What is the Hospital Outsourcing Market Size?

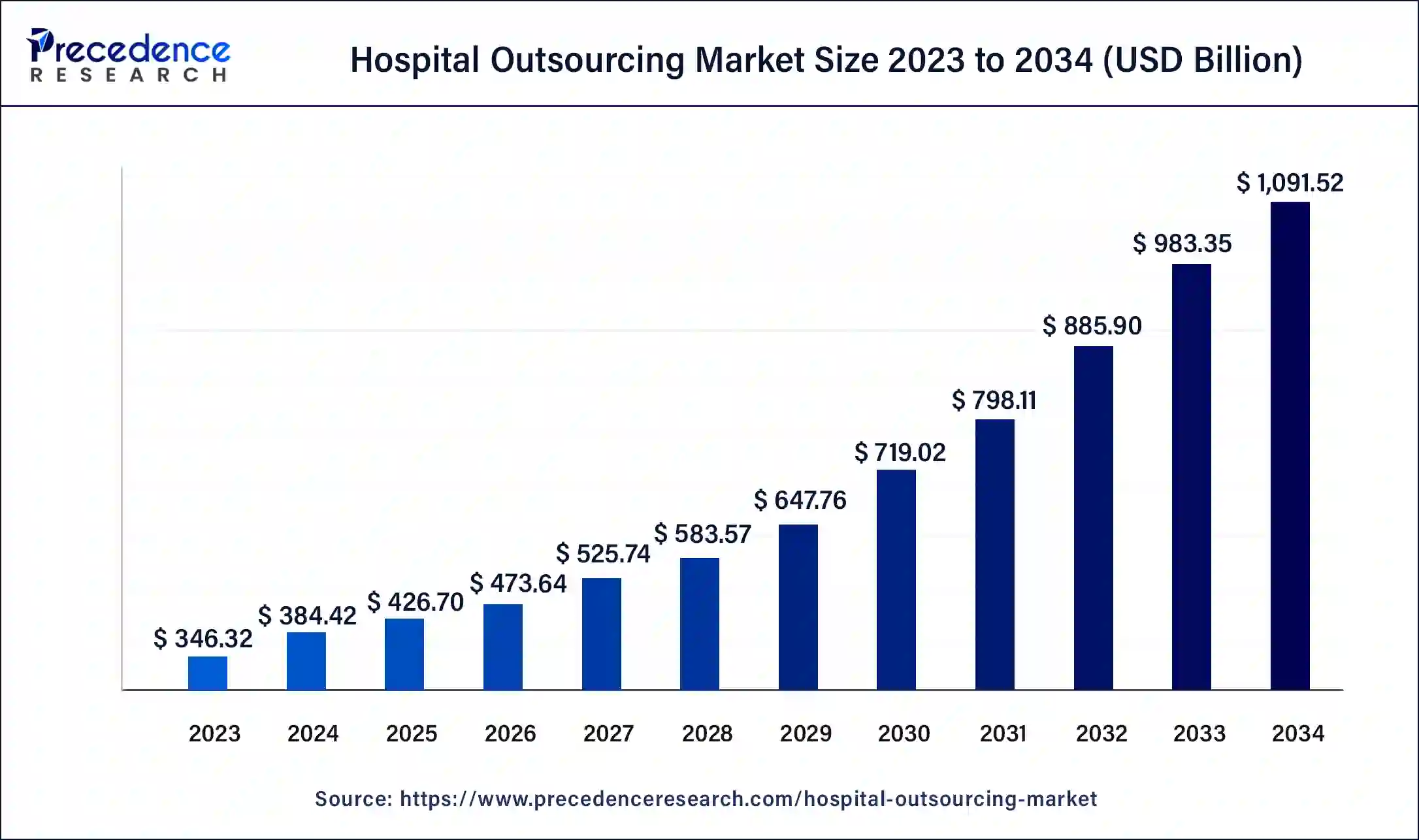

The global hospital outsourcing market size accounted for USD 426.70 billion in 2025 and is predicted to increase from USD 473.64 billion in 2026 to approximately USD 1,192.54 billion by 2035, at a CAGR of 10.82% from 2026 to 2035. The North America hospital outsourcing market size reached USD 249.35 billion in 2025.

Hospital Outsourcing Market Key Takeaways

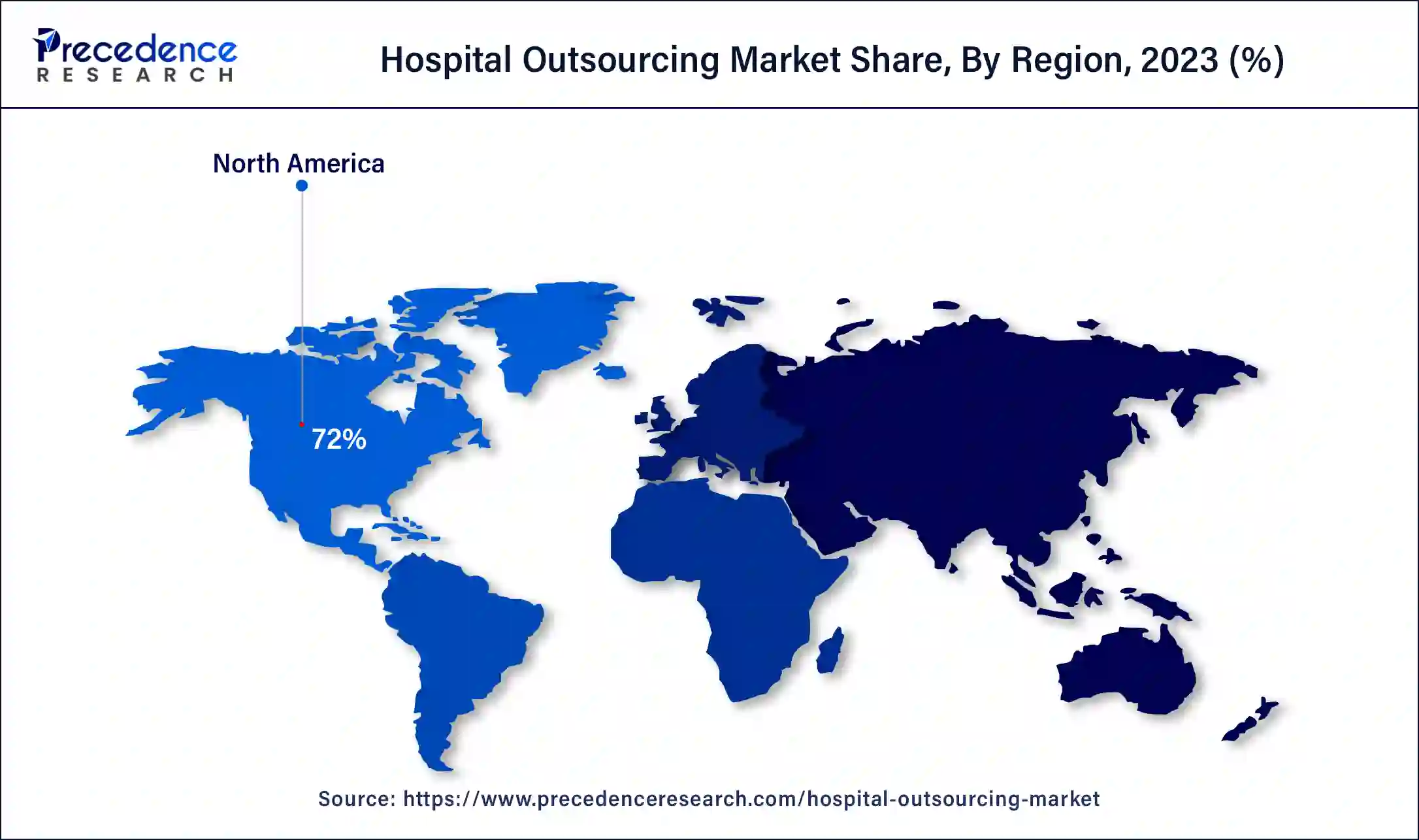

- North America led the global market with the highest market share of 72% in 2025.

- Middle East is expected to expand at the largest CAGR between 2026 to 2035.

- By Service, the clinical services segment is anticipated to grow at the fastest CAGR of 11.5% from 2026 to 2035.

- By Type, the private segment has held the highest market share of 70% in 2025 and it is projected to expand at the fastest CAGR of 11.5% over the projected period.

Artificial Intelligence: The Next Growth Catalyst in Hospital Outsourcing

AI is fundamentally reshaping the hospital outsourcing market by transforming it from a traditional cost-cutting measure into a strategic model for driving value and efficiency. Outsourcing providers are now leveraging AI to automate repetitive administrative tasks such as medical coding, billing, and data entry, which significantly minimizes errors and speeds up processing times. This shift allows for enhanced scalability of services without a linear increase in human staff, enabling outsourcing firms to manage higher volumes of work and optimize resource allocation more effectively.

Hospital Outsourcing Market Growth Factors

The hospitals are rapidly adopting the outsourcing services for the management of internal activities such as IT services, medical billing, back office operations, and other activities. The third party service providers specializes in managing the hospital activities and offers time savings, cost reduction, savings on infrastructure and technology, and staffing flexibility to the hospitals. For this, the hospital outsourcing services are gaining immense traction. The lack of managerial efficiency, in-house experts, and limited budget are few of the primary difficulties faced by the private hospitals. The third party service providers helps in eliminating these difficulties by undertaking administration and managerial tasks of the hospital. There are other such issues such as lack of efficiency in managing revenue cycle, payroll, supply management, and other services. All these issues are taken care of by the contract service providers. Hence the hospitals are extensively opting for the specialized services by outsourcing the tasks, which propels the growth of the global hospital outsourcing market.

Over the past few years, hospitals are witnessing an upsurge in outsourcing in-house activities due to the mandatory federal guidelines of maintaining electronic medical records. Moreover, rising healthcare costs, rising patient flow, and increasing burden of processes like maintaining records of patients' check-ins and check-outs and insurance related records are the various issues for which hospitals are increasingly outsourcing their in-house services. Therefore, the growing demand for the outsourcing services in hospitals is significantly contributing towards the growth of the global hospital outsourcing market.

Market Outlook

- Market Growth Overview: The hospital outsourcing market is expected to grow significantly between 2025 and 2034, driven by the focus on core competencies, regulatory compliance and data security, and cost containment and efficiency.

- Sustainability Trends: Sustainability trends involve energy efficiency and green facilities, waste management and circular practices, and sustainable procurement and supply chain.

- Major Investors: Major investors in the market include Blackstone Group, TPG Capital, KKR, Bain Capital, Temasek Holding, and Warburg Pincus.

- Startup Economy: The startup economy is focused on specialization, rising agility, innovation, and investing in healthcare services.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 426.70 Billion |

| Market Size in 2026 | USD 473.64 Billion |

| Market Size by 2035 | USD 1,192.54Billion |

| Growth Rate from 2026 to 2035 | CAGR of 10.82% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service, Type, Region |

| Segments Covered | Service, Type, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Segment Insights

Service Insights

By service, others segment led the market with a 40% revenue share in 2023 and is anticipated to retain its dominance throughout the forecast period. The others segment includes services such as laundry, food, cafeteria, security, and various other services. The presence of numerous small services together accounted for a large market share in this segment.

On the other hand, clinical services segment is anticipated to expand growth at a CAGR of 11.5% during the forecast period. Various services such as radiology, pathology, physiotherapy, microbiology, dialysis, and others together constitutes the clinical services segment. The growing penetration of diagnostic labs across the globe is a primary factor that is expected to fuel the market growth.

Type Insights

By type, the private segment led the market with 70% revenue share in 2023 and is anticipated to hit growth at a CAGR of 11.5% throughout the forecast period. This is attributed to the growing complexity in the in-house activities of the private hospitals coupled with the financial limitations. This is offering the opportunities for customer satisfaction due to experienced professionals.

Regional Insights

U.S. Hospital Outsourcing Market Size?

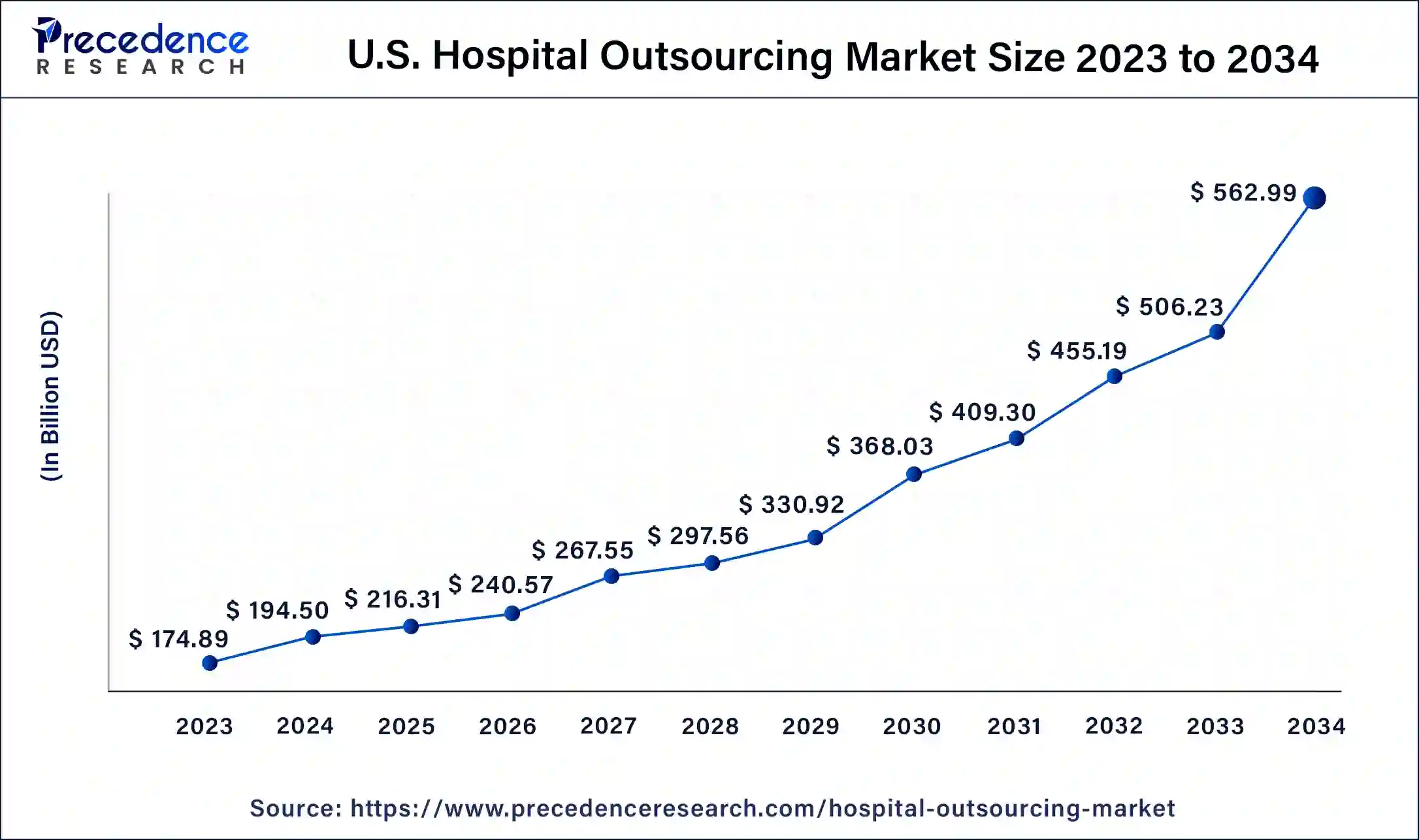

The U.S. hospital outsourcing market size was estimated at USD 216.31 billion in 2025 and is predicted to be worth around USD 615.94 billion by 2035, at a CAGR of 11.03% from 2026 to 2035.

Based on the region, in 2023 the North America region dominated the market with 72% in terms of revenue and is estimated to sustain its dominance during the forecast period. The presence of high number of private and public hospitals in North America and the mandatory government regulations for the hospitals to maintain various records related to patients is exponentially surging the growth of the market in the region. Further, the availability of numerous large and small service providers offers the hospital to acquire third party services at an optimum cost. The strict regulations imposed by the government to maintain electronic medical recordsin US has fostered the hospital outsourcing market in the past years.

U.S. Hospital Outsourcing Market Trends

The U.S.'s hospitals are strategically outsourcing non-core functions and revenue cycle management to cut costs and reinvest in patient care. This shift is enabled by the integration of AI, cloud computing, and robotics, streamlining operations and enhancing data security. Increased specialization has led to the outsourcing of clinical services like remote monitoring and lab testing.

On the other hand, the Middle East is expected to witness considerable growth in the upcoming years. The availability of low cost services and growing demand for advance technologies is propelling the market growth in the region.

The increased adoption of digital media in the management of hospital in-house services has opened the doors for the adoption and implementation of artificial intelligence technologies that will increase efficiency by eliminating errors.

However, data breaches and cybersecurity remains a major challenge for the hospital outsourcing industry that needs to be resolved as soon as possible. The cyberattacks may result in financial losses and may also put the patients' health at risk.

Saudi Arabia Hospital Outsourcing Market Trends

Saudi Arabia's healthcare landscape is rapidly evolving as Vision 2030 mandates the privatization and digital modernization of the sector. The surge in chronic diseases is driving a critical need for outsourced data analytics and preventive care platforms to manage high patient volumes efficiently.

How Did Asia Pacific Notably Grow in the Hospital Outsourcing Market?

The Asia-Pacific healthcare outsourcing market is thriving as regional giants like India and the Philippines leverage their massive, English-speaking talent pools and lower labor costs. This growth is accelerated by aging populations and a rise in chronic diseases, necessitating the use of outsourced AI and digital health platforms for efficient data management.

China Hospital Outsourcing Market Trends

China's healthcare providers are increasingly outsourcing IT and specialized clinical functions to manage the complexities of digital transformation and an aging population. This strategic shift allows hospitals to achieve significant cost optimization and scalability while meeting stringent government quality standards.

Value Chain Analysis of Hospital Outsourcing Market

- Inbound Logistics/Procurement (Source-to-Pay)

This stage involves the procurement, inspection, storage, and distribution of all necessary inputs, including medical supplies, equipment, and pharmaceuticals.

Key Players: McKesson Corporation, Cardinal Health, Oracle (software solutions). - Operations/Service Delivery

This encompasses the core activities of patient care delivery, from admission and diagnosis to treatment and eventual recovery or discharge.

Key Players: Sodexo (facilities and nutrition), Aramark Healthcare (facilities and clinical support), and Fresenius Medical Care (renal care/dialysis services). - Outbound Logistics/Distribution

This stage involves activities related to the post-treatment phase, such as discharge processes, follow-up appointments, remote monitoring, and distribution of medical records or home care instructions.

Key Players: LogistiCare Solutions

Hospital Outsourcing Market Companies

- Sodexoprovides non-clinical services such as food service, facilities management, and biomedical equipment maintenance, allowing hospitals to focus on patient care.

- Allscripts contributed through its role as a major health IT vendor, providing outsourced clinical and financial software solutions until its acquisition by a private equity firm in 2022.

- The Allure Group manages and operates skilled nursing facilities, often assuming the management of these assets from hospitals seeking to outsource post-acute care operations.

- Aramark Corp. offers a wide range of outsourced support services, including food service, uniform services, and facilities management, to help hospitals enhance efficiency and patient satisfaction.

- Cerner Corporation historically provided outsourced clinical information systems and related IT services until it was acquired by Oracle, integrating its health IT solutions into a larger cloud platform.

- LogistiCare Solutions (now part of ModivCare) manages and coordinates non-emergency medical transportation for hospitals and healthcare systems, ensuring patients can get to appointments efficiently.

Other Major Key Players

- ABM Industries

- Alere, Inc.

- Flatworld Solutions

- Integrated Medical Transport

Key Companies Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improvedand efficient services. Moreover, they are also focusing on maintaining competitive pricing.

In June 2020, intraFusion, a healthcare management company in US, was acquired by McKesson Corporation. This acquisition helped McKesson in strengthening of its core business.

In March 2021, Omega Healthcare acquired Himagine Solutions, a medical coding company. Omega Healthcare is a service provider of revenue cycle management. This acquisition will extend the company's services portfolio.

The various developmental strategies adopted by the key market players creates new opportunities and exponentially contribute towards the development of the market.

Recent Developments

- In August 2024, Accenture has partnered with UNICEF's Generation Unlimited (GenU) to enhance data security and navigate complex global regulatory frameworks.

Segments Covered in the Report

By Service

- Clinical Services

- Healthcare IT

- Transportation Services

- Business Services

- Others

By Type

- Private

- Public

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Get a Sample

Get a Sample

Table Of Content

Table Of Content