labels have put pressure on manufacturers to promote anthocyanins. Since they are natural based they provide certain health benefits like antioxidants and anti-inflammatory compounds that are healthier than synthetic colors.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 18.95 Billion |

| Market Size in 2026 | USD 20.76 Billion |

| Market Size in 2034 | USD 43.06 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.55% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Source, Application, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising health awareness

The anthocyanin food colors market is on the rise due to the increasing consumer taste for natural product dyes. This trend is reinforced by regulatory demands and clean label trends, which are associated with clear and simple food labeling and declaration of its ingredients. The awareness among consumers is gradually increasing and is leading to the change towards healthier and more natural foods. The antioxidants have been shown to decrease risks of heart diseases, different cancers, and neurological disorders. The demand for anthocyanin food colors has increased customer concern with cleaner and natural food labels.

- In September 2024, a study published in the Journal of Anti-Inflammatory and Anticancer Effects of Anthocyanins in In Vitro and In Vivo Studies indicates that consuming foods rich in anthocyanins can support cognitive function, improve memory, and also have a supportive effect on some neurodegenerative diseases, which is particularly important in the context of an aging society.

Restraint

Cost constraints

A major limitation in the anthocyanin food colors market is the high production cost related to extracting natural anthocyanins, which influences the pricing strategy and market competitiveness. Further, there is a limited supply of raw materials since anthocyanins are mainly sourced from specific fruits and vegetables, which restricts the supply chain. Stability is another drawback of anthocyanin pigments since they are sensitive to pH level and temperature fluctuations, and light exposure can frequently influence their usage in different types of food products.

Opportunity

Newer methods and technologies

Newer extraction techniques have made the process far easier and highly possible to utilize anthocyanins as a natural food color. The recent advancements in extraction methods provide efficient extraction with minimum time and with less harsh solvents. Furthermore, high-pressure processing (HPP) is a newly developed technique for the extraction of anthocyanin from plant materials by pressure, which is a non-toxic method with higher efficiency. These innovations enhance the profitability of the anthocyanin food colors market and increase the preservation of the active compounds and color of pigments, thus expanding the application of extracts in various foods.

Type Insights

The powder segment led the global anthocyanin food colors market in 2024. Powder anthocyanin food colors are the most popular type of anthocyanin food colors used in the food and beverage industry. The color comes from drying an anthocyanin-containing fruit or vegetable. Powder anthocyanin is user-friendly; it can be blended into many kinds of food, especially in drinks. It is easy to store and measure and can be incorporated into different food products; hence, it will be useful in both commercial and domestic sectors. Powdered food colors have a longer shelf life than liquid or gel forms, providing better stability and reducing the risk of spoilage.

The liquid segment is projected to witness the fastest growth in the anthocyanin food colors market during the forecast period. Anthocyanins are flavonoids, which are water-soluble pigments that fall under phenolic compounds. Anthocyanins that generate color, shades of red, purple, and blue, are present in fruits and vegetables. The liquid form of anthocyanin food colors is on the rise, specifically due to their convenience. Its advantage is that working with liquid material enables it to achieve varying intensities of color and make it darker or lighter easily. Furthermore, the liquid form of anthocyanin is soluble in food media, and it is evenly distributed in the food matrix. This makes it suitable for any type of food that should have a longer shelf life, and some of the products include biscuits and sauces.

Source Insights

The grapes segment noted the largest share of the anthocyanin food colors market in 2024. Anthocyanins are a class of water-soluble pigments and phenolic compounds that are incorporated within the group of flavonoids. They are produced in grape berries during ripening and in the leaves at the final stage of plant development. Anthocyanins are the main natural pigments in grapes and wines and are used as a food additive, i.e., a colorant. Anthocyanidins are water-soluble pigments occurring as red, purple, or blue pigments that are common in grapes and other fruits and veggies. Grape skin extract is one of the most prevalent sources of anthocyanins, and its content varies depending on the grape's ripeness. It is produced by distillation of grape marc, which is the solid residue after grapes have been crushed and the juice extracted.

Application Insights

The beverage segment dominated the global anthocyanin food colors market in 2024. The demand for anthocyanin food colors arises from its health effects, such as the antioxidant effect on foods, apart from making them colorful. Used in beverages, confectionery, dairy products, and baked products, which are favored by consumers to cherish their health. They are anthocyanidins, which are water-soluble pigments occurring naturally and responsible for the red, blue, and purple colors of fruits, vegetables, and flowers. Anthocyanins have applications in many food products and drinks, such as soft drinks, jams, jellies, confectioneries, bakery and dairy products, and powders. They are also applied in confectionery, desserts, ice cream, fructifications, sherbet, ices, pops, yogurts, gelatine products, and candies.

Distribution Channel Insights

The supermarkets segment contributed the largest share of the anthocyanin food colors market in 2024. The demand for anthocyanin food color is increasing, especially because consumers are shifting their preferences to natural food dyes. Food coloring from fruits and vegetables such as berries and grapes- anthocyanin is rich in bright shades and has benefits such as containing antioxidants and anti-inflammatory effects. Supermarkets are the sources of products that contain anthocyanin-sourced color to tap the emerging clean-label business. These colors are applied in many types of foods, such as drinks, sweet foods, and processed foods as snacks. It may be predicted that as the concern among consumers and approval by the regulatory authorities, the market for anthocyanin food colors will rise.

Regional Insights

What Made North America the Dominant Region in the Market?

North America accounted for the largest share of the anthocyanin food colors market in 2024. The growth of packaged and processed products within the region has been a key driver of the market. Added food colors are very common in processed foods because most of them lose color during processing or may not have the attractive color needed. Hence, there is a continued demand for food colors to enhance the attractiveness of processed foods, as consumers look for long convenience and a variety of foods to eat.

The U.S. has developed a food processing sector that leads the region. The need for clean-label products and natural ingredients increases the market's demand. Additional market factors include regulatory support for natural colorants that improve their market outlook. In addition, sophisticated extraction technologies are available in combination with constant R&D in the United States.

What Makes Asia Pacific the Fastest-Growing Region?

Asia Pacific is anticipated to witness the fastest growth in the anthocyanin food colors market during the forecasted years. Furthermore, the use of the product in the production of alcoholic and non-alcoholic spirits is likely to be responsible for market growth. There is an increasing trend in India to look for natural and organic products which has brought a revolution in the processing food industry. This trend is particularly well evident in the food and beverage sectors since anthocyanins are finding their application as natural dyes.

How Big is the Success of Europe in the Anthocyanin Food Colors Market?

The market in Europe is growing at a notable rate, driven by a significant shift towards clean-label products, strict regulatory frameworks from organizations like the European Food Safety Authority, and a well-established food and beverage industry in countries such as Germany, France, and the UK, which are increasingly adopting plant-based and traceable ingredients. The UK leads the market in Europe, thanks to its large, innovation‑driven food & beverage sector. There is a high demand for clean‑label ingredients among health‑conscious consumers. Strict regulatory enforcement by authorities such as the Food Standards Agency is boosting the demand for natural ingredients over synthetic additives.

How Crucial is the Role of Latin America in the Market?

Latin America offers significant opportunities in the anthocyanin food colors market, driven by abundant regional crops like berries and colored corn, growing consumer demand for natural, clean-label ingredients, and expanding food and beverage processing in countries such as Brazil and Mexico. Additionally, government support for value-added agriculture is enhancing local pigment extraction, further fueling market growth. Brazil dominates the Latin American market due to rising consumer demand for natural, clean-label ingredients, along with government support for agricultural innovation.

What Potentiates the Growth of the Middle East and Africa Anthocyanin Food Colors Market?

The market in the Middle East and Africa (MEA) region is fueled by rising disposable incomes, expanding processed foods and beverages industries, growing health and wellness awareness, and increasing regulatory support for clean-label natural colorants in key countries like the UAE and South Africa. The UAE leads the market due to rising demand for natural, clean-label ingredients amid increasing consumer awareness of health and wellness. Additionally, the UAE's growing food and beverage sector, bolstered by a shift toward plant-based and innovative food products and regulatory support for natural food colors, positions the market for significant expansion in the coming years.

Value Chain Analysis

- Raw Material Procurement

Suppliers source pigment-rich plants, berries, grapes, and red cabbage from farms and cooperatives. The raw materials are inspected for quality, tested for pigment content, and transported to extraction facilities under controlled conditions.

Key Players: Local farms and cooperatives (e.g., European berry and grape growers), raw material suppliers like GNT Group and Chr. Hansen, and contract farming. - Processing and Preservation

Anthocyanins are extracted using water, ethanol, or other safe solvents, then filtered, concentrated, and purified to ensure consistent quality. Stabilization is done via microencapsulation or natural additives to enhance shelf life and maintain vibrant color.

Key Players: Color manufacturers and ingredient companies such as Sensient Technologies, Naturex/Givaudan, and startups like Phytolon and Michroma; R&D labs optimizing extraction and stabilization methods - Retail Sales and Marketing

Finished pigments are packaged in bulk or retail-ready formats for use in food, beverages, bakery, and confectionery. Marketing emphasizes clean-label, natural, and sustainable attributes while distribution occurs through wholesalers, food manufacturers, and retail channels.

Key Players: Ingredient distributors and wholesalers (e.g., ADM, Kerry Group), food & beverage manufacturers that incorporate natural colors, and retail chains or e-commerce platforms that promote clean-label products. - Waste Management and Recycling

Extraction residues and plant waste are collected and processed through composting, anaerobic digestion, or conversion into animal feed or bioenergy. Solvents and water used in processing are recycled to minimize environmental impact.

Key Players: Bio-waste recycling and composting companies and environmental services firms that handle industrial effluents.

Anthocyanin Food Colors Market Companies

- Prinova: Prinova contributes to the anthocyanin food colors market by supplying natural color solutions derived from fruit and vegetable sources, catering to the demand for clean-label, plant-based ingredients.

- DDW The Colour House: DDW offers a wide range of anthocyanin-based colorants for the food and beverage industry, focusing on natural and sustainable color solutions.

- Archroma:Archroma provides innovative natural anthocyanin colorants, helping manufacturers meet the growing demand for clean-label, natural food ingredients.

- Lycored Limited: Lycored specializes in extracting natural anthocyanins from tomatoes and other fruits, offering plant-based color solutions for the food and beverage industries.

- Nanjing Nuode Import and Export Co., Ltd.:Nanjing Nuode supplies anthocyanin extracts from natural sources like blackberries and purple sweet potatoes, contributing to the clean-label food color market.

- GNT Group: GNT Group is a leader in the production of natural colors, including anthocyanins, from plant-based sources, helping food manufacturers meet consumer demand for transparent, natural ingredients.

- Jiangsu Ingredient Co., Ltd.: Jiangsu Ingredient produces high-quality anthocyanin-based colorants sourced from fruits and plants, catering to the increasing demand for natural food coloring.

- FMC Corporation:FMC Corporation offers anthocyanin-derived color solutions as part of its broader portfolio of natural ingredients for food, beverage, and nutraceutical applications.

- Hansen Holding A/S:Hansen provides natural colorants, including anthocyanins, that are used in a variety of food and beverage applications to meet the rising consumer demand for clean-label products.

- Kalsec Inc.: Kalsec develops anthocyanin-based natural colors for use in food and beverage products, supporting the market's shift toward healthier, clean-label ingredients.

- Anhui Greenlife Biotech Co., Ltd.: Anhui Greenlife specializes in the production of natural anthocyanin colorants from various plant sources, supplying the growing demand for natural food coloring solutions.

- Naturex: Naturex, now part of Givaudan, offers a range of natural colorants, including anthocyanins, helping food and beverage manufacturers adopt more natural, sustainable ingredients.

- Huzhou Qiaobang Biological Extract Co., Ltd.: Huzhou Qiaobang supplies anthocyanin extracts derived from various fruits and vegetables, meeting the growing consumer demand for natural, clean-label food colors.

- Sensient Technologies Corporation:Sensient Technologies manufactures a wide variety of natural anthocyanin-based colorants, offering innovative solutions for the food, beverage, and cosmetic industries.

- Nature's Flavours: Nature's Flavours provides organic and natural anthocyanin-based colorants to the food and beverage industry, addressing the demand for cleaner, plant-based color solutions.

Key Player Announcement

- In February 2024, a purple tomato that was genetically engineered by scientists in Norfolk almost two decades ago became a favorite for home growers after it hit the market in the U.S. Seeds of the high-anthocyanin purple tomato are in strong demand. Nathan Pumplin, CEO of Norfolk Healthy Produce, said that his company was pleased to provide such seeds to home gardeners. Tomato is just a tomato � you can grow it in the garden next to Sun Golds Purple Cherokees and other chosen varieties.

Recent Development

- In January 2025, ADM launched a new anthocyanin-rich ingredient for functional foods, highlighting antioxidant benefits and clean-label appeal, catering to rising health-conscious consumer demand.

(Source: nutraceuticalbusinessreview.com) - In February 2025, the FDA approved three natural color additives, including a butterfly pea flower-derived blue, enabling broader anthocyanin applications in beverages, bakery, and confectionery. Sensient Technologies expanded European production in Q2 2025 to meet increasing regional demand, reflecting the market's growth potential.

(Source: fda.gov) - In July 2024, Givaudan Sense Colour announced the launch of the new Amaize orange-red at IFT 2024. This development to the present Amaize line of corn-based anthocyanin colors has a bright orange-red shade that offers a close match to Red 40 in acidic applications. It is available in powder and liquid forms and is appropriate for low-pH applications, including beverages, confections, fruit preps, ice lollies, sorbets, and snack seasonings.

Segments Covered in the Report

By Type

- Powder

- Extract

- Liquid

By Source

- Grapes

- Berries

- Red Cabbage

- Pomegranates

- Black Carrots

By Application

- Beverages

- Confectionery

- Dairy Products

- Meat Products

- Bakery Products

By Distribution Channel

- Direct-to-Consumer

- Online Retailers

- Supermarkets

- Food Processors

- Pharmacies

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content