Smart Insulin Pens Market Size and Forecast 2025 to 2034

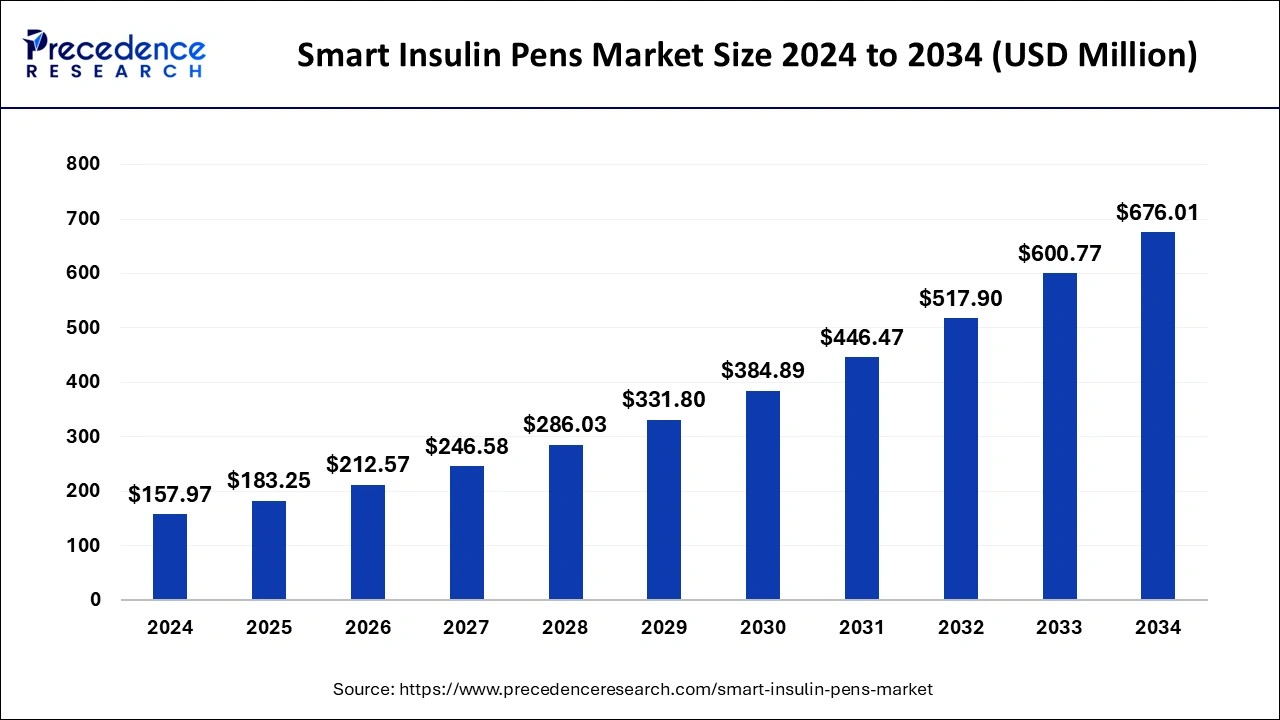

The global smart insulin pens market size was calculated at USD 157.97 million in 2024, and is expected to reach around USD 676.01 million by 2034. The market is expanding at a solid CAGR of 15.65% over the forecast period 2025 to 2034.

Smart Insulin Pens Market Key Takeaways

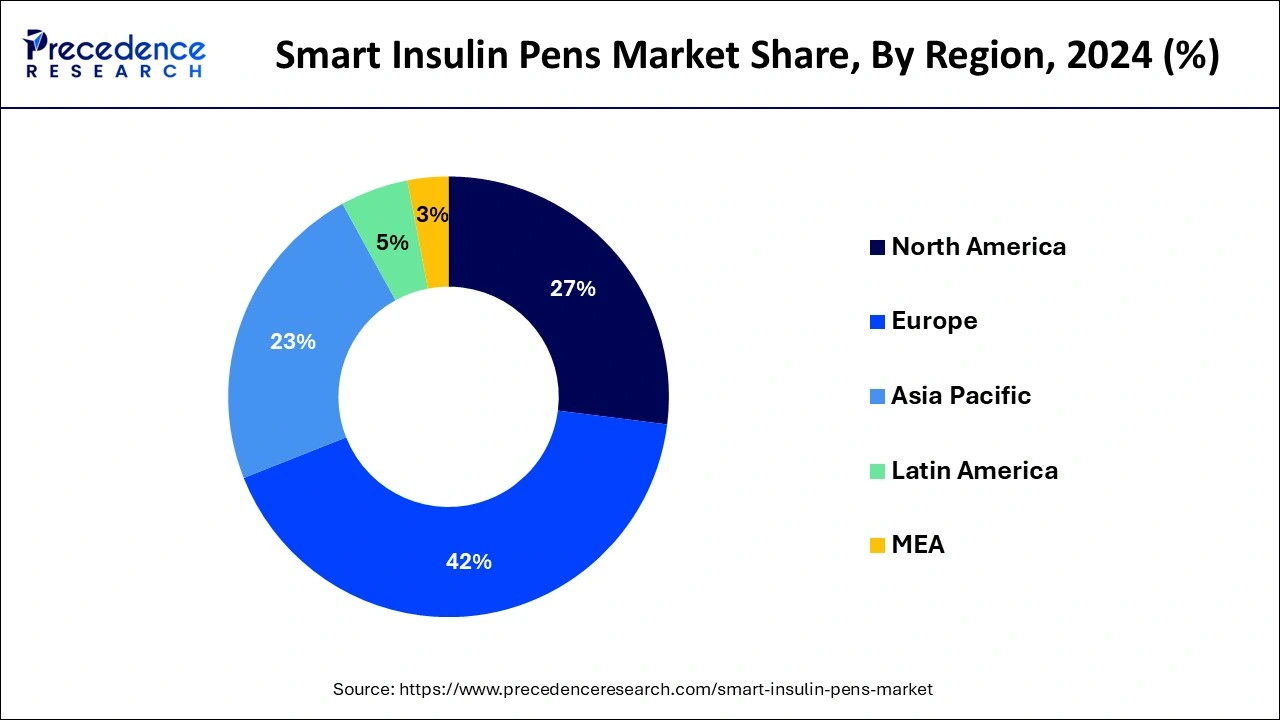

- Europe led the global market with the highest market share of 42% in 2024.

- The reusable indication segment accounted for 74% of revenue share in 2024.

- The prefilled segment garnered a market share of around 38% in 2024.

- By type, first-generation pens accounted largest market share 65% in 2024 while second-generation pens garnered 36%.

- By end user, the hospitals and clinics segment accounted for 41.5% of revenue share in 2024 while ambulatory surgical centers garnered 34.7%

- In 2024, the home care settings segment hit a 26% market share.

AI in the Market

AI-powered applications and smart insulin pens are considered to be changing the diabetes paradigm for the better by improving precision and minimizing human errors and care. These systems, based on glucose levels, diet, and activity, calculate the respective insulin dosage; in doing so, they reduce the chance of insulin interference with external factors and hypoglycemic conditions. Reminders for doses, automatic logging, and mobile phone integration add to adherence and convenience. Real-time data sharing and remote monitoring enable healthcare providers to interact with patients during therapy, allowing for timely treatment adjustments. The overall development of proactive management will be supported by AI-predictive capabilities and the integration of smart insulin pens and continuous glucose monitoring (CGM) systems. AI-enabled smart insulin pens are creating a user-friendly ecosystem that improves patients' quality of life and positions the future of diabetes.

Europe Smart Insulin Pens Market Size and Growth 2025 to 2034

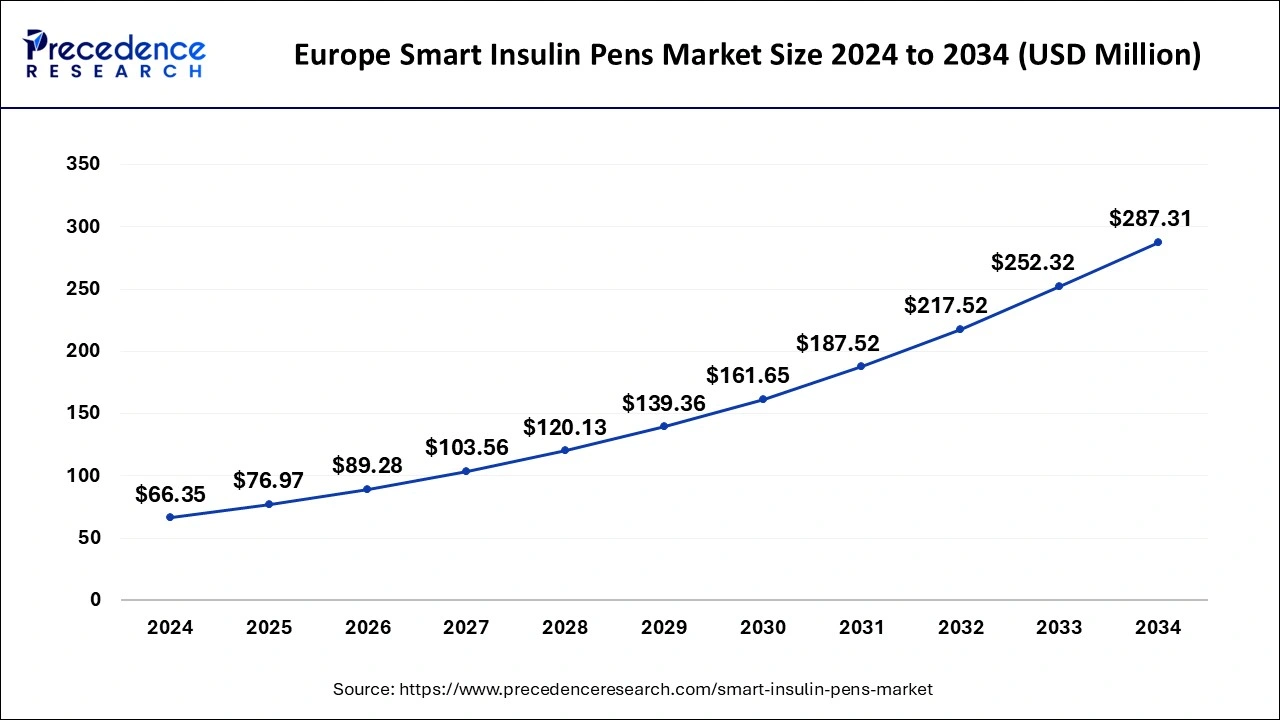

The Europe smart insulin pens market size was estimated at USD 66.35 million in 2024 and is predicted to be worth around USD 287.31 million by 2034, at a CAGR of 15.78% from 2025 to 2034.

On the basis of geography, the European market has shown major growth in the smart insulin market and is forecasted to rule the sector in the future as well. The rapid research and development which is carried out in this region along with the existence of the leading companies in this sector has help the market to show a tremendous growth. The Middle East and countries and Latin America have shown the fastest growth rate during the forecast period as a result of the new facilities which have been provided to the people.

Europe: Precision and Progress

Europe is the dominating region in the smart insulin pens market, bolstered by its commitment to patient-centric healthcare, evolving regulatory landscapes, and strong focus on sustainability in medical devices. Key contributors such as Germany, France, the UK, Italy, and the Netherlands are contributing significantly due to government-sponsored digital health programs, investments in diabetes-focused telemedicine platforms, inclusion of smart pen therapies in national healthcare reimbursement policies and growing collaborations between pharmaceutical giants and tech innovators, aiming to produce data-driven and patient-responsive solutions. The push towards remote diabetes management, especially after the pandemic, has further accelerated adoption, with physicians and endocrinologists recommending smart insulin pens for precise, real-time data tracking and adherence.

The region of the Asia Pacific has also shown a considerable amount of growth in this sector as a result of the increasing diabetic patients residing in the countries.

North America: Leading the Charge in Digital Diabetes Care

North America continues to fastest growing in the smart insulin pens market due to its strong healthcare infrastructure, high diabetes prevalence, and proactive government support.

- The United States leads the region with its adoption of digital therapeutics, frequent FDA approvals, and extensive use of wearable medical technology. The Centers for Medicare & Medicaid Services (CMS) has also recognised digital diabetes management as a reimbursable service, encouraging usage among senior citizens.

- Canada follows with public-private partnerships and community-level awareness campaigns focusing on better diabetes management.

These initiatives, paired with widespread smartphone penetration and EHR integration, have positioned North America at the forefront of smart insulin pen innovation. While innovation in digital health is steering global demand, regulatory support, patient awareness, and the rise in diabetes prevalence are influencing regional leadership.

Market Overview

Smart insulin pens offer a better solution for diabetes management as it it's useful for the external delivery of insulin for a diabetic patient. The smart insulin pens are designed in a way that helps in administering the doses periodically due to the timely reminders provided by the system as well as the alerts. There's a growing demand for smart insulin pens due to its ease of use. The smart device can be attached to the already existing insulin pens used by the diabetic patients Due to the facility of providing timely alerts or periodic reminders there is a growth in the market for smart insulin pen as it helps in providing accurate dosage of insulin. It also helps in keeping a track in case any doses are missed which happens to be very important for a diabetic patient.

The smart insulin pen helps to deliver the required number of doses for a particular patient depending upon his sugar levels. The disposable facility provided by the smart insulin pens helps to maintain the sterility of the product. Thus, in the patient is safe from sexually transmitted diseases which have become the most dreaded risk in the hospital and clinic sectors. This smart insulin pen has provided a very easy to carry remedies for the management of diabetes type 1 and type 2 diabetes. Maintain a record of the diabetes profile of the patient by tracking the diabetes levels during a particular time and date, and the sequential order is also maintained. The patient is assisted by this system to maintain his dozes on time and helps the patient to not miss the doses when prescribed. It helps to maintain the track record and the dosage of each insulin administration as per the date. It is also a good system for reminding the patient for their schedule doses as for the prescriptions. This advance technology is an expert at identifying in the temperature range of the insulin dose and also keeps a close check on the expiry date of the medicine in order to protect the patient from health hazards. It is the latest technology which is used by the hospitals and the clinics in order to maintain the diabetes profiles of numerous patients with accuracy and provide the best qualities service to the people.

The covid pandemic had a very negative impact on the smart insulin pen market due to which in the growth was hampered to a great extent. As the risk of cross infection had increased to operate extent the hospitals and clinics had made a rule to attend only in the emergency cases which were unavoidable and to keep the other cases on hold. The strict lockdown and restrictions imposed by the government along with the restricted movement had blocked people into their homes which declined the laboratory testing and resulted into unchecked diabetes profiles. Hence, the associated diabetic services provided by the medical sector were also hamper to a great extent.

Smart Insulin Pens Market Growth Factors

The healthcare industry which includes hospitals and clinics are the main channels through which the smart insulin pen market will see it's growth during the forecast period. The patients usually visit these places when they suffer with health issues. Hence it becomes the first step towards the detection of diabetes. DJ Babu zones help to manage the diabetic profiles of the patients along with the line of treatment that will be most suitable according to the lifestyle and parameters of the individual. The high number of diabetic patients among the geriatric age group population has also helped the market to show a tremendous growth during the forecast period.

The rapid organisation of the society and the increasing workload on the younger generation has boosted the number of diabetic patients. This results in the rapid sales of the insulin products in the market. Smart insulin pens have become a device of choice for the recent times. As a result of the workload on the people and the busy lifestyle keeping a record of the diabetes readings and schedules of the insulin doses has become impossible. Hence, the smart technology comes into play in order to make these difficulties easier. The increasing prevalence of needle stick injury has booster the sales of the smart insulin pen market. The current diabetes proves to be a great risk for the health of the individual. Since healing becomes a great problem for the diabetic individuals needle stick injury must be avoided under all circumstances.

With the rapidly changing lifestyle in the use of smart insulin devices has become the need of the current market. That diabetic profiles all the younger generations are more complicated as compared to the older generations. This condition is because of the complicated lifestyles and busy schedule by the younger generations in order to earn more money. With the increasing fashion of consuming packet food containing preservatives the chances of diabetes have increased to a great extent among the younger generation. The problems of diabetes among the infants have also seen a rise during the present times. This provides a great opportunity for the market to show a tremendous growth as a result of the increase in diabetic cases. The busy lifestyle has hampered in the physical activity of the people, hence sedentary lifestyle has become the way of life during the recent times. This leads to diabetes and hence the market has a great opportunity during the forecast period.

Clinics and hospitals are upgrading to the latest technologies in order to attract a huge population for treatment. This helps the market to record a good revenue return during the forecast period. The covid 19 pandemic had a negative in impact on the smart insulin pen market but also increased in the market size for the future. With the ongoing fashion of work from home people are have habituated to lead a sedentary lifestyle and perform their work by sitting at one place. This results in greater number of health hazards and diseases. These multiple factors help the market to show a considerable growth during the forecast period.

Market Key Trends: A Digital Shift in Diabetes Management

Smart insulin pens represent a seamless fusion of healthcare and technology, allowing patients to monitor insulin dosage, track injection timing, and sync data with mobile apps. The market is currently driven by the increasing adoption of connected healthcare devices, growing emphasis on personalized treatment, and rising concerns regarding insulin mismanagement and wastage. Moreover, companies are increasingly integrating AI and Bluetooth technologies to enhance user experience and real-time monitoring. Additionally, interoperability with glucose monitoring systems and user-friendly interfaces is shaping product innovation across the board.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 15.65% |

| Market Size in 2025 | USD 183.25 Million |

| Market Size by 2034 | USD 676.01 Million |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Usability, Product, Connectivity Type, Indication, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Convenience and Ease of Use

Simply put, smart insulin pens are an easy yet highly patient-friendly way of delivering insulin into the bloodstream as compared to the conventional methods. Therefore,these pens relieve the patient by eliminating the need to record doses, times, or the number of units injected. The smart insulin pen is designed with a busy individual in mind or for those who occasionally forget to maintain logs. And this ease of usage causes them to be much more likely to utilize their smart insulin pen and manage their diabetes. Also, this factor is something that favors the use of smart insulin pens among patients.

Restraint

Regulatory and Technological Hurdles

The market finds itself confronted with the challenge of having problems due to lengthy and complicated regulatory approval processes that delay the launch of products and increase costs for manufacturers. Any deviations into insulin delivery affect reliability and accuracy and therefore patient safety, and trust is deteriorated through such deviations. Lastly, issues arise with data security and privacy, as this type of sensitive information demands protection and compliance with stringent policies.

Opportunity

Integration of Advanced Technologies

Smart insulin pens are being developed with features such as dose memory, mobile app connectivity, and compatibility with CGM systems. Once installed, these newer devices enable seamless inter-device data flow, providing patients and physicians with real-time insights. The enhanced personalization of treatment and better decision-making improvements in insulin management are offering a better overall level of care for diabetes. This integration trend endows industry players with an opportunity to carve out an identity for their products and push for wider adoption within the emerging digital health landscape.

Type Insights

On the basis of type, the first generation accounted largest revenue share in 2024 as well as a result of the research and development activities which are carried out in the sector. The rapid advancements made by the market in health care services has strengthened its foot hold in the market. The rapid growth in the diabetic patients in the world has also led to the increase in the use of smart pen insulin devices. As a result of the rapid urbanization the intake of fast food has increased to a great extent. The second-generation devices for scene to display or rapid growth as a result of the growth in the number of old aged people in society.

Indication Insights

By application, the reusable devices accounted largest market revenue in 2024. The advanced features of memory recording have proved to be beneficial for the genetic age group. The time function of this device has also helped to grow the market to a great extent. The pre-field insulin pens have shown a considerable growth during the estimated period. The rapid growth in technology in the insulin sector has made people aware of the new technologies and advancements taking place in the market.

Being highly reliant on insulin therapy for disease management, the Type 1 diabetes segment commands a higher share under the indication section. Increasing awareness about patient self-management, together with a slew of innovative connected devices for treatment, tends to strengthen the share further. Moreover, the crucial need for precision in insulin delivery in this patient group will keep propelling adoption, rendering this portion an important market driver.

The Type 2 diabetes segment constitutes the fastest-expanding sector as a result of the growing prevalence of patients requiring advanced technologies for disease control. Due to shifting patient preference towards digital health facilities and connected devices, the demand in this class is growing by leaps and bounds. The segment draws additional benefits from heavier adoption trends, which see healthcare providers endorsing new solutions with vigor, thereby enhancing the accelerated growth outlook.

End User Insights

The healthcare sector which includes the local clinics and hospitals has dominated the segment in the recent years. Usually, the health care sectors are provided with multiple devices in order to manage diabetes and their complications. These industries also provide expert labour force and staff who are skilled in handling and managing these types of cases. Keeping patient safety on a priority list, the hospitals use advanced technologies in order to provide flawless services to the patients. In order to manage blood sugar in the simplest and most comfortable ways, such pens are increasingly being used by the healthcare industry. The next sector under this segment is the ambulatory surgical sector which includes such advanced facilities in order to provide first service to the patients. This sector has adopted this advanced technology in order to provide the best services possible to the patient in the absence of a proper hospital or a clinic at that particular moment.

Home care settings being the next sector under this segment has proved to be of great use to the growth of the market as a result of the high number of geriatric populations in the world who do not prefer to move out of their comfort zone in order to get themselves checked for diabetes. As a result, day end up using home kits in order to evaluate they are blood sugar levels.

Connectivity Insights

Bluetooth dominates the connectivity sector, mainly because it is highly adopted, multi-device compatible, and can operate over longer connectivity distances. Being available everywhere and supported by almost all platforms makes it a selection for connected insulin pens. With many manufacturers opting for Bluetooth, it boosts data sharing, convenient operation, and flexibility, making this mode the leading segment with a robust presence in the market.

The NFC segment is the fastest in growth, owing to technological enhancements that allow faster data transfer, high reliability, and secure data transmission. Ease of use and the role of enhancing user experience serve as good focuses for manufacturers. With a growing focus on secure and easy connectivity, NFC is fast gaining traction as a modern approach, which makes it promising for future connected healthcare applications.

Distribution Channel Insights

Hospital pharmacies hold a supreme position, owing to the procurement facilities available in the hospital setting and an optimized supply chain. Given that they would ensure the consistent availability of connected insulin pens, they would be the most trustworthy channel from the patients' and clinicians' point of view. The added advantage of easy access, coupled with the reputation enjoyed by hospital distribution, further enhances the dominance of this segment in the overall market spectrum.

Online pharmacies are growing the most rapidly as consumer preferences evolve towards ease and accessibility. The increases in dependence on community-based pharmacies and the growth rate of online channels are feeding further development of this sector. This trend is also stimulated by the shift toward at-home healthcare management and streamlined purchase experiences. These channels are gaining immense popularity among patients for convenience, flexibility, and reach.

Smart Insulin Pens Market Companies

- Emperra GmbH

- Bigfoot Biomedical

- Digital Medics Pty Ltd.

- Jiangsu Deflu Medical Device Co.

- Medtronic plc

- Eli Lilly and Company

- Novo Nordisk

- Pendiq

- Sanofi

- Berlin-Chemie

Recent Developments

- In May 2025, MedicaNova, a Sweden-based med-tech company, launched its AI-integrated smart insulin pen designed to record and predict insulin needs based on real-time glucose levels and food intake logs. This device features seamless cloud integration and multilingual support for European users.

- June 2019 - Companion Medical collaborated with Rimidi which is a cloud based solution provider. This is a software that was collaborated to help clinicians to judge the dosage of insulin in the real world which will be decided by reading the data from the glucometer. This was a great step taken towards the development of the market.

Segments Covered in the Report

By Type

- First Generation Pens

- Second Generation Pens

By Usability

- Prefilled

- Reusable

By Product

- Smart Insulin Pen

- Adaptors for Conventional Pen

By Connectivity Type

- Bluetooth

- USB

By Indication

- Type 1 Diabetes

- Type 2 Diabetes

By End User

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Home Care Settings

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting