What is Brucellosis Vaccines Market Size?

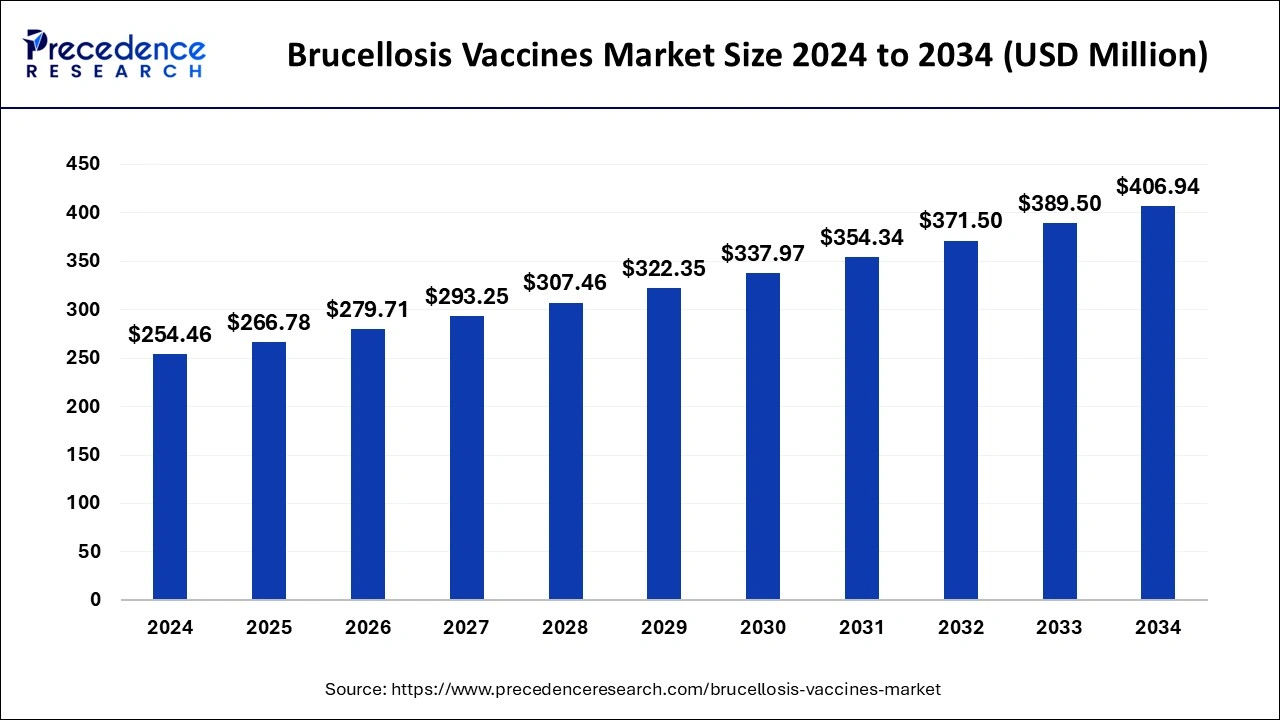

The global brucellosis vaccines market size was estimated at USD 266.78 million in 2025 and is predicted to increase from USD 279.71 million in 2026 to approximately USD 424.75 million by 2035, expanding at a CAGR of 4.76% from 2026 to 2035. This can be attributed to the rising incidence of brucellosis and vaccination campaigns. As more nations invest in their national vaccination programs, the potential for growth in this brucellosisvaccines market is expanding globally.

Market Highlights

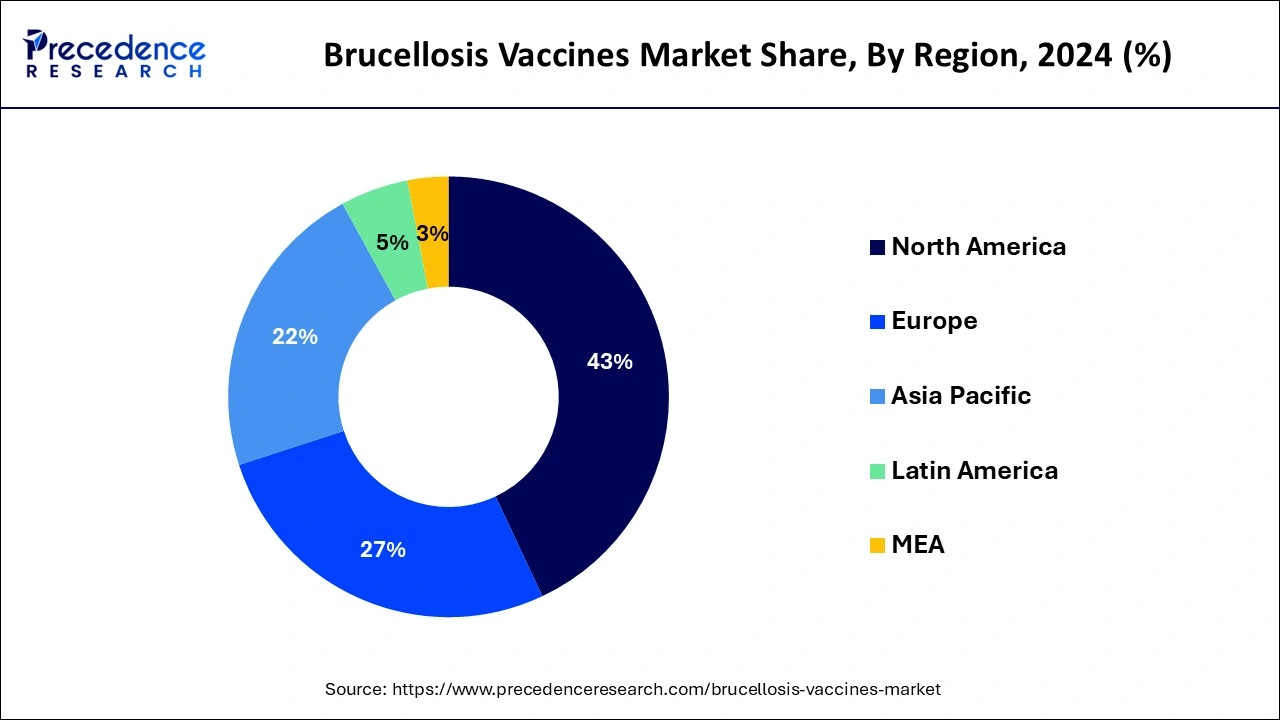

- North America has dominated the market with revenue share of 43% in 2025.

- By application, in 2023, the cattle segment has accounted 57% revenue share in 2025.

- By type, the RB51 vaccine segment dominated the market with revenue share of 43% in 2025.

- By Vaccine Type, the DNA Vaccines segment has captured 32.5% revenue share in 2025.

- By distribution channel, the public segment had the largest market share in 2025.

Market Overview

Brucellosis is a bacterial infection that can be transmitted from animals to humans. It typically spreads through the consumption of unpasteurized milk, contaminated food, and undercooked meat; the bacteria, known as Brucella, reside in the reproductive organs of infected animals, leading to infertility and miscarriages. Vaccination plays a crucial role in controlling bovine brucellosis, particularly in protecting cattle from infection and miscarriages. Different vaccine strains, such as RB51 and S19, are used to prevent brucellosis in animals like sheep, pigs, and cattle. However, it's important to note that the availability and usage of these vaccines may vary depending on the region due to ongoing research and regulatory approvals.

Brucellosis Vaccines Market Growth Factors

- The rise in demand for fish, milk, eggs, and animal protein is anticipated to drive brucellosis vaccines market growth in the future.

- Increasing awareness about various diseases and brucella vaccination benefits among most of the population is propelling the growth of the brucellosis vaccines market.

- The growing use of strategic agreements and acquisitions by key players is also expected to boost market growth.

- Ongoing research in the brucella vaccine sector is projected to fuel brucellosis vaccines market growth over the forecast period.

- The shift towards combination vaccines and the rising use of DNA vaccines can create further opportunities in the brucellosis vaccines market.

Market Trends

- Rising livestock populations: Increasing numbers of cattle, sheep, goats, and other farm animals are raising the need for vaccines to prevent brucellosis outbreaks.

- Government vaccination campaigns: Many countries run official programmes and offer subsidies for brucellosis vaccination, boosting demand.

- Advanced vaccine technologies: New vaccines are being developed to be heat-stable, DNA-based, and DIVA-compatible (allowing vaccinated animals to be distinguished from infected ones).

- Focus on small ruminants and diverse livestock: Attention is expanding beyond cattle to sheep, goats, and other animals that can carry brucellosis, opening more vaccine opportunities.

- Growth in emerging markets: Regions like Asia-Pacific, Latin America, and Africa are seeing increased vaccine adoption due to rising livestock farming and awareness.

- One Health and zoonotic prevention: Vaccinating animals helps prevent the disease from spreading to humans, making brucellosis vaccines an important public health tool.

- Distribution and affordability challenges: Cold-chain requirements, limited veterinary access, and cost issues can slow adoption, especially in rural areas.

- Combination vaccines: There is growing interest in vaccines that protect against brucellosis plus other livestock diseases, simplifying administration and increasing value for farmers.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 266.78 Million |

| Market Size in 2026 | USD 279.71 Million |

| Market Size by 2035 | USD 424.75 Million |

| Growth Rate from 2026 to 2035 | CAGR of 4.76% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, By Vaccine, By Application, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising global livestock population

The brucellosis vaccines market is thriving due to the increasing global livestock population. As the number of livestock grows, there's a greater need for effective vaccines to manage and prevent brucellosis in animals, which in turn drives market expansion. Government support and strict regulations mandating brucellosis prevention in livestock play an important role in driving market growth.

The enforcement of preventive vaccination programs and adherence to regulations significantly contribute to the market's growth. Furthermore, continuous advancements in vaccine development technologies, leading to improved efficacy and safety profiles, are boosting the market. Innovations in vaccine creation result in more efficient and reliable options, which can further foster market growth.

- In May 2022, Nagaland's animal husbandry and veterinary services department, under the aegis of the Nagaland Livestock Development Board (NLDB), officially launched the second phase of the National Animal Disease Control Vaccination Programme on Foot and Mouth Disease (NADCP).

Restraint

Limited accessibility in remote regions and funding for research

The brucellosis vaccines market faces challenges in reaching remote and underdeveloped regions due to limited accessibility. Infrastructure limitations make it difficult to distribute vaccines, hindering market growth in these areas. Additionally, insufficient funding for research and development in brucellosis vaccine technology is a barrier. This lack of financial resources hampers innovation and the introduction of better vaccines, impacting market growth. Moreover, public concerns and skepticism about vaccine safety could slow market growth. Transparent communication and thorough safety assessments are essential to address these concerns and ensure market success.

Opportunity

Efforts made by government and non-government organizations

Government and non-government organizations' efforts to raise awareness about animal health and diseases are driving growth in the brucellosis vaccines market. Many countries are implementing plans and guidelines for animal welfare while launching brucellosis vaccination programs for cattle and other animals. These initiatives are expected to have a positive impact on the market. Additionally, the introduction of the national livestock identification system (NLIS), which tags animals with radiofrequency identification devices, particularly benefits the cattle sector and contributes to the growth of the brucellosis vaccines market.

- In September 2022, The National Institute of Animal Biotechnology (NIAB) developed a new generation budget-friendly in-vitro diagnostic kit for brucellosis, an infectious zoonotic disease.

Segment Insights

Type Insights

The RB51 vaccine segment dominated the market in 2025. This can be linked to the high demand for the RB51 vaccine globally. The rising cases of brucellosis are anticipated to fuel the demand for the RB51 vaccine, which can drive the segment's growth. Moreover, robust preference and acceptance for RB51 vaccines over other vaccines within the market can also contribute to the market expansion.

The S19 segment is expected to show the fastest growth over the forecast period. The S19 vaccine protects cattle against the natural infection caused by Brucella melitensis. The diversity offered by this type of vaccine has enabled stakeholders and healthcare practitioners to address needs effectively.

Application Insights

The market for brucellosis vaccines witnessed a significant surge in the cattle segment, where it held a strong market position. This was mainly due to increased attention to bovine health and recognition of the economic impact of brucellosis in cattle. Cattle, being crucial globally, saw notable adoption of brucellosis vaccines, driven by heightened awareness among farmers and regulatory efforts promoting disease prevention. The high market share reflects the effectiveness and acceptance of brucellosis vaccines in protecting cattle herds, thus ensuring a more secure and sustainable livestock industry.

- According to the January 2022 report of the United States Department of Agriculture (USDA), there were about 91.9 million cattle and calves in the United States.

The sheep and goat segment is observed to grow at a significant rate during the forecast period in the brucellosis vaccines market. Ongoing research and development efforts have led to the development of improved brucellosis vaccines for sheep and goats. Modern vaccine formulations offer enhanced efficacy, safety, and ease of administration, making them suitable for use in diverse livestock production systems. The availability of advanced vaccines encourages widespread adoption and contributes to the expansion of the sheep and goat segment in the brucellosis vaccines market.

Brucellosis is a zoonotic disease, meaning it can be transmitted from animals to humans. The One Health approach emphasizes the interconnectedness of human, animal, and environmental health and advocates for collaborative efforts to address shared health challenges. Vaccinating sheep and goats against brucellosis not only protects animal health but also reduces the risk of human exposure to the bacteria, highlighting the importance of vaccination in both veterinary and public health strategies.

Vaccine Insights

The vector vaccines segment held a considerable share of the brucellosis vaccines market in 2025. Vector vaccines have the potential to provide long-lasting protection against brucellosis by inducing durable immune memory. Once administered, these vaccines can activate the immune system to recognize and respond to Brucella antigens upon subsequent exposure, thereby conferring sustained immunity against infection.

Vector vaccines offer flexibility in vaccine design and antigen selection, allowing for the incorporation of multiple Brucella antigens or genetic modifications to enhance vaccine efficacy. This versatility enables researchers to tailor vector vaccines to target different Brucella species or strains prevalent in specific geographical regions, optimizing vaccine effectiveness and coverage.

Distribution Channel Insights

The public segment had the largest share of the brucellosis vaccines market in 2025, mainly because more people visited veterinary clinics and hospitals to diagnose and treat brucellosis in animals, both in developed and developing countries. Additionally, government and non-governmental organizations are increasing awareness about animal health, welfare, and disease prevention through various programs, which is expected to further boost the segment's growth in the future. As the market continues to evolve, changes in the distribution landscape are expected, influenced by factors like consumer preferences, technological advancements, and strategic partnerships.

Regional Insights

What is the U.S. Brucellosis Vaccines Market Size?

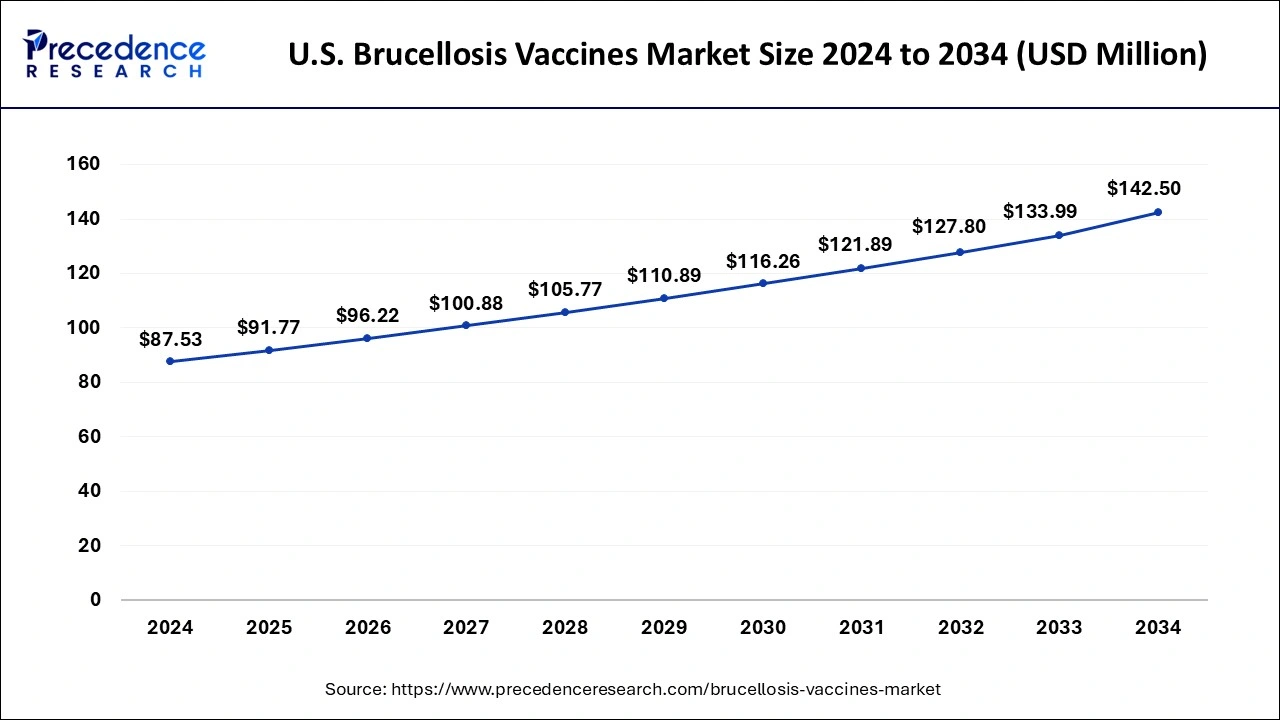

The U.S. brucellosis vaccines market size is surpassed USD 91.77 million in 2025 and is expected to be worth around USD 149.46 million by 2035 at a CAGR of 5% from 2026 to 2035.

North America dominated the brucellosis vaccines market share in 2025. This strong performance is due to several factors unique to the region's landscape. North America experiences a higher incidence of brucellosis compared to other continents, leading to a significant demand for vaccines as a preventive measure, which in turn drives market growth.

The region's advanced veterinary healthcare infrastructure, including well-established research and development facilities and sophisticated diagnostic capabilities, has also played a crucial role in shaping the market. These factors have facilitated the production and adoption of advanced Brucellosis vaccines, contributing to North America's leading position in the brucellosis vaccines market.

Asia Pacific is projected to experience the highest growth rate during the forecast period. This is driven by a strong demand for brucellosis vaccines in the region over recent decades, fueled by a large consumer base and growing awareness about the vaccine among them.

- In September 2023, a significant development in China's efforts to combat bovine brucellosis occurred. The country's Ministry of Agriculture and Rural Affairs expanded its approval for the Bovine Brucellosis S-19 Immunogen vaccine. This decision allows for the vaccine's use in larger-scale control programs, with the ambitious goal of eradicating brucellosis from Chinese cattle herds by 2030. This regulatory approval is poised to drive substantial demand for the vaccine within the Chinese market.

What are the Advancements in the Brucellosis Vaccines Market in Europe?

Europe is witnessing significant growth in the market. Rising awareness among farmers and veterinarians regarding the economic and health impacts of brucellosis has led to higher vaccination rates. The region also benefits from streamlined approval processes for vaccines and veterinary products, which leads to faster market entry and adoption. Supportive EU policies and funding support for brucellosis control programs also help in promoting vaccination efforts.

Germany Brucellosis Vaccines Market Trends

Partnerships between European research institutions and pharmaceutical companies in the country boost development efforts for next-generation vaccines. Strict regulations also ensure vaccine safety and efficacy. Growth is further supported by increasing awareness of zoonotic disease prevention, stronger livestock health programs, and the country's strategic position within Europe, which enhances both domestic use and export potential.

What are the Key Trends in the Brucellosis Vaccines Market in Latin America?

Latin America is expected to witness substantial growth in the market. This growth and development is driven by the rising incidence of brucellosis in livestock-dependent economies and increased human exposure to infected animals and animal products. Expanding screening programs and advancements in laboratory infrastructures help enable a higher diagnosis rate. The adoption of advanced serological and molecular diagnostic tools is also boosting early disease detection efforts in the region.

Brazil Brucellosis Vaccines Market Trends: Improved diagnostic capabilities are enabling earlier detection of brucellosis across both endemic and emerging regions. Growing livestock populations and intensive animal farming practices are also increasing disease transmission risks, further pushing the market.

How is the Middle East and Africa Region Growing in the Brucellosis Vaccines Market?

The Middle East and Africa are set to witness steady market growth throughout the forecast years. The growing demand for antibiotic-based treatment regimens and supportive therapies are contributing to this region's market expansion. Additionally, health organizations and government-led eradication programs are optimizing disease surveillance and boosting development. Improved diagnostic capabilities are also helping in enabling earlier detection across various countries like South Africa, the UAE, and Saudi Arabia.

Saudi Arabia Brucellosis Vaccines Market Trends

The country is witnessing growth due to strengthened collaborations between veterinary and human healthcare systems. Increased investments in research for novel therapies and vaccines are gaining traction, boosting the market even more.

Value Chain Analysis of the Brucellosis Vaccines Market

- Raw Material Sourcing

This stage deals with the sourcing of raw materials, antigens, and culture media, which are required to produce vaccines such as brucella strains, stabilizers, adjuvants, and pharmaceutical-grade recipients.

Key Players: CZ Vaccines, Bioveta, Vetal - Manufacturing Process

This stage includes controlled fermentation, attenuation, formulation, and lyophilization of live vaccines. Quality control includes potency testing, sterility, and batch consistency.

Key Players: Hester, Bioveta, Ceva Sante Animale - Distribution Process

Once manufactured and tested, these vaccines are distributed mainly through government veterinary services, livestock health programs, and authorized distributors.

Key Players: Zoetis, Indian Immunologicals, Onderstepoort Biologics

Brucellosis Vaccines Market Companies

- Merck & Co.

- CZ Vaccines

- Colorado Serum Company

- Indian Immunologicals

- Hester Biosciences

- Veterinary Technologies Corporation

- Laboratorios Tornel

- Five Animal Health

- VETAL Animal Health Products Inc.

Recent Developments

- In March 2024, Boehringer Ingelheim, a renowned player in the animal health sector, collaborated with Square Pharmaceuticals to launch Aftovaxpur in Bangladesh. This advanced foot-and-mouth disease (FMD) vaccine is specifically formulated for ruminants, including cattle and sheep, aiming to enhance livestock health in the region.

- In October 2023, Zoetis, a leading animal health company based in the US, made headlines by acquiring Semex, a Canadian company specializing in bovine genetics and reproductive technology. This strategic move aims to bolster Zoetis' standing in the cattle health market, particularly by enhancing its brucellosis vaccine offerings. The acquisition brings valuable expertise and a robust distribution network from Semex, strengthening Zoetis' position in cattle breeding management.

- In April 2023, Cornell University College of Veterinary Medicine (CVM) scientists researched and developed a novel diagnostic test to identify Brucella canis. This test helps in the early diagnosis of this zoonotic disease, which can spread to humans through contact with infected dogs. This will boost vaccination over time.

- In July 2023, A notable development came from Hester Biosciences, an animal health company in India, with the launch of a new oral brucellosis vaccine for cattle. This innovative vaccine, based on the Brucella Abortus B19 strain, offers a more convenient and potentially cost-effective alternative to traditional injection-based vaccines. The introduction of this oral vaccine could open up new market segments, particularly in regions with limited resources, such as India.

Segments Covered in the Report

By Type

- Rbs1 Vaccine

- S19 Vaccine

- Others

By Vaccine

- DNA Vaccine

- Subunit Vaccine

- Vector Vaccine

- Recombinant Vaccine

By Application

- Cattle

- Sheep & Goat

- Others

By Distribution Channel

- Veterinary Hospitals & Clinics

- Retail Channels

- Public

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting