What is the Active Pharmaceutical Ingredients Market Size?

The global active pharmaceutical ingredients market size is accounted at USD 238.68 billion in 2025 and predicted to increase from USD 252.16 billion in 2026 to approximately USD 425.26 billion by 2035, representing a CAGR of 5.95% from 2026 to 2035. The active pharmaceutical ingredients market is driven by an influence of precision medicine , an increasing Instances of cardiovascular diseases, high Instances of diabetes, and rising cases of strokes.

Active Pharmaceutical Ingredient (API) Market Key Takeaways

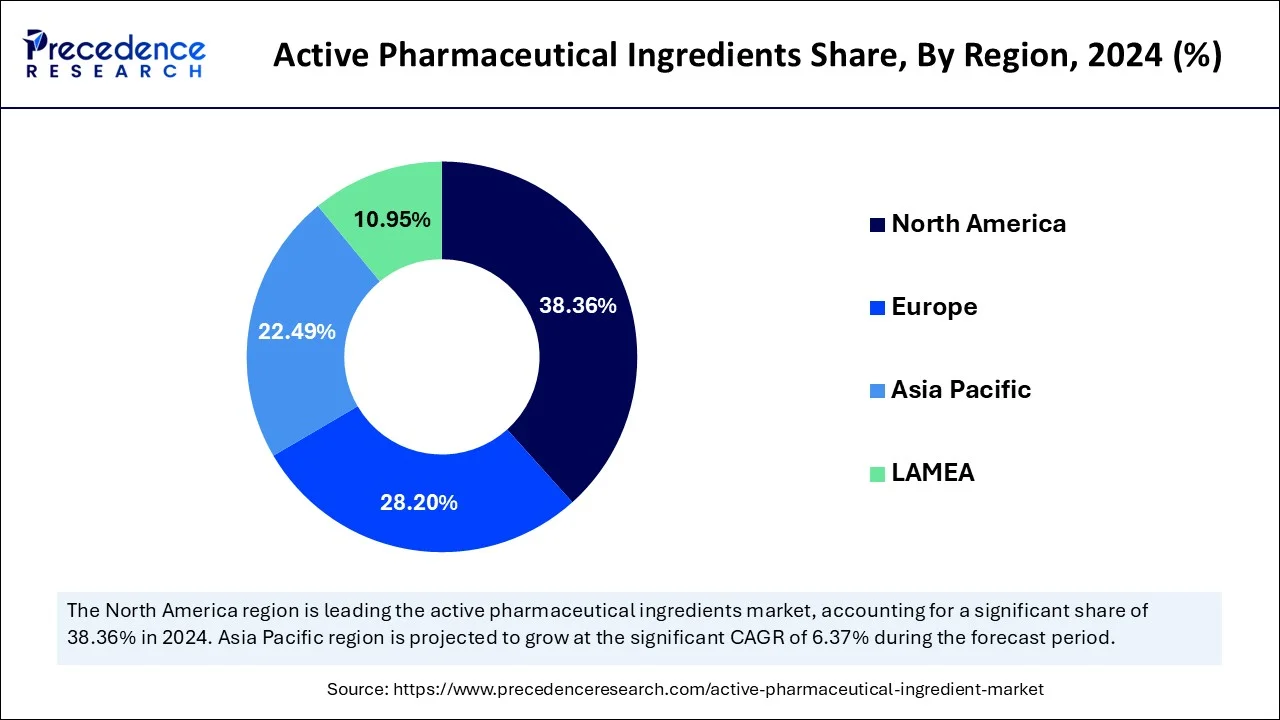

- North America dominated the market with the largest market share of 38.40% in 2025.

- Asia Pacific is expected to grow at a solid CAGR of 6.37% during the forecast period.

- By application, the cardiovascular diseases segment held the major market share of 21.05% in 2025.

- By application, the oncology segment is the fastest-growing application in the market between 2026-2035.

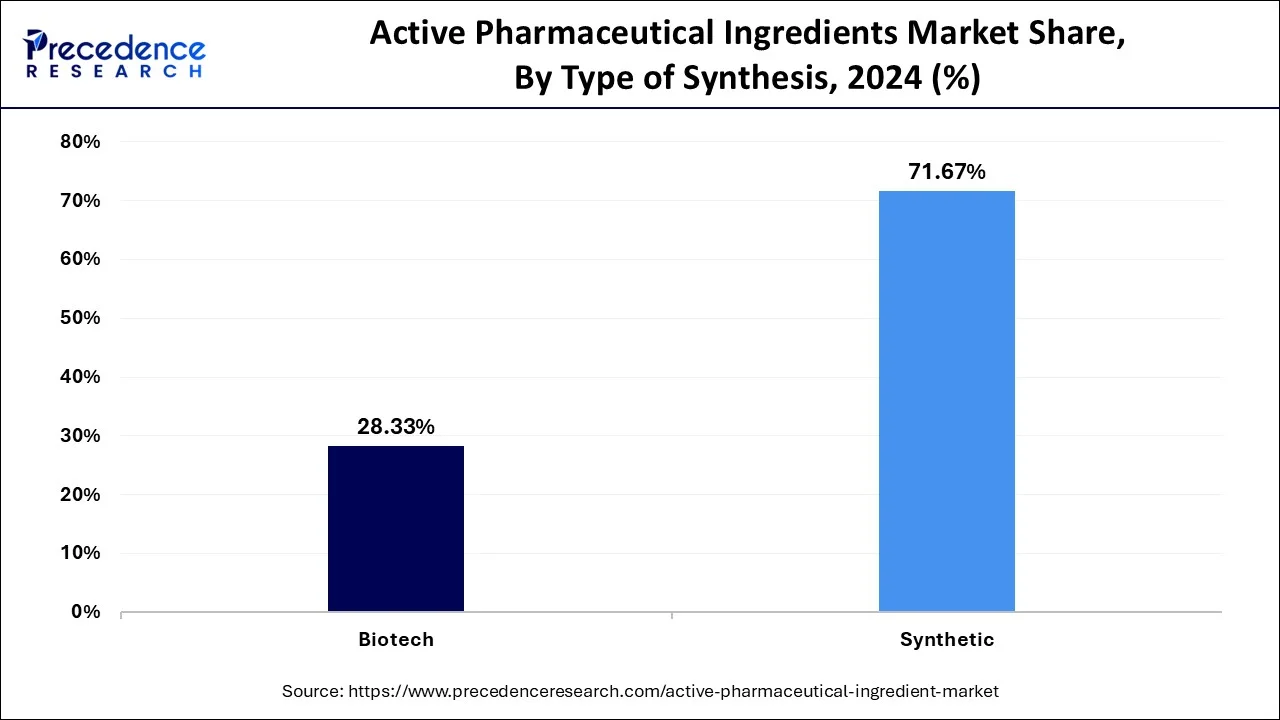

- By type of synthesis, the synthetic segment held the major market share of 71.61% in 2025.

- By type of synthesis, the biotech segment is the fastest growing application in the market between 2025-2036.

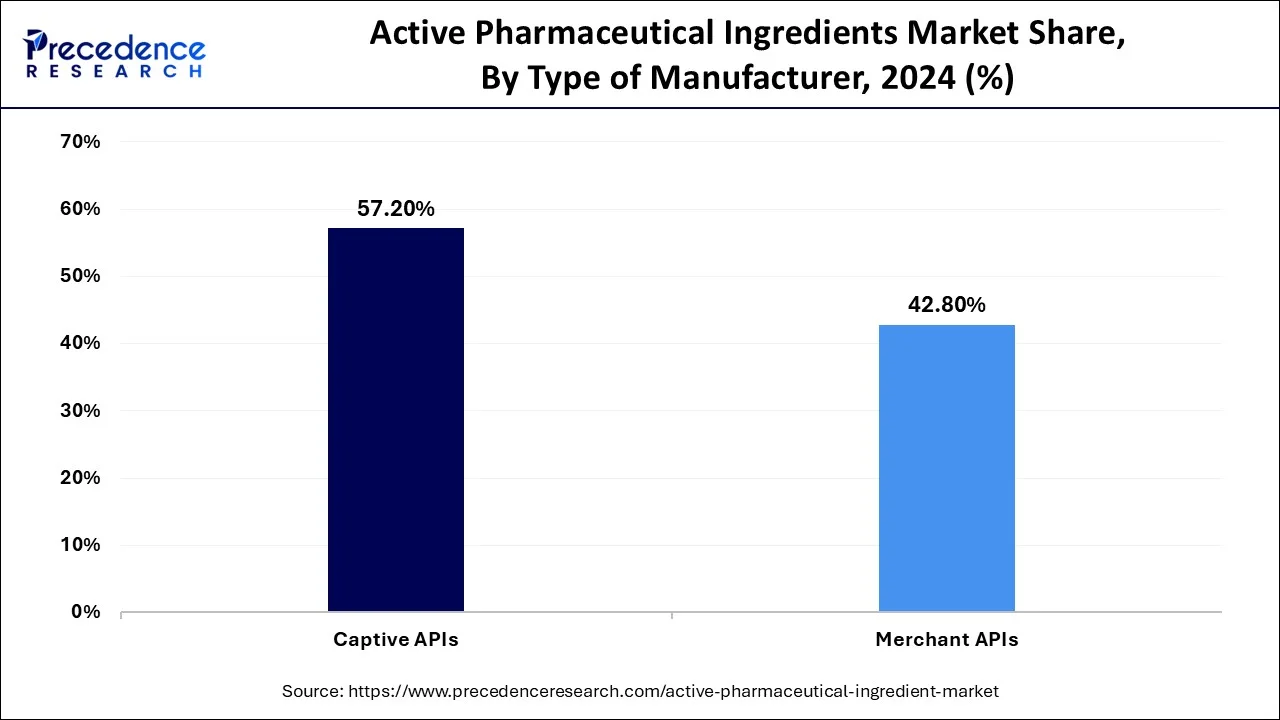

- By type of manufacturer, the captive APIs segment held a major market share of 57.14% in 2025.

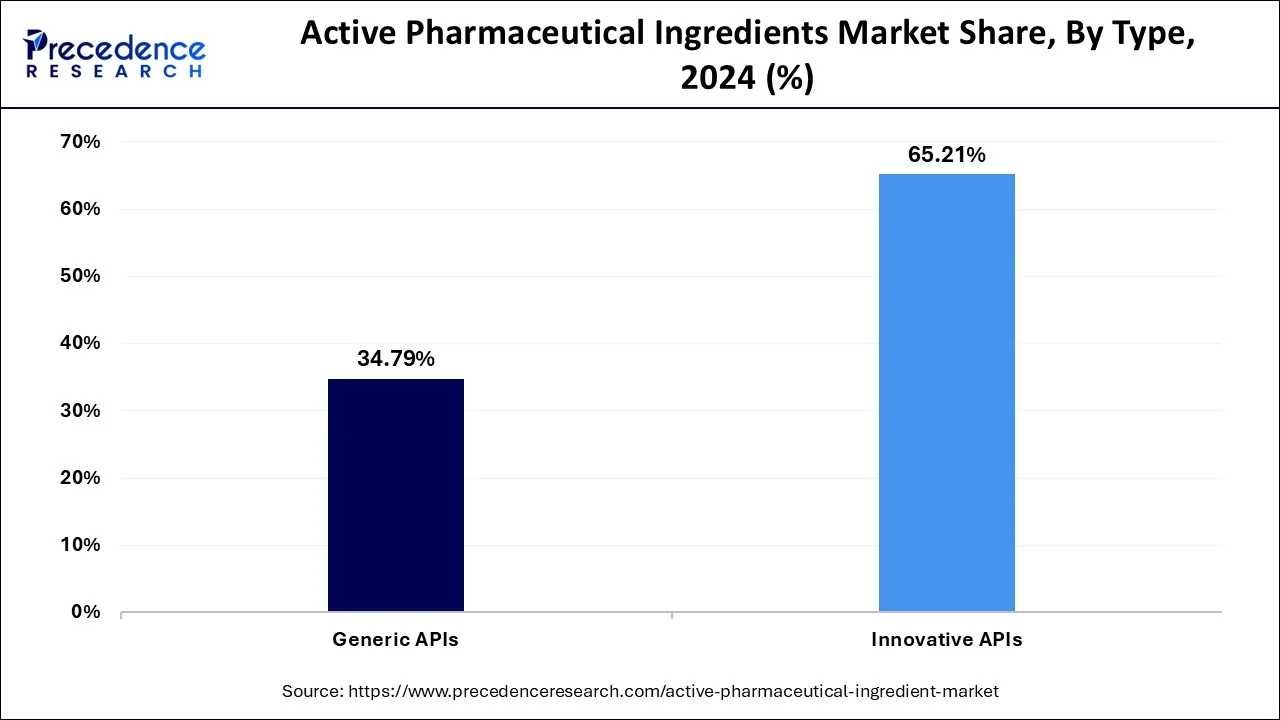

- By type, the innovative APIs segment contributed the highest share of 65.11% in 2025.

MarketOverview

The active elements in a pharmaceutical medicine that have the desired impact on the body to treat a condition are known as active pharmaceutical ingredients (APIs). Chemical substances are processed to create APIs. The active component of a biologic medication is referred to as a bulk process intermediate. Due to the rising incidence of chronic diseases including diabetes, asthma, and cancer, the API market has seen some appealing potential despite high manufacturing costs, rigorous regulatory laws, and policies in many countries restricting medicine prices.

Role of AI in the API Market

Artificial intelligence is playing a transformative role in the Active Pharmaceutical Ingredients market , enhancing efficiency, reducing costs, and accelerating innovation across the value chain. In drug discovery and development, AI algorithms are used to predict molecular interactions, identify promising compounds, and simulate drug target binding, significantly reducing the time and resources needed to develop new APIs.

In manufacturing, AI-powered systems enable predictive maintenance , real-time process monitoring, and quality control, helping companies maintain Good Manufacturing Practice (GMP) standards with greater precision. For example, AI can detect anomalies during synthesis is crystallization, preventing batch failures and reducing material waste. Additionally, AI enhances supply chain visibility by forecasting demand, optimizing inventory, and identifying risk, especially crucial in a global API market that relies heavily on outsourcing.

Machine learning tools also aid in regulatory compliance by streamlining documentation and tracking regulatory changes across jurisdictions. As APIs become more complex, particularly in the biotech and high potency segment, AI is proving essential for managing intricate production parameters. With increasing adoption across large pharmaceutical companies and contract manufacturing organizations (CMOs), AI is not only improving productivity but also supporting the shift toward personalized medicine and continuous manufacturing processes, making it a critical enabler of the API industry's future.

Active Pharmaceutical Ingredient (API) Market Growth Factors

- Patent expirations of blockbuster drugs enable the production of generic APIs and, hence, have positively impacted the market.

- Implementation of stringent quality and safety standards worldwide has, in turn, established trust in the manufacturing of APIs and the global supply chain.

- Outsourcing and contract manufacturing ties for cheaper drug development methodologies are in demand.

- Growth in biopharmaceutical research and biotechnology investments accelerates the development of complex APIs, as well as specialized ones.

- Chronic diseases such as cardiovascular diseases and cancer are on the rise, demanding more targeted and innovative APIs.

MarketScope

| Report Coverage | Details |

| Market Size in 2025 | USD 238.68 Billion |

| Market Size in 2026 | USD 252.16 Billion |

| Market Size by 2036 | USD 425.26 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.95% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type of Synthesis, Type of Manufacturer, Application, Type and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

MarketDynamics

Driver

A major driver of growth in the active pharmaceutical ingredients (API) market is the increasing prevalence of chronic diseases such as cancer, cardiovascular disorders, diabetes, and respiratory conditions. As populations age and lifestyles shift globally, the burden of non-communicable diseases continues to grow, creating sustained demand for both generic and innovative APIs. According to the World Health Organization, chronic diseases account for over 70% of all global deaths annually. This has led to an expansion of therapeutic drug development pipelines and increased healthcare spending, particularly in emerging economies. As a result, pharmaceutical manufacturers are scaling up API production to meet global treatment needs, further boosting the market.

Restraint

Complicated production methodology

One of the key restraints facing the active pharmaceutical ingredients (API) market is the complexity and cost associated with regulatory compliance. Manufacturers must adhere to strict quality, safety, and manufacturing guidelines set by agencies such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and similar bodies worldwide, this includes Good Manufacturing Practices (GMP), detailed documentation, facility audits, and batch testing all of which require significant investment in time, infrastructure, and skilled personnel.

These regulatory burdens are particularly challenging for small and medium-sized manufacturers, potentially delaying product launches or discouraging market entry altogether. Inconsistencies in regulatory standards across countries also create logistical hurdles for global API trade and exports.

Opportunity

Rising requirements for oncology therapies

Pharmaceutical companies and research institutions continually strive to develop new and more effective oncology treatments. These efforts lead to the discovery of potential active pharmaceutical ingredients candidates, providing active pharmaceutical ingredients manufacturers with opportunities to collaborate and supply active pharmaceutical ingredients for clinical trials and drug development. Many blockbuster oncology drugs are coming off-patent, leading to the rise of generic versions. Generic drug manufacturers need active pharmaceutical ingredients to produce these generic oncology drugs at a lower cost. This presents a significant opportunity for active pharmaceutical ingredients suppliers to cater to the growing demand for generic oncology drugs. As the complexity of oncology therapies rises, pharmaceutical companies often outsource the manufacturing of active pharmaceutical ingredients to specialized Contract Manufacturing Organizations (CMOs). CMOs can leverage their expertise in API synthesis to serve multiple pharmaceutical companies, leading to an increased demand for active pharmaceutical ingredients in the market.

Challenge

Quality concerns and contamination issues

The primary concern in pharmaceutical manufacturing is patient safety. Contaminated or impure active pharmaceutical ingredients can lead to adverse reactions, reduced efficacy, or even severe health risks for patients consuming the medications. Ensuring the highest quality standards are met is crucial to avoid such risks. Detecting trace amounts of contaminants in active pharmaceutical ingredients can be difficult using conventional analytical methods. The development and validation of sensitive and specific testing techniques to identify impurities is a constant challenge. Active pharmaceutical ingredients production often involves multiple manufacturers, suppliers, and distributors located in different countries. Coordinating quality control measures across the entire supply chain can be difficult, and the risk of contamination or quality issues increases as the product passes through multiple hands. Thus, the quality concerns and contamination issues create a challenge for the market.

Segment Insights

Type of Synthesis Insights

The synthetic API segment, by selling or having demand for the generic, is the largest in the market due to the cost-effectiveness of chemical processes. This synthetic API, having a strong presence in the treatment of chronic diseases and being mostly preferred for outsourcing, is the mainstay for supply and revenue generation. Especially from the angle of contract manufacturing, the massification of companies focusing on synthetic APIs has greatly benefited, considering scale and cost factors.

Biotech API is the fastest-growing segment due to the very rapid progress in biotechnology and biopharmaceutical research. With growing demand for advanced therapies, including biologics and antibody drug conjugates, biotech APIs are gaining speed in their trajectory. Because biotech API can treat complicated diseases such as cancer and autoimmune disorders, it is very lucrative, which attracts huge investments and expansion in this innovative space.

Active Pharmaceutical Ingredient (API) Market Revenue, By Type of Synthesis, 2023-2025 (USD Billion)

| Type of Synthesis | 2023 | 2024 | 2025 |

| Biotech | 60.70 | 64.06 | 67.75 |

| Synthesis | 154.02 | 162.08 | 170.93 |

TypeInsights

Biotech API is the fastest-growing segment due to the very rapid progress in biotechnology and biopharmaceutical research. With growing demand for advanced therapies, including biologics and antibody drug conjugates, biotech APIs are gaining speed in their trajectory. Because biotech API can treat complicated diseases such as cancer and autoimmune disorders, it is very lucrative, which attracts huge investments and expansion in this innovative space.

The faster-growing one is the generic API, fuelled by patent expiry of blockbuster drugs and increasing adoption of biosimilars. Manufacturers are trying to capitalize on this opportunity for affordability and accessibility, with developing economies mainly in mind. The increasing demand for cheaper substitutes to expensive branded drugs will ensure that the generic API market grows fast across the world.

Global Active Pharmaceutical Ingredient (API) Market Revenue, By Type, 2023-2025 (USD Billion)

| Type | 2023 | 2024 | 2025 |

| Generic APIs | 74.50 | 78.69 | 83.28 |

| Innovative APIs | 140.22 | 147.45 | 155.40 |

Type of Manufacturers Insights

The captive API segment is the dominant segment as companies prefer to produce in-house to control price, ensure quality, and secure the supply chain. Therefore, the segment is bolstered by novel chemical syntheses and AI-based manufacturing methods, with big pharmaceutical companies aiming to avoid outsourcing and maintain operational reliability.

The merchant API segment presents the fastest growth, driven by increasing contract manufacturing-clocking and outsourcing trends. The infrastructural and infrastructural, as well as cost, challenges prompt companies to entrust merchant suppliers. The increasing capabilities of contract manufacturers allow the rapid growth of efficient, scalable, and cost-effective API production.

CAPTIVE APIS

The in-house manufacturing of the API molecules by some of the pharmaceutical companies is referred to as captive APls. Due to the simple accessibility of raw materials and large expenditures made by key players to establish high-end manufacturing facilities, the captive APIs segment is predicted to grow significantly in the next years. Further evidence that key firms are more focused on internal production than outsourcing comes from recent developments and initiatives. For instance, Novartis revealed in November 2019 that it had acquired CellforCure, a CDMO with offices in France, in order to produce molecules internally that had previously been contracted to CellforCure. It is projected that the segment growth will be fueled by these initiatives by important players.

Along with major companies, the Indian government also intends to support indigenous API production. For instance, in March 2020, the government of India announced a 9.4 billion package for the bulk drug industry, which will augment the domestic production and exports. Further, as part of the production-linked strategy for the pharmaceuticals industry, 35 active pharmaceutical ingredients that were previously imported have begun to be manufactured in India. 35 of these active pharmaceutical ingredients (APIs) are amongst the 53 for which India is 90% dependent on imports. These factors are anticipated to support the segmental growth of the market in the years to come.

Application Insights

The cardiology segment holds sway, given that the global incidence of cardiovascular disorders is increasing. Widespread need for cholesterol-lowering, antihypertensive, and other cardiovascular drugs invariably causes demand for APIs in this therapeutic category. Hence, it is a market staple with sustainable growth prospects.

Oncology is the fastest-growing segment because of the increasing number of cancer cases and the continuous developments in targeted therapies and biologicals. The collaborative approach taken by pharma organizations with regulators speeds up drug approvals, and high demand from patients continues to favor APIs linked to oncology.

Cardiovascular Diseases

The cardiovascular diseases segment held the largest revenue share in the active pharmaceutical ingredients industry. This is due to the widespread use of numerous CVD medications brought on by the increasing occurrence of cardiovascular disorders. Cardiovascular diseases (CVDs) are the leading cause of mortality worldwide due to rising tobacco and alcohol consumption, bad eating habits, obesity, and physical inactivity. According to the European Society of Cardiology 2019 Statistics, there are currently more than 6 million new cases of cardiovascular diseases (CVD) in the EU and more than 11 million in all of Europe each year. With about 49 million sufferers in the EU, the disease has a significant economic cost of EUR 210 billion annually. Further, as per the WHO statistics, 17.9 million deaths worldwide in 2019 were attributable to CVDs, contributing to 32% of all global deaths. Heart attack and stroke deaths accounted for 85% of these fatalities. Also, in 2019, noncommunicable illnesses caused 17 million premature deaths (before the age of 70), and 38% of those fatalities were attributable to CVDs.

Cardiovascular drugs are essential for treating and preventing CVD. Cardiovascular drugs were the second most commonly used class of medication in the non-hospital sector in 2008, according to data from 84 of the countries included by the World Medicines Situation Report. Branded cardiovascular drug sales generated over US$40 billion in revenue in 2017 and are projected to reach US$90 billion by 2024. The WHO Anatomical Therapeutic Chemical (ATC) classification list5 and the British National Formulary (77/2019) both list 400 active pharmaceutical ingredients (APIs) or API combinations for the treatment or prevention of CVDs. The 2019 WHO Essential Medicines List (EML) contains thirty-two active pharmaceutical ingredients. As a result, the demand for active pharmaceutical ingredients has increased with the prevalence of cardiovascular disorders.

Oncology

The oncology segment is also expected to grow at the fastest CAGR during the forecast period. This is owing to the increasing prevalence of cancer and a larger percentage of people are anticipated to be affected by the disease in the years to come. The primary chemicals of chemotherapy for different forms of cancer are active pharmaceutical ingredients. Most of the market players are continuously developing and investing in new APIs to cater to the need in the oncology segment globally. For instance:

- According to the data released by the World Health Organization (WHO)'s cancer agency, the International Agency for Research on Cancer (IARC) in February 2024, Lung cancer was the most commonly occurring cancer worldwide, with 2.5 million new cases accounting for 12.4% of the total new cases. Female breast cancer ranked second (2.3 million cases, 11.6%), followed by colorectal cancer (1.9 million cases, 9.6%), prostate cancer (1.5 million cases, 7.3%), and stomach cancer (970,000 cases, 4.9%). Over 35 million new cancer cases are predicted in 2050, a 77% increase from the estimated 20 million cases in 2022.

- In December 2019, a generic version of Velcade, manufactured by Millennium Pharmaceuticals, called Bortezomib for injection was introduced to the US market by Dr Reddy's Laboratories. Adult patients with multiple myeloma or mantle cell lymphoma who have undergone at least one prior therapy are treated with Bortezomib.

- In June 2022, with the development of its plant in the USA, Merck's Life Science business segment has doubled its capacity to produce high-potency active pharmaceutical ingredients (HPAPI). To meet the need for essential cancer therapies, this new 70,000 square foot CDMO facility worth €59 million was built.

- In June 2022, after the business announced the introduction of the first generic version of Nexavar (Sorafenib) tablets in the US market, Natco Pharma increased 3.09% to Rs 713.45. The medication will be released by the international pharmaceutical company Viatris, a Natco business partner. Unresectable advanced Renal Cell Carcinoma (RCC), Hepatocellular Carcinoma (HCC) and Differentiated Thyroid Carcinoma (DTC) are treated with Sorafenib. It is an oral multi-kinase inhibitor used to treat advanced liver, thyroid, and renal cell cancers.

- In July 2022, a global development and commercialization agreement for Orion's experimental candidate ODM-208 and other medications that target the enzyme cytochrome P450 11A1 (CYP11A1), crucial in the manufacture of steroids, was announced by Merck and Orion Corporation. In a Phase 2 clinical trial, ODM-208, an oral, non-steroidal CYP11A1 inhibitor, is being tested for the treatment of individuals with metastatic castration-resistant prostate cancer (mCRPC).

Type of Drug Insights

The prescription segment is dominated by chronic diseases and advanced therapies that mostly need physician-prescribed drugs. Increasing acceptance of targeted therapies and biologics further strengthens this segment, making it an indispensable one in the global pharmaceutical landscape.

The OTC segment is the fastest-growing, buoyed by consumer-athlete attitudes toward preventive healthcare and self-medication. They are moving increasingly toward probiotics , supplements, and nutraceuticals for non-prescription drugs available easily, making this segment an immense potential candidate for expansion in the future.

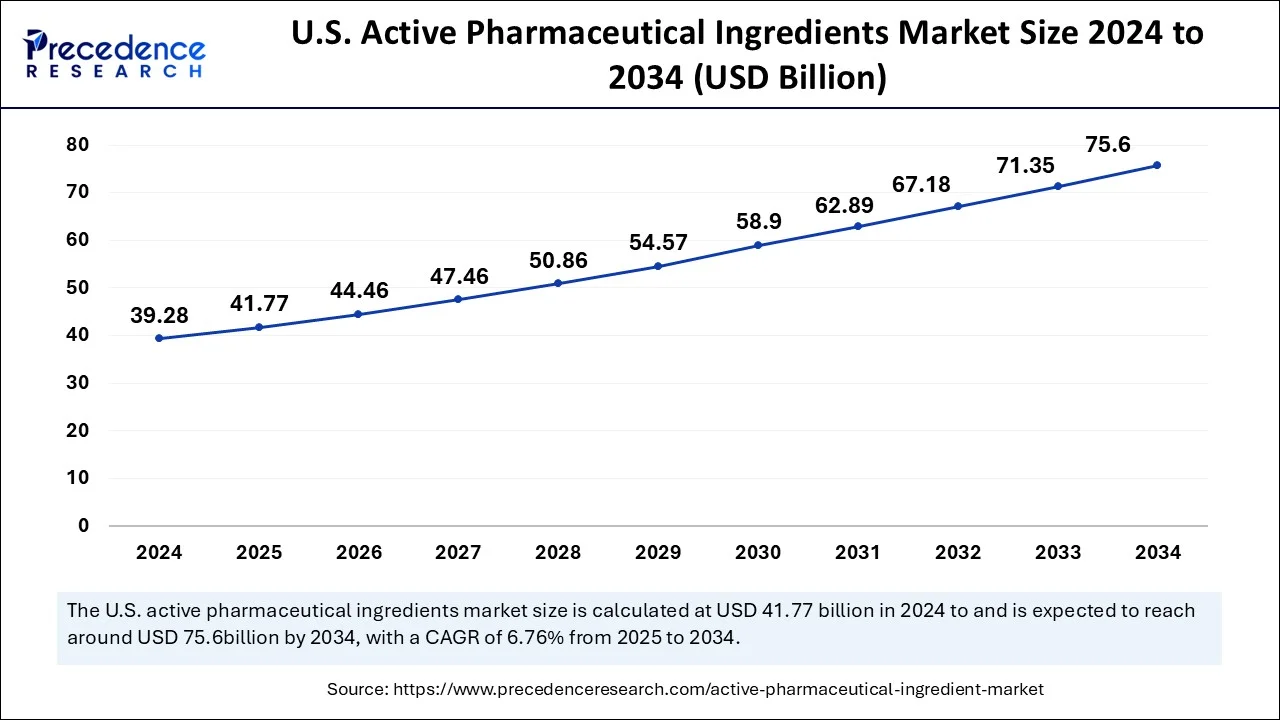

U.S. Active Pharmaceutical Ingredient (API) Market Size and Growth 2025 to 2035

The U.S. active pharmaceutical ingredients market size was valued at USD 41.77 billion in 2025 and is predicted to be worth around USD 79.80 billion by 2035, at a CAGR of 6.69% from 2026 to 2035.

Geographically, North America dominated the global API market closely trailed by Europe. The foremost influences motivating the whole growth of the market in this are budding incidence of chronic diseases, cumulative government emphasis on generic drugs, intensifying demand for specialty drugs andbiologics, and technological progressions in the manufacturing processes of APIs. Asia Pacific is expected to record fastest growth in the market throughout the estimate period. This growth is attributed to efforts of foremost corporations in the market for setting up API business plants in emerging nations such as India and China.

North America held largest share in the global active pharmaceutical ingredient (API) market. The U.S. held largest share followed by Canada and Mexico. The development in the active pharmaceutical ingredient (API) market is attributable to the rising expenditure on healthcare across the region. The rising prevalence of chronic diseases along with increasing government initiatives supports the creation of novel medicines and is also expected to accelerate the development of active pharmaceutical ingredients in North America.

The growing demand for biologic active pharmaceutical ingredients (API) in the region due to the patients' quick adoption of biologic medications for the treatment of various chronic illnesses is also driving the regional growth of the market. For instance, the Alzheimer's Association estimates that 6.2 million Americans over the age of 65 already have Alzheimer's disease, and the count will rise to 12.7 million by the year 2050. This boosts the demand for donepezil, a synthetic active pharmaceutical ingredient that can be utilized in pharmaceutical preparation for treating Alzheimer's disease. As a result, the prevalence of this chronic disease issue has augmented the growth of this market in the North American continent. The rising obesity rates across the U.S. are creating major market opportunities for the growth of the market. As per the 2021 National Health Statistics Report, the prevalence of obesity was 19.7% between 2017 to March 2020 among children and adolescents aged 2–19 years. The age-adjusted prevalence of obesity was 41.9% among adults aged 20 and over, severe obesity was 9.2%, and diabetes was 14.8%. Among adults aged 18 and over, the age-adjusted prevalence of hypertension was 45.1%. This has resulted in an increase in demand for active pharmaceutical ingredients which in turn has resulted in the growth of the active pharmaceutical ingredient (API) market in the region.

The active pharmaceutical ingredient (API) market in Canada is expected to grow owing to the presence of companies that are involved in the development and manufacturing of inventive medicines and generic medications, as well as over-the-counter drugs. Additionally, an increase in the prevalence of chronic diseases among Canadians and the comorbidities linked to the illnesses are projected to have a beneficial effect on the expansion of the active pharmaceutical ingredient (API) market during the forecast period. For instance, according to the Public Health Agency of Canada analysis, among the top chronic diseases and conditions most prevalent among Canadians are hypertension, ischemic heart diseases (IHD), osteoporosis, asthma, diabetes, chronic obstructive pulmonary diseases, and cancer. This will increase the demand for pharmaceutical products and is further likely to support the growth of the active pharmaceutical ingredient (API) market.

Asia Pacific is projected to grow at the fastest with a CAGR of 6.3% during the forecast period. China dominated the Asia Pacific region, followed by India and Japan. The China active pharmaceutical ingredients market has been calculated at USD 14.48 billion in 2025.The pharmaceutical and contract manufacturing industries are expanding in various countries, including China and India, and this is projected to fuel the growth in the Asia Pacific market. Due to factors such as accessibility of production- ready raw materials and cheaper labour costs, these countries are emerging as desirable locations to outsource the manufacturing of active pharmaceutical ingredients as well. Additionally, the region's favourable regulatory framework is enticing many manufacturers to increase their production capacity which is expected to fuel the market's growth in the region. Further, organizations are undergoing digital transformation through Manufacturing 4.0 with capabilities to ensure good manufacturing practice (GMP) compliance. Additionally, the rising life expectancy along with lifestyle and dietary changes contribute to more non-communicable diseases and are expected to increase in demand for pharmaceutical drugs and hence active pharmaceutical ingredients in the region.

Also, the Made in China 2025 initiative emphasizes on the biotechnology and pharmaceutical sectors to help China become a high value-add economy. China has completely redesigned its healthcare system with the Volume-based Procurement (VBP) policy and National Reimbursement Drug List (NRDL). The major objective is to give consumers more widespread access to high-quality medications at less cost. The need for higher-quality medications will also increase with rising consumer wealth in the future years. The government places more emphasis on the increased production of copyrighted medicines and increased innovation. The above- mentioned factors are expected to fuel the active pharmaceutical ingredient demand across the economy.

The Indian active pharmaceutical ingredient (API) market is expected to grow owing to a surge in generic drug exports. India emerged as one of the most attractive locations not only for investments but also for doing business. India jumped 79 positions from 142nd in 2014 to 63rd in 2019 in the ‘World Bank's Ease of Doing Business Ranking 2020'. India is one of the largest providers of generic drugs. The increasing percentage of heart disease and the growing pharmaceutical industry are anticipated to drive industry growth and competitiveness in the country. Further, the pandemic spurred Indian drug producers to significantly increase their R&D expenditure. In order to reduce their reliance on Chinese deliveries, Indian drug producers worked towards increasing the local production of Active Pharmaceutical Ingredients (APIs). These factors are likely to augment the growth of the active pharmaceutical ingredient (API) market.

Latin America

The active pharmaceutical ingredients (API) market in Latin America is merging, driven by rising healthcare spending and growing biotech investment. Brazil leads the region, though its local API manufacturing capacity remains limited, relying heavily on imports from countries like India and the U.S. Mexico and Argentina are also showing increasing demand, supported by expanding healthcare infrastructure. While regulatory frameworks are improving, supply chain inefficiencies and limited domestic production remain key challenges. Nonetheless, government initiatives and a growing focus on pharmaceutical self-reliance are expected to support market growth. Forecasts suggest a low double-digit compound annual growth rate (CAGR) in the coming years.

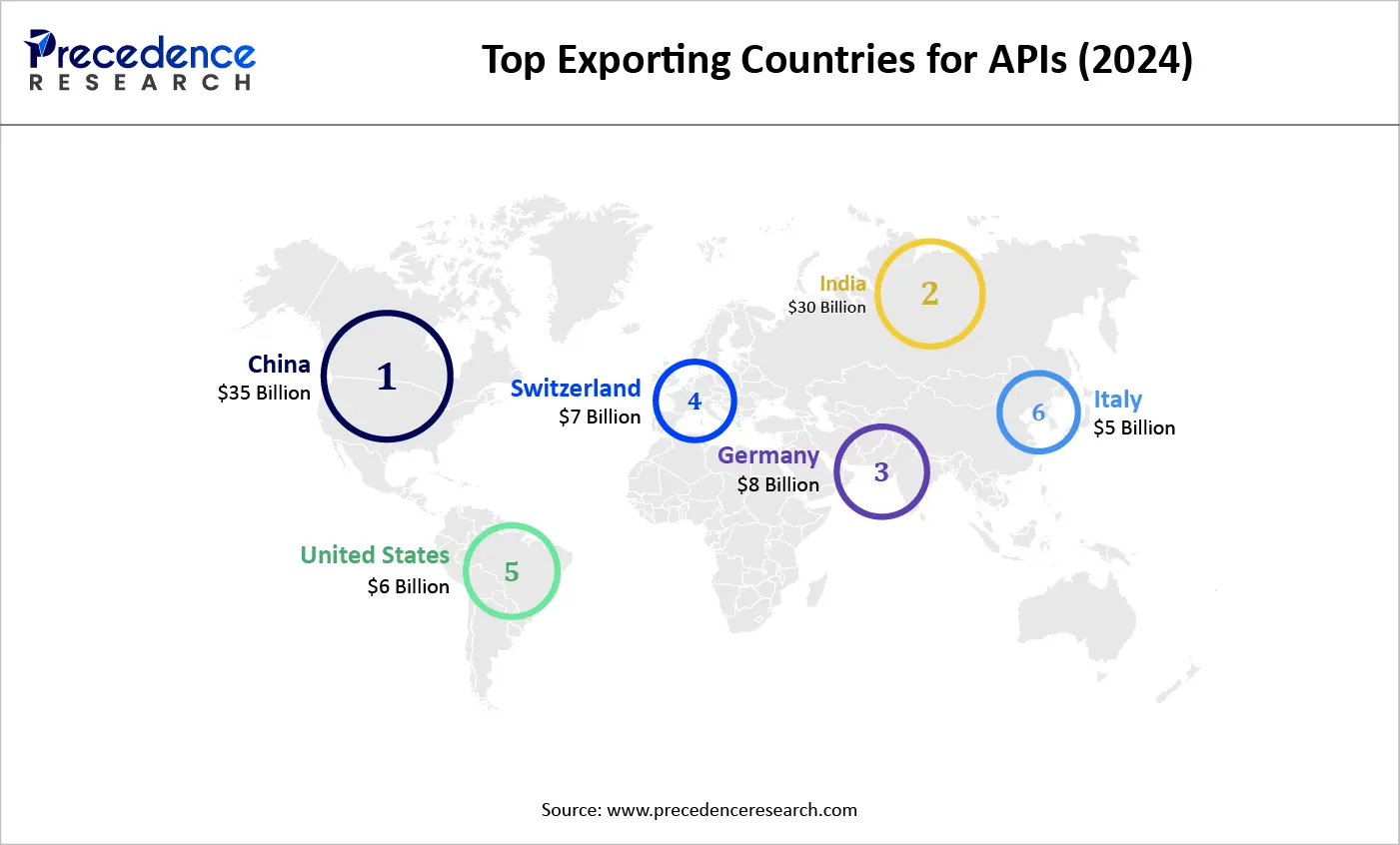

Top Exporting Countries for Active Pharmaceutical Ingredients (2024)

In 2024, China and India continue to dominate the global Active Pharmaceutical Ingredients (API) export market, with estimated export values of approximately USD 35 billion and USD 30 billion respectively. These two countries benefit from robust manufacturing infrastructure, cost efficiencies, and strong supply chain networks. European leaders like Germany and Switzerland also play significant roles, exporting around USD 8 billion and USD 7 billion worth of APIs, driven by their focus on high-quality and specialized products. The United States and Italy round out the top exporters, contributing USD 6 billion and USD 5 billion respectively. This data highlights the global distribution of API production and the importance of diverse geographic hubs in meeting pharmaceutical demand

Value chain analysis

- R&D (Research and Development): It involves the discovery of new Active Pharmaceutical Ingredients (APIs) and the development of processes to manufacture them in a way that optimizes purity, potency, and cost.

Key players: Pfizer, Sanofi, GSK, Novartis

- Clinical Trials and Regulatory Approval: Herein, the API serves as the primary substance for testing in clinical trials for safety and efficacy in humans before undergoing a stringent regulatory review for market authorization.

Key players: Pfizer, Teva, Sun Pharmaceutical, Dr. Reddy's

- Formulation and Final Dosage Preparation: The final dosage forms are prepared by mixing the API with inactive ingredients (excipients). These dosage forms could be administered to the patient in a comfortable form, in tablet, capsule, or injection form.

Key players: Johnson & Johnson, Pfizer, GlaxoSmithKline (GSK)

- Packaging and Serialization: In this final step, the packaged drug product is affixed with identifiers such as barcodes, which facilities can track from entry into the supply chain, thus providing a means to fight counterfeiting.

Key players: BASF, Amcor, and Honeywell

- Distributing to Hospitals and Pharmacies: The pharmacy sells the medicine to healthcare providers. APIs, from a completely different perspective than Active Pharmaceutical Ingredient, allow pharmacy systems to communicate with one another and speed up prescription processing.

Key players: Cencora, Cardinal Health, and McKesson Corporation

Key Companies & Market Share Insights

Pfizer is one of the foremost players in the global API marketplace. This prominent position of the corporation is majorly accredited to its comprehensive product offerings. The company has a robust brand imagethat offers it a competitive edge over other companies. To endure competitive position and reinforce its market position, the firmlargely focuses on implementing both organic and inorganic growth approaches including partnerships, agreements, collaborations, product endorsements, and acquisitions. In accordance with this, Pfizer acquired Anacor Pharmaceuticals, Inc. (US), a principal biopharmaceutical corporation developing small molecule therapeutics in June 2016.

Increasing numbers of players are subcontracting to curtail costs on employees, costly equipment, and infrastructure. However, there is sustained anxiety regarding the quality of these APIs manufactured abroad. Particularly, AstraZeneca Pharmaceuticals used to operate numerous manufacturing hubs in the U.S. Currently, only 15% of their APIs are generated in the U.S. and there are plans to end that small fraction and subcontract all manufacturing abroad.

| Company | Estimated Volume Share (%) | Rationale & Market Position |

| Teva Pharmaceutical Industries | 11.20% | The Scale Leader: Operates one of the world's largest API networks (Teva API), producing over 350 different ingredients for both internal and external use. |

| Divi's Laboratories | 8.80% | The Efficiency Engine: Specializes in high-volume generic APIs and is a top global supplier for large-scale custom synthesis, benefiting from India's low-cost manufacturing advantage. |

| Pfizer (CentreOne) | 7.50% | The Quality Pioneer: Utilizes its massive internal manufacturing capacity to provide specialized, high-potency APIs (steroids and antibiotics) to the global market. |

| Lonza Group | 3.33% | The CDMO Giant: Focuses on high-value, complex biological and small-molecule APIs, recently expanding its Swiss and Chinese plants to meet 2025–2026 demand. |

| Others (Rest of World) | 69.17% | Includes thousands of Chinese, Indian, and European firms (e.g., EuroAPI, Aurobindo, and Dr. Reddy's) that handle specialized or regional volume. |

Strategic Rationale & Takeaways

- Teva Pharmaceutical Industries (Israel)

Teva remains the "volume king" due to its massive portfolio of generic medicines. Its API division operates as a standalone business unit that sells to nearly all other major pharma companies. Their ability to manufacture hundreds of thousands of tonnes across a diverse chemical range makes them the primary benchmark for global supply security.

- Divi's Laboratories (India)

Divi's represents the shift of the market's "volume heart" to India. Unlike many companies that focus on a wide range of drugs, Divi's focuses on a smaller number of molecules but dominates them with massive scale and high-quality vertical integration, making them the leading supplier for generic blockbuster drugs.

- Pfizer CentreOne (USA)

Pfizer's significance in terms of volume comes from its internal consumption. By producing its own APIs, it avoids the supply chain chokepoints that affect other firms. Their contract manufacturing arm (CentreOne) leverages this massive internal infrastructure to offer high-volume production for complex steroids and anti-infectives.

- Lonza Group (Switzerland)

While Lonza may have a lower "tonne-per-tonne" volume than some generic firms, their economic share and strategic volume are critical. They are the leading partner for the world's top biotech firms, manufacturing the complex proteins and high-potency molecules that drive modern medicine. Their new Visp facility (launched in 2025) significantly boosts their total volume output.

Active Pharmaceutical Ingredient (API) Market Companies

- Albemarle Corporation

- AurobindoPharma

- Reddy's Laboratories Ltd.

- AbbVieInc

- Teva Pharmaceutical Industries Ltd.

- Mylan N.V.

- CiplaInc

- BoehringerIngelheim International GmbH

- Merck & Co., Inc

- Sun Pharmaceutical Industries Ltd

- Bristol-Myers Squibb Company

Recent Developments:

- In June 2025, Torrent Pharmaceuticals agreed to acquire a controlling stake in JB Chemicals for approximately 25,689 Crore (approximately US$3 billion), creating one of India's largest domestic pharma entities. The deal reflects ongoing consolidation in API and pharmaceutical manufacturing and boosts Torrent's scale and portfolio reach.

- In June 2025, Merck is acquiring biotech firm Verona Pharma in a US$10 billion all-cash deal, adding COPD drug Ohtuvayre to its respiratory API portfolio. This strategic move enhances Merck's pipeline and offsets looming patent expirations on its blockbuster oncology products. Deal expected to close by late 2025.

Segments Covered in the Report

By Type of Synthesis

- Biotech

- Monoclonal Antibodies

- Recombinant Proteins

- Vaccines

- Synthetic

By Type of Manufacturer

- Captive APIs

- Merchant APIs

- Generic APIs

- Innovative APIs

By Type

- Generic APIs

- Innovative APIs

By Application

- Cardiovascular Diseases

- Oncology

- CNS & Neurological Disorders

- Orthopedic Disorders

- Endocrinology

- Pulmonology

- Gastrointestinal Disorders

- Nephrology

- Ophthalmology

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Middle East & Africa

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting