In-vitro Colorectal Cancer Screening Tests Market Size and Forecast 2025 to 2034

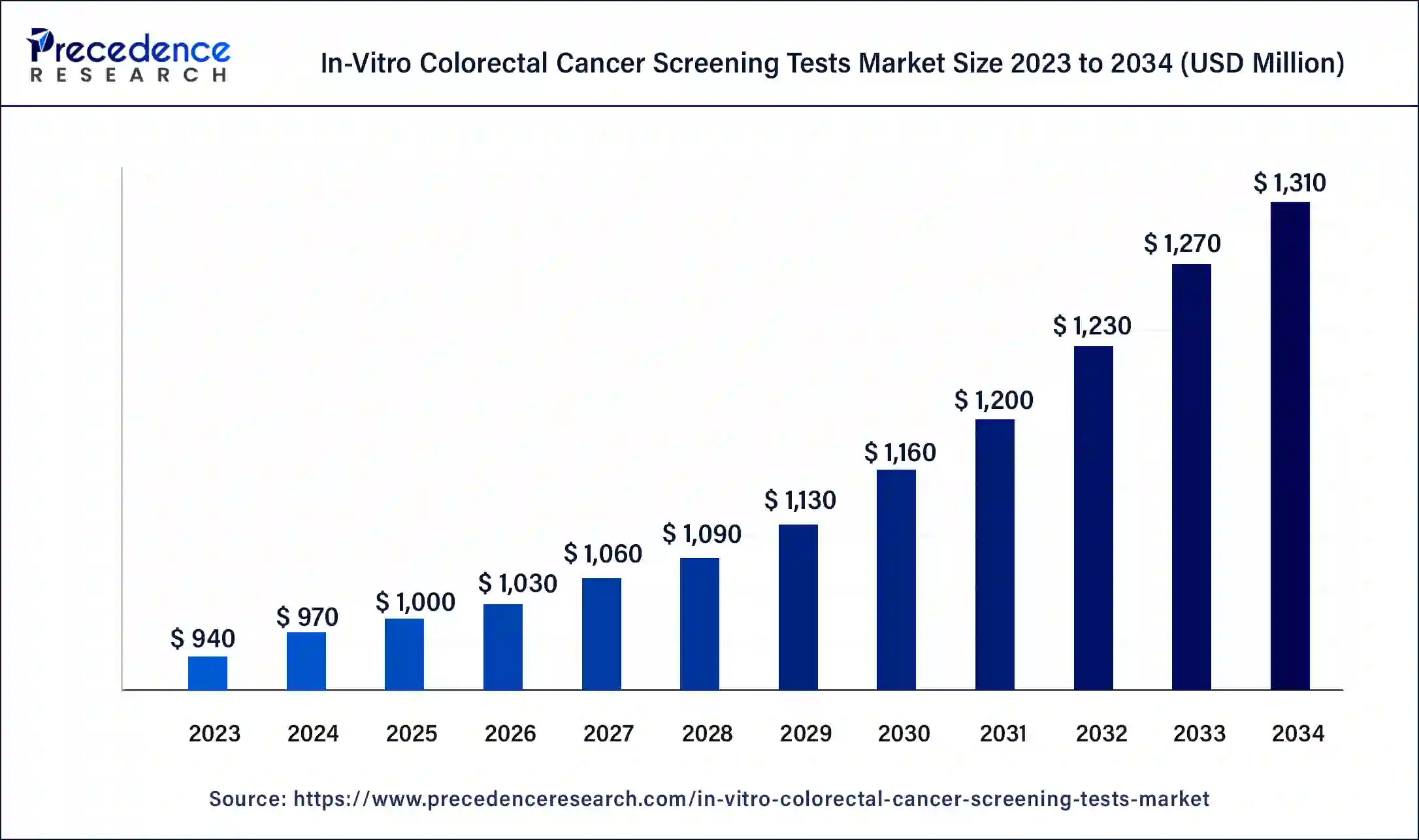

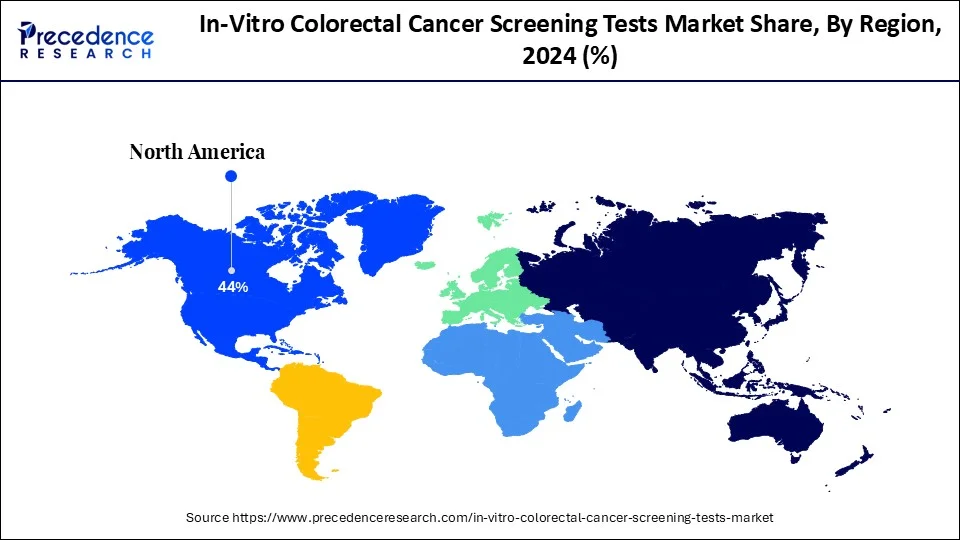

The global in-vitro colorectal cancer screening tests market size is projected to be worth around USD 1,310 million by 2034 from USD 970 million in 2024, at a CAGR of 3.05% from 2025 to 2034. The North America in-vitro colorectal cancer screening tests market size reached USD 426.80 million in 2024. The in-vitro colorectal cancer screening tests market growth is attributed to the increasing incidence of colorectal cancer.

In-vitro Colorectal Cancer Screening Tests Market Key Takeaways

- The global in-vitro colorectal cancer screening tests market was valued at USD 970 million in 2024.

- It is projected to reach USD 1,310 million by 2034.

- The in-vitro colorectal cancer screening tests market is expected to grow at a CAGR of 3.05% from 2025 to 2034.

- North America led the global in-vitro colorectal cancer screening tests market with the largest market share of 44% in 2024.

- Asia Pacific is expected to grow at a remarkable CAGR over the forecast period.

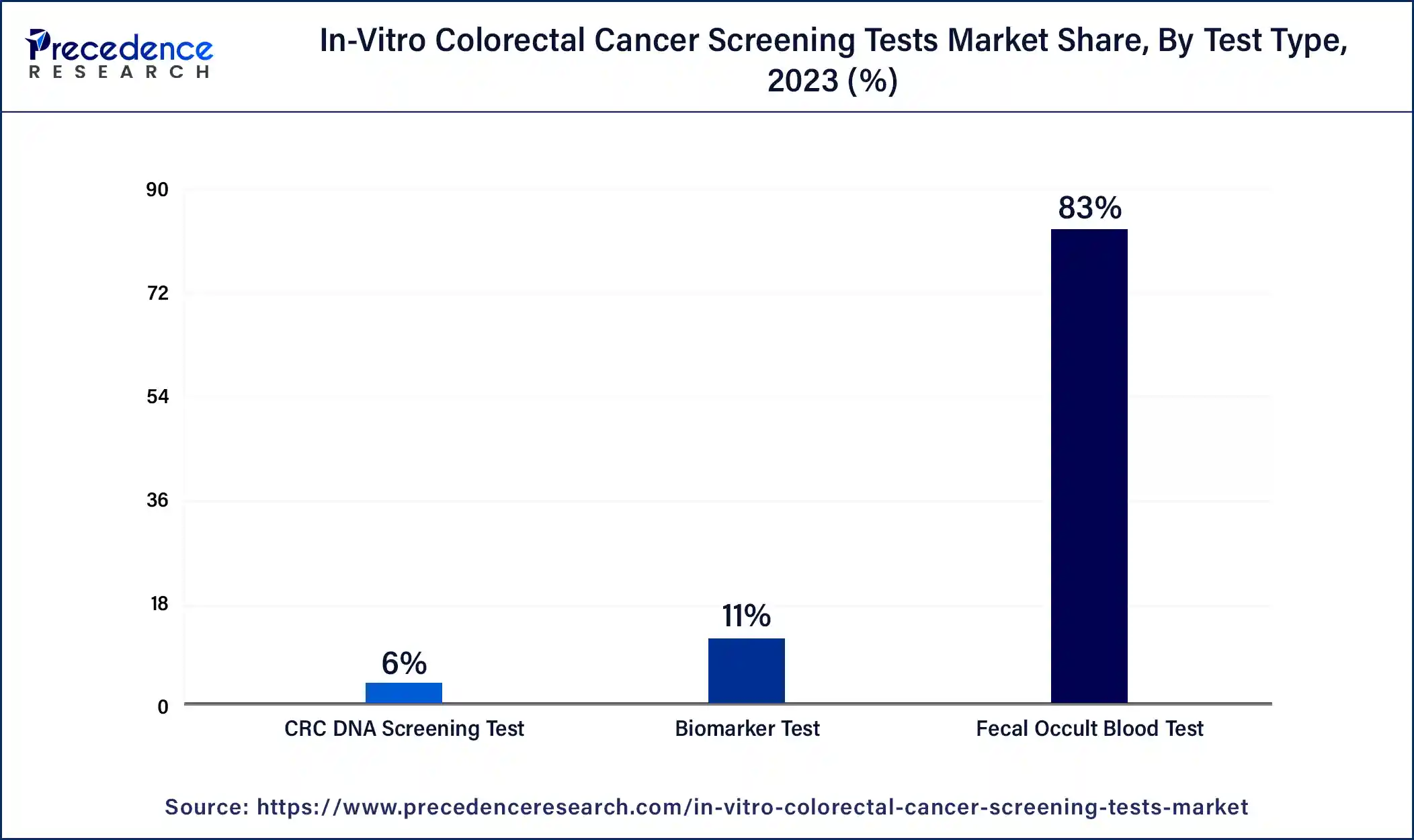

- By type, the fecal occult blood test (FOBT) segment dominated the market with the largest market share of 83% in 2024.

- By type, the CRC DNA screening test segment is projected to grow rapidly in the market in the future.

- By end user, the diagnostic laboratories segment held the largest share of the market in 2024.

- By end user, the hospital segment is projected to expand significantly in the market in the coming years.

Impact of Artificial Intelligence on In-vitro Colorectal Cancer Screening Tests Market

Actual Intelligence (AI) helps the in-vitro colorectal cancer screening tests market by improving diagnostic equipment precision and productivity. The superior computing power of AI algorithms makes computations on large sets of data with high accuracy, which improves the screening methods for the detection of colorectal cancer. These technologies fasten the diagnostics, eliminate lots of false positives, and enhance patient satisfaction by offering faster and more accurate data. Furthermore, AI helps create an effective approach to treatment by combining patient information with screening outcomes. Thus, AI unlocks the possibility of innovations in the market concerning the possibility of cancer diagnoses.

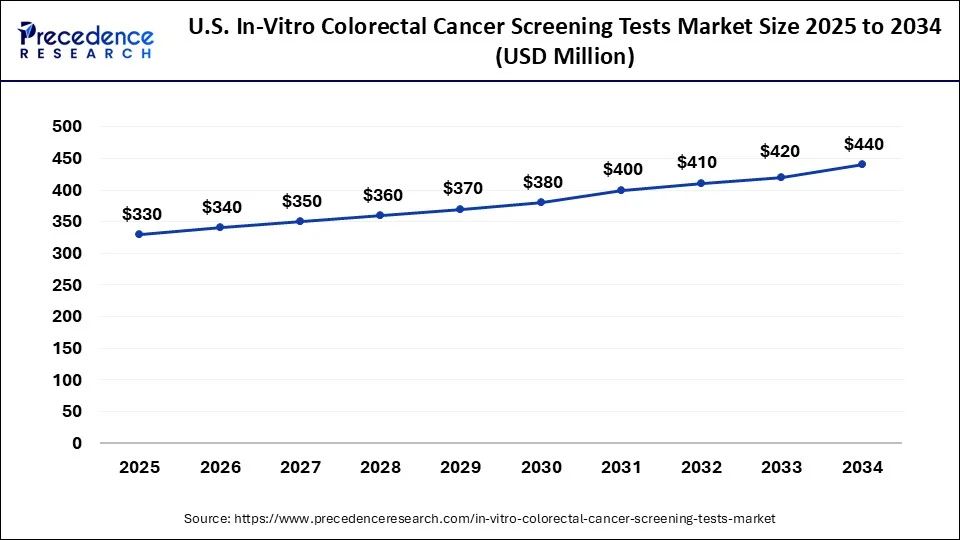

U.S. In-vitro Colorectal Cancer Screening Tests Market Size and Growth 2025 to 2034

The U.S. in-vitro colorectal cancer screening tests market size was exhibited at USD 320 million in 2024 and is projected to be worth around USD 440 million by 2034, poised to grow at a CAGR of 3.24% from 2025 to 2034.

North America led the global in-vitro colorectal cancer screening tests market in 2024 due to their well-developed health care, high incidence of colorectal cancer, and focus on early detection and prevention. The U.S. mainly has rather efficient screening courses, great insurance activity, and large investments in medical innovations. Furthermore, there is a growing presence of major diagnostic companies and research institutions in North America.

Estimated by the American Cancer Society, about 150,000 new cases were anticipated for the year 2023 in the U. S. This is the reason why early detection and screening are important in the region.

Asia Pacific is expected to grow rapidly in the in-vitro colorectal cancer screening tests market over the forecast period. The trend of enhancement of governmental support towards cancer screening programs and a growing interest in early detection of the disease. As the research is gradually broadening the limits of colorectal cancer screening and actively funding popular awareness programs. Increasing screening for cancer mortality and higher adoption of superior diagnostic tools accompanied with enhancement of people's awareness of colorectal cancer within the region.

Market Overview

A rise in lifestyle-related risk factors, namely obesity, smoking, and red or processed meat diets, is expected to boost the consumption of in-vitro colorectal cancer screening tests. These factors considerably increase the risk of getting colorectal cancer. Screening initiatives arising from public health campaigns that advocate for appropriate lifestyle alterations also increase this demand. This trend creates a greater pool of potential customers and makes the market for screening technologies expand and improve. Furthermore, growing rates of obesity and the incidence of colorectal cancer, as well as the proportion of cases associated with smoking, are observed.

- Based on the CDC data, it is estimated that around about 42% of the U.S. adults met the criteria for obesity in 2022, making the detection programs a signal necessity.

- WHO indicated that smoking is responsible for about 20% of colorectal cancer globally, which supports screening among such individuals.

In-vitro Colorectal Cancer Screening Tests Market Growth Factors

- Innovations in diagnostic technology, such as CRC DNA tests, are enhancing early detection capabilities and boosting the in-vitro colorectal cancer screening tests market growth.

- Enhanced public health funding and initiatives are expanding access to colorectal cancer screenings and promoting market growth.

- Increased public awareness and education about colorectal cancer screening are leading to higher test adoption rates.

- Improved healthcare infrastructure in emerging economies is increasing the availability and demand for advanced colorectal cancer screening tests.

- The adoption of digital health tools and telemedicine is facilitating greater access to colorectal cancer screening, driving market expansion.

- The prevalence of risk factors such as obesity and smoking are prompting a higher need for colorectal cancer screening tests.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,310 Million |

| Market Size in 2025 | USD 1,000 Million |

| Market Size in 2024 | USD 970 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.05% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Test Type, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Rising incidence of colorectal cancer

Rising incidence rates of colorectal cancer globally are projected to spur demand for in-vitro screening tests, which further drives the market. Conditions, including increasing population density and aging, poor diet, and lack of exercise, are causes of this disease. It is reported that cancer of the colon or rectum is one of the most frequent types of cancer. With an increasing number of cases, there is a growing need for efficient, non-invasive diagnostic tests for the healthcare industry.

The increasing demand for early diagnosis drives the technological development of the market and facilitates governments and healthcare institutions to incorporate colorectal cancer screening as an essential part of disease prevention. Additionally, increased spending on R&D and growth of better and affordable in-vitro screening technologies that enhance observation of disease early stage and patients' well-being.

- In 2022, the World Cancer Research Fund reported that 9.3% of the new cancer cases globally had colorectal cancer and more than 2 million patients.

Restraint

High costs of screening tests

High costs of the in-vitro colorectal cancer screening tests market services are anticipated to restrain market growth. Such tests are mostly complicated and demand automatic equipment as well as special laboratories, hence leading to enormous costs to the healthcare sector and individual patients. The global report from the World Health Organization states that in nations where the healthcare expenditure is low, the high out-of-pocket costs effectively deny access to early detection services, including cancer screening. This cost-related factor is likely to check the growth of these tests and, thus, the market for these tests, especially in the price-sensitive markets.

Opportunity

Increasing government support and funding

Increasing government support and funding for colorectal cancer screening programs are expected to create immense opportunities for the players competing in the market. Colorectal cancer screening is gradually gaining attention from the governments of various nations as they continue funding campaigns in this line. Increased funding for screening programs, the provision of subsidies for the cost of testing, and advertisements on the benefits of in-vitro tests are some ways that have led to high adoption levels.

- According to the CDC, the U.S. government invested around USD 320 million in colorectal cancer screening in 2023 with the intention of narrowing down the gap in screening.

Such measures promote the extension of these preventive tests and also help various practitioners adopt more sophisticated in vitro diagnostic tests in their daily practice, thus driving the in-vitro colorectal cancer screening tests market growth. Moreover, government-implemented programs ensure that vulnerable groups receive financial help for screening.

Test Type Insights

The fecal occult blood test (FOBT) segment dominated the in-vitro colorectal cancer screening tests market in 2024. This test is preferred by most people since it is cheap, easy to administer, and does not require any invasive procedures to be conducted on the body of the patient. FOBT allows the identification of hidden blood in the stool samples and also points to the presence of colorectal cancer or precancerous conditions.

Morbidity and mortality rates of colorectal cancer have been significantly reduced through the use of the fecal occult blood test (FOBT), especially in the developing world, according to research done by the American Cancer Society. Such orientation with FOBT, in combination with heightened and steady use, thus boosts the segment growth.

The CRC DNA screening test segment is projected to grow rapidly in the in-vitro colorectal cancer screening tests market in the future, owing to its high sensitivity coupled with a high level of specificity for colorectal cancer. Potty CRC DNA methods based on the markers in the stool to detect cancerous or precancerous mutations are more accurate than conventional tests. This rise in demand for these methods is in line with the shift to more sensitive and early detection systems.

The developments in molecular biology, molecular diagnostic tests' increased accuracy, and patient and physician preferences for advanced tests create a demand for these tests. Higher technological levels, the possibility of identifying the initial stage of cancer, and other convincing arguments make CRC DNA tests one of the most promising tests in the future. All these factors will contribute to propelling the market in the coming years.

End-user Insights

The diagnostic laboratories segment held the largest share of the in-vitro colorectal cancer screening tests market in 2024. Screening tests have been processed and analyzed by diagnostic laboratories due to the specialized equipment used in their centers and their extensive experience in performing complicated assays. These laboratories are well equipped with necessary high technology and are manned by skilled professional technicians who are able to afford to do very detailed analysis that increases the reliability of the results obtained. The need for fast and efficient diagnostics services and the development of specific organizations focusing on colorectal cancer screenings boosts the market in these types of laboratory settings.

The hospital segment is projected to expand significantly in the in-vitro colorectal cancer screening tests market in the coming years as a result of increasing utilization of in-vitro colorectal cancer screening tests in hospitals. Integrated services, which include diagnosis and treatment, make the hospitals important service deliverers of health care, especially cancer screening services. Thus, promoting early detection of colorectal cancer, together with the growing incidence of the disease, is expected to increase the number of hospitals that provide in-vitro tests as protection and prevention tools.

These factors increase the number of hospital-based screenings and the adoption of new technologies in hospital practices. Additionally, their capability to offer an entire gambit of diagnoses and follow-up treatments in general agreement with the holistic forces in apportioning patient care and aggressive disease detection further contributes to fuelling the segment in the coming years.

- According to the report published by the American Cancer Society, the lifetime risk of developing colorectal cancer is approximately 1 in 23 for men and 1 in 25 for women in 2024.

In-vitro Colorectal Cancer Screening Tests Market Companies

- Abbott Molecular

- BioMarCare Technologies

- Eiken Chemical

- Epigenomics AG

- Exact Sciences Corporation

- Immunostics.

- Novigenix

- OncoCyte Corporation-Bio time

- Quest Diagnostics

- Randox Laboratories

- Sysmex Corporation

Recent Developments

- In March 2024, Guardant Health, Inc. (Nasdaq: GH), a prominent player in precision oncology, revealed that the results from its ECLIPSE study will be featured in the March 14 issue of The New England Journal of Medicine. The study highlights the effectiveness of Guardant's Shield™ blood test in detecting colorectal cancer (CRC) in average-risk adults.

- In April 2023, PathAI, a global leader in AI-powered pathology, introduced PathExplore™, a groundbreaking tool designed to enhance the understanding of the tumor microenvironment (TME). PathExplore™ is the world's first structured, standardized, and scalable panel of human interpretable features (HIFs) that provides unprecedented resolution of the TME from H&E whole-slide images.

Segments Covered in the Report

By Test Type

- Fecal Occult Blood Test

- CRC DNA Screening Test

- Biomarker Test

By End-user

- Clinics

- Hospital

- Diagnostic Laboratories

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting