Clinical Laboratory Service Market Size and Forecast 2025 to 2034

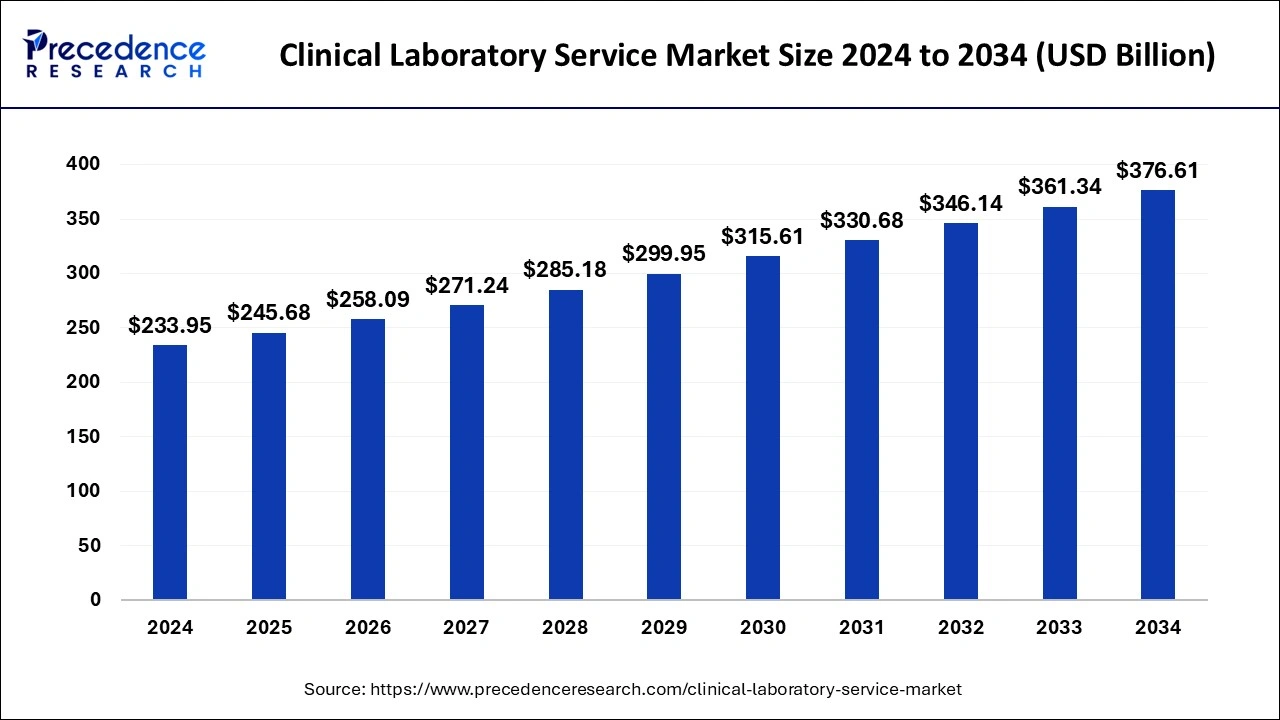

The global clinical laboratory service market size was valued at USD 233.95 billion in 2024, and it is expected to hit over USD 376.61 billion by 2034 with a registered growth at a CAGR of around 4.88% during the forecast period 2025 to 2034.

Clinical Laboratory Service Market Key Takeaways

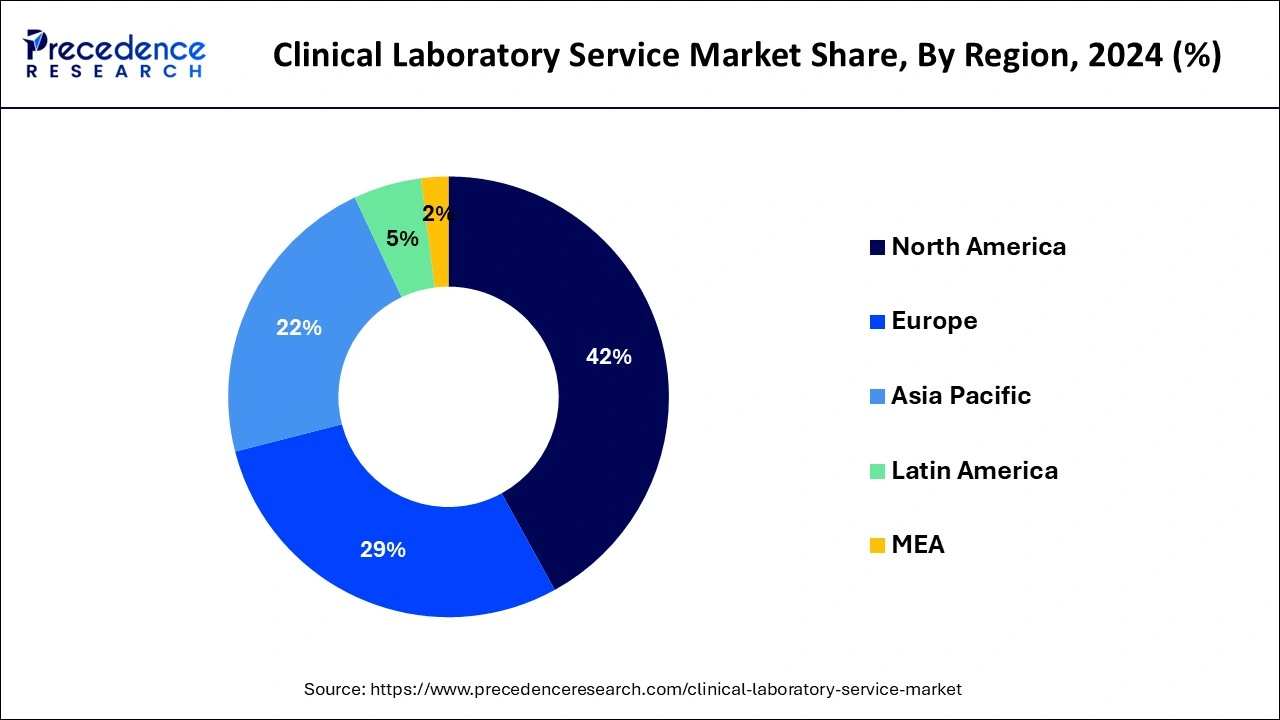

- North America led the global market with the largest market share of 42% in 2024.

- Asia-Pacific is anticipated to grow at the fastest CAGR during the forecast period.

- By Test Type, the clinical chemistry segment held the biggest revenue share of 52% in 2024.

- By Service Provider, the hospital-based laboratories segment had the biggest market share of 58% in 2024 and is expected to remain dominant during the forecast period.

- By Application, the bioanalytical and lab chemistry services segment is estimated to hold the highest market share of 52% in 2024.

- By Application, the toxicology testing services segment is expected to expand at the fastest CAGR over the projected period.

How has AI benefited the Market?

Combining AI into clinical laboratory setups is accelerating the diagnostics capacity concerning accuracy, speed, and efficiency. Artificial intelligence algorithms review medical images by detecting the early cases of diseases such as cancer and heart diseases. Machines learn from good volumes of datasets to identify slight patterns that render an accurate diagnosis. Automated methods-treating samples or interpreting data a reduction on the turnaround time for therapeutic intervention. Such systems enhance, stimulating workflow, resource optimization, and minimizing human error for operational efficiency. AI fosters personalized medicine by evaluating patient data to customize treatment methodologies and foresee risks. AI perfectly sits at the intersection of data-driven decision-making, outbreak prediction, and strategy support. Also, AI facilitates proactive interventions and early detection of diseases to better patient outcomes, placing a higher burden on chronic diseases with the general health system.

U.S. Clinical Laboratory Service Market Size and Growth 2025 To 2034

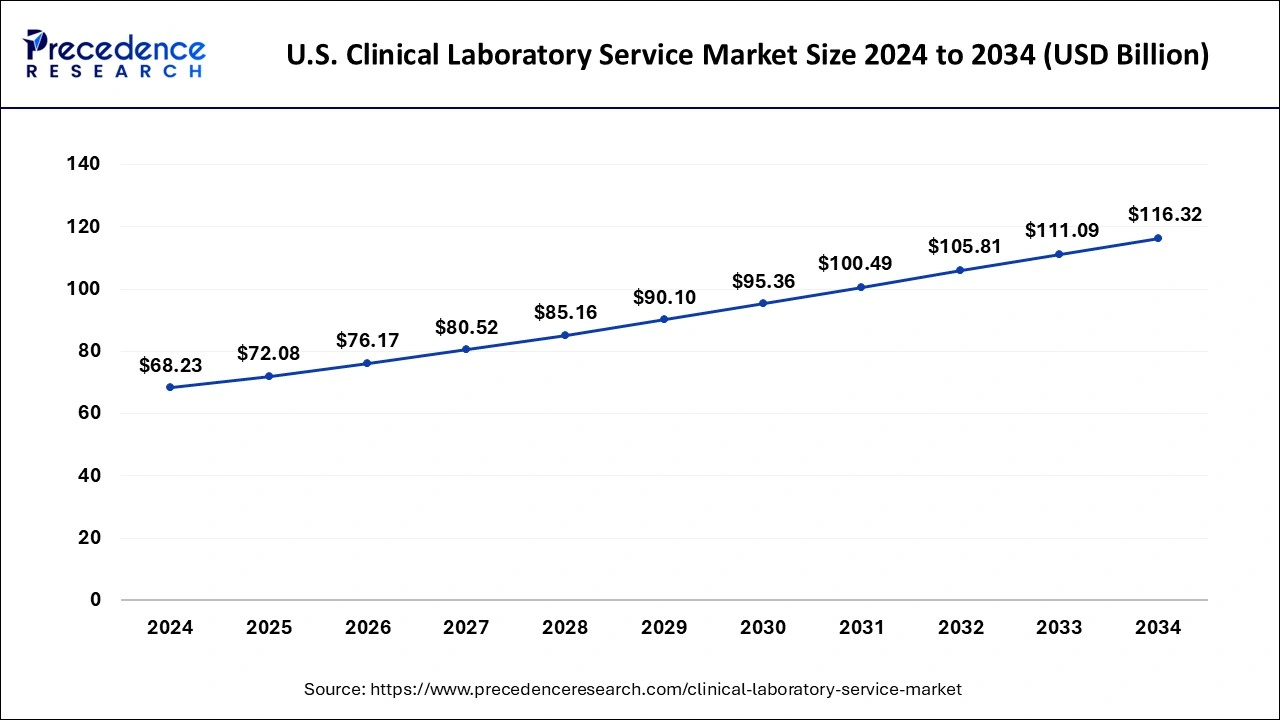

The U.S. clinical laboratory service market size reached USD 68.23 billion in 2024 and is anticipated to be worth around USD 116.32 billion by 2034, poised to grow at a CAGR of 5.48% from 2025 to 2034.

North America accounted for 42% of revenue share in 2024 and is projected to remain its dominant over the forecast period. North America is characterized by developed healthcare infrastructure, a higher adoption rate of advanced technologies, increased government investments for developing pharmaceutical and healthcare facilities, and an increasing number of research centers, which perfectly contributes to the growth and development of the Clinical laboratory service market in the region.

The Asia Pacific is expected to be the fastest-growing market during the forecast period. The rising government expenditure on the development of healthcare infrastructure, rapid urbanization, rising prevalence of diseases, and huge population drive the demand for the clinical laboratory service market. The increasing number of patients in hospitals owing to the huge population is driving the demand in the hospital sector and hence this region is expected to grow rapidly in the forthcoming years.

Clinical Laboratory Service Market Growth Factors

The clinical laboratory service market is primarily driven by the rising demand for early diagnostic tests and the increasing number of chronic diseases among consumers. The rapidly growing biotechnology and healthcare industries in developed regions like the US and Canada are significantly boosting the demand for Clinical laboratory services. The rising government investments coupled with the increased private investments to develop and expand the growth of the biopharma and healthcare industries are driving the market growth.

The rising prevalence of chronic diseases among the population has a significant role to play in the demand for the clinical laboratory service system. Moreover, the rising investments in research laboratories and increasing penetration of research centers across the globe have a huge demand for the storage and management of huge volumes of data. Further, the rising adoption of automated technologies to enhance productivity and reduce cost is likely to augment the growth of the market. The key players in the industry are introducing new services in the market to serve the patients. This has led to the growth of the market in the coming years.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 245.68 Billion |

| Market Size in 2034 | USD 376.61 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.88% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Test Type, ByService Provider, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Emergence of telehealth

Telehealth consultations often result in recommendations for diagnostic tests and lab work, as remote doctors may not have physical access to patients. This leads to a higher demand for clinical laboratory services. Telehealth allows patients to receive medical advice and prescriptions remotely, including orders for at-home testing kits. This drives the need for sample collection and analysis services provided by clinical laboratories. Telehealth platforms can seamlessly integrate with laboratory information systems, making it easier to order, process, and deliver test results. Telehealth makes healthcare more accessible, encouraging people to seek medical advice, including the need for diagnostic tests, which can be conveniently coordinated through clinical laboratories. Telehealth is often used for managing chronic conditions. Patients with chronic diseases may require frequent lab tests, creating a continuous stream of testing services. Thereby, being a crucial component for telehealth services, the clinical laboratory services market is expected to be accelerated.

Restraint

Regulatory challenges

Meeting stringent regulatory requirements often necessitates substantial investments in infrastructure, personnel, and technology to ensure compliance. This can increase operational costs for clinical laboratories. Obtaining and maintaining the necessary licenses and accreditations can be a complex and time-consuming process. Failure to meet these requirements can result in penalties or shutdowns. Regulatory bodies often set strict quality and safety standards for clinical testing. Meeting these standards can be challenging and costly for laboratories, especially smaller ones. For clinical labs operating globally, navigating different regulatory frameworks in various countries can be complex and resource intensive.

Opportunity

Emphasis on personalized medicine

Personalized medicine relies on precise diagnostic tests to tailor treatment plans to an individual's genetic, molecular, and clinical profile. Clinical laboratories can offer a wide range of specialized tests to support this approach. Clinical labs play a crucial role in identifying biomarkers and genetic variations that are important for personalized treatment decisions, such as targeted therapies in cancer. Laboratories can provide pharmacogenomic testing to determine how an individual's genetics may impact their response to specific drugs, allowing for personalized medication selection and dosing. Genetic testing and risk assessment for various diseases, such as hereditary conditions, allow individuals to make informed healthcare decisions, creating a demand for these services. Ongoing monitoring through laboratory tests helps adjust treatment plans in real time, ensuring that patients receive the most effective therapies.

Test Type Insights

The clinical chemistry segment accounted for 52% revenue share in 2024 and is estimated to sustain its dominance during the forecast period. This is attributable to the introduction of new technologies, presence of numerous clinic chemistry tests, and emergence of point-of-care testing methods. Moreover, the rising investments in the research activities by the healthcare industry players is further boosting the growth of the laboratories across the globe, and hence this segment is expected to be the fastest-growing segment during the forecast period.

The human and tumor genetics tests segment is expected to register the fastest growth rate during the forecast period, driven by surging cancer incidence and demand for targeted medicines. Developments in genomics bring prospective faster and more accurate ways of detecting genetic mutations through methods such as next-generation sequencing. This demand is being fuelled further by the increasing awareness of the early diagnosis of cancers and personalized ways of treatment. Further impetus to adoption comes from the rise in funding for research and the global arrival of AI in genetic testing equipment, both for clinical and research-oriented work.

Service Provider Insights

The hospital-based laboratories segment accounted for 58% of revenue share in 2024 and is expected to remain dominant during the forecast period. The increased prevalence of cancer among the population, growing research activities to develop innovative services, and growing demand for clinical chemistry services in hospitals has fostered the growth of this segment in the past few years.

The stand-alone laboratories segment is expected to register remarkable growth during the forecast period. The increased demand for at-home testing test to diagnose and monitor disease is likely to spur the growth of the stand-alone laboratories segment in the market.

Application Insights

Based on application, the bioanalytical and lab chemistry services accounted largest revenue share of over 52% in 2024and are estimated to sustain their dominance during the forecast period. The factors that augment the growth of the segment are the increasing number of investigational drugs undergoing clinical trials and the rising number of novel drugs candidates for trials.

The toxicology testing services segment is expected to be the fastest-growing segment during the forecast period. This is attributed to the advancements in clinical diagnostic methods and increasing awareness about the diagnosis and treatment of the disease.

linical Laboratory Service MarketCompanies

- Qiagen

- Quest Diagnostics, Inc

- OPKO Health, Inc

- Abbott

- Charles River Laboratories; International, Inc

- Cinven

- Arup Laboratories

- Sonic Healthcare

- Laboratory Corporation of America Holdings (LabCorp)

- NeoGenomics Laboratories, Inc.

Recent developments

- In June 2025, Amazon introduced its first-ever at-home lab testing service, Amazon Diagnostics, in India, in partnership with Orange Health Labs, a convenience-focused diagnostics provider. (Source: https://www.cnbctv18.com)

- In March 2025, IQVIA Laboratories launched Site Lab Navigator, a suite of solutions designed to automate and streamline lab workflows for clinical trial sponsors and investigator sites.(Source: https://www.businesswire.com)

Segments Covered in the Report

By Test Type

- Human & Tumor Genetics

- Clinical Chemistry

- Medical Microbiology & Cytology

- Other Esoteric Tests

By Service Provider

- Hospital-Based Laboratories

- Stand-Alone Laboratories

- Clinic-Based Laboratories

By Application

- Bioanalytical& Lab Chemistry Services

- Toxicology Testing Services

- Cell & Gene Therapy Related Services

- Preclinical & Clinical Trial Related Services

- Drug Discovery & Development Related Services

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting