What is the Diabetes Devices Market Size?

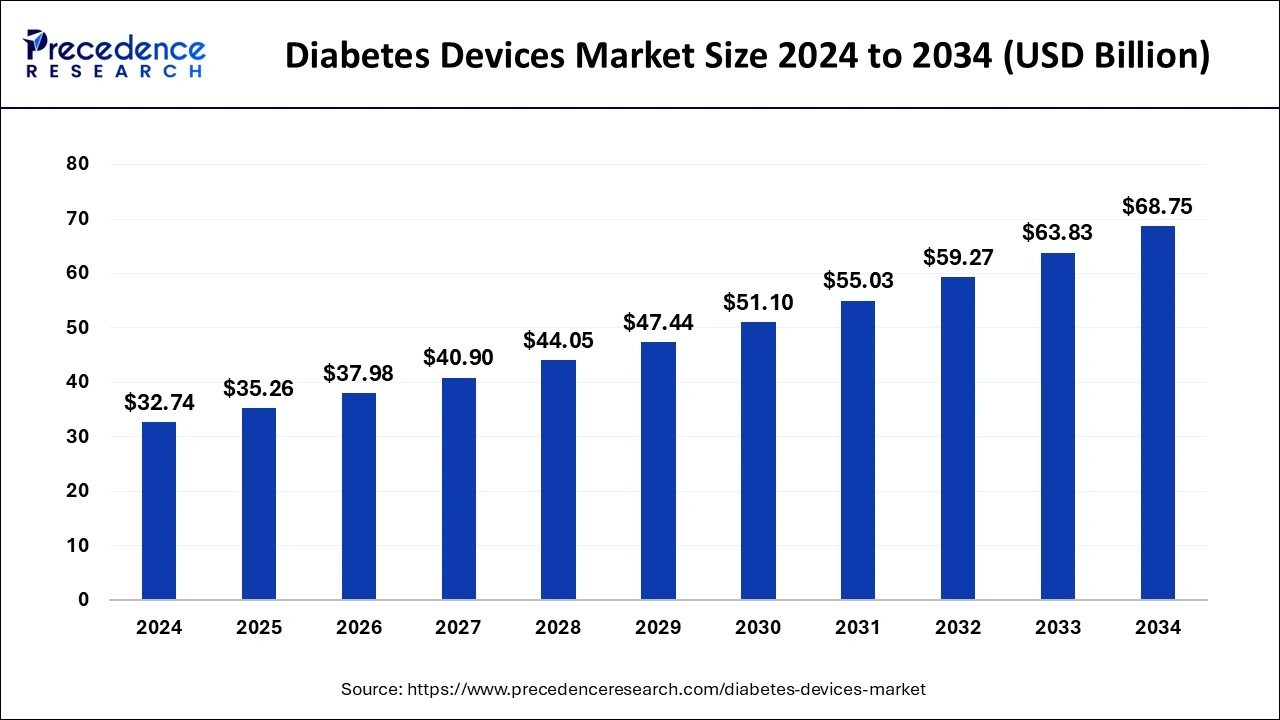

The global diabetes devices market size is accounted at USD 35.26 billion in 2025 and predicted to increase from USD 37.98 billion in 2026 to approximately USD 68.75 billion by 2034, representing a CAGR of 7.7% from 2025 to 2034.

Diabetes Devices Market Key Takeaways

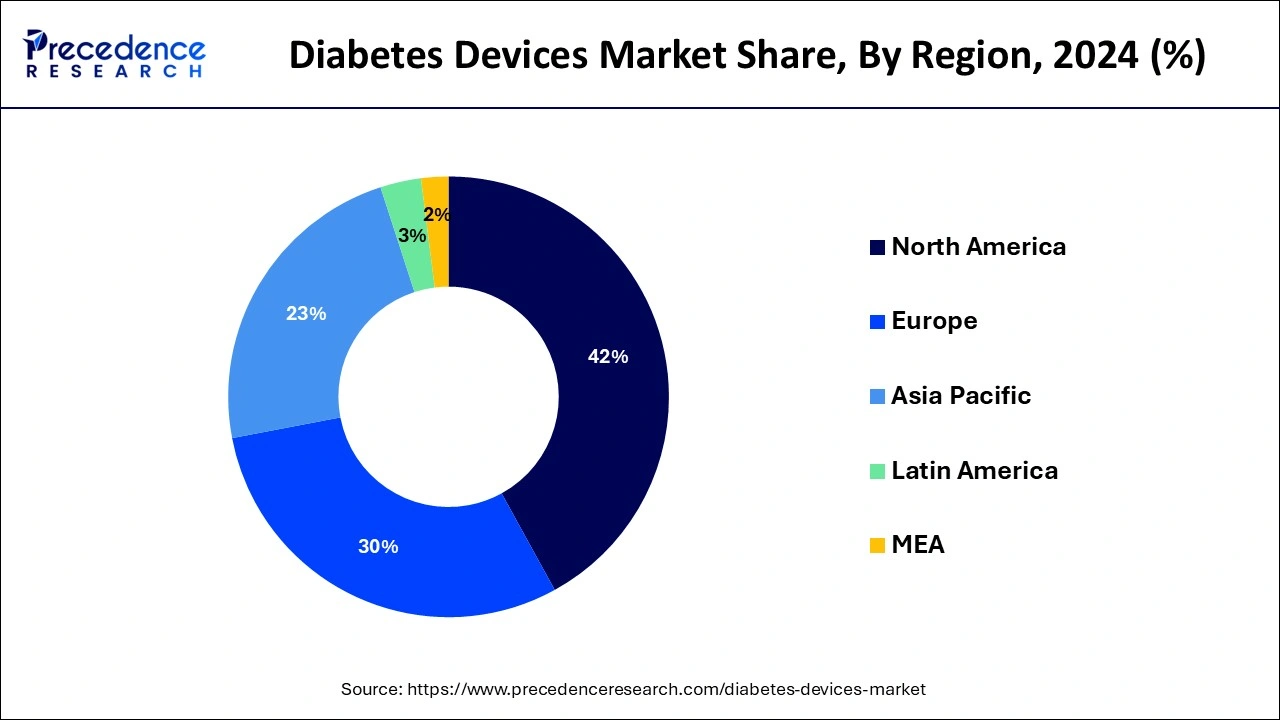

- North America region accounted highest market share of over 42% in 2024.

- By type, the insulin delivery devices segment generated a 57% revenue share in 2024.

- By distribution channel, the hospital pharmacies segment hit 54.5% revenue share in 2024.

- By end user, the hospital segment hit the highest market share of over 42% in 2024.

Connected Care: Wearables, AI, and the New Era of Diabetes Management

The diabetes devices market is notable because it offers essential tools for managing diabetes, a worldwide health concern affecting millions. Diabetes devices authorize individuals to take control of their health as well as live more independently. Improved blood sugar control along with reduced risk of complications led to a better quality of life. The market is undergoing significant growth because of the increasing prevalence of diabetes, driven by factors such as poor dietary habits, sedentary lifestyles, and increasing obesity rates.

- In February 2024, DexCom, Inc., a worldwide leader in real-time continuous glucose monitoring (CGM) for individuals with diabetes, declared the launch of its latest CGM system, Dexcom ONE+.

How is AI Enhancing the Diabetes Devices Industry?

In the modern healthcare industry, integrating artificial intelligence with wearable devices along with smart home systems has transformed the monitoring of physiological parameters for individuals with diabetes. AI technology permits real-time monitoring of vital indicators like blood glucose levels, blood pressure, and heart rate. The system immediately drives alerts upon detecting abnormalities, encouraging patients and healthcare professionals to take appropriate actions. This real-time monitoring approach has remarkably improved efficiency along with the precision of diabetes management.

Furthermore, AI can modify the dosing accuracy in real-time in drug selection along with dosing. Research has indicated that AI can aid insulin usage in diabetes care, which includes smart insulin pens together with artificial pancreases. Smart insulin pens, associated to mobile devices through Bluetooth, improve dose accuracy and enhance patient compliance.

AI-based telemedicine and health management platforms offer diabetes patients more convenient along with personalized service experiences, significantly improving patient engagement and treatment adherence. Patients can now hold the health status along with treatment progress in real-time, which is more effective partnership with healthcare teams in diagnostic and treatment activities.

Market Outlook

- Industry Growth Overview: The diabetes devices market is growing, driven by increasing worldwide prevalence of diabetes, incessant technological developments, and growing demand for remote and self-management medical care. The trend towards home-driven and self-management services.

- Global Expansion: The Diabetes Devices Market is expanding globally, driven by the increasing global prevalence of diabetes, important technological advancements, and an increasing demand for home-driven, self-management services. North America presently holds the largest market share, as it has an advanced infrastructure and a growing prevalence of diabetes.

- Major investors:Major investors in the diabetes devices sector include a combination of large medical tools and pharmaceutical companies that invest strategically in R&D and partnerships, and specialized venture capital firms and institutional investors.

Diabetes Devices Market Growth Factors

The growing prevalence of diabetes among the global population is the primary factor driving the global diabetes devices market. Furthermore, rising prevalence of obesity among the population, growing health consciousness, increasing awareness regarding diabetes, technological advancements in the diabetes monitoring devices, easy availability of diabetes devices, and rising personal disposable income are the key factors driving the demand for the diabetes devices across the globe. Obesity and unhealthy eating habits are the major reasons for the growing cases of diabetes. Moreover, growing geriatric population is another major factor leading to the growth of diabetes cases. According to the World Health Organization (WHO), around 422 million of the global population were suffering from diabetes. Diabetes is rising at a significant pace in the underdeveloped and developing nations. This is because of the low disposable income and less awareness regarding the availability of diabetes devices in the developing and under developed nations.

Around 1.5 million deaths were directly linked to diabetes in 2019, as per WHO. In 2012, around 2.2 million deaths were caused by high blood sugar levels. Diabetes causes kidney failure, blindness, stroke, and heart attacks. Therefore, rising awareness amongst the population regarding the various ill-effects of diabetes encourages them to acquire diabetes devices in order to keep a check on their blood glucose levels regularly and control diabetes. This is a major factor propelling the growth of the diabetes devices market across the globe.

- The growing prevalence of diabetes among the global population is the primary factor driving the global diabetes devices market.

- Furthermore, rising prevalence of obesity among the population, growing health consciousness, increasing awareness regarding diabetes, technological advancements in diabetes monitoring devices, easy availability of diabetes devices, and rising personal disposable income are the key factors driving the demand for diabetes devices across the globe.

- Obesity and unhealthy eating habits are the major reasons for the growing cases of diabetes. Moreover, a growing geriatric population is another major factor leading to the growth of diabetes cases.

Diabetes Devices Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 35.26 Billion |

| Market Size in 2026 | USD 37.98 Billion |

| Market Size by 2034 | USD 68.75 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.7% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Distribution Channel, End User, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Market Dynamics

Drivers

How are the increased awareness of diabetes management and the availability of telehealth options the driving forces for the diabetes devices market?

Increased awareness of diabetes management and the growing adoption of telehealth are key drivers for the diabetes devices market. This is because these factors uplift greater patient engagement in self-management along with improved access to care, leading to increased need for diabetes monitoring along with treatment devices. Increased awareness contributes to earlier diagnosis of diabetes, which raises the need for monitoring devices such as continuous glucose monitors (CGMs) and blood glucose meters. Telehealth platforms usually integrate with numerous diabetes management devices, such as CGMs and smart insulin pens, permitting seamless data transfer and remote monitoring.

Restraint

Why is a lack of awareness the restraint for the diabetes devices market?

A lack of awareness, particularly in emerging economies, is a significant restraint on the diabetes devices market. This is because limited awareness about diabetes diagnosis and treatment alternatives, including the advantages of advanced devices, hampers market growth. The consequences of limited knowledge are significant, which includes delayed diagnosis, poor disease management, along with increased risk of diabetes-related complications. This can contribute to a heavier burden on healthcare systems as well as reduced quality of life for individuals with diabetes.

Opportunity

How do innovations in diabetes care devices act as an opportunity for the diabetes devices market?

Innovations in diabetes care devices, like continuous glucose monitors (CGMs) as well as smart insulin delivery systems, are creating remarkable opportunities for market expansion by enhancing patient outcomes, improving user experience, along with expanding access to care. Innovations such as CGMs and smart insulin pumps permit more accurate and timely glucose monitoring as well as insulin delivery, contributing to better blood sugar management and lowered risk of complications. Companies are increasingly targeting on advancing digital solutions that integrate with their apparatus, creating a more connected as well as user-friendly experience for patients.

Type Insights

The insulin delivery devices segment led the market with a notable share in 2024 and will dominate over the forecast period. This is attributed to the increased adoption and convenience factor associated with the use of insulin pens and portable insulin pumps.

On the other hand, the blood glucose monitoring is estimated to fastest growing segment during the forecast period. The continuous glucose monitoring and self-monitoring blood glucose systems are the major drivers of this segment. The availability of continuous and self-monitoring devices is gaining rapid traction among the patients due to their ease of use.

Distribution Channel Insights

The hospital pharmacy segment dominated the market with a notable revenue share in 2024. This is attributable to factors such as easy availability, growing popularity of private brands, and easy availability. For this, this segment is expected to sustain its significance during the forecast period.

On the other hand, the online pharmacy is projected to be the most opportunistic segment owing to the growing penetration of internet and telemedicine services. Moreover, one day delivery formats and discounted prices will positively impact the segment growth.

End Use Insights

The hospital segment led the market with a notable revenue share in 2024. The growing number of hospitalization of diabetic patients is fueling the growth of this segment. Moreover, doctors' advice helps the patient to acquire more reliable type of diabetes devices.

On the other hand, the home care is expected to grow rapidly due to the higher adoption and easy availability of self-monitoring devices and insulin pens and pumps.

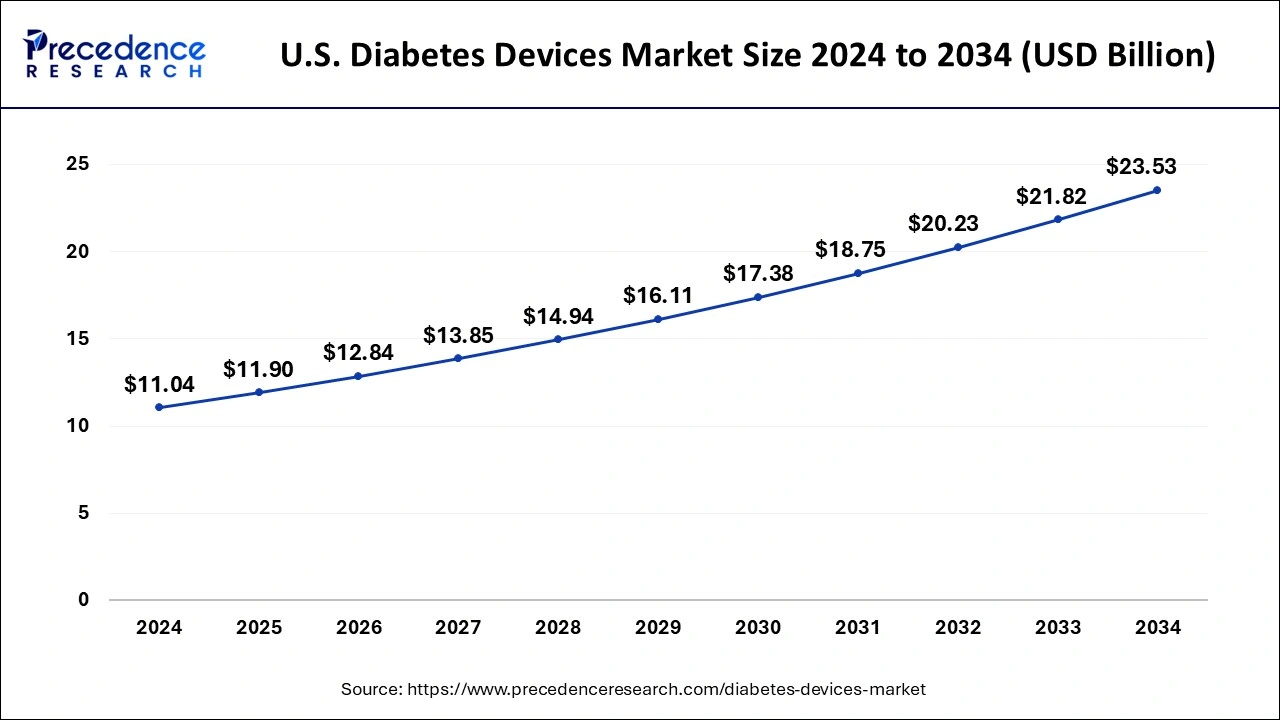

U.S. Diabetes Devices Market Size and Growth 2025 to 2034

The U.S. diabetes devices market size is valued at USD 11.9 billion in 2025 and is predicted to increase from USD 12.84 billion in 2026 to approximately USD 23.53 billion by 2034, expanding at a CAGR of 7.9% from 2025 to 2034.

Based on the region, the North America accounted largest revenue share in 2024 and is expected to sustain its dominance during the forecast period. North America was followed by Europe. The higher personal disposable income and increased healthcare expenditure in North America has exponentially contributed to the growth of the diabetes devices market in the region. Growing cases of obesity and unhealthy food habits is fueling the prevalence of diabetes in US. The higher penetration of fast food chains in North America has significantly influenced the consumption of various unhealthy fast foods and soft drinks. This is a major cause of diabetes in US. Rising health consciousness among the population and demand for diabetes monitoring devices coupled with the easy availability of advanced diabetes devices is fostering the market growth in this region.

U.S.: Presence of Key Manufacturers

In the U.S., technological advancements, a noteworthy diabetic population, and increasing healthcare investment with favorable repayment guidelines. The U.S. is a home for research and development in healthcare technology. Many of the leading worldwide manufacturers of diabetes tools and significant operations in the U.S. drive the growth of the market.

On the other hand, Asia Pacific is estimated to be the most opportunistic market. According to WHO, diabetes is rapidly increasing in low and middle-income countries. The huge and vast population of Asia Pacific provides the most lucrative growth opportunities to the vendors operating in the diabetes devices market. Therefore, rising prevalence of diabetes, rising disposable income, and increasing awareness regarding different types of diabetes devices is expected to drive the market in this region.

Vast Diabetic Population in China

In China, the presence a massive population with diabetes, a quickly growing economy, and helpful government guidelines. China's large and aging population, mutual with increasing lifestyle-related illnesses, creates a massive demand for devices. Increasing government initiatives, technological development, and the advancement of affordable products custom-made to the market, making administration more manageable.

Europe: Advancement in Fire Protection Systems

Europe is significantly growing in the market as a combination of high disease prevalence, advanced healthcare infrastructure, supportive government policies, high adoption of new technology, and the presence of major industry players and innovators. Growing awareness among patients and healthcare providers about the importance of active self-management.

Diabetes Devices Market - Value Chain Analysis

R&D: R&D process in diabetes devices involves device discovery and concept, preclinical research and prototype development and studying present technologies, and potential regulatory requirements.

- Key Players: Medtronic and Abbott Laboratories,

Clinical Trials: Clinical trials for diabetes devices, including testing their safety and efficacy through different phases, include evaluating devices like CGMs, insulin pumps, and artificial pancreas systems.

- Key Players: F. Hoffmann-La Roche

Patient Services: Patient services, including diabetes tools, are a core part of a combined management strategy, focusing heavily on education, mechanical support, and remote monitoring and consultation

- Key Players: Dexcom and Insulet Corporation

Top Vendors in the Diabetes Devices Market & Their Offerings

| Company | Headquarters | Key Strengths | Latest Info (2025) |

| B Braun Melsungen AG | Melsungen, Germany | Integrated and diverse product portfolio | In 2025, B. Braun Melsungen AG launched new products like Tromethamine Injection in EXCEL IV Container and Midazolam in 0.9% Sodium Chloride Injection, and acquired True Digital Surgery to enhance its digital microsurgery capabilities. |

| Abbott Laboratories | United States | diversified business model, a strong global presence | October 2025, Abbott, the global healthcare company, has announced the launch of AVEIR™ dual chamber (DR) leadless pacemaker system - the first of its kind in the world. |

| Bayer AG | Leverkusen, Germany | Pioneering Technology | Bayer AG no longer has a major offering related to diabetes devices |

| Medtronic Plc | Dublin, Ireland | Integrated product ecosystem and advanced automation algorithms | June 2025, Medtronic announces MiniMed as the name for the planned New Diabetes Company. |

| F.Hoffman-La-Ltd. | Basel, Switzerland | Integrated Personalised Diabetes Management (iPDM) | Accu-Chek brand of devices and the integrated digital solution mySugr |

Recent Developments

- In August 2024, Abbott declared a unique global collaboration with Medtronic to partnership on an integrated continuous glucose monitoring (CGM) system, based on Abbott's most developed, world-leading FreeStyle Libre technology that will connect with Medtronic's automated insulin delivery (AID) along with smart insulin pen systems.

- In August 2024, Medtronic plc, a worldwide leader in healthcare technology, declared the U.S. Food and Drug Administration (FDA) acceptance for its Simplera continuous glucose monitor (CGM), the firm's first disposable, all-in-one CGM that's half the size of previous Medtronic CGMs. The discreet design simplifies the insertion along with wear experience, eliminating the demand for overtape.

Key Companies Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improveddevices. Moreover, they are also focusing on maintaining competitive pricing.

In June 2020, Tandem Diabetes Care and Abbott agreed to work on the development of integrating continuous glucose monitoring system with insulin delivery system to offer more options to the consumers for diabetes management.

In March 2021, Roche launched Accu-Check Instant system that is connected to mySugar app via Bluetooth. This is a step towards providing personalized diabetes management services to the consumers.

These major developmental strategies focuses on creating new opportunities and drive the growth of the global diabetes devices market.

Segments Covered in the Report

By Type

- Blood Glucose Monitoring

- Self-Monitoring

- Continuous Glucose Monitoring

- Insulin Delivery Devices

- Pens

- Pumps

- Jet Injectors

- Syringes

By Distribution Channel

- Retail Pharmacy

- Hospital Pharmacy

- Clinics

- Online Pharmacy

- Others

By End Use

- Diagnostic Center

- Hospitals

- Home Care

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting