What is the Pharmaceutical Market Size?

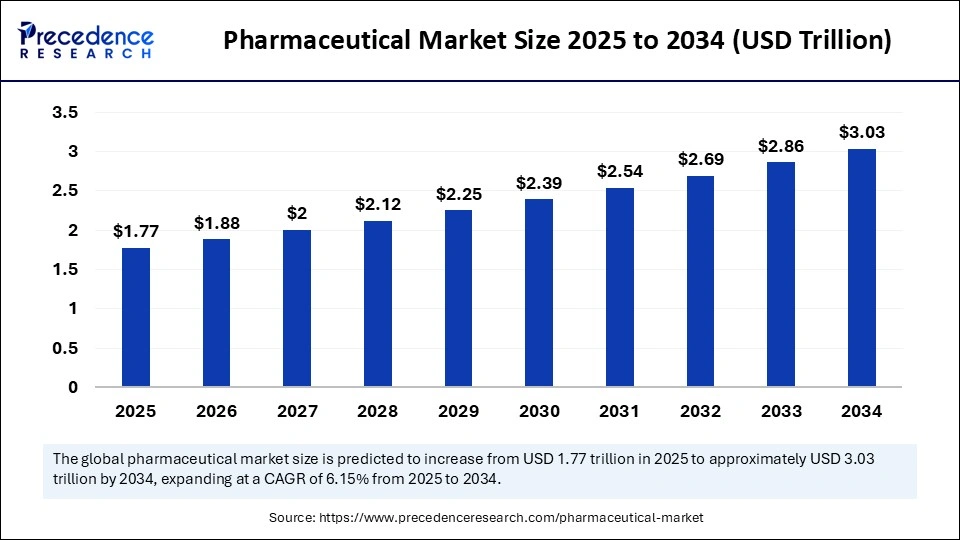

The global pharmaceutical market size is calculated at USD 1.77 trillion in 2025 and is predicted to exceed USD 3.03 trillion by 2034, with a CAGR of 6.15% from 2025 to 2034. The rising demand for vaccines, drugs, and personalized medicines is expected to boost the growth of the pharmaceutical market. The growing prevalence of chronic disease is fostering the demand for innovative drugs, contributing to market growth.

Market Highlights

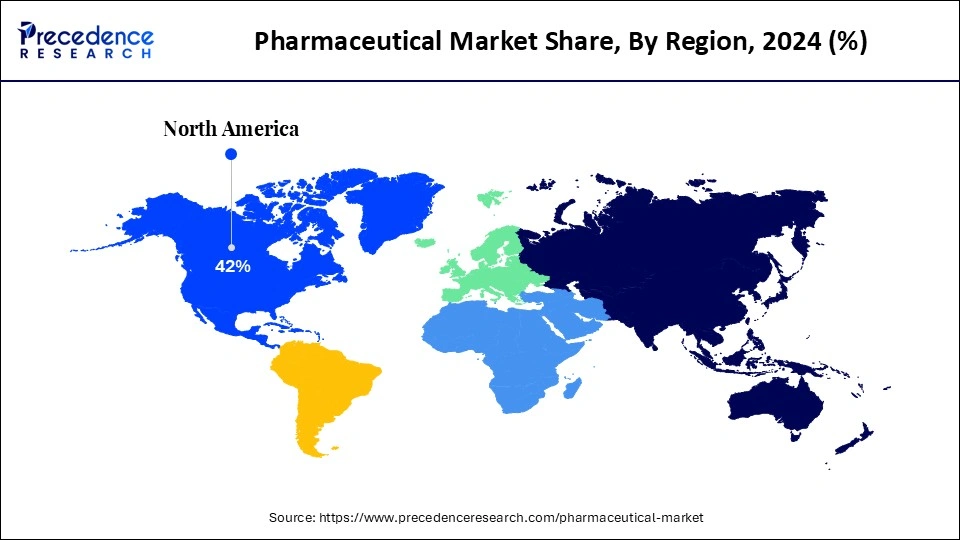

- North America dominated the global market with the largest revenue share of 42% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

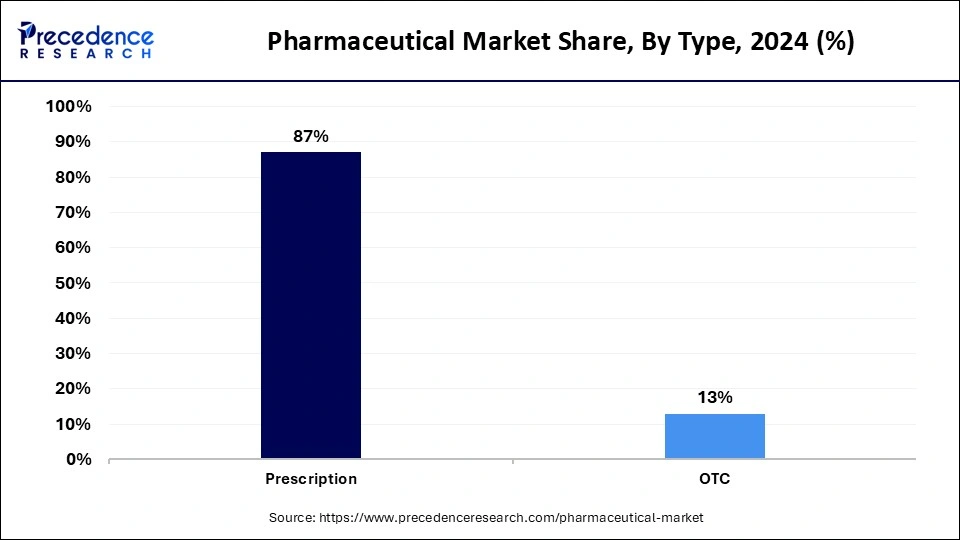

- By type, the prescription segment held the major market share of 87% in 2024.

- By type, the over-the-counter (OTC) segment is expected to grow at the fastest CAGR in the coming years.

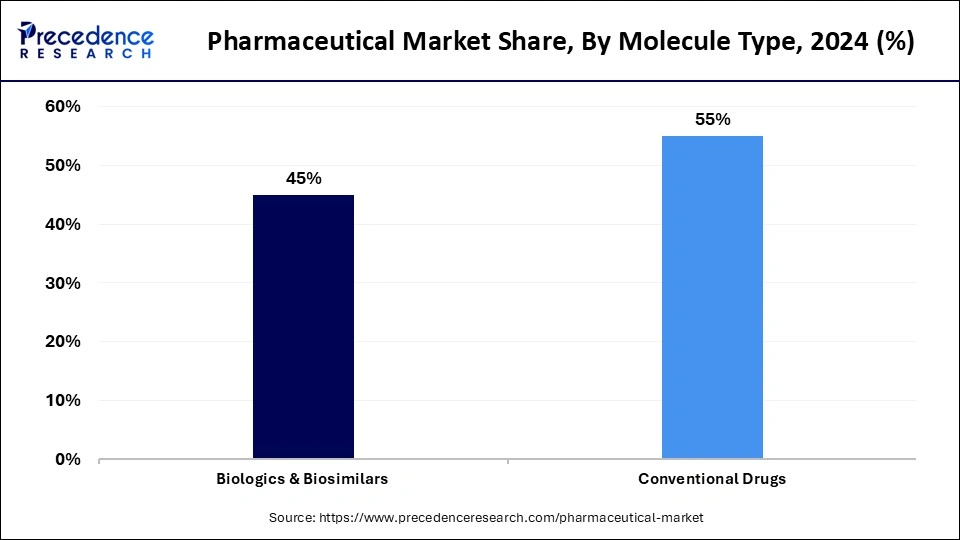

- By molecule type, the conventional drugs (small molecules) segment contributed the biggest market share of 55% in 2024.

- By molecule type, the biologics and biosimilars (large molecules) segment is expected to grow at the highest CAGR between 2025 and 2034.

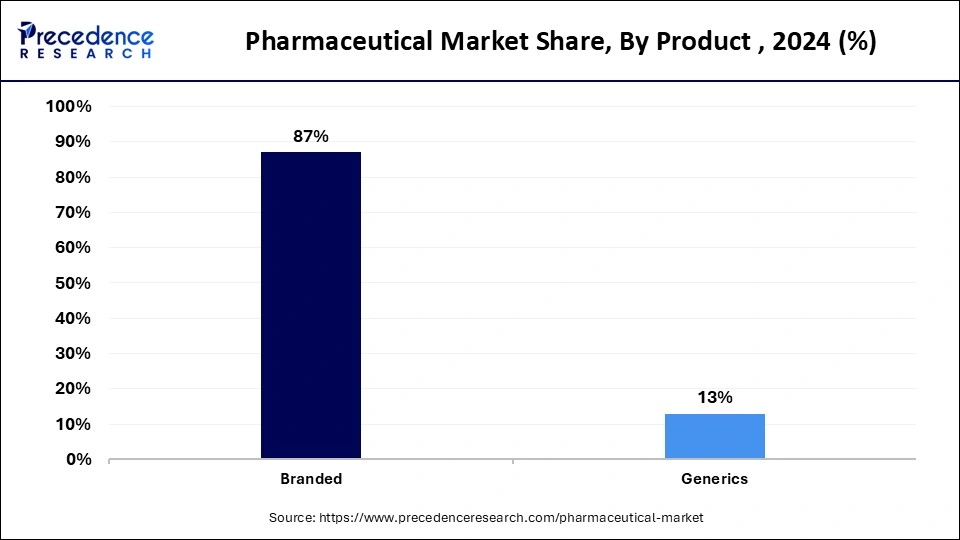

- By product, the branded segment captured the highest market share of 87% in 2024.

- By product, the generic segment is expected to grow at the fastest CAGR during the forecast period.

- By disease, the cancer segment generated the biggest revenue share of 19% in 2024.

- By disease, the obesity segment is expected to expand at a significant compound annual growth CAGR between 2025 and 2034.

- By route of administration, the oral segment accounted for the largest market share 58% in 2024.

- By route of administration, the parenteral segment is expected to expand at a significant CAGR between 2025 and 2034.

- By age group, the adult segment captured the highest market share of 64% in 2024.

- By age group, the geriatric segment is expected to grow at a significant CAGR in the upcoming period.

- By distribution channel, the hospital pharmacies segment dominated the market with major market share of 54% in 2024.

- By distribution channel, the retail pharmacies segment is expected to grow at the fastest rate over the projection period.

Strategic Overview of the Global Pharmaceutical Industry

The pharmaceutical market is witnessing transformative growth due to various factors like rising cases of chronic disease, the growth of the aging population, and the rising prevalence of age-related diseases. Government support and investments in research & development, wider use of biologics and biosimilars, and increased healthcare spending further support market growth. Pharmaceutical companies are focusing on adopting cutting-edge technologies like AI to boost the production of pharmaceuticals. With the growing burden of various life-threatening diseases, the demand for personalized medicine and digital health is rising, contributing to market expansion. Ongoing collaborations between pharmaceutical and healthcare organizations and government initiatives and policies to boost the development of novel drugs drive market growth.

Impact of Artificial Intelligence (AI) on the Pharmaceutical Industry

Artificial Intelligence significantly impacts the pharmaceutical industry by driving innovation, reducing cost, and improving patient outcomes. AI helps optimize drug discovery and development by analyzing vast datasets to identify potential drug candidates. AI also streamlines clinical trial processes by identifying suitable patients. The evolution of Pharma 4.0 is driving the adoption of AI among pharmaceutical companies and drug manufacturers. In addition, artificial intelligence (AI) predicts future demand, optimizes supply chain management, and reduces drug manufacturing costs, all of which are beneficial for pharmaceutical companies. In FY 2025, artificial intelligence (AI) is projected to boost 30% of new drug discoveries, reduce costs, and accelerate the development of personalized treatments. AI has proven successful in reducing the drug discovery downtimes and costs by 25 to 50% in preclinical strategie

Pharmaceutical companies have increased investments in AI for faster innovation and the reduction of drug development timelines and expenses. 85% of biopharma companies are planning to invest heavily in data, digital, and AI in R&D by 2025. Generative AI, machine learning, multimodal data, and longitudinal data significantly enhance efficiency, drug discovery & development, and manufacturing of personalized medicines. Investments in AI for healthcare are expected to reach $188 billion by 2030

What are the Key Trends in the Pharmaceutical Market?

- Chronic Disease Prevalence: The rising prevalence of chronic diseases like cancer, cardiovascular disease, obesity, and diabetes is driving demand for personalized medicine and innovative treatments.

- Aging Population: The growing aging population around the globe and rising age-related diseases are boosting the demand for advanced medications.

- Advancements in Biologics, Biosimilars and Personalized Medicine: The increased chronic disease prevalence has created the need for personalized medicines, biosimilars, and biologics, leading to improved patient outcomes. The ongoing innovations in biologics, target drugs, and gene therapies are driving market growth.

- Healthcare Spending: The spending on healthcare has increased. Additionally, government funding and support for local API production are driving market growth.

- Drug Pricing and Reimbursement: The ongoing focus on price negotiation and access to advanced medicines across the regions plays a vital role in market growth.

Market Outlook

- Market Growth Overview: The Pharmaceutical market is expected to grow significantly between 2025 and 2034, driven by the innovation in scientific and technology, ageing population and rising chronic diseases, and expanding access in emerging markets.

- Sustainability Trends: Sustainability trends involve carbon neutrality and net-zero goals, Green chemistry and eco-friendly production, and renewable energy and energy efficiency.

- Major Investors: Major investors in the market include Novartis AG, Pfizer Inc., Johnson & Johnson Services, Inc., and Sanofi.

- Startup Economy: The startup economy is focused on novel therapeutics & biologics, AI-driven drug discovery, and targeting underserved diseases.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.77 Trillion |

| Market Size in 2026 | USD 1.88 Trillion |

| Market Size by 2034 | USD 3.03 Trillion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.15% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type,Molecule Type, Product, Disease, Route of Administration,Age Group, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Generic Drug Manufacturing

The rising manufacturing of generic drugs is the major driver of the pharmaceutical market. There is a high demand for affordable medicines due to the rising healthcare costs. Generic drugs are cost-effective compared to branded medications. The ongoing expiration of patents on branded drugs is shifting patients toward generic drugs. The rising prevalence of chronic disease drives the need for affordable medications since chronic diseases require long-term medications, which leads to increased healthcare costs. Therefore, people are choosing generic drugs over branded drugs. Additionally, government initiatives promoting the use of generic drugs in order to reduce healthcare costs play a major role in boosting the manufacturing of generic drugs.

Restraint

Regulatory Challenges and High R&D Costs

Regulatory challenges hamper the growth of the pharmaceutical market. Stringent regulations regarding drug safety and quality, lengthy approval processes, lack of reimbursement policies, and intellectual property protection create challenges for global pharmaceutical companies. The pharma industry must comply with stringent regulations for testing, safety, efficacy, and marketing. Additionally, the time-consuming regulatory approval process contributed to increased costs and took a long time for the product to be available in the market, reducing accessibility. Moreover, costs associated with R&D, drug discovery & development, and clinical trials are substantial, hindering the market growth.

Regulations like the U.S.'s Inflation Reduction Act (IRA) and the European Commission's revision of the EU's general pharmaceutical legislation reduce the pharmaceutical companies' revenue. The U.S.'s Inflation Reduction Act (IRA) is projected to decrease 31% of U.S. pharmaceutical companies' revenue by 2039.

Opportunity

Rising Development of Biologics and Biosimilars

The rising development of biologics and biosimilars create lucrative growth opportunities for the pharmaceutical market. The rise of biologics and biosimilars has been driven by the increased need for innovative treatments for chronic disease. Biologics is revolutionizing chronic disease treatments, and biosimilars are enabling cost-effective therapies. The rising prevalence of chronic disease, increasing healthcare costs, and expiring patents on the blockbuster biologic have led to a surge in the use of biologics and biosimilars. As a result, pharmaceutical companies are increasingly focusing on the development of biologics and biosimilars, which provide new treatment options.

Segment Insights

Type Insights

Why did the Prescription Segment Dominate the Pharmaceutical Market in 2024?

The prescription segment dominated the market with the largest share of 87% in 2024. This is mainly due to increased demand for prescription medicines. Patients trust prescription medication more than over-the-counter drugs. Physicians mainly depend on prescribed drugs. The growing chronic diseases among the elderly population contribute to the segment's growth. The growing awareness about chronic diseases like diabetes, cancer, and cardiovascular disease is also fueling the need for prescribed medicines. Governments worldwide have implemented favorable reimbursement policies for prescribed medication, bolstering the segment growth.

The over-the-counter (OTC) segment is expected to grow at the highest CAGR during the forecast period. This is mainly due to the convenience, easy accessibility, and cost-effectiveness of OTC drugs. These drugs are easily available in the market compared to prescription medications. Twh growing trend of self-care and self-medication is boosting the demand for over-the-counter (OTC) drugs.

Molecule Type Insights

What made Conventional Drugs (small molecules) the Dominant Segment in the Pharmaceutical Market?

The conventional drugs (small molecules) segment dominated the market with a major share of 55% in 2024. This is mainly due to the high preference for cost-effective and highly efficient drugs for therapeutic areas. The conventional drugs (small molecules) have a widespread adoption rate, driven by well-established manufacturing processes. These drugs are mostly used for oral administration and exhibit consistent pharmacokinetics, making them ideal for treatments. The wide therapeutic application of conventional drugs (small molecules) contributes to the segment's growth.

The biologics and biosimilars (large molecules) segment is expected to grow at the fastest rate over the forecast period. The segment growth is attributed to the increasing use of biologics and biosimilars (large molecules) to foster innovations, decrease the financial burden, and broaden access to treatments. The growing prevalence of chronic diseases and the rising costs of healthcare have driven a shift towards affordable alternatives such as biologics and biosimilars. Furthermore, regulatory backing that embraces the unique characteristics of biologics and biosimilars, establishing specific approval processes and guidelines, is significantly contributing to the segment's growth.

Product Insights

How does the Branded Segment Lead the Pharmaceutical Market in 2024?

The branded segment led the market with the largest share of 87%in 2024. This is mainly due to increased investments in research and development and This is largely because of big investments in research, development, and getting regulatory approvals. Branded drugs, sold under their own names, let companies invest in research and keep the market competitive. Companies are working hard to promote their branded products, which is increasing their use and popularity, and helping the segment grow.

The generic segment is expected to grow at the fastest rate during the prediction period due to its affordability and easy accessibility. Generic medicines are alternatives to branded medications, helping healthcare become more accessible and affordable. Governments and regulatory bodies have established several policies promoting the use of generic drugs. The rising demand for cost-effective healthcare solutions supports segmental growth.

Disease Insights

Which Disease Segment Hold the largest Revenue Share of the Pharmaceutical Market?

The cancer segment dominated the market by holding the largest revenue share of 19% in 2024 due to the increased burden of cancer worldwide and increase in demand for effective pharmaceuticals. Advancements in diagnostic solutions enable early detection of cancer. This prompted the need for effective pharmaceuticals. The growing aging population and increasing cancer incidence among them and advancements in cancer treatments are fostering segment growth. With the increased burden of cancer, the demand for targeted therapies has risen. The rising clinical trials in oncology further support market growth.

The obesity segment is expected to grow at the fastest rate in the coming years, driven by rising awareness of weight-related disorders. The awareness of obesity has led to the development of more effective medications, and growing access to telehealth is contributing to market growth. There is high demand for personalized medicine for managing obesity. The rising rate of obesity worldwide boosts the demand for effective

Route of Administration

Why did the Oral Segment Dominate the Pharmaceutical Market in 2024?

The oral segment dominated the market with the largest share of 58% in 2024. This is due to the convenient nature of orally administered drugs. The high patient preference for oral route administration and cost-effectiveness of manufacturing oral formulations further bolstered the segment growth. Oral administration of drugs enables high stability of the active pharmaceutical ingredient, and the formulation impacts the absorption and bioavailability of drugs. Oral administration is widely preferred for the treatment of diseases requiring long-term medication.

The parenteral segment is expected to expand at a significant CAGR in the coming years. The parenteral administration provides immediate therapeutic effects and sustainability, making it suitable for the elderly population. The rapid onset of action makes it the preferred choice. The rising need for accurate dosing and targeted treatments further drive segment growth.

Age Group Insights

How Does the Adults Segment Dominate the Market in 2024?

The adult segment dominated the market by holding the largest revenue share of 64% in 2024 due to rising chronic disease prevalence in adults. The increased cases of chronic disease have increased demand for efficient medications. The healthcare spending has increased, creating thr need for cost-effective and easily accessible medications. Advancements in medical facilities and the adoption of telehealth support are driving segment growth. Moreover, the increased prevalence of obesity among adults boosts the demand for pharmaceuticals.

The geriatric segment is expected to grow at the fastest CAGR during the forecast period, due to rising geriatric populations and high prevalence of chronic disease among them. Since geriatric people are more prone to chronic diseases, they require ongoing medications. Pharmaceutical companies have increased their focus on the development of innovative and advanced drugs and therapies for elderly patients, with specific needs and high outcomes rates.

Distribution Channel

Why did the Hospital Pharmacies Segment Dominate the Market in 2024?

The hospital pharmacies segment dominated the pharmaceutical market with the highest market share of 64% in 2024. This is mainly due to the increased patient pool within hospitals. The increased chronic disease has led to a high rate of hospitalization. Hospital pharmacies are a key distribution channel for time-sensitive medication. Additionally, the government funding and policies for hospital coverage drive patient preference for the purchase of medications through hospital pharmacies. The easy availability of prescription medications in these pharmacies support segmental growth.

The retail pharmacy segment is expected to grow significantly over the forecast period, driven by easy access to both prescription and non-prescription medications, cost-effectiveness, and convenience. Retail pharmacies offer cheaper options than hospitals or clinics. The rising demand for over-the-counter drugs and the rise of online pharmacies are boosting the growth of the segment.

Regional Insights

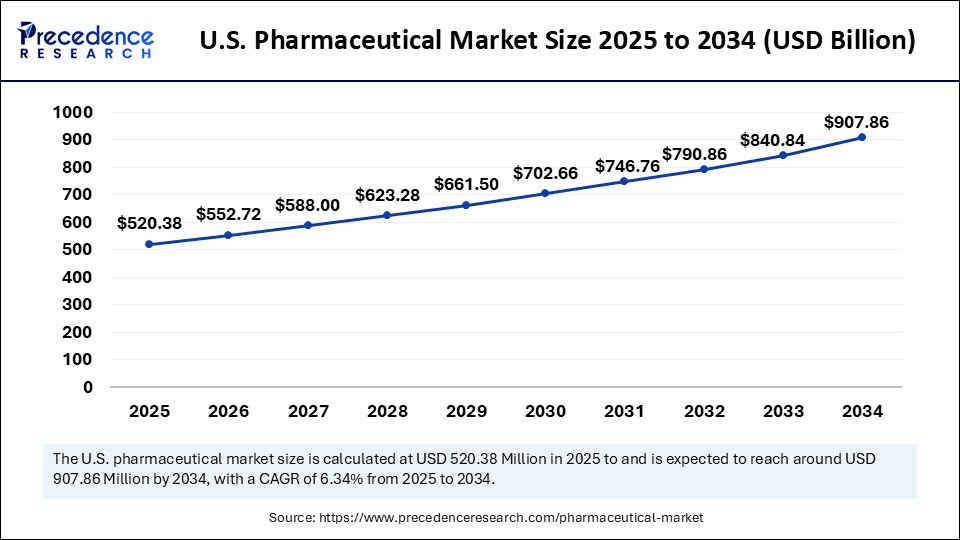

How Big is the U.S. Pharmaceutical Market Size?

Precedence Research predicts, the U.S. pharmaceutical market size is valued at USD 520.38 billion in 2025, up from USD 490.98billion in 2024 and is expected to reach nearly USD 907.86 billion by 2034, growing at a CAGR of 6.34% from 2025 to 2034.

What Made North America the Dominant Region in the Pharmaceutical Market?

North America dominated the global market by capturing the largest share of 42% in 2024. This is mainly due to the increased prevalence of chronic disease, high demand for personalized medicine, an aging population, and the adoption of automation in drug discovery. North America has a well-established pharmaceutical manufacturing base. Increased investment in R&D and a significant rise in clinical trials bolster the growth of the market in the region.

The U.S. is leading the market in North America. This is mainly due to the rising government spending on pharmaceutical R&D. There is a high demand for mRNA vaccines, biologics, and biosimilars. With the growing prevalence of chronic diseases, the demand for cell and gene therapies is rising, contributing to market expansion. In addition, the rising development of novel drugs supports market growth.

A US-based company, Merck & Co., has remained the “big dog” in the pharma industry in 2025, with revenue of $64.17 billion in FY2024. The company is the world's best-selling drug with sales that rose 18% to $29.5 billion in 2024 through Keytruda momentum. Keytruda accounted for about 46% of Merck's sales in FY 2024.

Asia Pacific Pharmaceutical Market and Trends

Asia Pacific is the fastest-growing region in the global market, driven by the rapid expansion of the pharmaceutical and biopharmaceutical sectors. The production of biologics is rising in the region. The rising prevalence of chronic diseases, such as diabetes, cardiovascular diseases, and cancer, is boosting the demand for effective drugs. Rising government investment in drug discovery and development, high demand for personalized medicine, and rising healthcare expenditure further contribute to the growth of the market.

India is set to be a major pharma manufacturer in the next decade, thanks to its growing population and increased healthcare spending. The Indian market is changing due to rising demand for high-quality pharmaceuticals. Also, government programs are making Indian drugs affordable and high-quality. The National Pharmaceutical Policy helps cut costs and reduce reliance on Chinese API imports. Moreover, Indian government is investing heavily in novel drug discovery and development, supporting market growth.

The pharmaceutical industry in India grew by 7.8% in April 2025, with the supply of 20% of the world's generic medicine. The country has registered a 7.8% year-on-year increase in revenue for April 2025, driven by increased innovations, exports, and government schemes, positioning India as a global supplier for cost-effective medicines and vaccines.

Europe Pharmaceutical Market and Trends

Europe is considered to be a significantly growing area. The growth of the market in the region is driven by high healthcare expenditure, the presence of some of the major pharmaceutical companies, and increasing R&D activities. The region's well-established healthcare and pharmaceutical sectors support market growth. Germany is a major player in the European pharmaceutical market, driven by the country's robust pharmaceutical industry, high R&D expenditure, and strong focus on technological advancements. Germany has a high incidence of chronic diseases like cancer and diabetes, boosting the demand for pharmaceutical products. After a 0.4% contraction in 2024, pharmaceuticals output and sales in the EU and the UK are anticipated to grow by 1.9% in 2025 and 0.4% in 2026.

Pharmaceutical Market Value Chain Analysis

- Research and Development (R&D) & Clinical Trials

This foundational stage involves identifying potential drug candidates, conducting rigorous preclinical laboratory testing, and executing multi-phase clinical trials in humans to ensure safety and efficacy.

Key Players: Pfizer Inc., Merck & Co., Inc., Johnson & Johnson, F. Hoffmann-La Roche Ltd., Bayer AG, and various biotechnology research startups. - Manufacturing and Production

This stage focuses on the large-scale production of active pharmaceutical ingredients (APIs) and the formulation into final dosage forms (tablets, capsules, injectables) following strict Good Manufacturing Practices (GMP).

Key Players: Pfizer Inc., Merck & Co., Inc., Teva Pharmaceutical Industries Ltd. (generics), Cipla Inc., large contract manufacturing organizations (CMOs) like Catalent, Inc. - Distribution and Logistics

This stage involves the complex process of storing, managing inventory, and transporting pharmaceutical products through a secure and compliant supply chain to wholesalers, hospitals, and pharmacies globally.

Key Players: McKesson Corporation, Cardinal Health, Inc., AmerisourceBergen Corporation, global logistics providers (e.g., DHL), specialized pharmaceutical distributors. - Marketing, Sales, and Market Access

This stage involves educating healthcare professionals about new drugs, securing favorable positions on insurance formularies (market access), and managing sales teams to promote products effectively.

Key Players: Major pharmaceutical companies (Pfizer, Bayer, AbbVie) with large sales and marketing teams, advertising agencies specializing in healthcare communications, and Pharmacy Benefit Managers (PBMs).

Key Players in Pharmaceutical Market and their Offerings

- Merck & Co., Inc.: Merck contributes a broad portfolio of innovative medicines and vaccines, focusing heavily on oncology, infectious diseases, and diabetes to address significant global health challenges.

- F. Hoffmann-La Roche Ltd: A leader in oncology, immunology, and neuroscience, Roche contributes to the market with highly specialized, personalized medicines and advanced diagnostics, driving innovation in targeted treatments.

- Johnson & Johnson Services, Inc.: J&J participates across pharmaceuticals, medical devices, and consumer health, bringing a diversified portfolio that addresses various health conditions globally, from oncology to immunology.

- Novartis AG: Novartis provides innovative medicines, generics, and eye care products, contributing to the market with a strong R&D pipeline and a focus on transforming care through advanced therapies.

- AbbVie Inc.: Known for its focus on immunology, oncology, and neuroscience, AbbVie contributes significant, high-impact therapeutics to treat complex and severe chronic diseases.

- GlaxoSmithKline plc.: GSK is a major player with a focus on respiratory diseases, vaccines, and specialty medicines, contributing a broad range of products aimed at improving health and preventing disease.

- AstraZeneca: AstraZeneca contributes a diverse portfolio concentrated on oncology, cardiovascular, renal, metabolism, and respiratory diseases, focusing on innovative R&D and strategic collaborations.

- Pfizer Inc.: As one of the world's largest pharmaceutical companies, Pfizer contributes a wide array of innovative medicines and vaccines, playing a critical role in global health and pandemic response efforts.

- Bristol-Myers Squibb Company: BMS focuses on serious diseases, particularly in oncology, immunology, and cardiovascular medicine, contributing high-value specialty medicines to the market.

- Sanofi: Sanofi provides a range of pharmaceutical products, vaccines, and consumer health solutions, contributing to the market with a strong presence in diabetes, rare diseases, and innovative vaccines.

- Takeda Pharmaceutical Co., Ltd.: Takeda focuses on specialized areas like oncology, rare diseases, and neuroscience, contributing an innovative R&D approach and a commitment to patient-focused therapies globally.

Recent Developments

- In March 2025, Daiichi Sankyo introduced its Datroway (datopotamab deruxtecan) in Japan for the treatment of adult patients with hormone receptor (HR) positive, HER2 negative (IHC 0, IHC 1+ or IHC 2+/ISH-) unresectable or recurrent breast cancer after prior chemotherapy. (Source:https://pharmabiz.com)

- In February 2025, Medexus Pharmaceuticals announced the availability of GRAFAPEX (treosulfan) for Injection in the U.S. After one month of FDA approvals, the company has achieved commercial launch in early 2025. (Source:https://www.medexus.com)

- In January 2025, AstraZeneca Pharma India Limited launched Breztri Aerosphere, marking a significant step forward in the treatment options available for COPD patients in the country. (Source: https://www.cnbctv18.com)

Segment Covered In the Report

By Type

- Prescription

- OTC

By Molecule Type

- Biologics & Biosimilars (Large Molecules)

- Monoclonal Antibodies

- Vaccines

- Cell & Gene Therapy

- Others

- Conventional Drugs (Small Molecules)

By Product

- Branded

- Generics

By Disease

- Cardiovascular diseases

- Cancer

- Diabetes

- Infectious diseases

- Neurological disorders

- Respiratory diseases

- Autoimmune diseases

- Mental health disorders

- Gastrointestinal disorders

- Women's health diseases

- Genetic and rare genetic diseases

- Dermatological conditions

- Obesity

- Renal diseases

- Liver conditions

- Hematological disorders

- Eye conditions

- Infertility conditions

- Endocrine disorders

- Allergies

- Others

By Route of Administration

- Oral

- Tablets

- Capsules

- Suspensions

- Other

- Topical

- Parenteral

- Intravenous

- Intramuscular

- Inhalations

- Other

By Age Group

- Children & Adolescents

- Adults

- Geriatric

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content