Immunoassay Market Size and Forecast 2025 to 2034

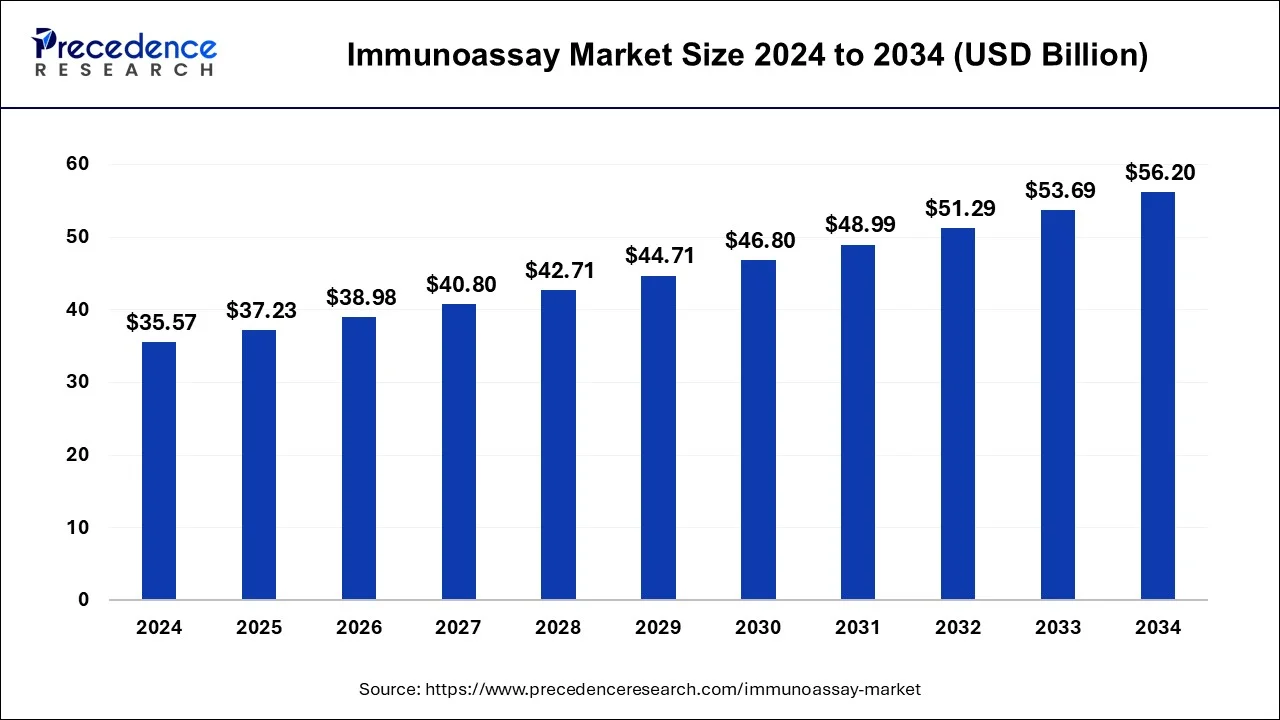

The global immunoassay market size accounted for USD 35.57 billion in 2024, grew to USD 37.23 billion in 2025 and is predicted to surpass around USD 56.2 billion by 2034, representing a healthy CAGR of 4.68% between 2025 and 2034. The immunoassay market is trending to grow significantly due to the growing demand for various immunoassay tests in disease diagnosis.

Immunoassay Market Key Takeaways

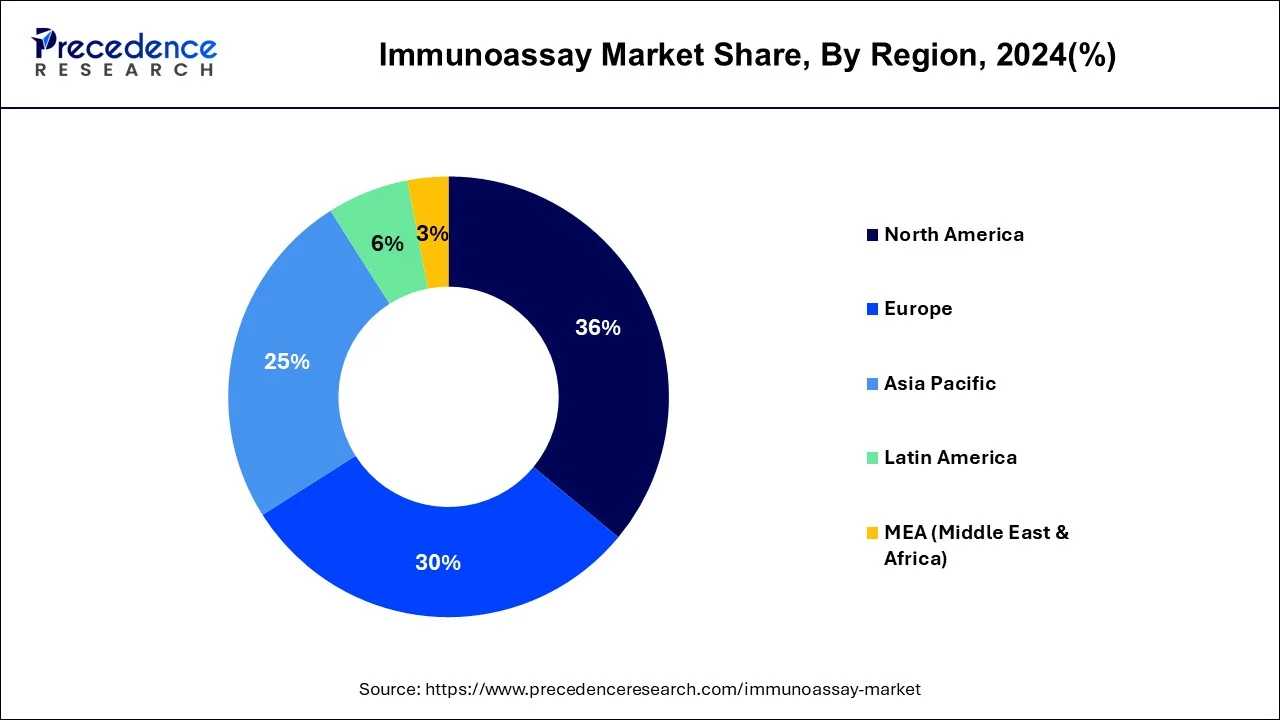

- North America dominated the market and captured more than 36% of the revenue share in 2024.

- Asia Pacific is expected to be the fastest-growing region.

- By product, the kit and reagent segment dominated the market and generated more than 61% of the total market share in 2024.

- By product, the software and services segment is expected to grow at a CAGR of 5.68% from 2025 to 2034.

- By technology, the ELISA segment dominated the market and capture more than 61% of the revenue share in 2024.

- By application, the infectious disease segment dominated the market and generated more than 31% of the market share in 2024.

- By end user, the hospital & clinical segment will dominate the market and contribute more than 31% market share in 2024.

- By end user, theblood banks are expected to grow at a healthy CAGR from 2025 to 2034.

U.S. Immunoassay Market Size and Growth 2024 to 2034

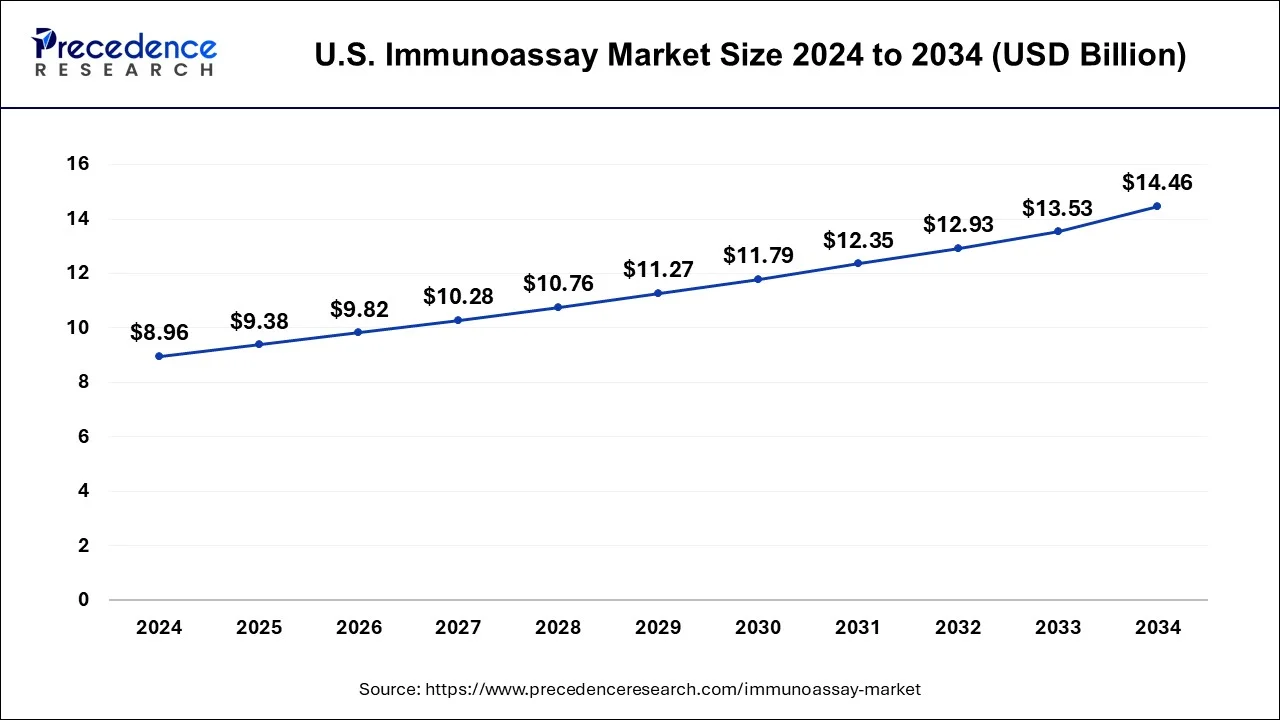

The U.S. immunoassay market size was estimated at USD 8.96 billion in 2024 and is expected to be worth around USD 14.46 billion by 2034, rising at a CAGR of 4.90% from 2025 to 2034.

North America dominated the immunoassay market, with a revenue share of more than 36% in 2024. The market is boosted by increased demand for diagnostics caused by the increase in cancer cases and access to technologically advanced diagnostic techniques. Furthermore, the region's high prevalence of infectious diseases such as HIV and tuberculosis is increasing the demand for detection and treatment.

The U.S. has a vital role in helping WHO safeguard and enhance the health of Americans and people worldwide because of decades of solid collaboration. The US is a fervent supporter of international health security. Other nations are assisted in strengthening their capabilities in critical health security domains by the robust collaboration between the United States and WHO for global health security.

In a similar vein, the U.S. has played a crucial role in providing areas ravaged by disease epidemics with life-saving humanitarian aid. By renewing their five-year collaboration and extending the Global Health Security Agenda (GHSA) until 2028, the United States of America and WHO are promoting global health security and expediting the implementation of the International Health Regulations (IHR).

- In 2024, there will likely be 88,100 cancer-related deaths and 247,100 new cancer diagnoses in Canada. Compared to the 239,100 new cancer cases in 2023, an anticipated 247,100 Canadians were told, "You have cancer," in 2024. This rise is probably due to the country's aging and expanding population.

Asia Pacific is expected to be the fastest-growing region. Due to the presence of a more senior population in this region and more prevalence of chronic and infectious diseases. Furthermore, one of the factors driving the regional market is the increasingly innovative laboratory procedures and techniques for faster diagnosis and investigation of infectious diseases.

More than two hundred laboratory specialists from across the world have come together to discuss the most recent developments and emerging trends in the field at 2024 MIIF China, which is being held April 23–24 and is organized in collaboration with IFCC, EFLM, SIBioC, and Mindray. Through incisive conversations on a wide range of subjects, from innovative biomarkers to state-of-the-art diagnostic technology, the event offers a glimpse into the industry's future.

Market Overview

Immunoassay is a highly selective bioanalytical technique that uses an antibody or an antigen as a biorecognition agent to determine the presence or quantity of analytes in a solution. Through signal transduction and amplification, it may achieve high specificity and sensitivity and is based on antibody-antigen immunoreaction. Immunoassays are a practical instrument for a number of uses in both clinical and scientific contexts.

The immunoassay industry is influenced by the rising prevalence of infectious & chronic diseases and government initiatives toward implementing mass testing. Additionally, an increase in several chronic and contagious diseases, including coronavirus, will drive market growth. Furthermore, an increase in the geriatric population vulnerable to infectious and chronic diseases contributes to market advancement.

Immunoassay Market Growth Factors

- Biotechnology industry growth: Research and development (R&D) of novel medications, treatments, and diagnostic instruments is a major focus of biotechnology businesses. In R&D procedures, immunoassays are essential for identifying and measuring biomarkers, evaluating the effectiveness of medications, and researching the causes of disease.

- Advancement in technology: High-throughput screening is made possible by technological advancements like automated platforms and microfluidics, which enable the examination of several samples at once.

- Growing prevalence of diseases: the rising incidence of infectious and chronic illnesses, which is fueling the need for precise and effective diagnostic instruments. Rapid and accurate diagnostic tests that can identify certain biomarkers or infections are becoming more and more necessary as disorders like cancer, heart disease, and infectious outbreaks increase in frequency.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 35.57 Billion |

| Market Size by 2034 | USD 56.2 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.68% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Technology, Specimen, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Increase in the number of infectious and chronic diseases driving market growth

The global burden of infectious diseases and chronic disorders is constantly increasing due to the growing geriatric population. In Italy, nearly half of those aged 65 and above have at least one chronic disease, and 17% have two or more.

Most of the population suffers from chronic diseases, including cancer, diabetes, cardiovascular disorders, obesity, etc., as well as infectious diseases caused by microorganisms such as diphtheria, Ebola, flu, hepatitis, HIV/AIDS, human papillomavirus, tuberculosis, and outbreaks such as dengue, Zika virus, Swine flu, and Covid-19. This has consistently impacted the growth of the infectious disease testing market.

The immunotherapy market has enormous potential to obstruct the path of rising disease incidences through early diagnosis and diagnostic-based treatment monitoring/modification. According to WHO (World Health Organization), noncommunicable diseases (NCDs) kill 41 million people yearly, equivalent to 74% of deaths globally.

Uncertain regulatory environments and restrictive medical device & test regulations are challenges faced by the immunotherapy market

Regulatory bodies of various countries have stringent marketing and licensing requirements for immunoassay equipment and consumables. The immunoassay market's growth has slowed due to technological challenges like antibody cross-reactivity, false negatives, the limited detection of antibodies, etc.

Immunoassay designers need help with designs, such as result misinterpretation. Furthermore, the clinical industry has been plagued for decades by a shortage of educated experts, hampered market growth.

Technological advancements provide immense opportunities for the immunoassay market growth

The immunoassay market has grown dramatically due to technological advancements. Automated laboratory instruments and equipment have been developed for faster testing and results. Automation benefits laboratories by increasing efficiency and reducing the need for space and labor. As a result, the market is expanding rapidly, as some players offer compact, portable automated laboratory systems and point-of-care tests.

Research labs, including biotechnology, need to become more familiar with the diagnostic development of instrumentation and lag behind their diagnostics counterparts in implementing automated immunoassay. Automation is penetrating every field, including healthcare. For instance, automated immunoassays provide more throughput, reproducibility, and assay transfer.

This process provides the double benefits of reduced time and also a reduction in operator depending on variability. For Instance, Siemens healthcare Diagnostic offers five fully automated immunoassay platforms in the US.

Product Insights

The kit and reagent segment dominated the immunoassay market, accounting for more than 61% of the total market share in 2024. The segment is expected to drive the market in the forecast period. With the increasing prevalence of infectious and autoimmune diseases, the more share can be attributed to the more demand for immunoassay kits and reagents for diagnostic purposes. Furthermore, the approval and release of immunoassay kits are expected to help in segment growth.

Over the forecast period, the software and services segment is expected to grow at a CAGR of 5.68% due to the high availability and increased demand for low-cost immunoassay services in emerging markets. Sysmex Corporation, for instance, began offering novel coronavirus (SARS-CoV-2) antibody lab assay services in June 2020.

Technology Insights

The ELISA segment dominated the immunoassay market, with a market share of more than 61% in 2024. The advantages of this method over immunoelectrophoretic & immunodiffusion include shorter assay times, qualitative & qualitative results, and the use of antiserum for analysis.

Rapid testing called lateral flow immunoassay detects a target analyte not using the equipment. The test technique shows a variety of applications, including dengue and Salmonella, Campylobacter, Legionella, and Listeria infections. Moreover, monoclonal antibodies use to precisely identify target analytes such as Immunoglobulin G (IgG), Immunoglobulin M (IgM), Immunoglobulin A (IgA), and Immunoglobulin D (IgD).

Application Insights

In 2024, the infectious disease segment dominated the market for immunoassay, accounting for more than 31% of the market share. This segment is expected to maintain its lead throughout the forecast period. The increased infectious diseases such as HIV, malaria, and SARS-COVID-19 drive the growth. The introduction of new products in the field of infectious disease testing is propelling the market even further.

The primary factor driving the growth of the immunoassay market during the forecast period is the rising prevalence of cancer cases worldwide. According to the International Agency for Research on Cancer, cancer was estimated to be more than 18.2 million new cases in 2020, with approximately More than 10 million deaths due to the disease. As a result, an increase in cancer incidence is expected to boost the use of immunoassays.

End-User Insights

The immunoassay market categorizes into hospitals & clinics, clinical laboratories, pharmaceutical & biotechnology companies, CROs, blood banks, research & academic laboratories, and home care settings. The hospital & clinical segment will dominate the immunoassay market with a 31% market share in 2023. The increase in the number of hospitals has resulted in the rapid growth hospital segment.

With the changes in the healthcare industry, there is a greater need for hospitals with advanced facilities. In addition, the clinical laboratory is the second fastest-growing segment due to increasing clinical trials and increased research and development activity influencing the immunoassay.

On the other hand, blood banks are expected to grow at a healthy CAGR over the forecast period. Blood banks are expected to grow during the forecast period due to an increase in the number of infectious diseases detected at blood banks through the screening and processing of donated blood.

One significant advantage of ELISA is that it is simple to use and does not necessitate the use of many specialized instruments or equipment. Therefore, it is commonly used in blood banks. As the demand for blood transfusions to treat infectious diseases rises, hospitals will likely see an increase in immunoassay testing. An increase in blood transfusions will benefit the blood bank segment.

Immunoassay Market Companies

- Abbott Laboratories

- Danaher Corporation (Beckman Coulter)

- Quidel Corporation

- Ortho Clinical Diagnostics

- Sysmex Corporation

- Bio-Rad Laboratories, Inc.

- Becton, Dickinson, and Company

- F. Hoffmann-La Roche AG

- Thermo Fisher Scientific, Inc.

- Siemens Healthinners

Latest Announcements by Industry Leaders

- In August 2024, the impetus our team has had this year to enter underserved areas has been great, and it is evidence that the diagnostic business is expanding and needs the appropriate technologies to advance research, said Mark Thornton, CEO of VION Biosciences. Ansh's dedication to quality and innovation is a perfect fit for VION, and the acquisition of Ansh Labs, along with our two prior acquisitions, gives VION the combined resources, capabilities, core competencies, and, of course, the talents of all VION employees to meet our customers' goals both now and in the future.

Recent Developments

- In October 2024, the Specialty Immunoassay (SPIA) Program of External Quality Assurance Services (EQAS) was introduced by Bio-Rad Laboratories. A user-friendly online platform for data access and reporting is provided by EQAS SPIA.

- In November 2023, a JSR Life Sciences company called Medical Biological Laboratories Co., Ltd. declared that it will make available the "iStar 500," an automated mono-test chemiluminescence immunoassay (CLIA) analyzer, all over the world.

Segments Covered in the Report

By Product

- Reagents & Kits

- ELISA Reagents & Kits

- Rapid Test Reagent & Kits

- ELISpot Reagents & Kits

- Western Blot Reagents & Kits

- Other Reagents & Kits

- Analyzer

- By Type

- Open-ended System

- Closed-Ended System

- By Purchased Mode

- Rental Purchased

- Outright Purchased

- By Type

- Software and Services

By Technology

- ELISA

- By generation

- Third generation & Above

- Second-generation & Below

- By generation

- Rapid Tests

- ELISpot

- Western Blotting

- Radioimmunoassay

- Other technologies

By Specimen

- Blood

- Saliva

- Urine

- Other Specimen

By Application

- Infectious diseases

- Endocrinology

- Oncology

- Bone and mineral disorders

- Cardiology

- Blood screening

- Autoimmune Disorders

- Allergy Diagnostics

- Toxicology

- Newborn Screening

- Other Application

By End-User

- Hospitals & Clinics

- Clinical Laboratories

- Pharmaceutical & Biotechnology Companies And Cro

- Blood Banks

- Research & Academic Laboratories

- Home Care Setting

ByGeography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content