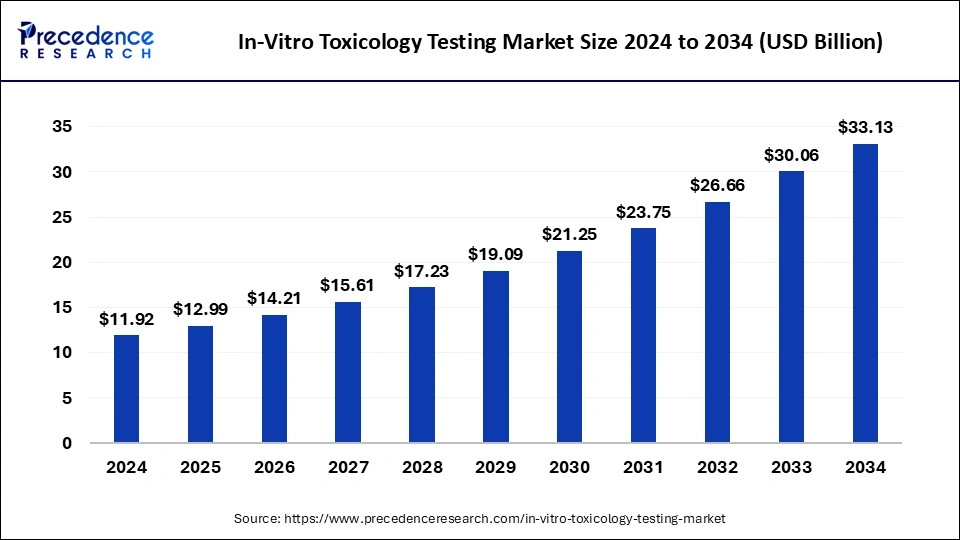

What is the In-Vitro Toxicology Testing Market Size?

The global in-vitro toxicology testing market size was calculated at USD 11.92 billion in 2024 and is predicted to increase from USD 12.99 billion in 2025 to approximately USD 33.13 billion by 2034, expanding at a CAGR of 10.97% from 2025 to 2034.

In-Vitro Toxicology Testing Market Key Takeaways

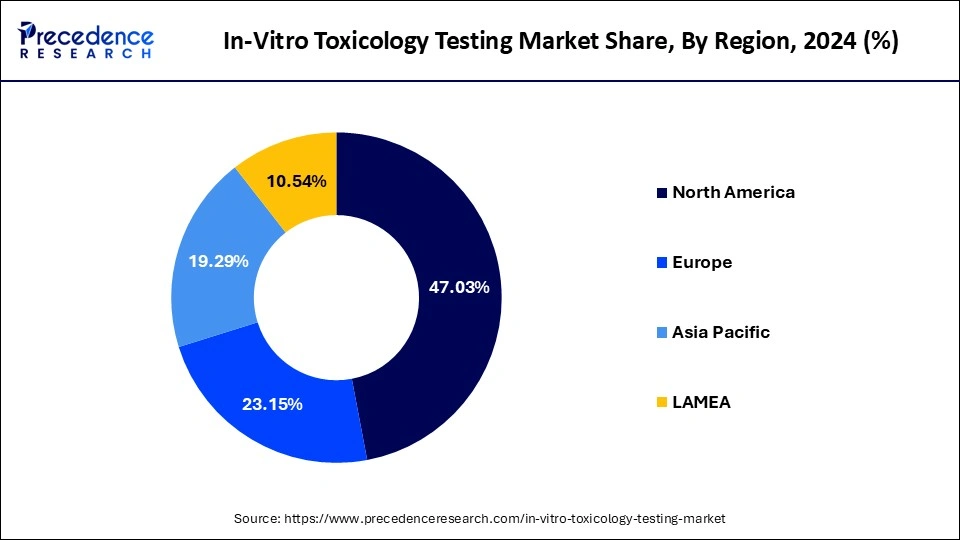

- North America captured more than 47.03% of the revenue share in 2024.

- By technology, the cell culture technology segment generated more than 43.16% of the revenue share in 2024.

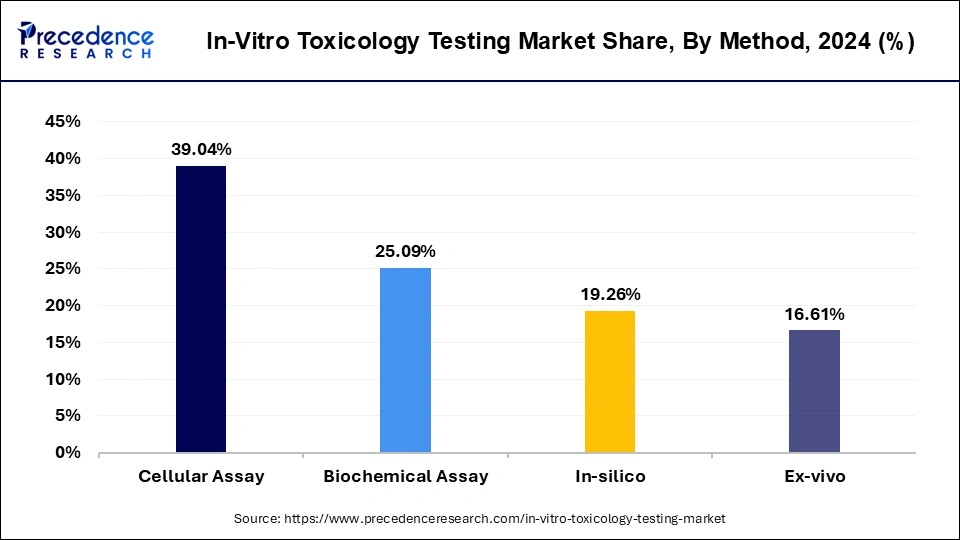

- By method, the cellular assay segment contributed more than 39.04% of revenue share in 2024.

- By application, the genotoxicity segment accounted for more than 20.90% of revenue share in 2024.

Role of Artificial Intelligence in the In-Vitro Toxicology Testing Market:

Artificial Intelligence (AI) is changing the landscape of the in-vitro toxicology testing space with improved predictive capabilities, efficiency, and data handling. AI methods can digest large volumes of data, which allows AI algorithms to map the intricacies of toxicity, predict toxic outcomes, and significantly reduce false-positive rates better than traditional methods. These methods utilize machine-led learning models to simulate and identify biological responses in humans to turn-around toxicity screening with high reliability and minimal, if any, animal testing needs.

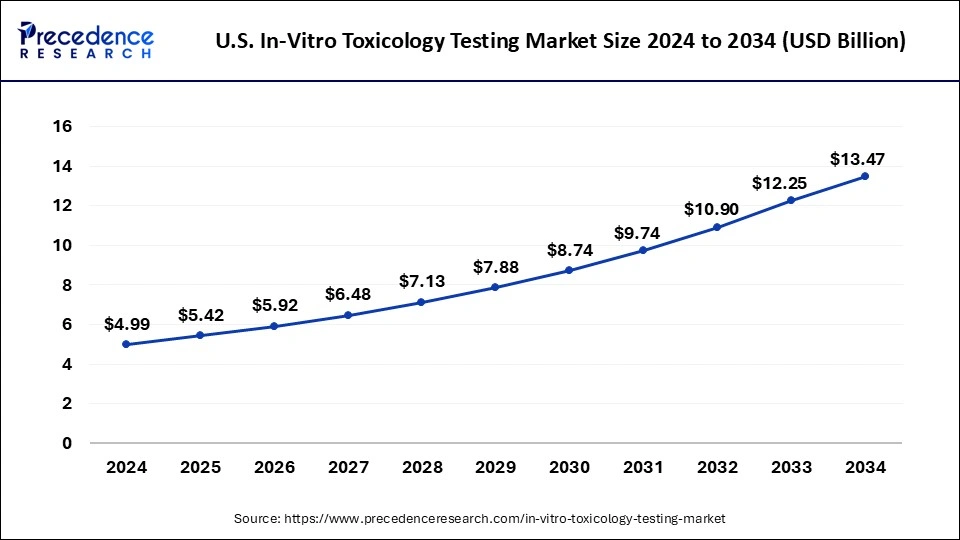

U.S. In-Vitro Toxicology Testing Market Size and Growth 2025 to 2034

The U.S. in-vitro toxicology testing market size was exhibited at USD 4.99 billion in 2024 and is projected to be worth around USD 13.47 billion by 2034, growing at a CAGR of 10.64% from 2025 to 2034.

North America holds the largest share of the market. The region is expected to sustain its dominance during the forecast periodowing to the sophisticated healthcare infrastructure, supportive government regulations, the increasing presence of prominent market players, advanced infrastructure & shifting focus on drug discovery in the region. Technological advancements and increasing adoption of in-vitro testing methods in the region also act as drivers for the growth of in-vitro toxicology testing market. The launch ofbiologicsby biopharmaceutical players in the United States has resulted in the rapid adoption of toxicology testing. The expansion of laboratory capabilities in the region has enabled clients to build toxicological profiles of biopharmaceuticals,medical devices, chemicals, and cosmetics.

On the other hand, the Asia Pacific market is growing at a significant CAGR during the forecast period.The rapid growth of the market in the region is owing to the rapidly increasing geriatric population in need of medicines, several government incentives for enhancing technology and development, rising healthcare expenditure, and rising focus of government organisations to encourage toxicology testing by in-vitro methods. The conducting of clinical trialsin the region is relatively cost-effective.

North America:

The in-vitro toxicology testing market is predominantly led by North America, as it holds the largest revenue share owing strong regulatory obligations with conforming technological, and capital investment in drug development which supports the use of in-vitro methods for toxicology testing. The existing presence of important industry players, discovery support structures already developed in the region, and supportive regulatory agencies like the U.S. FDA and EPA will only expand the existing acceptance of In vitro methods of testing for toxicology.

Also supportive of the market will be regulations such as the FDA Modernization Act 2.0 which calls for a reduction in animal testing, government intentions to expand personalized medicine, safety profiling, screening for toxicity rapidly in the discovery pipeline of pharmaceutical and cosmetic industries for safety. Increased innovation, development, and guidance for increased use of 3D cell models, high throughput platforms, and toxicogenomic provide the availability of In Vitro toxicology resources for both industry and academia, thus moving North America to be the epi-center for in vitro toxicology innovation.

Europe:

Europe accounts for a large proportion of the in-vitro toxicology testing market, driven by government mandates for animal testing, ethical concerns with respect to animal testing, and political backing from governments to move towards these alternative methodologies. Specifically, the European Union's REACH in regulation and Cosmetics Regulation (EC 1223/2009) both restrict animal-based testing, and as a result, in-vivo strategies have been promoted across all fields such as pharmaceuticals, cosmetics, and chemicals.

Countries such as Germany, France, and the UK are leading the charge because of their R&D facilities, funding, support, and existing collaborations including the European Partnership for Alternative Approaches to Animal Testing (EPAA). With increased public knowledge on product safety and environmental safety, an increased demand for high-quality products, and a growing demand for non-animal alternatives has accelerated further growth in the market throughout Europe.

Asia-Pacific:

The Asia-Pacific region is emerging as the fastest-growing market for in-vitro toxicology testing due to the expanding pharmaceutical and biotechnology sectors, rising R&D spending, and increasing regulatory reforms. Countries such as China, India, Japan, and South Korea are heavily investing in non-animal testing infrastructure to meet global safety standards while reducing reliance on conventional animal models. Others driving growth include rapid urbanization, increasing consumer awareness about product safety, and demand for cruelty-free cosmetics.

There are ongoing collaborations sector-wise and regionally with governments and organizations undertaking related work with international bodies to support training, validation, and uptake of in-vitro methodologies. With both cost-effective research capabilities and increasing commitment to ethical testing, the Asia-Pacific region is well-positioned to be the center for in-vitro toxicology innovations in the next few years.

Market Overview

An in vitro test is conducted outside of a living organism. This study involves the use of isolated cells, tissues, or organs. In vitro generally means “in glass”, and it refers to methods that are conducted on living material or components of living material cultured in test tubes or Petri dishes under particular conditions. In-vitro assays offer toxicity information in a less expensive as well as time-saving manner.

In vitro methods for the assessment of toxicity are one of the alternatives to whole-animal testing procedures. In vitro toxicology tests are rapidly gaining popularity in the regulatory community as they can lessen the number of animals used while providing predictions for some toxicological endpoints. In vitro, toxicology screening methods are the major tools to reduce the attrition of novel drug candidates as they progress through the development and discovery process.

In vitro toxicity, assays are employed to identify the potential of a new agrochemical, pharmaceutical, food additive, or any other chemical product to be dangerous to humans. In vitro studies are performed on mammalian cells or cultured bacteria and can be used as a screening to avoid the unnecessary use of animals in determining which candidates should go ahead for further safety testing.

In-vitro toxicology tests are widely used to replace multiple studies that earlier have been performed or tested on animals. The development of physiology-relevant in vitro models has recently advanced, and this is promising for enhancing the translation of test results to predict negative consequences in humans. Chemical toxicity testing is shifting toward a human cell and organoid-based in vitro method for several reasons such as ethical rightfulness, scientific relevancy, cost-effectiveness, and efficiency. In vitro toxicity tests adopt the latest advancement in vitro toxicology to assist clients in identifying compound viability in the preclinical phase of new product discovery or drug development. In vitro, toxicology studies can assist in reducing liabilities linked with the failure of late stage in the drug discovery process.

In-Vitro Toxicology Testing Market Growth Factors

- Heightened Ethical Concerns About Animal Testing: The awareness of animal welfare is augmenting across the globe and formal regulations are being created to promote humane alternative testing (e.g. in-vitro toxicology).

- Strong Regulatory Support: Regulatory agencies such as the OECD, FDA, and ECHA are endorsing the utilization of in-vitro models to satisfy requirements for safety compliance without animal testing.

- Technological Advancements: Emerging technology in the form of 3D cell cultures, organ-on-chip, and high-throughput screening presents increasing (greater) accuracy, reproducibility, as well as efficiency in toxicity testing.

- Increased Research & Development in Drug Development: The pharmaceutical industry is utilizing in vitro models for early-stage toxicity screening earlier than ever to cut down on time and costs.

- Growing Demand for Safer Consumer Products: The benign consumer demand surrounding cosmetic and chemical product safety is substantially increasing the demand for alternative non-animal testing options.

- Emerging Market Expansion: Emerging markets are positively adopting in-vitro testing and the adoption positively correlates with their improved healthcare infrastructure, regulatory modernization related to toxicology, and greater biotech investment.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 12.99 Billion |

| Market Size in 2024 | USD 11.92 Billion |

| Market Size by 2034 | USD 33.13 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 10.97% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Application, Method, and End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing Governments and organizational support to avoid animal testing

The rising favorable government initiatives, which are highly concerned with banning animal testing and can lead to an increase in the adoption of in-vitro toxicology testing during the forecast period. Increasing investment by public and private agencies for the development of in-vitro test techniques. Funding programs are generally aimed to safeguard animal health, human health, and the environment by minimizing the dependency on animal models for the safe measurement of new chemical formulations and compounds.

Moreover, the increasing demand for cost-effective and safer alternatives to animal testing in the cosmetics, food, and pharmaceutical sectors acts as a primary fueling market revenue growth. The adoption of in-vitro toxicology testing is rapidly gaining immense popularity as these days people are becoming more aware and concerned about the adverse consequences of chemicals on both the environment and human health.

Restraints

Lack of skilled professionals

The lack of skilled professionals is projected to hamper the global in-vitro toxicology testing market's growth. There is a requirement for skilled professionals to perform various activities such as experiments, analyzing data, and making observations. In addition, the less capability of in-vitro models to determine autoimmunity and immunostimulant is likely to limit the expansion of the global in-vitro toxicology testing market during the forecast period.

Opportunities

Government Initiatives taken in In-Vitro Toxicology Testing Market:

Government initiatives are expanding the in-vitro toxicology testing market and accelerating the adoption of ethical, non-animal testing. As a result of the FDA Modernization Act 2.0 in the U.S., the FDA does not require animal testing for new drug approval and created regulatory space for in-vitro models, including organ-on-chip and high-throughput screening. The U.S. EPA has undertaken similar efforts to advance predictive toxicology through in-vitro methods, including the investment of $249 million in ToxCast. Also, organizations like the Interagency Coordinating Committee on the Validation of Alternative Methods (ICCVAM) are increasing collaboration between government agencies with the purpose of validating and implementing alternative testing approaches.

In Europe, the REACH Regulation and Cosmetics Regulation (EC 1223/2009) promotes alternatives in regulatory constructs, with the 3Rs: Replacement, Reduction, and Refinement. In addition, various countries of the Asia-Pacific region are ramping up training, developing regulatory frameworks, and establishing partnerships to promote non-animal testing standards across industries (e.g. China, India, and South Korea).

Technological Advancements:

Continuous growth of technological innovations in the in-vitro toxicology testing market is improving the accuracy, time-efficiency, and scalability for evaluating toxicity across industries. New methods in 3D cell culture and organ-on-chip technologies are beginning to change the focus of how scientists are able to replicate human physiological responses in the lab. 3D and organ-on-chip models are providing greater accuracy and predictive capacity compared to 2D cellular models.

High-throughput screening (HTS) systems are allowing the ability to test thousands of different compounds at the same time, thereby decreasing testing time and costs. Microfluidics and lab-on-chip platforms are developing in usage for providing controlled labs for monitoring cellular responses on a real-time basis. In addition, omics technologies including genomics, proteomics, and metabolomics, are now providing cellular responses to molecular bases of toxicity, such that adverse responses can be observed sooner in the testing process.

This new innovation is bringing the field closer to mechanism-based toxicology and to the expectations of federal regulators for safety and reproducibility. As we see greater demands for faster, safer, and ethically compliant testing globally, these new technologies will continue to reshape the way in vitro toxicology is approached in the future.

Product Insights

Consumables, including reagents, cell culture media, assay plates, and other lab consumables, represent the largest product segment within the in-vitro toxicology testing market. This fact can be attributed to the recur-rent, repeated use of consumables in high-throughput screening and routine toxicology workflows. Demand for consumables is consistently high as pharmaceutical and biotech companies are increasing preclinical investigations, regulatory bodies are identifying a trend in reproducible testing, and as preclinical investigations include an increasingly large variety of toxins and support from experts for those tests.

Assays are indicating the fastest growing category for the product segments. Demand for mechanism-based testing and proof of concept or custom kits is increasing, contributing to the growth of assays. It is evident that the new and improved assay platforms which allow for things like live cell imaging, multi-endpoint analysis, and high-content screening, is changing how laboratories evaluate cytotoxicity, genotoxicity, and organ toxicity. More generally, the emphasis on precise toxicology testing as well as speed in the drug development and preclinical studies phase is providing laboratories with ample opportunity to implement new assay systems, likely resulting in fast past growth of this regulated market in the coming years.

Technology Insights

Based on the technology, the global in-vitro toxicology testing market is segmented into cell culture technology, high throughput technology, cellular imaging, and OMICS technology. The cell culture technology segment is expected to dominate the market over the forecast period. Advancements in human cell culture exposure enabled the development of in-vitro assay systems, which are demonstrative, highly predictive, and well-suited for toxicity screening of a wide range of chemicals. In-vitro toxicology includes using tissues or cells grown and maintained in an artificially controlled environment, outside of the natural environment to test the toxic attributes of several mixtures and compounds.

Global In-Vitro Toxicology Testing Market Revenue, By Technology, 2022-2024 (USD Million)

| Technology | 2022 | 2023 | 2024 |

| Cell Culture Tech | 4,416.5 | 4,756.6 | 5,415.3 |

| High Throughput Tech | 2,637.4 | 2,863.5 | 3,122.4 |

| Cellular Imaging | 2,077.7 | 2,249.3 | 2,445.7 |

| OMICS Tech | 1,044.7 | 1,120.3 | 1,206.6 |

Method Insights

Based on the method, the global in-vitro toxicology testing market is segmented into cellular assay, biochemical assay, in-silico, and ex-vivo. The cellular assay segment is expected to hold a key account share during the forecast period. Cellular assays can be used to efficiently assess the cytotoxicity, biochemical mechanisms, off-target interactions, and biological activity in biomedical research as well as drug-discovery screening applications. Cellular assays are attributed to the high revenue in the in-vitro toxicology testing market. Cellular assays as in-vitro models provide various advantages including minimum cost, speed of analysis, and technological advancement such as automation. Moreover, several efforts by key market players for the development of novel cellular assays are expected to boost market growth. On the other hand, the In-silico segment is projected to grow at a significant CAGR during the forecast period.

Application Insights

Based on the application, the genotoxicity segment led the in-vitro toxicology testing market in 2023. The genotoxicity segment has emerged as the leading application in the in-vitro toxicology testing market. This dominance can be attributed to the increasing focus on assessing the potential genetic damage caused by various chemicals, pharmaceuticals, and environmental agents. Regulatory authorities, such as the FDA and EMA, have placed stringent requirements on genotoxicity testing to ensure the safety of drugs and other compounds, further driving demand in this segment.

Global In-Vitro Toxicology Testing Market Revenue, By Application, 2022-2024 (USD Million)

| Application | 2022 | 2023 | 2024 |

| Genotoxicity | 2,145.5 | 2,307.2 | 2,491.8 |

| Cytotoxicity | 1,835.7 | 1,980.7 | 2,146.6 |

| Phototoxicity | 574.7 | 620.5 | 673.0 |

| Carcinogenicity | 1,570.3 | 1,703.0 | 1,855.0 |

| Neurotoxicity | 1,029.7 | 1,105.2 | 1,191.5 |

| Dermal Toxicity | 905.9 | 993.9 | 1,094.9 |

| Endocrine Disruption | 944.0 | 1,014.8 | 1,095.6 |

| Ocular Toxicity | 754.1 | 819.5 | 894.4 |

| Others | 416.4 | 444.9 | 477.4 |

Route of exposure Insights

The dermal/skin toxicity testing segment held the largest share of 29.60% in the 2024 global in vitro toxicology testing market. The segment is considered to be most approachable due to its advanced use of reconstructed human skin models, which seem to be reliable and convenient. Also, the dermal toxicity testing uses cell-based methods to evaluate skin sensitization, irritation, and corrosion. The segment is accelerating with the rising demand for sustainable procedures without any damage to the environment and animals.

The inhalation toxicity testing segment is expected to grow at a CAGR of 8.30% during the forecast period. The segment usage in the in vitro (cell-based) method is to evaluate chemical extremists and identify the price and ethical problems of traditional animal testing. The inhalation toxicity testing includes sensitization (respiratory), irritation/corrosion (respiratory tract), acute inhalation toxicity, chronic inhalation toxicity, and sub-acute/sub-chronic inhalation toxicity. The segment is gaining traction with its easy implementation and interaction.

Industry Vertical Insights

The pharmaceutical and biopharmaceutical industry segment held the largest share of 43.20% in the 2024 global in vitro toxicology testing market. The segment has largely been adaptive towards various testing/methods in vitro toxicology testing. There are various functions in the biopharmaceutical and pharmaceutical sector, including packaging material testing, excipient and drug substance/API testing. Following the market's demand and requirement, the medical device material testing has accelerated. This segment's setting is essential for biologics safety testing.

The consumer products industry segment is expected to grow at a CAGR of 7.90% during the forecast period. The consumer products industry emphasizes household products, textiles, cosmetics, personal care products, and toy materials to promote in vitro toxicology testing. The materials and recommendations from the leading brands fuel the segment. The segment is the center point to accelerate the global in-vitro toxicology testing sector.

By Test guideline and regulatory compliance

The OECD test guidelines segment held the largest share of 67.50% in the 2024 global in vitro toxicology testing market. The OECD test guideline is crucial to further proceed and evaluate in vitro toxicology's clinical testing. For many biopharmaceutical and pharmaceutical companies, it is essential to follow these guidelines to benevolently update and alter the testing methods or indications accordingly. The major subdivisions of this guideline are classified according to OECD TG 403, 400, 412, 413,452, 451.

The other major regulatory frameworks segment is expected to grow at a CAGR of 6.80% during the forecast period. The other major regulatory frameworks, like TSCA (US) and REACH (EU), are entitled to regional initiatives and their respective regions' guidelines for the particular clinical study. The equivalent regulations in Asia-Pacific and other regions are important to consider to performing an in-vitro toxicology clinical testing program. The segment has paved new pathways to reconsider the drugs and testing applicability.

Study duration Insights

The short-term toxicity studies segment held the largest share of 58.10% in the 2024 global in vitro toxicology testing market. The short-term toxicity studies involve acute and sub-acute duration. The acute inhalation toxicity provides single exposure lasting for <24 hours, and sub-acute shows repetitive exposure up to 28 days. The segment is considered for a quick and time-saving impact in the in-vitro toxicology testing. It's leading with the rising demand for hassle-free and quick identification to any extreme exposure.

The long-term toxicity studies segment is expected to grow at a CAGR of 8.50% during the forecast period. The segment is crucial for long-standing treatment for which the in-vitro toxicology testing has been performed. It depends on different conditions, including chronic, sub-chronic, carcinogenicity, and reproductive and developmental toxicity measures. Mainly, the analysis of the market for technologies contributing to long-term monitoring is also a key improvement to the segment that has supported it for years.

Testing methodology Insights

The alternative methods (non-animal methods-NAMs) segment held the largest share of 62.70% in the 2024 global in vitro toxicology testing market. There are many alternative methods promoting NAMs, such as in chemico methods, in vitro models (cell culture technologies, organoids on chip/microphysiological systems), in silico models, and integrated approaches for testing and assessment (IATA). The other new approaches to methodologies (NAMs) have paved the way to a vast category that covers popular methods and their market penetration in global in-vitro toxicology testing.

In-Vitro Toxicology Testing Market Companies

- Charles River Laboratories International, Inc.

- SGS S.A.

- Merck KGaA

- Eurofins Scientific

- Abbott Laboratories

- Laboratory Corporation of America Holdings

- Evotec S.E.

- Thermo Fisher Scientific, Inc.

- Quest Diagnostics Incorporated

- Agilent Technolgies, Inc.

- Catalent, Inc.

- Danaher Corporation

- Bio-Rad Laboratories, Inc.

- BioIVT

- Gentronix

- Labcorp Drug Development

- Acea Biosciences Inc.

- Cyprotex Plc

- Ge Healthcare

- Perkinelmer Inc.

- Qiagen Nv

- Biognosys Ag

- Imquest Biosciences Inc.

- Lonza Group Ltd.

- Promega Corporation

- Stemina Biomarker Discovery Inc.

- Vistagen Therapeutics Inc.

- Xenometrix Ag

- MB Research Laboratories

Recent Developments

- In January 2023, Charles River Laboratories finalized the acquisition of SAMDI Tech, integrating label‑free, mass spectrometry–based high‑throughput screening (HTS) capabilities into its drug discovery portfolio.

(Source- https://www.criver.com) - In October 2024, Charles River launched its Fast‑Track HTS service, a standardized, fixed‑cost workflow for rapid hit discovery in early‑stage screening campaigns.(Source- https://www.criver.com)

- In 2024, Thermo Fisher Scientific, a global life‑science leader, continues enhancing its cellular testing platforms: its range of cell‑based assays now spans cytotoxicity, apoptosis, and signal‑transduction applications widely used in toxicology evaluations.(Source- https://www.thermofisher.com)

Segments Covered in the Report

By Route of Exposure: (Focus on Materials)

- Inhalation Toxicity Testing: (Primary Focus)

- Acute Inhalation Toxicity

- Sub-acute/Sub-chronic Inhalation Toxicity

- Chronic Inhalation Toxicity (including Carcinogenicity studies)

- Irritation/Corrosion (Respiratory Tract)

- Sensitization (Respiratory)

- Dermal/Skin Toxicity Testing:

- Skin Irritation & Corrosion

- Skin Sensitization

- Dermal Absorption

- Phototoxicity

- Ocular/Eye Irritation Testing:

- Oral/Digestion Toxicity Testing:

- Acute Oral Toxicity

- Repeated Dose Oral Toxicity

- Environmental Toxicity Testing:

- Aquatic Toxicity

- Terrestrial Toxicity

- Biodegradability

By Industry Vertical: (Focus on Material Testing)

- Pharmaceutical & Biopharmaceutical Industry

- Drug Substance/API Testing

- Excipient Testing

- Medical Device Material Testing (e.g., leachables and extractables)

- Packaging Material Testing

- Biologics Safety Testing (specifically for non-biologic materials used in their production/delivery)

- Sub-segment: CROs (Contract Research Organizations) serving Pharma

- Chemicals Industry

- Industrial Chemicals

- Specialty Chemicals

- Agrochemicals

- Polymers & Plastics

- Paints & Coatings

- Consumer Products Industry (Excluding Food, but including household & cosmetics materials):

- Cosmetics & Personal Care Product Materials

- Household Product Materials (detergents, cleaners, etc.)

- Textile Materials

- Toy Materials

- Other Industries (Relevant to Material Testing):

- Automotive Materials

- Aerospace Materials

- Construction Materials

- Advanced Materials (e.g., Nanomaterials, Composites)

By Test Guideline & Regulatory Compliance

- OECD Test Guidelines (Specifically requested)

- OECD TG 403 (Acute Inhalation Toxicity)

- OECD TG 400 (Acute Oral Toxicity - as a general toxicology reference)

- OECD TG 412 (Subacute Inhalation Toxicity)

- OECD TG 413 (Subchronic Inhalation Toxicity)

- OECD TG 452 (Chronic Toxicity Studies - potentially including inhalation)

- OECD TG 451 (Carcinogenicity Studies - future interest/cancer research)

- Market impact and adoption rates of these specific guidelines.

- Other Major Regulatory Frameworks:

- REACH (EU)

- TSCA (US)

- Equivalent regulations in the Asia-Pacific and other regions

- ISO Standards for Material Biocompatibility (where relevant for medical devices, etc.)

By Study Duration

- Short-Term Toxicity Studies:

- Acute (single exposure, <24 hours)

- Sub-acute (repeated exposure, up to 28 days)

- Long-Term Toxicity Studies:

- Sub-chronic (repeated exposure, 28-90 days)

- Chronic (repeated exposure, >90 days, often 6 months to 2 years or longer)

- Carcinogenicity (typically 2 years for rodents)

- Reproductive and Developmental Toxicity (multi-generational studies)

- Analysis of the market for technologies supporting long-term monitoring (e.g., for years).

By Testing Methodology

- Animal Testing (In Vivo)

- Rodent Models (Rats, Mice)

- Non-Rodent Models (e.g., Guinea Pigs, Rabbits, Dogs - if applicable for specific material tests)

- Market share and trends of traditional animal testing in material toxicology.

- Alternative Methods (Non-Animal Methods - NAMs):

- In Vitro Models:

- Cell Culture Technologies: (2D, 3D cell cultures, co-cultures)

- Organoids on Chip / Microphysiological Systems (MPS): (Detailed analysis of adoption, applications, market size)

- Reconstructed Human Tissue Models (e.g., for skin and eye irritation)

- Stem Cell-based Assays

- In Chemico Methods: (e.g., Direct Peptide Reactivity Assay for skin sensitization)

- In Silico Models:

- Computational Toxicology (e.g., QSAR - Quantitative Structure-Activity Relationship)

- Predictive Modeling

- (Q)SAR & Read-Across Applications for material hazard assessment.

- Integrated Approaches for Testing and Assessment (IATA): (Market impact, adoption, case studies)

- Other New Approach Methodologies (NAMs): (Broader category, covering emerging methods and their market penetration)

- In Vitro Models:

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting