Syphilis Immunoassay Diagnostics Market Size and Forecast 2025 to 2034

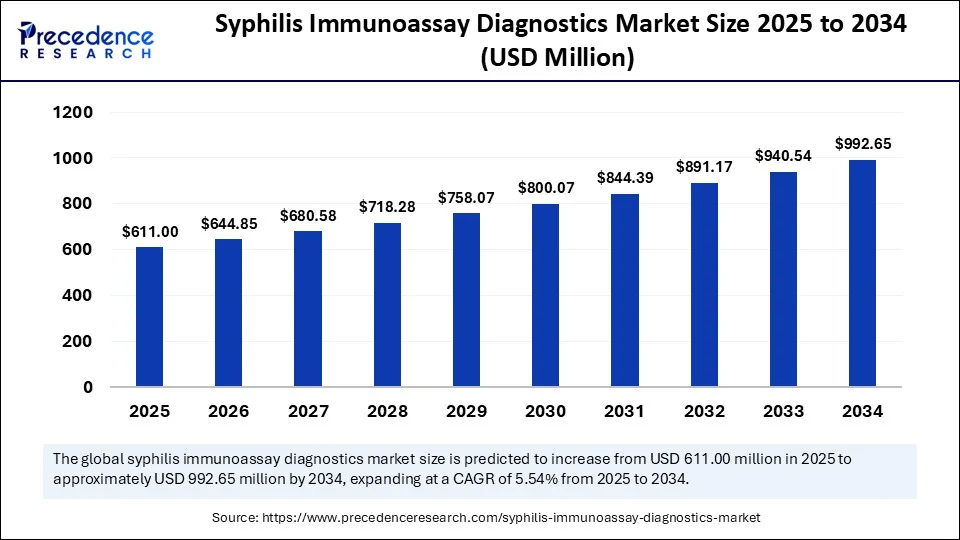

The global syphilis immunoassay diagnostics market size accounted for USD 578.93 million in 2024 and is predicted to increase from USD 611 million in 2025 to approximately USD 992.65 million by 2034, expanding at a CAGR of 5.54% from 2025 to 2034. The market is driven by increasing syphilis prevalence, higher public health incentives, government screening initiatives, and a high adoption rate of rapid point-of-care/immunoassay technology.

Syphilis Immunoassay Diagnostics MarketKey Takeaways

- In terms of revenue, the global syphilis immunoassay diagnostics market was valued at USD 578.93 million in 2024.

- It is projected to reach USD 992.65 million by 2034.

- The market is expected to grow at a CAGR of 5.54% from 2025 to 2034.

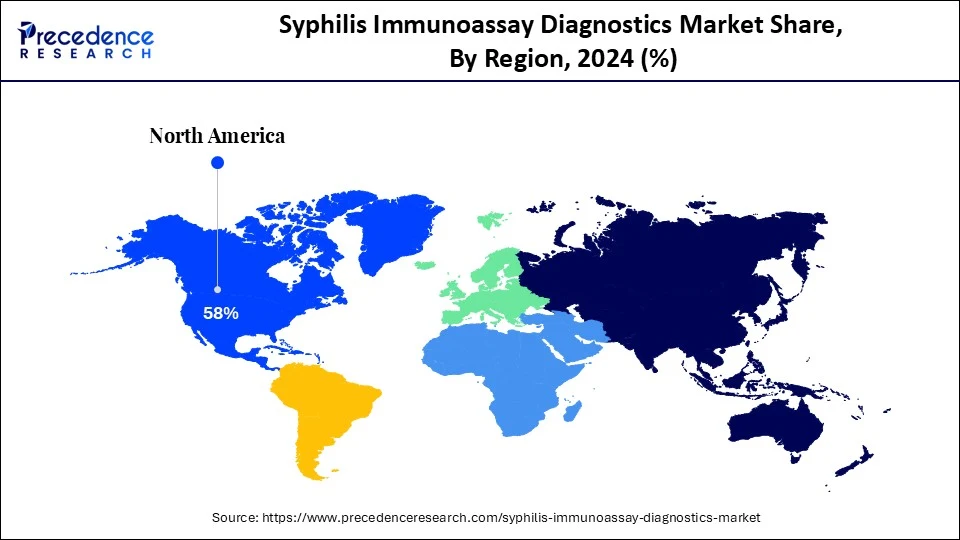

- North America dominated the syphilis immunoassay diagnostics market with the largest market share of 58% in 2024.

- Asia Pacific is estimated to expand the fastest CAGR in the market between 2025 and 2034.

- By test type, the treponemal tests segment captured the biggest market share of 60% in 2024.

- By test type, the point-of-care rapid tests segment is expected to grow at a CAGR of 10% during the forecast period.

- By technology, the enzyme-linked immunosorbent assay (ELISA) segment led the market in 2024.

- By technology, the lateral flow assays (LFA) segment is expected to grow at a CAGR during the forecast period.

- By sample type, the blood/serum segment contributed the highest market share in 2024.

- By sample type, the oral fluid segment is expected to expand at a notable CAGR over the projected period.

- By end user, the hospitals and specialty clinics segment generated the major market share of 40% in 2024.

- By end user, the blood banks segment is expected to grow at a CAGR of 20% during the forecast period.

AI Revolutionizing Syphilis Immunoassay Diagnostics with Real-Life Interventions

Artificial intelligence is impacting the field of syphilis immunoassay diagnostics with strong endorsement from public health organizations. As part of a field study in 2025, a smartphone-based deep learning AI platform analyzed 669 samples by interpreting Rapid Plasma Reagin (RPR) cards and yielding a sensitivity of 94.85%, specificity of 91.56%, PPV of 74.14% and NPV of 98.59%. (Source:https://pubmed.ncbi.nlm.nih.gov)

The CDC laboratory practices support the use of automated treponemal immunoassays (mainly EIA or CIA) in reverse-sequence algorithm that correlation from verifying TPPA testing.The NIH in 2023 has issued funding (RFA-AI-23-039) for the advancement advanced diagnostics for congenital and adult syphilis, with the intent to update employ serology practices no longer in modern use.These endorsed milestones are clearly demonstrating how AI is providing faster, more accurate and standardized syphilis tests. (Source:https://grants.nih.gov)

U.S. Syphilis Immunoassay Diagnostics Market Size and Growth 2025 to 2034

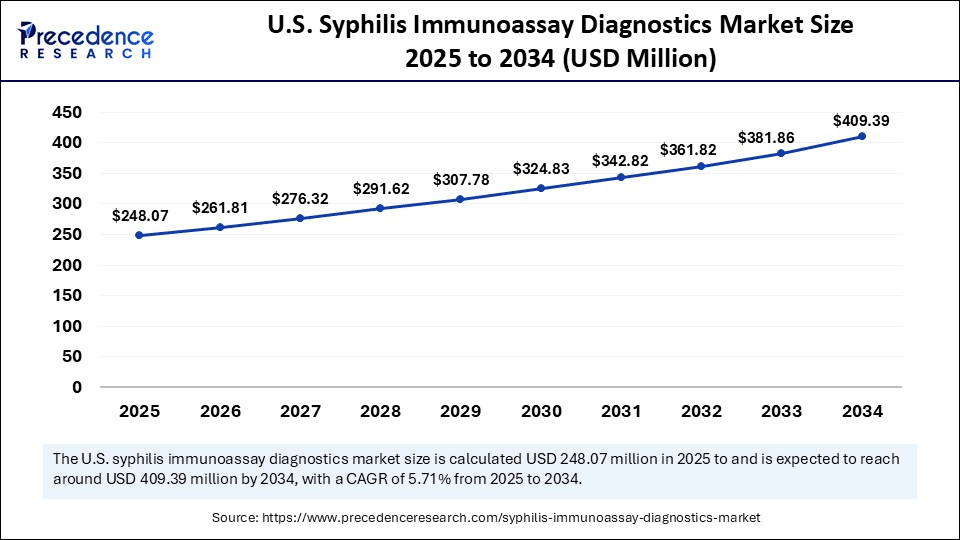

The U.S. syphilis immunoassay diagnostics market size was exhibited at USD 235.05 million in 2024 and is projected to be worth around USD 409.39 million by 2034, growing at a CAGR of 5.71% from 2025 to 2034.

North America Dominating the Syphilis Immunoassay Diagnostics Market in 2024

North America dominated the syphilis immunoassay diagnostics market in 2024, due to increasing rates of syphilis infections and the public health response. In the U.S., syphilis cases increased dramatically as the CDC reported over 207,225 cases in 2022, the highest numbers reported in more than two decades.

(Source:https://pmc.ncbi.nlm.nih.gov)

This trend has prompted a comprehensive response from health officials to increase access to testing and awareness. The FDA has also recently approved an over-the-counter syphilis test kit for use at home the first of its kind to facilitate early detection and efforts to reduce the spread of infection.

The U.S. is responsible for most of the growth of obsolescence in this region as the rates of infection are higher than in Canada and Mexico combined and there is a strong institutional response to develop diagnostic tools. The CDC has created a Syphilis Serum Repository to assist with development and validation of novel diagnostic assays, and agencies such as the NIH are even funding research to improve the sensitivity of tests and reduce the time for testing and diagnosis processes. The availability of at-home rapid test kits, and support from public-private partnerships, has increased access to immunoassay based syphilis diagnostics especially in underserved populations who may have limited access to testing.

Asia Pacific is Growing Rapidly, With a Rise in Healthcare Expenditure and Increased Tourism

Asia Pacific expects the fastest growth in the market during the forecast period due to the increase in awareness, improved access to healthcare services and screening for syphilis through initiatives and disease control programs led by national governments. Countries like India, China and Southeast Asian nations are showing dramatic rises in syphilis incidence, especially related to maternal and neonatal health. The World Health Organization has been supporting dual HIV/syphilis testing in antenatal care settings, particularly in lower-resource settings that use inexpensive rapid immunoassays to test routine screening.

India is emerging as an important driver of growth in the region as it expands its public health infrastructure, has high volume screening and testing initiatives. The Indian Ministry of Health has recommended syphilis testing as part of routine antenatal care through rapid immunoassays to identify syphilis infections early, treat infections early and prevent congenital syphilis. Awareness and access to care have resulted in increased opportunities for people to undertake immunoassay based tests with India poised as a leading contributor in the regional market growth.

European Syphilis Immunoassay Diagnostics Market

Europe expects the notable growth in the syphilis immunoassay diagnostics market during the forecast period, as the number of reported infections increases and countries implement government-sponsored screening initiatives. According to the European Centre for Disease Prevention and Control (ECDC), the rates of reported syphilis cases have increased across many European countries, especially within men who have sex with men (MSM) and older adults. In response, many public health systems have developed stronger STI surveillance, increased access to free testing, and put immunoassay rapid diagnostics as routine in public hospitals and sexual health clinics.

Germany is by far the leader in Europe when it comes to syphilis diagnostics, due in part to the country's outstanding laboratory infrastructure and strong health policies. They contain national surveillance data, which has proven consistent increases in syphilis rates over the last decade. Considering this health issue, Germany has implemented high-throughput immunoassays as a matter of practice for STI screening throughout its national health system. In addition to national initiatives, German diagnostic manufacturers are working hard on immunoassay platforms that offer both rapid and accurate testing, which will support broader adoption of the platforms across other EU member nations.

Market Overview

What is Syphilis Immunoassay Diagnostics Market?

The syphilis immunoassay diagnostics market comprises serological testing solutions designed to detect antibodies (IgG, IgM) or antigens related to Treponema pallidum, the bacterium causing syphilis. These assays are critical for early-stage screening, confirmatory testing, blood donor screening, and antenatal care. Rising incidence of syphilis and especially congenital syphilis combined with mandated screening protocols in developed and emerging nations, is fueling market growth. Immunoassay-based diagnostics are preferred due to their high sensitivity, specificity, automation compatibility, and rapid turnaround time.

Innovations like multiplex immunoassays, chemiluminescence platforms, and point-of-care kits are increasing detection capabilities and access. Increased public health investments especially in STI prevention and maternal health programs, are increasing demand in the market. But the inconsistent healthcare infrastructure and lack of awareness in poorer settings is an obstacle.

Syphilis Immunoassay Diagnostics MarketGrowth Factors

- Syphilis Prevalence- The rise of syphilis, along with increasing congenital cases globally, has driven wide-ranging demand for timely, accurate diagnostic testing within healthcare systems.

- Screening Mandates- Regulations for mandatory syphilis tests in antenatal care, blood banks, and high-risk groups are providing consistent demand for trusted immunoassay diagnostic products.

- Testing Technologies- As tests become more laser-focused through automated platforms, chemiluminescent assays, and rapid point-of-care kits, while becoming more publicly acceptable the simultaneous improvement in the tests sensitivity, specificity, and time to diagnosis will surely propel immunoassay testing.

- STI Awareness Campaigns- Public health information campaigns and global awareness campaigns have inspired early testing for STIs, which is leading to greater acceptance and uptake of routine syphilis screening.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 992.65 Million |

| Market Size in 2025 | USD 611 Million |

| Market Size in 2024 | USD 578.93 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.54% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Test Type, Technology, Sample Type, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Could the Approval of At-Home Syphilis Tests by FDA Really Increase Immunoassay Needed More Broadly?

A major kick to the syphilis immunoassay diagnostics market is the U.S. FDA's 2024 approval of the first over the counter, at-home syphilis test, allowing for self-screening at home in 15 minutes (FDA). This move is particularly notable as the global syphilis burden continues to rise. At home tests can drive awareness and detection along with lab-based immunoassays; however, lab-based immunoassays are still critical to diagnose, stage and report as lab-based immunoassays will always be a critical component of the Global strategy to combat STIs of all types, including syphilis.

Restraint

Could Limitations Of Diagnostics Restrict The Uptake Of Syphilis Immunoassays?

One important barrier to the syphilis immunoassay diagnostics market is the treponemal immunoassays' inability to distinguish between active infection or past infections. The WHO (2023) noted that most rapid tests are treponemal tests that detect treponemal antibodies and these treponemal antibodies will remain after successful treatment, leading to possible unreasonable/erroneous diagnosis (WHO). The' CDC (2024) guidance additionally highlights that the non-treponemal tests must be performed as follow-up to confirm that active infection, so delays in access to non-treponemal tests or not enough time to interpret results can delay appropriate treatment (CDC).

In the disadvantaged setting or isolated populations, this might lead to under-treatment or overtreatment of syphilis, which could lead to a lack of confidence in the results of the testing. Such limits on diagnostics are preventing widespread implementation, particularly in sensitive, care scenarios such as maternity and emergency room situations when timely and appropriate decisions must be made.

Opportunity

Could Home-Based and Multiplex Immunoassays Be the Next Major Breakthrough in Syphilis Diagnostics?

One of the biggest opportunities in the syphilis immunoassay diagnostics market is the introduction of home testing kits and multiplex platforms for diagnosis. In August 2023, the U.S. FDA approved the first over-the-counter rapid syphilis test, made by NOWDiagnostics, with results available within 15 minutes and empowering sexually active individuals with privacy and access.(Source: https://www.businesswire.com)

Further, In July 2023, the WHO prequalified a multiplex diagnostic panel that screens for HIV, hepatitis B, and syphilis simultaneously, allowing for detection of these diseases as part of maternal health programming. With syphilis cases continuing to rise globally and congenital syphilis cases in the U.S. rising 10-fold from 2012-2021, there is a greater need for testing that is decentralized, fast, and accurate, all of which opens new opportunities for diagnostic innovation in public health systems.

Test Type Insights

Why Personal Health Products Have the Largest Share of Product Type?

Treponemal tests segment dominate the syphilis immunoassay diagnostics market in 2024 as they specifically detect antibodies against Treponema pallidum, the causative agent of syphilis. These tests, including enzyme immunoassays (EIA), chemiluminescence immunoassays (CIA), and fluorescent treponemal antibody absorption (FTA-ABS), offer high sensitivity and are widely used for confirmatory diagnostics. Their application in hospitals, STD clinics, and blood banks ensures accurate detection across all stages of infection. The reliability and clinical acceptance of these tests continue to make them the preferred diagnostic method in standard laboratory workflows.

Point-of-care rapid tests segment expects the fastest growth in the market during the forecast period, due to their portability, simplicity, and suitability for decentralized testing environments. These lateral flow assays and rapid card tests are widely adopted in community-based health programs, especially in low- and middle-income countries. Their ability to deliver quick results without the need for lab equipment makes them ideal for outreach initiatives, antenatal care, and rural healthcare settings. The global push for early syphilis detection and treatment, particularly to prevent congenital syphilis, is accelerating the use of these rapid diagnostic tools.

Technology Insights

Why ELISA Technology is Dominates the Syphilis Immunoassay Diagnostics Market in 2024?

Enzyme-Linked Immunosorbent Assays (ELISA) segment dominated the syphilis immunoassay diagnostics market in 2024, because of its sensitivity, throughput, and automation. ELISA is widely used in clinical laboratories and blood banks for high volume screening of syphilis, especially in places experiencing high prevalence amongst at-risk populations. ELISA correctly identifies syphilis antibodies that reside in serum or plasma samples. ELISA integrates into an automated diagnostic platform which improves workflow efficiency, and consistent results. Because of this capability, ELISA is an appropriate immunoassay for routine and confirmatory testing for syphilis in established settings (e.g. healthcare and laboratory).

Lateral flow assays (LFA) segment expects the fastest growth in the market during the forecast period, because of their portability and delivery of results, and minimal infrastructure requirements. LFAs become the immune-assays of choice for point-of-care use during mobile health units, outreach clinics, in areas where there may not be a laboratory nearby, and in rural areas. LFAs are especially suited for use during screening for public health campaigns and field interventions in areas experiencing high syphilis prevalence and regions without laboratories. LFAs use fingerstick samples and do not require cold-chain logistics, and its ease of use has contributed to its rapid uptake for community health initiatives for early syphilis detection, and maternal health programs.

Sample Type Insights

Why Is Blood/Serum the Dominant Sample Type for Syphilis Immunoassays?

Blood or serum segment dominated the syphilis immunoassay diagnostics market in 2024, because it aligns with existing "off-the-shelf" test platforms such as ELISA, CLIA, and most assays that use lateral flow technology. When testing from blood serum or whole blood, the diagnostic yield is well established, and blood serology is recognized and accepted in clinical and laboratory settings. Blood as a sample type is common in hospitals, specialty clinics, and blood banks where it is critically important to accurately detect and confirm the presence of syphilis.

Oral fluid segment expects the fastest growth in the market during the forecast period. Oral fluid enables the non-invasive, simple and painless way of sample collection, which is highly advantageous for large-scale screening efforts and access for hard-to-reach populations. Oral fluid tests are increasingly becoming available information community health initiatives and through pilot programs to increase early detection and patient compliance.

End User Insights

Why is the Hospitals And Specialty Clinics Dominates End-User Segment?

Hospitals and specialty clinics segment dominated the syphilis immunoassay diagnostics market in 2024, as they continue to offer the primary setting for screening of sexually transmitted diseases (STDs), prenatal care, and management infectious disease. Each of these facilities conducts diagnostic testing, including syphilis testing, as a routine service for their clientele which is predominantly for obstetrics and gynaecology. These clinical facilities are usually well-equipped with laboratory facility and qualified personnel, which allow the use of treponemal tests and ELISA-based platform technologies efficiently. In addition, swab testing that can be administered while someone is for example under quarantine; thus, they become the stronger consideration for accurate and precise laboratory diagnostics for syphilis.

Blood banks segment expects the fastest growth in the market during the forecast period, as they are bound by regulations, in which they must screen for syphilis in all blood donations. The section of transfusion safety and infection control in blood banks is an area that is taking increasingly realized support the advanced diagnostic technologies, including reliable and high-throughput capability in confirmatory diagnostics. Over the last couple of years, regulation in blood donations have been established for voluntary blood donation some becoming routine principal for phased bans depending on the realities of the healthcare in some developing nations, thus accessing rapid.

Syphilis Immunoassay Diagnostics Market Companies

- Abbott Laboratories

- bioMérieux

- Siemens Healthineers

- F. Hoffmann-La Roche AG

- Bio-Rad Laboratories

- Thermo Fisher Scientific

- Zephyr Biomedicals (Trinity)

- Omega Diagnostics

- Chembio Diagnostics

- Sekisui Diagnostics

Latest Statements and Investments By Major Players

- In July 2025- Health Canada authorized MedMira's Multiplo TP/HIV rapid test for investigational testing, thus clearing the way for self-testing and non-professional testing to help address the rise in HIV and syphilis, with clinical research led by REACH Nexus.(Source: https://www.tipranks.com)

- In January 2025 – MedMira received Health Canada authorization for investigational testing of its Multiplo Complete Syphilis (TP/nTP) antibody test, which is a new three-minute device that detects both active and past syphilis infection with a finger prick sample. (Source: https://www.newswire.com)

- In August 2024, The FDA has approved NowDiagnostics' "First To Know" over-the-counter syphilis antibody blood test that provides results in 15 minutes from a single drop of blood. It detects current and past infections, but clinical confirmation testing will still be required for diagnosis.(Source:https://www.medtechdive.com)

Segments Covered in the Report

By Test Type

- Treponemal Tests

- Non-Treponemal Tests

- Point-of-Care Rapid Tests

By Technology

- Enzyme-Linked Immunosorbent Assay (ELISA)

- Chemiluminescent Immunoassays (CLIA/CIA)

- Lateral Flow Assays (LFA)

- Fluorescent Treponemal Antibody Absorption (FTA-ABS)

By Sample Type

- Blood/Serum

- Oral Fluid

- Whole Blood via Fingerstick

By End-User

- Hospitals and Specialty Clinics

- Diagnostic Laboratories

- Blood Banks

- Mobile/Community Health Centers

- Home-Based Self-Testing

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content