What is Next Generation Sequencing Market Size?

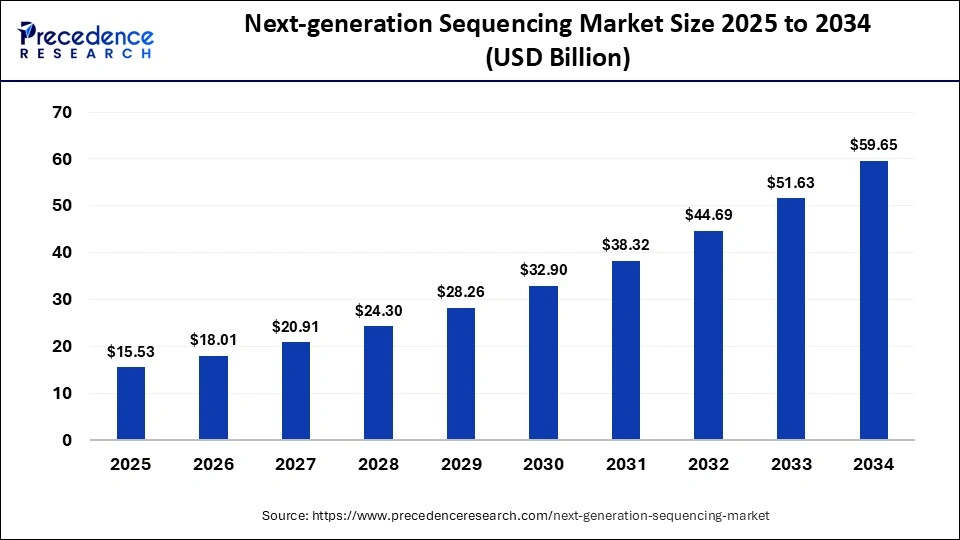

The global next-generation sequencing market size is valued at USD 15.53 billion in 2025 and is expected to surpass around USD 60.33 billion by 2034, poised to grow at a remarkable CAGR of 16.20% from 2025 to 2034. the broad utility of next-generation sequencing in medicine, agriculture, ecology, and many other fields, as it is used in disease diagnosis, prognosis, and therapeutic decisions, is surging the market's growth.

Market Highlights

- North America dominated the next generation sequencing market in 2024.

- Asia Pacific is expected to witness significant growth during the forecast period.

- By product, the consumables segment led the market in 2024.

- By product, the platform segment is observed to grow at the fastest rate during the forecast period.

- By application, oncology contributed the highest market share in 2024.

- By application, the consumer genomics segment is expected to grow at a significant CAGR during the forecast period.

- By end-use, the academic research segment held a notable market share in 2024.

- By end-use, the clinical research segment is anticipated to show the fastest growth during the anticipated period.

- By technology, the targeted sequencing & resequencing segment contributed the highest market share in 2024.

- By technology, the WGS segment is expected to witness the fastest CAGR during the forecast period.

- By workflow, the sequencing segment held the largest market share in 2024.

- By workflow, the NGS data analysis segment is anticipated to grow at the fastest CAGR during the forecast period.

Market Size and Forecast

- Market Size in 2025: USD 15.53 Billion

- Market Size in 2026: USD 18.01 Billion

- Forecasted Market Size by 2034: USD 60.33 Billion

- CAGR (2025-2034): 16.20%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Market Overview

Next-generation sequencing comprises DNA and RNA sequencing technology which has the ability to rapidly analyze large amounts of genetic material. It holds the potential to sequence hundreds and thousands of genes or whole genomes in a limited duration. The commercial use of NGS was initially known as massively parallel sequencing. The advantages that come along with NGS are lower sample input requirement, higher accuracy, and the ability to detect variants at lower allele frequencies compared to the traditional Sanger sequencing by capillary electrophoresis (CE). Next-generation sequencing technology is transforming the biological science field by allowing laboratories to perform a wide variety of applications and study biological systems at an advanced level.

How is AI changing the Next Generation Sequencing Market ?

Integration of artificial intelligence and machine learning in next-generation sequencing has the potential to transform the biotechnology industry. It offers more valuable insights on genomic research and opens new opportunities. An analysis of a large amount of generated next-generation sequencing data is time-consuming and complex. AI and ML algorithms have the ability to automate and optimize NGS data analysis, making the process more accurate and efficient. The primary application of AI and ML in NGS is noted for aligning sequences to a reference genome.

Next Generation Sequencing Market Growth Factors

Building new genome: Researchers use de novo sequencing with assembly for the development of new genomes from unknown organisms. Assemblers are tools that put together the fragmented reads on DNA by aligning regions with overlap to build a genome sequence.

Measurement of genetic variation: this is achieved from an organism with an existing reference genome. When the reference genomes are compared with sequencing results, researchers get the genetic variation such as single nucleotide polymorphisms (SNPs), structural variation, copy number variation and others using software programs.

NGS technologies: the advanced technologies allow microbial ecology scientists to investigate genetic material from environmental samples on a large scale. With this, scientists are able to extract DNA from the environment without cloning.

Next Generation Sequencing Market Outlook

- Industry Outlook:The next generation sequencing market is experiencing strong growth from 2025 to 2034, driven by its increasing use in clinical diagnostics, oncology, infectious disease surveillance, reproductive health, and population genomics. Falling sequencing costs, high-throughput platforms, and quick turnaround times are making it more accessible for research and clinical applications. Additionally, the integration of NGS and AI-based analytics is improving diagnostic accuracy and patient stratification, further promoting their adoption in hospitals and laboratories.

- Sustainability & Efficiency Trends:Sustainability and efficiency are increasingly shaping the development of NGS platforms. Companies are prioritizing the reduction of energy use, optimizing reagent usage, and minimizing chemical waste. Illumina and Thermo Fisher are investing in green library prep kits, recyclable consumables, and energy-efficient sequencers. Regulations requiring responsible lab operations are encouraging NGS labs to adopt greener practices, supporting the long-term goals of sustainability.

- International Growth:NGS companies are actively expanding internationally to target emerging markets with growing genomics infrastructure and healthcare modernization. The firm, BGI / MGI Tech, is strengthening its presence in the Asia-Pacific and Latin America by establishing sequencing hubs and service centers. Strategic partnerships with diagnostic and pharmaceutical companies help NGS players integrate solutions into broader clinical and research workflows.

- Major Investors:The market has attracted significant interest from private equity firms, venture capitalists, and strategic investors due to its high margins, rapid growth, and advanced technology. Startups developing sequencing instruments and bioinformatics platforms have received funding from investors like Sequoia Capital, Andreessen Horowitz, KKR, Temasek, and SoftBank. Additionally, NGS startups are being supported by strategic investors such as pharmaceutical and biotech companies to accelerate the development of precision medicine programs.

- Startup Ecosystem:The NGS startup ecosystem is highly dynamic, with companies developing hardware, reagents, and bioinformatics solutions to lower costs, increase speed, and improve accuracy in sequencing. New entrants like Element Biosciences, Ultima Genomics, Singlera Genomics, and others are creating ultra-high-throughput, portable, and scalable sequencing systems. Collaborating with well-known sequencing firms and research centers helps startups expand operations and enter global markets more effectively.

Market Scope

| Report Coverage | Details |

| Market Size In 2025 | USD 15.53 Billion |

| Market Size In 2026 | USD 18.01 Billion |

| Market Size by 2034 | USD 60.33 Billion |

| Growth Rate | CAGR of 16.20% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, Technology, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Precision medicine

Rising demand for precision medicine is observed to be increasing significantly with the advancement in next-generation sequencing (NGS) technology which rapidly sequences large parts of an individual's genome to help create precision medicine. It is a medicine in a healthcare model that uses genomic data to design treatments for a person, instead of using a “one-size-all” approach. NGS in precision medicine allows for rapid and accurate sequencing of a tremendous number of genes at once. Researchers at the Next Generation Precision Medicine Program have developed a Childhood Cancer Model Atlas (CCMA), which is the world's largest single-site collection of high-risk paediatric cancer cells. Precision medicine is proven to be beneficial in oncology to deliver the right cancer treatment to a particular patient with the right dose at the right time.

Restraint

Inaccurate data quality and interpretation

When a massive amount of data is been analysed, there is a chance of quality discrepancy. The next generation sequencing data can be affected by various sources such as sequencing errors, sample contamination PCR bias, and alignment errors. These errors could lead to false positive results, false negatives or misinterpretation of the results. This problem can be mitigated by the development and implementation of robust methods and standards for data quality assessment, error correction and variant calling.

Opportunity

Research and application

Next-generation sequencing market future is expected to expand immersive in terms of evolving and improvement, offering new opportunities in the field of biotechnology and advanced research and application. Single-cell sequencing is a new and impactful technique that allows the analysis of individual cells instead of a bulk population. Long-read sequencing is an emerging technique involving a generation of longer reads, ranging from hundreds to thousands of base pairs. In comparison with should read of NGS which has less than 300 base pairs. This technique offers more information on the haplotype, phase, and context of the variants. Along with that, long-read sequencing can be performed by various platforms, such as nanopore, PacBio, and 10x Genomics. In situ sequencing is a modern technique used to perform sequencing directly in the tissue or cell, without any extraction, amplification, or library preparation. In situ sequencing can also enable the simultaneous detection and visualization of multiple types of molecules.

Segment Insights

Product Insights

The platform segment is projected to witness the fastest growth during the forecast period. The growth of this segment is expected to witness as it allows researchers to sequence everything from specific targeted regions to the entire human genome in a single day with the help of millions of DNA fragments in parallel. Choosing the right NSG platform for every laboratory develops on the method, software needed and technology and support. Considering all this, it should benefit from application flexibility, expert-level technical support and a global community of scientists and researchers.

Application Insights

The oncology segment contributed the largest market share in 2024. The dominance of this segment is noticed as it facilitates genetic diagnostic techniques which offer analysis of multiple genes in tumours simultaneously to help identify specific mutations and understand cancer treatment. In some cases, the patients' blood test sample is taken is a small amount of tumour DNA that may be shed from the cancer. NGS is employed to identical new and rare cancer mutations, detect familial cancer mutation carriers and provide a molecular rationale for targeted therapy. NSG has been adopted in clinical oncology for the development of advanced personalized treatment of cancer.

The consumer genomics segment is anticipated to register a significant CAGR during the forecast period. The expansion of this segment is noted as the next generation sequencing technology is used in consumer genomics to provide insights into an individual's genome. The consumer genomics is significantly expected to grow due to the increase in advertising spending from key players, and a decrease in genotyping and sequencing costs. Additionally, more companies are expected to enter the direct-to-consumer market in genomics.

End User Insights

The academic research segment dominated the surgical snare market in 2024. The dominance of this segment is observed as next-generation sequencing is a robust platform in academic research allowing researchers to analyse genetic material quickly. The university and community benefit factor contributes to providing significant growth to the market as the increasing acceptance towards scientific research, scholarship supports universities. Additionally, it offers the exploration of laws and theories that ring a better understanding of social phenomena towards NGS.

The clinical research segment is observed to grow rapidly in the surgical snare market during the forecast period. The expansion of this segment is expected as it plays a crucial part in the development of novel treatments, medications, and tools to prevent and treat any disease. clinical research in NSG uses sequence DNA and RNA, and detect genetic variants and mutations. On a clinical level, next-generation sequencing helps in the identification of rare and new cancer mutations, detects carriers of similar cancer mutations, and provides the molecular basis of particular therapies.

In July 2024, Thermo Fisher Scientific, the world leader in serving science, is partnering with the National Cancer Institute, helps to accelerate research into a new treatment for Acute Myeloid Leukaemia and Myelodysplastic Syndrome on clinical research and treatment utilizing next-generation sequencing technology.

Technology Insights

The whole genome sequencing (WGS) segment is observed to grow rapidly in the next generation sequencing market during the forecast period. WSG stands for whole genome sequencing which has a specific application of next-generation sequencing. The expansion of this segment is expected as it offers the most comprehensive data about the given organism. This also offers novel genome assembly, it provides a high-resolution view of the complete genome including coding and non-coding regions. WSG is widely applicable in cancer research, genetic disease research, epidemiology, and genotyping.

Workflow Insights

The sequencing segment held the largest share of the next generation sequencing market in 2024. Sequencing by synthesis (SBS) chemistry is used to detect single bases as they are incorporated into growing DNA strands. Plenty of sequencing frameworks are available to support the extensive spectrum of throughputs and applications. Most sequencing instruments use optical detection to determine nucleotide incorporation during DNA synthesis.

The NGS Data Analysis segment is observed to expand rapidly in the next generation sequencing market during the forecast period. The growth of this segment is noticed due to the growing acceptance of sequencing systems for clinical diagnosis reason behind its hefty cost reduction of installation. Additionally, the availability of easy genomic and proteomic information is expected to generate a significant growth opportunity in the industry in the coming future.

Regional Insights

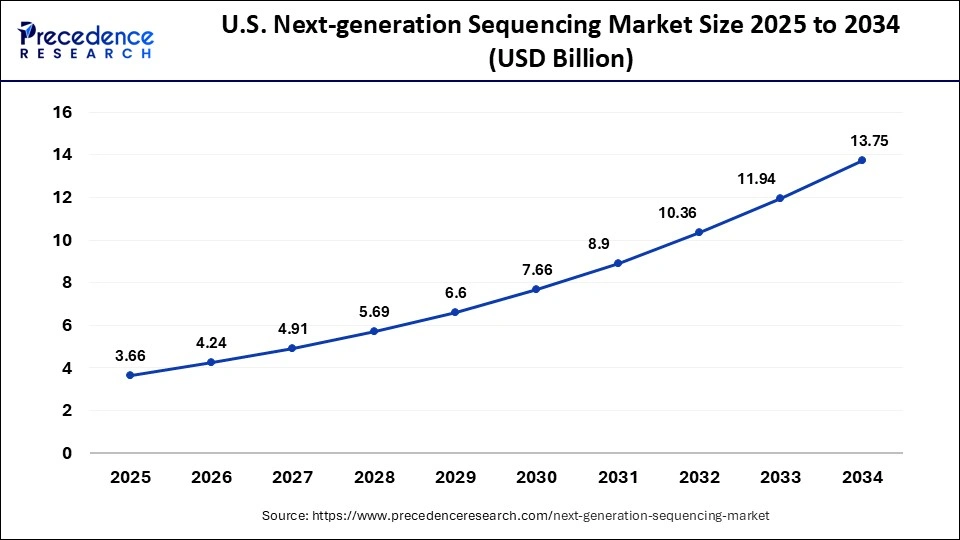

U.S. Next-generation Sequencing Market Size in 2025 to 2034

The U.S. next-generation sequencing market is estimated at USD 3.66 billion in 2025 and is projected to expand around USD 10.36 billion by 2034, at a CAGR of 15.90% between2025 to 2034

.

U.S. Next Generation Sequencing Market Trends

The U.S. is a major contributor to the market in North America because it boasts a well-established healthcare and research ecosystem with substantial funding, widespread adoption of NGS for oncology, rare disease, and prenatal diagnostics, and a high presence of leading technology providers and diagnostic laboratories. The country's regulatory environment, including reimbursement policies and national genomics initiatives, further accelerates uptake and innovation in NGS technologies.

Based on the region, the North America segment dominated the global next-generation sequencing market in 2022, in terms of revenue and is estimated to sustain its dominance during the forecast period. The direct presence of key manufacturers, the active government support, and the rising cancer prevalence are the primary drivers of the market expansion in North America throughout the forecast period.

On the other hand, the Europe is estimated to be the most opportunistic segment during the forecast period. Due to increased research expenditure, a focus on precision pharmaceuticals, and strategic alliances, the next-generation sequencing (NGS) market in Europe is expected to grow.

What made North America the Dominant Region in the Next Generation Sequencing Market?

North America has become the dominant region in the next generation sequencing market in 2024, largely thanks to its well developed healthcare infrastructure and the presence of leading genomics companies such as Illumina and Thermo Fisher Scientific. The region benefits from strong funding for genomic research and favorable regulatory support for integrating diagnostic testing, which accelerate the adoption of NGS technologies. Furthermore, the high prevalence of chronic diseases and the demand for precision medicine are driving widespread sequencing in clinical diagnostics, reinforcing North America's leadership.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is expected to grow at the fastest rate during the forecast period, driven by strong government-supported genomics initiatives across major countries, such as large-scale population sequencing projects and precision medicine programs. Increasing incidences of cancer and genetic disorders are boosting demand for NGS tools in diagnostics and biomarker discovery throughout the region. Advances in technology, falling sequencing costs, and rising investments in bioinformatics infrastructure further fuel the market's growth in Asia-Pacific.

China Next Generation Sequencing Market Trends

China is a major contributor to the market in Asia Pacific, largely because of its extensive government backing for genomics and precision medicine initiatives, including large scale sequencing projects and substantial investments in bioinformatics infrastructure. Its vast population base and rising incidence of cancer and genetic disorders are driving strong demand for NGS testing and diagnostics.

How is the Opportunistic Rise of Europe in the Next Generation Sequencing Market?

Europe's rise in the market is being driven by robust governmental support for genomics and precision medicine initiatives, coupled with a strong academic and healthcare infrastructure that accelerates clinical adoption. The region's leadership in oncology and rare disease research is fuelling demand for targeted sequencing technologies and comprehensive diagnostics pathways. Strategic collaborations between industry, research institutes, and national health programs, along with declining sequencing costs, are creating significant opportunities for market expansion.

Latest Announcements by Industry Leaders

In October 2024, Jacob Thaysen, CEO of Illumina said, “Our customers told us they need a faster, smaller, and easy-to-use instrument, and that's what we're delivering with the MiSeq i100.”

Next Generation Sequencing Market – Value Chain Analysis

- Reagents and Consumables Production The foundation of NGS lies in high-quality reagents, enzymes, nucleotides, and library preparation kits that enable accurate sequencing reactions.

Key Players: Illumina, Thermo Fisher Scientific, QIAGEN, Agilent Technologies, New England Biolabs. - Instrument / Platform Manufacturing Sequencing instruments and platforms are developed for various throughput, read-length, and application needs, including benchtop, high-throughput, and portable sequencers.

Key Players: Illumina, Pacific Biosciences, Oxford Nanopore Technologies, BGI / MGI Tech, Element Biosciences. - Bioinformatics & Data Analysis Raw sequencing data is processed, aligned, and analyzed using bioinformatics pipelines, cloud platforms, and AI-driven tools for genome interpretation and clinical insights.

Key Players: DNAnexus, QIAGEN Digital Insights, Seven Bridges Genomics, Fabric Genomics, Partek. - Service Providers / Contract Research Organizations (CROs) NGS services include sample sequencing, clinical genomics, oncology panels, and population genomics, often outsourced to specialized CROs or sequencing centers.

Key Players: BGI Genomics, Novogene, Eurofins Genomics, Genewiz (Azenta Life Sciences), Macrogen. - Integration into Clinical & Research Applications Sequencing results are applied in precision medicine, oncology diagnostics, reproductive health, infectious disease monitoring, and agricultural genomics.

Key Players / End Users: Hospitals, academic research institutes, biotech/pharma companies, national genome programs. - Regulatory & Standards ComplianceAll NGS processes must comply with regulatory standards for clinical diagnostics, including validation, quality control, and accreditation.

Key Players: ISO, CLIA-certified labs, FDA-regulated clinical testing laboratories, CAP-accredited genomics facilities.

Key players in Next Generation Sequencing Market and their Offerings

- BGI Group – Provides comprehensive genomics solutions, including sequencing platforms, bioinformatics services, and large-scale genome projects globally.

- F. Hoffmann-La Roche AG– Offers NGS-based diagnostic assays and companion diagnostics for oncology and rare diseases.

- Pacific Biosciences of California Inc. – Develops long-read sequencing platforms that enable accurate genome assembly and structural variant detection.

- Thermo Fisher Scientific Inc. – Supplies NGS instruments, reagents, and informatics solutions for research and clinical applications.

- Agilent Technologies Inc. – Provides NGS library preparation kits, target enrichment solutions, and bioinformatics tools for genomics research.

- Precigen Inc. – Uses NGS technologies to advance precision medicine, gene and cell therapy development, and genomic research.

- Illumina Inc. – Leads in high-throughput NGS platforms, reagents, and analysis software for research and clinical genomics.

- Qiagen N.V.– Offers sample and assay technologies, including NGS library preparation and molecular diagnostic solutions.

- PerkinElmer Inc.– Supplies NGS instruments, consumables, and informatics solutions for clinical diagnostics and research.

- PierianDx Inc. – Provides NGS-based clinical bioinformatics and decision-support software for genomic medicine.

Recent Developments

- In October 2024, Illumina, a global company in DNA sequencing and array-based technologies launched the MiSeq i100 series for next-generation sequencing. The aim is to focus on speed, flexibility, and simplicity for laboratory use with worldwide availability in 2025.

- In June 2024, The Armed Forces Medical College (AFMC) in Pune inaugurated A new genome sequencing laboratory equipped with cutting-edge facilities. The new lab is equipped with Next Generation Sequencing (NGS) facilities, featuring advanced ‘Nextseq 2000' and ‘Miniseq' analysers.

- In December 2024, Unisa launched Africa's first next-generation DNA sequencing platform, the PacBio Revio, developed in collaboration with Inqaba Biotec. The aim is to advance DNA research, contribute to breakthroughs in health, agriculture, and environmental research, and develop further the areas that are critical towards Africa's development.

Segments Covered in the Report

By Product

- NGS Consumables

- Sequencing Services

- Exome & Targeted Resequencing & Custom Panels

- Whole-Genome Sequencing & De Novo Sequencing

- RNA Sequencing

- Other Sequencing Services

- Presequencing Products & Services

- Library Preparation & Target Enrichment

- Quality Control

- NGS Platforms

- Illumina

- Novaseq Systems

- Nextseq Systems

- Miseq Systems

- Miniseq Systems

- iSeq Systems

- Thermo Fisher Scientific

- ION PGM Systems

- ION Proton Systems

- ION Genestudio Systems

- Ion Torrent Genexus Systems

- Oxford Nanopore Technologies

- Pacific Biosciences

- Other Platforms

- Illumina

- Bioinformatics

- Data Analysis Services

- NGS Data Analysis Software & Workbenches

- NGS Storage, Management, & Cloud Computing Solutions

- Services for NGS Platforms

By Application

- Diagnostics

- Cancer Diagnostics

- Infectious Disease Diagnostics

- Reproductive Health Diagnostics

- Other Diagnostic Applications

- Biomarkers and Cancer

- Reproductive Health

- NIPT

- Aneuploidy

- Microdeletions

- PGT

- Newborn Genetic Screening

- Single Gene Analysis

- Personalized Medicine

- Agriculture and Animal Research

- HLA Typing/Immune System Monitoring

- Metagenomics, Epidemiology & Drug Development

- Consumer Genomics

- Others

By Technology

- whole genome sequencing (WGS)

- Sequencing by Synthesis

- Ion Semiconductor Sequencing

- Sequencing by Ligation

- Pyrosequencing

- Single Molecule Real Time Sequencing

- Others

By Workflow

- Pre-Sequencing

- NGS Library Preparation Kits

- Semi-automated Library Preparation

- Automated Library Preparation

- Sequencing

- NGS Data Analysis

- NGS Primary Data Analysis

- NGS Secondary Data Analysis

- NGS Tertiary Data Analysis

By End-use

- Academic Research

- Clinical Research

- Hospitals & Clinics

- Pharma & Biotech Entities

- Other Users

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting