What is the Molecular Diagnostics Market Size?

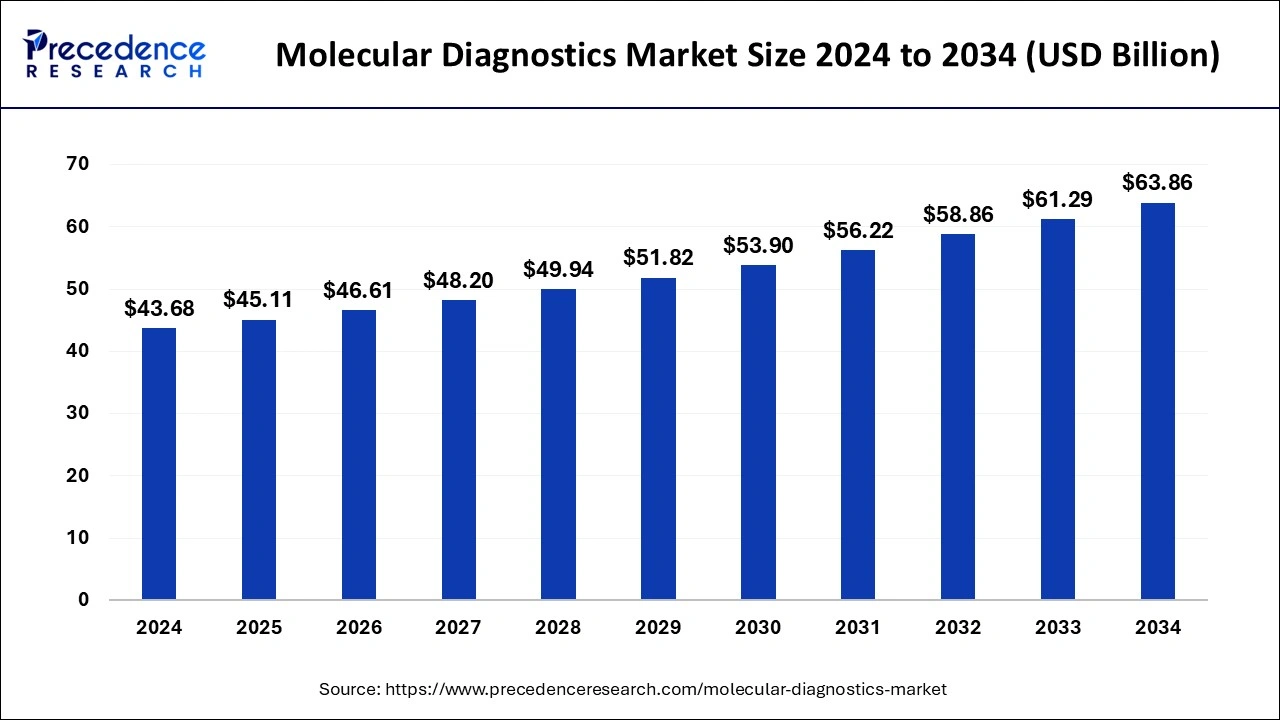

The global molecular diagnostics market size is calculated at USD 45.11 billion in 2025 and is predicted to increase from USD 46.61 billion in 2026 to approximately USD 66.34 billion by 2035, expanding at a CAGR of 3.93% from 2026 to 2035.

Market Highlights

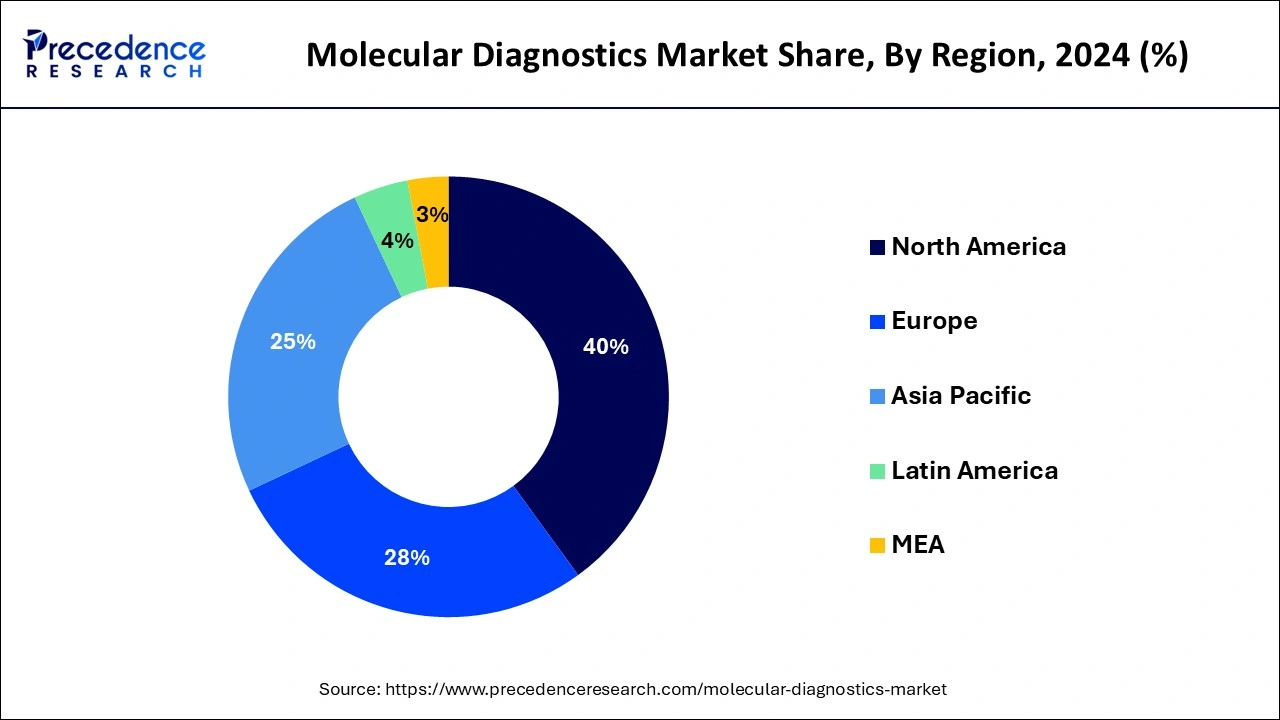

- North America market has accounted highest revenue share of over 40% in 2025.

- By region, Asia Pacific market growth is registering at a CAGR of 4.9% during the forecast period.

- By product type, the reagent segment held a 66% market share in 2025.

- By application, the infectious disease segment has reached 78% market share in 2025.

- By end user, the hospitals segment has held the largest market share in 2025.

Market Size and Forecast

- Market Size in 2025: USD 45.11 Billion

- Market Size in 2026: USD 46.61 Billion

- Forecasted Market Size by 2035: USD 66.34 Billion

- CAGR (2026-2035): 3.93%

- Largest Market in 2025: North America

- Fastest Growing Market: Asia Pacific

How is AI Influencing the Molecular Diagnostics Industry?

AI is transforming molecular diagnostics by improving precision, speed, and automation in data analysis, mainly in genomics and imaging. By leveraging machine learning along with deep learning, AI detects complex, subtle patterns in molecular information for earlier disease detection, personalized treatment planning, and enhanced diagnostic accuracy. Automated AI systems decrease human error and increase throughput in clinical laboratories.

Molecular Diagnostics Market Growth Factors

The increase in the geriatric population globally and an increase in the attracting numerous diseases has led to a growth in the market. Diseases like cancer, cardiovascular diseases, neurological disorders, diabetes and obesity which could be linked to the rising geriatric population is driving the growth of the market. An increase in the incidence of infectious diseases is expected to propel the market growth.

Increase in various other diseases like HIV, HPV and STI shall help in expanding the market. There is an increase in the initiatives taken by the major market players in order to improve the access to various cost-effective resources that they offer. Infections are anticipated to drive the molecular diagnostics market growth during the forecast period till the year 2033. There is an acute and effective result generation in the molecular diagnostic tests and it has indispensable application in many disease diagnostics. These molecular tests or associated with high prices.

Factors like the technological advancements, rising elderly population and the increase in demand for genetic testing is creating great opportunities for the growth of this market. Also, an increase for self-testing diagnostic and the awareness among the patient about these faster diagnostics is creating a great growth.

Market Outlook

- Start-up Ecosystem: The startup growth is accelerating in at-home settings, and contributing to the molecular diagnostics sector shift from centralised expensive laboratories to decentralised POC. The startups are establishing battery-operated, portable devices that incorporate isothermal amplification to serve the results in an hour, avoiding high-cost cyclers.

- Industry growth overview:The industry growth in the molecular diagnostics sector is witnessing a major transformative growth in 2025, determined by the extension of decentralised testing, increased technological advancements and transition towards personalised drugs.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 45.11 Billion |

| Market Size in 2026 | USD 46.61 Billion |

| Market Size by 2035 | USD 66.34 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 3.93% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Test Location, Technology, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Market Drivers

Rising requirement for cancer diagnostics

According to the National Institutes of Health's projection, there will be approximately 1,958,310 cancer cases in the United States in 2023. This number of rising cases of cancer brings demand for early diagnosis of cancer across the globe. Molecular diagnostics plays a crucial role in the early detection of cancer. Molecular diagnostics identify cancer-related biomarkers at an early stage, healthcare providers can diagnose cancer before symptoms arise, leading to earlier treatment initiation. Cancer continues to be a leading cause of morbidity and mortality across the globe, as the cancer cases increase, the demand for accurate and precise diagnostic method also grows. This element is observed to pose a driver for the market.

Development of precision medicine

Precision medicine focuses on tailoring medical treatments and interventions to individual patients based on their unique genetic makeup, lifestyle, and environmental factors. Molecular diagnostics play a crucial role in this approach by enabling the identification of specific biomarkers, genetic mutations, and gene expression patterns that can guide treatment decisions for each patient. Molecular diagnostics have become an essential component of the drug development process. Companion diagnostics are tests used to identify patients who are most likely to respond positively to a particular treatment. By identifying suitable candidates for specific therapies, companion diagnostics help pharmaceutical companies improve the success rates of clinical trials and streamline the drug development process. Thereby, drives the growth of the market.

Market Restraints

Presence of alternative diagnostic methods

Alternative diagnostic methods, such as traditional laboratory tests or imaging techniques, may already be established and widely accepted in the medical community. When molecular diagnostics compete with these existing methods, it can be challenging to gain market share and acceptance, especially if the alternatives are perceived as more cost-effective or easier to implement. Molecular diagnostics often involve sophisticated technologies and specialized equipment, making them more expensive than some conventional diagnostic methods. This cost factor can hinder their adoption, especially in resource-limited settings where healthcare facilities may not have the financial means to invest in expensive molecular diagnostic infrastructure. Thus, the presence of alternative testing methods in the market creates a restraint for the market.

Stringent regulatory policies

Stringent regulatory requirements act as barriers to entry for new entrants in the molecular diagnostics market. As a consequence, established companies with already approved products may have a competitive advantage, making it difficult for newcomers to gain a foothold. Regulatory agencies often work closely with healthcare payers to determine the coverage and reimbursement of molecular diagnostic tests. Uncertain or restrictive reimbursement policies can create financial uncertainties for companies, affecting their willingness to invest in research and development, market expansion, or product improvement. Such policies or guidelines are observed to hamper the market's expansion.

Market Opportunity

Rising focus on less-invasive testing methods

Less invasive testing methods can enable earlier detection and continuous monitoring of diseases, leading to better treatment outcomes and overall patient management. Patients often prefer non-invasive or minimally invasive procedures as they are less painful, have shorter recovery times, and reduce the risk of complications. The aging population is more prone to chronic diseases that require frequent monitoring, making less invasive testing methods particularly beneficial for this demographic. Molecular diagnostics has enabled the development of blood tests that can detect specific genetic, or protein markers associated with various diseases. These tests can provide valuable information without the need for invasive procedures, making them more appealing to both patients and healthcare providers. Thus, the rising demand for less invasive testing methods creates significant opportunities for the molecular diagnostics market.

Market Challenge

Data safety challenges

Molecular diagnostics heavily rely on the analysis and sharing of sensitive genomic information, data privacy and security becomes critical issues. The rise in cyberattack and data breaches to personal health information could deter patients and healthcare providers from embracing molecular diagnostics technologies. Concerns about how companies handle, or store genetic data might also deter users, patients or consumers from adopting such services. All these factors associated with data safety concerns create a significant challenge for the market.

Segments Insights

Product Insights

The reagent segment had the largest market share until 2025. The revenue share of the reagents segment is expected to maintain its dominance in the coming years. The segment is expected to grow during the forecast period as it is widely adopted in many research and clinical settings. Standard reagents are effective in achieving efficient and extremely accurate results.

Due to the standardization of these results, improved efficiency and the cost-effective nature the segment is expected to support the growth of the market during the forecast period. In February 2022 Roche Diagnostics extended the COVID test portfolio to new cobas 5800 system in the countries that accept the CE mark approval.

Location Insights

The central laboratories had the largest market share in the recent years. In the future the central laboratory segment is expected to grow as there are high procedure volumes for COVID testing in these laboratories. An increasing number of initiatives that are taken by the government to provide different services like reimbursement for these diagnostics test is another factor that is helping in the growth of this market. There is a growing demand in the development of molecular diagnostic platforms which can also be used in POC settings. Many major market players are designing the molecular diagnostic platforms. The growing development of this platform will offer quick POC results which are expected to provide a boost to the market.

Application Insights

The infectious diseases segment accounted for the largest revenue share in the molecular diagnostics market. Due to the use of the tests for the diagnosis of COVID-19 the infectious diseases segment dominated the market. In the coming years the oncology segment is expected to drive the market.

The oncology segment is expected to have a high CAGR during the forecast period. About 19.3 million cancer cases were diagnosed across the globe in the year 2020 in order to provide better access and the improvement in the oncology molecular diagnostics the British in vitro diagnostics association along with NHS England developed a commissioning framework for molecular diagnostics in oncology.

Technology Used Insights

The use of PCR technology to detect various infectious diseases or genetic diseases is expected to drive market growth. The polymerase chain reaction segment had the largest revenue till the year 2025 due to its use in the detection of COVID-19 and other infectious diseases in the recent years. DNA sequencing processes and technologies are integrally linked to novel drug development, drug discovery and personalized medicine.

Regional Insights

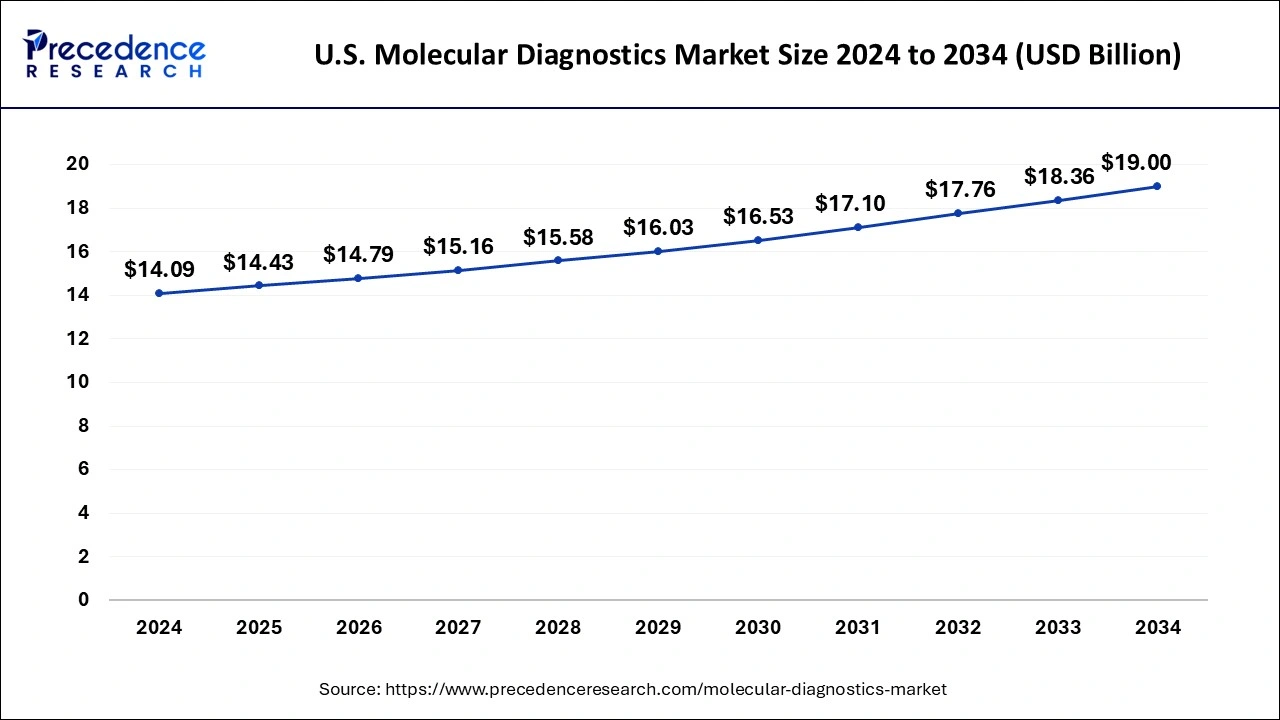

U.S. Molecular Diagnostics Market Size and Growth 2026 to 2035

The U.S. molecular diagnostics market size is estimated at USD 14.43 billion in 2025 and is expected to reach around USD 19.61 billion by 2035, growing at a CAGR of 3.11% from 2026 to 2035.

North America holds the dominating share in the molecular diagnostics market. The region has a relatively high prevalence of chronic diseases such as cancer, cardiovascular diseases, and infectious diseases. Molecular diagnostics play a crucial role in the early detection, diagnosis, and monitoring of these conditions, driving the market's growth.

North America is a hub for technological innovation and research in the field of molecular diagnostics. The region is home to many leading biotechnology and diagnostic companies that drive the development and commercialization of cutting-edge molecular diagnostic technologies. North America has one of the highest healthcare expenditures globally. The substantial investment in healthcare infrastructure, research, and development facilitates the adoption of advanced diagnostic technologies, including molecular diagnostics.

U.S. Molecular Diagnostics Market Trends

The U.S. market is driven by the rapid growth of oncology diagnostics and a change toward point-of-care testing and automated, high-throughput systems in labs. Increased acceptance of next-generation sequencing, digital PCR, and even non-invasive liquid biopsy techniques is improving diagnostic accuracy and allowing earlier, more personalized treatment.

How is Europe advancing the Molecular Diagnostics Market?

Europe is the fastest growing market for the molecular diagnostics market with a significant CAGR during the forecast period, driven by the increasing need for personalized treatment, widespread implementation of advanced diagnostic tools, and supportive governmental policies. The growing prevalence of cancer, infectious diseases, and genetic disorders has spurred the adoption of molecular testing technologies. Significant investments in research and development, a well-established healthcare system, and rising awareness among patients and healthcare practitioners further propel this progress. Nations such as Germany and the UK are at the forefront of innovation in precision diagnostics, whereas EU regulatory harmonization is facilitating cross-border market growth.

Europe has advanced the market, and it's still ongoing with the major expansion of point-of-care (POC) potential, increased automation and a transitional shift towards personalised medicines. The European labs are largely adopting the end-to-end systems that can streamline over 1000 results by the end of the day.

The special and popular AI technology is also equipped with suitable operations to leverage clinical decision making and primer/probe design. The growth hubs in Poland and Germany hold the highest advancement rate. Europe's beating cancer plan is a crucial policy driver, mainly funding the ‘Cancer Diagnostic and Treatment for All' project to elevate access to biomarker and NGS testing.

Germany

Germany plays a pivotal role in Europe's molecular diagnostics sector, backed by sophisticated healthcare systems and strong investments in biotech innovation. The nation prioritizes early disease identification and preventive healthcare, which boosts the demand for molecular testing. Government initiatives promoting the integration of digital health and precision medicine within clinical environments are also improving adoption rates. Moreover, collaborations between research organizations and diagnostic firms continue to speed up new product development and commercialization.

Asia Pacific Market Trends

Asia Pacific is observed to grow at a considerable growth rate in the upcoming period, driven by increased healthcare spending, a rising incidence of chronic and infectious diseases, and the expansion of diagnostic laboratories. Nations like China, India, and Japan are investing in biotechnology infrastructure and public health screening initiatives. Technological advancements in PCR, NGS, and point-of-care testing are being increasingly utilized in hospitals and diagnostic facilities. Enhanced healthcare accessibility, heightened awareness, and a large aging demographic further stimulate the regional need for accurate, timely diagnostics, positioning Asia Pacific as a crucial market for global expansion strategies.

China

China's molecular diagnostics market is quickly evolving due to substantial governmental backing, ongoing healthcare reforms, and heightened public health awareness. The demand for early disease detection tools, especially during and following the COVID-19 pandemic, has resulted in a spike in PCR and NGS-based testing. Strategic collaborations between local biotech companies and international diagnostics firms have strengthened the innovation pipeline, while a burgeoning middle class continues to drive the demand for high-quality diagnostic services.

What initiatives of Latin America are strengthening the Molecular Diagnostics Market?

Latin America's initiatives in this market so far are its national elimination plans, decentralised diagnostic networks, public-private health partnerships and regional surveillance networks. The region is initiating a decentralised automation model. The Genetics of Latin American Diversity (GLAD) and COVID-19 Regional Genomic Surveillance Network (COVIGEN) project has allowed regions to inform responses and share the detailed genomic findings on genetic predispositions and infectious diseases. This large scale collaborative projects have long helped the initiatives to flourish in the region.

Argentina Molecular Diagnostics Market Trends

The market is driven by the rising need for early detection of infectious diseases, the rising adoption of molecular tests, and a growing focus on personalized medicine. NGS panels and AI-based analysis are rapidly emerging for high-accuracy molecular diagnostics, along with oncology, with NGS projected to grow strongly. Infectious diseases, thus, represent the largest segment, while oncology or cancer biomarkers are also advancing rapidly.

Decoding Disease: The Rise of Molecular Diagnostics in MEA

MEA's market shows rapid growth during the forecast period. It is driven by the demand for early disease detection, the rising prevalence of chronic diseases, and developments post-COVID-19; the market is undergoing significant growth. Increasing incidences of cancer along with genetic disorders are driving the need for personalized medicine, which depends on molecular profiling.

Saudi Arabia Molecular Diagnostics Market Trends

Saudi Arabia's market is driven by Vision 2030. There is a high need for molecular diagnostics in detecting infectious diseases, along with handling rising cases of chronic diseases and even genetic disorders. The market is further supported by rising chronic disease incidence, a growing elderly population, and the need for early detection and personalized treatment approaches.

Value Chain Analysis

- Research and Development: The analysis involves addressing and validating the main target and development of the testing and biomarker process that is presented in action. The refining of techniques such as PCR, microarray and NGS analysis is executed and promising technical characteristics such as portability, seamless interpretation, and testing time are a race in the molecular diagnostics sector.

- Operations and Manufacturing:The operations and manufacturing analysis includes quality management for molecular components, conversion of raw materials into instruments and finished diagnostic kits. Alongside, the management of supply chain logistics for fragile biological materials is also a part of the operation.

- Outbound Logistics and Distribution:The distribution refers to the efficient systems that are circulated for transport and sample referral for conditions where POC solutions are required (tuberculosis). Accurate delivery conditions and storage for diagnostic products are essential for safe distribution.

Top Companies in the Molecular Diagnostics Market & Their Offerings

- F. Hoffmann-La Roche Ltd.: F. Hoffmann-La Roche Ltd. is a dominant contributor in the molecular diagnostics market, providing a comprehensive, integrated portfolio driven by Polymerase Chain Reaction, along with Next-Generation Sequencing technologies.

- Hologic, Inc.: Hologic, Inc. offers a comprehensive molecular diagnostics portfolio centered on its automated Panther and Panther Fusion systems, aiming on virology, women's health, and respiratory testing.

Molecular Diagnostics Market Companies

- Siemens Healthineers AG

- Quidel Corporation

- F. Hoffmann-La Roche Ltd.

- Hologic, Inc.

- Thermo Fisher Scientific, Inc.

- Danaher Corporation, Illumina, Inc.

- Becton

- Dickinson and Company

- Grifols, S.A.

- PerkinElmer, Inc.

- Abbott Laboratories

- bioMérieux SA

- QIAGEN N.V.

- Myriad Genetics, Inc.

- Agilent Technologies, Inc.

- geneOmbio Technologies Pvt. Ltd.

Key Market Developments

- In August 2024, Sysmex Corporation broadened its strategic partnership with QIAGEN to enhance genetic testing, focusing on research, development, production, clinical trials, and global sales marketing.

- In January 2023, QIAGEN revealed the introduction of its EZ2 Connect MDx platform, designed to improve its automation capabilities for sample processing. This platform will be compatible with dPCR, PCR, and other downstream applications.

- In February 2023, BD received Emergency Use Authorization from the FDA for a molecular diagnostic test that detects COVID-19, influenza A/B, and RSV. The test, which is used with the BD MAX System, delivers results in less than two hours from a single nasal or nasopharyngeal swab, enhancing testing efficiency during respiratory virus seasons.

- F. Hoffmann-La Roche Ltd. (Switzerland) announced the acquisition of TIB Molbiol (Germany) in 2021 to expand its PCR test portfolio with a wide range of assays for infectious diseases that were increasing across the globe.

- QIAGEN N.V.(Netherlands) partnered with Verogen (US) in June 2021 to broaden its portfolio in NGS technologies.

- Hologic, Inc. (US) acquired Mobidiag Oy (Finland) which is an innovator in acute care molecular diagnostic testing. This acquisition was made in the year 2021 which will aid in expanding Hologic's molecular diagnostics product portfolio.

- For high-throughput molecular testing of infectious diseases Becton, Dickinson and Company (BD) announced expansion of its BD COR system to include MX instruments in December 2021.

- Roche announced an agreement to acquire GenMark Diagnostics in march 2021 which can provide molecular diagnostic tests, which are designed for the detection of various pathogens with a single patient sample.

Segments Covered in the Report

By Product

- Instruments

- Reagents

- Services & Software

By Test Location

- Central laboratories

- Point of care

- Over the counter or self-test kits

By Technology

- Polymerase Chain Reaction (PCR)

- Isothermal Nucleic Acid Amplification Technology (INAAT)

- DNA Sequencing & Next- generation Sequencing (NGS)

- In Situ Hybridization (ISH)

- DNA Microarrays

- Others

By Application

- Infectious diseases

- COVID-19

- Hepatitis

- HIV

- CT/NG

- HAI

- HPV

- Tuberculosis

- Influenza

- Other Infectious Diseases

- Oncology

- Breast Cancer

- Colorectal Cancer

- Lung Cancer

- Prostate Cancer

- Other

- Genetic testing

- Neurological disease

- Microbiology

By End User

- Diagnostic Laboratories

- Hospitals & Clinics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting