Vaccines Market Size and Forecast 2025 to 2034

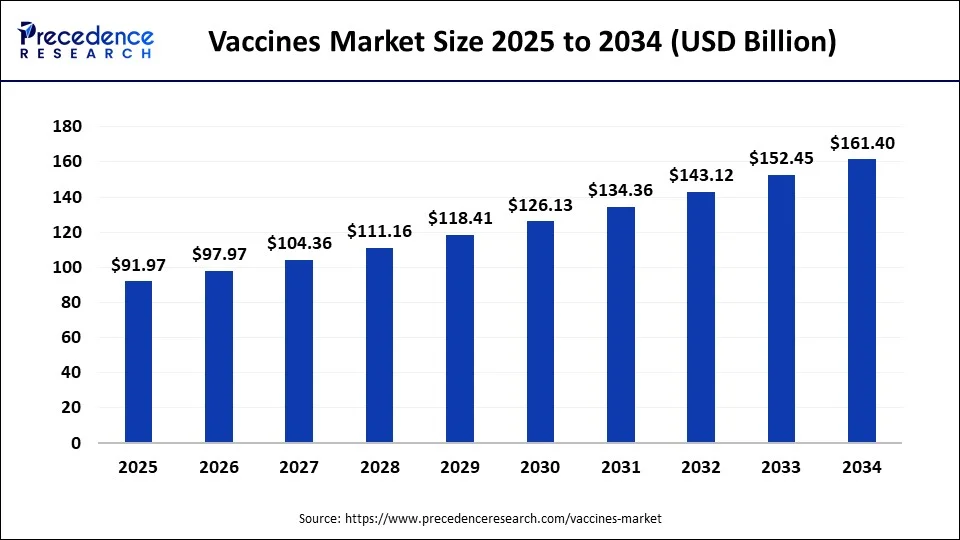

The global vaccines market size was estimated at USD 86.35 billion in 2024 and is predicted to increase from USD 91.97 billion in 2025 to approximately USD 161.4 billion by 2034, expanding at a CAGR of 6.69% from 2025 to 2034.

Vaccines Market Key Takeaways

- In terms of revenue, the global vaccines market was valued at USD 86.35 billion in 2024.

- It is projected to reach USD 161.4 billion by 2034.

- The market is expected to grow at a CAGR of 6.69% from 2025 to 2034.

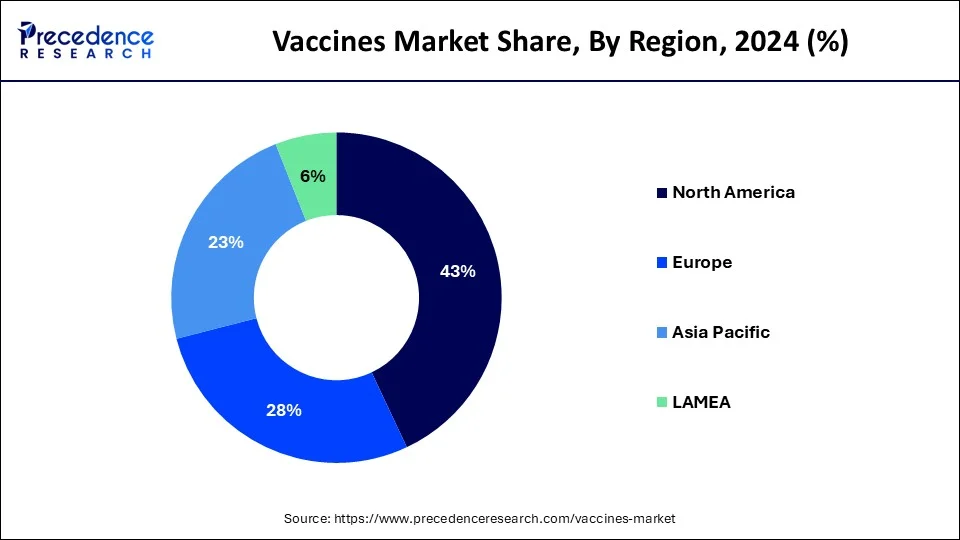

- North America led the market with the largest revenue share of 43% in 2024.

- Asia Pacific is projected to expand at the fastest rate during the forecast period of 2025-2034.

- By type, the recombinant/conjugate/subunit segment dominated the market in 2024.

- By route of administration, the parenteral segment dominated the market in 2024.

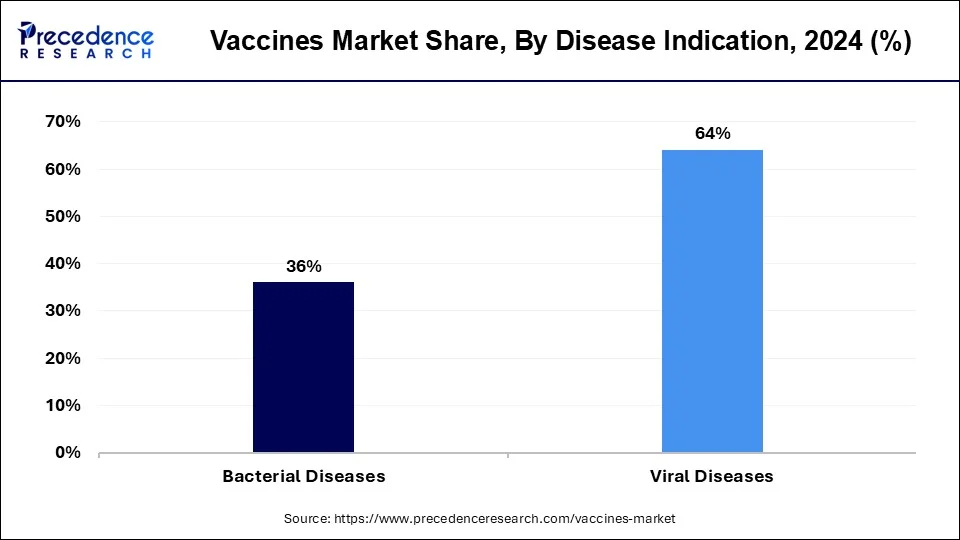

- By disease indication, the viral disease segment has held the major revenue share of 64% in 2024.

- By age group, the pediatric segment dominated the vaccines market in 2024.

- By age group, the adults segment is estimated to grow at the fastest rate during the forecast period.

- By distribution channel, the hospital and retail pharmacies segment held the dominating share of the vaccines market.

U.S. Vaccines Market Size and Forecast 2025 to 2034

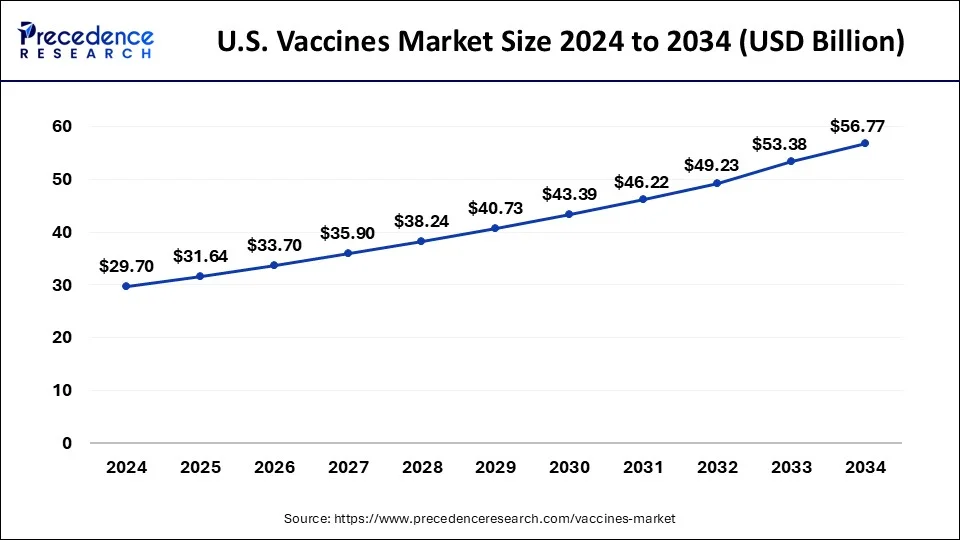

The U.S. vaccines market size was estimated at USD 29.7 billion in 2024 and is predicted to be worth around USD 56.77 billion by 2034 with a CAGR of 6.69% from 2025 to 2034.

North America led the market with the biggest market in 2024. North America continues to dominate the global vaccine market due to high healthcare expenditure, robust infrastructure, and extensive vaccination programs. Moreover, increasing investments in research and development, along with a favorable regulatory environment, contribute to the region's leadership in vaccine development and distribution. In the U.S., With the goal of assisting in lowering the burden of preventable infectious disease, the Office of Infectious Disease and HIV/AIDS Policy (OIDP) is in charge of the National Vaccine Program. It offers strategic leadership and coordination of vaccine and immunization activities among federal agencies and other stakeholders. The National Vaccine Plan and the National Vaccine Advisory Committee are included in this portfolio.

- In March 2025, MSD unveiled that it has opened a new USD 1 billion, 225,000-square-foot vaccine manufacturing facility at its site in Durham, North Carolina, U.S. The Investment in the new manufacturing plant strengthens Merck (MSD)'s vaccine production capacity in the U.S.

Asia-Pacific is expected to witness growth at a significant rate in the vaccines market during the forecast period of 2025-2034. Factors such as a large population base, rising awareness about preventive healthcare, and improving healthcare infrastructure are driving the growth of the market in this region. Additionally, initiatives by governments and international organizations to expand immunization programs further fuel market expansion in the Asia Pacific. As a result, the region is witnessing rapid advancements in vaccine manufacturing, distribution, and adoption, positioning it as a key player in the global vaccines market.

- In October 2024, Mylab and Serum Institute of India (SII) introduced Nasovac S4, India's inaugural needle-free nasal influenza vaccine. This live quadrivalent vaccine, in alignment with WHO guidelines, contains four influenza virus strains. Nasovac S4 will be distributed through healthcare providers and clinics nationwide.

Vaccines Market Overview

The vaccines market has experienced significant growth and evolution over the years, with increasing emphasis on preventive healthcare and advancements in biotechnology. This market encompasses a wide range of vaccines, including those for infectious diseases, chronic conditions, and emerging threats. From childhood immunizations to adult booster shots, vaccines play a crucial role in disease prevention and public health initiatives worldwide.

In recent years, the application of vaccines has expanded beyond traditional infectious disease prevention to include areas such as cancer immunotherapy and therapeutic vaccines for chronic conditions like HIV and Alzheimer's disease. This broader application reflects ongoing research and innovation in vaccine development, as well as a growing recognition of the immune system's potential in combating various diseases.

Additionally, the advent of mRNA technology has revolutionized vaccine development, enabling rapid responses to emerging threats like the COVID-19 pandemic. The vaccines market is characterized by a diverse landscape of players, including pharmaceutical companies, biotech firms, academic institutions, and government agencies. Competition within the market is fierce, driven by the need for efficacy, safety, and accessibility. Moreover, factors such as regulatory requirements, public health policies, and global health crises continue to shape the dynamics of the vaccines market, driving investment in research and development and fostering collaborations across sectors to address unmet medical needs and ensure equitable access to life-saving vaccines.

Vaccines Market Growth Factors

- As the global population grows and urbanizes, the prevalence of infectious diseases and chronic conditions rises, driving demand for vaccines as a preventive measure.

- Innovations such as mRNA technology, recombinant DNA techniques, and adjuvant development have enhanced vaccine efficacy, safety, and production efficiency, fostering vaccines market growth.

- Government initiatives, international organizations, and public health campaigns promote vaccination coverage, particularly in developing regions, fueling market expansion and addressing unmet medical needs.

- Outbreaks of novel pathogens stimulate investments in vaccine research and development, accelerating market growth to address evolving public health challenges.

Vaccines Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.52% |

| Market Size in 2024 | USD 86.35 Billion |

| Market Size in 2025 | USD 91.97 Billion |

| Market Size by 2034 | USD 161.4 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Route of Administration, Disease Indication, Age Group, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Vaccines Market Dynamics

Drivers

Vaccine advancements

Breakthroughs in vaccine technologies have revolutionized the vaccines market, leading to the development of novel platforms such as mRNA vaccines. This includes the groundbreaking success of mRNA-based vaccines, which have demonstrated remarkable efficacy and safety profiles. The versatility of mRNA technology allows for rapid vaccine development and production scalability, enabling a swift response to emerging infectious threats. Additionally, advancements in adjuvant technology and vaccine delivery systems have enhanced immunogenicity and efficacy, expanding the potential applications of vaccines beyond infectious diseases to include therapeutic and prophylactic treatments for chronic conditions and cancer immunotherapy.

- In December 2024, a biotechnology firm launched EasyFourPol, a fully-liquid wP-IPV-based pentavalent vaccine in India, safeguarding against diphtheria, tetanus, pertussis, polio, and Haemophilus influenza type B infections. Additionally, its subsidiary, Panacea Biotec Germany GmbH, registered Valganciclovir 50 mg/mL powder for oral solution in Germany, an inhibitor of cytomegalovirus DNA polymerase.

Global health security initiatives

The pandemic has underscored the critical importance of global health security and pandemic preparedness, prompting increased investments in vaccine research, development, and manufacturing capacities. International collaborations, public-private partnerships, and government-led initiatives have accelerated vaccine development timelines and facilitated equitable access to vaccines worldwide. Furthermore, heightened awareness of the interconnectedness of global health systems has spurred efforts to strengthen vaccine supply chains, enhance surveillance capabilities, and improve vaccine distribution networks, fostering resilience against future pandemics and driving sustained growth in the vaccines market.

Restraint

Regulatory hurdles and compliance challenges

The vaccines market faces significant regulatory hurdles and compliance challenges, which act as enduring restraints on its growth and development. Stringent regulatory processes, including clinical trial requirements and approval procedures, often prolong the time and increase the cost associated with bringing new vaccines to market. Additionally, complex manufacturing processes and quality control standards necessitate adherence to strict regulatory guidelines, further impeding market entry and expansion. Furthermore, vaccine hesitancy and misinformation contribute to public skepticism and compliance issues, affecting vaccination rates and market uptake. Addressing these regulatory hurdles and compliance challenges requires collaboration between industry stakeholders, regulatory bodies, and public health authorities to streamline processes, enhance transparency, and foster public trust in vaccination programs.

Opportunities

mRNA vaccine development

The emergence of mRNA vaccine technology presents a transformative opportunity in the vaccines market. Recent advancements in mRNA vaccine development, notably demonstrated by the success of COVID-19 vaccines, have opened new avenues for addressing infectious diseases, cancer immunotherapy, and other therapeutic applications. mRNA vaccines offer advantages such as rapid development timelines, scalability, and potential for tailored immune responses. This opportunity encourages investment in research and development, partnerships, and infrastructure to harness the full potential of mRNA technology in vaccine production and delivery. By capitalizing on this innovative approach, vaccine companies can diversify their portfolios, address unmet medical needs, and contribute to global health security.

- In January 2025, the U.S. Department of Health and Human Services (HHS) announced USD 590 million in support for Moderna to speed the development of mRNA vaccines against potential pandemic flu viruses and to better prepare the platform to respond to other emerging infectious diseases.

Vaccine equity and access initiatives

There is a growing emphasis on vaccine equity and access initiatives, driven by the need to address disparities in vaccination coverage and ensure fair distribution of life-saving vaccines. Recent global health crises have underscored the importance of equitable access to vaccines for all populations. Opportunities abound for vaccine manufacturers, governments, and international organizations to collaborate on initiatives aimed at improving vaccine access, particularly in underserved communities and low-income countries.

By investing in infrastructure, supply chain logistics, and affordability measures, stakeholders can enhance vaccine distribution networks, strengthen healthcare systems, and promote health equity worldwide. This opportunity aligns with sustainable development goals and fosters collaboration across sectors to address health disparities and promote universal healthcare access.

Type Insights

The recombinant/conjugate/subunit segment dominated the vaccines market with the largest share in 2024. Conjugate vaccines are highly effective against bacterial infections, particularly in infants and young children, by coupling a weak antigen with a strong one to enhance immune response. Recombinant vaccines utilize genetic engineering techniques to produce antigens, which are safer and easier to manufacture compared to traditional methods. Moreover, recombinant vaccines offer advantages such as scalability, reduced risk of contamination, and potential for rapid development against emerging pathogens. These qualities make them favored choices in addressing evolving public health challenges globally.

Route of Administration Insights

The parenteral segment dominated the vaccines market in 2024. Parenterally given medications have a quicker beginning of effect than those taken orally because they are absorbed more quickly. Unlike oral drugs, they are digested differently and have a larger effect since they do not go through the digestive processes that oral medications do in the gastrointestinal tract. In cases when patients are nauseous or unable to swallow, the parenteral route may also be recommended.

The oral segment also has a significant share of the vaccines market in 2024. Oral vaccines offer several advantages, including ease of administration, non-invasiveness, and enhanced patient compliance, especially in pediatric and resource-limited settings. These vaccines are administered orally, typically in the form of drops, capsules, or tablets, and are designed to stimulate mucosal immunity in the gastrointestinal tract. Oral vaccines are particularly effective against pathogens that infect mucosal surfaces, such as poliovirus and rotavirus, and they can elicit both systemic and mucosal immune responses, providing broader protection against infections. The convenience and efficacy of oral administration make these vaccines valuable tools in public health efforts to control infectious diseases.

Disease Indication Insights

The virus disease segment dominated the vaccines market with the largest share in 2024. Influenza vaccines remained vital in mitigating the annual burden of seasonal flu. With the co-circulation of influenza viruses alongside the SARS-CoV-2 virus, vaccination against influenza became even more critical to alleviate strain on healthcare systems and reduce the risk of concurrent COVID-19 and flu infections. Both COVID-19 and influenza vaccines played pivotal roles in public health strategies, highlighting the ongoing importance of vaccine development, distribution, and uptake in combating infectious diseases and safeguarding global health. In 2024, two disease segments that saw significant utilization were COVID-19 and influenza vaccines.

The COVID-19 pandemic prompted an unprecedented global effort to develop and deploy vaccines to mitigate its impact. COVID-19 vaccines became crucial tools in controlling the spread of the virus, preventing severe illness, and ultimately saving lives. Governments worldwide implemented mass vaccination campaigns to achieve widespread immunity and suppress transmission.

Age Group Insights

The pediatric segment dominated the vaccines market with the largest share in 2024. In the pediatric vaccine segment, advancements in immunization technology and increased awareness about the importance of childhood vaccinations have led to a surge in demand. Governments and healthcare organizations are focusing on expanding immunization programs to protect children against a wider range of diseases, driving growth in this market.

The adults segment is expected to show the fastest growth in the vaccines market during the forecast period. Similarly, in the adult vaccine segment, there's been a growing recognition of the importance of vaccinations in preventing diseases and reducing healthcare burdens. With the aging population and rising prevalence of chronic conditions, there's a greater emphasis on adult immunization to prevent vaccine-preventable diseases and improve public health outcomes.

Distribution Channel Insights

The hospital and retail pharmacies segment held the dominating share of the vaccines market in 2024. Hospitals and retail pharmacies have extensive networks that ensure widespread access to vaccines. Their established distribution channels make it easier to deliver vaccines efficiently and reach a broad population, including both urban and rural areas. Both hospitals and retail pharmacies administer a high volume of vaccinations. Hospitals handle routine immunizations for inpatients and outpatients, while retail pharmacies have become increasingly popular for administering vaccines due to their convenience and accessibility.

Vaccines Market Companies

- GSK plc

- Merck & Co Inc

- Pfizer Inc

- Sanofi

- CSL (Australia), Emergent

- Johnson and Johnson Services, Inc.

- Astrazeneca

- Serum Institute of India Pvt Ltd

- Bavarian Nordic

- Mitsubishi Tanabe Pharma Corporation

- Daiichi Sankyo Company, Limited

- Panacea Biotec

- Biological E Ltd.

- Bharat Biotech

- Novavax

- Inovio Pharmaceuticals

- Sinovac

- Incepta Pharma

- Valneva Se

- VBI Vaccines Inc

- Bio Farma

- FSUE NPO MICROGEN

- Zhi Fei Biological

- Indian Immunologicals Ltd.

Recent Developments

- In March 2024, Cadila Pharmaceuticals announced the launch of Cadiflu Tetra, a new quadrivalent influenza vaccine approved by the Drug Controller General of India (DCGI). This vaccine targets four strains of influenza virus subtypes A and B, providing protection against seasonal flu epidemics in both adults and children.

- In January 2024, Indian Immunologicals Ltd (IIL), a subsidiary of the National Dairy Development Board (NDDB), introduced Havisure, India's first domestically produced Hepatitis A vaccine.

- In December 2024, to boost Africa's vaccine manufacturing capacity, IFC announced a financing package for vaccine maker Institute Pasteur de Dakar (IPD) that will support the construction of a state-of-the-art, multi-vaccine production facility in Senegal. The facility can produce up to 300 million vaccine doses annually, supplying African markets with essential vaccines. The planned facility, known as the Manufacturing in Africa for Disease Immunization and Building Autonomy (Madiba) project, will be located in Diamniadio.

- In October 2024, GSK announced its plan to invest USD 800 million into its drug substance and product manufacturing capabilities at the company's Pennsylvania site. The investment is expected to create more than 200 new jobs. At the Marietta site, GSK will be able to manufacture sterile liquid vaccines and medicines, while also having the ability to manufacture medicines for clinical trials with its R&D pilot plant.

- In December 2024, IAVI, a nonprofit scientific research organization dedicated to addressing urgent global health challenges including HIV, tuberculosis, and emerging infectious diseases (EIDs), and the Institut Pasteur de Dakar (IPD), a non-profit foundation focused on equitable, sustainable, and affordable access to health in Senegal, Africa, and worldwide, have signed an agreement to formally collaborate for vaccine development, manufacturing, and access in Africa.

Segments Covered in the Report

By Type

- Recombinant/conjugate/Subunit

- Inactivated

- Live Attenuated

- Viral Vector

- mRNA

- Toxoid

- Others

By Route of Administration

- Parenteral

- Oral

By Disease Indication

- Viral Diseases

- Hepatitis

- Influenza

- Human Papillomavirus

- Measles/Mumps/Rubella

- Rotavirus

- Herpes Zoster

- Others

- Bacterial Diseases

- Meningococcal Disease

- Pneumococcal Disease

- Diphtheria/Tetanus/Pertussis

- Others

By Age Group

- Pediatric

- Adults

By Distribution Channel

- Hospital & Retail Pharmacies

- Government Suppliers

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content