Oncology Clinical Trials Market Size and Forecast 2025 to 2034

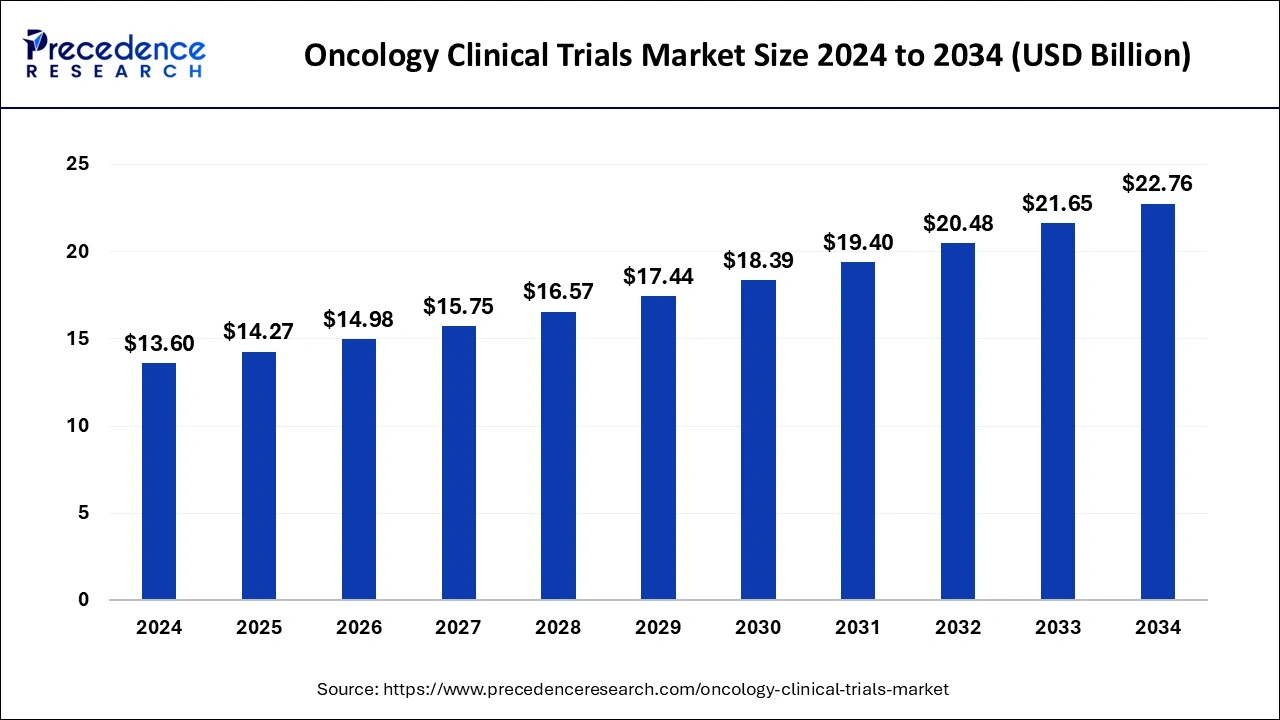

The global oncology clinical trials market was estimated at USD 13.60 billion in 2024 and is predicted to increase from USD 14.27 billion in 2025 to approximately USD 22.76 billion by 2034, expanding at a CAGR of 5.28% from 2025 to 2034.

Oncology Clinical Trials Market Key Takeaways

- The global oncology clinical trials market was valued at USD 13.60 billion in 2024.

- It is projected to reach USD 22.76 billion by 2034.

- The oncology clinical trials market is expected to grow at a CAGR of 5.28% from 2025 to 2034.

- North America contributed more than 42% of revenue share in 2024.

- Asia-Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By phase type, the phase III segment generated over 49% of revenue share in 2024.

- By phase type, the phase I segment is anticipated to grow at a remarkable CAGR of 5.14% between 2025 and 2034.

- By study design, the interventional studies segment generated over 88% of revenue share in 2024.

- By study design, the observational studies segment is expected to expand at the fastest CAGR over the projected period.

U.S.Oncology Clinical Trials Market Size and Growth 2025 to 2034

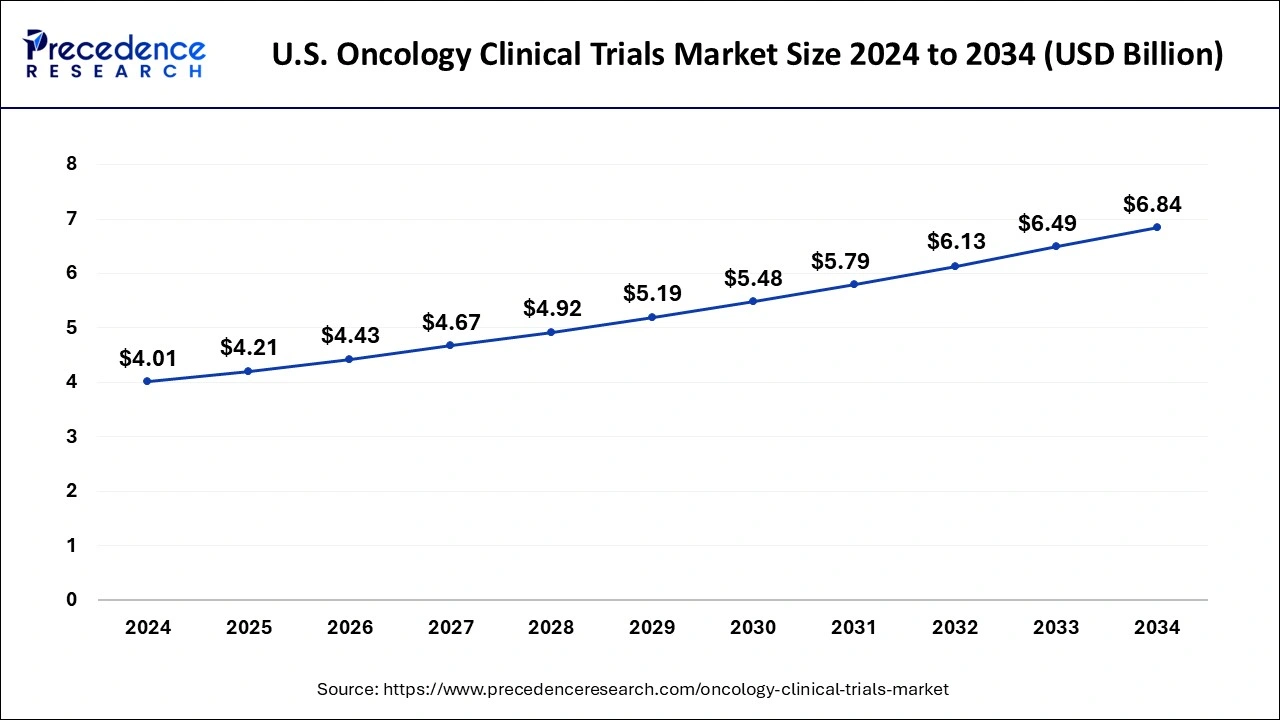

The U.S. oncology clinical trials market size was exhibited at USD 4.01 billion in 2024 and is projected to be worth around USD 6.84 billion by 2034, growing at a CAGR of 5.49% from 2025 to 2034.

North America held the largest share of 42% in the oncology clinical trials market owing to a combination of factors. The region boasts advanced healthcare infrastructure, a robust research ecosystem, and a high prevalence of cancer. Additionally, stringent regulatory standards and a mature pharmaceutical industry contribute to its dominance. Key players and research institutions based in North America actively drive innovation, attracting a significant number of clinical trials. This consolidated environment, coupled with a skilled workforce, facilitates efficient trial execution, making North America a major hub for oncology clinical research and market leadership.

- As per the U.S. Government Accountability Office, the National Institutes of Health (NIH), an entity within the Department of Health and Human Services (HHS), holds the primary position as the leading public funder of biomedical research and development (R&D).

Asia Pacific is positioned for swift growth in the oncology clinical trials market. The vast and diverse population presents an opportunity for extensive participant recruitment, ensuring a more representative sample in trials. Rising cancer cases in the region highlight the demand for novel treatments. Favorable regulations, cost-effective operations, and advanced healthcare infrastructure in key nations enhance the region's appeal for conducting efficient and economical oncology clinical trials. This convergence of factors propels significant expansion in the market for cancer research in the Asia-Pacific region.

On the other hand, Europe is experiencing significant growth in the oncology clinical trials market due to various factors. The region boasts a robust research infrastructure, renowned medical institutions, and a well-established regulatory framework, fostering an environment conducive to clinical research. Increasing collaboration between academia, industry, and research organizations further accelerates trial initiation and completion. Additionally, the rising prevalence of cancer and a proactive approach towards adopting innovative treatments contribute to the surge in oncology clinical trials. This combination of factors positions Europe as a key hub for advancing cancer research and propelling substantial growth in the market.

The Middle East and Africa are expected to grow significantly in the oncology clinical trials market during the forecast period. The increasing cases of cancer in the Middle East and Africa are increasing the demand for new diagnosis and treatment options. This, in turn, is increasing the development of various drug candidates and diagnostic approaches. Hence, this is leading to a rise in the demand for oncology clinical trials for their faster approval and launches. Furthermore, these trials are supported by the regulatory bodies to enhance their approval. At the same time, to make the treatment and diagnostic approaches more accessible and affordable government and the regulatory bodies are providing their support. Thus, all these factors are promoting the market growth.

Market Overview

Oncology clinical trials represent investigative studies designed to explore innovative treatments and interventions for individuals diagnosed with cancer. These trials seek to evaluate the safety and effectiveness of emerging modalities, including pharmaceuticals, immunotherapies, and targeted treatments, with the overarching goal of advancing cancer therapeutics. Diverse participants, spanning various cancer types and stages, enroll in these trials, adhering to meticulous protocols that meticulously document treatment outcomes and potential adverse effects.

Oncology Clinical Trials Market Growth Factors

- Advancements in technology, including enhanced diagnostic tools and advanced data analysis, play a pivotal role in shaping the realm of oncology clinical trials. These progressions not only refine the precision of patient categorization and biomarker identification but also enable real-time monitoring of treatment responses. Consequently, these technological strides significantly elevate the effectiveness and efficiency of clinical research processes.

- The increasing global incidence of cancer serves as a driving force behind the expansion of oncology clinical trials. With a growing number of individuals grappling with various types of cancer, the imperative to invest in research and development becomes more pronounced. The pursuit of novel and improved therapeutic approaches becomes paramount, making clinical trials indispensable in addressing the evolving challenges posed by diverse forms of cancer. The trend towards personalized medicine, tailoring treatments based on individual patient characteristics and genetic makeup, is fueling the growth of oncology clinical trials. By identifying specific molecular targets, these trials assess the safety and effectiveness of customized treatments designed to improve overall patient outcomes.

- A regulatory environment that supports oncology clinical trials and streamlined approval processes contributes to market growth. Initiatives aimed at simplifying trial initiation, reducing bureaucratic hurdles, and ensuring patient safety create a conducive atmosphere for researchers and organizations to engage in clinical research, promoting the expansion of the oncology trials market.

- Increasing investments by pharmaceutical companies, biotech firms, and government entities in oncology research and development are driving the expansion of clinical trials. Funding for novel therapies, drug discovery, and therapeutic innovations accelerates the pace of clinical research, fostering a positive environment for the growth of the oncology clinical trials market.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.28% |

| Market Size in 2025 | USD 14.27 Billion |

| Market Size by 2034 | USD 22.76 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Phase Type and Study Design |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising cancer incidence

The increasing worldwide occurrence of cancer significantly boosts the demand for oncology clinical trials.

- According to the World Cancer Research Fund, there were an estimated 19.3 million new cancer cases globally in 2020.

As different types of cancer become more prevalent, there is a growing necessity for groundbreaking therapeutic options. This surge in demand propels pharmaceutical firms, research institutions, and healthcare entities into actively participating in extensive clinical research efforts. This surge in cancer incidence fuels a parallel rise in the need for diverse and targeted treatment options, propelling the oncology clinical trials market forward.

The trials become essential mechanisms for evaluating the safety and efficacy of emerging therapies, providing a crucial avenue for patients to access cutting-edge treatments while advancing the broader understanding of cancer biology and treatment modalities. In essence, the mounting global cancer burden underscores the pivotal role of oncology clinical trials in addressing the unmet medical needs of patients and steering the course of cancer care toward more effective and personalized solutions.

Restraint

Patient recruitment and retention challenges

Patient recruitment and retention challenges present significant restraints for the oncology clinical trials market. The meticulous criteria for enrolling eligible participants in oncology trials, given the specific characteristics and medical backgrounds required, often lead to prolonged recruitment periods. This delay not only extends the overall trial duration but also increases operational costs, hindering the timely progression of research initiatives. Additionally, the competitive landscape and the limited pool of eligible patients further exacerbate recruitment difficulties, as multiple trials vie for the same participant demographic. Retaining patients throughout the trial duration poses another formidable challenge.

Factors such as the demanding nature of oncology treatments, potential side effects, and logistical issues can contribute to patient dropout rates. High dropout rates not only impact the reliability of trial results but also necessitate additional recruitment efforts to maintain adequate sample sizes. Effectively addressing these patient recruitment and retention challenges is crucial for ensuring the successful execution of oncology clinical trials, expediting the development of new cancer therapies, and meeting the evolving demands of the market.

Opportunity

Patient-centric trial designs

Patient-centric trial designs are revolutionizing the oncology clinical trials market by placing the patient experience at the forefront, creating significant opportunities for innovation and efficiency. Embracing decentralized and virtual trial models enables greater patient participation by reducing the burden of frequent site visits. This approach not only enhances overall patient satisfaction but also broadens the pool of potential participants, improving trial diversity and representation. Furthermore, patient-centric designs prioritize outcomes that matter most to patients, fostering increased engagement and adherence.

By incorporating patient-reported outcomes and leveraging digital health technologies for remote monitoring, these designs provide a more holistic understanding of treatment effects. As the industry continues to shift towards a patient-centric paradigm, there is a unique opportunity to enhance the success and speed of oncology clinical trials, ultimately accelerating the development of novel cancer therapies that resonate with patient needs and preferences.

Phase Type Insights

The Phase III segment had the highest market share of 49% in 2024.In the oncology clinical trials market, phase III represents the advanced stage where experimental treatments undergo rigorous testing in a large patient population. This phase aims to confirm the effectiveness and safety of the investigational therapy compared to standard treatments. Trends in Phase III oncology clinical trials include anincreasing focus on personalized medicine, with trials designed to identify biomarkers for targeted therapies. Additionally, collaborative efforts between industry and regulatory bodies aim to streamline processes and expedite the translation of promising treatments from research to clinical application.

- In July 2020, Novartis AG initiated a Phase III clinical trial investigating the combination of alpelisib with pertuzumab and trastuzumab. The trial aims to evaluate the safety and efficacy of this combination as supportive therapy for individuals with HER2-positive advanced breast cancer.

The phase I segment is anticipated to expand at a significant CAGR of 5.14% during the projected period. In oncology clinical trials, the phase I segment is the initial stage of testing novel therapies in humans. Phase I trials focus on assessing the safety and tolerability of experimental drugs, determining the appropriate dosage, and identifying potential side effects. A trend in Phase I oncology trials involves an increased emphasis on biomarker-driven approaches, personalized medicine, and the exploration of innovative drug combinations. This trend aims to optimize treatment efficacy while minimizing adverse effects, aligning with the broader industry shift toward precision oncology and targeted therapies.

Study Design Insights

The interventional studies segment has held 88% market share in 2024. Interventional studies in the oncology clinical trials domain actively examine the impact of specific treatments on cancer outcomes. Frequently carried out through randomized controlled trials, these studies evaluate the safety and effectiveness of emerging therapies or treatment combinations. A noteworthy trend in this segment is the increasing focus on personalized medicine, tailoring treatments to individual patient characteristics. This shift towards customized interventions aims to enhance treatment outcomes and propel the field of precision oncology forward in a patient-centered approach.

The observational studies segment is anticipated to expand fastest over the projected period. Observational studies in the oncology clinical trials market involve the systematic collection and analysis of real-world data to understand the natural history of diseases, treatment outcomes, and patient characteristics. These studies observe participants in their everyday settings, providing valuable insights into the effectiveness and safety of cancer treatments outside controlled trial conditions. The trend in oncology clinical trials reflects an increasing reliance on observational studies to complement traditional trial data, offering a more comprehensive understanding of treatment patterns, long-term outcomes, and real-world patient experiences in diverse oncology settings.

Oncology Clinical Trials Market Companies

- Novartis

- Merck & Co.

- Pfizer Inc.

- Roche

- Bristol Myers Squibb

- AstraZeneca

- Johnson & Johnson

- Eli Lilly and Company

- GlaxoSmithKline

- Sanofi

- AbbVie Inc.

- Celgene Corporation (now part of Bristol Myers Squibb)

- Astellas Pharma Inc.

- Daiichi Sankyo

- Takeda Pharmaceutical Company Limited

Recent Developments

- In July 2025, to develop a new UAE-based investment and clinical platform, a non-binding term sheet was signed by NeOnc Technologies Holdings, Inc., which is a clinical-stage biotechnology company developing transformative treatments for brain and central nervous system cancers, with Quazar Investment and this platform will focus on the Middle East and North Africa (MENA) region. Furthermore, the clinical trial infrastructure of the UAE will be utilized by the Cleveland Clinic Abu Dhabi, which is responsible for conducting the trials under US FDA protocols, in this collaboration.

- In June 2025, it was announced that the second patient was dosed in the Phase 2 clinical trial protocol conducted for the evaluation of stenoparib, which is a differentiated, dual PARP and WNT pathway inhibitor, in patients with recurrent, advanced, platinum-ineligible or platinum-resistant ovarian cancer. The stenoparib was developed by Allarity Therapeutics, Inc., which is a Phase 2 clinical-stage pharmaceutical company.

(Source: https://menafn.com/)

(Source: https://uk.finance.yahoo.com/) - In June 2022, Novartis reported positive outcomes from the Phase III RATIONALE 306 trial, revealing that tislelizumab in combination with chemotherapy significantly enhanced overall survival (OS) as a primary treatment for adult patients dealing with unresectable, locally advanced, or metastatic esophageal squamous cell carcinoma (ESCC), irrespective of their PD-L1 status.

- In March 2021, Merck Sharp & Dohme Corp. initiated a phase II clinical study to assess the safety and efficacy of the fixed-dose co-formulated pembrolizumab/quavonlimab (MK-1308A) in conjunction with lenvatinib for patients with hepatocellular carcinoma (HCC).

Segments Covered in the Report

By Phase Type

- Phase I

- Phase II

- Phase III

- Phase IV

By Study Design

- Interventional Studies

- Observational Studies

- Expanded Access Studies

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content