What is Medical Waste Management Market Size?

The global medical waste management market size accounted for USD 14.06 billion in 2025 and is expected to exceed around USD 26.08 billion by 2034, growing at a CAGR of 7.20% from 2025 to 2034.

Market Highlights

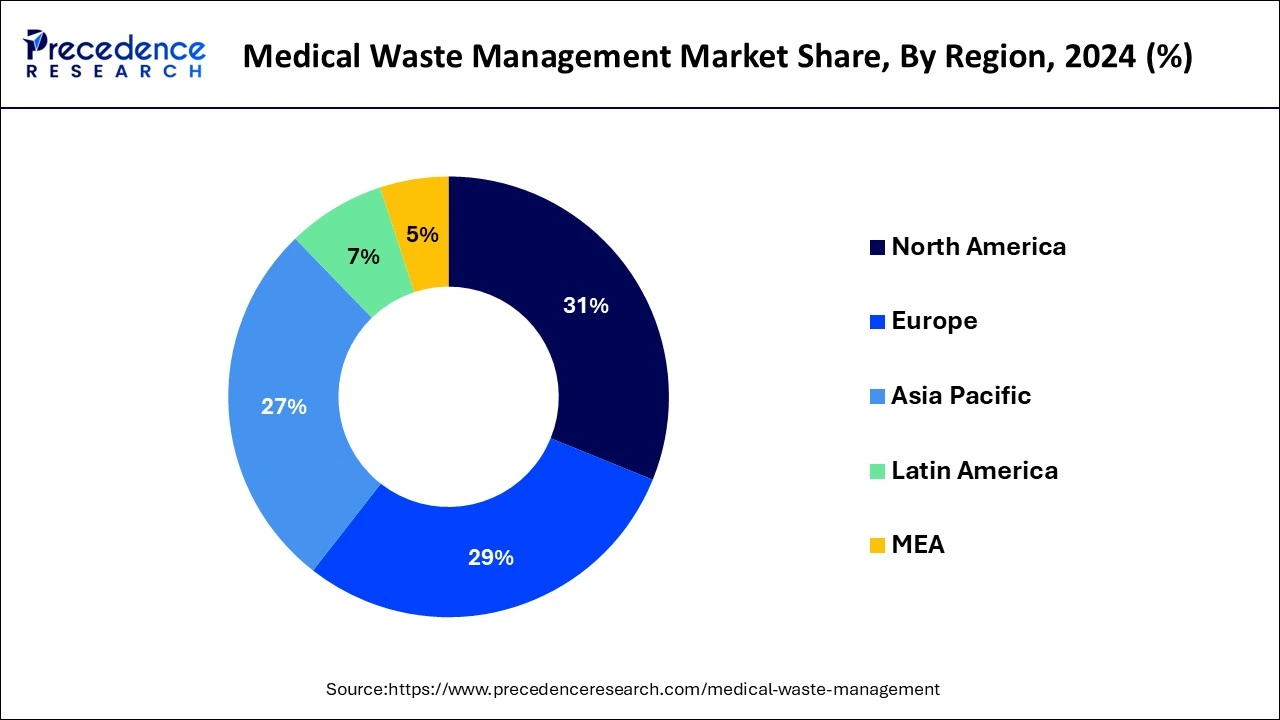

- North America held a market share of 31.14% in 2024.

- The non-hazardous waste segment reached USD 8 billion in 2024.

- The treatment and disposable services segment accounted for a 30% market share in 2024.

- The hospital's waste generation segment garnered a 33% market share in 2024.

Market Size and Forecast

- Market Size in 2025: USD 14.06 Billion

- Market Size in 2026: USD 15.07 Billion

- Forecasted Market Size by 2034: USD 26.08 Billion

- CAGR (2025-2034): 7.20%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

How has AI benefited the Market?

Artificial intelligence is revolutionizing the medical waste management industry by rendering the services more efficient, accurate, and safer. Waste segregation is automated using machine learning, whereby the machines classify the waste properly and select suitable transportation. AI also predicts equipment failures, thereby reducing downtime and expenses. Sorters powered by AI improve recycling and call attention to waste that is hazardous to ensure safer handling and environmental protection. The real-time monitoring from these discharges gives the insight required to improve waste processes, ensuring compliance and advancing green initiatives. Altogether, AI is the enabling force behind smarter, safer, and cheaper medical waste management.

Crucial factors accountable for market growth are

- Exponentially increasing volume of medical waste

- Rising geriatric population

- Increasing prevalence of chronic disorders such as cardiovascular diseases and diabetes

- Growing obese population

- Increasing requirement for sustainable and effective medical waste management

- Increasing focus of governments all over the world to tackle the issue of medical waste management

- Increasing number of accidents

- Integration of latest technologies

- Growing investment by key manufacturers

- Increasing per capita healthcare expenditure

Major Trends in the Medical Waste Management Industry

Medical wastes need careful containment and disposal before gathering and consolidation for handling. The measures for discarding controlled medical-waste substances are designed to shield the staffs who generate medical scrap and who tackle the wastes from generation point to disposal point. To avert injuries from needle sticks and other infected sharps should not be repeated, firmly bent, or cracked by hand. Centers for Disease Control and Prevention have broadcasted general rules for managing sharps. Healthcare amenities may need added precautions to avert the creation of aerosols during the management of blood-contaminated objects for some rare diseases or situations.

Storage and transportation of regulated medicinal wastes within the healthcare organization prior to termination of treatment are often essential. Healthcare organizations are instructed to clear out medical waste frequently to avoid buildup. Medical scrap requiring storing should be reserved in puncture-resistant, leak-proof, labeled containers under situations that lessen or avert foul smells. The storage area must be well-ventilated and be unreachable to pests. Every facility that produces regulated medical scrap should have a controlled medical waste management strategy to ensure well-being and environmental protection as per local guidelines.

Incineration of medical scrap has conventionally been the foremost medical waste managing technique globally. However, incineration results in the emission of numerous harmful fumes such as Sulphur dioxide, dioxins, and carbon monoxide which augment global warming. Thus, the development of other techniques is gaining popularity for sustainable medical waste management.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 14.06 billion |

| Market Size in 2026 | USD 15.07 Billion |

| Market Size by 2034 | USD 26.08 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.20% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Segments Covered | Treatment, Waste Type, and Regions |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Market Dynamics

Drivers

Increasing Healthcare Services

Due to the building and expanding of healthcare facilities, aging, and increasing population, medical waste generation is heading towards higher volumes. With increasing numbers of patients undergoing treatment and surgeries, the demand for efficient waste management solutions also rises. These trends hence shall strengthen the need for newer disposal methods and compliance with stricter regulations that would safely yet effectively dispose of these waste materials.

Restraint

Infrastructure Deficiencies

Due to insufficient infrastructure for waste management, many regions, especially in developing countries, encounter issues. With the deficiency of facilities meant for proper collection, storage, transportation, and treatment, the creation of an efficient medical waste management system is paralyzed. The infrastructural gaps, hence, delay the implementation of the best practices, increase the risk to health and the environment, and altogether impair the market growth for those areas.

Opportunity

Focus on Sustainability

Sustainability emphasis is creating new opportunities for the disposal of medical waste. A growing public awareness of environmental effects has increased demand for various forms of recycling, resource recovery, eco-friendly disposals, and treatment. Providers using green technologies under the circular economy model should seize this opportunity to offer services that provide extra waste reduction and resource conservation benefits while adhering to increasingly stringent environmental regulations.

Segment Insights

Treatment Insights

Incineration Segment Reported Foremost Market Stake in 2024

Incineration displayed the major share in the worldwide medical waste management market in 2024. Incineration is the lone method employed for pathological scrap such as identifiable tissue and body parts that augments the segmental share. The factors such as the generation of a high volume of medical waste due to the increasing prevalence of viral diseases and the low cost of incineration are expected to retain the dominance of incineration in the near future.The chemical treatment segment is anticipated to grow at the maximum CAGR through the forecast time frame mainly due to high anticipated demand.

Why did the incineration segment dominate the medical waste management market?

The incineration segment dominated the medical waste management market in 2024. The growing prevalence of viral diseases and low cost increases demand for incineration. The growing demand for lowering the mass and volume of medical waste helps the market growth. Incineration lowers mass up to 70% & volume up to 90%, and high-temperature incineration supports treating agents like bacteria & viruses.

Being a technically simple process requiring fewer capital investments, this segment occupies the topmost position in the medical treatment of waste. Despite some environmental concerns, incineration has been preferred as the disposal method for medical waste. Basically, owing to its applicability and acceptance through regulations, the method still retains its former glory. The fastest growing treatment method is autoclaving, with increasing medical waste arising from surgical and chronic disease treatments. Waste is sterilized by means of steam under high pressure in an autoclave; this method allows for a cheap and eco-friendly option that is growing in popularity as health facilities seek much safer and efficient alternatives to disposal.

Waste Type Insights

Hazardous Waste Dominated the Market Revenue

Hazardous waste is generated in high volumes at hospitals and other healthcare facilities. Moreover, the implementation of stringent regulations for the safe disposal of hazardous waste by governments all over the world is expected to boost the demand for hazardous waste management in the near future.

How hazardous waste segment dominated medical waste management?

The hazardous waste segment dominated medical waste management in 2024. The growing production of chemicals, sharps, and infectious materials helps in the market growth. The growing demand for specialized treatment to manage hazardous waste helps in the market growth.

Treatment Site Insights

The offsite treatment segment remains dominant, given the centralized management of medical waste generated in healthcare facilities. This relieves hospitals and laboratories from operational duties, ensures the medical waste is disposed of as per regulatory standards, and provides the best environmental model with specialized waste handling. The on-site treatment segment is expected to grow at fastest rate with the up-gradation in technologies offering compact and efficient treatment of waste, allowing the healthcare provider to treat the waste immediately at the point of its generation. On-site treatment reduces transport and enhances safety and also fulfills growing environmental regulations to lessen health-care waste footprints.

The on-site segment is expected to register the lucrative CAGR during the forecast period, due to the increasing adoption of advanced on-site equipment. These technologies allow healthcare facilities to manage their waste more effectively, reducing the need for transportation and storage. In addition, on-site treatment providesreal-time data about waste generation, enabling better planning and resource allocation. This shift towards on-site treatment is also influenced by stringent regulations and the growing awareness about the importance of minimizing environmental impact.

Regional Insights

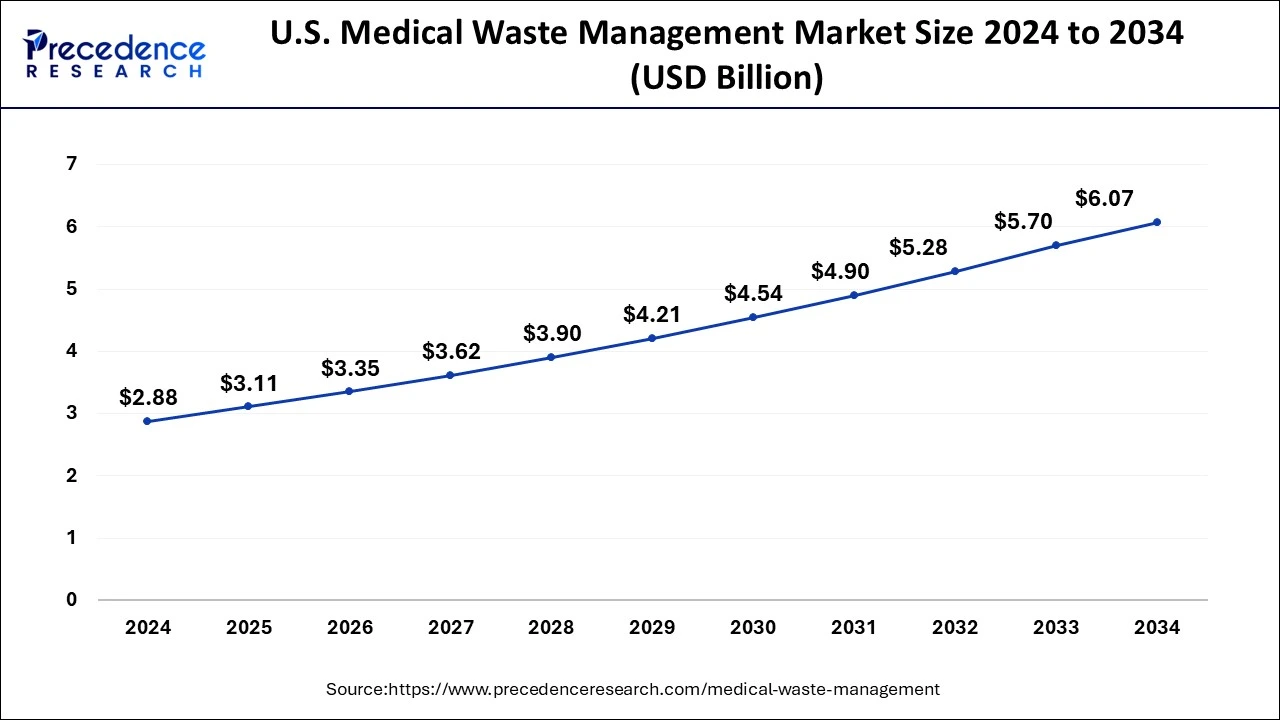

U.S. Medical Waste Management Market Size and Growth 2025 to 2034

The U.S. medical waste management market size exhibited at USD 3.11 billion in 2025 and is projected to be worth around USD 6.07 billion by 2034, growing at a CAGR of 7.90% from 2025 to 2034.

The detailed research report covers significant prospects and inclinations of medical waste management products throughout different regions including Europe, North America, Asia-Pacific, Africa, the Middle East, and Latin America. By region, the medical waste management market is led by North America due to the high incidence of cancer and early implementation of the latest medical waste management techniques. Europe reported the second maximum share predominantly due to the high geriatric population and positive reimbursement scenario.

The U.S. is a major player in the regional market, growth driven by the country's large healthcare industry, stringent regulations, and increased demand for effective waste management solutions. The growing demand for sustainable waste management practices is fueling innovation and development areas. The strict regulations, including the US Environmental Protection Agency (EPA), play a crucial role in regulating waste management, including medical waste disposal.

Asia-Pacific is also anticipated to witness a rapid growth rate, on account of increasing investment by major manufacturers and increasing per capita healthcare expenditure. India is a significant player in the Asian medical waste management market, driven by rising awareness of the importance of proper biomedical waste management, government regulations, investments in R&D, technological advancements, and the rise of third-party waste management service providers.

- In February 2025, Union Minister Dr. Jitendra Singh launched India's first indigenous Automated Bio Medical Waste Treatment Plant at AIIMS New Delhi. The Automated Biomedical Waste Treatment Rig, named “S?janam,” was developed by CSIR NIIST Thiruvananthapuram.

The growing expansion of healthcare facilities like clinics & hospitals increases production of waste, fueling demand for medical waste management. The aging population and rising demand for healthcare services help in the market growth. The strong government support and regulations to improve medical waste management increase demand for an eco-friendly waste management system. Additionally, growing awareness about medical waste management and growing healthcare activities in Japan, China, and India drive the overall growth of the market.

India's medical waste management trends

India is significantly growing in the medical waste management. The growing healthcare infrastructure, like diagnostic labs, hospitals, and clinics, increases the production of medical waste, fueling demand for an efficient waste management system. The growing demand for healthcare services and stringent government regulations to ensure biomedical waste management help in the market growth. The growing awareness of medical waste among healthcare professionals & the public, and technological advancements like the automated waste segregation system, drive the overall growth of the market.

Medical Waste Management Market Companies

- BioMedical Waste Solutions

- Stericycle Inc.

- Clean Harbors

- Citiwaste

- MedPro Waste Disposal

- Sanpro

- Waste Management, Inc.

- Sharps Compliance, Inc.

Recent Developments

- In February 2025, India's first indigenous Automated Biomedical Waste Treatment Rig, S?janam, was launched by Union Minister Dr. Jitendra Singh at AIIMS New Delhi, marking a significant breakthrough in sustainable waste treatment solutions. (Source: https://impressivetimes.com)

- In September 2024, KMC plans to establish a plant in Dhapa to treat and recycle bio-medical waste from government hospitals and private healthcare facilities. (Source: https://timesofindia.indiatimes.com)

- In January 2023, BeMC launched bio-medical waste management for healthcare centers. The special vehicle performs tasks like transportation, disposal, collection, and treatment of clinical wastes. The total waste generated by health centers is about 500 kilos. (Source: https://www.thehansindia.com)

- In September 2024, KMC to set up a bio-medical waste treatment plant at Dhapa. The plant treats biomedical waste collected from private hospitals and government hospitals. (Source: https://timesofindia.indiatimes.com)

- In September 2024, the Bengal government launched a bar-coded system for bio-medical waste management at hospitals. The bar-coded system ensures accountability of bio-medical waste. There are two types of bar-coded present: pasted barcodes and pre-printed barcodes. Pre-printed barcodes printed on color-coded containers & waste bags, and pasted barcodes affixed on containers or bags by hospital staff. (Source: https://timesofindia.indiatimes.com)

Segments Covered in the Report

By Treatment

- Chemical Treatment

- Autoclaving

- Incineration

- Others

By Waste Type

- Hazardous

- Nonhazardous

- Infectious & Pathological Waste

- Pharmaceutical Waste

- Sharp Waste

- Other Medical Waste

By Waste Generator

- Hospitals & Diagnostic Laboratories

- Other Waste Generators

By Treatment Site

- Offsite Treatment

- Onsite Treatment

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting