Molecular Biology Enzymes, Reagents, and Kits Market Size and Forecast 2025 to 2034

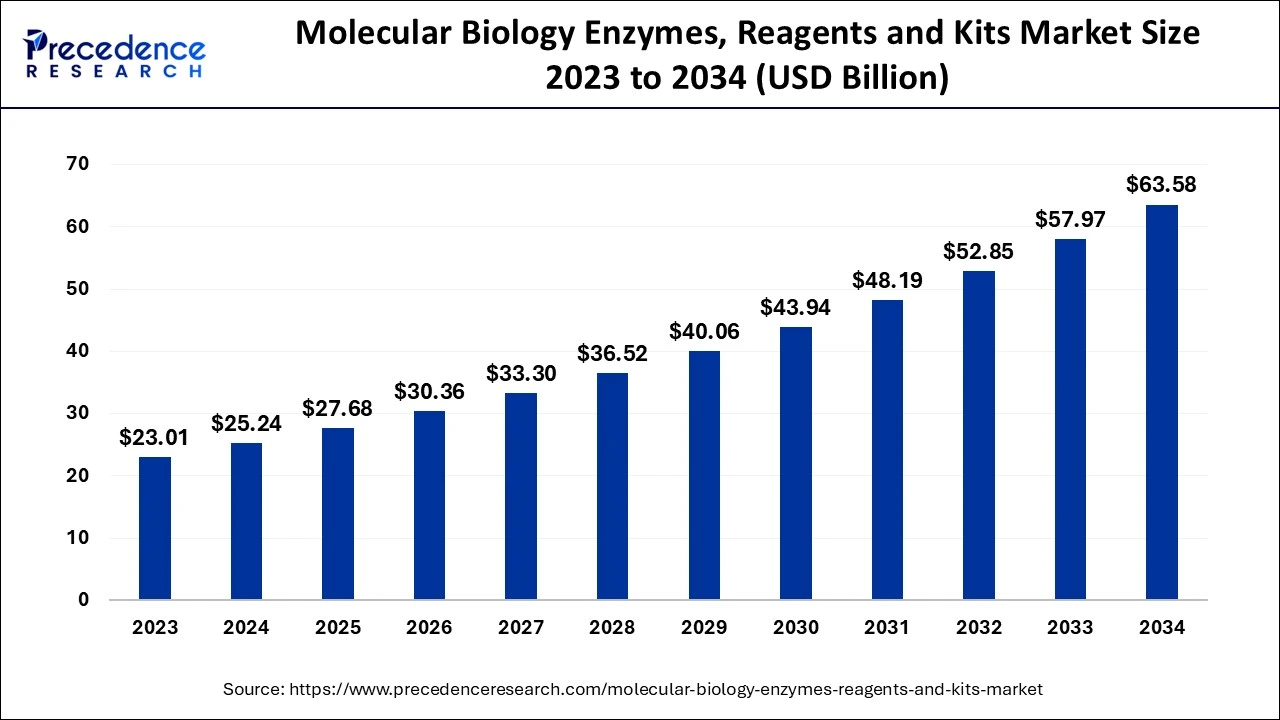

The global molecular biology enzymes, reagents, and kits market size was calculated at USD 25.24 billion in 2024 and is predicted to reach around USD 63.58 billion by 2034, expanding at a CAGR of 9.68% from 2025 to 2034. The molecular biology enzymes, reagents, and kits market is rising along with the increased genomic application, the growing need for molecular diagnostics, expectations for molecular personalized medicine, greater investment in research and development, and innovations in next-generation sequencing and automatization.

Molecular Biology Enzymes, Reagents, and Kits Market Key Takeaways

- The global molecular biology enzymes, reagents, and kits market was valued at USD 25.24 billion in 2024.

- It is projected to reach USD 63.58 billion by 2034.

- The molecular biology enzymes, reagents, and kits market is expected to grow at a CAGR of 9.68% from 2025 to 2034.

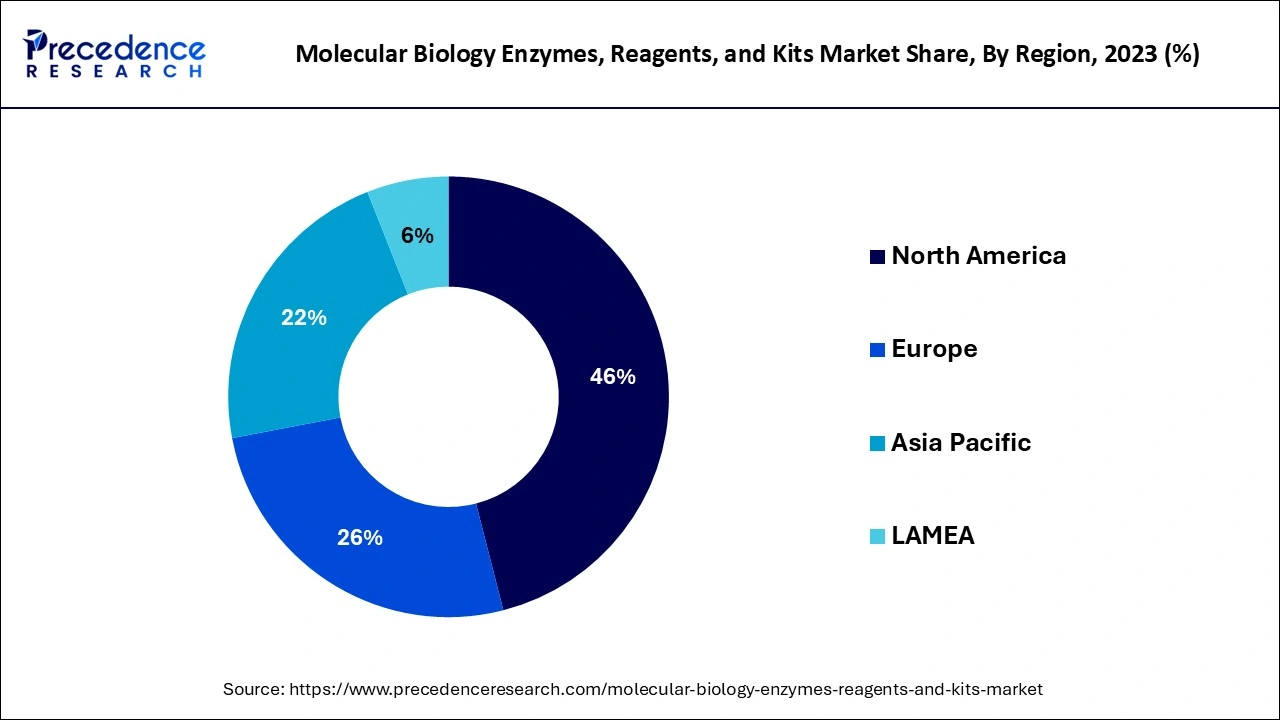

- North America dominated the global market with the largest market share of 46% in 2024.

- Asia Pacific is anticipated to witness the fastest growth during the forecasted years.

- By technique, the real-time/quantitative PCR (qPCR) segment dominated the market with a 28.4% share in 2024.

- By technique, the next-generation sequencing (NGS) segment is expected to grow at the highest CAGR of 9.6% in 2024.

- By raw material type, the enzymes segment held the largest market share of 33.7% in 2024.

- By raw material type, the chemically defined media segment is expected to grow at the highest CAGR of 8.8% in 2024.

- By end user, the clinical diagnostic laboratories segment led the market by holding 27.5% share in 2024.

- By end user, the biotech & pharma companies segment is expected to grow at the highest CAGR of 8.9% in 2024.

- By application, the clinical diagnostics segment dominated the market with a 41.2% share in 2024.

- By application, the public health and epidemiological surveillance segment is expected to grow at the highest CAGR of 9.2% in 2024.

AI Integration in the Molecular Biology Enzymes, Reagents, and Kits Market

Artificial intelligence (AI) enhances the speed of data elaboration in genomics and proteomics sectors to optimize the enzyme as well as reagents. Across the laboratories, AI improves workflow automation, such as PCR setups and high throughput screening, while decreasing variability. Meanwhile, in the synthesis of specialty reagents in targeted populations, artificial intelligence-integrated quality control systems maintain the uniformity of a reagent. However, AI helps to enhance the supply chain, making arrangements to deliver some critically sensitive products in a timely manner. It enhances innovation, reduces cost elements, and fosters diagnoses, therapeutics, and personalized medicine.

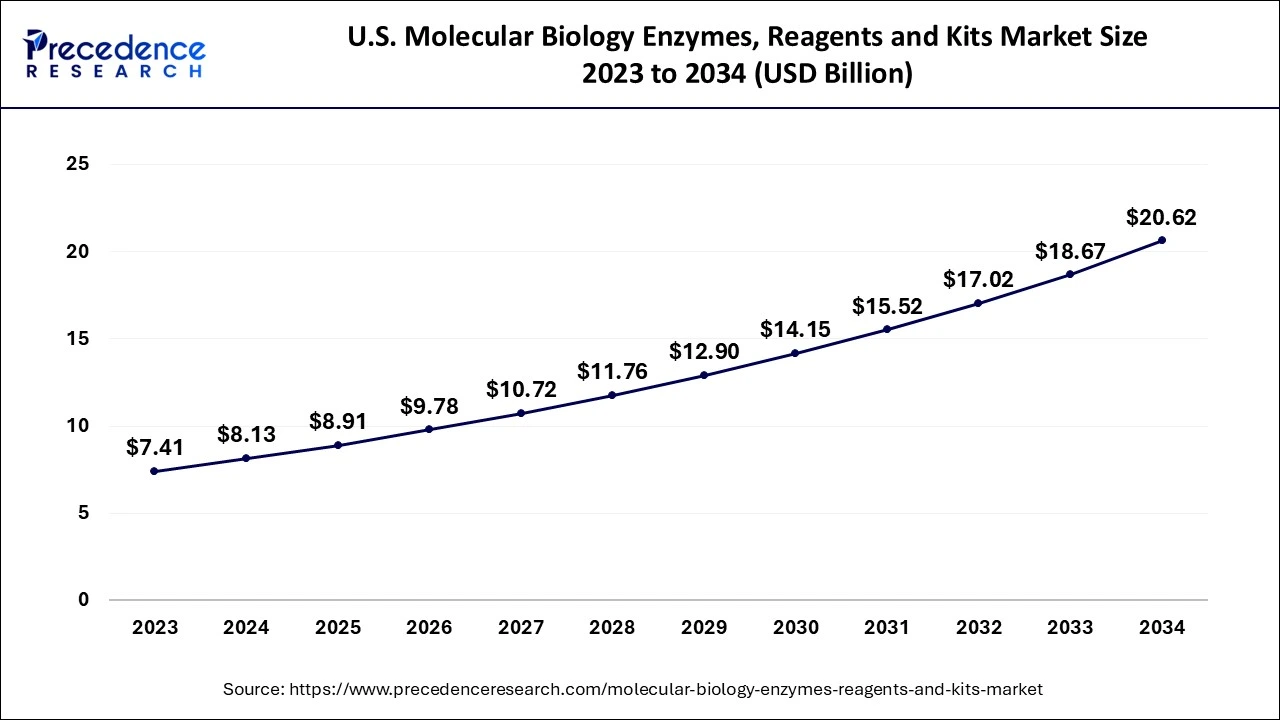

U.S. Molecular Biology Enzymes, Reagents, and Kits Market Size and Growth 2025 to 2034

The U.S. molecular biology enzymes, reagents, and kits market size was exhibited at USD 8.13 billion in 2024 and is projected to be worth around USD 20.62 billion by 2034, growing at a CAGR of 9.75% from 2025 to 2034.

North America accounted for the largest share of the molecular biology enzymes, reagents, and kits market in 2024. The main factors that contributed to the expansion of the market in North America include a strong and steady increase in research activities in genomics, the increasing growth of pharmaceuticals in North America, and awareness campaigns and activities being launched by the government and private sectors. The key drivers include the availability of industry players in the region, research institutes, government and private funding, developed healthcare infrastructure, and high adaptability of new technologies due to the growing incidence of chronic diseases such as cancer, cardiovascular diseases, rare hereditary diseases, genetic disorders, and infectious diseases, and demand for individualized therapies and new technologies in the region.

Asia Pacific is anticipated to witness the fastest growth in the molecular biology enzymes, reagents, and kits market during the forecasted years. China, India, and Japan are major players and have shown positive growth in the market, which is fuelled by the rising investment of governments in the region. The growth and the research for genomics are expected to boost the molecular biology enzymes, kits & reagents market in the forecast period. The government of India has embarked on several initiatives for the startups in the biotechnology sectors that will drive the growth of the molecular biology enzymes, kits & reagents market in the country.

Market Overview

Molecular biology enzymes, kits, and reagents are biochemical reagents that are used to perform both qualitative and quantitative analysis of DNA, RNA, and proteins. They are used in a variety of fields, including Analytical, diagnostic testing, drug discovery, and life science research. Some of these tools are DNA polymerases for DNA amplification, restriction endonucleases for cutting DNA at specific sites, and ligases to join DNA molecules, among others. This field focuses on the characteristics, roles, and controls of biomolecules, including DNA, RNA, Protein, and small molecules in cells and organisms.

Molecular biology enzymes, kits, and reagents are specialized commercial products for varied work in laboratory investigations and associated biotechnological processes in molecular biology. These integrated research activities related to consumables include molecular biology technologies, advanced research generating patterns of developing methods that have a wide application. The molecular biology enzymes, reagents, and kits market sales are also on the rise due to the rising application of bioinformatics computational genome analysis, and drug discovery.

Molecular Biology Enzymes, Reagents, and Kits Market Growth Factors

- Advancements in life sciences research: Technological advancement in genomics, proteomics, and molecular biology increase the usage of enzymes, kits, and reagents in a variety of applications.

- Rising diagnostic needs: The incidence of bacterial and viral infections, cancer, and genetic diseases requires molecular diagnostic tests.

- Increased R&D funding: The investments from the government and the private sector in life sciences and biotechnology fuel market advancement.

- Technological innovations: The establishment of new products and the upgrade in enzyme formulation increases precision and effectiveness, and this boosted the market significantly.

- Global healthcare expansion: Technological advancement in healthcare institutions of emerging economies makes them acquire molecular biology tools.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 63.58 Billion |

| Market Size in 2024 | USD 25.24 Billion |

| Market Size in 2025 | USD 27.68 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.68% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Market Dynamics

Driver

Increasing prevalence of genetic diseases

There has been an increased incidence of genetic diseases in recent years, resulting in an increase in the use of molecular diagnostics. The processes of molecular diagnostics, including epigenetics and polymerase chain reaction, require the essentials of molecular biology enzymes, kits & reagents. The global rise in the cases of inherited diseases and disorders known as genetic diseases, including Down syndrome, Sickle Cell Anemia, Turner syndrome, and chromosomal abnormalities, is also accountable for the increasing demand for molecular biology enzymes, kits & reagents. A need for innovative diagnostic tools, such as molecular cytogenetics, to guarantee accurate and timely diagnosis.

Restraint

Limited access to technology

The lack of technology to store genetic information could negatively impact the use of molecular biology enzymes, kits, and reagents. This results in the slowing down of the growth of the molecular biology enzymes, reagents, and kits market because users in some regions or institutions will not be able to have access to the technology required for the usage of the products. Molecular biology tools are limited because of expensive equipment, a shortage of skilled personnel, and limited infrastructure. Due to the absence of facilities and capital to support more technologically developed research, laboratories in developed countries or remote districts can have limited access to the necessary equipment and knowledge to use molecular biology tools proficiently.

Opportunity

Personalized treatment

The use of molecular biology enzymes, kits, and reagents makes tailored treatment a key factor in revenue enhancement. With the advancement of precision medicine in healthcare today, precision tools that facilitate the use of therapeutic interventions according to genetic, molecular, and phenotypic variation are becoming essential. Molecular biology enzymes, kits, and reagents are critical in working with individualized treatments for patients through the combination of genetic and protein profiling. These tools apply in diagnostics, drug discovery, and therapeutic target identification. These are employed in health research and diagnostics to come up with tailored treatment therapies as well as cures for conditions such as cancers, metabolic disorders, and immune disorders.

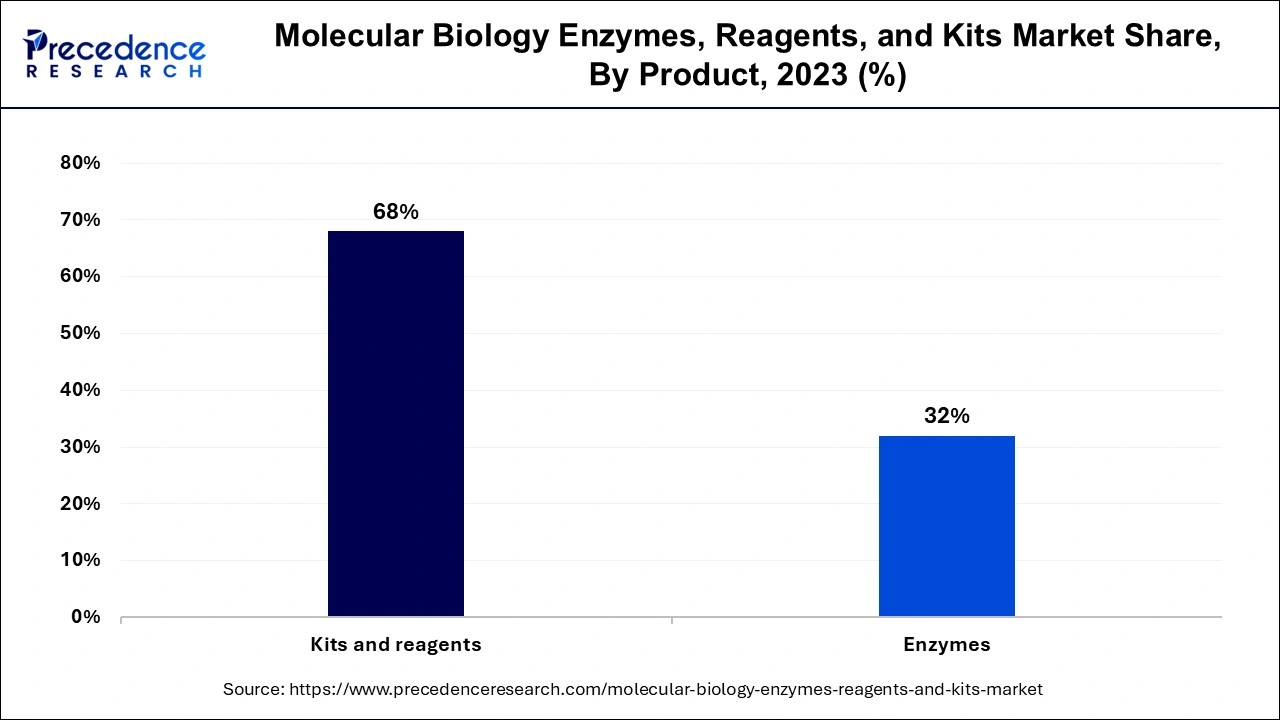

Product Insights

The kits and reagents segment noted the largest share of the molecular biology enzymes, reagents, and kits market in 2024. Molecular Biology Reagents and kits are products applied in laboratories for identifying, analyzing, synthesizing, or quantifying substances. Molecular biology kits and reagents are ready to use multi-component systems for conducting certain operations in molecular biology experiments. They can be applied to many applications, including DNA extraction, DNA purification, RNA isolation, RNA purification, and nucleic acid labeling and determination.

The enzymes segment is projected to witness the fastest growth in the molecular biology enzymes, reagents, and kits market during the forecast period. These enzymes are proteins that express importance to the field of molecular biology. They are used to isolate, characterize, and replicate genes. Due to the availability of various sources of enzymes, including ligases, polymerases, nucleases, methylases, phosphatases, and topoisomerases, cloning applications have improved. Further, to achieve excellence in the field, companies are doing more work to come up with innovative and improved enzymes.

Application Insights

The clinical diagnostics segment dominated the market with a 41.2% share in 2024. The dominance of the segment can be driven by increasing incidence of infectious and chronic diseases and innovations in technology such as AI and automation. Furthermore, the growing use of POC diagnostic products is boosting the growth of healthcare facilities, enabling diagnostics to be more accessible for patients.

The public health and epidemiological surveillance segment are expected to grow at the highest CAGR of 9.2% in 2024. The growth of the segment is owing to the innovations in digital health technology and the rise in infectious disease risks, along with the heavy government investment. The global effort to control antimicrobial resistance (AMR) has facilitated the adoption of surveillance solutions further.

End-use Insights

The clinical diagnostic laboratories segment led the market by holding 27.5% share in 2024. The dominance of the segment can be linked to the increasing chronic disease incidence, coupled with the rising demand for early disease detection. Moreover, a surge in global emphasis on preventive healthcare and the growth of healthcare infrastructure in emerging nations can drive segment growth soon.

The biotech & pharma companies' segment is expected to grow at the highest CAGR of 8.9% in 2024. Molecular biology enzymes, kits, and reagents are core products that are used extensively by pharmaceutical and biotechnology companies for drug discovery, development, and manufacture. Several enzymes, such as DNA polymerases and ligases, are widely used in molecular cloning, gene synthesis, and recombinant DNA technology for designing new receptor organisms for producing therapeutic proteins or bioactive molecules. This is because most of these molecular biology products, like PCR, sequencing, genotyping, and DNA/RNA extraction enzymes, are widely accepted to ease the workflow.

Molecular Biology Enzymes, Reagents, and Kits Market Companies

- Thermo Fisher Scientific, Inc.

- Illumina, Inc.

- Agilent Technologies, Inc.

- QIAGEN

- Promega Corporation

- New England Biolabs

- Merck KGaA

- F. Hoffmann-La Roche Ltd.

- Bio-Rad Laboratories, Inc.

- Takara Bio, Inc.

- LGC Limited

- Bausch Health Companies Inc.

Key Player Announcement

- In November 2024, Intact Genomics (IG), a molecular biology reagent company is introduced to the market with 03 unique new products to complement Recombinase Polymerase Amplification (RPA). These new additions mark a substantial step forward in delivering reliable, efficient, and user-friendly solutions for rapid nucleic acid detection. CEO of Intact Genomics Charles Wu. Said RPA technology has become a cornerstone in molecular diagnostics and genome research. By investing in new equipment and increasing productivity, we can afford to make cheaper quality products. These new offerings aim to empower scientists with the tools they need for faster and more reliable results at lower costs.

Recent Developments

- In November 2024, Takara Bio USA, Inc., introduced SmartChip ND Real-Time PCR System an automated, research-use-only high throughput qPCR solution for infectious disease. SmartChip ND is now available for order at Takara Bio USA.

- In November 2023, BioEcho Life Sciences, a company in the field of molecular biology, presented the EchoLUTION FFPE RNA Kit. In this kit, investigators are offered a clean process and great RNA for their research. The isolated RNA is made good for use in RT-qPCR thus enabling preparation of reliable results.

- In August 2023, HiMedia approved the commercial production of an Influenza PCR detection kit (MBPCR263), DNA/RNA extraction kit, and PCR reagents.

- In June 2022, Altona Diagnostics introduced the RealStar Zoonotic Orthopoxvirus PCR kit, a reagent system for real-time RT-PCR that detects zoonotic (non-variola) Orthopoxvirus species-specific DNA, including the Central and West African monkeypox virus DNA.

- In May 2022, Cipla collaborated with Genes2Me to launch a COVID-19 RT PCR testing kit, RT-Direct multiplex COVID-19 RT PCR, in the country.

Segments Covered in the Report

By Technique / Technology Type

- Conventional PCR

- Real-Time / Quantitative PCR (qPCR)

- Sanger Sequencing

- Next-Generation Sequencing (NGS)

- LAMP (Loop-mediated Isothermal Amplification)

- Other Molecular Biology Techniques (e.g., CRISPR-based diagnostics, digital PCR)

By Raw Material Type

- Enzymes

- Taq Polymerase (Standard, Hot-start, High-fidelity)

- Reverse Transcriptase (for RT-PCR/qPCR)

- Uracil-DNA Glycosylase (UDG)

- dNTPs

- Standard Mix (dATP, dTTP, dCTP, dGTP)

- dUTP (optional)

- Buffers & Additives

- PCR/RT Buffers (with/without MgClâ‚‚)

- Stabilizers (BSA, trehalose)

- Passive Reference Dyes (e.g., ROX)

- Additives & Enhancers (DMSO, betaine, RNase Inhibitors)

- Primers & Probes

- Custom Primers

- Hydrolysis Probes (e.g., TaqMan)

- Intercalating Dyes (e.g., SYBR Green)

- Sequencing-Specific Reagents

- Adapters, Indexes, Library Prep Kits

- Nucleic Acid Purification Kits

- Flow Cells, Beads, Polymerases for Sequencing

- LAMP-Specific Components

- Bst DNA Polymerase

- Loop primers, dNTPs, Colorimetric dyes

- Others

By End-User

- IVD Kit Manufacturers

- Conventional PCR

- Real-Time / Quantitative PCR (qPCR)

- Sanger Sequencing

- Next-Generation Sequencing (NGS)

- LAMP (Loop-mediated Isothermal Amplification)

- Other Molecular Biology Techniques (e.g., CRISPR-based diagnostics, digital PCR)

- Academic and Research Institutions

- Conventional PCR

- Real-Time / Quantitative PCR (qPCR)

- Sanger Sequencing

- Next-Generation Sequencing (NGS)

- LAMP (Loop-mediated Isothermal Amplification)

- Other Molecular Biology Techniques (e.g., CRISPR-based diagnostics, digital PCR)

- Clinical Diagnostic Laboratories

- Conventional PCR

- Real-Time / Quantitative PCR (qPCR)

- Sanger Sequencing

- Next-Generation Sequencing (NGS)

- LAMP (Loop-mediated Isothermal Amplification)

- Other Molecular Biology Techniques (e.g., CRISPR-based diagnostics, digital PCR)

- Biotech & Pharma Companies (including R&D divisions)

- Conventional PCR

- Real-Time / Quantitative PCR (qPCR)

- Sanger Sequencing

- Next-Generation Sequencing (NGS)

- LAMP (Loop-mediated Isothermal Amplification)

- Other Molecular Biology Techniques (e.g., CRISPR-based diagnostics, digital PCR)

- CROs and CDMOs

- Conventional PCR

- Real-Time / Quantitative PCR (qPCR)

- Sanger Sequencing

- Next-Generation Sequencing (NGS)

- LAMP (Loop-mediated Isothermal Amplification)

- Other Molecular Biology Techniques (e.g., CRISPR-based diagnostics, digital PCR)

- Public Health Laboratories

- Conventional PCR

- Real-Time / Quantitative PCR (qPCR)

- Sanger Sequencing

- Next-Generation Sequencing (NGS)

- LAMP (Loop-mediated Isothermal Amplification)

- Other Molecular Biology Techniques (e.g., CRISPR-based diagnostics, digital PCR)

- Veterinary Diagnostics Labs

- Conventional PCR

- Real-Time / Quantitative PCR (qPCR)

- Sanger Sequencing

- Next-Generation Sequencing (NGS)

- LAMP (Loop-mediated Isothermal Amplification)

- Other Molecular Biology Techniques (e.g., CRISPR-based diagnostics, digital PCR)

- Agriculture & Breeding Labs (Plant & Animal Genotyping)

- Conventional PCR

- Real-Time / Quantitative PCR (qPCR)

- Sanger Sequencing

- Next-Generation Sequencing (NGS)

- LAMP (Loop-mediated Isothermal Amplification)

- Other Molecular Biology Techniques (e.g., CRISPR-based diagnostics, digital PCR)

- Others

- Conventional PCR

- Real-Time / Quantitative PCR (qPCR)

- Sanger Sequencing

- Next-Generation Sequencing (NGS)

- LAMP (Loop-mediated Isothermal Amplification)

- Other Molecular Biology Techniques (e.g., CRISPR-based diagnostics, digital PCR)

By Application Type

- Clinical Diagnostics

- Infectious Disease Detection (e.g., viral, bacterial, fungal pathogens)

- Oncology Diagnostics (mutation detection, fusion gene analysis)

- Genetic & Rare Disease Testing (carrier screening, newborn screening)

- Pharmacogenomics (drug response analysis)

- COVID-19 and Respiratory Pathogen Panels

- Antimicrobial Resistance (AMR) Monitoring

- Research Applications

- Gene Expression Analysis

- SNP Genotyping and Mutation Detection

- Copy Number Variation (CNV)

- Epigenetic Analysis (e.g., methylation studies)

- Gene Editing Validation (e.g., CRISPR screening, knockout confirmation)

- Transcriptomics (RNA-seq prep)

- Single-cell Analysis (scRNAseq prep workflows)

- Industrial & Biopharma R&D

- Biologic Drug Development (biosimilar screening, vector verification)

- Cell Line Development (transgene integration analysis)

- Viral Load Quantification in Bioprocessing

- Contamination Monitoring (Mycoplasma, endotoxins, etc.)

- Companion Diagnostic Development

- Vaccine Development (pathogen characterization, strain identification)

- Public Health and Epidemiological Surveillance

- Outbreak Tracing & Monitoring (e.g., SARS-CoV-2 variants, flu strains)

- Wastewater Surveillance

- AMR Surveillance Programs

- Travel-related Pathogen Detection

- Agricultural and Environmental Applications

- Plant Genotyping & Marker-Assisted Selection

- Trait validation (e.g., drought resistance, yield genes)

- GMO Screening

- Animal Breeding & Livestock Genotyping

- Pedigree mapping, trait selection

- Veterinary Pathogen Detection

- Animal disease surveillance (avian flu, swine fever, etc.)

- Food Safety Testing

- Microbial contamination (Salmonella, Listeria, E. coli)

- Allergen and GMO presence

- Environmental Microbial Monitoring

- Soil and water pathogen detection

- Microbiome diversity studies

- Plant Genotyping & Marker-Assisted Selection

- Forensic and Identity Testing

- DNA Fingerprinting / STR Profiling

- Human Identification and Ancestry Analysis

- Sample Authentication / Contamination Detection

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting