What is the Laboratory Equipment Market Size?

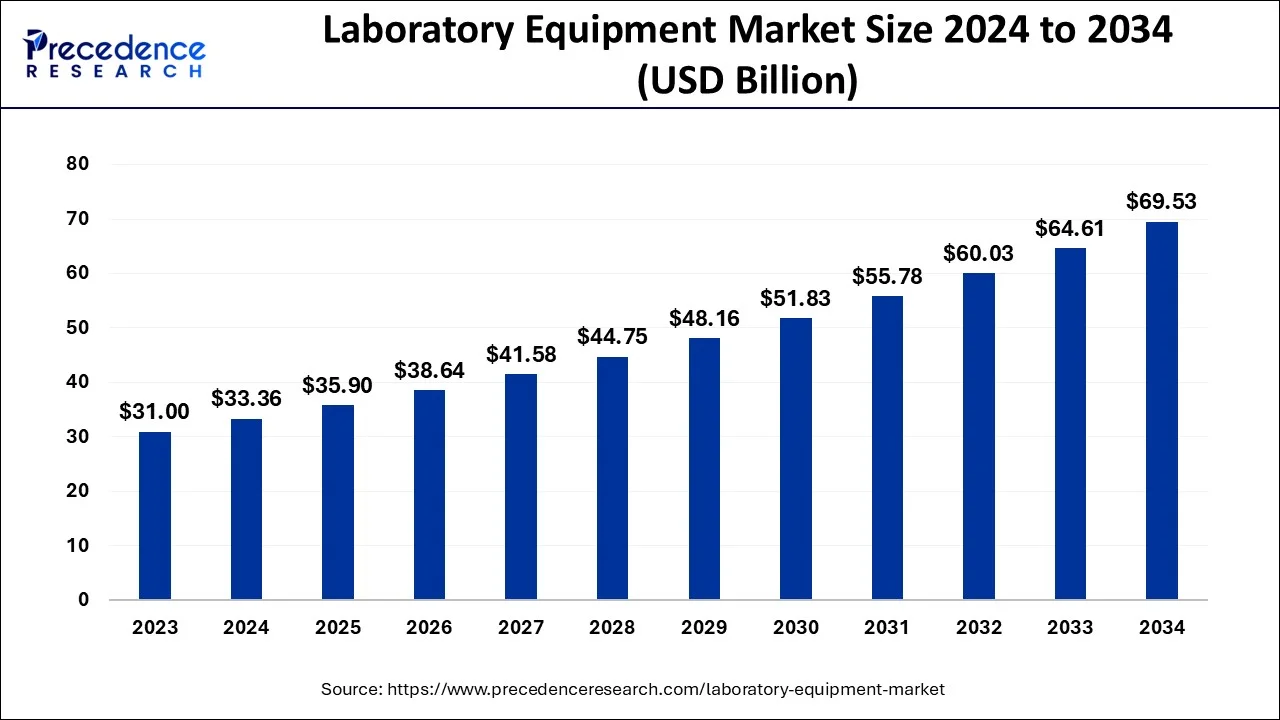

The global laboratory equipment market size is estimated at USD 35.90 billion in 2025 and is predicted to increase from USD 38.64 billion in 2026 to approximately USD 74.22 billion by 2035, expanding at a CAGR of 7.53% between 2026 to 2035.

Key Takeaways

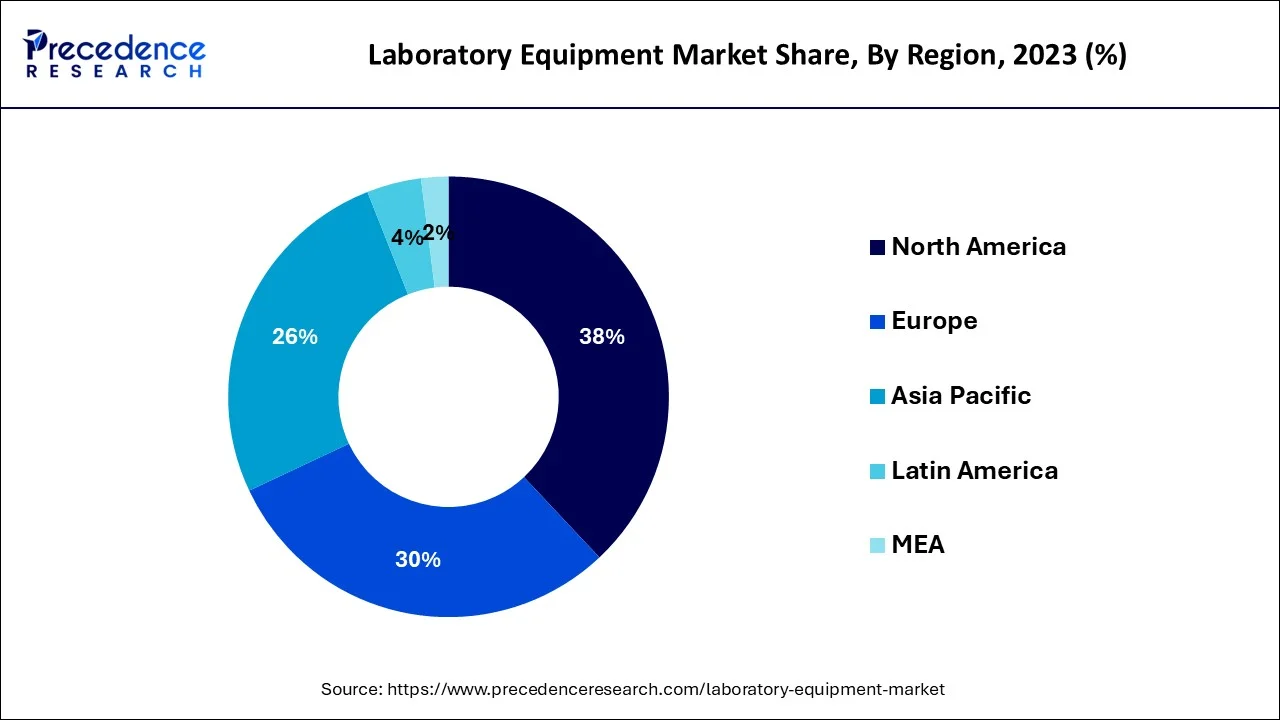

- North America dominated laboratory equipment market in 2025.

- By equipment type, the specialty-equipment segment dominated the market in 2025.

What is Laboratory Equipment?

The gadgets and tools experts and students use while working in a laboratory are called laboratory equipment. Laminar flow hoods, centrifuges, incubators, scopes, micromanipulation systems, homogenizers, sterilizers, and autoclaves are some of the equipment. Laboratory disposables, on the other hand, are one-time-use devices that assist in keeping labs clean.

Some disposables frequently used during clinical testing include tubes, cuvettes, dishes, gloves, masks, pipettes, and tips. Since they help to increase testing efficiency and prevent laboratory accidents, laboratory supplies and disposables are frequently used to store, collect, and process specimens. In order to conduct research, conduct scientific experiments, and carry out analyses of various scientific materials, they find extensive uses in clinical diagnostic, pathology, research, microbiology, and educational labs.

This study thoroughly discusses the global laboratory equipment market's strengths. The study includes a summary of dynamics, segmentation, essential players, geographical analysis, and other crucial elements. The study also thoroughly analyzes the worldwide Laboratory Equipment Market forecast through 2032.

How is AI contributing to the Laboratory Equipment Industry?

Laboratories equipped with AI will benefit in many ways: they will be able to do hard work like a human, make predictions about the time the machine needs maintenance, and give better explanations of the data. The process of conducting research, for example, is made much easier by the use of intelligent triage that allows for the instant integration of real-time monitoring and the prompt detection of errors, all of which enhance the overall accuracy of the laboratory.

AI, in fact, has a very positive impact on the diagnostics sector since it is able to provide insights into the treatment of certain patients by mediating between the data generated from various sources, recognizing the presence of pathogens, and finally offering insights for such individualized treatment.

Laboratory Equipment Market Growth

The increase in funding and investment in R&D activities in the pharmaceutical and biotechnology industries is a significant factor driving the market. Due to the consistent and reliable supply of laboratory equipment, the market is anticipated to expand steadily over the next few years. Research on coronaviruses has increased as a result of the COVID-19 pandemic. However,

the main objective of the lockdown was to avoid close contact with others, labs investigating other diseases before the pandemic were closed, which resulted in low demand for lab materials. Numerous academics have claimed that prolonged and extensive shutdowns substantially impacted the speed of other scientific advancements, according to Stat News. The need for lab supplies is increasing as a result of developments in technology in the fields of chemical and biological research.

The rising number of life science research studies and clinical laboratory testing drives the need for disposable laboratory products. The market is also anticipated to experience a rise in demand from procurement managers in the pharmaceutical and healthcare industries for a steady supply of essential laboratory tools and equipment.

All kinds of research facilities are in desperate need of better safety protocols. In addition to cups, beakers, and test tubes, there are a variety of other safety and preventive items used in laboratories. Throughout the research, the integrity of a specific study must be upheld. It is realistic to assume that, as a result of the considerations above, the global market for laboratory equipment and disposables will generate substantial sums of money in the coming years. The existence of a high-end medical research facility has also facilitated market expansion.

Market Outlook

- Industry Growth Overview:

Increasing scientific research is worldwide; thus, the market is growing with the adoption of improved diagnostics, and more and more labs are upgrading. - Sustainability Trends:

An operational framework based on environmental awareness and energy-efficient instruments, recycling materials, and the like, is also through sustainability. - Global Expansion:

The world is getting smaller, and research in developing countries is getting more and more diverse, supported by the use of advanced laboratory instruments that not only accelerate the improvement of technology but also accelerate its use of technology. - Major investors:

Thermo Fisher Scientific, Agilent Technologies, Danaher Corporation, and Bio-Rad Laboratories are the main beneficiaries of the innovation, investment, and strategic laboratory expansion at the forefront.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 35.90 Billion |

| Market Size in 2026 | USD 38.64 Billion |

| Market Size by 2035 | USD 74.22 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.53% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Equipment Type, By Contract Type and By Service Provider |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Market Drivers

The rising frequency of numerous infectious diseases worldwide is leading to an increase in clinical diagnostic procedures, further propelling the industry. Diseases like AIDS, TB, and hepatitis are treated and diagnosed using laboratory supplies and equipment, including homogenizers and spectrophotometers. In line with this, the market expansion is aided by the rising demand for better safety protocols across all research facilities.

By lowering the risk of exposure to toxic and corrosive substances, flammable solvents, high-pressure gases, explosive compounds, and harmful germs, laboratory supplies and disposables contribute to the market's expansion. In addition, several product improvements, including the release of eco-drying glassware, biological safety cabinets, and sustainable and eco-friendly equipment, are boosting the market growth.

The market is predicted to be influenced by several other factors, such as significant research and development (R&D) efforts, improved diagnostic capabilities, and the implementation of numerous government initiatives to set up hospital laboratories.

Market Restraints

With the integration of cutting-edge technology to boost productivity and efficiency, laboratory equipment services are now more expensive. Throughout the forecast period, rising laboratory equipment costs are anticipated to restrain the development of the global market for laboratory equipment services. This aspect is projected to significantly negatively affect the market potential for laboratory equipment services in the developing world.

The industry's main obstacle is the move away from laboratory-based diagnosis and toward point-of-care diagnostics. Inadequate laboratory infrastructure exists in emerging and developing countries.

Market Opportunities

The vendor environment is defined by the numerous suppliers' usage of effective business strategies to compete in the laboratory equipment market outlook. Due to the market's extreme fragmentation, manufacturers must use organic and artificial growth tactics to remain competitive. Market participants should concentrate on the development potential in the fast-growing categories while retaining their presence in the slow-growing varieties to optimize opportunities and recover from the post-COVID-19 effect.

To conduct tests and conduct research, laboratories need several tools. General lab technology is used in research, education, clinical labs, quality control, R&D, marketing, and other sectors. By utilizing laboratory technology, analyses can be completed more quickly, boosting the laboratory's value by enabling it to do more daily tests. As a result, expenditures for materials, upkeep, legal documentation, and overall expenses might be lowered.

Segment Insights

Equipment Type Insights

Based on the kind of equipment used, the market is segmented into Specialty Equipment, General Equipment, Analytical Equipment, and Others. The upgrading of laboratories resulted in a broad scope for the specialty-equipment market. The specialized instruments produce findings that are precise and timely. Time will be saved by using this equipment.

An electric current is used in the gel electrophoresis to separate DNA, RNA, or proteins in an agarose gel. Systems for horizontal and vertical gel electrophoresis, chemicals, imaging systems, and power sources are all included in the electrophoresis apparatus. The market is growing due to the segment's capacity to provide quick results at a reasonable price.

Contract Type Insights

Based on the type of contract, the market is split into two categories: customized and standard service contracts. A standard service contract is a legally binding agreement between two parties that cannot be altered, accepted, or rejected. The Standard Service Contract presents a unique opportunity for a large company to take advantage of a person's weakness by imposing on him terms that mimic private legislation and may even release the company from all liability under the contract. Thus, the future of the essential service was quite promising.

Service Provider Insights

Depending on the kind of service provider, the market is segmented into OEMs, Third-party Service Providers, and Others. The OEM segment outperforms the others in terms of growth. Companies that produce their equipment and sell it in a variety of ways. Customers can readily obtain information and buy things thanks to the internet.

Regional Insights

What is the U.S. Laboratory Equipment Market Size?

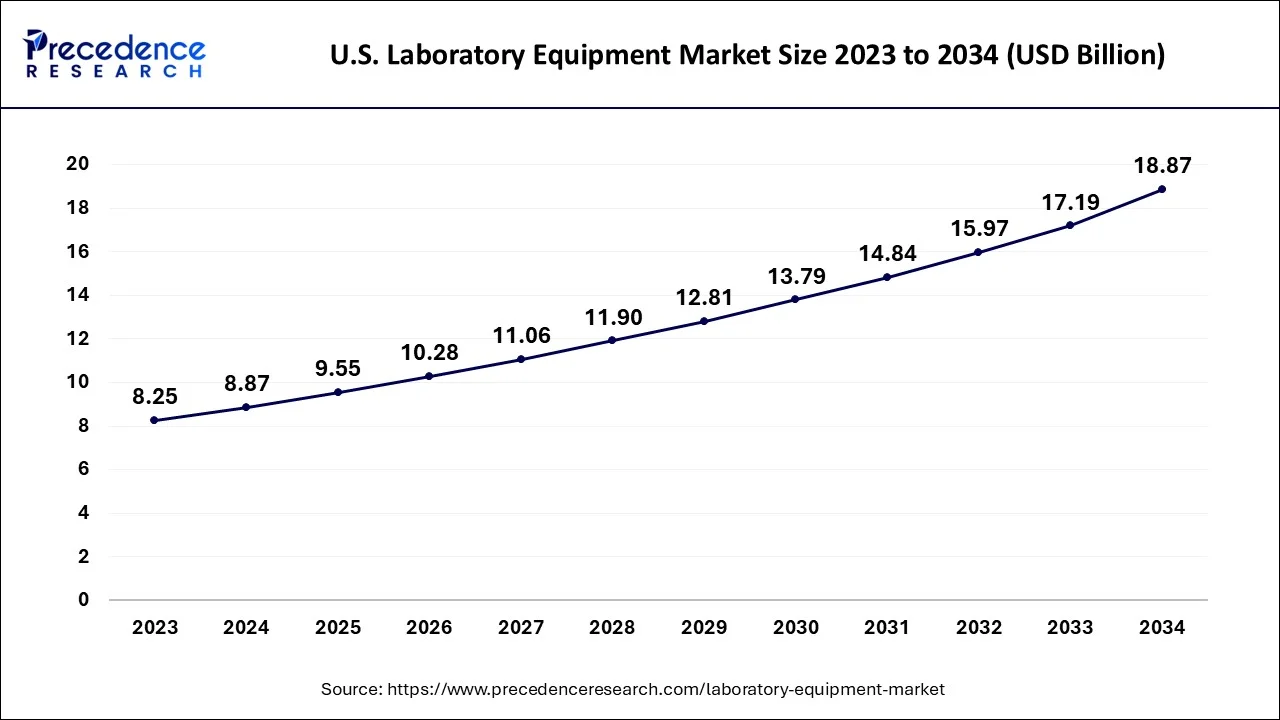

The U.S. laboratory equipment market size is accounted for USD 9.55 billion in 2025 and is expected to be worth around USD 20.24 billion by 2035, growing at a CAGR of 7.80% between 2026 to 2035.

North America accounted for the largest share in 2023.This is explained by the existence of numerous pharmaceutical and biopharmaceutical companies actively involved in R&D. Additionally, a rise in grants from government institutions, such as the National Institutes of Health (NIH), to advance research initiatives is projected to promote market expansion.

U.S. Laboratory Equipment Market Trends

The U.S. is at the forefront of the world by means of heavy research funding, quick adoption of technology, and the gradual modernization of laboratories. Automation and digitization are the main factors that create new markets besides personalized medicine, diagnostics, and analytical workflow for those who are working in the academic, clinical, and industrial sectors.

It is anticipated that additional investments in research will be attracted during the projected period due to the caliber and track record of companies that have operated in the region. Regarding funding research, the biopharmaceutical sector ranks among the top industries in the area. Many businesses concentrate on creating fresh leads and have a ton of samples on hand, which increases demand for these goods. Due to the coronavirus outbreak, numerous companies are also working to create treatments and vaccines, helping the market expand.

In terms of growth, the Asia Pacific region dominates the global market for laboratory equipment and is predicted to develop at the quickest CAGR through 2032. The demand for research and development activities is expected to continue to grow, which will, in turn, fuel the market potential for laboratory equipment over the projection period. Through 2032, India and China are anticipated to be the two biggest markets in this area.

How is Asia-Pacific Performing in the Laboratory Equipment Market?

The Asia-Pacific area is on a rapid development wave due to the growing awareness of health, the enlargement of research facilities, and the more extensive use of laboratory technologies that are cost-effective. The governments in the region are creating a favorable environment for modern equipment to be used in the areas of diagnostics, academia, pharmaceuticals, and industry.

Chin/India Laboratory Equipment Market Trends

China and India are the leading forces in the pharmaceutical research sector as they continue to spread their momentum through the patient flow, lab establishment, and diagnostics investment. Fashionable equipment demand, research infrastructure improvements, and competent technologically equipped centers for varied support are some of the major factors that are creating new opportunities.

What are the Driving Factors of the Laboratory Equipment Market in Europe?

Europe has a very strong healthcare system and research institutions that give the continent a massive market share. The alignment of the regulatory systems allows the laboratories to maintain the same high quality and to move towards more and more energy-efficient and automated systems that are of the highest level for testing, thus making the invention and the precision of the analysis even more reliable in different sectors like clinical and industrial.

Germany Laboratory Equipment Market Trends

Germany is characterized by quality control that is very much relied upon, and this culture of innovation is what keeps the country going. The R&D labs are dynamically active, and the initiatives are positive that automated, energy-efficient instruments are being adopted that, in turn, are making labs more productive and facilitating the further integration of advanced technologies in the scientific and medical fields.

Laboratory Equipment Market-Value Chain Analysis

- R&D: The research and development (R&D) process introduces and brings into existence the new laboratory equipment through scientific research, testing of innovations, and the discovery of potential technological breakthroughs.

Key Players: Thermo Fisher Scientific, Danaher - Clinical Trials and Regulatory Approvals: Conducting clinical trials and getting approval to use the equipment commercially are among the most important steps that the laboratory has to go through to ensure equipment safety, validate performance, and obtain authorization from the regulatory authorities.

Key Players: Laboratory Corporation of America (LabCorp), Eurofins Scientific - Formulation and Final Dosage Preparation: In the formulation and final dosage preparation, the necessary components are combined, and the final product is made either through the ready-to-use laboratory tools or through the consumable formats.

Key Players: Sartorius, Merck KGaA - Packaging and Serialization: Packaging and serialization are the steps that take place after the finalization of the equipment, and they are in charge of assigning the identifiers for traceability, protecting the equipment, and supporting effective quality control and inventory management.

Key Players: West Pharmaceutical Services, Gerresheimer - Distribution to Hospitals, Pharmacies of Electronic Health Record Software: The distribution of laboratory equipment to hospitals and pharmacies is done in such a way that there is no delay in the delivery, and proper logistics coordination is ensured.

Key Players: McKesson, Cardinal Health

Laboratory Equipment Market Companies

With a focus on the global market and some of the key players like Danaher Corporation , Eppendorf AG , Waters Corporation, Thermo Fisher Scientific Inc., Agilent Technologies, Siemens Heathineers, PerkinElmer, Inc., Pace Analytical Services, Inc., Bio-Rad Laboratories, Inc., and Becton, Dickinson, and Company, the "Global Laboratory Equipment Market" study report will offer helpful insights.

- Danaher Corporation: Danaher has a large selection of life science and diagnostic equipment, which includes available solutions for microscopy, flow cytometry, and mass spectrometry.

- Eppendorf AG: Eppendorf has a range of products and solutions for liquid, cell, and sample handling, including pipettes, centrifuges, bioreactors, and consumables.

- Waters Corporation: Waters is providing analytical instruments for the entire range of experimental processes, including chromatography, mass spectrometry, and laboratory automation.

Recent Development

- In October 2025, Copia Scientific unveiled a new brand identity, emphasizing accessibility, sustainability, and reliability in laboratory science. Amid a slowing lab automation market, Copia aims to enhance efficiency while addressing tighter budgets and increasing quality demands.

(Source: https://www.businesswire.com/ ) - In March 2022, Under the Dynamica brand, Precisa Gravimetrics AG unveiled their Halo line of very advanced UV-Vis spectrophotometers, model number GB 30.

- INTEGRA Biosciences introduced the D-ONE single-channel pipetting module in February 2021 for hands-free transfers from individual tubes or wells utilizing the ASSIST PLUS pipetting robot. This device efficiently automates tiresome activities like serial dilutions, sample normalization, hit selecting, or pipetting of intricate plate layouts, boosting lab efficiency and repeatability while lowering manual labor, processing errors, and physical strain.

Segments Covered in the Report

By Equipment Type

- Specialty Equipment

- General Equipment

- Analytical Equipment

- Others

By Contract Type

- Customized Service Contract

- Standard Service Contract

By Service Provider

- Third-party Service Providers

- OEMs

- Other

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting