What is the Generic Drugs Market Size?

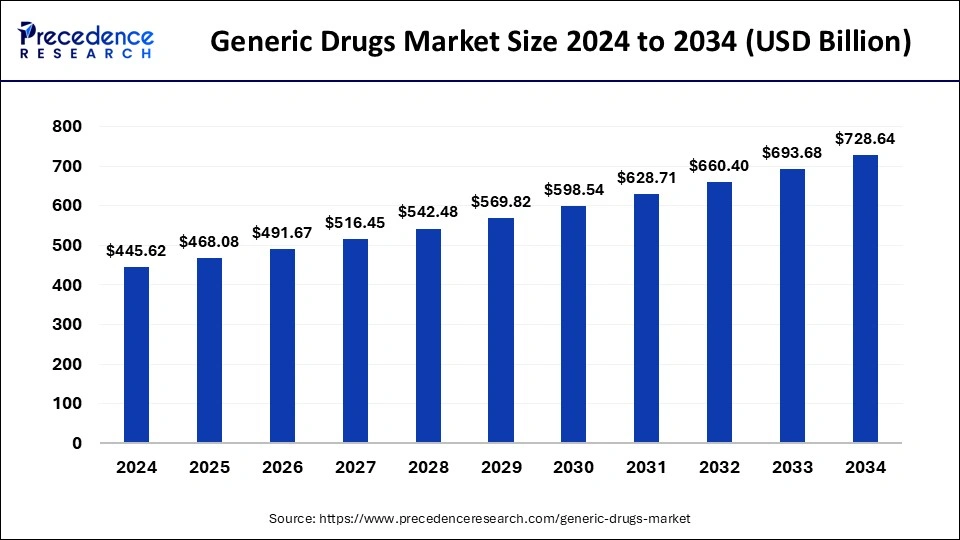

The global generic drugs market size is calculated at USD 468.08 billion in 2025 and is predicted to increase from USD 491.67 billion in 2026 to approximately USD 762.48 billion by 2035, expanding at a CAGR of 5% from 2026 to 2035.

Generic Drugs Market Key Takeaways

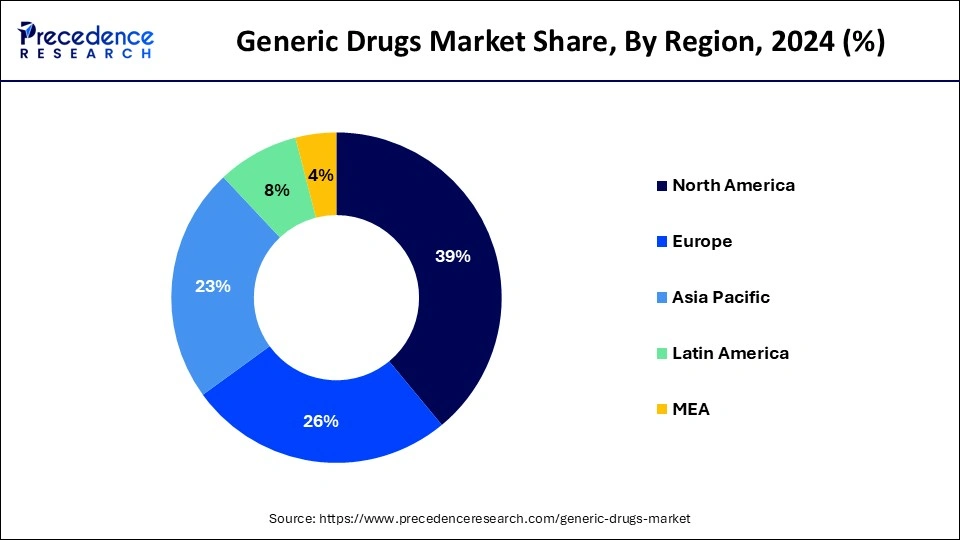

- North America led the global market with the highest market share of 39% in 2025.

- By brand, the pure generics segment has held the largest market share in 2025.

- By route of administration, the oral generics segment held a dominant presence in the market in 2025.

- By route of administration, the injectables segment is expected to grow at the fastest rate in the market during the forecast period of 2026 to 2035.

- By distribution channel, the retail pharmacy segment captured a significant portion of the market in 2025.

- By distribution channel, the hospital pharmacy segment is set to experience the fastest rate of market growth from 2026 to 2035.

How Has AI Benefited the Generic Drugs Market?

Artificial Intelligence assists manufacturers in the generic medicines industry to accelerate development and guarantee quality. Together with machine-learning technologies, AI and machine-learning systems can predict how a drug acts in the body and suggest excipients to use, thereby avoiding lab trials and increasing precision and accuracy in formulation. AI also helps manufacturers to supply the drugs with less deviation from the design that is adopted routine, and automated production lines, and address quality assurance in the local area based in Ahmedabad, where select companies have been adopting AI worldwide to a good extent to expedite generics faster and provide a cheap alternative based on machine intelligence.

Generic Drugs Market Insights

Global generic drugs market is expected to rise at substantial CAGR during the forecast era. The low cost of generics, as an alternative to branded drugs is major factor expected to fuel growth of the target industry in the near future. Additionally, increasing use of RPA to ensure regulatory and standards compliance can create lucrative growth opportunities for the key players operating in the global market.

The use of artificial intelligence (AI) technology to automate routine, rules-based processes is robotic process automation. Through this automation, key operating players in the target market are capable to devote more time, energy, and capitals to advanced value tasks. The use of RPA to ensure compliance with regulatory and standards is one of the major trends in the market for generic brands that will gain traction in the coming years. Company process automation systems such as RPA are commonly used by pharmaceutical firms to conduct high-volume R&D and production activities. RPA technology includes software that logs into programs, enters data, measures and completes the necessary activities, and logs out. It aims to ensure conformity with laws and requirements, to complete procedures at a faster speed and to reduce costs.

Generic companies are finding it more difficult to launch new medications as originator products that have gone off-patent become more difficult to develop, produce, and market. When comparing the status of generic firms to that of industrial or communications companies, it is clear that generic companies have a larger and more diverse range of options to pick from. Over $217 billion in original patents are set to expire shortly, and they cover everything from biologics to oral solids, injectable, and inhalers to over-the-counter (OTC) drugs.

By 2025, industry analysts predict that generics will have the luxury of generating $60 billion in net growth. Now is the moment for businesses to carefully consider where they should invest before deciding on their next product. As shown below, opportunities and obstacles differ substantially from one product category to the next.

One of the major restraints limiting the growth of generic drugs is stringent regulations, as the FDA examines the accuracy, side effects and other ingredients used in generic drugs. If the manufacturers fails to follow the regulatory guidelines, the drugs are usually recalled. Emerging economies such as India and China hold immense potential for the market growth due to the cost effectiveness of the generic drug in these countries. Purity, potency, stability, and drug release are the crucial factors that determine the quality of generic medications, and these should be controlled within a suitable limit, range, or distribution to achieve the required drug quality. Therefore, approval required for generic drugs due to the stringent governmental regulations, which is expected to obstruct market growth.

Generic Drugs Market Growth Factors

- The low cost of generics as an alternative to branded drugs

- Large number of patents expired branded drugs

- Initiatives by governments and other regulatory bodies across the globe

Future of Global Generic Drugs Market

Major companies of the global industry including Abbott Laboratories and Teva Pharmaceutical Industries Ltd. are pointing towards commercial growth by adopting strategies like mergers and acquisitions, heavy investments in the manufacturing facilities that is predictable to flourish the global market growth in next few years. This trend is probable to continue and will augment growth of the target industry in the near future.

- For instance, in August 2016, Teva Pharmaceutical Industries Ltd. acquired Anda, a wholesale distributor of pharmaceutical products in the United States.

Generic Drugs Market Trends

- Prevalence of Chronic Disease: The increased number of chronic diseases is driving the adoption of generic drugs.

- Government Initiatives: Governments worldwide are focusing on reducing healthcare expenditure and promoting the importance of generic drug use, fostering market growth.

- Patent Expiration on Branded Drugs: Several branded drugs are about to expire, making a key opportunity for generic manufacturers to enter the market.

- Affordable Medicine: The demand for cost-effective and efficacious medicines has increased, driving the adoption of generic drugs.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 468.08 billion |

| Market Size in 2026 | USD 491.67 Billion |

| Market Size by 2035 | USD 762.48 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Drug, Brand, Route of Drug Administration, Therapeutic Application, Distribution Channel |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Market Dynamics

Drivers

Rising cases of cancer

Cancer treatment can be prohibitively expensive, especially with the rising costs of branded cancer medications. Generic drugs offer a more affordable alternative to branded counterparts, allowing patients to access essential cancer treatments at lower costs. As the number of cancer cases increases, the demand for cost-effective treatment options also rises, driving the growth of the generic drugs market. Many branded cancer drugs face patent expirations, allowing generic pharmaceutical companies to introduce bioequivalent versions of these medications into the market. Generic versions of cancer drugs can be approved more quickly and at a lower cost compared to the development of new branded drugs. Patent expirations create opportunities for generic manufacturers to enter the market and offer affordable alternatives to branded cancer treatments.

Restraint

Regulatory hurdles

Generic drug manufacturers often face stringent regulatory requirements and lengthy approval processes before they can bring their products to market. Compliance with regulatory standards imposed by agencies such as the U.S. Food and Drug Administration (FDA) or the European Medicines Agency (EMA) can be costly and time-consuming, delaying market entry for generic drugs.

Patent protection granted to branded drugs can pose a significant barrier to the entry of generic competitors. Pharmaceutical companies invest heavily in research and development to develop new drugs, and patents provide them with exclusive rights to manufacture and sell these drugs for a specified period. Generic manufacturers must wait for patents to expire or challenge them through legal means, which can delay market entry and increase litigation costs.

Opportunity

It is anticipated that the generic drugs market would continue to grow strongly over the coming years as many branded drug patents expire, allowing established generic drug manufacturers an opportunity to launch bioequivalent products and gain market share, while governments create and promote low-cost medicines by way of policy and/or bulk procurement, enhancing demand. Opportunities also exist in the area of digital pharmacy and with the automation of pharmacy supply chains for pharmaceutical companies, allowing them to forecast demand, avoid lapses in medications, and even reach new patient populations through online engagements. Furthermore, emerging and transition countries like India and China have an increasing chronic disease rate with an increasing number of middle-class patients that need low-cost health care. These trends enable manufacturers with the option of increasing their reach and decreasing the costs of production, while maintaining quality.

Segment Insights

Brand Insights

The pure generics segment accounted largest revenue share 52.57% in 2025. Emerging markets can be challenging for pharmaceutical companies that are more accustomed to operating in developed markets, but understanding the unique problems these markets present may distinguish winners from losers, especially as the competitive battlefield becomes more global. Emerging markets are home to more than 70% of the world's population, cover 46% of the planet's surface, and generate 31% of global GDP. As a result, they are the industry's next great growth engine.

Branded generics, on the other hand, are given names to increase consumer recognition and loyalty. Cryselle, for example, is a brand-name generic contraceptive pill. To improve the possibility of patients requesting it by name, it is referred to as Cryselle rather than its generic name (norgestrel and ethinyl estradiol). To achieve cost savings, formulary administrators must examine the drugs on their formularies regularly. Branded generics, like generics, offer a cost-effective alternative to branded medications. When it comes to ways that PBMs avoid complete disclosure of their revenues, there is some friction between formulary managers and PBMs. Some pharmacy benefit consultants believe that one of the ways pharmacy benefit managements hide revenue is through branded generics.

Route of Administration Insights

The oral generics segment held a dominant presence in the market in 2025 as they are easier to take, cheaper, and no medical person or facilities are needed. Patients preferred pills over injection forms, and pharmacies stocked more oral generics than injections.

The injectables segment is anticipated to grow with the highest CAGR in the market during the studied years because many new chronic and specialty drugs focus on things like diabetes and cancer therapies, which require precise delivery, and doctors are ordering more injectables than other formats.

Why did the oral segment dominate the generic drugs market?

The oral segment dominated the generic drugs market in 2024. The growing demand from healthcare systems, patients, and physicians helps in the market growth. Oral formulations do not require special equipment and training. It is easily accessible and very convenient for patients. The growing demand for long-term therapy increases the adoption of generic drugs. Oral formulations are an affordable and widely accepted form of medication. The growing production of capsules and tablets drives the overall growth of the market.

Drug Type Insights

What made simple generic segments dominate the generic drugs market?

The simple generic drugs segment dominated the generic drugs market in 2025. The growing prevalence of various chronic diseases like cancer, cardiovascular disease, and diabetes increases demand for simple generic drugs. The increasing demand for easily accessible treatment and cost-effective drugs helps in the market growth. The simple regulatory processes for approving simple generic drugs and wider availability drive market growth. The growing demand from doctors and patients supports the overall growth of the market.

Super generics are expected to grow with the fastest CAGR in the generic drugs market because they are a better version of expired-brand medicines at significantly lower prices. They have better delivery, longer-lasting effects, so people tend to choose them over any other brand options.

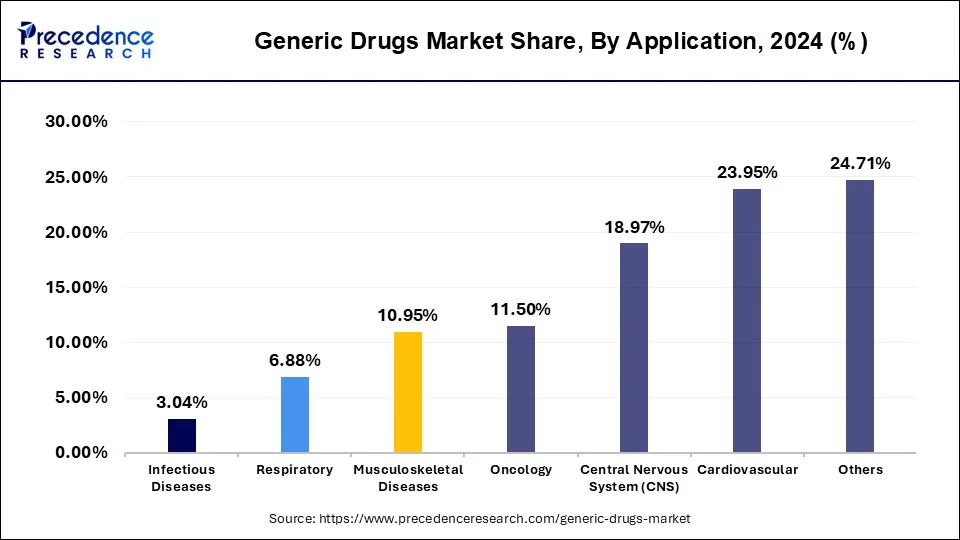

Therapeutic Application Insights

The oncology segment is observed to witness the fastest rate of expansion at a CAGR of 6.6% during the forecast period. Cancer is one of the leading causes of mortality globally, and the demand for effective cancer treatments continues to rise. Oncology drugs are essential for treating various types of cancer, including breast cancer, lung cancer, prostate cancer, leukemia, and lymphoma. As a result, the oncology segment represents a substantial portion of the pharmaceutical market.

The high cost of branded oncology drugs can pose significant financial burdens on healthcare systems, insurers, and patients. Generic oncology drugs offer a more cost-effective alternative, helping to reduce overall healthcare expenditures and improve affordability and access to cancer treatments. As a result, payers and healthcare providers often encourage the use of generic drugs to lower healthcare costs while maintaining treatment quality.

Distribution Channel Insights

The retail pharmacies segment captured a significant portion of the market in 2025 because they are the most common places where people can buy generic drugs easily and at low cost. People trust them as they often buy generics, and they stocked up on many options. Retail pharmacies and online pharmacies gave patients access to super generics and education about their potential benefits.

The hospital pharmacies segment is expected to see notable performance in growth between 2026–2035 because patients in admitted beds are using more complex generics like injectables and specialty drugs. Hospitals and specialty clinics are bulk buyers of generic medicine with consistent demand for reliable generics for treatment.

Regional Insights

What is the U.S. Generic Drugs Market Size?

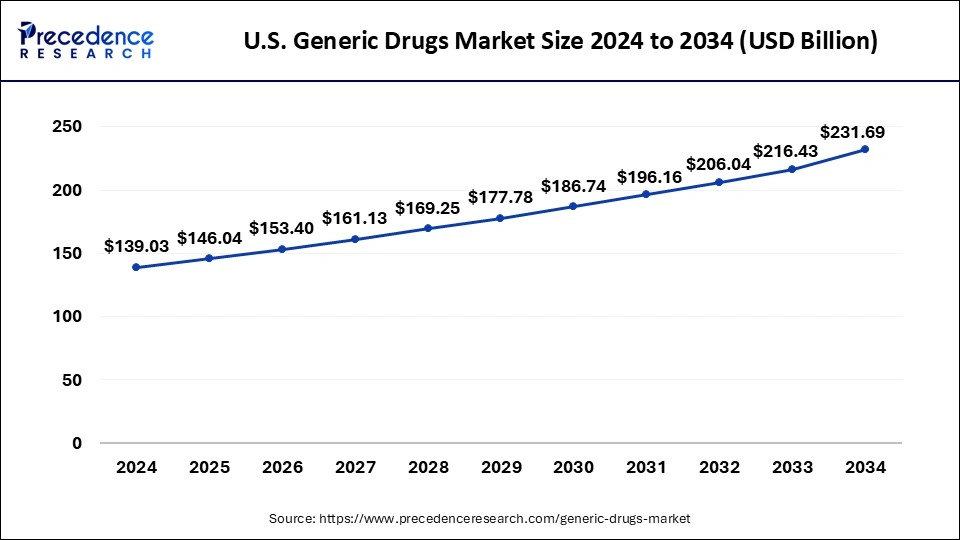

The U.S. generic drugs market size was exhibited at USD 146.04 billion in 2025 and is projected to be worth around USD 243.70 billion by 2035, growing at a CAGR of 5.25% from 2026 to 2035.

Why did North America hold the Largest Revenue Share in the Generic Drugs Market in 2025?

North America acquired the largest revenue share of 39% in the year 2025. U.S. recorded the highest sale in Generics Drugs Market in the year 2021. While the region's primary healthcare emphasis remains on the pandemic as it moves through the 3rd year of its disruptive impacts and the death toll which approached to 1 million, other key dynamics are playing out with respect to health services utilization, the associated level of spending including patient costs out-of-pocket, and the use of prescription medicines. Understanding these factors of the health care system and how they may develop over the next few years remains critical to stakeholders and decision makers including patients. Spending and drivers for growth reflect the substantial differences in spending levels by stakeholders as rebates and discounts deforms these trends even as the most affecting driver has been the amount which is spent on COVID-19 therapeutics andvaccines.

U.S. Generic Drugs Market Analysis

The U.S. is a major player in the regional market, growth driven by the existence of robust pharmaceutical companies, the existence of key vendors, and government support. The U.S. is the hub for pharmaceutical innovation and development. The demand for generic drugs has increased in the country due to their affordability and regulatory standards. Increased number of geriatric patients, prevalence of chronic disease, and high availability of branded medication are supporting this demand. Additionally, U.S. collaboration with other leading countries is fostering the U.S. market. For example, the U.S. accounts for about 30% of India's total pharma exports.

- Despite a rise in spending overall, costs per prescription generally are flat or a little declining.

- Use of Prescription drug reached a record 194 billion daily doses in the year 2021 as new prescription starts for both acute and chronic care recovered from the slacking off in 2020.

- Utilization of Health services returned to pre-pandemic stratum by the end of the year 2021 but still has to make up for the pandemic-lured backlog in screenings and diagnostics, missed patient visits, new prescription starts, and elective procedures.

- Spending on medicines is likely to return to pre-pandemic trend lines by the year 2024.

- The medicines use in the U.S. region based on definite daily doses has risen 9.6% over the last few years to nearly 194 billion days of therapy in both non-retail as well as retail settings in the year 2021.

The growth is attributed to speedy increase in the prevalence of chronic disease in the countries of APAC owing to changing lifestyle which is creating demand for the generic drugs. Additionally, growing demand for the generic drugs for the end users in LATAM and the countries of Middle East and Africa is anticipated to propel industry growth in the next 10 years.

How did Asia Pacific hold a Dominating Position in the Generic Drugs Market?

Asia-Pacific dominated the global generic drugs market as many millions of people needed affordable medicine, there were government policies that supported the expansion of generics, and healthcare systems were developing. Furthermore, with an aging population, together with ever-increasing chronic disease, demand for affordable, low-cost treatments quickly grew. India and China are the major driving forces within this growth, with digital pharmacy models alongside increased access to healthcare in urban and rural communities expanding the uptake of generics. The same holds true when it comes to online delivery and mobile pharmacies.

As regulators and governments have supported new manufacturers to market, many cases have been able to scale up and export regionally and worldwide. The markets offered opportunities for greater investment in local production with multi-national companies to strategic partnerships that allow entry of generics in a broad variety of therapeutic areas, including cardiovascular and diabetes treatment, and positioned this region as a center for global growth of generics.

India Generic Drugs Market Analysis

India is the anticipated country with the most significant rate of growth in the Asia Pacific generic drug market because India is the largest producer of low-cost generic medicines, and it exports them widely. It had a large?scale capability with hundreds of FDA?approved plants, as well as the recent governmental 'Jan Aushadhi' scheme to promote low?price access for domestically manufactured generic medicines. Indian companies could reverse?engineer and produce high?quality generic medicines efficiently and competently, making them the best in the world. The government also made plans to increase the number of Janaushadhi stores throughout the country to increase distribution capabilities. This combined scale, supportive governmental policy, and globalization led India as the key nation contributing to the growth of the global generic drugs market.

- For instance, India made up about 20 % of global generic drug volume and about 40 % of U.S. generic demand.

Asia Pacific Generic Drugs Market Trends

Asia Pacific experiences the fastest growth in the market during the forecast period. The growing demand for affordable treatment and rising healthcare costs increases demand for generic drugs. The lower incomes of individuals and the increasing population help in the market growth. The strong government policies for the adoption of generic drugs and chronic diseases like cancer, diabetes, and cardiovascular conditions drive the market growth.

The growing acceptance of generic drugs and increasing age-related health conditions increases demand for generic drugs. The strong generic drugs manufacturing abilities in countries like South Korea, India, and China support the overall growth of the market.

China Generic Drugs Market Analysis

China is a major contributor to the generic drugs market. The growing demand for pharmaceutical products in the nation increases the demand for generic drugs. The strong government support for improving access and lowering healthcare costs helps in the market growth. The growing healthcare system, the growing production of generic drugs, and a large population support the overall growth of the market.

Europe

How did Europe hold a Notable Revenue Share in the Generic Drugs Market?

Europe is expected to grow at a notable rate in the market in 2025, owing to the emerging trends in oncology and biosimilars, rising healthcare costs, and regulatory support. A new deal reported by the European Parliament aims to promote innovation and increase access to medicinal products across the EU.

Mergers, acquisitions, and partnerships among pharmaceutical companies are strengthening production capabilities and distribution networks, while biosimilars are emerging as a significant segment within the generics landscape.

- In December 2025, the European Parliament and Council negotiators introduced a deal on comprehensive reform of EU pharmaceutical legislation.

South America

How does South America Reach Significant Growth in the Generic Drugs Market?

South America is expected to experience significant growth during the forecast period, driven by favorable regulatory and policy support, local production, partnerships, and the expansion of distribution networks. South American countries like Brazil hold the presence of a robust domestic generics industry.

MEA

How is the Momentous Growth of the Middle East and Africa in the Generic Drugs Market?

MEA is expected to grow at a lucrative rate in the market in the coming years, driven by digital health and e-pharmacy expansion, localized manufacturing, and huge investments. The dynamic growth of the pharmaceutical market in the MENA region is driven by rising healthcare demands, government reforms, and advancements in medicine manufacturing.

Value Chain Analysis of the Generic Drugs Market

- R&D: This stage includes strategic planning, candidate selection, pharmaceutical development, bioequivalence, clinical studies, scale-up, manufacturing, regulatory submission, and review.

Key Players: Sandoz, Sun Pharma, Fosun Pharma, Viatris, Aurobindo Pharma, Teva Pharmaceuticals, Cipla, Lupin. - Distribution to Hospitals, Pharmacies: This stage involves the core distribution workflow, which includes manufacturer to distributor, warehousing, order management, and last-mile fulfilment.

Key Players: McKesson Corporation, Cencora, Cardinal Health, Sandoz, Teva Pharmaceuticals, Viatris, Sun Pharma, and Fosun Pharma. - Patient Support & Services: This stage ensures enrollment, awareness, access, affordability, initiation, education, adherence, and maintenance.

Key Players: Fortrea, AssistRx, CareMetx, LLC, ConnectiveRx, Lash Group, McKesson Corporation, Cardinal Health, EVERSANA, United BioSource LLC.

Generic Drugs Market Companies

- Mylan N.V.

- Abbott Laboratories

- ALLERGAN

- Teva Pharmaceutical Industries Ltd.

- Eli Lilly and Company

- STADA Arzneimittel AG

- GlaxoSmithKline Plc.

- Baxter International Inc.

- Pfizer Inc.

- Sandoz International GmbH

Recent Developments

- In June 2025, Advent International announced that it has signed a definitive agreement to invest US$ 175 million through primary and secondary transactions to acquire a significant minority stake in Felix Pharmaceuticals, based in Dublin, Ireland, a company which developed and manufactures generic veterinary medicines for companion animals with 14 FDA-approved generic products and additional products in the pipeline.

( Source: https://www.livemint.com) - In August 2025, the Sertraline Hydrochloride capsules (150 mg and 200 mg), developed by Zenara Pharma Private Limited, were approved by the FDA in the United States, as the first FDA-approved generic equivalent of Almatica Pharma's product. It was granted Competitive Generic Therapy (CGT) designation, which provided 180 days of U.S. marketing exclusivity.

( Source: https://www.pharmtech.com) - In August 2025, Swiss generic drugmaker Sandoz plans to introduce unbranded semaglutide and tirzepatide based weight loss drugs in Canada starting January 2026 to better access, with discounts of up to 70% over branded versions and prices forecasted which is a generic CAD 40–50 for patient access.

( Source: https://www.businesslive.co.za)

Segments Covered in the Report

By Drug Type

- Simple Generics

- Super Generics

By Brand

- Pure generic drugs

- Branded generic drugs

By Route of Drug Administration

- Oral

- Injection

- Cutaneous

- Others

By Therapeutic Application

- Central Nervous System (CNS)

- Cardiovascular

- Infectious Diseases

- Musculoskeletal Diseases

- Respiratory

- Oncology

- Others

By Distribution Channel

- Retail Pharmacy

- Hospital Pharmacy

- Online and Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting