What is the Smart Healthcare Market Size?

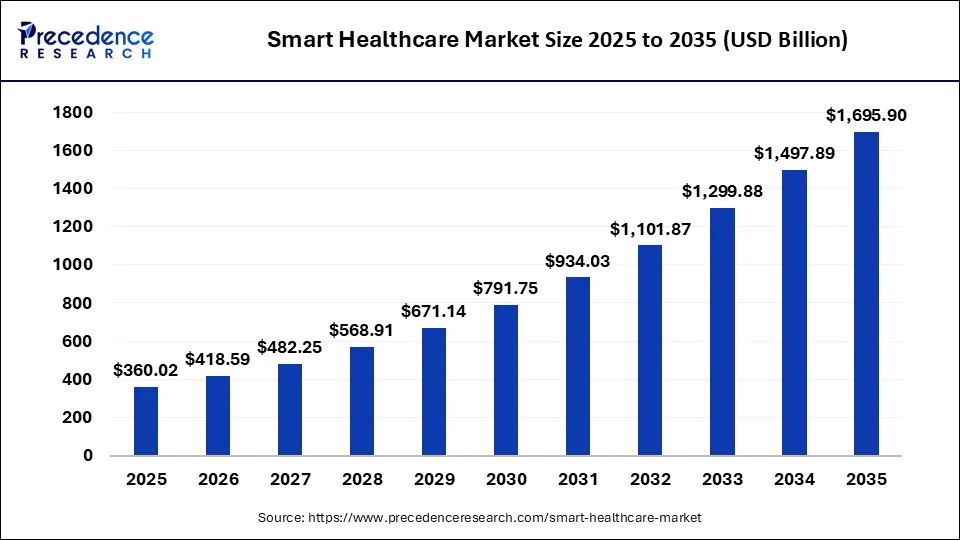

The global smart Healthcare market size accounted for USD 360.02 billion in 2025 and is projected to reach USD 1,497.89 billion by 2035, growing at a CAGR of 16.76% between 2026 and 2035. The increased adoption of remote patient monitoring and telehealth solutions, along with government support and investments, drives the global smart healthcare market.

Market Highlights

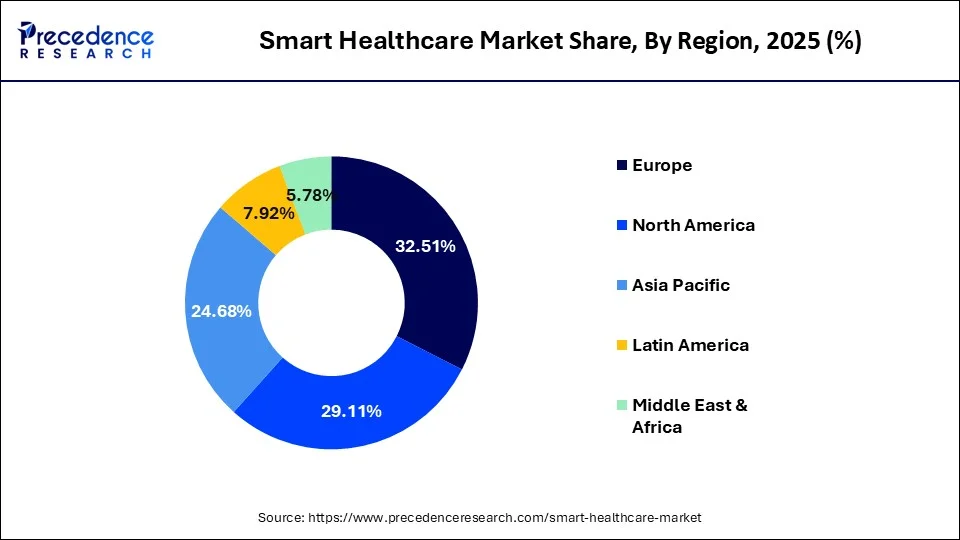

- North America held a market share of 17.18% in 2025

- Asia Pacific region is estimated to expand the fastest CAGR of 24.68% between 2026 to 2035

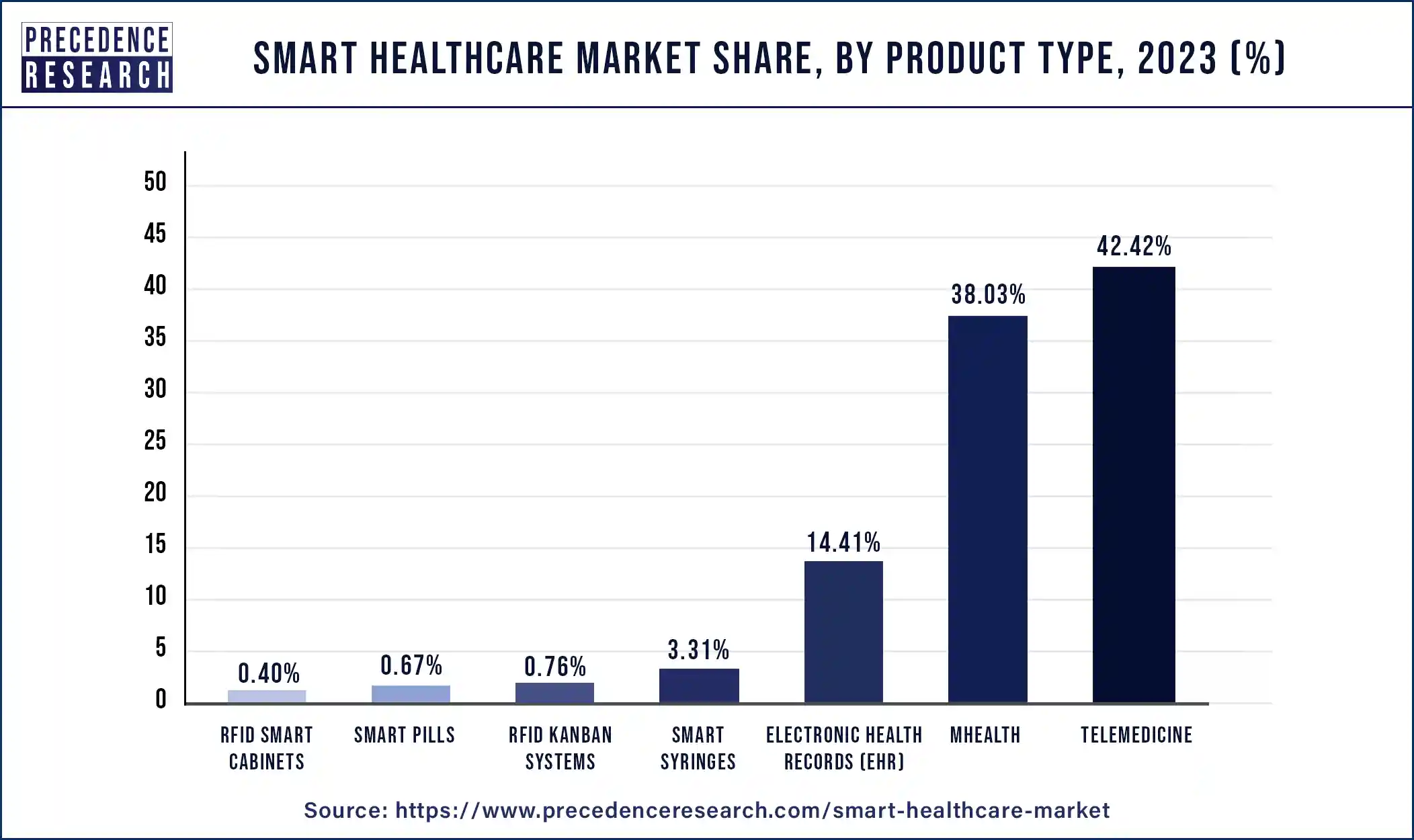

- By product, the telemedicine segment registered a maximum market share of 42.42% in 2025

How Did AI Benefit the Smart Healthcare Market?

Healthcareartificial intelligence is revolutionizing medicine by improving diagnosis, treatment, and efficiency. It aids in disease detection by interpreting medical images and analyzing patient data, thus facilitating the formulation of personalized treatment plans. It optimizes workflows by taking away administrative burdens and streamlining clinical operations so that one can have cost-effective remedial approaches toward patient care, including remote monitoring, risk alerting, and virtual assistance. AI speeds up drug discovery, cutting drug development costs and introducing innovations that lead to cost reduction and improved outcomes for the healthcare network.

Smart Healthcare Market Growth Factors

Smart healthcare products are a tool that incorporates advanced technologies to provide patients with improved treatment and enhance the quality of life. Some of the most popular kinds of smart health care items are smart pills, smart syringes, electronic health care, etc. They have reliable patient-related data and assist physicians to properly handle their patients. The growth of this market is driven by rising chronic illnesses such as diabetes, cancer, heart disease, etc. The healthcare sector has been changed by digitalization. In recent years, the adoption of mHealth has increased significantly, primarily due to increasing smartphone use and digitization. Rising adoption of mHealth, government initiatives to digitize healthcare, and the prevalence of chronic disorders are likely to accentuate the demand for smart healthcare systems. For example, in March 2020, the Government of Quebec, in collaboration with the Canadian Medical Association (CMA), agreed to expand access to telehealth facilities in various provinces of Canada, such as Alberta, New Brunswick, British Columbia, Manitoba, Ontario, Newfoundland and others in collaboration with the Canadian Medical Association (CMA). These attempts are expected to place digital patient-oriented healthcare systems at the forefront globally.

Market Outlook

- Industry Growth Overview: The smart healthcare industry is experiencing significant growth due to rapid digital transformation and technological advancements. With the increased chronic disease prevalence and ageing population are the major adapters of smart healthcare infrastructure. Supportive government policies and significant investments in healthcare infrastructure and innovative technologies are further boosting this industrial growth.

- Sustainability Trends: The smart healthcare industry had saw a significant shift towards sustainability driven by the rising environmental concerns and increasing healthcare demands. Manufacturing companies are focusing on innovating biodegradable and recyclable materials for the production of eco-friendly and sustainable medical devices. The spectacular surge of energy-efficient infrastructure, sustainable medical materials, green manufacturing practices, circular economy principles, and AI adoption is solidifying sustainability efforts in the industry.

- Global Expansion: The smart healthcare industry is expanding rapidly in emerging regions, including Latin America and the Middle East & Africa, due to an increased focus on technological advancements and increased demand for patient-centric care. Governments of these regions are investing heavily in supporting digital health deployments to provide affordable smart healthcare and patient-centric services. These efforts are expanding healthcare expenditure across emerging economies.

MarketScope

| Report Highlights | Details |

| Market Size in 2025 | USD 360.02 Billion |

| Market Size in 2026 | USD 418.59 Billion |

| Market Size in 2034 | USD 1695.90 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 16.76% |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Chronic Diseases and Aging Population

The increasing number of diseases like diabetes, cardiovascular diseases, and cancer is driving an urgent need for efficient and proactive healthcare solutions. These requireconstant monitoring and have different treatment plans being laid down for every individual-personal approach that smart health technology provides efficiently. Besides that, another big fuel for this growing demand is the worldwide aging population, as the elderly require patient monitoring at a distance, together with personal healthcare management on a specific plan to keep up with the current living platform, hence the need for smart healthcare.

Restraint

Issues Related to Data Privacy and Data Security

The wide-scale implementation of any smart healthcare technologies implies this great collection, wireless connectivity, and big data concept, thus raising concerns about data privacy and security. Patients and healthcare providers often consider breaches or unauthorized access to or misuse of their sensitive health information as grave threats. Such factors may pose resistance to and delay in developing and implementing smart healthcare solutions, because ensuring data protection, along with compliance with different regulations, is a difficult matter but is crucial for maintaining trust and upholding the confidentiality of patients.

Opportunity

Robotic Surgery

Robotic surgery is a key growth area within smart healthcare, with systems providing improvements in precision and control in minimally invasive interventions. It has decreased the risks of surgery and hence lowers recovery times and fosters better results for patients. There is always potential for improvements within robotics and AI integration, thereby enabling surgical procedures to be made safer and more efficacious to a greater extent, and enabling their applicability in many other specialty areas as well. With rising acceptance, robotic surgery is poised to revolutionize operative care and offer a notable competitive edge for healthcare providers.

Segments Insights

Product Type Insights

The telemedicine segment held the largest share of 48.06% in 2025. Telemedicine is often integrated into a broader health tech ecosystem, working alongside electronic health records (EHRs), data analytics, and other smart healthcare solutions. This integration enhances overall healthcare efficiency and data-driven decision-making. Telemedicine supports elderly care by enabling remote health monitoring in the comfort of patients' homes. This is particularly important for seniors who may face challenges in traveling to healthcare facilities regularly.

Telemedicine contributes to cost savings for both healthcare providers and patients. Reduced travel expenses, lower operational costs for healthcare facilities, and potential early intervention in medical conditions can lead to overall healthcare expenditure reduction.

On the other hand, the mHealth segment is observed to witness the fastest rate of growth during the forecast period. The widespread availability and use of smartphones and tablets provide a ready platform for mHealth solutions. These devices serve as powerful tools for accessing health-related information, monitoring, and managing one's health. mHealth enables remote monitoring of patients with chronic conditions or those recovering from surgeries. Wearable devices and sensors connected to mobile apps facilitate real-time monitoring, leading to better management of health conditions and reduced hospitalization.

Smart Healthcare Market Revenue, By Product Type, 2023-2025 (USD Million)

| By Product | 2023 | 2024 | 2025 |

| RFID Kanban systems | 1,975.4 | 2,428.4 | 2,979.1 |

| RFID Smart Cabinets | 1,032.0 | 1,152.5 | 1,283.7 |

| Electronic Health Records (EHR) | 37,342.0 | 39,358.4 | 41,680.6 |

| Telemedicine | 1,09,916.7 | 1,39,044.6 | 1,73,027.1 |

| mHealth | 98,563.8 | 1,13,545.0 | 1,28,526.3 |

| Smart Pills | 1,746.8 | 1,951.5 | 2,199.4 |

| Smart Syringes | 8,566.3 | 9,385.2 | 10,327.3 |

Regional Insights

U.S. Smart Healthcare Market Size in the 2026 to 2035

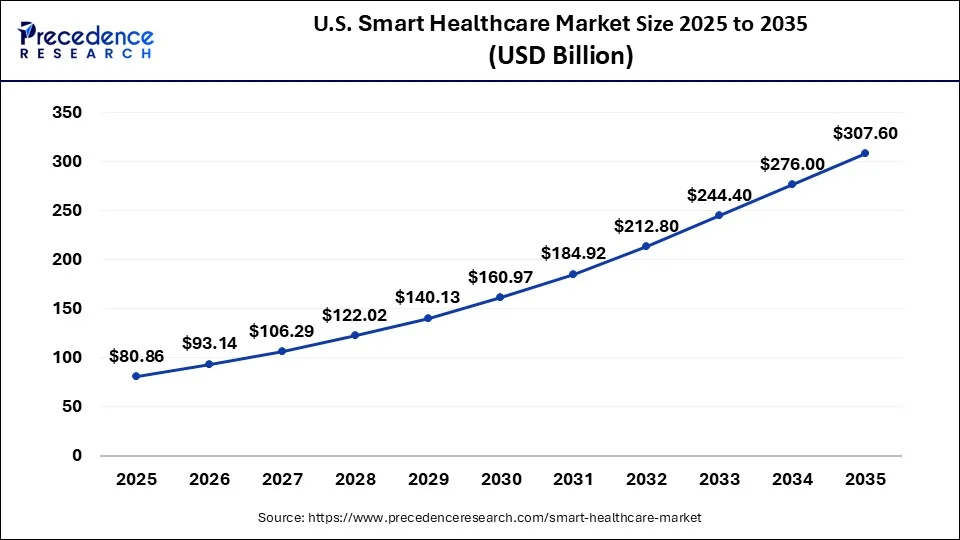

The U.S. smart healthcare market size is estimated at USD 80.86 billion in 2025 and is predicted to be worth around USD 307.6 billion by 2035, at a CAGR of 14.29% from 2026 to 2035

North America's Smart Advantages: To Make it a Healthcare Innovation Hub

North America held a revenue share of 29.11% of the market, in 2024. This is due to supportive government policies for digital health deployment and accessibility of highly digital literacy resources. In addition, the involvement of key market players, rising knowledge of connected healthcare, high internet penetration, and smartphones, along with the use of health-related apps, are some of the key factors responsible for market growth. The American Hospital Association (AMA) announced on March 10, 2020, that, due to its affordability and high healthcare value, approximately 76 percent of hospitals in the U.S. use telehealth to communicate with consulting professionals and patients. In addition, the successful adoption of e-prescription systems and electronic health records (EHR) in different healthcare centers is driving regional market development.

U.S. Smart Healthcare Market Trends

The US is a major player in the regional market, driven by its well-established healthcare infrastructure and high adoption of technology. Europe is home to an advanced digital infrastructure that enables seamless integration of smart healthcare solutions. The strong existence of key market players and government support makes the US an early adopter for innovative technologies like electronic health records (EHRs) and telemedicine variable devices. The government has implemented several supportive regulations and policies, including the FDA's digital health centre for excellence promoting the research and adoption of smart healthcare technologies across the country.

Asia Pacific Unleashed Growth, with Booming Smart Healthcare

Over the forecast era, Asia Pacific is expected to exhibit profitable growth. Due to their existing healthcare IT infrastructure and increasing investments in smart healthcare, countries such as Japan, Australia, and India exhibit significant potential. The government of Asia is focusing on the implementation of EHR and data interoperability for centralizing patient data and enhanced care coordination. Government initiatives, including India's Ayushman Bharat digital mission and Singapore's one citizen, one record project, have been completed in the first phase in 2025, stepping toward a paperless healthcare system. Asia's emerging trend of patient 2.0 consumers, actually making patients participate in their own healthcare.

- In May 2025, MSD IDEA Studio Asia Pacific secured strategic investment for Ekincare to advance AI-driven preventive healthcare across Asia. EkinCare is constantly evolving into a groundbreaking digital health platform leveraging data analytics, telemedicine, and AI for delivering personalized, preventive, and accessible care.

China Smart Healthcare Market Trends

China is a major player in the regional market due to the country's government initiatives and technological advancements. Government initiatives like the ‘Healthy China to 2030' plan promote integration in healthcare of advanced technologies like digital health solutions and innovations. The regulatory frameworks are providing approvals for medical devices and drugs the increased adoption of HER and AI is fueling this growth. Companies like Ping An Good Doctor and Alibaba Health are significantly leveraging telemedicine and AI to enhance healthcare access and outcomes.

India's Pharmaceutical Exports to Top 10 Countries

| Rank | Country | 2023-2024 |

| 1 | U.S.A | 8731.3 |

| 2 | U.K. | 784.33 |

| 3 | Brazil | 655.64 |

| 4 | France | 667.53 |

| 5 | South Africa | 718.54 |

| 6 | Canada | 502.42 |

| 7 | Netherlands | 699.27 |

| 8 | Germany | 567.42 |

| 9 | Russia | 518.47 |

| 10 | Nigeria | 508.12 |

India's pharmaceutical exports has reached USD 30,466.85 million during the period April-May 2025, that has marked 9.40% development form the last developing year. The drug formulations and biologicals has dominated with USD 22,928.83million as it counts 75% of total exports ,which is being followed by Bulk Drugs of amount USD 4, 869.98 million and the vaccines up to USD 1,222.40 million. India has shows rigid leadership in solving infectious diseases like HIV and tuberculosis that has merged with organizations like as the Global Fund and have USD25 million for its Seventh Replenishment. The country has opposed its strategic position as an main exporter of reliable and quality medicines that has pharmaceutical exports who has reached USD 30,4666.85 million in 2025.

Tighter on the Run: European Explosive Smart Healthcare Expansion

Europe is a notable player in the global market, contributes to the growth due to the region's robust push toward digitalization, strong research investment, and regulatory advancements. With investments becoming more selective, Europe is significantly focusing on high volume and later-stage deal for companies with proven clinical and financial impacts. European digital health has announced 52% year on year a rise in H1 2025, increasing by $3.4 billion across 182 deals. European digital health has captured a record 26% share of global funding.

Germany Smart Healthcare Market Analysis:

Germany dominates the regional market, driven by its well-established infrastructure, high adoption of novel and innovative technologies, and large economic base. Germany is a hub for pharmaceutical and biopharmaceutical companies, leading to significant innovations in the healthcare sector. The German market has some growth and healthcare spending, and an aerobic system for integration of technology across healthcare provider and home care setting. With the strong existence of the medtech industry, Germany is expected to enhance its access to digital solutions in both hospital-based smart healthcare and home care-based services.

Latin America's Digitalization Efforts: To Boost Healthcare 2.0

Latin America is a significant player in the regional market, driven by the region's advancement in technology and increasing demand for healthcare solutions. The utilization of mHealth apps for patient health monitoring and facilitating communications has increased in the Latin American healthcare sector. The government is implementing supportive policies to promote digital health tools and research in healthcare. The post-pandemic regulations in Brazil are fueling the growth of remote monitoring and teleconsultations.

Additionally, novel initiatives like collaboration between IDM Lab and 19Labs are piloting a drone delivery system in Guyana to enhance its telemedicine access for remote areas. Spectacular shift toward implementation of AI for enhanced diagnostics in countries like Brazil, Chile, Argentina, and Colombia, solidifying regional position in the global market.

Brazil Smart Healthcare Market Outlook

Brazil is leading the regional market, driven by its expanding healthcare infrastructure and increasing adoption of digital technologies. The government's efforts for modernizing healthcare infrastructure, robust regulatory support for digital health, and a high percentage of Internet-connected households in Brazil are fueling the adoption of smart healthcare. Razzle has experienced increased investments in telemedicine, electronic health record (EHRs), revenue cycle management, and AI technologies. Partnership of SK Biopharmaceuticals with Brazilian firm Eurofarma is leveraging the significant development of an AI-enabled platform for the prediction of seizures.

Middle East & Africa (MEA) Taking Transformation Seriously: Smart Technologies at the Edge

Middle East & Africa (MEA) is a significant player in the global market, driven by strong government initiatives and technological advancements. The adoption of telemedicine and EHRS has increased. Degree government initiatives like supportive policies and investments and digital health infrastructure, including the UAE's vision 2071 and Saudi Arabia's vision 2030, contributes to this growth. The strong presence of key leading players like GE Healthcare, Siemens Healthcare, and Oracle are enabling significant innovations and development of smart healthcare services and facilities.

- For instance, in February 2025, a National Unified Licensing Platform was launched by the Ministry of Health and Prevention. This platform was designed to consolidate licensing services for healthcare professionals across all federal and local authorities, standardizing and simplifying the process nationwide.

Saudi Arabia Smart Healthcare Market Trends

Saudi Arabia is a major player in the regional market, due to countries strong government initiatives under vision 2030 and spectacular investments. The focus on expanding digital health platform, integration of AI in diagnostics, and virtual care is fueling this growth. Additionally, the increasing private-sector investments are enabling access to smart healthcare services and facilities. The Minister of Health secured $33 billion in healthcare agreements, including a landmark $8.4 billion investment for accelerating hospital and infrastructure development. This announcement was made during the Global Health Exhibition in Riyadh in October 2025, under the Vision 2030 and the Health Sector Transformation Program.

European Health Horizons: Smart Healthcare Revolution - Analyzing Digital Health Landscape, Policy Drivers, and Initiatives

| Turning Point | Policy Updates & Major Investments |

| January 2025 | The European Commission unveiled an action plan for enhancing the cybersecurity of hospitals and healthcare providers across the EU, under the 2024-2029 mandates. |

| March 2025 | To facilitate the secure and cross-border exchange of health data, the European Health Data Space (EHDS) regulation entered into force. These initiatives are expanding innovations by offering broader data access for research and AI development. |

| March 2025 | 240 million was raised by a Berlin-based AMBOSS, a leading resource for medical education and clinical decision-making in Germany and the US. This action is expected to expand the company's position as a leading co-pilot for physicians worldwide. |

| April 2025 | The EU launched the i2X project with €8 million in funding from the European Commission for the creation of a common format for electronic health records (EHRs) across Europe. This project is advancing the European Health Data Space to enhance interoperability between various health information systems in EU member states, including Germany, Ireland, Belgium, and the Netherlands. |

Top Companies in the Smart Healthcare Market & Their Offerings:

Tier 1 Companies

- Allscripts – Specialized in offering cloud-based software platforms like EHR and Veradigm, population health management, patient engagement, telehealth, and interoperability.

- Logi-Tag Systems – Specialized in smart label and RFID solutions, and offers comprehensive smart healthcare

- solutions with a strong focus on asset and inventory management, including RFID and NFC tags and supply chain optimization.

- Cerner Corporationhas been integrating Oracle Health's portfolios since its acquisition by Oracle, fueling its expertise in cloud-based analytics and AI technologies.

- SAMSUNG– Offering sophisticated wearable devices, remote care, digital diagnostics, digital health infrastructure, and secure mobile platforms for hospitals, care providers, and patients.

- Cisco Systems – creating a secure and connected network infrastructure for small hospitals, including cloud management networks, smart space solutions, collaborative tools, and indoor wayfinding.

- GENERAL ELECTRIC COMPANY – Provide cutting-edge medical technologies and AI-enabled applications, such as AI-driven analytics, patient monitoring, smart workflow & dose management, and medical imaging and diagnostics.

Tier 2 Companies

- Siemens Healthcare Private Limited

- IBM Corporation

- BD

- AirStrip

- Terumo Corporation

- eClinicalWorksResideo Technologies, Inc.

- STANLEY Healthcare

- Medtronic

Smart Healthcare Market Companies

- Allscripts

- Logi-Tag Systems

- Cerner Corporation

- SAMSUNG

- Cisco Systems

- GENERAL ELECTRIC COMPANY

- Siemens Healthcare Private Limited

- IBM Corporation

- BD

- AirStrip

- Terumo Corporation

- eClinicalWorksResideo Technologies, Inc.

- STANLEY Healthcare

- Medtronic

Recent Developments & Innovations in the Smart Healthcare Industry

- In May 2025, Oracle Health partnered with the Cleveland Clinic and G42 for the development of a comprehensive AI-driven healthcare delivery platform to enhance patient care and public health management. This platform is leverages AI, intelligent clinical applications, and nation-scale data analytics for creating secure, accessible, and scalable care models to positively impact on health and longevity of people.

- In March 2025, Samsung Electronics launched the ‘smart home health initiative' in collaboration with Florida State University (FSU). This announcement was made by Samsung Electronics' North American subsidiary and the FSU's College of Nursing and Digital Health Innovation Research Institute.

Smart Healthcare Market – Value Chain Analysis

- R&D – the research and development plays a crucial role in smart healthcare due to its strong innovation and advancement activities. The adoption of innovative technologies like daily medicine, wearable and IoT devices, personalized medicine, and insights of health data analytics makes R&D facilitate smart healthcare.

- Clinical Trials and Regulatory Approvals – the smart healthcare sector involves several clinical trials and regulatory approval processes for novel technologies and medications, including digital health technologies, medical devices, and data protection.

- Formulation and Final Dosage Preparation – the smart healthcare undergoes a significant formulation and final dose preparation process for defining product development, personalization, and technological integration. This process helps to optimize efficacy, safety, stability, and patient complaints.

- Distribution to Hospitals, Pharmacies – the distribution to hospitals and pharmacies crucial process for ensuring the medical products and devices reach their end users efficiently and effectively. Distribution channels like direct hospital, wholesalers and distributors, and pharmacy chains are the main smart healthcare infrastructure.

- Patient Support and Services – there are several components in smart healthcare require patient support and services to enable seamless delivery and adoption of advanced solutions. Technical Support, clinical support, and patient support a crucial players in this sector.

Segments Covered in the Report

By Product Type

- RFID Kanban Systems

- RFID Smart Cabinets

- Electronic Health Records (EHR)

- Telemedicine

- mHealth

- Smart Pills

- Smart Syringes

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting