What is the Infectious Disease In-Vitro Diagnostics Market Size?

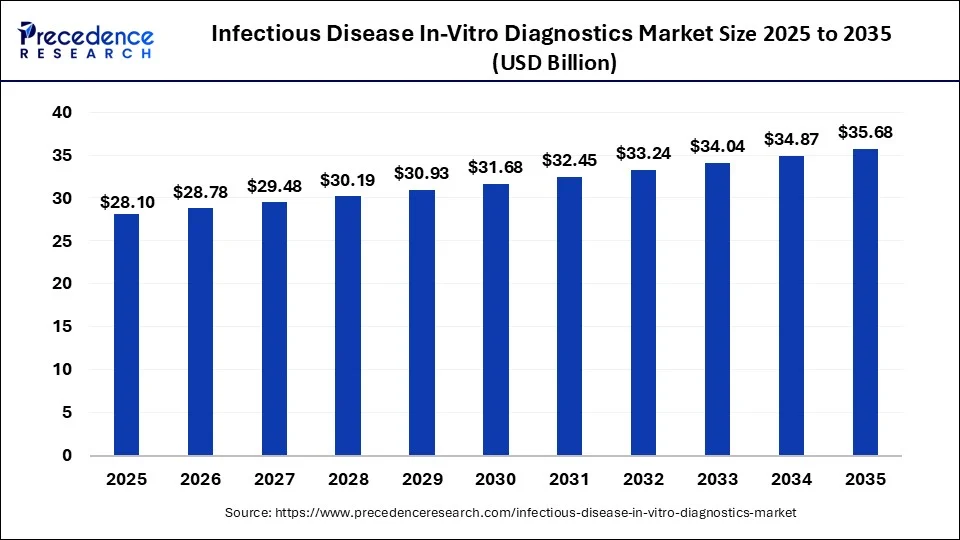

The global infectious disease in-vitro diagnostics market size is valued at USD 28.10 billion in 2025 and is predicted to increase from USD 28.78 billion in 2026 to approximately USD 35.68 billion by 2035, expanding at a CAGR of 2.42% from 2026 to 2035. The growth of the infectious diseases in-vitro diagnostics market can be attributed to rising demand for fast and accurate diagnostic tools, innovations in the enhancement and development of technologies for better treatment options by utilizing early disease detection and prevention techniques, increased success rates in ongoing clinical trials and growing support from governments and regulatory authorities.

Infectious Disease in-Vitro Diagnostics Market Key Takeaways

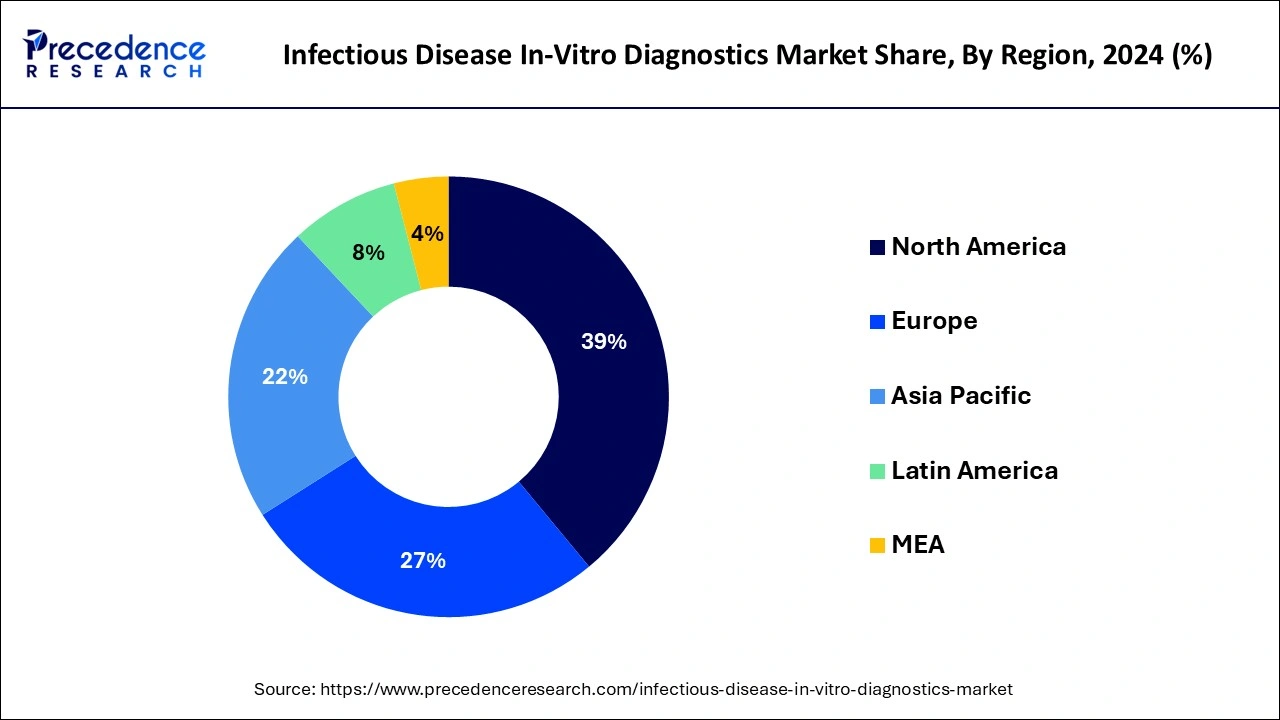

- North America dominated the global market with the largest market share of 39% in 2025.

- Asia Pacific is projected to expand at a notable CAGR during the forecast period.

- By product, the reagents segment has held the largest market share in 2025.

- By technology, the molecular diagnostics segment captured the biggest market share in 2025.

- By technology, the immunoassay segments is estimated to be the fastest-growing segment during the forecast period.

- By test location, the central laboratories segment contributed the highest market share in 2025.

How is Artificial Intelligence (AI) is Transforming Infectious Diseases In-Vitro Diagnostics?

AI is being widely used in infectious disease in vitro diagnostics for microbial identification through automated image analysis and analysis of stain pattern recognition. Furthermore, AI can enhance antimicrobial resistance prediction by phenotypic and genotypic analysis and also for detection and surveillance of outbreaks through real-time data analysis and strain typing for faster identification of potential outbreaks and tracing the spread of infections. Utilizing machine algorithms such as convolutional neural networks (CNNs) for analysis and predictions tasks along with the need for large datasets for training accurate AI models can significantly improve the development of new applications of AI for infectious disease diagnostics.

Market Overview

The infectious disease in vitro diagnostics market is a critical component of the healthcare industry, focused on the detection and diagnosis of diseases caused by pathogens such as bacteria, viruses, fungi, and parasites. This market encompasses a wide range of diagnostic tests that are performed outside the human body, typically in a laboratory setting.

The market is characterized by a diverse array of diagnostic methods, including molecular diagnostics (PCR, DNA/RNA sequencing), immunoassays (ELISA, lateral flow assays), microbiology culture, and point-of-care testing (rapid antigen and antibody tests). Each of these methods has its own advantages and limitations, catering to different clinical needs and settings.

Furthermore, the rising advancements in development of innovative diagnostics tools, development of diagnostics laboratories for infectious disease research, increased involvement of government and global organizations for implementing infection control guidelines and rising approvals from regulatory authorities for advanced testing kits and diagnostic methods is boosting the growth of infectious disease in-vitro diagnostics market.

- For instance, in July 2024, the World Health Organization released “Consolidated guidelines on differentiated HIV testing services.”

Infectious Disease in-Vitro Diagnostics Market Growth Factors:

- The rising global burden of infectious diseases.

- Ongoing demand for rapid and accurate diagnostic procedures for early disease detection, treatment and prevention thereby mitigating potential risks.

- Advancements in developing innovative diagnostic technologies.

- High demand for point-of-care diagnostics.

- Guidance and acceleration of clinical trials for treating infectious diseases by regulatory agencies.

- Implementation of new guidelines by various governments and global organizations like the World Health Organization (WHO) for treatment and preventing spread of infectious diseases.

- Development of new diagnostic procedures and treatments through clinical trials for patients with severe infections.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 28.10 Billion |

| Market Size by 2035 | USD 35.68 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 2.42% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Technology, Test Location, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing aging population

A dramatic change in the demographic landscape of the world is being brought about by an aging population. According to WHO, by 2030, 1 in 6 individuals worldwide would be 60 years of age or older. The number of individuals in the globe who are 60 or older will double by 2050. Healthcare is only one of several industries affected by this demographic shift. The increased susceptibility of elderly people to infections is one of the noticeable repercussions, and this has a significant effect on the market for in vitro diagnostics for infectious diseases.

Immunosenescence is the term for the immune system's tendency to deteriorate as people age. Older persons are more vulnerable to infections including influenza, pneumonia, urinary tract infections, and even developing diseases because of this reduction in immune function. Furthermore, these infections tend to react differently in older individuals, often presenting with atypical symptoms that can complicate diagnosis.

In order to effectively detect infectious pathogens in elderly patients, there is an increasing demand for prompt and accurate diagnostic techniques. This demand drives the creation and uptake of sophisticated in vitro diagnostics adapted to the special traits of aging populations. These diagnostics help distinguish between various pathogens, aid in the identification of diseases, and direct the selection of the most suitable treatments.

Diagnostics that take into account age-related physiological changes are being developed to serve the unique demands of older persons. These tests take into account things like weakened immune responses, ongoing medical problems, and possible drug interactions with prescription drugs frequently taken by elderly individuals.

Restraint

Regulatory challenges

The field of infectious disease in vitro diagnostics (IVD) is subject to strict regulatory scrutiny due to its crucial role in maintaining public health. In order to guarantee the safety, effectiveness, and caliber of diagnostic tests, governmental organizations like the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA) implement a complicated web of regulations such as getting regulatory approvals for new IVD products may be an expensive and time-consuming process. In-depth clinical trials are required to prove the accuracy and reliability of diagnostic tests. A tremendous amount of effort, money, and experience must be put toward this. Smaller businesses, particularly startups, frequently struggle to get the necessary clearances through this regulatory maze, which can hinder innovation and prevent them from entering new markets. The regulatory standards also keep changing frequently. Regulatory organizations regularly revise their policies and specifications, demanding continual compliance activities. As a result of having to modify their processes and products to meet new regulations, IVD producers may feel more pressure as a result of this changing environment. Failure to do so may lead to product recalls or market withdrawals, which could harm a company's finances and reputation.

Market access may also be hampered by regional variations in regulatory requirements. Businesses that want to grow internationally must deal with differences in documentation requirements and approval procedures, which adds to the difficulty and expense of launching new products. As a result, there may be discrepancies in the availability of modern diagnostic technologies, with some countries enjoying quicker product approvals and wider product availability than others.

Opportunity

Home testing for infectious diseases:

A combination of technology development and a change in healthcare preferences has led to a major uptake in the idea of infectious disease testing at home in recent years. Home testing offers a practical and confidential method of disease identification, empowering people to take control of their health.

Home testing provides unmatched comfort. People can either utilize self-contained test kits or take samples (such as blood, saliva, or nose swabs) in the comfort of their own homes and submit them to a laboratory. For those who often monitor chronic ailments or who reside in distant places with little access to medical services, this convenience is particularly alluring. For infectious diseases associated with social stigma, like HIV or sexually transmitted infections, home testing provides a discreet alternative. It encourages more people to get tested, helping with early diagnosis and prevention.

Product Insights

In 2025, the reagents segment had the largest share, and it is anticipated that it would continue to dominate during the forecast period. The necessity for the accurate diagnostics is driving up the need for high-quality reagents. Acute and chronic infectious diseases are becoming more prevalent globally, and flow cytometry techniques are being more widely used in academic and research settings. The growing demand for protein treatments and customized pharmaceuticals is also predicted to create lucrative opportunities for reagent market participants. The last two to three decades have seen a significant increase in R&D activities in academic institutions and government research institutes due to increased funding from various government organizations, the complexity of clinical trials, and higher drug failure rates in earlier phase studies.

In the global market, the instrument segment is seen as having the fastest rate of growth. Continuous technical advancements have significantly improved the precision, sensitivity, and effectiveness of in-vitro diagnostic instruments. New technologies, such as molecular diagnostics, next-generation sequencing, and immunoassays, which enable speedier and more precise diagnosis, are revolutionizing the field. These innovations are promoting the usage of in-vitro diagnostic instruments and hastening market growth. The aim of personalized medicine, which is gaining more attention and awareness, is to tailor medical care for each patient in accordance with their particular genetic features. Genetic testing, molecular profiling, and identification all rely significantly on the in-vitro diagnostic instruments.

Technology Insights

The molecular diagnostics segment dominated the market in 2025. It is anticipated that market growth will accelerate throughout the projected period as high-throughput PCR technology becomes more widely employed to identify viral and genetic illnesses. In Point of Care (PoC) settings, the usage of molecular diagnostic platforms has increased recently. For POC or near-patient testing, many businesses are developing molecular diagnostic platforms and assays. Furthermore, it is anticipated that the growing accessibility of innovative assays that deliver speedy PoC outcomes would speed industry expansion.

In the global market, the immunoassay category is anticipated to be the one that is expanding most quickly. Immunoassays are essential for tracking drug levels in patients, assuring accurate dosage, and reducing side effects. This is particularly important for drugs with limited therapeutic windows. It is increasingly being modified for use at the point of care, offering quick outcomes in clinics, ERs, and outlying locations. As a result, underserved areas now have greater access to healthcare.

Test Location Insights

In 2024, the central laboratories sector held the largest share of the market. Since central laboratories offer centralized and standardized testing services, they play a crucial part in clinical trials and drug development. Comprehensive and trustworthy testing is becoming necessary due to the intricacy of pharmaceutical research and the development of biologics, which central labs excel at providing.

Technology advancements have made it possible for central labs to provide a greater range of diagnostic services, from advanced imaging and biomarker analysis to genomes and proteomics. For cutting-edge research and tailored medicine, these qualities are essential.

Regional Insights

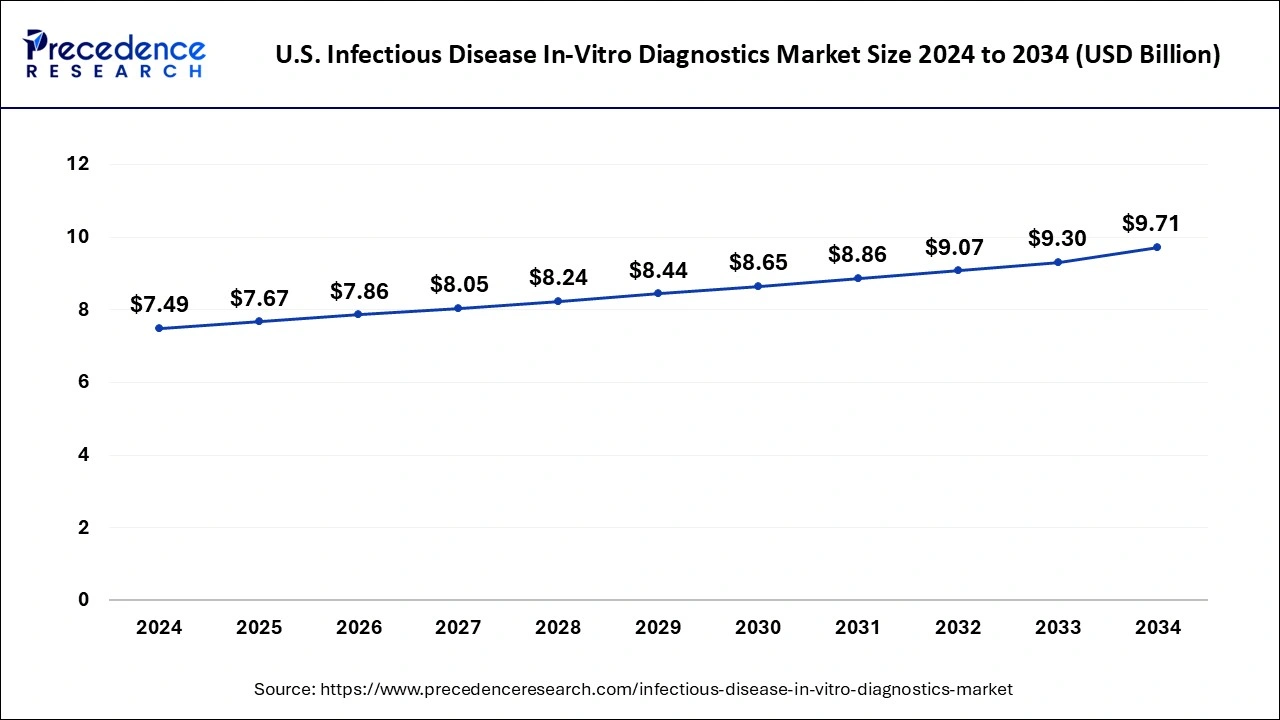

U.S. Infectious Disease In-Vitro Diagnostics Market Size and Growth 2026 to 2035

The U.S. infectious disease in-vitro diagnostics market size is exhibited at USD 7.67 billion in 2025 and is projected to be worth around USD 10.00 billion by 2035, growing at a CAGR of 2.69% from 2026 to 2035.

What made North America the Dominant Region in the Infectious Disease in-Vitro Diagnostics Market?

The North American region currently dominates the global market for in-vitro diagnostics for infectious diseases, and it is anticipated that it will continue to do so during the projected period. The growing importance of diagnostic tools have increased their reliability. In order to improve their capacity to effectively diagnose, monitor, and manage infectious diseases, governments and healthcare organizations in North America have boosted their IVD investments. Seasonal flu, HIV, hepatitis, and other infectious diseases are among the issues that North America continues to face. This increases the need for diagnostic solutions that are easier to access and more precise. Infectious disease diagnosis has become more precise and rapid due to ongoing developments in diagnostic technologies like PCR, next-generation sequencing, and point-of-care testing. Both healthcare professionals and patients are drawn to these advancements.

U.S. Infectious Disease in-Vitro Diagnostics Market Analysis

The supply chain resilience regarding diagnostic kits and reagents, and technological innovations in molecular diagnostics, boost the U.S. industry. The market is further driven by heightened awareness of early disease detection, ongoing public health surveillance needs, and increased demand for rapid, accurate diagnostic testing. In May 2024, the U.S. FDA published a final rule on the regulation of laboratory-developed tests as medical devices.

How did Europe become the Fastest-Growing Region in the Infectious Disease in-Vitro Diagnostics Market?

Europe has one of the largest and fastest-growing infectious disease in-vitro diagnostics markets globally due to rising private company investments in research and development of IVD technologies. Due to its connectivity and accessibility, Europe is more prone to disease epidemics, demanding advanced diagnostic tools. Moreover, the overall well-established healthcare sector also promotes the growth of the market in Europe.

Germany Infectious Disease in-Vitro Diagnostics Market Trends

Germany has a strong footprint of molecular diagnostics sector, driven by the growing geriatric population, growth in software and services, the rising demand for point-of-care testing, and infectious disease cases. The German government is dedicated to strengthening the medical technology and pharmaceutical industry, for which the country has launched the Pharmaceutical and Medical Technology Dialogue process in November 2025.

What Factors have influenced Asia Pacific to hold a Notable Share of the Infectious Disease in-Vitro Diagnostics Market?

Asia Pacific is expected to grow at a notable rate in the market, owing to the high burden of diseases such as dengue, hepatitis, tuberculosis, and respiratory infections, and the expansion of laboratories through government funding. The APACMed is committed to supporting the medical devices and in-vitro diagnostics industry in the Asia Pacific.

What made Latin America hold a considerable share of the Infectious Disease in-Vitro Diagnostics Market?

Latin America is expected to experience significant growth in the market due to the expansion of over-the-counter and at-home testing, a rapid shift towards point-of-care diagnostics, and high-sensitivity tests like PCR for the early detection of pathogens. Latin America boasts a robust healthcare system and leads in the production of essential medical products, including vaccines and in vitro diagnostics.

How did the Middle East and Africa reach a Pivotal Growth in the Infectious Disease in-Vitro Diagnostics Market?

The Middle East and Africa are expected to grow at a lucrative rate in the market, driven by a high burden of endemic diseases, a shift toward decentralized testing, and investments in laboratory modernization. Saudi Arabia has earned international recognition for its investments in digital health infrastructure, effective COVID-19 response, and efforts to advance biotechnology and precision medicine.

Value Chain Analysis of the Infectious Disease in-Vitro Diagnostics Market

- R&D

This stage includes concept and feasibility, design and development, verification and validation, and regulatory submission.

Key Players: Roche Diagnostics, Abbott Laboratories, Danaher Corporation, Siemens Healthineers, bioMérieux, QIAGEN. - Distribution to Hospitals, Pharmacies

This stage encompasses digital sourcing, automation, integrated logistics, decentralized point-of-care hubs, and over-the-counter and self-testing kits.

Key Players: Cardinal Health, Sandor Medicaids, Quest Diagnostics, Entero Healthcare, Roche Diagnostics, Abbott Laboratories, Danaher Corporation. - Patient Support & Services

This stage is gaining traction due to digital patient navigation, AI support, home-based testing support, and integrated disease management programs.

Key Players: Becton, Dickinson and Company, bioMérieux, Roche Diagnostics, Abbott Laboratories, Danaher Corporation, Siemens Healthineers.

Infectious Disease in-Vitro Diagnostics Market Companies

- QIAGEN

- BD

- BioMérieux SA

- F. Hoffmann-La Roche, Ltd.

- Hologic, Inc. (Gen Probe)

- Abbott

- Quidel Corporation

- Siemens Healthineers AG

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- OraSure Technologies, Inc.

Recent Developments

- In January 2025, the Indian Council of Medical Research declared the selection of Bangalore Medical College and Research Institute (BMCRI) for setting up South India's first Infectious Disease Research and Diagnostic Laboratory (IRDL) focusing on diagnosing infectious diseases caused by bacteria, fungi and parasites.

- In December 2024, the World Health Organization (WHO) granted prequalification to the molecular diagnostic test for tuberculosis (TB) called Xpert MTB/RIF Ultra which is the first test meeting prequalification standards of WHO for the TB diagnosis and antibiotics susceptibility testing.

Segments Covered in the Report

By Product

- Instruments

- Reagents

By Technology

- Immunoassay

- Molecular Diagnostics

- Microbiology

By Test Location

- Point of Care

- Central Laboratories

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting