Clinical Communication and Collaboration Market Size and Forecast 2025 to 2034

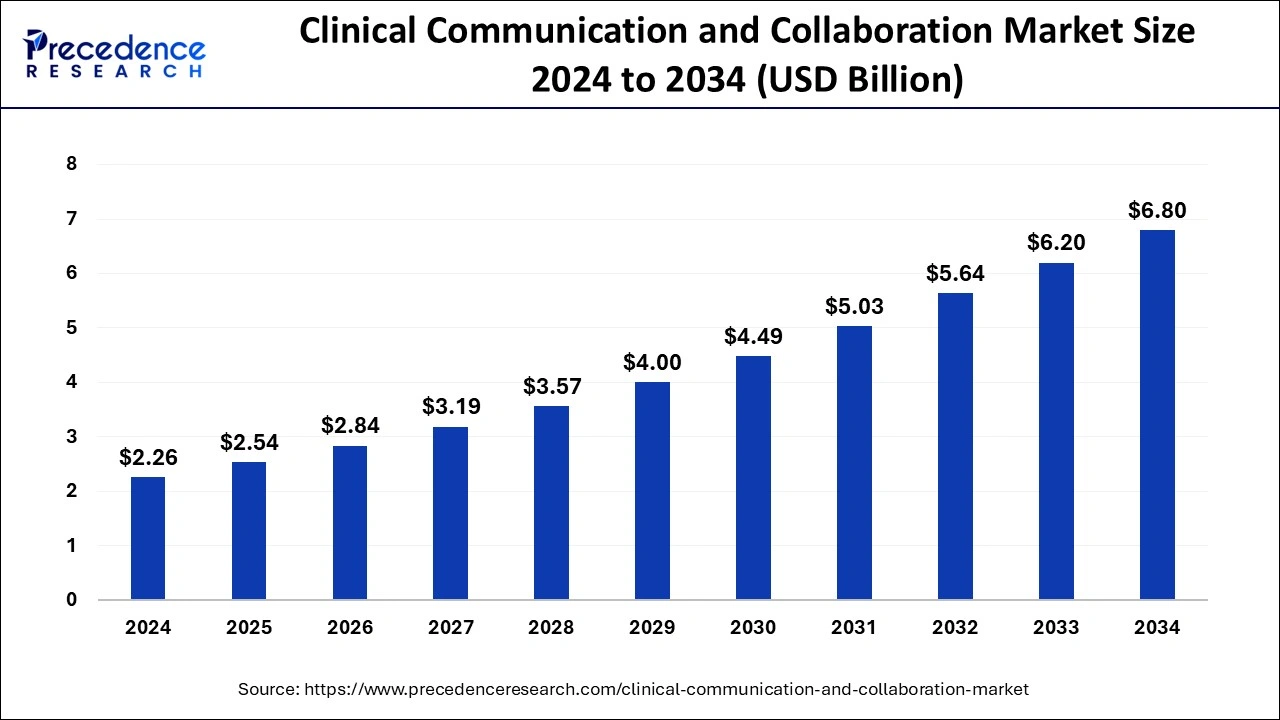

The global clinical communication and collaboration market size was exhibited at USD 2.26 billion in 2024 is predicted to increase from USD 2.54 billion in 2025 to approximately USD 6.80 billion by 2034 , growing at a CAGR of 11.64% from 2025 to 2034.

Clinical Communication and Collaboration Market Key Takeaways

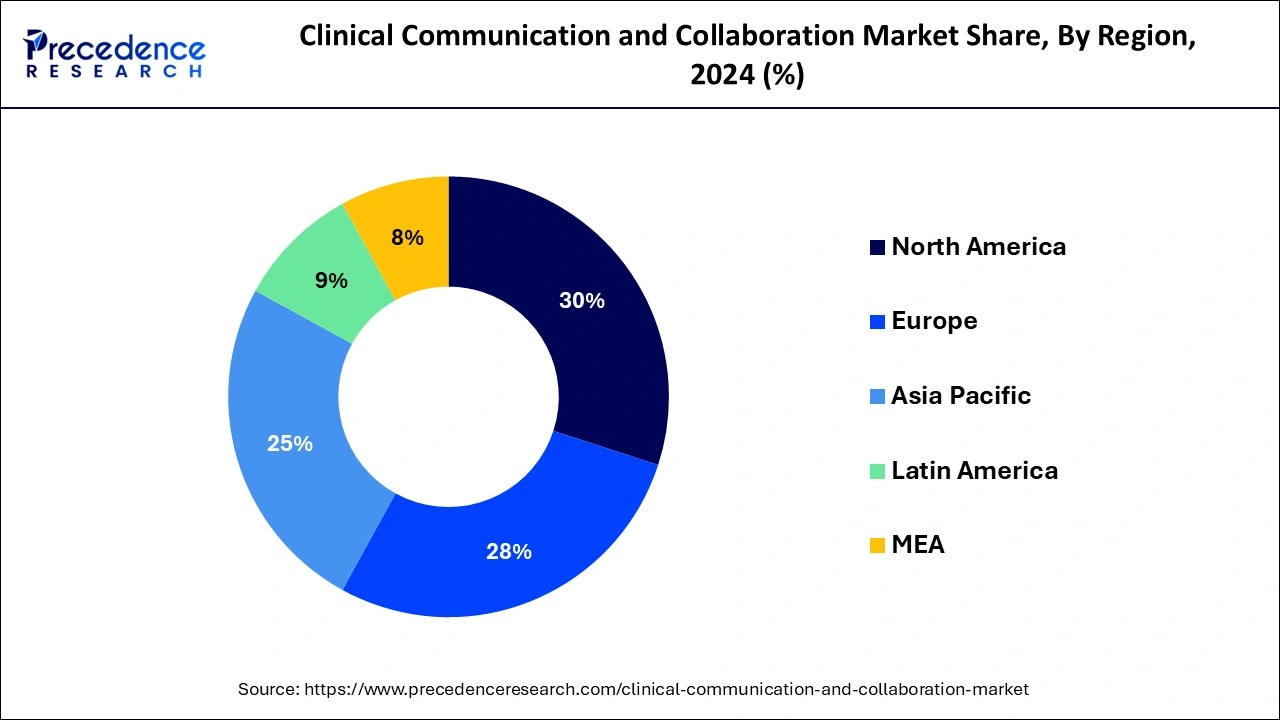

- North America dominated the market with the largest market share of 30% in 2024.

- By component, the silica segment contributed more than 60% of market share in 2024.

- By end use, the hospitals segment generated the highest market share of 52% in 2024.

- By deployment, the on-premise segment recorded more than 55% of market share in 2024.

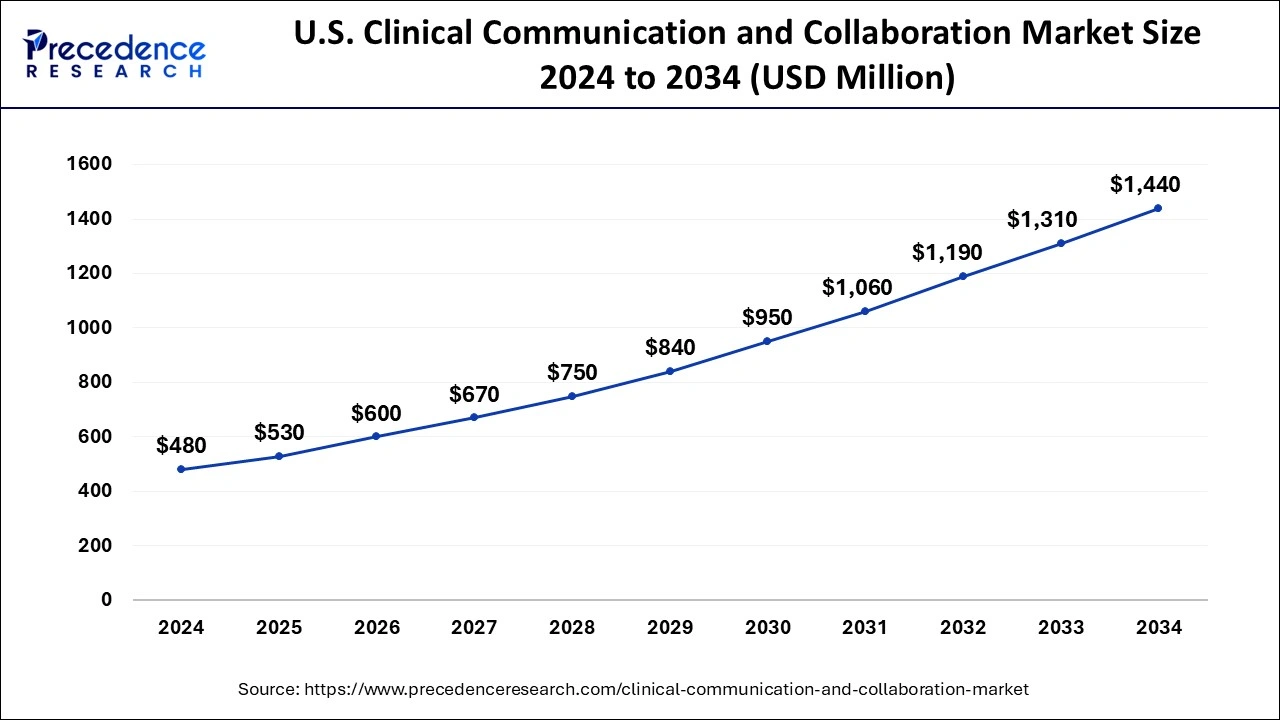

U.S. Clinical Communication & Collaboration Market Size and Growth 2025 To 2034

The U.S. clinical communication and collaboration market was valued at USD 480 million in 2024 and expected to reach USD 1,440 billion by 2034, growing at a CAGR of 12% between 2025 to 2034.

North America accounted for over 30% of the market share in 2024 and is predicted to sustain its dominance during the forecast period. The North America clinical communication and collaboration market is driven by certain factors such as increased healthcare expenditure, increased demand for the automated technology, rising number of patients, growing geriatric population, and increasing need for the storing data, and effective communication across the hospitals and clinics.

North America dominated the clinical communication and collaboration market due to technological advancements in healthcare infrastructure and awareness regarding optimization of the digital medium for healthcare purposes. The advanced infrastructure provides individuals with the topmost clinical facility that helps prevent diseases like breast and colorectal cancer.

Early detection assists in identifying and prescribing medication for rare diseases, and clinical communication significantly improves the prevention of diseases, as they provide personalized treatment plans through digital solutions that include telehealth, telemedicine, and mobile applications. In addition, Canada also plays a crucial role as it provides patients with telehealth and personalized care through streamlined processes.

On the other hand, the clinical communication and collaboration market in Asia Pacific is estimated to the fastest-growing during the forecast period. Asia Pacific is characterized by increasing urbanization, rising demand for the automation and advanced software, increasing number of hospital admissions, and rising government investments on the development of better healthcare infrastructure. All these factors are expected to drive the demand for the CC&C systems across the hospitals and clinics in the region.

In Asia Pacific, the clinical communication and collaboration market is also experiencing rapid growth, fueled by a combination of factors including a diverse and growing patient population base, the presence of prestigious hospitals, high levels of medical tourism, and an increasing emphasis on a sustainable healthcare system. These dynamics contribute to the region's elevated demand for the healthcare system, particularly within the digitalization and high-end sectors.

Asia Pacific consumers exhibit a wide range of preferences, from those seeking affordable treatment to those desiring personalized telehealth, such as telemedicine and virtual care platforms. Moreover, India is home to numerous digital healthcare solutions and government initiatives, which reinforce a strong presence in the market for high-quality, digitalized healthcare infrastructure.

Clinical Communication and Collaboration Market Growth Factors

Clinical communication and collaboration is the IT system that helps the clinicians and clinical staff members to communicate and collaborate regarding the patient related activities. There are various benefits associated with the deployment of the clinical communication and collaboration systems such as enhanced care quality, improved care transitions, saving response and waiting time, and helps to improve the overall efficiency of the clinic care. The rising awareness regarding the availability of CC&C systems across the hospitals and clinics is expected to drive the demand for the CC&C, during the forecast period. Moreover, rising penetration and development of healthcare sector across developed and developing nations is anticipated to drive the global clinical communication and collaboration market. The increased demand for the automated and technologically advanced systems in the healthcare sector to improve the quality and efficiency of healthcare units is a trending factor in the market. Therefore the trend of adopting advanced technologies in the healthcare units is expected to drive the global clinical communication and collaboration market, during the forecast period.

The clinical communication and collaboration systems are gaining traction across the globe owing to the increasing adoption of smart devices in clinics and hospitals. Further, the introduction of advanced technology like artificial intelligence (AI) is expected to play a crucial role in the improvement of healthcare services. According to the World Health Organization, the introduction of AI in telemedicine will play an important role in driving innovations in various fields such as telepathology, teledermatology, and teleradiology across the global markets. This technological development will provide improved access to patients' data like medical records, effective communication related to patient, and improved administration. All these benefits are projected to drive the CC&C market at a rapid rate in the forthcoming years.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 6.80 Billion |

| Market Size in 2025 | USD 2.54 Billion |

| Market Size in 2024 | USD 2.26 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.64% |

| Largest Market | North Amreica |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, End Use, Deployment, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Component Insights

The solution segment accounted for more than 60% of the market share in 2024 and is projected to sustain its dominance. Various benefits such as real-time data sharing, improved alarm system, and video communication integration has boosted the adoption rate of the CC&C solutions in hospitals. The integration of advanced alarm system, text messaging, alerts and notification system, and video communication in a single platform is the major factor that had fostered the growth of this segment.

Moreover, the integration of internet of things (IoT) with the CC&C solutions is expected to improve the efficiency of the solutions and will help to offer better patient care. The healthcare IoT will configure smart and wearable devices to facilitate the patients to properly follow their care programs. Further, the Bluetooth beacon along with the mobile phones helps in navigation in the large hospital campuses. All these factors are expected to boost the market growth and sustain its significance throughout the forecast period.

End Use Insights

The hospitals segment accounted for more than 52% of the market share in 2024 and is projected to sustain its dominance in forecast period. The rising burden of chronic diseases and growing geriatric population is resulting in an increasing volume of hospital admissions. The need for real-time, fast, and effective communication systems in hospitals have increased more than ever before. Moreover, the rising number of hospitals owing to the increased government expenditure on building sophisticated healthcare infrastructure has boosted the growth of the hospitals across the developed and developing markets.

The clinical segment is estimated to be the most opportunistic segment during the forecast period. This is attributed to the rising number of medical errors owing to the ineffective and traditional communication systems. Further, the rapidly growing number of private clinics across the globe is expected to drive the growth of this segment.

Deployment Insights

On-premise segment accounted for around 55% of the market share in 2024 and is estimated to sustain its dominance during the forecast period. The rising adoption of data storing and accessing systems in the hospitals and clinics has developed the on-premise segment. The rising investment by the hospitals and clinics in the development of improve IT infrastructure has led to the growth of this segment.

The hosted segment is estimated to grow at a rapid rate throughout the forecast period. The surging popularity of the cloud-based storage owing to its flexibility and low cost is pampering the segment growth. The hosted CC&C allows the staffs to remotely operate and communicate effectively using smart devices like smartphones. Moreover, the cloud-based storage also enables the users to record and review any event. Therefore, these advanced features associated with the hosted segment at low cost is boosting its adoption across the globe.

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

- In July 2021, Vocera Communications, Inc., introduced Vocera Edge, a cloud-based clinical communication and collaboration software for the smartphones that enables the healthcare system to efficiently access electronic health record and improves communication among the doctors and staffs.

The various developmental strategies like new product launches with latest and innovative features fosters market growth and offers lucrative growth opportunities to the market players.

Clinical Communication and Collaboration Market Companies

- Vocera Communications, Inc.

- Jive Sotware

- Microsoft Corporation

- Everbridge

- Ascom

- TigerConnect

- Cisco Systems Inc.

- UDG Healthcare PLC

- Spok Inc.

- NEC Corporation

- Intelligent Business Communication

- Voalte

Recent Developments

Suki

- In October 2024, Suki, an artificial intelligence provider for healthcare, raised USD 70 million and was able to raise a maximum funding of USD 165 million. Hedosophia and Venrock were the main participants as investors.

Mount Sinai Medical Center

- In February 2025, Mount Sinai Medical Center incorporated AI into its healthcare system to enhance the patient-centric experience and create an efficient and streamlined approach for clinical communication. In addition, the centre has previously launched AI initiatives to improve clinical documentation.

Segments Covered in the Report

By Component

- Solution

- Service

By End Use

- Hospitals

- Clinics

By Deployment

- Hosted

- On-Premise

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content