What is the Prostate Cancer Market Size?

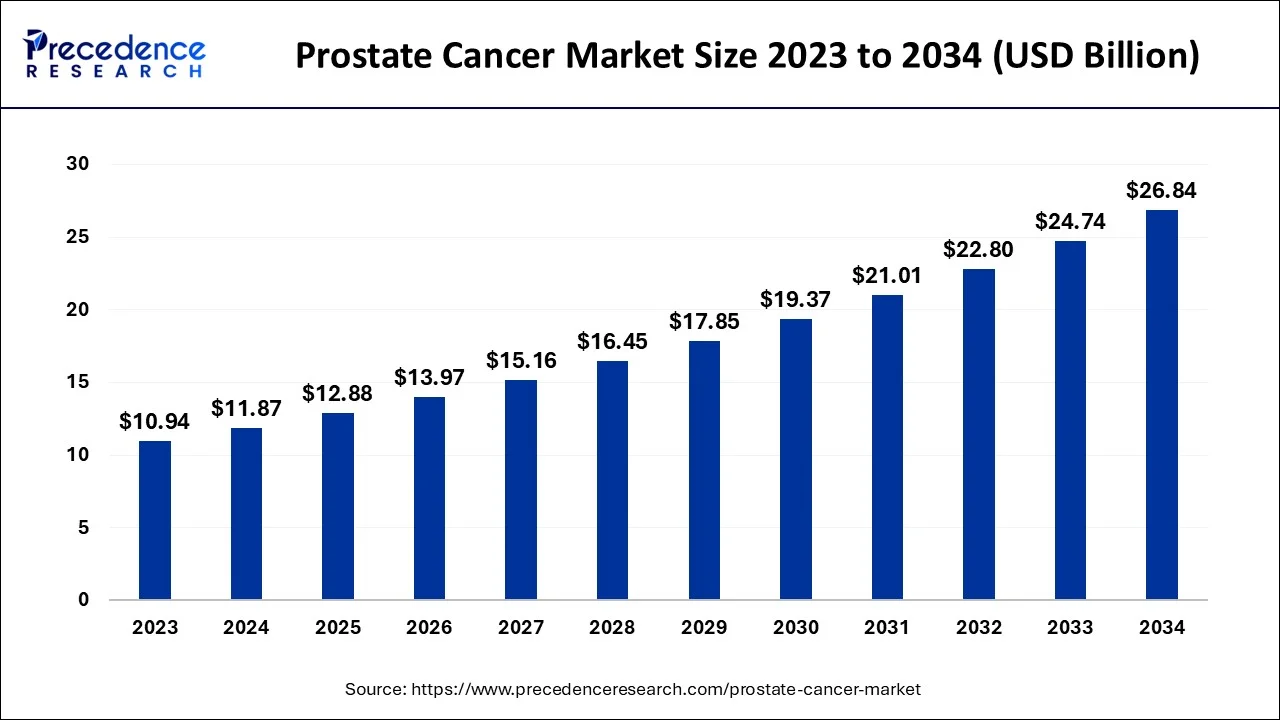

The global prostate cancer market size is calculated at USD 12.88 billion in 2025 and is predicted to increase from USD 13.97 billion in 2026 to approximately USD 28.83 billion by 2035, expanding at a CAGR of 8.50% from 2026 to 2035.

Prostate Cancer Market Key Takeaways

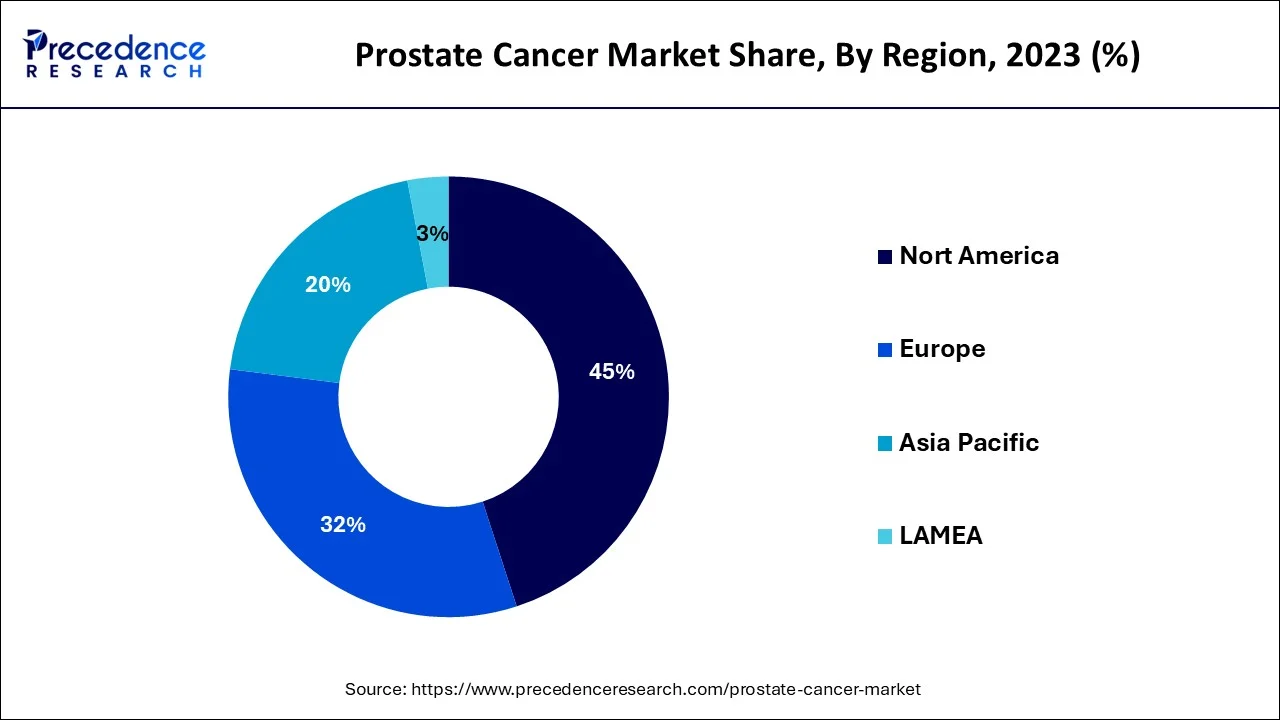

- North America dominated the global market and accounted for the largest revenue share in 2025.

- The AR-directed therapies drug class segment is expected to remain the dominant drug class in 2035.

- The hospital pharmacies distribution channel segment led the market in 2025.

Market Overview

Prostate cancer is the second leading cause of cancer worldwide. After only lung cancer, prostate cancer patients die in 1 out of every 41 men. Prostate cancer is a severe disease, but most men diagnosed with it do not die from it. Over 3.1 million men in the United States who were diagnosed with prostate cancer at some point in their lives are still alive. Prostate cancer is more observed in older men and non-Hispanic black men. About 6 out of 10 cases are diagnosed in men 65 and older, and it is rare in men under 40. According to findings, men are diagnosed with prostate cancer at an average age of 66.

According to WHO estimates, approximately 1.41 million prostate cancer cases will be present globally in 2022. The rising prevalence of cancer, the usage of diagnostic technologies and novel screening, and government initiative for new prostate cancer therapies influence the therapeutic market for prostate cancer. The adoption of diagnostic technologies is expected to increase therapeutic adoption. Recent therapeutic breakthroughs employ bioinformatics and computational biology technologies to help to achieve optimal treatment.

Additionally, key market players are developing successful techniques for developing new cures and treatments through a focused strategy that includes proteome profiling, exome sequencing, and whole-genome sequencing. Additionally, increased clinical trials for prostate cancer drugs boost the market growth in the forecast year. For Instance, in 2022, over 4,000 men will be enrolled in a phase III trial for Olaparib, in which tumor genomic testing will be used to identify patients.

Table 1: Estimate the Number of New Cancer Cases and Deaths in the United States in 2022

| Cancer | Estimated New cases (Male) |

Estimated New Deaths (Male) |

| Prostate cancer | 2,68, 490 | 34,500 |

Covid 19 Impact:

Since December 2019, the number of people infected with the novel coronavirus (CoV) severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) causing coronavirus disease 2019 (COVID-19) has been increasing regularly and it caused a global health crisis. While this disease affects men of all genders, ages, and ethnicities, it is more lethal in older men, overlapping with the prostate cancer (PCa) population. Furthermore, along with other comorbidities, a cancer diagnosis may increase SARS-CoV-19 mortality. Every year, over 1.2 million new patients are added to the survivorship of PCa patients worldwide. Given the pandemic's global spread, millions of men with PCa are likely to become infected before the end of the year. Non-urgent procedures and treatments in hospitals were frequently postponed or canceled as the number of infected patients and who needed to be admitted increased. Furthermore, patients who feared becoming infected or wanted to relieve the healthcare system canceled appointments with their general practitioner (GP).

Prostate Cancer Market Trends

- Rising Awareness and Screening Programs

Increased public awareness and government-led screening initiatives are encouraging earlier detection of prostate cancer, resulting in higher demand for diagnostic tests such as PSA and imaging. Early diagnosis improves patient outcomes and expands the market for preventive and monitoring services. - Advancements in Diagnostic Technologies

Innovations like multiparametric MRI, PET imaging, and biomarker-based diagnostics are improving detection accuracy and reducing false positives. These technologies are increasingly adopted in hospitals and specialized clinics, driving growth in the diagnostic segment. - Growth of Personalized and Precision Medicine

Targeted therapies and precision treatment plans are gaining traction, allowing interventions to be tailored to individual genetic and molecular profiles. This trend supports improved efficacy and patient outcomes, while opening new revenue streams in therapeutics. - Expanding Therapeutics Portfolio

Hormonal therapies, chemotherapy, radiotherapy, and newer immunotherapies are seeing broader adoption in both emerging and mature markets. The expansion of treatment options enhances patient care and contributes to higher market revenue. - Increasing Healthcare Infrastructure and Access

Investments in hospitals, oncology centers, and regional clinics are improving access to prostate cancer care, particularly in urban centers. Better infrastructure allows for the deployment of advanced diagnostics and treatment options, fostering market growth. - Challenges of Cost and Market Disparities

High costs of advanced diagnostics and therapies, along with disparities in access across regions and socioeconomic groups, remain key challenges. Addressing affordability and accessibility is critical to expanding the patient base and achieving sustained market growth.

Prostate Cancer Market Outlook

- Industry Growth Overview:The prostate cancer market is expected to experience rapid growth between 2025 and 2034, driven by rising incidence rates and expanding adoption of precision oncology across major economies. Market demand continues to grow due to increased awareness of early screening, greater availability of advanced diagnostics, and an aging population of men. Screening coverage remains extensive in North America, supported by favorable reimbursement structures, while the Asia-Pacific region is witnessing a surge in cases due to improved detection capabilities and increased healthcare investments.

- Advances in Treatment Modalities: There is a rapid shift toward precision medicine and personalized therapy models. Management of advanced stages increasingly relies on PARP inhibitors, androgen receptor antagonists, and radioligand therapies with strong clinical evidence. Companies such as AstraZeneca and Merck are driving advances in DNA damage repair (DDR)-targeting agents, while Bayer's Radium-223 radiopharmaceutical continues to play a key role in shaping metastatic cancer treatment regimens.

- Global Expansion: Cross-border partnerships and international expansion are increasingly shaping the competitive dynamics of the prostate cancer market. Major pharmaceutical companies are strengthening their presence in emerging markets to reach the growing patient population. Astellas Pharma has enhanced its oncology network in Asia through strategic alliances with local research institutes, while Pfizer and Johnson & Johnson have expanded clinical trials in Latin America and Central Europe to accelerate drug accessibility. This trend is also fostering collaborations between multinational drugmakers and domestic biotech firms, driving the development of regional innovation hubs in oncology.

- Major Investors: The large unmet medical need and expanding therapy pipeline in prostate cancer are attracting significant interest from both institutional and venture capital investors. Major global investment firms such as Blackstone Life Sciences, Bain Capital, and OrbiMed Advisors are increasingly backing biotech startups with first-in-class oncology assets. This sustained investor attention underscores the strong commercial potential of the market, with prostate cancer therapies poised to become key pillars in oncology portfolios in the coming years.

- Startup Ecosystem:The startup ecosystem around prostate cancer is thriving, fueled by the intersection of biotechnology, data science, and molecular diagnostics. New players are developing liquid biopsy, continuous biomarker monitoring, and AI-guided pathology technology to improve early detection accuracy. Freenome (USA), Tempus (USA), and OncoHost (Israel) are leading companies using data to customize treatment plans and monitor recurrence. This rapidly evolving ecosystem is creating new solutions that extend prostate cancer care beyond diagnosis to survivorship.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 12.88 Billion |

| Market Size in 2026 | USD 13.97 Billion |

| Market Size by 2035 | USD 28.83 Billion |

| Growth Rate from 2025 to 2035 | CAGR of 8.41% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Drug Class and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Rising prevalence of prostate cancer cases boosting demand for prostate therapies

Reduced morbidity rates in developed countries have resulted in an increase in the elderly population, which is more susceptible to prostate cancer. According to the Prostate Cancer Foundation, males over the age of 65 account for most prostate cancer cases. Thus, an increase in the geriatric population, sedentary lifestyles in developed countries, and childhood obesity all contribute to the global prevalence of prostate cancer. This increases both the need for and the demand for prostate cancer treatments. According to the National library of medicine, accounting for 2,68 490 new cases and 34,500 deaths (3.8% of all cancer deaths in men) in 2022. The global incidence and mortality rate of prostate cancer increase with age, with the average age at diagnosis being 66 years. It is noticeable that African American men have a higher incidence rate than White men, with 158.3 new cases diagnosed per 100,000 men. Their mortality rate is roughly twice that of White men. Differences in social, environmental, and genetic factors have been proposed as explanations for this disparity. Although 2,293,818 new cases are expected by 2040, mortality will vary slightly.

Pipeline drugs for prostate cancer in phase III trials

The prostate cancer phase III pipeline is diverse, with molecules in approved drug classes as well as drugs with novel mechanisms of action, such as radioligands targeting prostate-specific membrane antigen (PSMA), kinase inhibitors, and immune checkpoint inhibitors. In 2021, a Novel anti-B7-H3 protein proved to be a promising novel target for treatment with immunotherapy in prostate cancer. Additionally, FDA in October 2021 regarding its investigational therapeutic radiopharmaceutical product 177Lu-PSMA-I&T, allowing it to advance with the phase 3 ECLIPSE trial assessing the product in patients with mCRPC. Moreover, PARP inhibitors are one of the most promising drug classes in the phase III pipeline, based on the proven efficacy of Olaparib and rucaparib in prostate cancer. Talazoparib (Talzenna, Pfizer) and niraparib (Zejula, Janssen) are being developed in combination with an AR-directed therapy for first-line treatment of mCRPC, such as Olaparib and rucaparib (TALAPRO-2 and MAGNITUDE, respectively). Novartis announced in March 2021 that VISION met both primary endpoints, overall survival and radiographic progression-free survival (PFS), with US and European regulatory submissions expected in 2021. In May 2021, TLX591 (177Lu-DOTA-rosopatamab, Telix Pharmaceuticals), an antibody-based radiopharmaceutical targeting PSMA, will enter phase III development.

Table 2: Therapies in Phase III Pipeline for Prostate Cancer

| Product | Companies | Target or MOA |

| Talazoparib | Pfizer | PARP |

| Niraparib | Janssen | PARP |

| Lu-PSMA-617 | Novartis | PSM |

| TLX591 | Telix Pharmaceuticals | Telix Pharmaceuticals |

| Ipatasertib | Roche/Genentech | AKT |

| Capivasertib | AstraZeneca | AKT |

| Masitinib | AB Science | KIT |

| Cabozantinib | Takeda/Ipsen | TKI |

| Pembrolizumab | Merk. co. | PD1 |

Segment Insights

Drug Class Insights

Based on drug class the global prostate cancer market is categorized into Hormonal ADT, AR-Directed Therapies, Cytotoxic agents, Bone metastases, therapeutic vaccines, PARP inhibitors, Kinase inhibitors, AND PSMA-targeted radioligands. AR-directed therapies is expected to remain the dominant drug class in 2032, accounting for 58% of the total prostate cancer market ($17.4 billion). The apalutamide and enzalutamide will be the best-selling agents in the overall prostate cancer market by 2029, with sales totaling approximately $14.2 billion across the major markets. The rising uptake of apalutamide and enzalutamide in currently approved settings, in addition to anticipated label expansions in hormone-sensitive settings, will help drive the prostate cancer market.

PARP inhibitors are expected to be the second most lucrative drug class, accounting for 16% of total major-market sales. anticipate significant sales of niraparib in combination with abiraterone in the mHSPC setting by 2029 ($2.6 billion); its sales will reflect its high cost and long duration of treatment, rather than its high uptake. The anticipated approval of kinase inhibitors and PSMA-targeted radioligands should also increase major-market sales in 2029.

However, the biomarker defined populations and high costs of some therapies, as well as strong competition between current and emerging therapies across multiple patient populations, will most likely limit their sales.

Distribution Channel Insights

Based on the distribution channel, the global prostate cancer therapeutics market is categorized into hospital pharmacies, Drug store & Retail pharmacies, and Online pharmacies. The hospital pharmacies segment dominated the market in 2022. Hospital pharmacies and pharmacists play an important role in the market because they manage pharmaceuticals in a critical hospital setting where quick access to drugs and supplies is required. Furthermore, these pharmacies offer both in-patient and out-patient services, allowing patients to treat a wide range of illnesses. Furthermore, these pharmacies strive to reduce clinical decision-making errors and focus on generating revenue from medicine purchases while aiming to reduce overall prescription costs.

The online pharmacy segment will grow in the forecast period due it is the most preferable platform during covid 19 pandemic as people are attracted to online modes of purchasing.

Prostate cancer therapeutics market startups:

Technological advancements in therapeutics are allowing new companies to enter the prostate cancer therapeutics market and gain a competitive advantage. These companies continually invest in research and development to stay ahead of changing consumer preferences. The company strives to advance the market to improve its position in the prostate cancer market

Cancer Targeted Technology (CTT) is a research and development company that is working on developing small molecular weight enzyme inhibitors with imaging and drug delivery capabilities for use in cancer diagnostics and treatment. CTT-54, the company's lead product, targets circulating tumor cells and delivers radio-photo- and chemotherapeutics to the overexpressed Prostate Specific Membrane Antigen (PSMA). The CTT-54 PET diagnostic is said to be able to image within an hour and determine personalized treatment options, as well as monitor them. In 2022, Neo Genomics is a cancer reference laboratory that provides cancer testing and partnership programs to pathologists and oncologists and it funded by USD350.5 million.

Regional insights

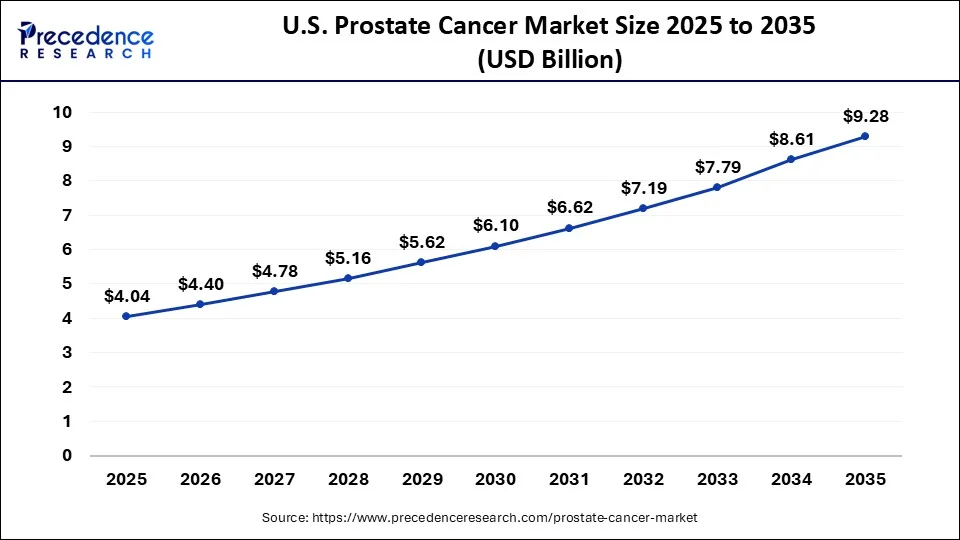

U.S. Prostate Cancer Market Size and Growth 2026 to 2035

The U.S. prostate cancer market size reached USD 4.06 billion in 2025 and is predicted to be worth around USD 9.28 billion by 2035, at a CAGR of 8.67% from 2026 to 2035.

North America dominated the prostate cancer therapeutics market and accounted for the largest revenue share in 2024, Due to an increase in the disease's prevalence and a strong need for prostate cancer therapeutic products in this region. However, the emergence of promising new medicines in thebiologicsand hormone therapy divisions is attributed to North American expansion. The planned introduction of some pipeline drugs is expected to drive the market in the area during the projection period. For Instance, the US FDA approved an advanced accelerator application for Pluvicto drug in March 2022, which will be used to treat adult patients with prostate cancer. Additionally, the presence of a strong pipeline and government support for the innovation and key players offering therapeutics for prostate cancer majorly present in the North American region is anticipated to drive the market over the forecast period.

US. Prostate Cancer Market Analysis

The U.S. leads the prostate cancer market in North America, due to its high incidence rate. The U.S.'s market dominance has been reinforced by a strong clinical infrastructure, quicker regulatory approvals from the U.S. FDA, and the early rollout of new androgen receptor inhibitors like enzalutamide and apalutamide. Additionally, emerging genomic testing and precision oncology initiatives are encouraging more patients with BRCA1/2 mutations to use PARP inhibitors.

What Makes Asia Pacific the Fastest-Growing Area in the Market?

The Asia Pacific region is expected to grow the fastest during the forecast period. The market's expansion is due to cost-effective treatment, tailored medicines, technological advancements, the availability of numerous treatment options, and the rising incidence of prostate cancer. For example, Xtandi (enzalutamide), which is co-licensed by Astellas Pharma of Japan and Pfizer of the United States for the treatment of men with prostate cancer, is five times less expensive in Japan than in the United States. Such low-cost treatments and technological advancements in the market are expected to drive market growth during the forecast period.

Japan Prostate Cancer Market Analysis

Japan is a key player in the Asia-Pacific market, supported by an aging population and advanced healthcare systems. Prostate cancer is one of the top three cancers in men. Its incidence is rising due to increased detection from screening programs nationwide. Growing collaborations with international biotech companies and the wider adoption of precision diagnostics are expected to help Japan maintain a high growth rate over the next decade.

What Makes Europe the Second-Largest Market?

Europe is regarded as the second-largest market, supported by a high disease burden and well-established oncology care systems. Several nationwide screening programs, universal healthcare, and widespread access to advanced diagnostics have driven growth in the region. Additionally, regulatory harmonization through the European Medicines Agency (EMA) and positive reimbursement policies in major markets like the UK, Germany, and France facilitate the rapid adoption of innovation in these key markets.

German Prostate Cancer Market Analysis

Germany is a major European center for prostate cancer treatment and diagnostics, supported by advanced healthcare infrastructure and robust reimbursement policies under its statutory insurance system. PSA testing in the country has extensive screening coverage, which leads to high rates of early detection and timely treatment. Bayer AG, Charité – Universitätsmedizin Berlin, and the German Cancer Research Centre (DKFZ) have teamed up in research to accelerate next-generation radioligand therapy trials.

What Potentiates the Growth of the Prostate Cancer Market in Latin America?

The market in Latin America is growing at a notable rate due to healthcare reform efforts and increased cooperation with the private sector in countries like Brazil and Argentina, which are improving access to screening and advanced treatments. The expanding middle-class male population and rising awareness campaigns about oncology are additional factors driving this growth.

Brazil Prostate Cancer Market Analysis

Brazil dominates the prostate cancer market in Latin America, holding the majority of the share. Earlier detection is being promoted through government screening initiatives and awareness campaigns like "Novembro Azul" (Blue November). The availability of advanced medicines is improving due to collaborations between multinational companies such as Pfizer and local distributors.

How is the Opportunistic Rise of the Market in the Middle East & Africa?

The Middle East & Africa (MEA) is experiencing a significant rise in prostate cancer market growth. Market conditions are improving due to urbanization, increased government spending on healthcare, particularly in GCC countries, and the growth of cancer screening programs. The expansion of private healthcare, medical tourism, and the development of regional oncology centers are boosting access to treatment and newer therapies for patients.

Saudi Prostate Cancer Market Analysis

Saudi Arabia is emerging as a key player in the Middle East and Africa market, fueled by significant healthcare modernization as part of Vision 2030. The Saudi Cancer Registry indicates a steady increase in prostate cancer cases, which can be attributed to greater awareness and the expansion of diagnostic centers. The government's efforts to attract international pharma companies to conduct local clinical trials are fast-tracking the transfer of technology and the introduction of new therapies into the market.

Prostate Cancer Market – Value Chain Analysis

- Research & Drug Discovery

The foundation of prostate cancer treatment lies in the discovery of novel therapeutic targets, biomarkers, and molecular pathways associated with prostate cancer progression.

Key Players: AbbVie, Astellas Pharma, AstraZeneca, Bayer - Clinical Trials & Development

Promising compounds undergo preclinical testing followed by phased clinical trials to evaluate safety, efficacy, and optimal dosing for prostate cancer patients.

Key Players: Clovis Oncology, Johnson & Johnson (Janssen), Merck & Co., Pfizer - Drug Manufacturing & Formulation

Approved therapies are produced under stringent GMP standards, including oral agents, injectables, and immunotherapies, ensuring consistent quality and stability.

Key Players: Sanofi, Ferring Pharmaceuticals, Bayer, Astellas Pharma - Distribution & Supply Chain

Manufactured drugs are distributed to hospitals, oncology clinics, specialty pharmacies, and treatment centers worldwide to ensure patient access.

Key Players: Pfizer, Johnson & Johnson (Janssen), Sanofi, AbbVie - Patient Care & Post-Market Support

Healthcare providers deliver therapy administration, monitoring, and supportive care while collecting real-world data for long-term efficacy, safety, and patient outcomes.

Key Players: Hospitals, Cancer Centers, Prostate Cancer Clinics, Patient Advocacy Organizations

Prostate Cancer Market Companies

- AbbVie, Inc.: AbbVie is a global biopharmaceutical company offering advanced therapies for prostate cancer, including androgen receptor inhibitors and combination treatments.

- Astellas Pharma, Inc.: Astellas specializes in oncology therapeutics, particularly next-generation hormonal therapies and targeted treatments for advanced prostate cancer.

- AstraZeneca plc: AstraZeneca develops innovative oncology medicines, including PARP inhibitors and targeted therapies for metastatic prostate cancer.

- Bayer AG: Bayer provides pharmaceutical solutions for prostate cancer management, focusing on radioligand therapies and hormonal treatment options.

- Clovis Oncology, Inc.: Clovis focuses on precision oncology, offering targeted therapies for prostate cancer patients with specific genetic mutations.

- Dendreon Pharmaceuticals LLC: Dendreon is known for its immunotherapy approaches, including prostate cancer vaccines designed to stimulate the patient's immune response.

- Ferring Pharmaceuticals: Ferring develops hormone-based therapies and supportive care solutions for prostate cancer patients.

- Johnson & Johnson: Janssen focuses on prostate cancer treatments with hormonal agents, clinical trial innovations, and combination therapy regimens.

- Merck & Co., Inc.: Merck offers targeted therapies and checkpoint inhibitors for prostate cancer, emphasizing immuno-oncology approaches.

- Pfizer, Inc.: Pfizer provides advanced hormone therapies and combination treatment options for metastatic prostate cancer, with strong clinical trial support.

- Sanofi S.A.: Sanofi develops oncology therapeutics, including novel androgen receptor-targeted agents and supportive care medications for prostate cancer.

Recent Development

- In March 2025, AbbVie, Inc. presented its early pipeline and scientific advances in oncology research and development at the 2025 annual meeting of the American Association of Cancer Research (AACR). The presentations include data from new investigational molecules, ABBV-514 and ABBV-969.

(Source: news.abbvie.com ) - In September 2024, Astellas Pharma, Inc. presented scientific progress in advanced and hard-to-treat cancers at the 2024 congress of the European Society for Medical Oncology (ESMO). Wight abstracts across a broad range of cancer types were presented at the conference.

(Source: newsroom.astellas.com ) - March 2022, Pluvicto (lutetium Lu 177 vipivotide tetraxetan) has been approved by the US Food and Drug Administration (FDA) for the treatment of adult patients with prostate-specific membrane antigen-positive metastatic castration-resistant prostate cancer that has spread to other parts of the body.

- March 2022, for the treatment of adults with advanced prostate cancer, BioPharma announced the launch of camcevi (leuprolide), a 42mg injection emulsion. The company further offers AccordConnects mobile application access for the management of Camcevi inventory management.

- In March 2022, US FDA approved 177Lu-PSMA-617, a new metastatic prostate cancer treatment.

- In March 2022, Merck announced keylynk-010 a trial for evaluating keytruda in combination with lynparza in patients with metastatic castration-resistant prostate cancer.

Segment Covered in the Report

By Drug Class

- Hormonal ADT

- AR-Directed Therapies

- Cytotoxic agents

- Bone metastases

- therapeutic vaccines

- PARP inhibitors

- Kinase inhibitors

- PSMA-targeted radioligands

By Distribution Channel

- Hospital Pharmacies

- Drug store & Retail pharmacies

- Online pharmacies

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content