What is the Healthcare Facilities Management Market Size?

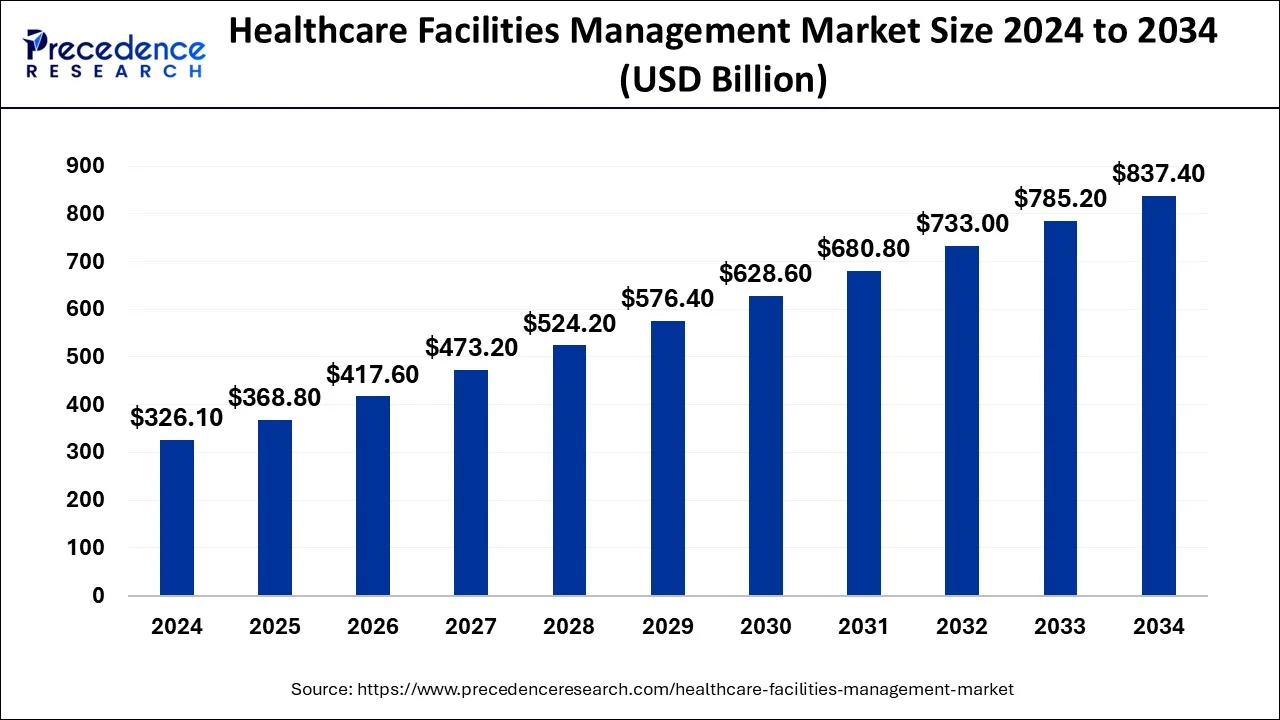

The global healthcare facilities management market size is calculated at USD 368.8 billion in 2025 and is predicted to increase from USD 417.6 billion in 2026 to approximately USD 889.6 billion by 2035, expanding at a CAGR of 9.2% from 2026 to 2035.

Healthcare Facilities Management Market Key Takeaway

- The global healthcare facilities management market was valued at USD 368.8 billion in 2025.

- It is projected to reach USD 889.6 billion by 2035.

- The healthcare facilities management market is expected to grow at a CAGR of 9.2% from 2026 to 2035.

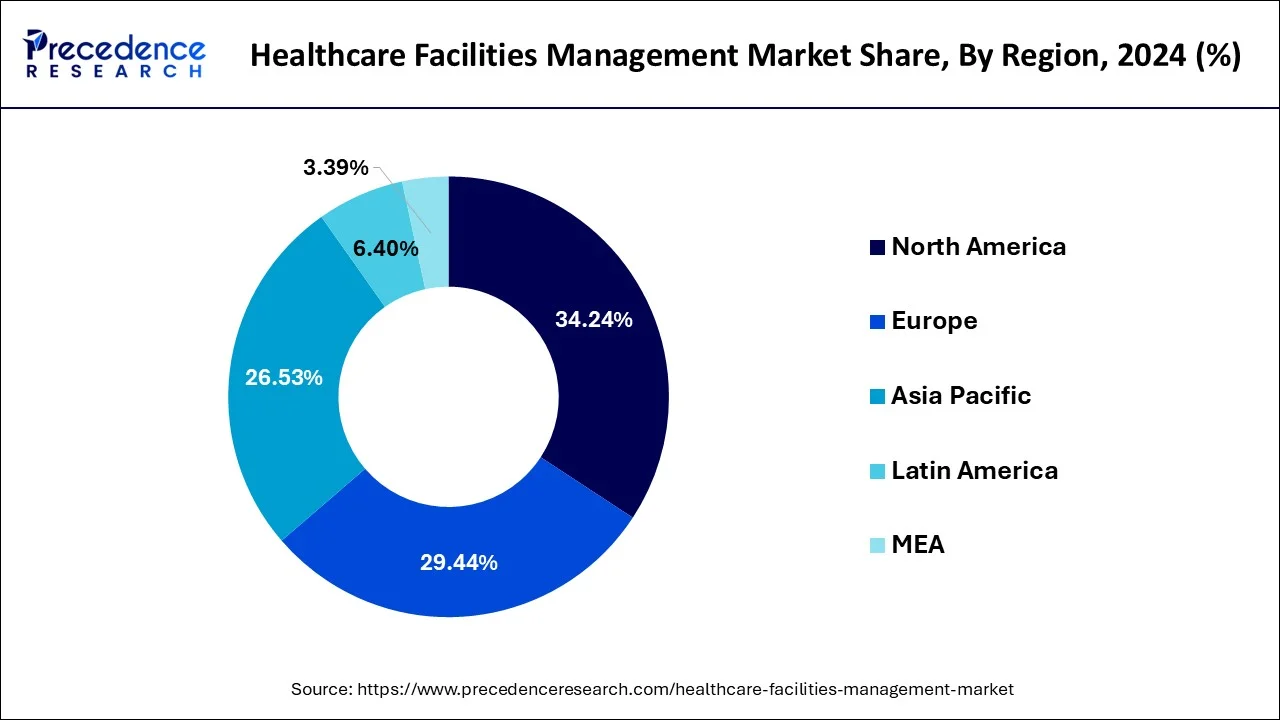

- North America has held 34.24% revenue share in 2025.

- Asia Pacific market has captured revenue share of around 26.53% in 2025.

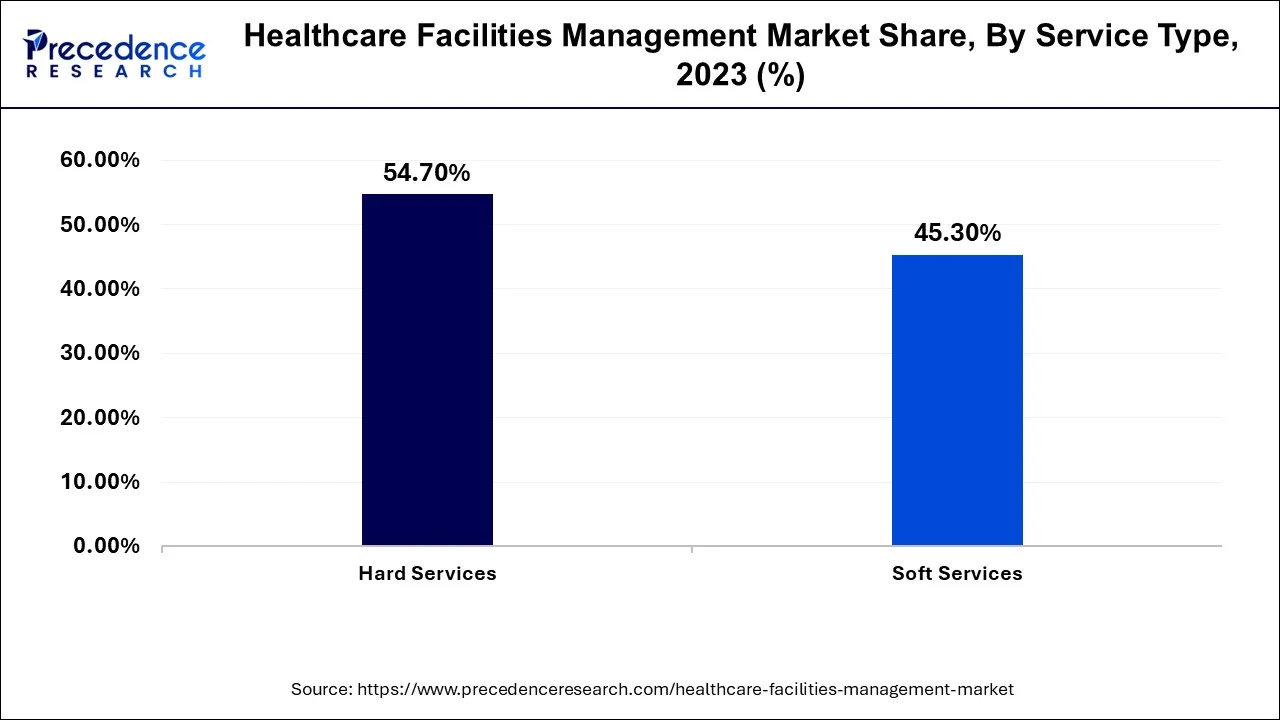

- By service type, the soft services segment has captured 54.7% revenue share in 2025.

- The hard services segment has generated revenue share of around 45.3% in 2025.

- By end-user, the long-term care facilities segment is set to experience the fastest rate of market growth from 2026 to 2035.

Healthcare Facilities Management Market Growth Factors

Growing focus on health and wellness will infuse more facets of business and private life during coming years. Healthcare facility management market is observing a change in technology to advance facility monitoring, efficiency and cost effectiveness. IoT is anticipated to transform the current healthcare BAS (Building Automation System). Implementation of new ICT such as IoT by facility management service providers is anticipated to empower healthcare facilities access real-time information via interconnected sensors that may aid them to enhance manage their business.

Healthcare has emerged as one of the most promising sectors due to growing number of patients and increasing healthcare spending by the private and public participants in healthcare systems. In 2017, according to the CMS (Office of the Actuary) report, the U.S. spent around USD 3.5 trillion on healthcare sector and this number was augmented to around USD 3.8 trillion in 2019. Thus there has been excellent growth in the healthcare expenses that has led to the expansion of numerous facilities in clinics or hospitals for the welfare of patients. These factors are propelling the growth of healthcare facilities management market across the world. Hospitals and clinics are expected to observe profitable progress because of the growing awareness about the cleanliness required to evade scattering of diseases and responsiveness concerning the requirement for controlling the pollution of the environment. However, lack of technical expertise may impede the growth of the market in few regions.

How Has AI Benefited the Healthcare Facilities Management Market?

AI is emerging as a formidable force in the healthcare facilities management market. It supports hospitals and clinics in becoming more operationally expeditious around maintaining cleaning, security, energy consumption, and maintenance management. AI systems can analyze the data in real-time and provide suggestions on what to clean, when to clean, when to repair, or when energy can be saved. This allows for reducing wasted energy, saving costs, as well as improving patient safety.

AI also helps to keep track of how many individuals are within any given area, which helps avoid overcrowding. In some hospitals, AI provides a level of security by analyzing and observing security cameras for any unsafe incidences. AI can also be used to coordinate worker schedules with optimized efficiency and reduced human error. As health care buildings are getting larger, in terms of floor space and more complex, AI is afforded as a tool that makes operational assessments that can keep everyone safe without adding extra staff. Finally, AI can also be utilized to enable greener practices in support of more environmentally conscious hospitals.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 368.80 Billion |

| Market Size in 2026 | USD 417.6 Billion |

| Market Size in 2035 | USD 889.6 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 9.2% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Service Type, By End User, By Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing elderly population

A major factor causing growth in the healthcare facilities management industry is the aging population requiring additional care, hospital visits, and long-term care support. Hospitals, nursing homes, and clinics are open and available to the public at all times and must maintain an acceptable level of cleanliness, safety, and management. Senior population growth has triggered new long-term care centers to open, which has increased the demand for facility management services such as cleaning, maintenance, security, etc., and management of energy use. Countries like Japan, China, and the U.S. are experiencing rapid growth in their elderly populations.

Restraint

High Costs Incorporated With Advanced Technology

An ongoing problem for healthcare facilities management is that it is expensive to implement new technologies. Healthy facility management systems that use AI, robots, or IoT tools provide hospitals with better ways of thinking about their operations, but they are very expensive to purchase if a hospital has not yet developed an infrastructure to support them. Many small hospitals or clinics cannot afford these tools even when they work and also need certified staff to use the facility management systems, which adds an additional expense on top of everything else. If these systems are never used, are too expensive to modify, or break down, they take a considerable amount of money and time to fix. This results in many of these healthcare facilities only looking to their existing systems or waiting to implement advanced technology into their facilities, which affects the market from growing fast enough to support healthcare management modernization and efficiency, as high-cost technology prevents many healthcare facilities from upgrading or modernizing and being efficient.

Opportunity

Over the next few years, healthcare facilities management will advance steadily as hospitals and clinics seek improved processes to remain clean, safe, and prepared for emergencies. More patients, larger hospitals, and smarter buildings with digital solutions such as AI, augmented and virtual reality, voice interaction, and robotics will be part of the managed systems. In addition, there are significant initiatives to build green hospitals and environmentally friendly high-performing buildings that will lead to new jobs and innovations. Telehealth is expanding, which means healthcare buildings must continue to improve their digital programs. In many jurisdictions, governments are investing in building improvements, particularly with health facilities, which provide additional scale for companies to capitalize on. There is also an upgrade opportunity for existing hospitals and new hospitals; the latter become smart buildings that will reduce expenses and save energy.

Service Insights

The hard service held a significant share in healthcare facilities management market. "Hard services" in the context of healthcare facilities management usually refers to the technical and physical management and maintenance duties required to guarantee the efficient, safe, and appropriate operation of healthcare facilities. These services frequently entail systems, equipment, and infrastructure that need to be maintained by people with certain training and experience. This covers the upkeep and repairs of boilers, chillers, HVAC (heating, ventilation, and air conditioning) systems, and other mechanical devices that are necessary to keep healthcare facilities' interior temperatures, humidity levels, and air quality within acceptable bounds. This entails maintaining electrical systems, such as lighting, emergency backup systems (like generators), power distribution systems, and power supply for medical equipment. services pertaining to the upkeep of water supply systems, pipes, and fixtures in plumbing systems. This includes managing and treating the water to guarantee that it is safe and clean for the facility's many applications. The physical structure of the building, which consists of the walls, floors, ceilings, windows, doors, and roofing, must be maintained. To avoid structural problems and keep patients, employees, and visitors in a secure and comfortable environment, routine inspections and repairs are crucial. Upkeep and testing of fire detection, alarm, and suppression systems are necessary to guarantee adherence to safety protocols and safeguard inhabitants during a fire emergency.

The soft services section has been further classified as laundry, medical waste management, catering, cleaning and pest control, security, and other soft services including administrative services. In 2025, soft healthcare facility management services segment occupied majority of the market share compared to hard healthcare facility management services. However, the hard services segment is foreseen to develop at a sophisticated growth rate years to come.

End User Insights

Why Hospitals and Clinics are dominating the Healthcare Facilities Management Market?

The hospital and clinic sector is the leading provider of healthcare facility management services because of the need for facilities to be maintained and supported for the life of the facility with all types of services from cleaning, to HVAC, to waste disposal, to security, and many other associated services such as infection prevention, and increased patient volume. Moreover, they are providing a growing need for integrated and outsourced facility management services in large hospital networks as they expand the number of facilities supporting an increasing patient population.

Long-term care facilities are anticipated to be the fastest-growing segment in the healthcare facilities management market due to an increasingly aging population requiring long-term care. Long-term care takes place in a facility where assistance is provided for activities of daily living, along with care for medical needs for elderly people or others with medical needs who cannot stay at home. There will be increased long-term care facility demand as the population ages and more people require care.

U.S. Healthcare Facilities Management Market Size and Growth 2025 to 2035

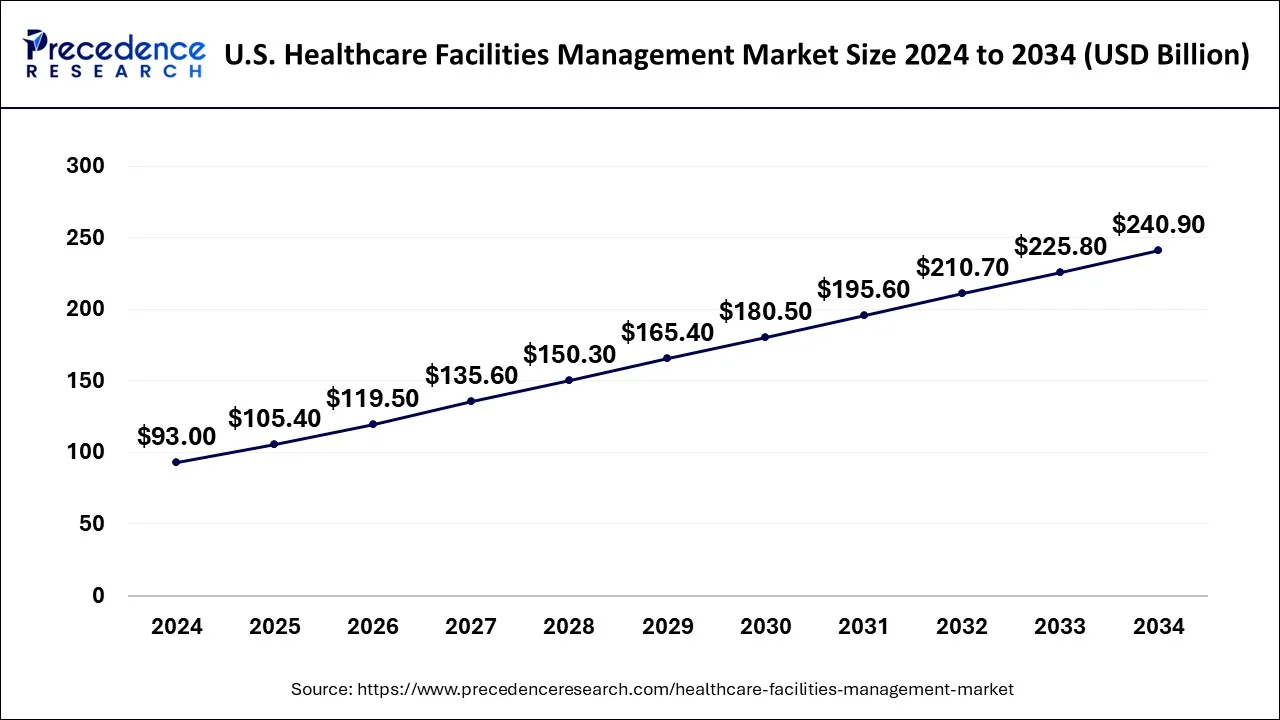

The global healthcare facilities management market size was estimated at USD 105.4 billion in 2025 and is expected to be worth around USD 256 billion by 2035, expanding at a CAGR of 9.28% from 2026 to 2035.

North America is projected to lead the global healthcare facilities management market during years to come. This growth is on account of the strong healthcare organization and the introduction of diverse technologies for healthcare facilities. The complete circumstance of the healthcare structure varies extensively in North American. Presently, some of the hospitals have formed robust market position and certain hospitals have recognized a basic healthcare facility management. In 2020, American Cancer Society projected that there will be about 1.8 million new cancer cases detected and around 606,520 cancer deaths will occur in the U.S. Additionally, growing elderly population and rising chronic diseases throughout the region is expected to supplement the development of the healthcare facilities management market in the near future.

U.S.

The U.S. is currently the leading country in healthcare facilities management because of its vast amount of healthcare infrastructure and high levels of expenditure within the healthcare sector. As hospitals invest in integrated Facilities management to reduce costs while meeting regulatory requirements; facilities are utilizing technology and outsourcing their facility services as they face challenges from an aging facility, the sustainability movement and worker shortages.

Is Europe on the Verge of Becoming a Major Powerhouse?

The growth of Europe is largely due to the increase in infrastructure modernization/hospital enhancements and sustainable practices in facility operations. The emphasis on energy efficiency and waste management identifies many understands why hospitals must also focus on the infection prevention and control. Growing numbers of people aged 65 and older require a long-term care facility, so the requirement for specialized facility management services is increasing; regulations compel health care providers to adhere to regulations and to incorporate standardization within their facility operations. Therefore, technology-based maintenance services and digital monitoring solutions will continue to drive growth in the market for public and private health care organizations.

Germany

Germany will continue to lead because of its highly advanced health care infrastructure coupled with its commitment to operational excellence; hospital facilities are increasingly turning to professional facility management for assistance in achieving their sustainability goals, managing aging building conditions, and maintaining their standards of care for patients.

In what ways are the countries in the Middle East & Africa developing?

Due to government investment in healthcare infrastructures, and increased medical tourism, the Middle East & Africa is experiencing tremendous growth. Governments have set a focus on increasing hospital capacity; creating smart health facilities; and the establishment of international care standards. There is also a growing need to ensure that facilities continue to operate by maintaining proper hygiene protocol, managing the lifecycle of assets through facility management. The increase in private sector funding and the adoption of integrated facility solutions is helping to increase operational efficiencies for hospitals and specialty clinics throughout the region.

Saudi Arabia

Saudi Arabia is currently leading the way in terms of both large-scale Healthcare Infrastructure development as well as large scale healthcare system transformation initiatives. Additionally, professional facilities management is being utilized to help ensure the continued operation and sustainability of new hospitals, by supporting the hospitals with all aspects related to operational efficiency and compliance.

Asia-Pacific

Healthcare facilities management in the Asia-Pacific region is seeing rapid demand growth due to greater public need for clean, adequate hospitals, clinics, and health facilities. Most countries are now investing more publicly and privately in health facilities and assets. Cities and populations are larger and older, requiring more care. There is also greater engagement with new technologies such as smart hospital systems. Sustainable, green, and clean healthcare is also gaining momentum. There are many opportunities for additional investment, building new health facilities, training new health staff, and using smart technology, machines, and equipment to maintain healthy, safe, and clean spaces. There are many new companies entering the marketplace and looking to support better health services and facilities management.

China

China is the dominating country in Asia-Pacific in the healthcare facilities management market in the Asia-Pacific region. The country has a large number of hospitals and clinics, and the government is investing a lot of money in improving healthcare facilities. China is using technology to provide improved cleaning, safety, and management of health facilities, as it also wants to develop green spaces and safe places. As China continues to deal with an aging population and growing cities, it needs additional managed health facilities services, providing a tremendous opportunity for companies to serve this market and provide their services and products throughout the country.

Why Is Latin America is emerging in Healthcare Facilities Management Market?

Latin America is becoming a new healthcare facility market because of the increased focus of healthcare facility management as a way to improve service quality as well as operational reliability. The expansion of private healthcare networks and the gradual improvement of public infrastructure have created a need for healthcare facility management services. The increased awareness of hygiene standards, patient safety, and cost control has helped increase the demand for these services. The economic reforms in Latin America and the establishment of initiatives that improve healthcare access in all areas of society are helping to establish organized facility management services.

Brazil

Brazil is the leading country in Latin America for healthcare facility management services. This is due to Brazil's large healthcare network and growing private hospital sector, along with the increased amount of investment being made in order to modernize hospitals and operate them more efficiently. As a result, there has been an increase in the demand for outsourced healthcare facility management services throughout all urban areas.

Healthcare Facilities Management Market Companies

- ABM Industries Inc

- ISS World Services A/S

- Jones Lang LaSalle, IP, Inc

- Manutencoop Facility Management S.p.A.

- Medxcel Facility Management

- Mitie Group plc

- Aramark Corporation

- Compass Group plc

- Ecolab, Inc.

- OCS Group

- Secro Group plc

- Sodexo

- Vanguard Resources

- UEM Edgenta Berhad

Recent Developements

- In August 2025, PBCToday reported that AI and Building Information Modelling (BIM) transformed healthcare infrastructure by optimizing the whole AECO lifecycle. The improved efficiency, sustainability, and patient-centric nature of facilities resulting from (real-time) data, predictive maintenance, and generative design were consistent with the demands of an evolving digital and environmental healthcare system.

Source : ( https://www.pbctoday.co.uk/ )

- In November 2024, the World Health Organization issued new guidance for developing health care facilities that are safe, climate-resilient, and environmentally sustainable. In collaboration with global partners, the WHO addressed the issues that the health care infrastructure is facing due to climate change and hopes to support governments in their health systems for the future, given the further environmental changes yet to come.

Source : ( https://www.who.int )

- In June 2025, ISS announced it will launch a new Training Academy with IWFM and SFG20 for the benefit of the UK facilities management industry (FM). The aim of this Academy is to enhance the FM profession, upskill facilities management professionals in line with talent development activities in relation to the everyday challenges of facility management professionals that include digital transformation and sustainability.

Source : ( https://fmindustry.com/ )

- In March 2025, PAHO launched ultra-portable telehealth kits to deliver primary-care and specialized health services to people living in remote locations. The kit is a solution to the gaps in health care.

Source : ( https://www.paho.org/ )

- In April 2025, SIMPPLE Ltd invented SIMPPLE Vision, a Vision-as-a-Service (VaaS), video analytics, and computer vision platform to manage physical facilities. They entered a paid pilot deal with a national healthcare provider in Singapore who is using SIMPPLE Vision to monitor safety, cleanliness, and productivity using real-time visual data augmented and powered by AI.

Source: ( https://www.globenewswire.com/ )

Segments Covered in the Report

By Service Type

- Hard Services

- Mechanical and Electrical Maintenance

- Plumbing, Air Conditioning Maintenance

- Fire Protection Systems

- Others

- Soft Services

- Laundry

- Waste Management

- Cleaning & Pest Control

- Catering

- Security

- Others

By End User

- Hospitals and Clinics

- Long-Term Healthcare Facilities

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Middle East & Africa

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting