What is the Pharmaceutical Water Market Size?

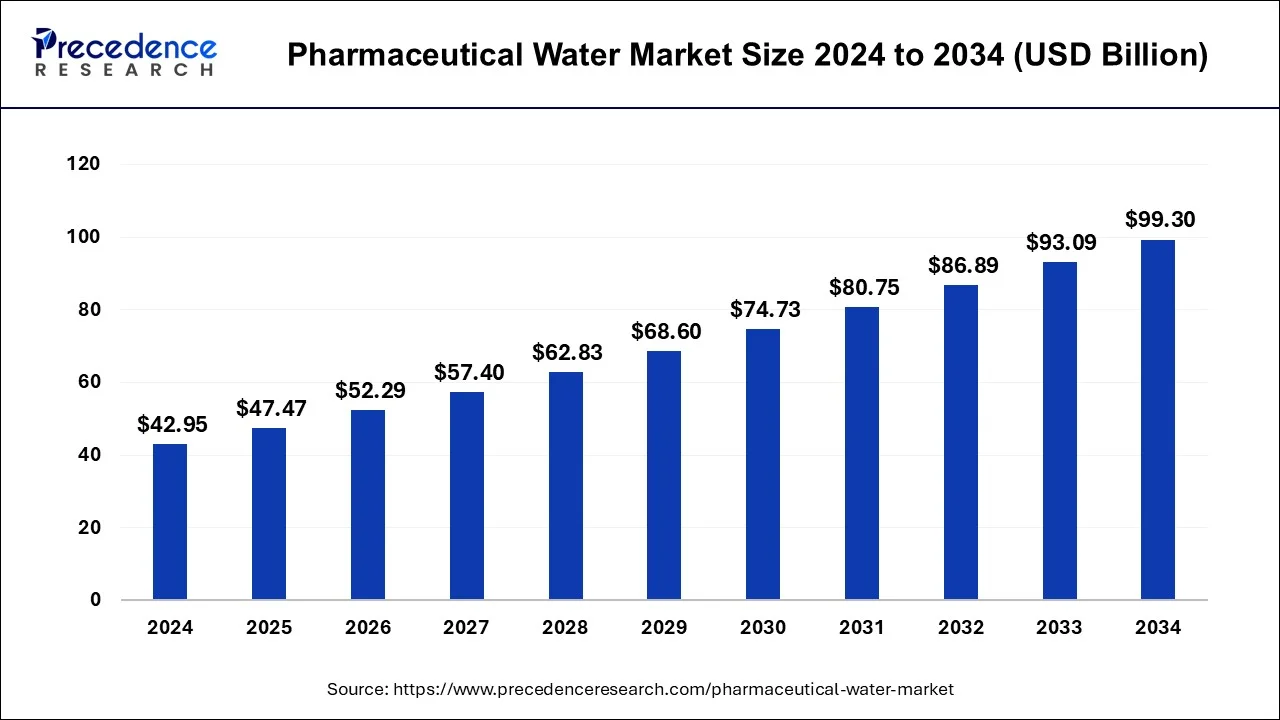

The global pharmaceutical water market size accounted for USD 47.47 billion in 2025, grew to USD 52.29 billion in 2026 and is projected to surpass around USD 99.30 billion by 2034, representing a healthy CAGR of 8.55% between 2025 and 2034.

Pharmaceutical Water Market Key Takeaways

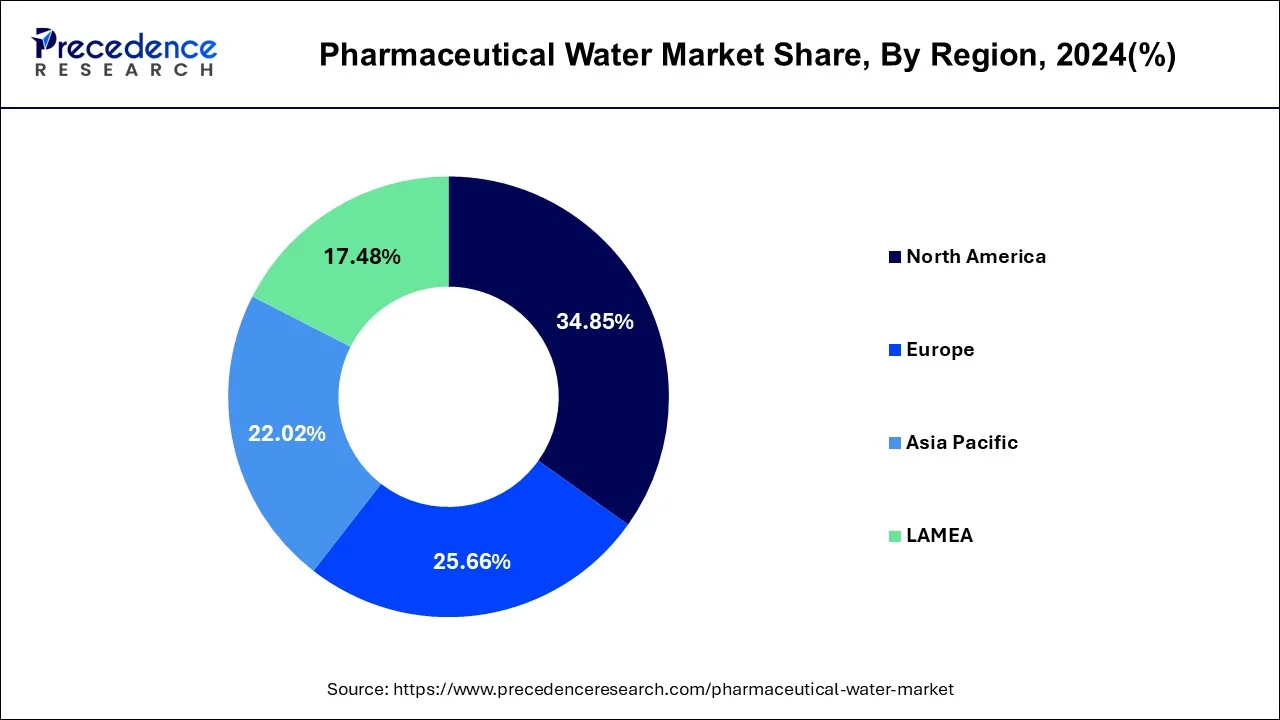

- North America led the global market with the highest market share of 34.85% in 2024.

- Asia-Pacific is estimated to expand at the fastest CAGR of 9.3% from 2025 to 2034.

- By type, the water for injection segment held the largest share of the market in 2024.

- By type, the HPLC grade water segment is anticipated to grow rapidly in the coming years.

- By application, the pharmaceutical and biotechnology companies segment dominated the market in 2024.

- By application, the academics and research laboratories segment is projected to expand at the highest growth rate over the studied period.

How is Artificial Intelligence (AI) Impacting the Pharmaceutical Water Market?

Artificial intelligence (AI) is revolutionizing the market. Integrating AI technologies in pharmaceutical water production will produce high-quality water. AI can optimize the quality control process by analyzing data from water purification systems. Several pharmaceutical companies are increasingly leveraging the power of AI to manufacture pharmaceutical products. AI assists pharmaceutical companies in streamlining operations, ensuring quality, minimizing downtime, optimizing supply chain management, and driving innovations. AI also detects flaws in water purification systems, thus reducing errors and ensuring water meets stringent regulatory standards.

Water for Rx: Critical Ingredient of Pharmaceuticals

Pharmaceutical water, also known as sterile water, is a vital component used as a raw material or ingredient in manufacturing pharmaceutical products, such as active pharmaceutical ingredients (APIs) and intermediates. This highly purified water is free from microorganisms and other contaminants. Thus, it is used in various medical applications such as injectable medications, IV fluids, and other sterile solutions. The market is experiencing significant growth due to the rising demand for high-quality water for various applications. It is used in drug formulation and cell culture production. In addition, it is used to clean and purify pharmaceutical products. The rising production of pharmaceutical products and increasing focus on drug discovery and development can have a positive impact on the market.

Market Outlook

- Industry Growth Overview: The pharmaceutical water industry is experiencing spectacular growth due to increased demand for high-quality water in pharmaceutical manufacturing. The demand for biopharmaceuticals and biosimilars has increased, driving the need for advanced pharmaceutical water. Pharmaceutical companies are focusing on meeting strict regulatory requirements and complaints for water purity, leading to significant advancements in water purification technologies.

- Sustainability Trends: The growth in environmental concerns and regulatory pressure for high-quality water is bringing significant sustainability trends in the pharmaceutical water industry. The pharmaceutical industry a fueling the adoption of cutting-edge technologies like membrane filtration and reverse osmosis to enable efficient water recycling and reduce consumption by up to 50%. The adoption of green technologies like solar power distillation, an electro-dionization, and the implementation of a closed-loop system to reduce water waste and environmental impact making the pharmaceutical industry to shift toward a circular economy.

- Startup Ecosystem: the complex challenges of water purification, sustainability, and management has emerged numerous innovative startups in the pharmaceutical water industry, including NematiQ, Inosep, Alternative Engineering, WaterTDS, LAT Water, Aquature, and MWTP Solutions, focusing on the introduction of innovative technologies to enhance sustainability, efficiency, and monitoring. Silicon Valley and Boston have become leading global hubs for 141 pharma startup companies.

Global Pharmaceutical Water Market Trade Analysis: Growth Projection and Regulations in Purified Water Production, Sustainability, and Distribution Practices

| Country | Regulatory Framework | Overview |

| U.S. | The U.S. Pharmacopeia (USP) | A draft revision of general chapter <1231> water for pharmaceutical purposes was released in July 2025. This draft included the novel section on nitrosamines in the pharmacopeia forum (PF) 51 (4). |

| Europe | The European Pharmacopoeia Commission (EPC) | In June 2025, EPC adopted three revised texts related to pharmaceutical waters to meet with global quality standards for sterilized water for injections, including water for injection (0169), water, purified (0008), and total organic carbon in water for pharmaceutical use (2.2.44). |

| India | Updated GMP Regulations | India updated the Good Manufacturing Practices (GMP) regulations through the revised Schedule M of the Drugs and Cosmetics Rules, 1945. This update aligns Indian pharmaceutical companies with global standards for enhancing drug quality and international competitiveness of the industry. |

| Indonesia | BPOM | On April 23, 2025, a regulation enacting the number 10 concerning guidelines for the verification of analytical methods for drugs and drug ingredients was issued. |

Pharmaceutical Water Market Growth Factors

- The rapid expansion of the biopharmaceutical industry and the rising demand for generic injectables boost the growth of the global pharmaceutical water market during the forecast period.

- With the increasing burden of rare and chronic diseases, there is a high demand for novel and targeted medicines. Moreover, the increasing need for biopharmaceuticals, such as proteins, vaccines, plasma, antibodies, biologics, enzymes, and peptides, drives the market.

- Rising investment in R&D activities and increasing clinical trials are expected to drive the market's growth in the coming years.

- Stringent guidelines imposed by regulatory authorities to ensure the efficacy, safety, and quality of pharmaceuticals positively impact the market.

- Moreover, rising investments in the production of vaccines and life-saving drugs are likely to fuel the market's growth.

Market Scope

| Report Highlights | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.55% |

| Market Size in 2025 | USD 47.47 Billion |

| Market Size in 2026 | USD 47.47 Billion |

| Market Size by 2034 | USD 99.30 Billion |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing Application of WFI

With the growing prevalence of chronic diseases, the demand for pharmaceutical products is increasing, leading to a higher need for high-quality pharmaceutical water. Water for injection (WFI) is high-quality, sterile water used to manufacture drugs and vaccines. This water is also used to manufacture parenteral and ophthalmic products. Moreover, WFI is used as a cleansing solution to clean implantable medical devices and laboratory equipment that come in direct contact with fluids and other bacteria. Moreover, the rising production of biopharmaceuticals, such as recombinant proteins, monoclonal antibodies, and cell & gene therapies, fuel the growth of the market. WFI ensures that these biopharmaceuticals meet stringent purity standards.

- In February 2024, Veolia Water Technologies launched the latest generation of Polaris, its leading high-capacity water distillation and steam generation solutions, developed for the pharmaceutical industry. Using a range of standard options, the skid-mounted PoIaris 2.0 Multiple Effect Distiller (MED) and Polaris 2.0 Pure Steam Generator (PSG) systems have been engineered to reliably deliver the required volumes of water for injection (WFI) and pure steam in line with European, Japanese, and US Pharmacopoeia standards.

Restraint

High Investments

The purchase of pharmaceutical water purification systems requires a high investment, which often discourages small and medium-sized pharmaceutical and biotechnology companies from adopting these technologies, particularly in low and middle-income countries. In addition, water purification systems require regular maintenance to reduce errors and control water quality, which further increases operational costs, thereby hindering the growth of the market.

Opportunity

Rising Need for Advanced Purification Technologies

The rising need for advanced purification technologies across pharmaceutical and biopharmaceutical companies is projected to create lucrative opportunities in the pharmaceutical water market. Technological advancements in water purification systems, such as reverse osmosis, ultrafiltration, UV oxidation, and distillation, can enhance the effectiveness of water treatment processes. Additionally, the rising demand for ultrapure water for the production of biologics propels market growth.

- In November 2024, CN Water unveiled its water technology solutions under the theme “Purer, Safer, Greener Water” at CPHI-PMEC 2024, which is held in Noida, India, from November 26 to 28, 2024. The company unveiled key innovations, including a new method for Water for Injection (WFI) generation and a remote monitoring solution for pharmaceutical water systems.

Type Insights

The water for injection segment dominated the market with the largest share in 2023. This is mainly due to the rise in the production of vaccines and rising chronic illnesses worldwide. Water for injection (WFI) is a high-purity, sterile water that is widely used in the formulation of pharmaceutical products such as injectables, infusions, and sterile solutions. In addition, regulatory agencies such as the United States Pharmacopeia (USP), European Pharmacopoeia (EP), Japanese Pharmacopoeia (JP), and most other worldwide pharmacopeias mandate strict quality standards for water for injection (WFI) to ensure product safety, efficacy, and compliance with good manufacturing practices (GMP), contributing to segmental growth.

The HPLC grade water segment is expected to expand at a rapid pace during the forecast period. High-performance liquid chromatography (HPLC) grade water is ultrapure with low ultraviolet absorbance and has a conductivity of 16 to 18 megaohms. HPLC-grade water is suitable for the HPLC mobile phase and sample preparation. Factors such as the stringent regulations regarding water quality control and the rising demand for high-quality water to develop complex drug formulations are expected to boost segmental growth.

Pharmaceutical Water Market Revenue, By Type, 2022-2024 (USD Bn)

| By Type | 2022 | 2023 | 2024 |

| HPLC Grade Water | 7.29 | 8.10 | 8.95 |

| Water for Injection | 27.41 | 30.60 | 33.99 |

Application Insights

The pharmaceutical & biotechnology companies segment accounted for the largest share of the pharmaceutical water market in 2023. This is mainly due to the rise in the production of vaccines and biologics. Pharmaceutical water is a critical component in manufacturing pharmaceutical products, as it is used in various stages of production, including drug formulation, cleaning equipment, and quality control. Regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have stringent requirements for the quality and purity of water used in pharmaceutical manufacturing. Pharmaceutical and biotechnology companies have the expertise, resources, and infrastructure to meet these regulatory standards and ensure the production of high-quality pharmaceutical water. Furthermore, the rise in drug discovery and development investments by pharmaceutical companies augmented the segment.

The academics and research laboratories segment is projected to expand rapidly in the coming years. The segmental growth is attributed to the increasing demand for high-purity water from research laboratories. These laboratories heavily invest in developing innovative drugs and therapeutics for rare and chronic diseases. Research and clinical trials require high-purity pharmaceutical water to develop new drugs and therapeutics. Moreover, rising R&D activities contribute to segmental growth.

Pharmaceutical Water Market Revenue, By Application, 2022-2024 (USD Bn)

| By Application | 2022 | 2023 | 2024 |

| Pharmaceutical & Biotechnology Companies | 19.97 | 22.30 | 24.78 |

| Academics & Research Laboratories | 14.72 | 16.39 | 18.16 |

Regional Insights

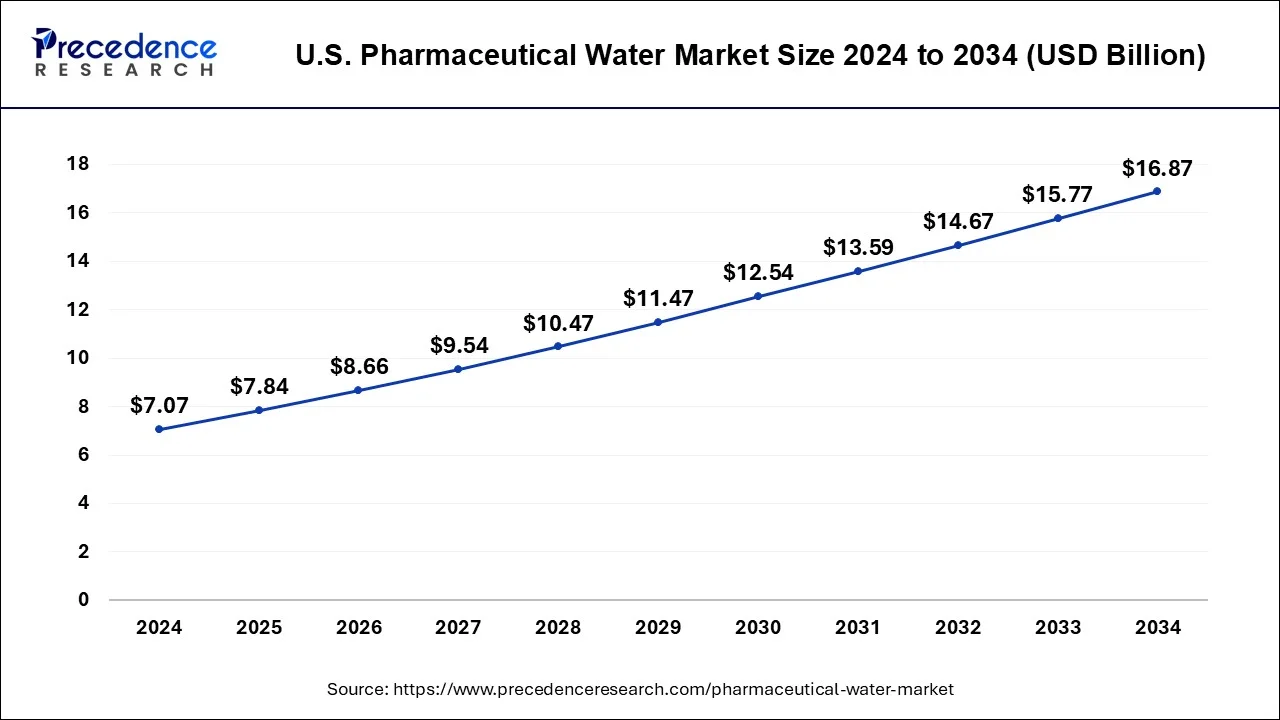

U.S. Pharmaceutical Water Market Size and Growth 2025 to 2034

The U.S. pharmaceutical water market size reached USD 7.84 billion in 2025 and is predicted to be worth around USD 16.87 billion by 2034, growing at a CAGR of 8.90% from 2025 to 2034.

North American Rapid Flow: Pharmaceutical Water Leadership

North America dominated the pharmaceutical water market with the largest share in 2024. This is mainly due to the rapid expansion of the pharmaceutical and biotechnology industries, heightened demand for generic injectables, growing innovations in genetic engineering, increasing R&D activities, stringent regulatory policies, increasing demand for outsourcing of pharmaceutical manufacturing, the surge in biologics and biosimilar production, and rapid adoption of advanced purification technologies.

The U.S. Pharmaceutical Water Market Trends

The U.S. is a major contributor to the market in the region due to the presence of a large number of pharmaceutical companies, the rise in collaboration or partnership among prominent market players, and the increase in investment by pharmaceutical companies in novel drugs. The increased burden of chronic diseases led to the increased production of biopharmaceuticals, such as proteins, vaccines, monoclonal antibodies, and plasma, that are extensively used to manufacture life-saving drugs. Several prominent market players operating in the region shifted their focus toward developing innovative water purification systems to enhance the quality of water.

Asia Pacific Surge in Pharma Water: Fastest Growing Position

Asia Pacific is anticipated to witness rapid growth in the pharmaceutical water market during the forecast period. This is primarily due to the increasing investments in establishing advanced healthcare infrastructure andexpansion of the biopharmaceutical sector. With the increasing prevalence of infectious diseases in the region, there is a significant rise in investments in injectable drugs. Rising number of clinical trials, increasing production of generic medicines, and increasing adoption of multi-parameter water quality testing further contribute to regional market growth.

China Pharmaceutical Water Market Trends

China is a major player in the regional market, driven by the country's strong pharmaceutical manufacturing sector and increased demand for high-quality water. China is a home for pharmaceutical production along with several companies setting up facilities for leveraging cost advantages. The expanding biopharmaceutical sector of the country is fueling innovations and developments of advanced low water purification technologies due to increased demand for high purity water in the production process. The government of China has implanted several policies for supporting the growth of pharmaceutical industry, such as regulatory policies and investments in healthcare infrastructure, which contribute to the market growth.

Purity by Design Focus: Boost European Pharma Water Leadership

Europe is a notable player in the global market due to its advanced healthcare infrastructure and growing demand for high-quality water. Europe is a strong and major hub for pharmaceutical manufacturing companies, regulatory enforcement by agencies like FDA and a high adoption of water purification technologies. The key trends, like technological integration of IoT and AI for process optimization and meeting with sustainable practices, contribute to this growth. European pharmaceutical companies are focusing on the adoption of sustainable and advanced technologies to meet with strict regulatory pressure and requirements like the EU's extended producer responsibility framework.

- The European Pharmacopoeia and the Pharmaceutical Waters Expert Committee (EPC) are the major regulatory frameworks of the European Union. They have officially replaced the older “oxidizable substances” test with the more sensitive Total Organic Carbon (TOC) test for water for injection (WFI) in 2025. The global pharmacopoeia harmonization has supported these changes with efforts and is being implemented by adapting the TOC test to provide a more accurate and sensitive measure of organic impurities in pharmaceutical water.

Germany Pharmaceutical Water Market Trends

Germany dominates the regional market due to its well-established healthcare infrastructure and robust pharmaceutical industry. The German Pharmaceutical industry have strong foreign investments fuels by high adoption of water purification technologies. The ongoing focus on sustainability with the adoption of energy-efficient water treatment systems further contributes to this growth. Additionally, the increasing health-conscious consumers is with strong investments by key players like Mark, Buyer AG, and Evoqua Water Technologies, solidifying the country's position in the global market.

Southward Bound: Key Trend in the Latin America's Pharmaceutical Water Industry

Latin America playing a significant role in the global market due to an increased pharmaceutical industry base and demand for high quality water across the region. The growing prevalence of chronic diseases, as well as the expanding biopharmaceutical sector driving innovations and the development of high-quality water purification technologies. A regulatory support and investments in healthcare infrastructure are the key trends to market growth. Government and private sectors are collaborating to invest in water infrastructure to enhance the region's production and water treatment capacities. Additionally, Latin America is experiencing significant investments and expansion by foreign companies in countries like Brazil, Mexico, Argentina, and Chile. For example, the investment of $600 million by AstraZeneca and Bayer for their Mexican operation in August 2025, expanding innovative efforts.

(https://pharma.economictimes.indiatimes.com)

Brazil Pharmaceutical Water Market Trends

Brazil is a major player in the regional market, driven by the country's advanced public health system and extensive pharmaceutical manufacturing base. Brazil saw an increase in investments in healthcare infrastructure. The Pharmaceutical industry of Brazil is expanding rapidly with the adoption of technologies for a major strategy by the pharmaceutical infrastructure for transparency.

- For instance, in April 2025, Novo Nordisk invested $1 billion in its Brazilian manufacturing operations. This investment is projected to expand the production capabilities of injectable drugs, particularly for diabetes and obesity. This facility is expected to expand operations by 2028.

https://pharma.economictimes.indiatimes.com

Middle East & Africa (MEA) Pharma Water: A Growing Landscape

The Middle East and Africa a significant players in the global market, driven by their increasing demand for high-quality water in pharmaceutical manufacturing. The Pharmaceutical industry in the Middle Eastern Africa is taking significant growth spread due to Saudi Arabia's leadership and government initiatives. Growing investments in healthcare infrastructure and a growing conscious consumer base have increased demand for high-purity water. The government has implemented several policies to support the growth of the pharmaceutical industry through investments in water treatment technologies in countries like Saudi Arabia, the United Arab Emirates, and Egypt. Additionally, the growing focus on sustainability and advancements in water purification technologies like reverse osmosis further contributes to this growth.

Saudi Arabia Pharmaceutical Water Market Trends

Saudi Arabia dominates the regional market, driven by the region's strong economy and strategic location. The country's focus on expanding its domestic pharmaceutical production for the reduction of import reliance is a key factors contributing to the growth. The public investment fund (PIF) has established Lifera in Saudi Arabia as a large-scale contract development and manufacturing organization (CDMO) to push the local biopharmaceutical industry. In October 2025, the novel oncology pharmaceutical facility and other facilities were inaugurated to establish new plans for specialized pharmaceutical-grade water for operations.

- In July 2025, Saudi Arabia invited Indian pharmaceutical companies for investing and partnering in its healthcare sector as part of Vision 2030 localization goals. In August 2025, the Embassy of India in Riyadh and Saudi Arabia's Public Investment Fund (PIF) organized a webinar to target Indian pharmaceutical and medical device manufacturers. (https://www.pharmabiz.com/NewsDetails.aspx?aid=180438&sid=1#)

Company Landscape for Baxter International: A Major Shareholder in Pharmaceutical Water Market

Company Overview

Corporate Information

- Headquarters: Deerfield, Illinois, USA

- Year Founded: 1931

- Ownership Type: Public company (NYSE: BAX)

History and Background

Baxter International began as a manufacturer of intravenous (IV) solutions and has grown into a global healthcare leader providing essential products across hospitals, clinics, and home care settings. Over the decades, the company has expanded through innovation and acquisitions, with a strong focus on pharmaceuticals, medical devices, and hospital products.

Key Milestones / Timeline

- 2023: Divested BioPharma Solutions business to focus on core medical and hospital segments.

- 2024: Expanded injectable pharmaceutical portfolio with multiple new product launches.

- 2025: Reported steady sales growth and announced new global investments in sterile fluid production.

Business Overview

Business Segments / Divisions

- Medical Products & Therapies

- Healthcare Systems & Technologies

- Pharmaceuticals

Geographic Presence

Operations span over 100 countries across North America, Europe, Asia-Pacific, and Latin America.

Key Offerings

- Sterile IV solutions and infusion systems

- Parenteral nutrition and injectable pharmaceuticals

- Connected care and monitoring technologies

- Water conservation and sustainable manufacturing initiatives

End-Use Industries Served

- Hospitals and surgical centers

- Home healthcare and renal care facilities

- Pharmaceutical manufacturing and compounding

Key Developments and Strategic Initiatives

Mergers & Acquisitions

- Divested BioPharma Solutions business in 2023 to streamline its portfolio.

Partnerships & Collaborations

- Engages in technology collaborations to enhance sustainability and smart hospital systems.

Product Launches / Innovations

- Introduced ten new injectable pharmaceuticals in 2024 to strengthen its portfolio.

Capacity Expansions / Investments

- Announced investment in Australian saline manufacturing facility in March 2025 to boost local production capacity.

Regulatory Approvals

- Secured multiple U.S. approvals for injectable products during 2024.

Distribution Channel Strategy

- Global direct sales network supported by distributor partnerships and e-commerce for hospital products.

Technological Capabilities / R&D Focus

Core Technologies / Patents

- Expertise in sterile manufacturing, fluid systems, and connected healthcare technology.

Research & Development Infrastructure

- Global R&D centers focusing on product innovation and process optimization.

Innovation Focus Areas

- Next-generation injectables, IV fluids, and sustainability-driven production technologies.

Competitive Positioning

Strengths & Differentiators

- Broad product portfolio serving critical healthcare sectors.

- Global footprint and well-integrated supply chain.

Market Presence & Ecosystem Role

- Leading supplier in hospital and infusion therapy markets.

SWOT Analysis

- Strengths: Diverse product range, global reach, sustainability focus.

- Weaknesses: Exposure to manufacturing disruptions.

- Opportunities: Expansion in emerging markets and specialty pharmaceuticals.

- Threats: Regulatory and supply chain risks.

Recent News and Updates

Press Releases

- Reported full-year 2024 results showing stable growth.

- Published annual corporate responsibility report in mid-2025.

Industry Recognitions / Awards

- Recognized for sustainability initiatives and manufacturing innovation.

Top Companies in the Pharmaceutical Water Market & Their Offerings

- Merck KGaA – specializes in offering comprehensive water purification systems, including the Milli-Q system and Elix and RiOs systems for highly sensitive analytical and bioprocessing applications and production of pure and reverse osmosis water, respectively.

- Braun Melsungen AG – Provides water-based infusion therapy products, like dextrose solutions and sodium chloride solutions, which uses high-quality water as a base treatement for conditions like dehydration and blood loss.

- Thermo Fisher Scientific, Inc. – Specialized in offering a broad range of water products and water purification systems for applications like research, laboratory, and manufacturing.

- Cytiva (Danaher) – provides water products, such as HyClone Cell Culture Grade Water, HyClone Molecular Biology Grade Water, and HyClone WFI Quality Water, specifically for cell culture applications and biomanufacturing applications.

- Fresenius Kabi AG – Offers sterile water for injections, sterile water for irrigation, and water for injection freeflex, which are based on high-purity water and standalone sterile water.

- Pfizer, Inc. – Laboratory technologies like high-performance liquid chromatography (HPLC) and mass spectrometry (MS) receives highly refined water from Pfizer for its commitment for analytical and research application standards.

- CovaChem, LLC – Provides high-purity water for pharmaceutical manufacturing, including USP water for injection (WFI), USP water for irrigation, and other grades of water.

- Intermountain Life Sciences – Works on state-of-the-art facilities for the production of cGMP-compliant water solutions, particularly for pharmaceutical manufacturing and laboratory applications.

Recent Developments

- In April 2024, Asahi Kasei began selling membrane systems to produce WFI (water for injection), a type of sterile water that is used for the preparation of injections. The membrane system was developed as an alternative to the conventional distillation processes for the production of WFI by leveraging system design and development capabilities of Microza hollow-fiber membrane for water treatment and filtration of liquid products.

- In May 2023, Xylem Inc., a US-based company that offers water technology, acquired Evoqua Water Technologies Corp. for an undisclosed amount. The acquisition is expected to strengthen Xylem's position in water technology, expand its product offerings, and drive innovation in water management solutions. Evoqua Water Technologies Corp. is a US-based company that specializes in providing advanced water treatment solutions tailored for the pharmaceutical industry.

- In 2025, AQU@Sense and a remote monitoring platform were demonstrated by CN Water, India's leading provider of high-purity water systems, at the Pharma Pro & Pack Expo 2025. AQU@Sense represents a hundred-year leap in microbial management, and CNtinel platforms offer manufacturers high visibility and control of water systems. These solutions are designed to redefine water operations for pharmaceutical manufacturing. (https://www.pharmabiz.com)

Pharmaceutical Water Market - Value Chain Analysis

- R&D: the pharmaceutical water industry requires research and development activities to focus on developing innovative water purification technologies, ensuring compliance with strict regulatory standards, and improving existing systems. RND enables the development of advanced water purification technologies and creates effective solutions for preventing biofilm formation.

- Clinical Trials and Regulatory Approvals: Clinical trials and regulatory approvals for pharmaceutical water play a crucial role in ensuring water use in pharmaceutical products to meet strict quality standards. Regulatory bodies like the United States Pharmacopoeia (USP), European pharmacopoeia (EP), and World Health Organization (WHO) it provides approval for pharmaceutical water products.

- Formulation and Final Dosage Preparation: for formulation and final dosage preparation of any medication, the pharmaceutical water plays a crucial role, enabling high-purity water, solvent properties, and controlling pH and buffering. This water is crucially in the final dose's preparation, like sterile products, non-sterile products, and final rains.

- Packaging and Serialization: Pharmaceutical water requires standard packaging and sterilization to meet quality standards. Container selection, closure system, and labelling are the prior packaging, also sterilization like validated sterilization methods validation, and aprogenicity, it's crucial.

- Distribution to Hospitals, Pharmacies: Pharmaceutical water undergoes a process of ensuring the water meets quality standards and proper handling before you distributed to hospitals and pharmacies. There are some regulatory complaints and standards like GMP guidelines and USB, and EP standards for pharmaceutical water quality to distribute and store.

- Patient Support and Services: companies offer several patient support and services for pharmaceutical water to ensure patients receive safe and effective water for medical treatment.

Major Market Segments Covered

By Type

- HPLC Grade Water

- Water for Injection

By Application

- Pharmaceutical & Biotechnology Companies

- Academics & Research Laboratories

By Geography

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- United Kingdom

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content