What is the Smart Hospitals Market Size?

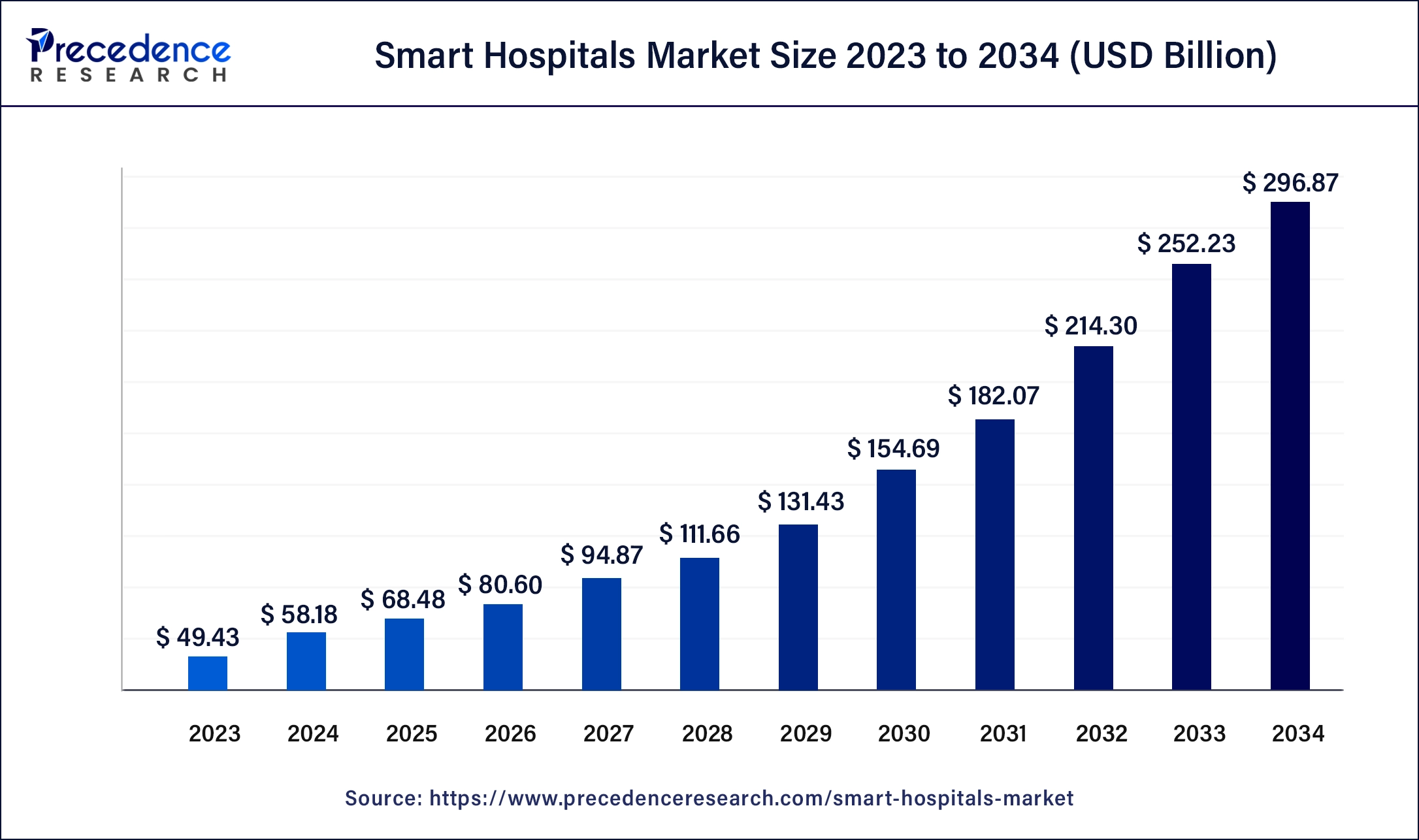

The global smart hospitals market size is calculated at USD 68.48 billion in 2025 and is predicted to increase from USD 80.6 billion in 2026 to approximately USD 337.04 billion by 2035, at a CAGR of 17.28% from 2026 to 2035.

Market Highlights

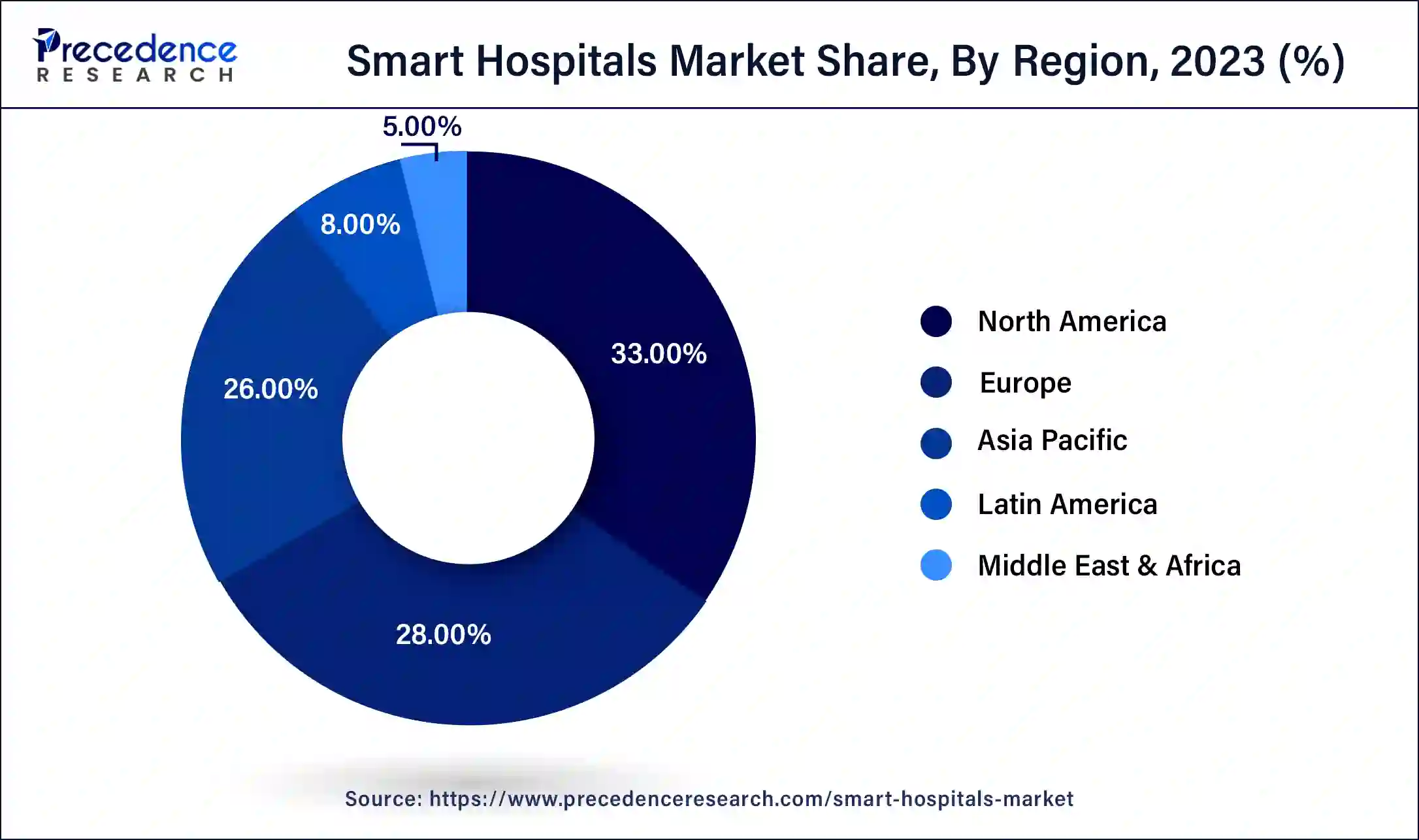

- North America led the global market with the highest market share of 33% in 2025.

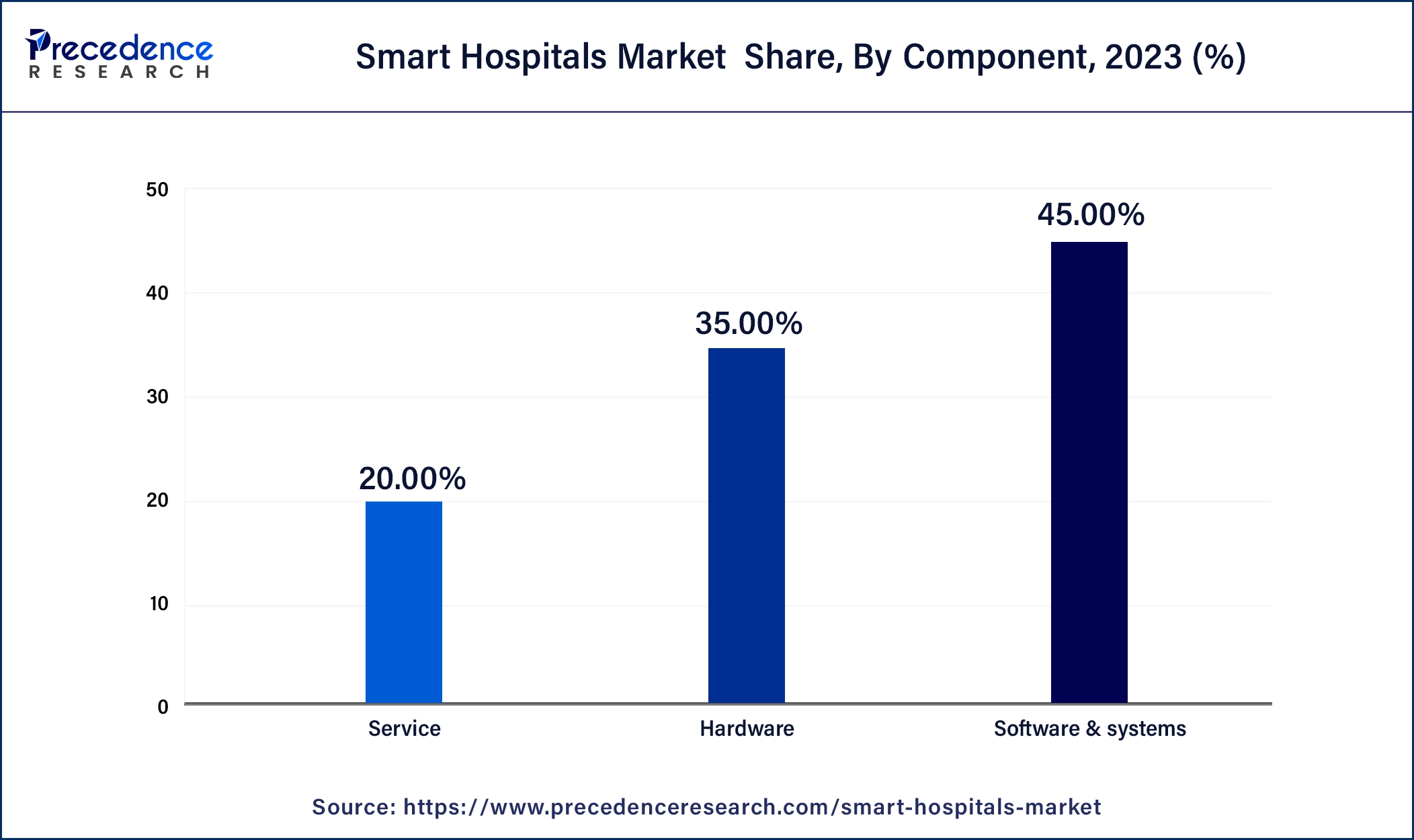

- By component, the software & systems segment has held the highest market share of 45% in 2025.

- By product, the telemedicine segment captured the biggest market share in 2025.

- By connectivity, the wireless segment registered the maximum market share in 2025.

How is AI contributing to the Smart Hospitals Market?

Artificial Intelligencetransforms smart hospitals by improving diagnostics through image analysis, a whole range of personalized treatment decisions, and the automation of workflows, predicting admissions, as well as staff and resource allocation optimization. The technology allows the application of remote monitoring through wearables, the provision of patient assistance via virtual bots, and the speeding up of radiology diagnostics, all while keeping the inventory and facility management predictive. AI promotes patient participation, diminishes operational heavy lifting, and enhances the accuracy of treatments. This whole scenario results in hospitals being transformed into proactive, connected, data-centric healthcare ecosystems that enjoy the benefits of being more efficient and incurring fewer costs for patient care.

Smart Hospitals Market Growth Factors

The adoption of technologically advanced software and devices in the healthcare industry across the globe has evolved the traditional hospitals into smart hospitals. The adoption of advanced technologies was powered by the growing need to reduce the operational costs and increase profitability and offer enhanced patient care services. The emergence of the wireless connectivity and latest technologies like internet of things (IoT) and artificial intelligence (AI) are expected to rapidly boost the growth of the global smart hospitals market. The growing government and corporate investments in the digitalization of the healthcare sector to improve the operational efficiency is also a significant driver. The rising prevalence of various chronic diseases among the population and growing geriatric population has increased the need for the advanced and efficient healthcare services. Moreover, the rising healthcare expenditure is also benefitting the global smart hospitals market.

The rising number of hospital admissions owing to the rising prevalence of chronic diseases, road traffic accidents, growing geriatric population, and various other factors is creating a pressure on the healthcare system. The smart hospitals will help to serve the rapidly growing inflow of patients and provide affordable treatment for various diseases. The rapidly surging technologies like AI, IoT, robotics, augmented reality, and precision medicine are expected to provide cost-efficient and sustainable healthcare solutions, thereby significantly contributing towards the growth of the global smart hospitals market. The rising adoption of telemedicine, telehealth, and electronic health record has exponential contributions in the development of the smart hospitals market.

Market Outlook

Rapidly deploying smart hospitals adopting cutting-edge technology, and thus making patient-centric operations and healthcare delivery more efficient.

Greener medical environments are supported by digital workflows and energy-efficient infrastructure, which also reduces waste.

The adoption is widening geographically, thus facilitating care accessibility and the penetration of digital healthcare.

Google and Microsoft's venture arms are the major players who not only invest heavily but also drive the innovation of smart hospitals with their strong funding interest.

The development of specialized smart hospital solutions that enable operational automation and personalization is the result of the efforts of AI, IoT, and data startups.

MarketScope

| Report Highlights | Details |

| Market Size in 2025 | USD 68.48 Billion |

| Market Size in 2026 | USD 80.6 Billion |

| Market Size by 2035 | USD 337.04 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 17.28% |

| Largest Market | North America |

| Fastest Growing Market | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Product, Connectivity, and Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Segment Insights

Component Insights

Based on the component, the software & systems segment dominated the largest revenue share in 2025. This is attributed to the increasing need to increase profitability by reducing the healthcare costs and improve the data management systems equipped in the smart hospitals. Furthermore, the increasing adoption of latest technologies like AI, AR, IoT, and VR is increasing the demand for the smart hospitals for its efficient services.

On the other hand, the services segment is estimated to be the most opportunistic segment during the forecast period. This is simply due to the lack of proper knowledge about handling the digital systems used in the smart hospitals setting, among the healthcare workers and professionals. Therefore, the third-party services are being increasingly adopted for the efficient utilization of advanced and various digital devices and software in order to achieve efficiency and low operational costs.

Product Insights

Based on the product, the telemedicine segment dominated the global smart hospitals market in 2025. This is simply due to the increased adoption of the telemedicine platforms among the consumers and the healthcare professionals. Further, the rising penetration of internet and rising adoption of smartphones along with the rising urban population has boosted the growth of this segment across the globe. According to ITU, around 4 billion people were using internet by the end of 2019. Most of the internet users operate through their smartphones. Doctors and physicians are now increasingly adopting the telehealth platforms for offering consultations and other services.

On the other hand, the electronic health records segment is estimated to be the fastest-growing segment during the forecast period. This is attributed to the increasing government initiatives to record the patients' details and health related data that can be utilized for the treatment of the patient. For instance, Allscripts Healthcare Solutions entered into a strategic partnership with the US Orthopedic Alliance to introduce improved electronic health records.

Connectivity Insights

Based on the connectivity, the wireless segment dominated the highest revenue share in 2025. This is simply attributed to the increased adoption of various wireless technologies such as internet, cloud-based servers, and Bluetooth. The wireless connectivity offers wireless communication, easy data transfer, and remote access to the stakeholder that boosts the adoption of the wireless connectivity in the smart hospitals across the globe.

Key Companies Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

In January 2020, KT Corporation and Samsung Medical Center collaborated to develop a 5G Smart Hospital.

The various developmental strategies like collaborations, acquisition and new product launches with latest and innovative features fosters market growth and offers lucrative growth opportunities to the market players.

Regional Insights

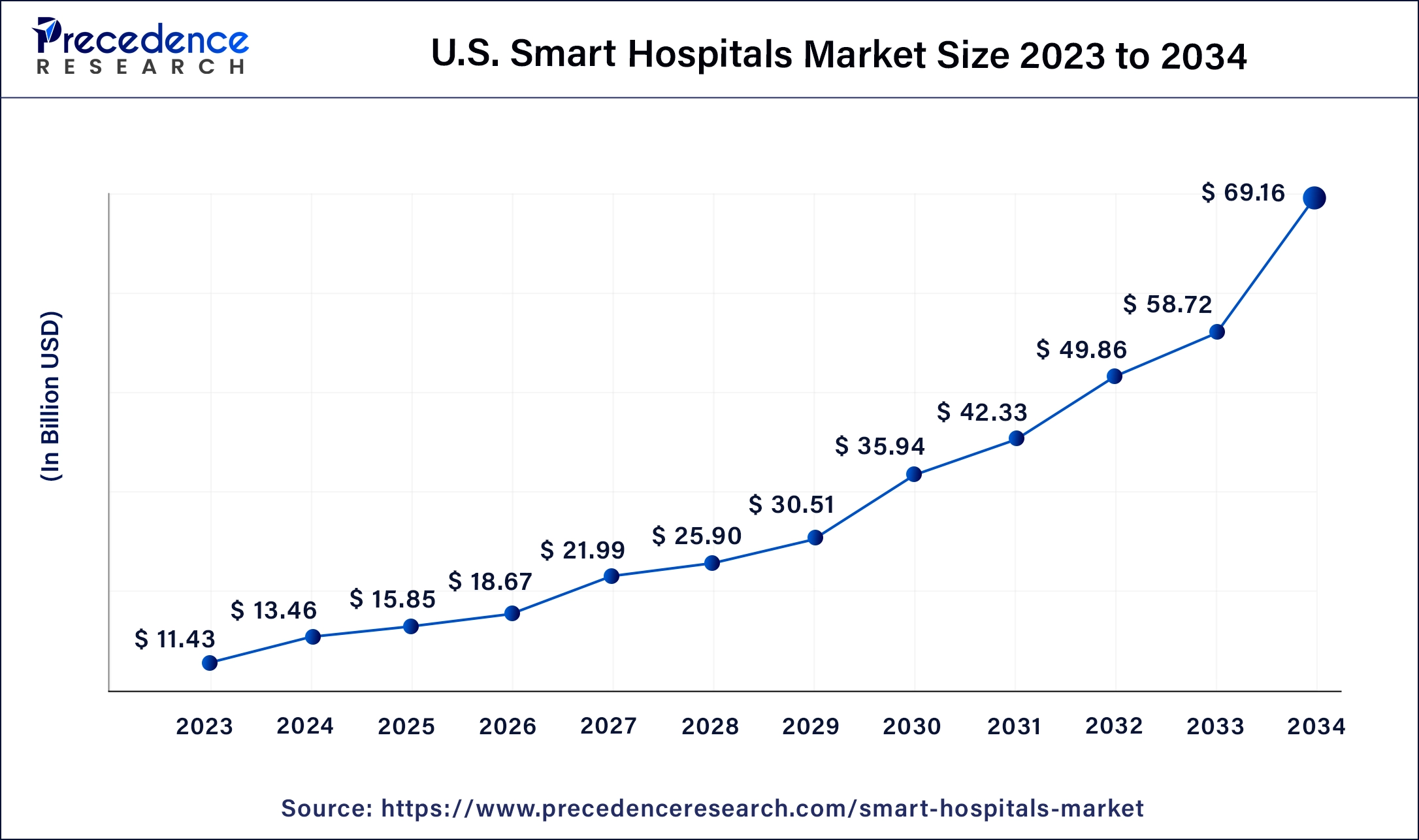

The U.S. smart hospitals market size is estimated at USD 15.85 billion in 2025 and is predicted to be worth around USD 78.55 billion by 2035, at a CAGR of 17.36% from 2026 to 2035.

Based on region, North America dominated the market with largest revenue share in 2025. This can be attributed to the higher adoption rate of the automation, digital, and advanced technologies in the healthcare industry. The increasing importance of the healthcare sectors towards the GDP contribution of the US is a major factor that states the penetration of the smart hospitals in the region. Moreover, increased per capita healthcare expenditure in the US due to the increased demand for the latest and efficient therapeutics. Moreover, the increased penetration of telehealth and electronic health records in the region has resulted in the significant growth of the smart hospitals market in North America.

How is North America leading in the Smart Hospitals Market?

The market is characterized by high adoption, which is backed by the digital infrastructure and a strong funding environment. The integration of telemedicine, remote monitoring, and AI-genomics is opening up more opportunities for advancements. The growth of the market is in line with the models of cost-efficient healthcare and the widespread adoption of smart healthcare that is eventually coming.

United States Smart Hospitals Market Trends:

The primary cause of the US leading position in the health sector is the massive investment in e-Health and the very favourable regulatory framework. The additional points include the use of virtual platforms for staff optimization, the automation of AI diagnostics, which will further improve patient flow, reduce costs, and make care more efficient.

Europe is estimated to be the most opportunistic segment during the forecast period. This is due to the rising government expenditure on the development of healthcare infrastructure and adoption of digital technologies in the sector. Moreover, the rising number of private hospitals, clinics, and diagnostic centers in the region coupled with their heavy investments in the automation and digitalization is expected to significantly drive the market growth in the region.

In the wake of well-laid-out digital health-supporting policies, governments are funding the programs and thus focusing on their digital health sustainability. The running of AI clinical systems has the effect of improving the coordination of medical care. Also, the hospitals using eco-friendly buildings are taking a step towards modernized health service delivery.

Germany Smart Hospitals Market Trends:

In addition to the digital policies, these opportunities, such as e-prescription expansion and the use of big data, will be seen. The hospitals are already very efficient, thus making it easy the transition towards the adoption of advanced smart health technologies that are advanced.

The region is the fastest-growing one, characterized by the government pushing digitization in the healthcare sector. The development of hospital networks, medical tourism, and technology adoption are the factors that create new investment opportunities even in smaller cities that are developing.

India Smart Hospitals Market Trends:

The growth of the country is mainly attributed to the increasing use of telemedicine and a more developed infrastructure. Investments that are being made are aimed at modernizing hospitals, creating new facilities, and strengthening the networks of private healthcare in the emerging regions.

Value Chain Analysis

Identifies, screens, and develops drug compounds, building an intellectual property foundation.

Key Players: Pfizer, GSK, and Merck

Test drug safety and efficacy to secure regulatory market authorization.

Key Players: IQVIA, Parexel, and ICON plc

Converts drug ingredients into a stable patient-ready dosage format.

Key Players: Patheon and Catalent

Prepares product for transport with traceability to prevent counterfeiting.

Key Players: Gerresheimer AG, Amcor plc, and PCI Pharma Services

Delivers products to hospitals, pharmacies through compliant healthcare logistics networks.

Key Players: Cardinal Health, Movianto, and Rhenus Logistics

Smart Hospitals Market Companies

Enables hospitals to utilize AI-driven solutions for virtual healthcare, analytics, collaboration, and smart asset tracking all on the cloud.

AI-based workflow support of the EHR systems interoperating, providing superior patient record management and operational processes.

Connected medical devices with AI automation for continuous monitoring and informed clinical decisions are the company's offerings.

Other Major Key Players

- Honeywell Life Care Solutions

- GE Healthcare

- SAP

- Qualcomm Life

- Cerner Corporation

- Philips

- Stanley Healthcare

Recent Developments

- In September 2025, Hospitals face challenges in delivering patient care, ensuring staff safety, meeting regulations, optimizing resources, and managing rising costs and environmental pressures.(Source: healthtechmagazine.net)

- In July 2025, KIMS Hospitals, Thane, introduced the Thane region's first AI-integrated 5G Smart Ambulance with Medulance, enhancing emergency medical services and pre-hospital patient management.(Source: expresshealthcare.in)

Segments Covered in the Report

By Component

- Software& systems

- Hardware

- Service

By Product

- Smart Pills

- Telemedicine

- M Health

- Electronic Health Record

By Connectivity

- Wireless

- Wired

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting