Molecular Biology Enzymes Market Size and Forecast 2025 to 2034

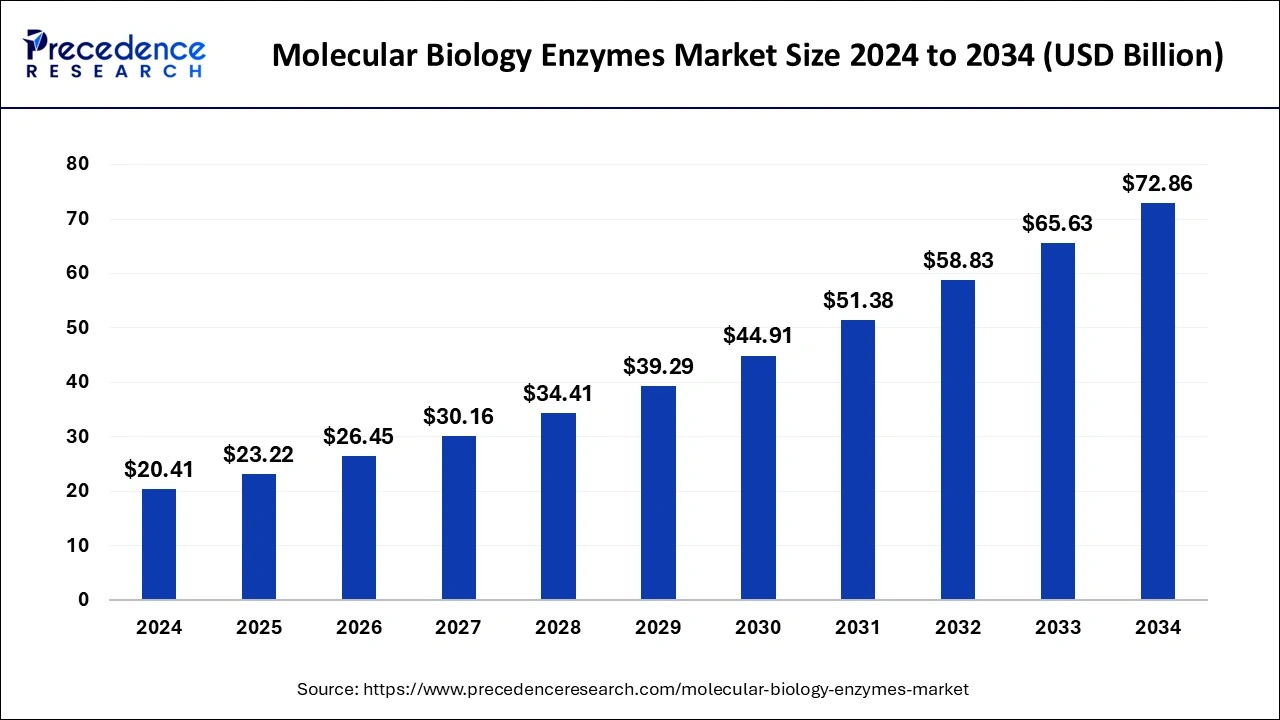

The global molecular biology enzymes market size accounted for USD 20.41 billion in 2024 and is predicted to increase from USD 23.22 billion in 2025 to approximately USD 72.86 billion by 2034, expanding at a CAGR of 13.57% from 2025 to 2034.

Molecular Biology Enzymes Market Key Takeaways

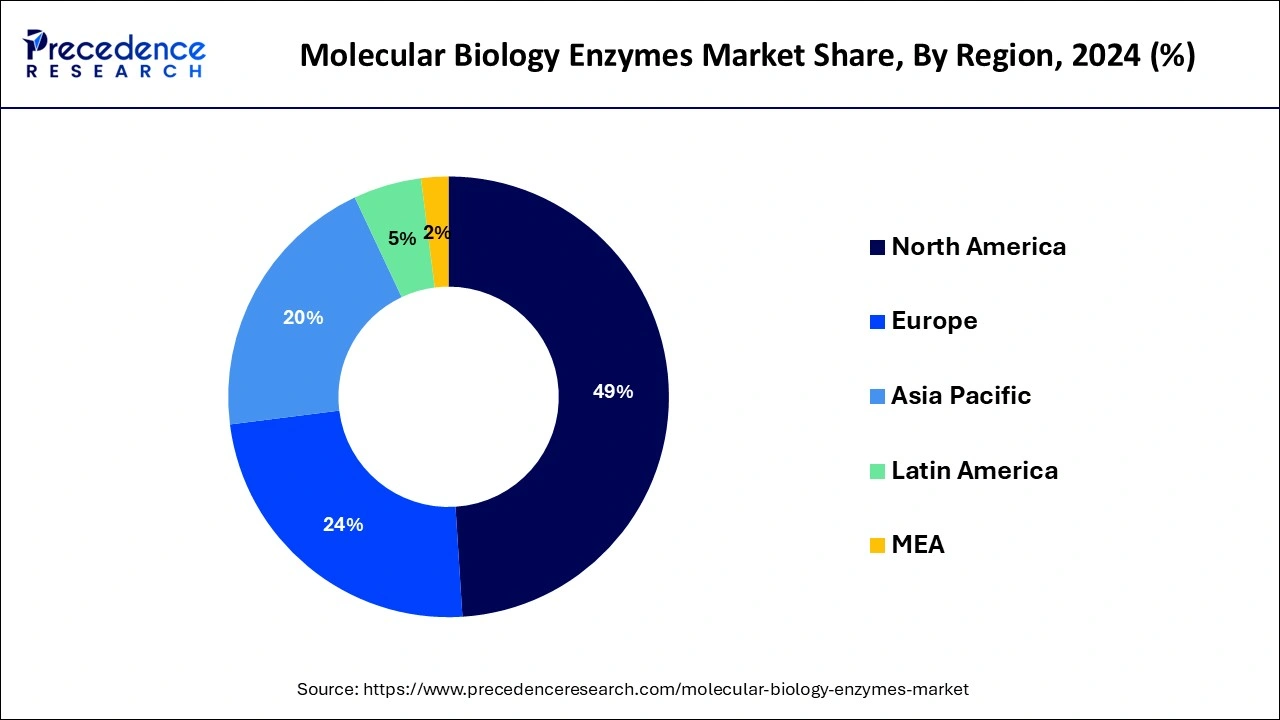

- North America contributed more than 49% of revenue share in 2024.

- Asia-Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By product, the kits segment held the largest market share in 2024.

- By product, the enzyme segment is anticipated to grow at a remarkable CAGR of 15.9% between 2025 and 2034.

- By application, the PCR segment generated over 26% of revenue share in 2024.

- By application, the synthetic biology segment is expected to expand at the fastest CAGR over the projected period.

- By end user, the research institutes segment generated over 78% of revenue share in 2024.

- By end user, the hospitals segment is expected to expand at the fastest CAGR over the projected period.

U.S.Molecular Biology Enzymes Market Size and Growth 2025 to 2034

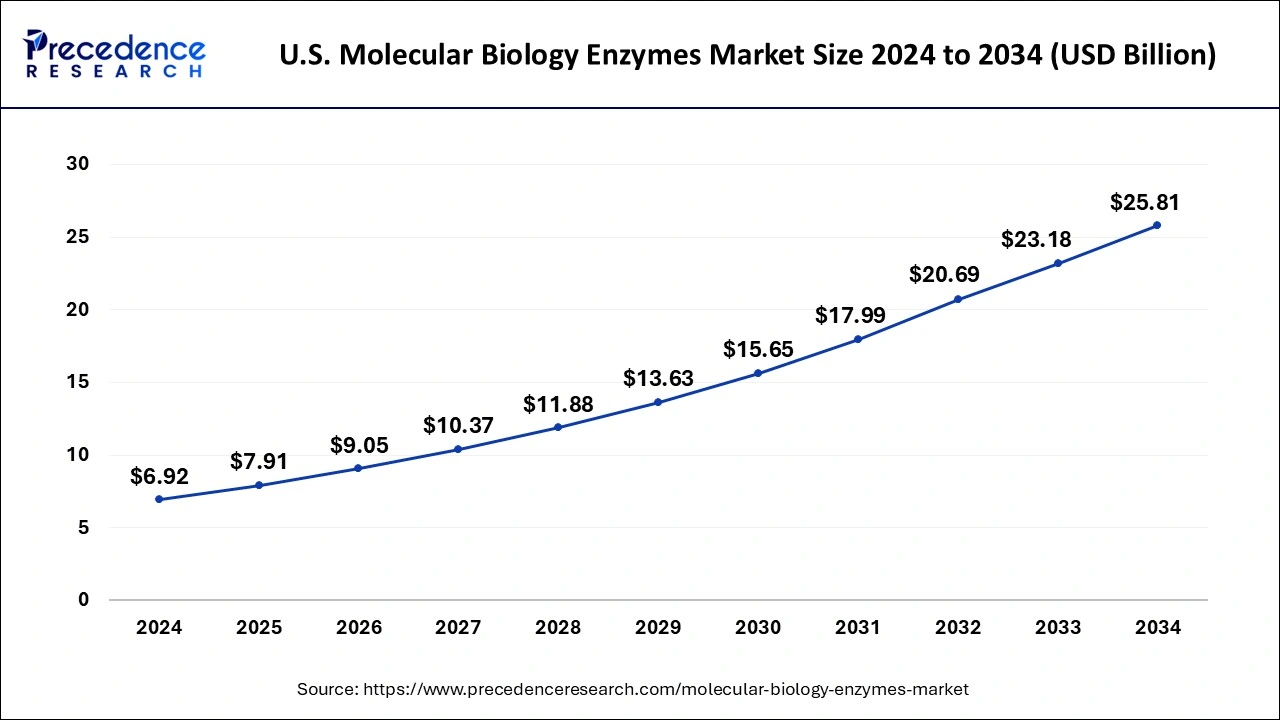

The U.S. molecular biology enzymes market size was exhibited at USD 6.92 billion in 2024 and is projected to be worth around USD 25.81 billion by 2034, growing at a CAGR of 14.07% from 2025 to 2034.

North America has held the largest revenue share of 49% in 2024. North America commands a significant share of the molecular biology enzymes market due to a robust infrastructure supporting advanced research and development in biotechnology and healthcare. The region houses prominent pharmaceutical and biotech companies, fostering innovation and enzyme adoption.

Additionally, a high prevalence of chronic diseases and a strong emphasis on personalized medicine contribute to increased demand for molecular biology enzymes. Well-established regulatory frameworks and substantial investments in life sciences research further consolidate North America's leading position in this dynamic market.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific holds a significant growth in the molecular biology enzymes market due to the increasing investment in life sciences research, expanding biotechnology sector, and rising prevalence of genetic disorders. The region's pharmaceutical and biotech industries drive demand for enzymes in drug development and bioprocessing applications.

Additionally, the growing population, coupled with advancements in healthcare infrastructure, fuels the adoption of molecular biology techniques in diagnostics and personalized medicine, contributing to the prominent market share held by Asia-Pacific.

Market Overview

Molecular biology enzymes are specialized proteins essential for managing and controlling DNA, RNA, and protein activities within cells. They play vital roles in fundamental cellular processes like DNA replication, transcription, and translation. One notable enzyme, DNA polymerase, is responsible for crafting new DNA strands during replication, ensuring the precise transfer of genetic information. Another key player, RNA polymerase, transcribes DNA into RNA, a crucial step in gene expression.

Additionally, restriction enzymes are pivotal tools in molecular biology, cutting DNA at specific recognition sites and enabling the manipulation of genetic material. Ligases, on the other hand, facilitate the joining of DNA fragments by catalyzing the formation of phosphodiester bonds. Enzymes like helicases and topoisomerases are crucial for unwinding and manipulating the structure of DNA during processes like replication and repair. Overall, molecular biology enzymes are indispensable in understanding and manipulating genetic information, forming the foundation for advances in biotechnology, genetic engineering, and medical research.

Molecular Biology Enzymes Market Growth Factors

- Growing interest in genetic engineering applications fuels the demand for molecular biology enzymes.

- Rising biopharmaceutical research relies on enzymes for DNA manipulation and protein production.

- Molecular biology enzymes play a key role in diagnostic techniques, driving demand for improved and specialized enzymes.

- The expanding biotech sector relies on enzymes for various applications, boosting market growth.

- Enzymes are critical in gene therapy, propelling the market forward as this field evolves.

- Ongoing advancements in enzyme technologies enhance their efficiency and broaden their applications.

- Growth in academic research activities, particularly in molecular biology, stimulates enzyme market expansion.

- Enzymes find applications in modifying crops, contributing to the growth of the molecular biology enzymes market.

- Increased investments in life sciences research drive the demand for molecular biology enzymes.

- Enzymes are integral to CRISPR-based technologies, boosting market growth in gene editing applications.

- Enzymes play a vital role in drug discovery and development processes, fostering market growth.

- Increasing focus on proteomics research fuels the demand for enzymes used in protein analysis.

- Growing interest in stem cell research amplifies the need for enzymes in various molecular biology applications.

- Enzymes are essential in diagnostic and therapeutic applications, driving market expansion.

- Enzymes are critical in bioprocessing, contributing to their increased demand in industrial applications.

- Intensified research in cancer biology utilizes enzymes, supporting market growth.

- Enzymes are employed in environmental monitoring applications, contributing to market expansion.

- The trend toward personalized medicine relies on molecular biology enzymes for genetic profiling.

- Enzymes play a role in researching and treating rare diseases, influencing market growth.

- The emphasis on high-quality molecular biology reagents, including enzymes, drives market growth in the life sciences sector.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 13.57% |

| Market Size in 2025 | USD 23.22 Billion |

| Market Size by 2034 | USD 72.86 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing biotechnology sector and diagnostic advancements

The expanding field of biotechnology, covering areas like medicine, agriculture, and industry, is a key driver for the molecular biology enzymes market. Enzymes, essential in genetic engineering and the development of biopharmaceuticals, see heightened demand as biotech applications diversify and grow. Simultaneously, diagnostic advancements, especially in molecular diagnostics, contribute significantly to the surge in demand for molecular biology enzymes.

These enzymes serve as critical components in the precise analysis of genetic material, supporting diagnostic tests that detect and characterize various diseases. The relentless pursuit of more accurate and efficient diagnostic tools amplifies the reliance on molecular biology enzymes, positioning them as indispensable in the rapidly evolving fields of biotechnology and diagnostics.

Restraint

Stability and storage challenges

Stability and storage challenges present significant restraints to the growth of the molecular biology enzymes market. Many enzymes exhibit sensitivity to environmental conditions, requiring specific storage conditions to maintain their efficacy. The need for stringent temperature controls and other specialized storage conditions can increase operational complexity and costs, particularly for end-users in research laboratories and industrial settings.

Moreover, these challenges may result in the degradation of enzyme activity over time, impacting the reliability of experimental outcomes and hindering the scalability of certain applications. Researchers and industry professionals often face the dilemma of balancing the demand for consistent enzyme performance with the logistical challenges of maintaining ideal storage conditions. As a consequence, the market faces limitations in reaching its full potential as stability and storage challenges constrain the seamless integration and broader adoption of molecular biology enzymes in various scientific and industrial processes.

Opportunity

Bioprocessing and industrial applications

Bioprocessing and industrial applications represent a significant growth avenue for the molecular biology enzymes market. Enzymes play a pivotal role in bioprocessing, offering sustainable solutions for various industrial applications. Their ability to catalyze specific reactions efficiently is harnessed in processes such as biofuel production, food and beverage processing, and pharmaceutical manufacturing, driving demand. The shift towards green chemistry and sustainable practices further accentuates the opportunities for enzyme utilization in eco-friendly industrial processes.

In particular, enzymes contribute to the optimization of production processes, reducing energy consumption and waste generation. Their versatility in breaking down complex substrates enhances the efficiency of bioprocessing, making those valuable tools in industries embracing bio-based alternatives. As industries increasingly prioritize environmentally conscious practices, the demand for molecular biology enzymes in bioprocessing and industrial applications is expected to grow, presenting opportunities for innovation and market expansion.

Product Insights

In 2024, the kits segment had the highest market share based on the product. In the molecular biology enzymes market, the kits segment refers to comprehensive sets of pre-packaged reagents and enzymes designed for specific molecular biology applications. These kits streamline experimental processes, offering convenience and efficiency. A notable trend in this segment includes the development of all-in-one kits for applications like DNA/RNA extraction, PCR, and cloning. Such kits, often tailored for specific research needs, reduce laboratory workflow complexities, minimize errors, and cater to the increasing demand for user-friendly solutions in molecular biology research and diagnostics.

The enzyme segment is anticipated to expand at a significant CAGR of 15.9% during the projected period. In the molecular biology enzymes market, enzyme segments encompass a diverse range, including DNA polymerases, RNA polymerases, ligases, and restriction enzymes. DNA polymerases, crucial for DNA replication, exhibit a trend towards engineered variants with enhanced fidelity and performance.

RNA polymerases, vital for gene expression, see advancements in their utility in transcriptomics. Ligases and restriction enzymes continue to evolve with increased specificity. As the demand for precise molecular tools grows, the market anticipates further innovations and customization in enzyme products tailored to specific applications, driving segment expansion and technological refinement.

Application Insights

According to the application, the PCR segment held a 26% revenue share in 2024. Polymerase Chain Reaction (PCR) is a pivotal application segment in the molecular biology enzymes market. PCR involves enzymatic amplification of DNA, enabling researchers to replicate and analyze specific DNA segments. A notable trend in this segment is the increasing demand for high-fidelity DNA polymerases, enhancing the accuracy of DNA amplification.

Additionally, there is a growing preference for hot-start PCR enzymes, reducing non-specific amplification and improving reaction specificity. The PCR segment continues to evolve with innovations that enhance efficiency, sensitivity, and reliability in DNA amplification processes, catering to diverse research and diagnostic applications.

The synthetic biology segment is anticipated to expand fastest over the projected period. In the molecular biology enzymes market, the synthetic biology segment involves the application of enzymes in designing and constructing artificial biological systems. This includes the synthesis of novel DNA sequences, genetic circuits, and engineered organisms for various purposes. A notable trend in this segment is the increasing integration of molecular biology enzymes in creating customized biological components, contributing to advancements in fields such as biofuel production, pharmaceuticals, and sustainable materials. As synthetic biology continues to evolve, the demand for specialized enzymes tailored for these innovative applications is expected to rise.

End-user Insights

In 2024, the research institutes segment had the highest market share of 78% based on the end-user. The research institutes segment in the molecular biology enzymes market encompasses academic and research institutions utilizing enzymes for diverse molecular biology applications. As a key end-user, research institutes contribute to advancements in genetic research, drug discovery, and biotechnology.

Current trends in this segment include a growing focus on precision medicine, CRISPR-based technologies, and collaborative research initiatives, driving the demand for specialized enzymes. The continuous expansion of academic and research collaborations further propels the utilization of molecular biology enzymes in cutting-edge scientific investigations within research institutes.

The hospitals segment is anticipated to expand fastest over the projected period. In the molecular biology enzymes market, the hospitals segment refers to healthcare institutions utilizing enzymes for diagnostic applications, genetic testing, and personalized medicine. The trend in hospitals involves an increasing reliance on molecular biology enzymes for precise genetic profiling, disease diagnosis, and therapeutic monitoring. As hospitals strive to enhance patient care through advanced molecular diagnostics, the demand for these enzymes is driven by their crucial role in supporting accurate and personalized medical interventions within the healthcare setting.

Recent Developments

- In February 2021, Thermo Fisher made a strategic move by acquiring Mesa Biotech, a step aimed at expanding its Life Sciences Solutions business segment. This acquisition is projected to significantly boost the segment's revenue, with an expected increase of around USD 200 million in 2021. Thermo Fisher's decision to integrate Mesa Biotech aligns with its commitment to enhancing capabilities and offerings in the life sciences domain.

Molecular Biology Enzymes Market Companies

- Thermo Fisher Scientific Inc.

- New England Biolabs

- Merck KGaA

- Illumina, Inc.

- Qiagen

- Agilent Technologies, Inc.

- F. Hoffmann-La Roche Ltd.

- Promega Corporation

- Takara Bio Inc.

- Bio-Rad Laboratories, Inc.

- NEB (New England Biolabs)

- GenScript Biotech Corporation

- Affymetrix (acquired by Thermo Fisher Scientific)

- Bruker Corporation

- Enzymatics (acquired by Qiagen)

Segments Covered in the Report

By Product

- Kits

- Reagents

- Enzyme

By Application

- PCR

- Sequencing

- Epigenetic

- Synthetic Biology

By End-User

- Research Institutes

- Pharma & Biotech Company

- Hospitals

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content