What is the Clinical Laboratory Services Market Size?

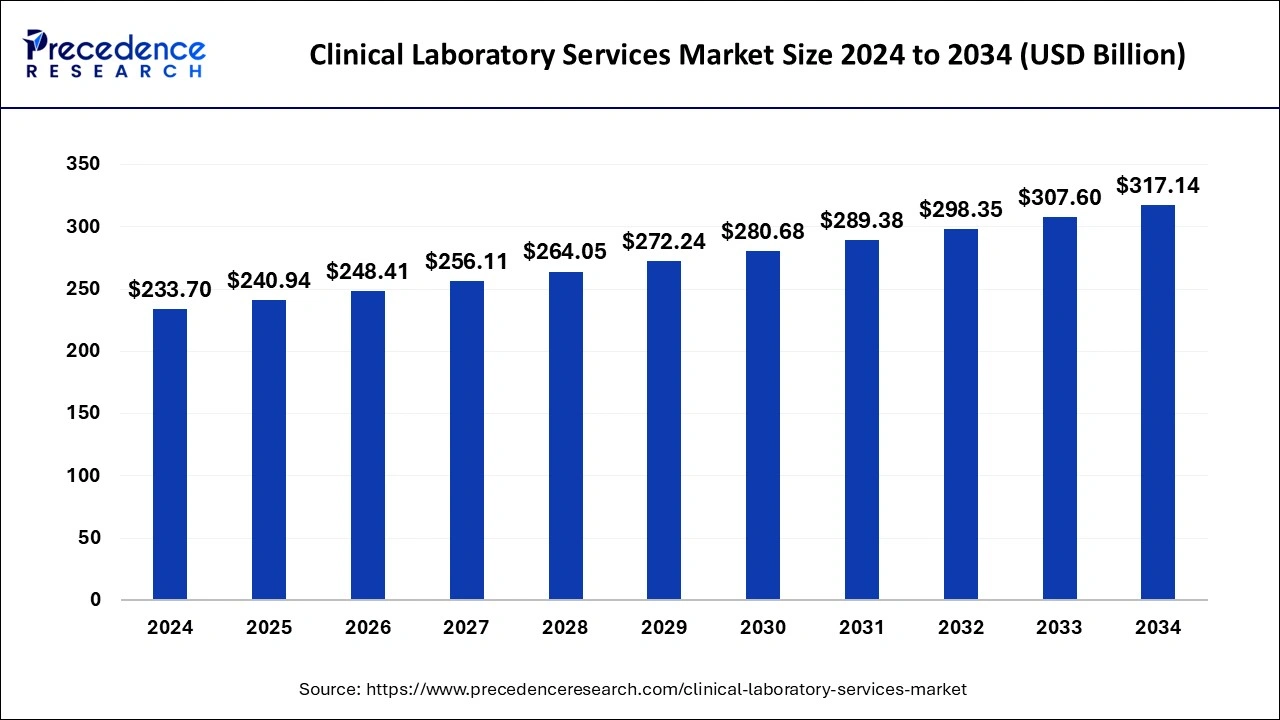

The global clinical laboratory services market size is calculated at USD 240.94 billion in 2025 and is predicted to increase from USD 248.41 billion in 2026 to approximately USD 317.14 billion by 2034, expanding at a CAGR of 3.10% from 2025 to 2034.

Clinical Laboratory Services Market Key Takeaways

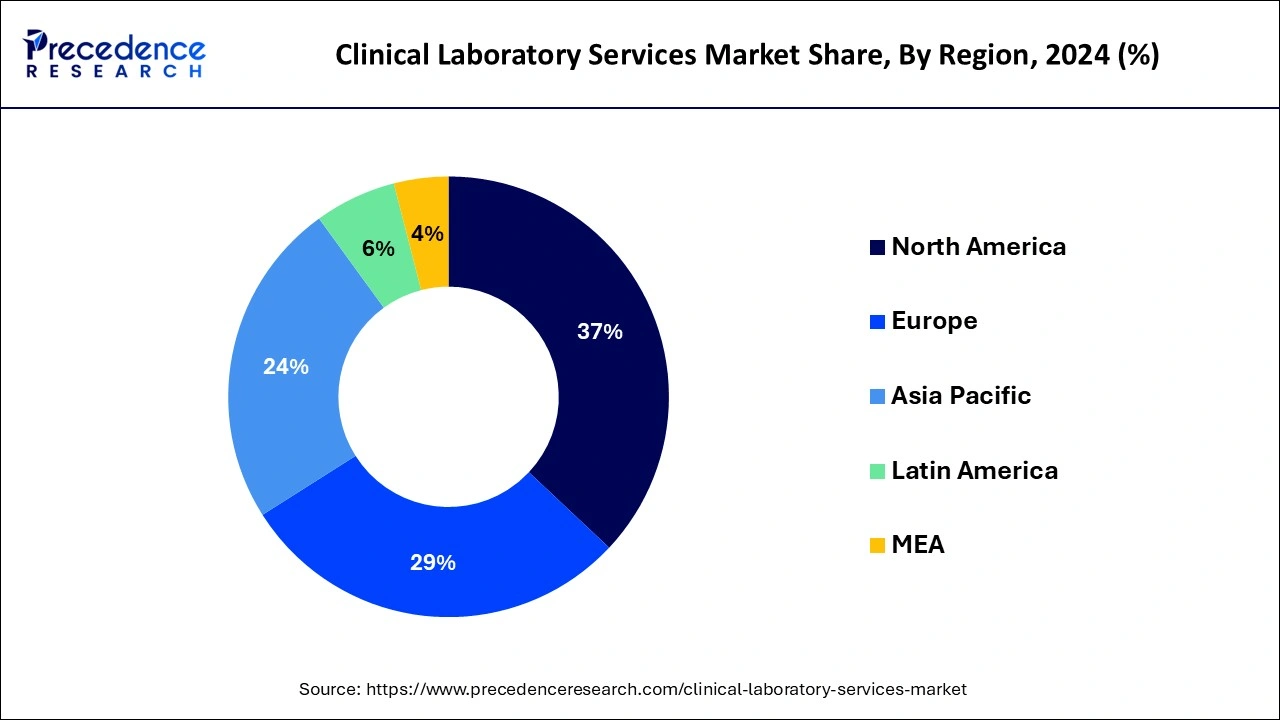

- North America dominated the global clinical laboratory services market with the largest market share of 37% in 2024.

- Asia Pacific is expected to expand at a solid CAGR during the forecast period.

- By test type, the clinical chemistry segment contributed the highest market share of 57% in 2024.

- By test type, the genetics testing segment is projected to grow at a solid CAGR during the forecast period.

- By service provider, the hospital-based laboratories segment accounted for the highest market share of 54% in 2024.

- By service provider, the stand-alone laboratories segment is expected to grow at a notable CAGR during the forecast period.

- By application, the bioanalytical and lab chemistry services segment has held a major market share of 53% in 2024.

- By service provider, the toxicology testing services segment is expected to grow at a notable CAGR during the forecast period.

Clinical Laboratory Services Market Growth Factors

The clinical laboratory services are applicable for all type of laboratories. The growth of the global clinical laboratory services market is attributed to the growing number of clinical trials and research and development activities in the healthcare sector. One of the prominent factors driving the growth of the global clinical laboratory services market is growing prevalence of targeted disorders globally. The treatment and diagnosis of targeted disorders require utmost research, which is boosting the expansion of the global clinical laboratory services market over the forecast period.

The diseases or disorders such as cancer, diabetes, and HIV should be diagnosed and treated with latest tools and technologies. These types of diseases should be treated at an early stage. Thus, the demand and need for early disease diagnosis is increasing all around the globe. This is directly impacting the growth of the global clinical laboratory services market. In addition, the technological advancements and innovative solutions and tools are creating growth prospects for the clinical laboratory services market all around the globe.

Another factor that is boosting the growth and development of the global clinical laboratory services market is growing geriatric population. The ageing population rate is growing rapidly in developed and developing countries. The old people are vulnerable to chronic disorders and sometimes are infected with new disease. To study and get results about the specific disease, the clinical trials and research and development is very crucial. Thus, the demand for clinical laboratory services is growing at a rapid pace.

The impact of the COVID-19 pandemic on the growth of the global clinical laboratory services market was moderate in nature. The COVID-19 epidemic resulted into growing demand for clinical trials across healthcare industry. Due to coronavirus outbreak, the importance of clinical laboratory services has grown up significantly. This had positive impact on the clinical laboratory services market growth.

The government firms are getting more aware about the clinical laboratory services all around the world. For this, they are heavily investing in the healthcare sector. In addition, constant efforts are being carried out for the growth and development of the clinical laboratory services market. Furthermore, key market players are actively adopting major marketing strategies for creating awareness regarding clinical laboratory services all around the globe. The strategies that are adopted by clinical laboratory services market players are new service launch, partnership, joint venture, merger, acquisition, and business expansion.

Clinical Laboratory Services Market Outlook

- Industry Growth Overview: The clinical laboratory services market is projected to grow substantially between 2025 and 2034. The growth of the market is driven by the rising prevalence of chronic and infectious diseases, an aging global population, and a strong emphasis on preventive healthcare. The rising demand for point-of-care testing (POCT) further contributes to market growth.

- Global Expansion: Leading companies are broadening their geographic presence, especially in high-growth emerging markets in Asia-Pacific and Latin America, driven by rising healthcare spending, rapid urban growth, and increased awareness of healthcare and diagnostics. North America remains a key market due to its advanced infrastructure and substantial R&D investment, while Europe is strengthening its market through acquisitions and adherence to EU regulations.

- Major Investors: The market is attracting significant investment from venture capital, private equity, and strategic corporate investors. Key players such as Quest Diagnostics, LabCorp, Eurofins Scientific, and Sonic Healthcare are major investors, driving growth through M&A and R&D spending, particularly in personalized medicine and companion diagnostics.

- Startup Ecosystem: The startup scene is maturing, emphasizing innovation in data analytics, AI integration in diagnostics, and digital health solutions. Emerging companies are securing funding to develop new testing methods, such as advanced genetic and molecular diagnostics, and building platforms that connect laboratory services with telehealth and remote monitoring.

Report Scope of theClinical Laboratory Services Market

| Report Coverage | Details |

| Market Size by 2034 | USD 317.14 Billion |

| Market Size in 2026 | USD 248.41 Billion |

| Market Size in 2025 | USD 240.94 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 3.10% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Test Type, Service Provider, Application, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Segments

Test Type Insights

The clinical chemistry segment contributed the highest market share of 57% in 2024. The growing number of clinical tests is driving the demand for clinical chemistry tests. The growth of the segment is attributed to the growing importance of point of care tests and launch of new and advanced technologies. In addition, the adoption of clinical chemistry tests in countries such as India, the U.S., and Japan is creating growth prospects for the segment.

The genetics testing segment is projected to grow at a solid CAGR during the forecast period. The market for human and tumor genetic tests is growing due to the growing incidences of cancer. This is resulting into growing need and requirement for cancer screening at early stage. These tests provide accurate and precise results for cancer testing and diagnostics.

Service Provider Insights

The hospital-based laboratories segment accounted for the highest market share of 54% in 2024. The growth of the clinical laboratory services in the hospital-based laboratories is anticipated to the growing number of patient's visits. The growing prevalence of diseases and disorders is resulting into growing number of tests of various diseases. The tests that are carried out in hospital-based laboratories are quite cost intensive in nature.

The standalone laboratories segment is fastest growing segment of the clinical laboratory services market in 2022. After the COVID-19 pandemic, the demand for clinical laboratory services in standalone laboratories increased at a rapid pace. The tests that are being carried out in standalone laboratories help in the improvement of patient health.

Application Insights

The bioanalytical and lab chemistry services segment has held a major market share of 53% in 2024.The growth of the bioanalytical and lab chemistry services segment is attributed to the growing new product launches and drugs. All the new drugs and medications require clinical trials which is driving the growth of the segment.

The toxicology testing services segment is fastest growing segment of the clinical laboratory services market in 2022. The growth of the toxicology testing services segment is being driven by growing introductions and released of consumables. This helps in the enhancement of drug testing services those results into the growth of the segment.

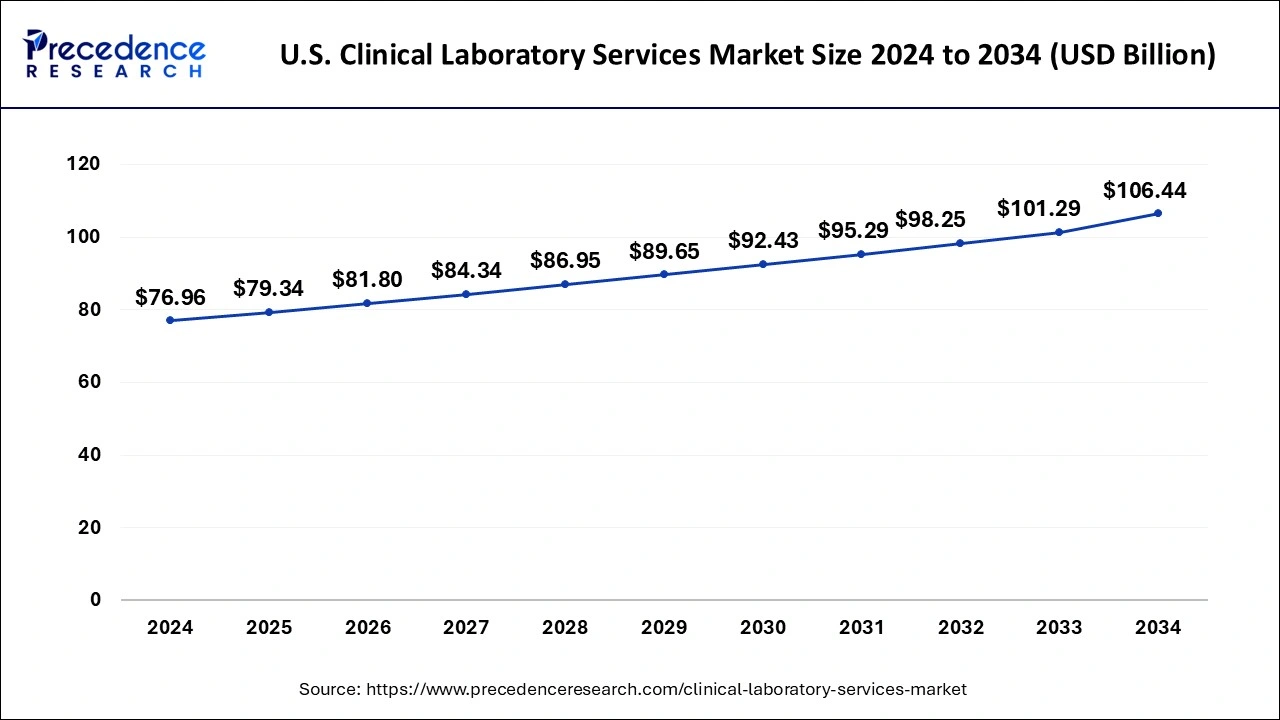

U.S. Clinical Laboratory Services Market Size and Growth 2025 to 2034

The U.S. clinical laboratory services market size was estimated at USD 79.34 billion in 2025 and is anticipated to be surpass around USD 106.44 billion by 2034, rising at a CAGR of 3.29% from 2025 to 2034.

North America dominated the global clinical laboratory services market with the largest market share of 37% in 2024. The U.S. dominated the clinical laboratory services market in North America region. The clinical laboratory services market in North America region is being driven by growing prevalence of chronic disorders. In addition, favorable government conditions are also driving the growth of clinical laboratory services market in the region.

U.S. Clinical Laboratory Services Market Trends

The U.S. plays a leading role in the North American market, characterized by a highly developed healthcare infrastructure, significant R&D investment in advanced technologies like precision medicine and AI, and the presence of major global corporations such as Quest and Labcorp. Its role is to drive technological innovation, establish global quality standards through rigorous regulation such as CLIA and FDA, and support a market sustained by high healthcare spending and an established reimbursement framework.

What Makes Asia-Pacific the Fastest-Growing Market for Clinical Laboratory Services?

Asia-Pacific region is expected to develop at the fastest rate during the forecast period. China and India dominate the Asia-Pacific clinical laboratory services market. The ongoing research and development activities combined with government initiatives are creating new opportunities for the growth of clinical laboratory services market in the region. The factors such as rapid urbanization and rising disposable income are also driving the growth of the Asia-Pacific clinical laboratory services market.

China Clinical Laboratory Services Market Trends

China is a major contributor to the Asia Pacific health insurance market due to the increasing demand for diagnostic and healthcare services among its large and aging population. Rapid urbanization and rising chronic disease prevalence are driving the need for comprehensive health coverage. Strong government initiatives and substantial investments in healthcare infrastructure and technology further support market growth and the expansion of domestic capabilities.

What Factors Contribute to the Growth of the European Clinical Laboratory Services Market?

Europe is expected to grow significantly in the clinical laboratory services market during the forecast period. The increasing incidence of various diseases in Europe is increasing the demand for clinical laboratory services. At the same time, increasing technological advancements are also contributing to the same. Furthermore, support is also being provided by the government. Thus, these factors promote the market growth.

The industries in the UK are focusing on various diagnostic approaches for enhancing the clinical laboratory services to deal with the rising incidence of diseases. This, in turn, increases the collaboration between the companies for increasing the production. Furthermore, to improve these services as well as to make them affordable the government is also providing its support.

The demand along with the use of clinical laboratory services are growing in Germany, due to the adoption of various advanced technologies. These technologies are improving the diagnostic procedures as well as reducing the manual errors. This, in turn, is attracting a large number of patients, enhancing the clinical laboratory services.

How is the Opportunistic Rise of Latin America in the Clinical Laboratory Services Market?

Latin America is seeing significant growth in the clinical laboratory services market due to higher healthcare spending, increased awareness of preventative medicine, and a rising prevalence of chronic diseases. The region's diverse healthcare systems, which include both publicly funded and private payer models, boost demand for both basic and advanced diagnostic services. There is also a push for technological improvements, such as automation and molecular diagnostics, to enhance efficiency and accuracy. Collaborations between local laboratories and multinational companies like Quest Diagnostics and Laboratory Corporation of America are fueling this growth.

Brazil Clinical Laboratory Services Market Trends

Brazil has the largest and most developed clinical laboratory services market in Latin America, marked by high competition and industry consolidation. The market growth is mainly driven by an aging population, a heavy load of chronic diseases, and a mix of public and private healthcare systems. There is a strong trend toward consolidation, with major networks like Dasa and Fleury acquiring smaller labs to broaden their reach and services, aiming to improve efficiency and patient care.

What Potentiates the Growth of the Clinical Laboratory Services Market in the Middle East and Africa?

The MEA clinical laboratory services market is growing steadily, fueled by rising healthcare spending, a high rate of lifestyle-related diseases like diabetes and heart conditions, and government efforts to upgrade healthcare infrastructure. Mandatory health insurance in several GCC countries serves as a major driver. Key trends include the adoption of advanced technologies such as next-generation sequencing (NGS) and a focus on Public-Private Partnerships (PPPs) to improve access to high-quality diagnostic services.

Saudi Arabia Clinical Laboratory Services Market Trends

Saudi Arabia's clinical laboratory services market is expanding, bolstered by the government's Vision 2030 initiatives focused on healthcare reform and privatization. The growth is mainly driven by a high prevalence of chronic diseases and a rising demand for advanced diagnostic services. The Kingdom is investing heavily in modern laboratory infrastructure and adopting innovative technologies. The market includes both large private companies and public hospital labs that aim to provide high-quality, efficient, and standardized lab services.

Value Chain Analysis

Research and Development (R&D) & Technology Development - This focuses on innovating new diagnostic tests (e.g., genetic, molecular) and platforms, using biomarker discovery and assay development to improve accuracy.

- Key Players: Thermo Fisher Scientific, Siemens Healthineers, Abbott Laboratories, Roche Diagnostics, Illumina.

Manufacturing and Production - This stage involves the large-scale, quality-controlled production of diagnostic kits, reagents, and analytical instruments, all in compliance with strict regulatory standards.

- Key Players: Thermo Fisher Scientific, Siemens Healthineers, Abbott Laboratories, Roche Diagnostics, Danaher Corporation, BD.

Distribution and Supply Chain Management - This stage ensures efficient logistics and product delivery to laboratories and patient centers, including inventory control and specialized storage (e.g., cold chain).

- Key Players: Cardinal Health, McKesson Corporation, AmerisourceBergen, Quest Diagnostics, LabCorp, Sonic Healthcare.

Laboratory Operations and Testing - This is the core stage where specimens are processed, tests are performed, and quality assurance is maintained, all while complying with regulations like CLIA.

- Key Players: Quest Diagnostics, Laboratory Corporation of America (LabCorp), Sonic Healthcare, Eurofins Scientific.

Results Interpretation and Reporting - Test results are analyzed by professionals and reported to healthcare providers. This stage uses data management and informatics to integrate findings into EHRs for better decision-making.

- Key Players: Epic Systems, Cerner (Oracle Health), LIS specialists.

Customer Service, Support, and Payments - This involves interfacing with providers and patients, managing billing, processing insurance claims, and providing education and support.

- Key Players: UnitedHealth Group, Elevance Health, Humana, Aetna, Quest Diagnostics, LabCorp, Sonic Healthcare.

Clinical Laboratory Services Market Companies

Key Players in Clinical Laboratory Services Market & Their Offerings:

- Quest Diagnostics Inc.: Offers a vast range of routine and esoteric testing through a nationwide network of laboratories and patient service centers.

- Laboratory Corporation of America Holdings:Provides comprehensive clinical laboratory services, genomics testing, and end-to-end drug development support through a global network.

- Sonic Healthcare: A leading international provider of medically-led clinical pathology services, genetic testing, and diagnostic imaging across multiple continents.

- Siemens Healthcare GmbH: A major medical technology company that provides the advanced equipment and instruments used within clinical laboratories for diagnostics (e.g., analyzers, automation systems).

- Charles River Laboratories International Inc.: Primarily a contract research organization (CRO) focusing on preclinical and clinical trial lab services that support pharmaceutical and biotech R&D.

Other Key Players

- NeoGenomics Laboratories Inc.

- Fresenius Medical Care

- Viapath Group LLP

- Almac Group

- OPKO Health Inc.

Key Developments

- In May 2025, Imaging Core Lab Services, with the brand name of Centafore, was launched and announced by Bayer. To support the clinical trials and software as a medical device (SaMD) development in different development phases and therapeutic areas developed by the external customers, tailored services will be provided by Centafore, making it a distinct imaging solution provider.

- In May 2025, for reestablishing the Clinical Laboratory Improvements Advisory Committee (CLIAC), a letter was issued to Secretary of the Department of Health and Human Services (HHS) Robert F. Kennedy Jr. by the Association for Diagnostics & Laboratory Medicine (ADLM, formerly AACC). (Source: https://www.pharmabiz.com)

- ADLM calls on HHS to reinstate essential committee that is needed to ensure the safety and efficacy of clinical laboratory tests

- The pathology labs at Homerton Hospital began offering urine and blood analysis in February 2020. The labs have been relocated to the Royal London Hospital. Homerton and two other trusts, namely Barts Health and Lewisham & Greenwich will now share the clinical laboratory services.

- Illumina acquired disease testing business Grail in March 2020 to accelerate the marketing and acceptance of pioneering multi malignancy screening assays that can detect more tumors earlier and provide better findings. Galleri was expected to go commercial in 2021 when a multi disease research center developed a test for early cancer detection from blood.

- Pharmaceutical Product Development and NeoGenomics collaborated to open a NeoGenomics oncology based clinical trials testing laboratories in Singapore in July 2019. In the Asia-Pacific area, this development strengthens the company's pathology and molecular expertise.

Segments Covered in the Report

By Test Type

- Human and Tumor Genetics

- Clinical Chemistry

- Medical Microbiology and Cytology

- Genetic Testing

- Drug of Abuse Testing

- Other Esoteric Tests

By Service Provider

- Hospital based laboratories

- Standalone laboratories

- Clinic based laboratories

By Application

- Bioanalytical and Lab Chemistry Services

- Toxicology Testing Services

- Cell and Gene Therapy Related Services

- Preclinical and Clinical Trial Related Services

- Drug Discovery and Development Related Services

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting