What is the Hospital Services Market Size?

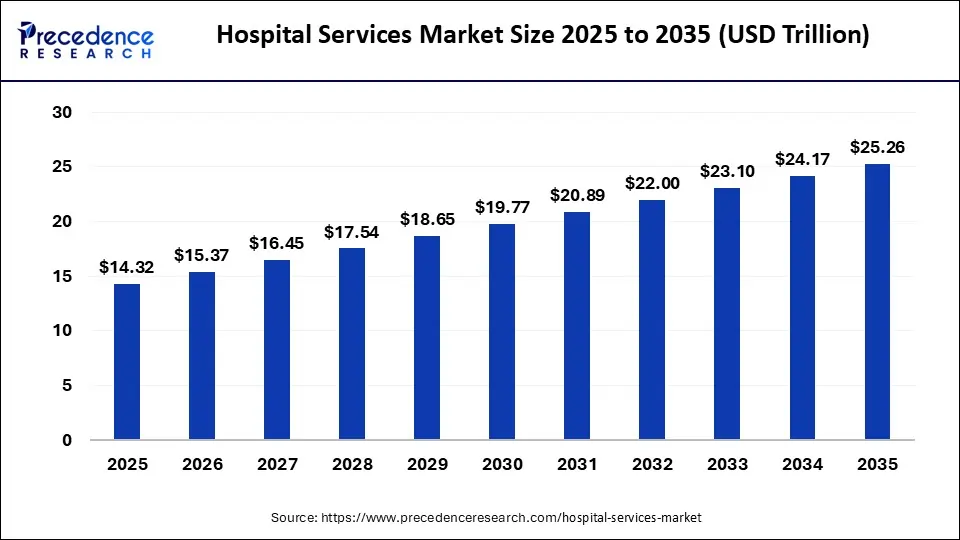

The global hospital services market size was estimated at USD 14.32 trillion in 2025 and is predicted to increase from USD 15.37 trillion in 2026 to approximately USD 25.26 trillion by 2035, expanding at a CAGR of5.84% from 2026 to 2035.

Hospital Services Market KeyTakeaways

- In terms of revenue, the global hospital services market was valued at USD 13.30 trillion in 2025.

- It is projected to reach USD 24.17 trillion by 2035.

- The market is expected to grow at a CAGR of 5.99% from 2026 to 2035.

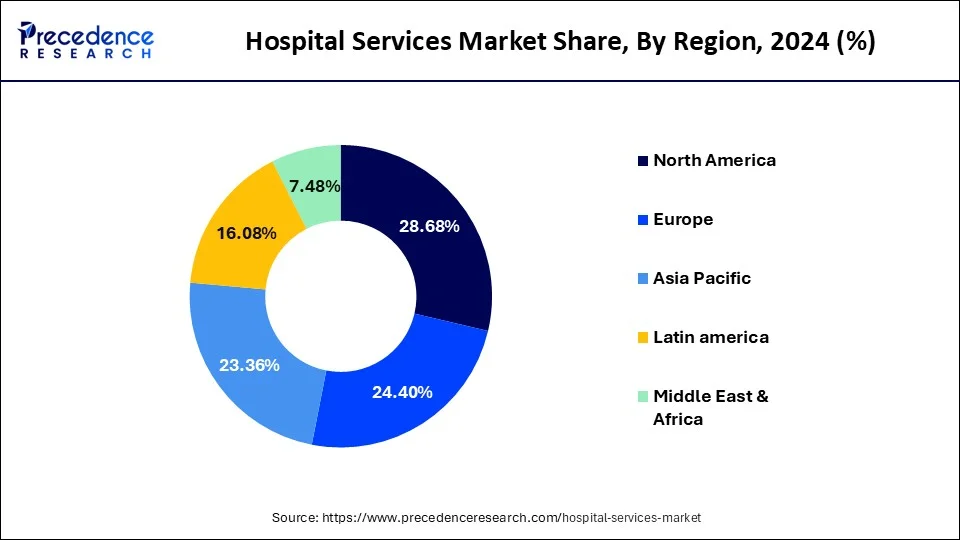

- North America dominated the global market with the largest market share of 28.44% in 2025.

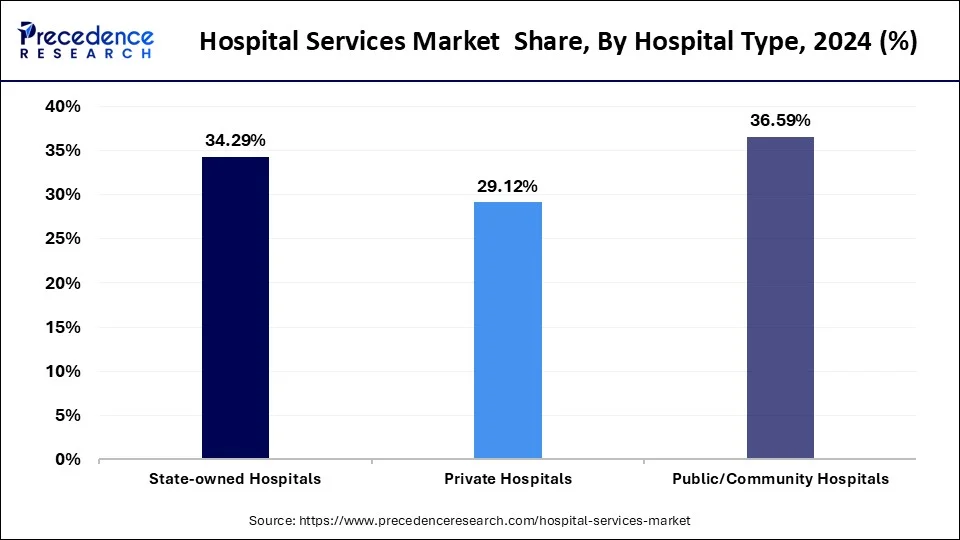

- By Hospital Type, the public/community hospitals segment held the biggest market share of 36.47% in 2025.

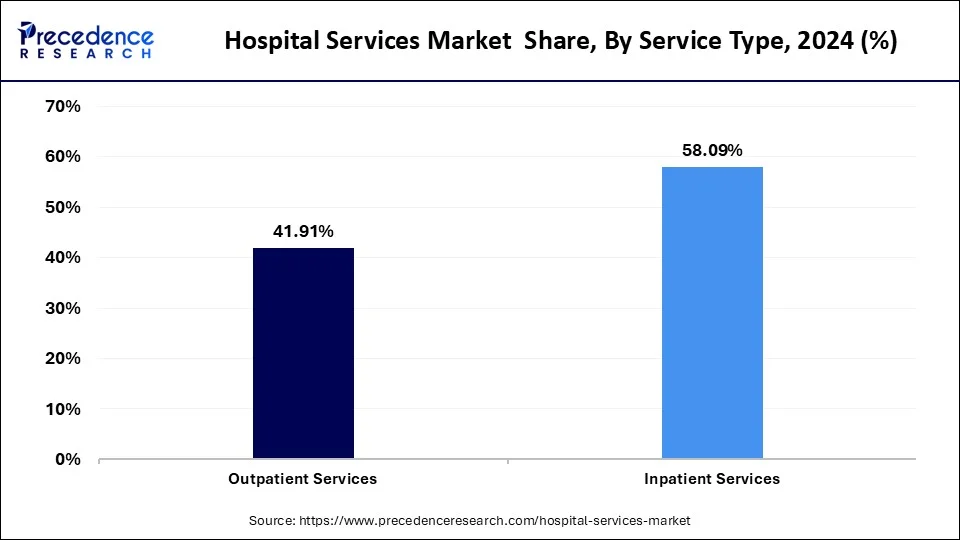

- By Service Type, the inpatient services segment captured the highest market share of 57.72% in 2025.

- By Service Areas, the cardiovascular segment generated the major market share of 21.48% in 2025.

Hospital Services Market Growth Factors

Rising cancer incidence globally, increasing number of knee replacement surgeries, and availability of next-generation stents are key factors that are anticipated to drive the global hospital services industry over the forecast period. However, high cost of surgical procedures coupled with lack of insurance coverage will subsequently restrain the market growth.

Cost of medical facilities have seen spike in past few decades. Advanced diagnostic technologies have paved their way for early and improved detection of disease as well as supported research for terminal disease treatment such as cancer. Increasing affordability and awareness among people medical services market expected to spur, which is already evident in many countries, as it contributes significantly towards the growth of Gross Domestic Product (GDP).

With increasing cost of healthcare facilities, several developed nations have established health insurance plans. In North America, healthcare insurance is an integral and the most important sector of healthcare industry. Its rising influence among consumers and public projected to spur their demand over the coming years. In addition, healthcare service contributes significantly towards revenue in the overall healthcare industry. Pharmaceutical companies, term care services, medical devices sector, medical consumables industry, and healthcare facility management services together contribute prominently toward the healthcare services market. As an end-use segment, hospitals capture significant consumer base in the healthcare industry.

Hospitals, therefore, are an integral part of healthcare industry as well as a major revenue source for the overall industry that also fuels research & innovation in the stream. Various healthcare product manufacturers invest prominently in terms of both marketing strategies and revenue to promote their product and services among hospitals. Hence, strategic decisions within the hospital sector affects notably to the other associated industry within healthcare steam.

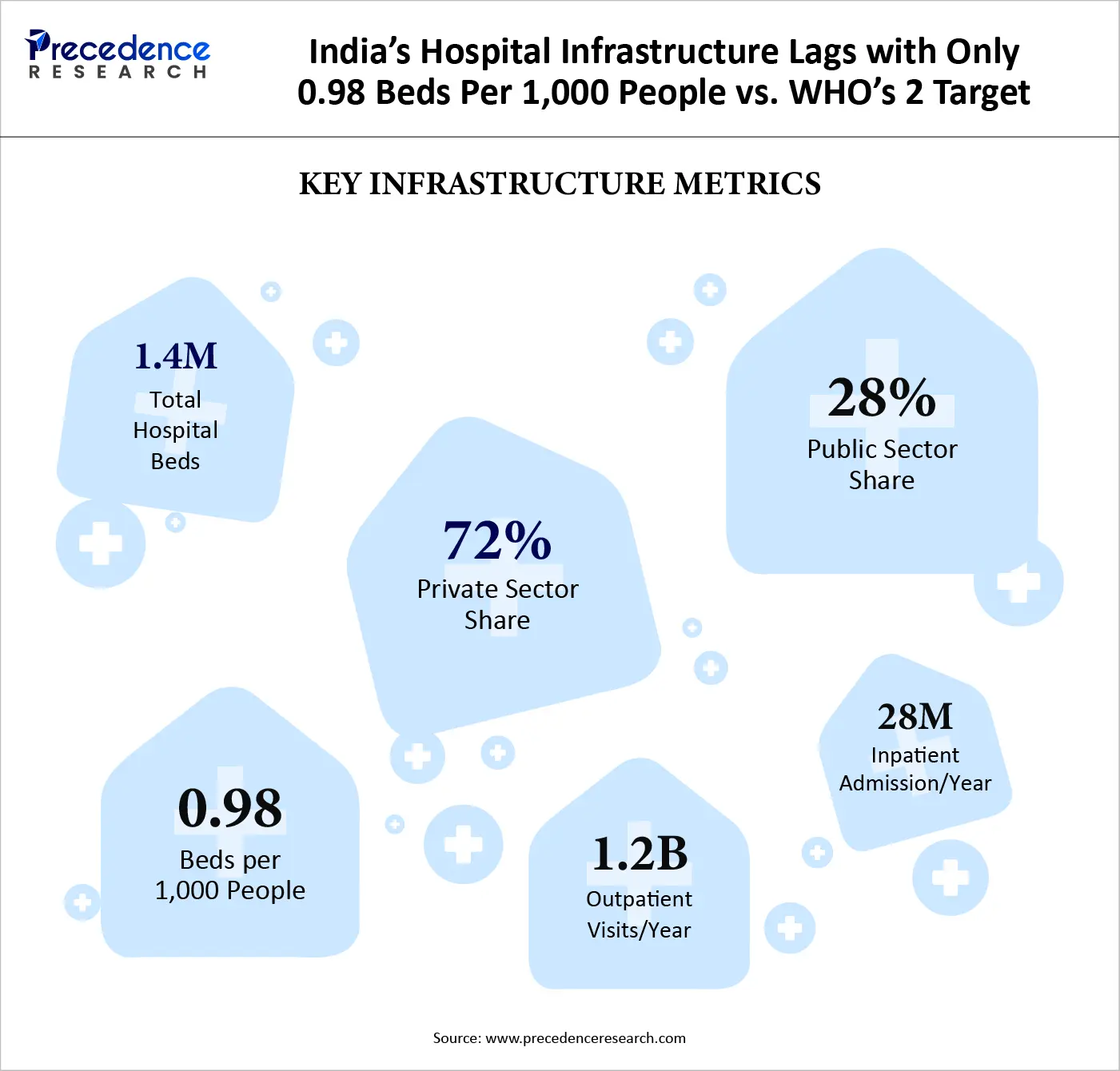

India's hospital infrastructure in 2023 reflects both massive scale and significant capacity gaps. With approximately 1.4 million hospital beds and only 0.98 beds per 1,000 people, availability remains well below the WHO's suggested benchmark of around two beds per 1,000 population. The private sector dominates service delivery, accounting for 72% of total beds, compared to 28% in the public system. Demand pressure is evident, with nearly 1.2 billion outpatient visits and about 28 million inpatient admissions annually. These figures highlight strong healthcare utilization, expanding private sector influence, and substantial opportunities for infrastructure expansion and capacity strengthening across India.

How AI Creating a Business Impact and Future Business Growth Opportunities

AI is having the greatest impact on hospital service delivery by increasing operational efficiency, improving medical diagnosis, and providing more effective means of providing medical care, using data-driven means. As hospitals around the globe continue to invest in IT and AI, the trend is being driven by the need to streamline clinical documentation, imaging, and decision support to allow hospital staff to focus on providing higher-value services for patients while increasing patient outcomes. Hospitals in India will increase their innovation budget by 20-25% in the upcoming year to scale AI use cases for optimizing resources and workflow automation.

Additionally, in January 2026, OpenEvidence have increased $12 billion in just over one year's time by providing AI-based solutions designed specifically for physicians, which demonstrates strong investor confidence in AI-based platforms for healthcare. With this surge in AI adoption, it is clear that hospital providers view AI as a key component in maintaining both a competitive edge in the marketplace as well as being a significant driver for future growth in the healthcare sector.

Hospital Services Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 14.32Trillion |

| Market Size in 2026 | USD 15.37Trillion |

| Market Size by 2035 | USD 25.26 Trillion |

| Growth Rate from 2026 to 2035 | CAGR of 5.84% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service Class, Hospital Type, Service Area, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

COVID-19 Impact

The COVID-19 pandemic resulted in placing unparalleled demands on healthcare systems, however, the industry has exhibited resilience and the ability to bring innovations to the market rapidly. Nonetheless, the various sub-segments of the healthcare sectors are being affected by COVID-19. There was tremendous pressure on pharmaceutical companies to manufacture vaccines. Post the clinical trials, these companies are now facing production pressures to meet the demand across the globe. They are being challenged by complex supply chains, new models for engagement with healthcare professionals, a largely remote workforce, and disruption to many clinical trials . Similarly, hospitals are caring for COVID-19 patients with evolving protocols while maintaining continuity of care for others, often against the backdrop of vulnerable staff, supply and equipment shortages, and, for some, accelerating financial headwinds.

Private hospitals and clinics are experiencing a reduction of in-patient footfalls due to nationwide lockdown and several other factors as well which are leading to inadequate utilization of health?care services by the patients and decrease in medical services volumes which resulted in acute economic crisis.

The high requirement of isolation wards and patient beds has resulted in the majority of the non-emergency care facilities being converted to dedicated wards for corona infected patients. Furthermore, the healthcare supply chain has been disrupted due to the exponential demand for hand sanitizers, personal protection equipment, face masks, and other protective gear. Lockdowns for extended periods across economies have affected all other industries and over the last year, the focus of the economy has shifted to focus only on healthcare facilities catering to the infection.

Hospital Type Insights

Hospital service structure differs by region, in the U.S. and UK the market structure was influenced by the private hospitals. This was mainly due to several retail clinics comes under the network of private hospitals. In addition, the overall growth of the hospital services market was controlled by the private and community hospitals.

In 2025, public/community hospitals accounted for the largest market share at 36.47%, whereas, state-owned hospitals accounted for the second-largest market share. Both these segments are expected to lose their shares to the private hospital segment on account of advanced hospital services offered by them. Furthermore, the presence of superspecialty procedures in private hospitals is expected to increase the footfall of patients. These types of hospitals have the largest capacity of patient beds and cater to various medical conditions or service areas though specialized departments. Philanthropist organizations, crowd-funded communities, and corporations are the significant promoters of community hospitals.

On the other hand, private hospitals seek lucrative growth over the forecast period. As per analysis in the hospital sector, growth of private hospitals is mainly due to expansion of specialist capabilities as well as specifically caters to the critical patients suffering from chronic disease such as cardiovascular care & cancer. Besides this, state-owned hospitals mainly focus on the patients that require acute care such as accident/trauma and infection control treatments. In the wake same, these hospitals observed to have a plummeting market share in the coming years, specifically in the developed countries.

Hospital Services Market Revenue, By Hospital Type, 2023-2025 (USD Billion)

| Hospital Type | 2025 | 2024 | 2025 |

| State-owned Hospitals | 4,227.8 | 4,561.6 | 4,905.3 |

| Private Hospitals | 3,565.2 | 3,873.3 | 4,194.0 |

| Public/Community Hospitals | 4,521.0 | 4,868.0 | 5,224.0 |

Service Type Insights

In 2025, inpatient services accounted for 57.72% of the global hospital service market share, whereas outpatient services accounted for the remaining share. This was mainly because of hospitalization procedures that require long hospital stays.

The inpatient services segment has been experiencing rapid growth due to the increased complexity of hospital inpatient care for more complicated, long-term care, and the increased number of patients treated as inpatient for long-term, acute, and chronic illnesses. This demand for the inpatient services segment is supported by the increasing number of older adults, an increase in ambulatory surgery cases, and a corresponding increase in hospital inpatient treatment for chronic and acute illnesses. The increased demand for inpatient services has also been bolstered by improvements in hospital services, the development of advanced treatment options, and continued improvement in post-operative care provided by the hospital.

The high costs of inpatient services along with limited insurance coverage are expected to result in patients opting for outpatient services during the forecast period. Thus, the inpatient services segment is expected to lose a notable chunk of its share to the outpatient services segment. However, with the advancement in the wound healing capability along with quick recovery from surgeries have significantly reduced the duration of hospital stay.

Hospital Services Market Revenue, By Service Type, 2023-2025 (USD Billion)

| Service Type | 2023 | 2024 | 2025 |

| Outpatient Services | 5,115.8 | 5,575.3 | 6,055.5 |

| Inpatient Service | 7,198.2 | 7,727.5 | 8,267.8 |

Service Areas Insights

Cardio-vascular services accounted for the largest market share in 2025, followed by the diagnostics & imaging segment. Although neurorehabilitation & psychiatry services accounted for a 12.50% market share in 2025, the segment is expected to witness the highest growth on account of rising patient awareness regarding mental health. Cancer care is anticipated to be the second-fastest growing segment due to the rising prevalence of cancer, especially among women.

Conversely, development in the communication technology anticipated to spur the growth of outpatient service over the analysis period. Developed communication technology has paved the way for growth in remote consultation procedures and telemedicine. Consequently, shorter hospital stays and high cost for inpatient service have made outpatient service as the most opportunistic segment among the hospital service providers.

The diagnostics and imaging sector has been expanding rapidly, primarily because of the increased incidence of chronic illnesses, the increasing demand for routine health screenings, and the increased demand for history and diagnosis for both chronic and acute illnesses. In addition, continued advancements in imaging technologies, an increased number of patients who know of the availability of imaging services and the incorporation of diagnostic analysis into the everyday routine of the hospital have contributed to the rapid growth of this segment through frequent utilization, faster decision-making, and improved treatment outcomes.

Hospital Services Market Revenue, By Service Areas, 2023-2025 (USD Billion)

| Service Areas | 2023 | 2024 | 2025 |

| Cardiovascular | 2,663.1 | 2,857.5 | 3,055.6 |

| Acute Care | 524.3 | 567.1 | 611.4 |

| Cancer Care | 1,774.9 | 1,922.3 | 2,075.0 |

| Diagnostics and Imaging | 1,953.5 | 2,112.9 | 2,277.7 |

| Neurorehabilitation & Psychiatry Services | 1,526.5 | 1,656.2 | 1,790.9 |

| Gynecology | 675.2 | 727.7 | 781.6 |

| Others | 3,196.4 | 3,459.2 | 3,731.1 |

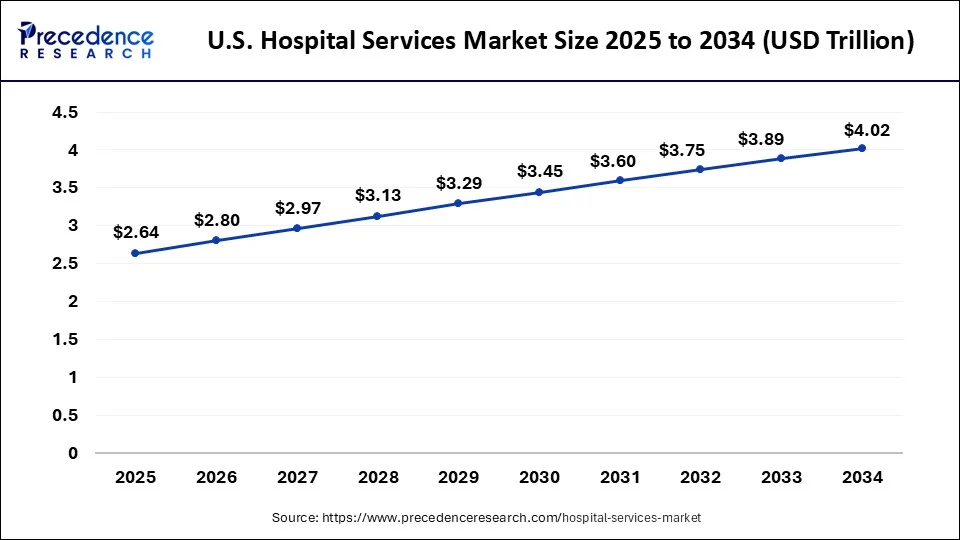

U.S. Hospital Services Market Size and Growth 2026 to 2035

The U.S. hospital services market size reached USD 2.64 trillion in 2025 and is projected to be worth around USD 4.16trillion by 2035, poised to grow at a CAGR of 4.65% from 2026 to 2035.

In 2025, North America emerged as a global leader accounting for a revenue share of 28.44% in the global hospital services market. Rising incidence of cancer along with increasing cost of medical services in the region expected to propel the market growth of the region. In addition, the region anticipated to maintain its dominance during the forecast period owing to developed medical centers and healthcare facilities. Upcoming economies of Middle East, Africa, Latin America, and Asia Pacific are expected to drive the regional market growth during the forecast period due to high potential government investments for improving their healthcare infrastructure.

The global hospital services market is highly fragmented due to the presence of several large and small firms with a global and regional focus. HCA Healthcare, Ascension Health, Tenet Healthcare Corporation, Mato Clinic, and Community Health Systems, Inc. are some of the largest hospital service providers in the world with a global presence. Several of these firms have hospital networks across North America and Europe. Over the last few years, these companies have been focusing on various strategies such as acquisitions, and expansions & investments.

Why Asia Pacific is the fastest growing Region in Hospital Services Market?

The Asia Pacific region is considered to be the fastest growing region for hospital services due to an increasing awareness of health care, a fast-growing population, and rapid growth of government and private investment in hospital facilities. Governments are increasing their investment in health care to improve access to quality care, and private sector investment in building multi-discipline hospital service networks is robust. High levels of medical tourism, urbanization, and an increase in the prevalence of chronic and lifestyle-related disease have continued to drive patients to hospitals and health systems in both urban and semi-urban locations.

China

China is the dominant leader in Asia's Pacific hospital services markets because it has one of the largest hospital networks in the world and the most focused government policy on reforming and improving the health care system. Continued government investment in modernizing hospitals, building health care facilities in tiered cities (tier 2/3) and continually improving access to advanced outpatient and inpatient services through continued investment have sustained its dominance in the Asia-Pacific hospital services market.

Why Europe Showing Steady Expansion in Hospital Services Market?

Europe's hospital service market is growing due to many factors including universal healthcare systems and large government expenditures on hospitals. The increasing prevalence of an ageing population and related demands for rehabilitation, chronic disease management and long-term care are greatly contributing to intensive use of European hospitals. In addition to increased usage, hospitals are also changing the way they operate by emphasizing increased efficiency through the expanding use of digital health technology and expanding their outpatient services. Also helping to sustain growth across Europe are cross-border health partnerships as well as medical tourism.

Germany

Germany leads the market for European hospital services due, in large part, to its developed health system and large number of hospital beds available throughout the country. Additionally, Germany has a large presence of both public and private hospitals; continual upgrades to hospital infrastructures; and a continued focus on specialist treatments and innovative technology for diagnosis.

Why Latin America is Emerging Quickly in Hospital Services Market?

The rapid emergence of Latin America as a new market for hospital services is driven by increased access to healthcare and the growing number of private hospitals. Public healthcare systems are being enhanced while private providers invest in newer facilities and adding locations in addition to expanding specialty services. Increases in health insurance coverage, urban population density, and growing awareness of both preventive and specialty care are creating greater demand for hospital services across all major Latin American economies.

Brazil

Brazil is leading country in the Latin American market, where the largest number of hospitals is located, followed by Argentina, Mexico and Colombia. The Brazilian hospital services' market has continued to grow due primarily to the large size of the health care system and the increasing need for improved hospital services in the private hospital sector. Furthermore, the need for additional multi-specialty hospitals has led to increased investment in this area as well as increased consumer demand from the middle class for quality hospital services.

How Middle East and Africa Advancing in Hospital Services Market?

The Middle East & Africa region has seen growth in terms of healthcare infrastructure investment by providing governments with increased funding for health system improvement and building new hospitals, medical cities and specialty care centers to prepare patients for medically necessary treatments and improve patient access to care. The rising population, increased chronic disease prevalence, enticing medical tourism plans in certain countries and greater use of hospitals are driving up hospital volume across much of the Middle East & Africa. Additionally, the private sector participates in healthcare delivery through the establishment of joint ventures and partnerships with organizations in other countries, which expands and enhances hospital service delivery across the region.

Saudi Arabia

Saudi Arabia has an outstanding reputation as a leader in the Middle East & Africa hospital services market due to the large scale of investment by the Saudi government and its many hospital expansion initiatives over the years. Government initiatives to improve modernize healthcare facilities, create more opportunities for private participation, create and expand specialized and tertiary services are all contributing to the Saudi Arabia's leading position in the region.

Key Companies & Market Share Insights

The global hospital services market players are largely focusing on merger & acquisition and regional expansion strategy to establish their retail clinic chain in various parts of the country or the region. According to the hospital merger report published by the Journal of the American Medical Association (JAMA), merger & acquisition among hospital sectors have paved way for large institutions, although resulted in increased cost.

Hospital Services Market Companies

- Mayo clinic

- HCA Healthcare

- Cleveland clinic

- Spire Healthcare Group plc

- Ramsay Health Care

- Ascension Health

- Community Health Systems, Inc.

- Tenet Healthcare

- Fortis Healthcare

Recent Developments

- In January 2026, Pulsenmore and Clalit Health Services launch Israel's first at-home follicular monitoring service for IVF and fertility preservation, enabling remote ultrasound scans with clinical oversight via a virtual hospital partnership.

- In March 2025, PATH begins a large randomized clinical trial in Kenya testing artificial intelligence tools to improve primary health care diagnostics, treatment quality, and guideline-based care in low-resource settings.

- In November 2025, Apollo Hospitals inaugurated its third facility in Maharashtra at Swargate, Pune, opening a quaternary care hospital initially with 250 beds and plans to expand to 400 beds.

Segments Covered in the Report

This research study comprises complete assessment of the market by means of far-reaching qualitative and quantitative perceptions, and predictions regarding the market. This report delivers classification of marketplace into impending and niche sectors. Further, this research study calculates market size and its development drift at global, regional, and country from 2021 to 2035. This report contains market breakdown and its revenue estimation by classifying it on the basis of hospital type, service type, service areas, and region:

By Hospital Type

- State-owned Hospital

- Private Hospital

- Public/ Community Hospital

By Service Type

- Outpatient Services

- Inpatient Service

By Service Areas

- Cardiovascular

- Acute Care

- Cancer Care

- Diagnostics, and Imaging

- Neurorehabilitation & Psychiatry Services

- Gynecology

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting