What is the Biotechnology Market Size?

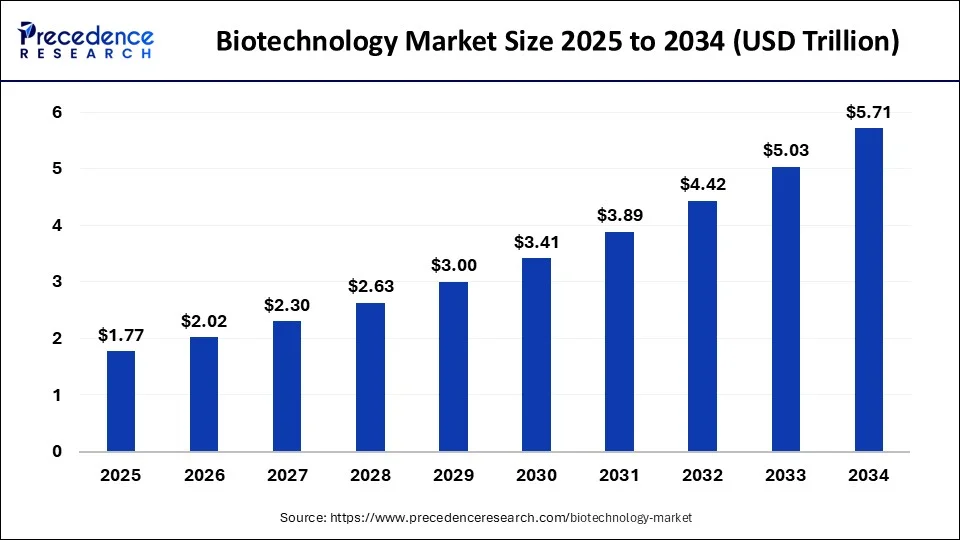

The global biotechnology market size is accounted at USD 1.77 trillion in 2025 and predicted to increase from USD 2.02 trillion in 2026 to approximately USD 6.34 trillion by 2035, representing a CAGR of 13.61% from 2026 to 2035

Market Highlights

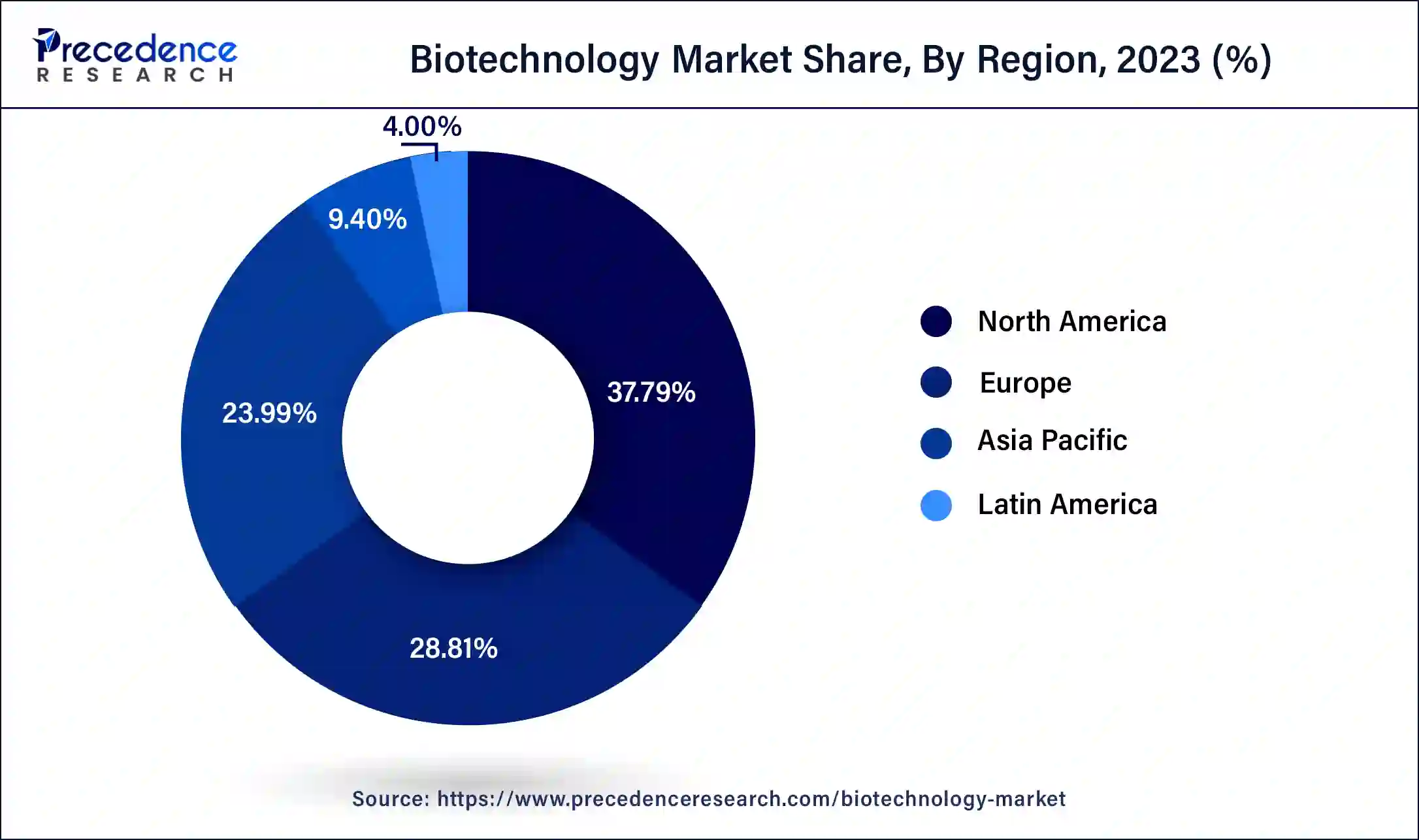

- North America accounted for a revenue share of 37.42% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR of 14.8% during the period.

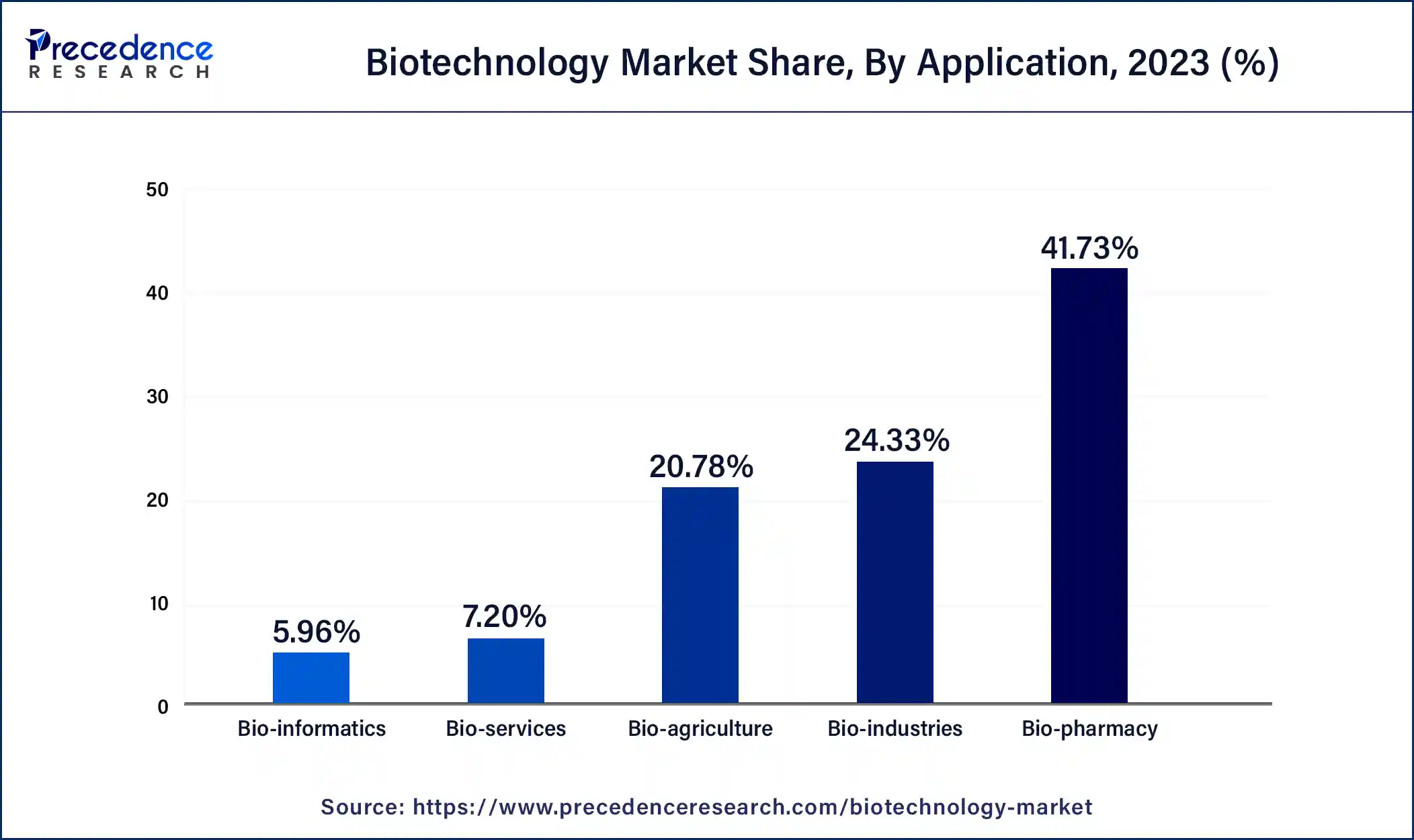

- By application, the bio-pharmacy segment captured the biggest market share of 42% in 2025.

- By application, bio-informatics segments segment is expected to grow at a solid CAGR of 13.2% during the forecast period

- By technology, the tissue engineering and regeneration segment held the highest market share of 19.17% in 2025.

- By technology, the chromatography segment is projected to grow at a solid CAGR of 15.1% during the forecast period

AI's Biotechnology Breakthrough: A Simple and Practical Roadmap

The biotechnology market is being transformed by artificial intelligence (AI), which not only speeds up the research process but also increases the precision and lowers the cost. One of the significant areas where AI impacts is in drug discovery, where it recognizes new targets, predicts molecules' behavior, and screens compounds effectively. In clinical research, AI works effectively in trial design by predicting the outcome and also through patient selection. AI can do data analysis that is based on gene interpretation, which in turn leads to personalized treatment plans and early disease detection. The manufacturing process also incorporates AI in optimizing the bioprocess parameters, predicting maintenance for the machines, and increasing the yield of the products. Moreover, AI is actively engaged in the already stated processes of the biological reactions as well as in digitalizing the bioinformatics and genomic aspects.

BioTech Boom: Shaping Tomorrow's Medicine Today

Key Government Initiatives for the Biotechnology Market

| Government | Initiative | Key Objectives |

| India | BIO-E3 Policy | Accelerate high-performance biomanufacturing, establish Bio-AI Hubs and Biofoundries, promote regenerative bioeconomy, and drive sustainable economic growth. |

| U.S. | Agricultural Biotechnology Education and Outreach Initiative | Increase public understanding of agricultural biotechnology and biotech-derived food products through FDA education and outreach. |

| EU | EU Biotech and Biomanufacturing Initiative | Boost competitiveness and innovation, streamline regulations, increase funding for biotech and biomanufacturing, and establish a "Biotech Hub". |

| Brazil | National Bioeconomy Strategy; Inter-ministerial coordination (MCTI, MAPA, MMA) | Integrate biotechnology with biodiversity protection, promote the bio-industry. |

Biotechnology Market Outlook

- Industry Growth Overview: The biotechnology market is expected to experience significant expansion from 2026 to 2035, driven by increasing rates of chronic diseases, technological advances such as gene editing (CRISPR) and AI-driven drug discovery, and rising demand for precision medicine. Key high-growth areas include biopharmaceuticals, bioinformatics, and regenerative medicine.

- Sustainability Trends: Sustainability is a major driver, emphasizing the use of biotech to create a greener economy. Trends include developing sustainable alternatives to petrochemicals, like biofuels and bioplastics, and promoting green agricultural practices such as nitrogen-fixing crops. The industry is also adopting more eco-friendly lab practices and integrating sustainability into biomanufacturing processes.

- Global Expansion: Leading biotechnology players are expanding into high-growth regions such as the Asia-Pacific, Latin America, and Europe, seeking regulatory advantage and leveraging lower operating costs. Favorable government policies and rising healthcare investments in countries such as India and China are accelerating regional market growth. Emerging markets in Latin America and the Middle East & Africa are gaining traction

- Major Investors: Significant funding continues to flow into the biotechnology sector from venture capital, private equity, and strategic investors. Although investment volume has decreased from pandemic peaks, firms specializing in life sciences and the strategic divisions of large tech companies are actively supporting promising startups and advanced platforms, especially in AI-enhanced drug discovery.

- Startup Ecosystem: The biotech startup scene is growing, especially in areas like gene editing, synthetic biology, and AI-driven bioinformatics. New companies are gaining significant funding by creating innovative, scalable, and personalized therapies and diagnostic tools, backed by incubators and government programs in major hubs worldwide.

Biotechnology Market Growth Factors

- The market is fueled by growth in developing countries like China, Japan, and India, supported by government efforts to simplify regulations, speed up product approvals, improve reimbursement policies, and accelerate the approval process, all of which will offer the industry substantial growth potential.

- Agricultural companies are advancing technologies like developing new stacked traits in crops and new germplasm through breeding innovations and gene sequencing. Increasing instances of diseases, improvements in Polymerase Chain Reaction (PCR) technologies, and higher research funding are further driving market growth.

- The use of genomic techniques in diagnosing infectious diseases such as HIV and malaria is rapidly progressing, which boosts the demand for clinical diagnostic tests. Emerging economies benefit from better healthcare infrastructure and higher spending, leading to increased demand for biotechnology solutions.

- As chronic and genetic diseases increase, the need for innovative diagnostics and treatments grows. Government support in developing countries is essential, while advances in molecular biology and genomics fuel new biotechnological applications in medicine and agriculture. Overall, the biotechnology market benefits from rising healthcare spending and the demand for personalized medicine and sustainable bioprocesses.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.77 Trillion |

| Market Size in 2026 | USD 2.02 Trillion |

| Market Size by 2035 | USD 6.34 Trillion |

| Growth Rate from 2026 to 2035 | CAGR of 13.61% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Application, Technology, and Region |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

Opportunity

Precision Medicine

With progress in genomics, proteomics, and bioinformatics, there exists a considerable opportunity to create precision medicine customized to personal genetic profiles. Tailored therapies can improve treatment effectiveness, minimize side effects, and result in better patient outcomes. Businesses focusing on genetic testing, biomarker identification, and personalized treatment strategies can take advantage of this increasing need. The demand for eco-friendly farming methods offers a significant chance for biotech companies. Creating genetically altered crops that are more resistant to climate change, pests, and illnesses can greatly improve food security.

Market Challenge

Stricter Regulatory Compliance

For biotech firms working globally, managing varied regulatory landscapes in different areas poses a major difficulty. Even with efforts for global standardization, significant discrepancies remain in approval criteria, timelines, and compliance benchmarks among key markets like the European Union, United States, China, and Japan. These differences can greatly influence product development plans, necessitating that companies create clinical trials that meet the needs of various regulatory bodies at once.

Segment Insights

Application Insights

The bio-pharmacy segment dominated the biotechnology market with a 42% share in 2025. This is mainly due to the increasing demand for biopharmaceuticals, driven by the increased prevalence of chronic diseases, such as cancer and autoimmune diseases. Ongoing innovation in biopharmaceuticals to discover novel drugs to treat a range of diseases further supports segmental growth. Moreover, rising regulatory approvals for novel biopharmaceuticals contributes to segmental expansion.

The bio-informatics segment is expected to grow at the fastest CAGR of 13.2% during the forecast period. This is because it serves as an essential toolkit for analyzing the massive, complex datasets produced by modern biological research. High-throughput technologies like NGS and various omics studies are creating a data deluge. Bioinformatics provides the computational infrastructure and algorithms needed to store, process, and interpret this information for personalized medicine and drug discovery

The bio-agriculture segment is expected to grow at a notable rate in the upcoming period. The growth of the segment is attributed to the increasing focus on enhancing food products. This prompts the need for agricultural biotechnology to improve crop yields. Bio-agriculture offers sustainable solutions by reducing the need for chemical-based pesticides, enhancing crop protection, and minimizing potential side effects. Moreover, stringent regulations regarding food safety contribute to segmental growth.

Global Biotechnology Market Revenue, By Application, 2022-2024 (USD Billion)

| Application | 2022 | 2023 | 2024 |

| Bio-pharmacy | 507.57 | 575.26 | 652.56 |

| Bio-industries | 298.88 | 335.41 | 376.75 |

| Bio-services | 91.91 | 99.30 | 107.38 |

| Bio-agriculture | 253.40 | 286.43 | 324.06 |

| Bio-informatics | 72.55 | 82.23 | 93.04 |

Technology Insights

The tissue engineering and regeneration segment held the largest share of 19.17% in 2025. Tissue engineering and regeneration technologies are finding applications across a broad spectrum of healthcare domains, including orthopedics, cardiology, dermatology, and neurology. The versatility of these approaches in addressing diverse medical needs further strengthens their dominance in the biotechnology market. Regulatory agencies worldwide are increasingly recognizing the potential of tissue engineering and regeneration technologies and providing support for their development and commercialization. Clinical validation through successful trials and regulatory approvals has bolstered confidence in these approaches, paving the way for their widespread adoption and market dominance.

The chromatography segment is observed to grow at the fastest CAGR of 15.1% during the forecast period. Chromatography techniques offer unparalleled analytical precision, allowing biotechnologists to separate and analyze complex mixtures of biomolecules with high resolution and accuracy. This precision is crucial for various applications in biotechnology, including drug discovery, proteomics, genomics, and quality control. Chromatography techniques, particularly affinity chromatography, ion exchange chromatography, and size exclusion chromatography, are essential for protein purification in biotechnology research and production. These techniques enable the isolation and purification of target proteins from complex biological matrices, facilitating downstream applications in biopharmaceuticals, diagnostics, and research.

Global Biotechnology Market Revenue, By Technology, 2022-2024 (USD Billion)

| Technology | 2022 | 2023 | 2024 |

| Fermentation | 103.04 | 116.39 | 131.58 |

| Tissue Engineering and Regeneration | 236.90 | 265.50 | 297.81 |

| PCR Technology | 63.08 | 70.78 | 79.49 |

| Nanobiotechnology | 120.60 | 136.14 | 153.82 |

| Chromatography | 43.28 | 49.24 | 56.07 |

| Spectroscopy | 30.41 | 33.61 | 37.18 |

| Cell-Based Assay | 157.35 | 178.64 | 203.01 |

| DNA Sequencing | 203.70 | 229.01 | 257.70 |

| Others | 265.94 | 299.31 | 337.14 |

Regional Insights

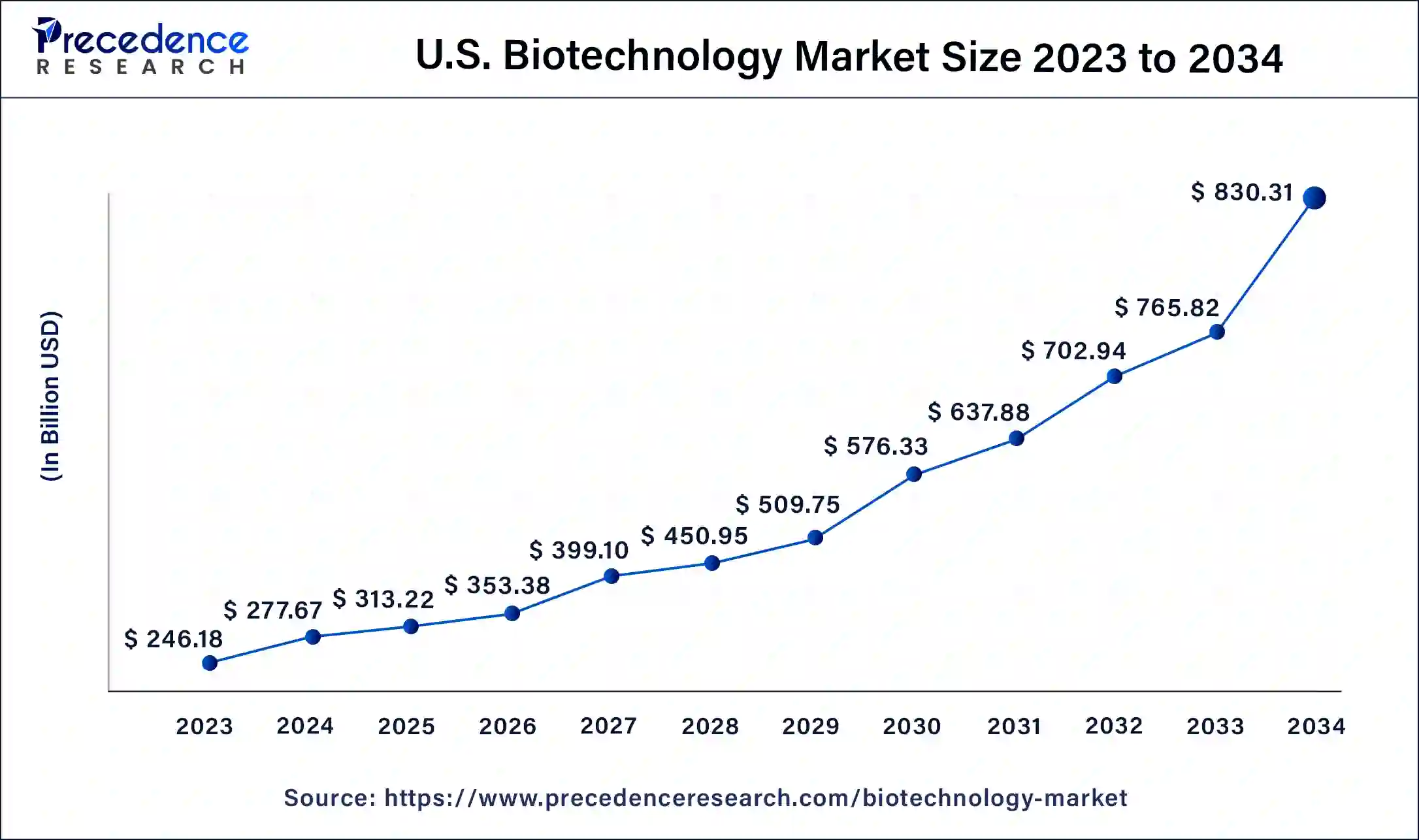

U.S. Biotechnology Market Size and Growth 2026 to 2035

The U.S. biotechnology market size is estimated at USD 316.41 billion in 2025 and is predicted to be worth around USD 1142.07 billion by 2035, at a CAGR of 13.7% from 2026 to 2035.

What Made North America the Dominant Region in the Global Biotechnology Market?

North America dominated the global biotechnology market with a 37.42% revenue share in 2025. This leadership is fueled by a strong R&D ecosystem, advanced healthcare infrastructure, and widespread adoption of genomic research. The market's growth is also supported by favorable regulations and investments in personalized medicine. The presence of top biotech companies and a highly skilled workforce consistently drive innovation and progress in biopharmaceuticals, diagnostics, and agricultural biotechnology.

U.S. Biotechnology Market Trends

With its strong innovation ecosystem, significant R&D investments, and leading institutions, the U.S. remains a leader in the global biotechnology market. Its primary focus areas include personalized medicine, genetic research, and the development of new biopharmaceuticals, driving ongoing technological breakthroughs. The U.S. acts as a hub for biotech innovation and commercialization through collaboration between academia and industry, speeding up discovery.

From Emerging to Established: Asia Pacific's Biotechnology Wave

Asia-Pacific is expected to grow at a 14.8% CAGR during the forecast period in the biotechnology market, driven by government initiatives, increasing healthcare spending, and a vibrant startup ecosystem. Countries such as China, Japan, and India are heavily investing in genomics, biopharmaceuticals, and agricultural innovations. With improved healthcare access, higher demand for affordable therapeutics, and faster scientific breakthroughs in molecular biology, the region's biotechnology industry is experiencing rapid growth.

China Biotechnology Market Trends

China benefits from government support, improved research infrastructure, and increasing private investments. It is also making rapid advances in genomics, precision medicine, and agricultural biotechnology. Its strategic initiatives, such as the Made in China 2025 plan, identify biopharmaceuticals as one of 10 critical sectors for national growth. Cities such as Hangzhou and Suzhou, biotech hubs, are fostering innovation and attracting investment.

How is the Opportunistic Rise of Europe in the Biotechnology Market?

Europe is expected to experience significant growth in the market. The EU has created a regulatory framework that guarantees safety, efficacy, and quality standards for agricultural biotech products, biopharmaceuticals, and GMOs. The combination of biotechnology with digital technologies like AI, ML, and big data opens new doors for innovation and market expansion. European biotech firms are also advancing drug discovery, optimizing healthcare services, and boosting market competitiveness.

Germany Biotechnology Market Trends

Germany plays a distinctive role in the global biotech landscape, driven by a strong research ecosystem, government funding, and specialized clusters. The country is home to a high concentration of biotech companies and well-funded research clusters, enabling a robust pipeline from basic research to market-ready products, as exemplified by BioNTech's mRNA vaccine, supported by significant government and private-sector investments and a highly skilled workforce.

How Biotechnology Is Gaining Ground in South America?

The South American biotechnology market is expanding rapidly, leveraging its extensive biodiversity and established agricultural sector. It is increasingly contributing to global health by producing biopharmaceuticals, vaccines, and biosimilars locally, fueled by growing demand for innovative healthcare solutions and public investment. The region also supports a lively deep-tech startup scene, especially in areas like bioinformatics. Countries such as Brazil and Argentina are leading these efforts, aiming to broaden equitable access to biotech innovations.

Brazil Biotechnology Market Trends

Brazil stands out in South America's biotech landscape, especially in agri-tech, biofuels, and a rapidly expanding biopharmaceutical sector. It is the second-largest producer of biotech crops and a pioneer in advanced biofuels like sugarcane-based ethanol, along with increased local production of vaccines and biosimilars to meet rising healthcare demands. Its rich biodiversity and agricultural base support innovation, reinforcing its position in healthcare and sustainable bioeconomy.

MEA Biotechnology Market: Strategic Market Entry and Expansion

The Middle East and Africa (MEA) is emerging as a significant biotech hub, driven by strong growth fueled by increased government investment and economic diversification efforts, particularly in GCC countries. Focus areas include advancing healthcare through genomics and precision medicine, with projects like the Emirati and Saudi Genome initiatives advancing research and infrastructure. The region is also developing localized diagnostic tools and using AI to address specific health challenges.

Saudi Arabia Biotechnology Market Trends

Saudi Arabia is transforming into a global biotech hub through substantial government investments and strategic initiatives. Its focus on localizing advanced therapies, vaccine manufacturing, and genomics is rapidly expanding its biomanufacturing capabilities. Streamlined regulations and strategic alliances aim to achieve health sovereignty and economic diversification, though the country needs a larger, more skilled workforce to meet its ambitious goals.

Regulatory Landscape for the Biotechnology Market

| Country | Key Regulatory Bodies | Regulatory Stance |

| India | Genetic Engineering Appraisal Committee (GEAC), Drugs Controller General of India (DCGI), Food Safety and Standards Authority of India (FSSAI) | Multi-agency oversight, complex approvals. Recent moves streamline regulations for some gene-edited crops and regenerative medicines. |

| U.S. | Food and Drug Administration (FDA), Department of Agriculture (USDA), Environmental Protection Agency (EPA) | Use-based regulation under existing laws; flexible approval pathways, including for GRAS food ingredients. |

| EU | European Medicines Agency (EMA), European Food Safety Authority (EFSA), Proposed EU Biotech Act | Historically cautious, following the precautionary principle. Gene-edited crops are regulated like GMOs, but a new act aims to speed up processes. |

| Brazil | National Health Surveillance Agency (ANVISA), National Technical Biosafety Commission (CTNBio) | Comprehensive Biosafety Law (11.105/2005) for GMOs and by-products. Clear process for genetically modified crops. |

Value Chain Analysis

- R&D: The initial stage, which includes the discovery, research, and development of new drugs, medical devices, or diagnostic tools.

Key Players:Pfizer, Johnson & Johnson, Roche, Novartis - Clinical Trials and Regulatory Approvals: Conducting exhaustive human testing to determine safety and effectiveness, and then getting governmental permission for marketing the product.

Key Players: IQVIA, ICON plc, LabCorp, Parexel, and Syneos Health - Formulation and Final Dosage Preparation: The process of making drugs like tablets or injections that are stable and ready for patients through the combination of active substances and excipients.

Key Players: Pfizer, Novartis, Roche, and Merck & Co. - Packaging and Serialization: The process of assigning unique identifiers to each unit to ensure traceability, authenticity, and compliance with the global quality standards.

Key Players: Amcor, AptarGroup, Nipro Pharma Packaging - Distribution to Hospitals, Pharmacies: Logistics management to guarantee the biotech products' daily and safe delivery to the healthcare providers and retailers.

Key players: McKesson Corporation, AmerisourceBergen - Patient Support and Services: Strengthening treatment adherence, providing patient education, and offering technical support as part of post-sale programs to enhance patient outcomes.

Key players: HealthPlix Technologies and BestDoc

Top Companies in the Biotechnology Market

Johnson & Johnson

Corporate Information

- Headquarters: One Johnson & Johnson Plaza, New?Brunswick, New?Jersey, U.S.

- Year Founded: 1886

Business Overview

Johnson & Johnson is a global healthcare company operating in pharmaceuticals, medical devices, diagnostics, and formerly consumer health. In recent years, J&J has placed greater emphasis on its pharmaceuticals (biologics and biotechnology) and medical technology businesses, especially after spinning off its consumer health division. In the biotechnology market, J&J contributes through biologics, vaccines, cell and gene therapies, and advanced therapeutic modalities, primarily developed by its Janssen/Innovative Medicine unit.

Business Segments / Divisions

- Pharmaceuticals (Innovative Medicine): Focused on immunology, oncology, neuroscience, infectious diseases, cardiovascular & metabolic diseases, and cell/gene therapies.

- MedTech (Medical Devices & Diagnostics): Devices and solutions across orthopedics, surgery, interventional solutions, vision care, diabetes care, and diagnostics.

- Consumer Health: (Note: J&J spun off this division; now a separate company) Historically included baby care, skin care, oral care, OTC drugs, women's health, and wound care.

Geographic Presence

J&J operates in nearly 175 countries, with a global network of operating companies and manufacturing sites across North America, Europe, Asia Pacific, Latin America, and Africa.

Key Offerings

- Biologic therapies and vaccines: J&J's Janssen/Innovative Medicine business develops and markets biologics for oncology (e.g., Darzalex), immunology (e.g., Stelara, Tremfya), neuroscience, infectious disease, and more.

- Cell & gene therapy modalities: J&J emphasizes new therapeutic modalities, including cell and gene therapies, as part of its pharmaceuticals strategy.

- Diagnostic & device adjunct technologies: While primarily in MedTech, these support the biotechnology ecosystem by enabling diagnostics and monitoring in biologic therapies.

- Research & development investment: J&J invests heavily in R&D to drive its biotech pipelines.

SWOT Analysis

Strengths:

- Global scale and diversified operations across biopharma, devices, and formerly consumer health provide resilience.

- Strong brand reputation, well-established biologics portfolio, and deep R&D capabilities.

- Global presence with broad distribution networks and manufacturing footprint, enabling access to emerging markets.

Weaknesses:

- Large size and legacy business structures may slow agility compared to pure play biotech firms.

- Legal and regulatory risks (e.g., litigation over certain products) can weigh on reputation and financials.

Opportunities:

- Expansion in biologics, cell & gene therapies, and new therapeutic modalities offers high growth potential in biotechnology markets.

- Strategic acquisitions and collaborations in biotechnology are expected to accelerate the pipeline and innovation.

Threats: - Intense competition from specialized biotechnology firms and generic/biosimilar entrants.

- Pricing pressures, reimbursement challenges, and regulatory scrutiny in many markets.

- Rapid technological change in biotech (e.g., mRNA, gene editing) may disrupt models and require adaptation.

Other Major Companies

- Amgen – A leading pure-play biotech company specializing in innovative biologics, including monoclonal antibodies and recombinant proteins for oncology, nephrology, and inflammation.

- Pfizer – Develops a wide range of biopharmaceutical products, including vaccines, gene therapies, and mRNA-based medicines, making significant contributions to biotech innovation. This diversified company offers biopharmaceutical products including vaccines, oncology drugs, and treatments for rare diseases. Key products include the Prevnar vaccine and Eliquis. Pfizer's annual revenue was $63.6 billion in 2024.

- Merck & Co. – Advances biotechnology through biologics, cancer immunotherapies, and vaccines, integrating R&D with large-scale production and commercialization.

- Gilead Sciences – Focused on antiviral therapies, cell and gene therapy, and immunology, making it a key player in therapeutic biotechnology. Primarily known for its antiviral treatments for HIV and viral hepatitis, Gilead also has a growing oncology portfolio with therapies like Biktarvy and Trodelvy.

- Biogen – Specializes in neurological and neurodegenerative disease biologics, including therapies for multiple sclerosis and rare neurological conditions.

- Moderna – Pioneer in mRNA technology, driving the development of vaccines and therapeutics with rapid design and scalable production capabilities.

- Regeneron Pharmaceuticals – Develops monoclonal antibodies and other biologics for inflammatory, cardiovascular, and ocular diseases, with strong clinical pipelines.

- Novavax – Focused on recombinant protein vaccines and nanoparticle technology, contributing to infectious disease prevention via biotech innovation.

- Vertex Pharmaceuticals – Specializes in precision medicine for genetic disorders, notably cystic fibrosis, using advanced biologic approaches.

- BioNTech – Innovates mRNA-based vaccines and personalized immunotherapies, playing a leading role in oncology and infectious disease biotechnology.

- CRISPR Therapeutics – A pioneer in gene-editing therapies, leveraging CRISPR-Cas9 technology to develop treatments for genetic disorders and rare diseases.

Recent Developments

- In May 2025, Layn Natural Ingredients has recently launched an upgraded biotechnology facility, which will greatly improve the company's abilities in precision fermentation and enzyme manufacturing. The initial innovation to come from the facility is Galacan, an advanced beta glucan. The company states that, in contrast to beta glucans sourced from oats, yeast, algae, or mushrooms, Galacan is produced through precision fermentation, resulting in a distinct spiral-shaped heteropolysaccharide.

- In May 2025, Nestlé announced a strategic overhaul of its worldwide R&D activities, featuring improved proficiency in biotechnology and the establishment of a new deep tech center in Orbe, located in the canton of Vaud. These modifications seek to enhance the company's innovation pipeline and improve operational efficiency.

- In January 2025, Biosphere, a startup creating innovative bioproduction systems, has come out of stealth with the introduction of a revolutionary UV-sterilized bioreactor. This innovation represents a significant breakthrough for industrial biotechnology, enabling a substantial decrease in the capital intensity that has hindered the sector for many years.

Recent News

- In Jan 2025, Johnson & Johnson announced plans to acquire Intra-Cellular Therapies, a CNS-focused biotech, marking one of the largest healthcare deals in over a year and strengthening J&J's portfolio after its consumer health spin-off and the $13.1?bn Shockwave Medical acquisition.

Segments Covered in the Report

By Application

- Bio-pharmacy

- Bio-industries

- Bio-services

- Bio-agriculture

- Bio-informatics

By Technology

- Fermentation

- Tissue Engineering and Regeneration

- Polymerase Chain Reaction (PCR) Technology

- Nanobiotechnology

- Chromatography

- Deoxyribonucleic Acid (DNA) Sequencing

- Cell Based Assay

- DNA Sequencing

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting