What is the Laboratory Informatics Market Size?

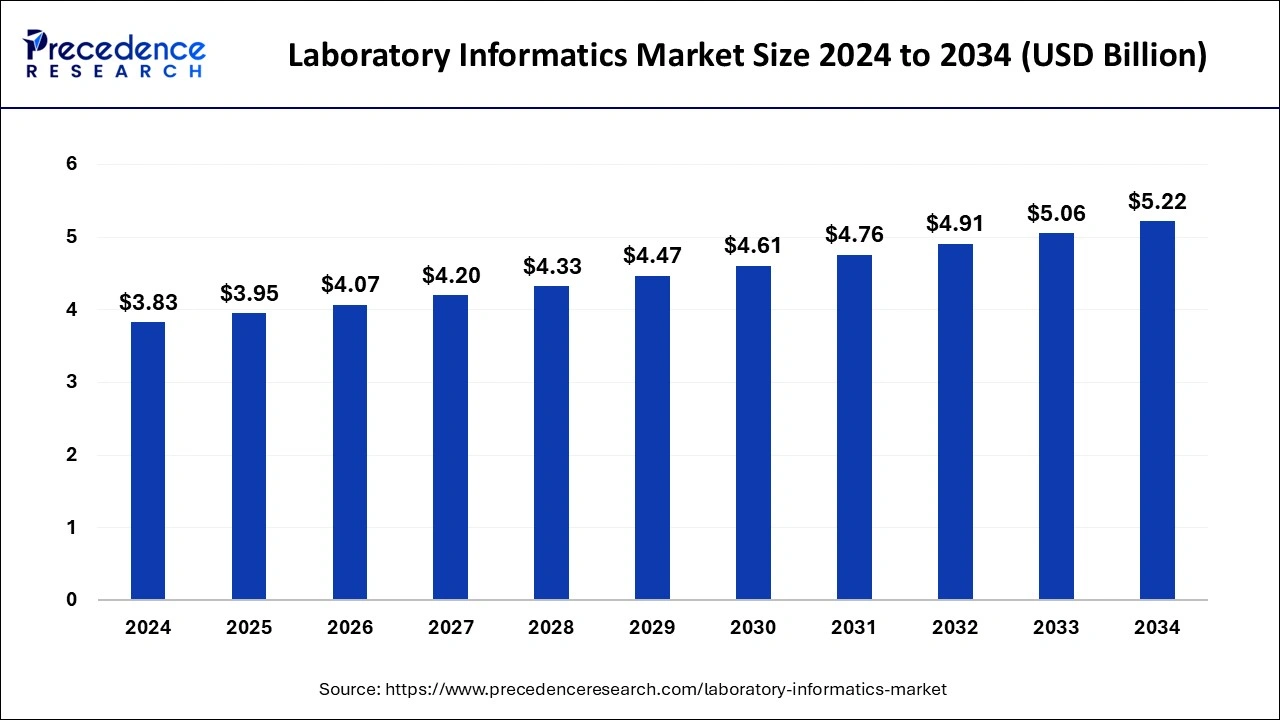

The global laboratory informatics market size is calculated at USD 3.95 billion in 2025 and is predicted to reach around USD 5.22 billion by 2034, expanding at a CAGR of 3.14% from 2025 to 2034. The rising adoption of advanced technologies in laboratories and the growing focus on laboratory automation boost the growth of the market.

Market Highlights

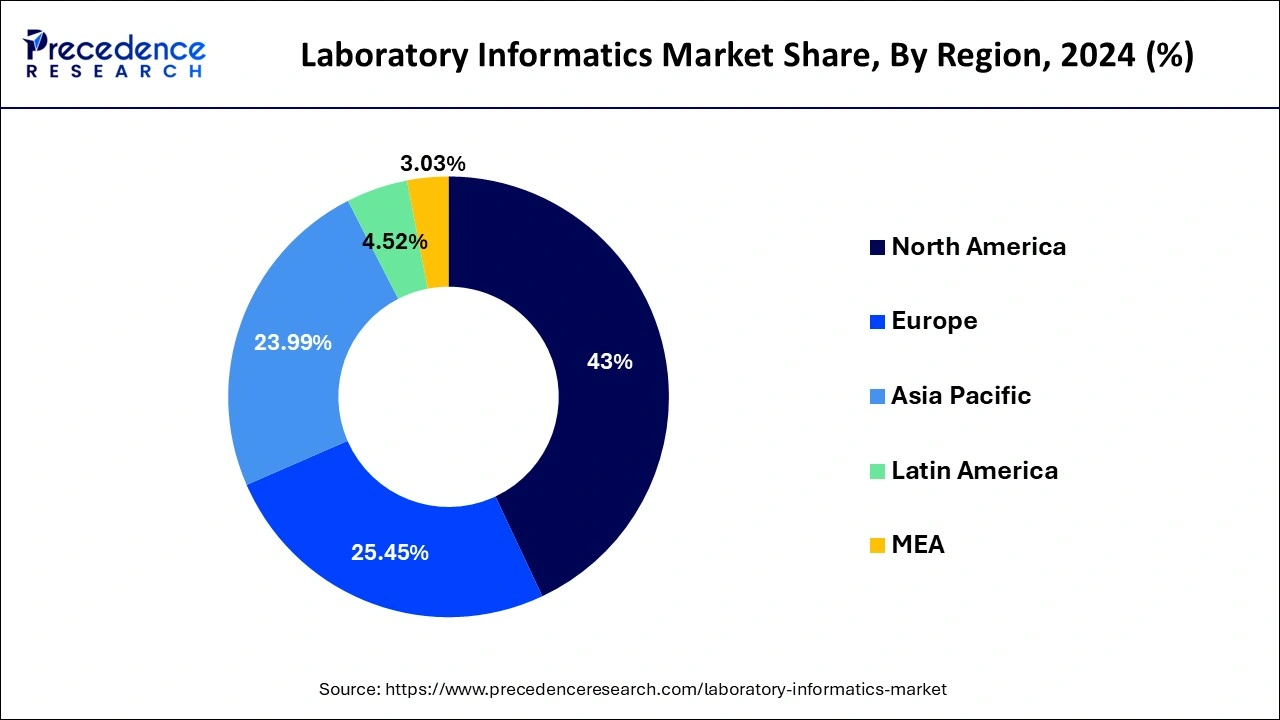

- North America dominated the global market with the largest market share of 43% in 2024.

- Asia Pacific is projected to expand at the notable CAGR during the forecast period.

- By product, the laboratory information management systems (LIMS) segment contributed the highest market share in 2024.

- By product, the enterprise content management (ECM) segments is estimated to be the fastest-growing segment during the forecast period.

- By delivery mode, the cloud-based segment captured the biggest market share in 2024.

- By delivery mode, the on-premise segments is predicted to be the fastest-growing segment during the forecast period.

- By component, the services segment has held the largest market share in 2024.

- By component, the software segment is expected to grow at a significant CAGR from 2025 to 2034.

- By end use , the science companies segment has held the largest market share in 2024.

- By end use , the CROs segments is expected to be the fastest-growing segment during the forecast period.

Market Size and Forecast

- Market Size in 2025: USD 3.95 Billion

- Market Size in 2026: USD 4.07 Billion

- Forecasted Market Size by 2034: USD 5.22 Billion

- CAGR (2025-2034): 3.14%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

How does AI impact the Laboratory Informatics Market?

The integration of artificial intelligence in laboratory informatics will ease the process of storing and extracting data. AI algorithms monitor and analyze large volumes of data easily, which helps in precise diagnosis and treatment planning. AI also reduces human errors and streamlines laboratory workflows. By integrating AI technologies, laboratory informatics enables the systematic gathering, processing, and analysis of scientific data. They can manage and store large volumes of data, which can be then used for future research, lab testing endeavors, and product development activities.

Laboratory Informatics Market Growth Factors

- The rising adoption of digital tools, including advanced instruments, data management software, and analytical tools, to automate laboratory operations and improve laboratories' efficiency and effectiveness boosts the market's growth.

- The rising need for data management positively impacts the market. Laboratory informatics helps collect raw data from various laboratory instruments, which is then organized and stored using robust data management tools. This data can be analyzed to extract meaningful insights, facilitating immediate decision-making and application in ongoing experiments.

- Growing awareness about the importance of laboratory informatics It not only enhances workflow efficiency but also promotes collaboration among researchers by allowing data sharing and accessibility. Laboratory informatics is crucial for driving innovation and advancing scientific knowledge, leading to more effective laboratory practices and better research outcomes.

Laboratory Informatics Market Outlook

- Industry Growth Overview: The laboratory informatics market will experience significant growth from 2025 through 2030, resulting from digitalization projects within R&D and healthcare. The growth of cloud-based LIMS and ELN adoption supporting this growth is particularly strong in the North American and European pharmaceutical, biotech, and environmental testing sectors.

- Sustainability Initiatives: The market is moving toward a trend toward sustainable digital workflows focused on less paper, less energy, and less redundant data. Companies are deploying more climate-efficient cloud architectures in conjunction with AI tools to support lab efforts. Thermo Fisher and Agilent are two companies leading greener software-enabled laboratory ecosystem initiatives.

- Global Expansion: Many vendors are growing their global efforts by targeting new research markets in the Asia-Pacific and the Middle East. For example, LabWare and Autoscribe Informatics have announced new partnerships with regional labs to meet growing compliance and data integrity needs.

- Key Investors: Venture capital and strategic investors continue to win the support of informatics and data platforms offering AI-based analytics, interoperability, and cybersecurity. Significant investments from investors such as Sequoia Capital and Insight Partners point to increasing investor confidence in lab automation and data in the cloud.

- Startup Ecosystem: The startup ecosystem is thriving, with relatively new startups like Benchling (US) and Scitara (US) bringing improved data connectivity and workflow automation to market. The promise of driving digital transformation and collaboration throughout scientific enterprises has led to these companies receiving substantial funding.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.95 Billion |

| Market Size in 2026 | USD 4.07 Billion |

| Market Size in 2034 | USD 5.22 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 3.14% from 2025 to 2034 |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Delivery Mode, Component, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Patients might spend less time recovering due to medical innovations including more comfortable scanning equipment and better monitoring systems. Automation in surgeries has resulted from the acceptance of technology in medical equipment and telemedicine since, in some situations, clinicians do not even need to be present in the operating room with the patient when the procedure is performed. The constant advancement of technology used in health care has resulted in the adoption of laws and regulations governing its application. As a result, new techniques of providing care can be used.

The growth of the laboratory informatics market could also be fueled by a few factors. An increase in the number of diagnoses and high precision and effectiveness of discoveries are only a few of them. The laboratory informatics solutions are used to handle laboratory information and data and follow progress throughout the laboratory procedure with high precision. As a result, laboratory informatics improves the overall effectiveness of laboratories.

Market Dynamics

Drivers

Increase in R&D Activities

An increase in R&D activities in pharmaceuticals, biotechnology, and healthcare has significantly fueled the demand for laboratory informatics solutions. With experiments having gained much complexity and the increasing volumes of scientific data produced, laboratories require current methods to swiftly store, analyze, and report their findings. Thus, such systems prove to be very useful in regard to time; workflows get automatically eliminated in cascade with human errors, and they also enforce certain standards for regulators. Hence, with the advent of biomedicine and precision medicine, what is being more highly stressed is the data side of things, further directing laboratories to work on augmenting their productivity by embracing informatics, growing innovation, and turning large datasets into actionable insight for interrelated drug discovery, diagnostics, and even the applied healthcare presentation levels.

Restraints

Data Security and Privacy Threats

Laboratories implementing an informatics system undergo critical data security and privacy exposures during these attacks since the attacking platform often contains highly sensitive data, such as medical records of patients or research results. These call upon heavy encryption methods, and conscious access control, coupled with monitoring, considerations on confidentiality, integrity, and availability seemingly too costly and difficult to maintain. Smaller enforcement agencies must lay the foundations for these heavy safeguards, yet cannot carry the financial burden to do so. Hence, in the versions, regulations such as HIPAA and GDPR have been imposed on their versions of compliance requirements. Any attack leading to breaches or mishandling of data utterly threatens the privacy of the patient and goodwill of laboratories; thus, crossing disruptions in their operations-thus enclosing alone in restraining the market acceptance.

Opportunity

Cloud-Based Laboratory Informatics

On account of scale, nonfarm flexibility, and associated costs, cloud-based laboratory informatics offers a highly lucrative expansion opportunity. Cloud solutions form an ideal Bouquet in empowering laboratories with advanced data management tools without the burden of investing in costly infrastructure. A SaaS platform is able to streamline workflows for greater real-time access to data, and hence, collaboration in situ or off-site, also easing the flow of information from the point of integration into instruments and other healthcare IT solutions, thus facilitating automation, compared

with making more intelligent decisions based on data. Besides, cloud platforms are usually paired with this capability to iterate features on a regular basis as an automatic load relief tool for laboratories from maintenance. The fast-paced research, outsourcing activities, and international collaborations demand informatics solution sets in the cloud, which are redefining laboratory management today.

Segments Insights

Product Insights

In 2024, the laboratory information management systems (LIMS) segment dominated the laboratory informatics market. In the upcoming years, the demand for completely integrated services in the life sciences and research industries to reduce data management errors and increase qualitative analysis of research data is likely to drive the segment's growth.

The enterprise content management (ECM) segment, on the other hand, is predicted to develop at the quickest rate in the future years. Enterprise content management is being widely used as it provides integrated and complete solutions to address the healthcare industry's expanding issues.

Delivery Mode Insights

In 2024, the cloud-based segment dominated the laboratory informatics market. Cloud-based technology allows for the remote storage of massive volumes of data, saving space on devices and facilitating data retrieval according to customer requirements.

The on-premise segment, on the other hand, is predicted to develop at the quickest rate in the future years. The installation of services and solutions on computers within the organization is known as on-premise delivery.

Component Insights

In 204, the services segment dominated the laboratory informatics market. The expansion of the segment is being added by an increase in the outsourcing of LIMS solutions. Large pharmaceutical research labs outsource these services because they lack the resources and aptitude required for analytics adoption.

The software segment, on the other hand, is predicted to develop at the quickest rate in the future years. This is due to the availability of technologically advanced software such as SaaS, which provides excellent information management solutions for laboratories.

End Use Insights

In 2024, the life science companies segment dominated the laboratory informatics market. In order to produce innovative products and increase product quality and operational efficiency, the life sciences sector is growing its demand for laboratory informatics.

The CROs segment, on the other hand, is predicted to develop at the quickest rate in the future years. The lucrative expansion of the CROs segment is being aided by increasing usage by outsourcing organizations to reduce healthcare expenses.

Regional Insights

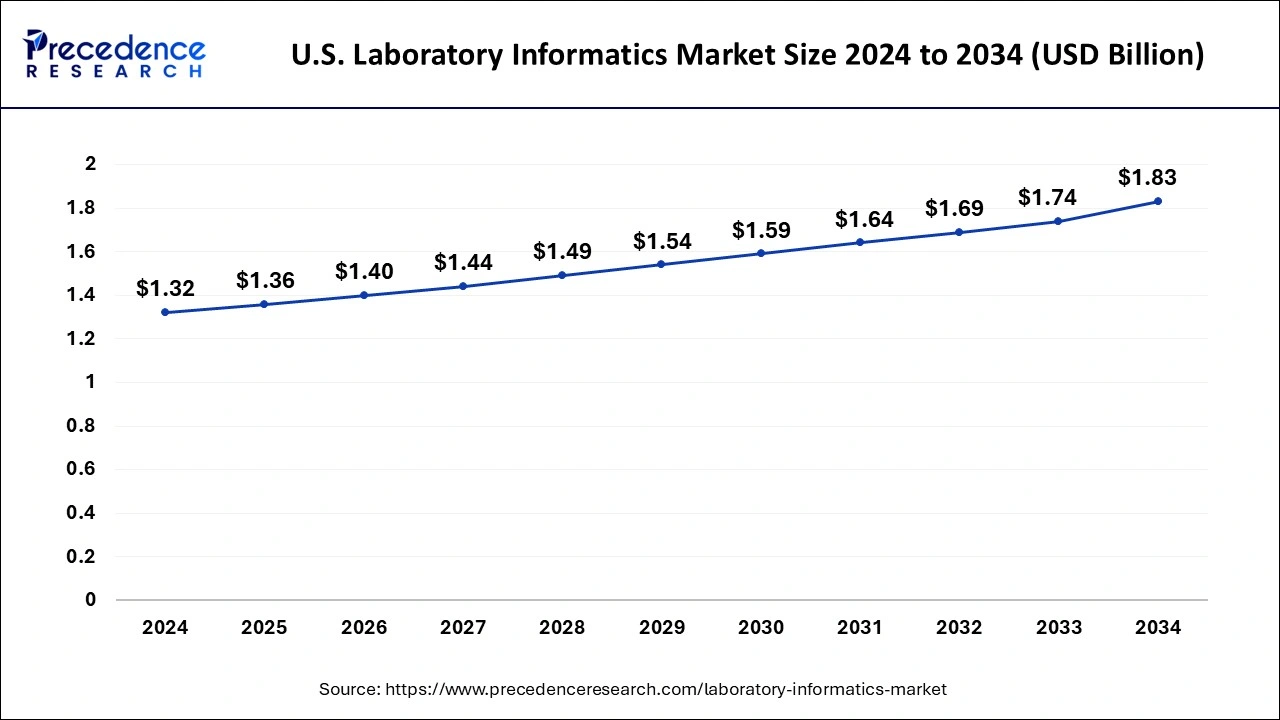

U.S. Laboratory Informatics MarketSize and Growth 2025 to 2034

The U.S. laboratory informatics market size was exhibited at USD 1.36 billion in 2025 and is projected to be worth around USD 1.83 billion by 2034, growing at a CAGR of 3.32% from 2025 to 2034.

How Did North America Dominate the Laboratory Informatics Market?

North America was the leading region in the laboratory informatics market because of advanced research and laboratory facilities, some of the largest pharmaceutical industries in the world, and early adoption of laboratory digital solutions. Additionally, the investments made by the government in R&D and the increasing need for improved accuracy of data supported opportunities for continuous software development in the future.

The United States comprises a strong chamber of pharmaceutical companies, key academic and research institutes, and advanced cloud infrastructure, making it a leading region of the North American laboratory informatics market. Constant funding of laboratory automation, along with strict government requirements on data administration, has strongly supported and propelled the adoption rates of LIMS and ELN systems.

Asia-Pacific's Laboratory Informatics Market: Racing Towards Smart Labs

The Asia-Pacific region is expected to grow at the fastest rate in the global laboratory informatics market due to advanced pharmaceutical manufacturing capabilities, accelerated digital healthcare transformation, and government support for smart laboratories. The region also presented significant opportunities for cost-effective cloud deployments and collaborations of global vendors with local research institutes.

China had a dominant position in the Asia-Pacific market due to the enormous levels of R&D investments and government-driven innovation agenda, plus rapidly modernizing laboratory operations. Chinese pharma companies were adopting AI and cloud-based informatics to improve drug discovery and enhance global competitiveness.

Europe Laboratory Informatics: Precision meets Digital Power

Europe is anticipated to grow at a rapid rate in the laboratory informatics market through strict data regulations, advanced research networks, and a solid pharmaceutical production base. The region's digital transformation and compliant and secure laboratory systems led to notable opportunities for cloud-based and AI-enabled solutions.

Germany led Europe in advanced industrial research, a strong biotechnology sector, and government-supported digital health initiatives. A focus on precision manufacturing and compliance standards encouraged the use of advanced laboratory information platforms.

Middle East & Africa – Lab Modernization on the Rise

The Middle East & Africa experienced slow growth attributed to modernization in healthcare, digital laboratory initiatives, and increased university research activities. There were capabilities for continued growth in core areas of hospital and laboratory food testing using cloud-based informatics solutions.

The UAE was a leader in the region, and notably advanced smart healthcare and digital transformation activities in conjunction with significant investment from the government. Government, along with university, research, and agreements with global technology companies, supported the adaptation of laboratory informatics systems into primary testing laboratories within the UAE.

Value Cain Analysis

- R&D: It is the research and development phase of drug discovery, involving basic research, lead compound identification, and preclinical testing.

Key Players: Pfizer, Dr. Reddy's Laboratories, Cipla) - Clinical Trials and Regulatory Approvals: It has to do with testing drugs in humans for safety and efficacy with a view to obtaining government approval for market entry.

Key Players: U.S. FDA, India's CDSCO) - Formulation and Final Dosage Preparation: Along these lines, the active pharmaceutical ingredients are further prepared into the final usable drug form before being administered to the patient.

- Packaging and Serialization: It works for boxing and labeling drug products with serialization applied to track and trace an individual unit for safety and authenticity.

Key Players: Amcor, Smurfit Kappa) - Distribution to Hospitals, Pharmacies: It deals with the logistics of delivering drugs to providers, hospitals, and pharmacies to ensure timely and secure access to the patients.

Key players: McKesson or AmerisourceBergen - Patient Support and Laboratory Informatics Services: Offers services related to patient support after drug sales, concerning drug usage, adherence, and maintenance of laboratory data and information for diagnostics and patient care.

Key Players: IQVIA

Laboratory Informatics Market Companies

- Thermo Fisher Scientific Inc.

- LabVantage Solutions Inc.

- Core Informatics

- ID Business Solutions Ltd.

- McKesson Corporation

- Abbott Informatics

- PerkinElmer Inc.

- Agilent Technologies

- Waters Corporation

- LabLynx Inc.

Latest Announcement by Industry Leader

- In May 2024, LabVantage Solutions, Inc., a leading provider of laboratory informatics solutions and services, announced the acquisition of software innovator SEIN Infotech South Korea. Michel Gerlicher, President of LabVantage International, stated, "we aim to empower labs to transform scientific data into valuable business insights. We are ready to deliver even greater value to our clients and expand our offerings through this acquisition.

- Ed Krasovec, Director of Clinical Solutions at LabWare:

Clinical Health 5.06 reflects our ongoing commitment to drive improved clinical laboratory operational efficiency with innovative LIMS capabilities. - Kevin Cramer, CEO & CTO, Sapio Sciences:

Almost one year ago, I predicted that AI would eat the ELN, and with Sapio ELaiN, traditional ELNs are now a thing of the past. Instead of merely recording and storing data, Sapio ELaiN acts as a new kind of agentic AI scientific collaborator, guiding scientists at every step

Recent Development

- In August 2025, TetraScience launched Tetra Workflows, a solution that automates scientific data workflows at scale, addressing the challenge of manual processes that delay discoveries and slow clinic time. (Source: https://fox59.com)

In April 2025, LabWare ASSURE, a SaaS platform, offers digital control over food and beverage quality, safety, and compliance processes, enabling automation, digital traceability, and real-time decision-making in laboratories. (Source: https://www.prnewswire.com) - In July 2024, The Ministry of Statistics and Programme Implementation (MoSPI) notified the governing council to set up the framework for the Data Innovation Lab.

Segments Covered in the Report

By Product

- LIMS

- ELN

- SDMS

- LES

- EDC & CDMS

- CDS

- ECM

By Delivery Mode

- On-premise

- Web-hosted

- Cloud-based

By Component

- Software

- Services

By End Use

- Life Sciences Companies

- CROs

- Chemical Industry

- F&B and Agriculture

- Environmental Testing Labs

- Petrochemical Refineries & Oil and Gas Industry

- Other Industries

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting