What is the Type 1 Diabetes Market Size?

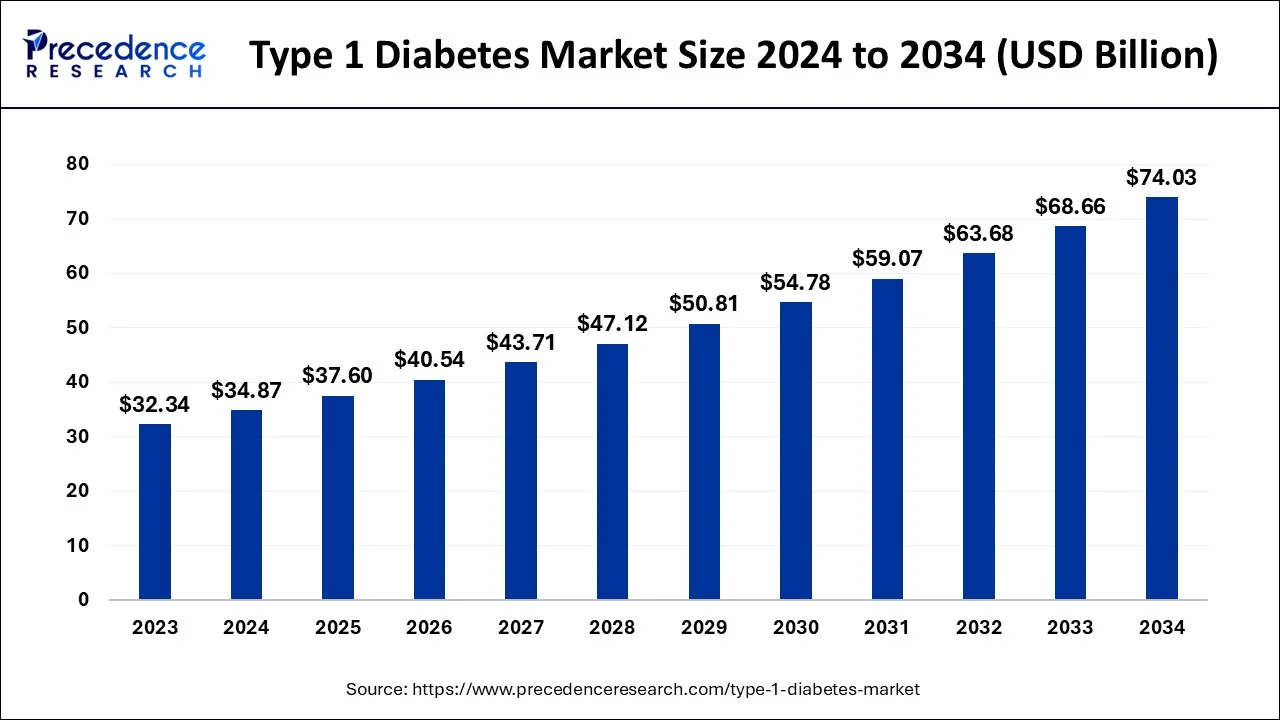

The global type 1 diabetes market size is calculated at USD 37.60 billion in 2025 and is predicted to increase from USD 40.54 billion in 2026 to approximately USD 79.14 billion by 2035, expanding at a CAGR of 7.73% between 2026 and 2035.

Type 1 Diabetes Market Key Takeaways

- On the basis of insulin analog, the rapid-acting insulin analog segment generated the highest revenue share in 2025.

- On the basis of devices, the insulin pump segment is experiencing significant growth.

- On the basis of end-user, the hospital segment is the fastest-growing segment.

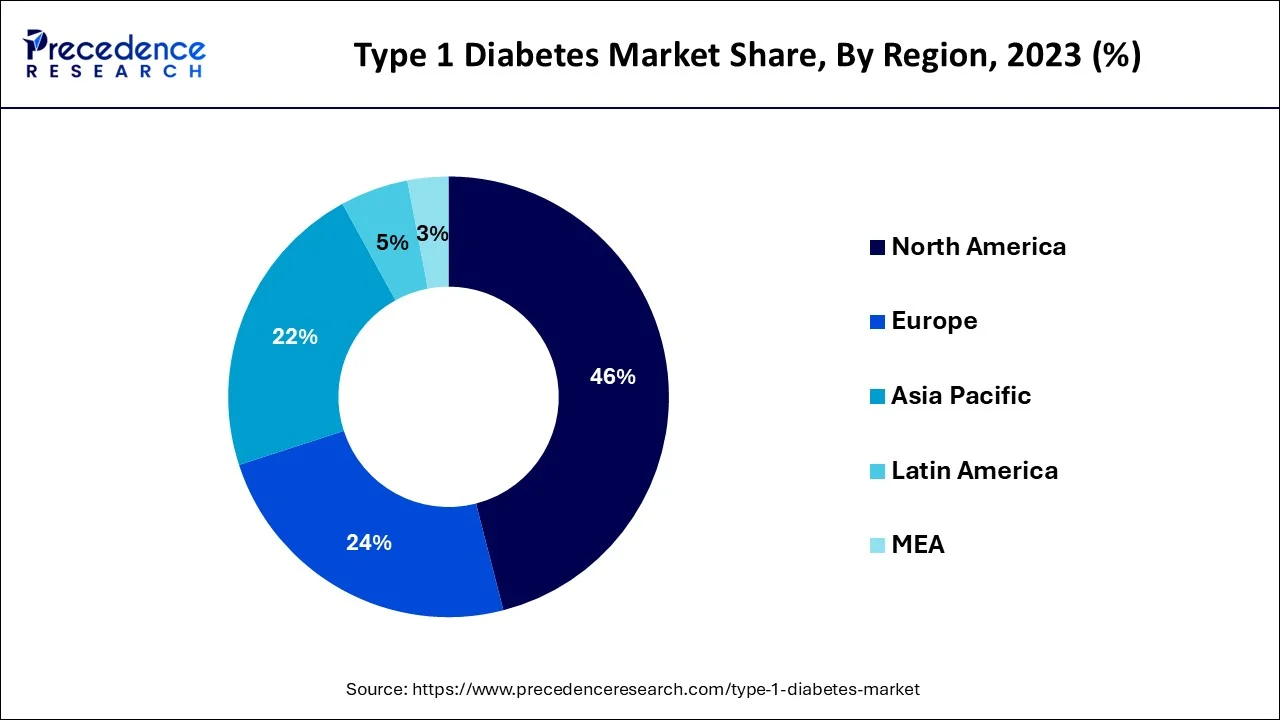

- On the basis of Geographically, North America accounted for the largest revenue share.

What is Type 1 Diabetes?

When a pancreas fails to produce insulin or significantly less insulin, the type of diabetes is considered type 1 diabetes. Type 1 diabetes is a genetic condition known as insulin-dependent diabetes. Type 1 diabetes requires daily corrections to maintain the ideal blood glucose level in the body. Patients with type 1 diabetes are usually provided with insulin. Although type 1 diabetes is less common than type 2 diabetes, nearly 10% of diabetic patients have type 1 diabetes. Type 1 diabetes is mainly diagnosed in children and teenagers.

Frequent urination, extreme thirst, rapid weight loss, and upset stomach are a few significant symptoms of type 1 diabetes. The primary treatment for curing or controlling risks associated with type 1 diabetes is injecting insulin, and the oral route of administration is not applicable for treating type 1 diabetes. The high dependency of type 1 diabetes patients on daily injectable insulin has shown significant growth in the global type 1 diabetes market. The global type 1 diabetes market comprises various vital players, treatments for type 1 diabetes, several end-users, advancements in drugs, and many other factors that propel the growth of the global type 1 diabetes market.

How is AI contributing to the Type 1 Diabetes Industry?

AI is a great support for patients with type 1 diabetes by implementing hands-off insulin delivery systems, doing glucose forecasting, and offering customized lifestyle suggestions. It also marks early signs of the disease, monitors the patient's condition through image analysis, and connects therapy to clinical data using machine learning.

It is through real-time monitoring and predictive alerts that the AI system helps patients to safely control their glucose levels, as well as to avoid major fluctuations, which in turn improves adherence to the treatment, strengthens patient self-management, and makes daily care more efficient and responsive to the individual's health patterns.

Market Outlook

- Industry Growth Overview: Innovation and technological improvements, along with an increase in the number of patients, are the primary drivers of the market, which also leads to the development of new methods in global diabetes care.

- Sustainability Trends:Prolonged efficient handling of the condition, fairness in insulin availability, and consciousness about the environment are the main factors that help the new developments in the diabetes market during its transformation.

- Global Expansion:The increase in treatment options and patients' access worldwide, thanks to the rising acceptance of the new technology in both developed and new markets.

- Major Investors: Eli Lilly, Novo Nordisk, Sanofi, and AstraZeneca are keeping type 1 diabetes research and development alive through their continued financial support to the innovators.

Type 1 Diabetes Market Companies

| Report Coverage | Details |

| Market Size in 2025 | USD 37.60 Billion |

| Market Size in 2026 | USD 40.54 Billion |

| Market Size in 2035 | USD 79.14 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.73% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Largest Revenue Share | North America |

| Segments Covered | By Insulin Analog, By Devices, and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

MarketDynamics

The global type 1 diabetes market is projected to grow during the forecast period of 2023-2032, owing to the increasing demand for measures to treat type 1 diabetes. Technological advancement in remote blood glucose monitoring devices is likely to accelerate the growth of the global type 1 diabetes market. Moreover, acquisitions, strategic partnerships, and collaborations by prominent players in the type 1 diabetes market are seen as another driver for the growth of the global type 1 diabetes market. For instance, in July 2021, Eli Lilly & Company announced the acquisition of Promoter Technologies, Inc. This acquisition aims to help Eli Lilly & Company to focus on the advancement of its glucose-responsive insulins. Research & development activities, investments in the innovation of new insulin drugs to treat type 1 diabetes, increased number of license agreements, and approvals for the use of new drugs by administrative bodies are considered driving factors for the market.

The increased risk of type 1 diabetes in children and teenagers rapidly increases the demand for advanced insulin delivery options in the healthcare sector. This factor is a significant driver for the global type 1 diabetes market. Along with this, the rapid adoption of advanced tools and techniques in treating diabetes is likely to propel the growth of the type 1 diabetes market. The global type 1 diabetes market is driven by factors such as the growing adoption of home-care settings by diabetic patients for convenient healthcare, growing funds for drug development, and growing awareness of early checkups for diabetes to prevent risks in the future.

Strict guidelines and regulations for approvals of new insulin/drugs to treat type 1 diabetes hold the market's growth and are seen as a major restraining factor. Potentially dangerous side effects caused by medications for type 1 diabetes hamper the development of the global type 1 diabetes market. The high cost associated with the diagnosis and treatment of type 1 diabetes is a restraining factor for the global type 1 diabetes market.

Covid-19 Impacts

The Covid-19 pandemic forced industries to shut down and governments to impose prolonged lockdowns. The spread of the coronavirus impacted negatively on almost every sector. However, the healthcare sector showed significant growth due to increased admissions of Covid positive patients. Patients with diabetes or other chronic diseases were more vulnerable to coronavirus infection. There has been a substantial decrease in visitors to hospitals or research institutes as people prefer staying at home. Hence it became difficult for doctors to treat diabetes complications. The strictly imposed lockdown has adversely impacted the economy of the type 1 diabetes market in the initial phase due to the disrupted supply chain of drugs, medications, insulin, active pharmaceutical ingredients, and devices required for diabetes treatment. China is one of the biggest manufacturers of insulin pumps used to treat type 1 diabetes. The outbreak of the pandemic disease started in Wuhan, China, negatively affected the supply chain of insulin pumps.

On the other hand, hospital administration and patients with diabetes preferred remote glucose monitoring systems to manage their health data accurately during the lockdown period. The sudden outbreak of coronavirus forced the population to focus on self-health care, which increased the demand for diabetes control drugs, insulin, and tools. Manufacturers continued to develop diabetes control tools owing to the increased demand during the peak period, which offered a significant profit to the global diabetes market. For instance, in May 2020, Tandem company stated that the company is still on profit margin due to increased demand and positive feedback from diabetic patients for their slim x2 electronic insulin pump.

Along with this, during the Covid-19 pandemic, where the invention of a novel drug/vaccine became a need of the hour, the governmental bodies and administration boosted the number of approvals for research and development of new drugs. This helped the type 1 diabetes market grow as multiple prominent pharmaceutical companies got licenses for supplying drugs, insulin, and glucose monitoring systems to treat high-risk diabetic patients properly. For instance, the U.S. Food & Drug Administration, in April 2020, approved Dexcom and Abbott to provide continuous glucose monitoring systems to hospitals. Moreover, the rise in price for diabetes treatment post-Covid-19 pandemic will likely generate profit for the global type 1 diabetes market.

Segment Insights

Insulin Analog Insights

Based on insulin analogs, the type 1 diabetes market is segmented into rapid-acting, short-acting, and long-acting insulin. The rapid-acting insulin analog segment accounts for the highest revenue share in the global type 1 diabetes market. The rapid-acting insulin is widely used in the treatment of type 1 diabetes as compared to type 2 diabetes. The rapid-acting insulin prevents the sharp rise in glucose/sugar levels in the blood after a meal. Rapid-analog insulin is prescribed to be taken before meals to avoid diabetic complications such as ketoacidosis. Patients with type 1 diabetes require a continuous and fast-acting dose of insulin. Thus, in the global type 1 diabetes market, rapid-acting insulin is expected to grow during the forecast period.

Devices Insights

Based on devices, the type 1 diabetes market is segmented into an insulin pumps, insulin pens, blood glucose meters, and others. Blood glucose meters are widely used by hospitals, specialty clinics, and home care segments as they provide accurate details of glucose/sugar amount present in the blood. A blood glucose meter comes with a strip and a device that indicates the amount of glucose. The blood glucose meter is the largest segment owing to its easy function and accurate determination of blood glucose targets. Blood glucose meters do not require any skilled professionals; thus, it is widely used by type 1 diabetic patients as a home health care device.

On the other hand, the insulin pump segment is experiencing significant growth in the global type 1 diabetes market. Insulin pumps relieve a diabetic patient by releasing insulin in the required amount and according to the instructions provided by the device. In the modern healthcare sector, insulin pumps are considered an alternative to injections as they offer a continuous stream of insulin with fewer needles. These pumps are programmed and do not require timely attention for insulin delivery. The benefits associated with insulin pumps are projected to grow in the segment in the upcoming years.

End-User Insights

Based on end users, the type 1 diabetes market is segmented into hospitals, research institutes, and home care. The hospital segment is the fastest growing segment among all, owing to the increasing prevalence of types of diabetes. Hospitals offer special units for treating type 1 diabetes that ensure proper treatment. The hospital segment for the global type 1 diabetes market has accounted for the largest revenue share due to the advancement in treatment options for type 1 diabetes. Initiatives for accessible or affordable diabetes treatment by several governments implemented in government hospitals have propelled the growth of the type 1 diabetes market. For instance, the National Health Ministry of India has recently started a free drug service for diabetic patients in government hospitals. The free drugs service provides free insulin for poor/low-income populations suffering from diabetes. The reduced cost of treatment and medications in government hospitals has upheld the hospital segment.

Moreover, the home care segment is considered the fastest-growing segment in the global type 1 diabetes market during the post-Covid-19 pandemic. The Covid-19 pandemic accelerated the culture of remote glucose monitoring, which has helped patients and healthcare providers in monitoring patients' blood glucose levels remotely. Considering the cost and time-saving benefits associated with home care for type 1 diabetes, the segment will likely maintain growth from 2024 to 2034.

Regional Insights

What is the U.S. Type 1 Diabetes Market Size?

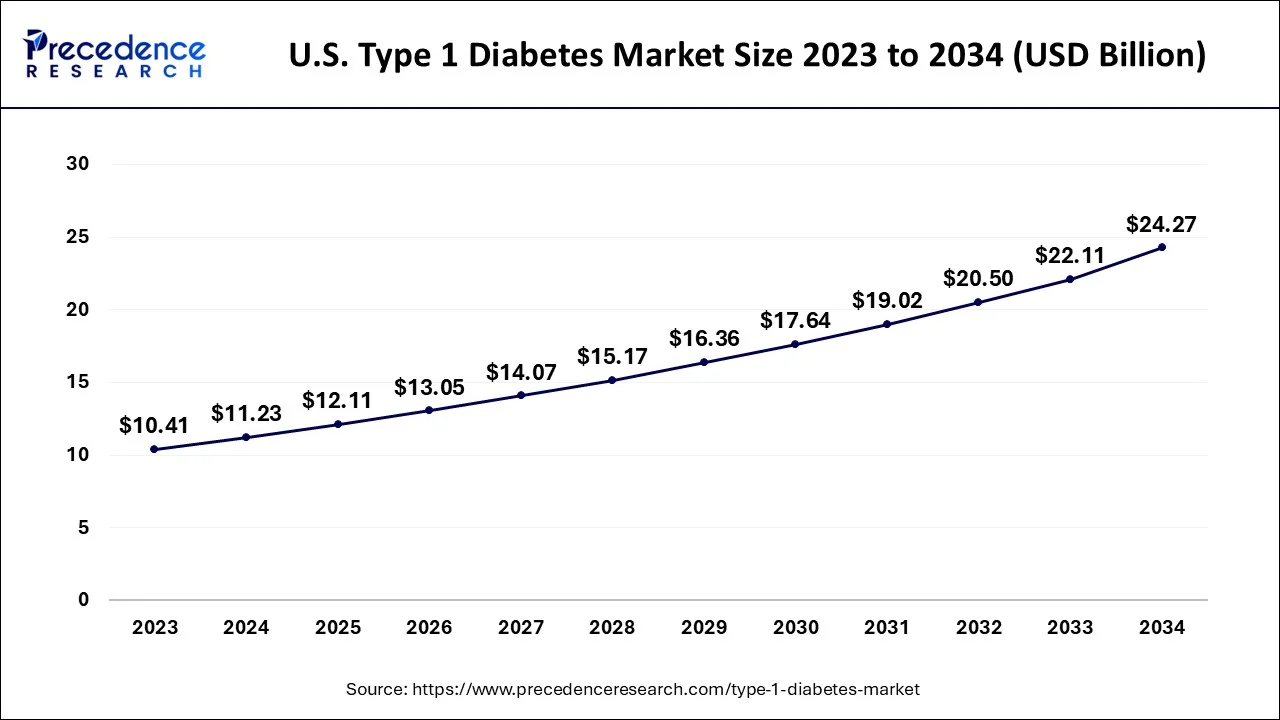

The U.S. type 1 diabetes market size accounted for USD 12.11 billion in 2025 and is anticipated to reach around USD 26.06 billion by 2035, growing at a CAGR of 8% between 2026 to 2035.

Geographically,North America accounted for the largest revenue share in the global type 1 diabetes market.Increasing patients of type 1 diabetes, including children and adolescents, is a major driving factor for the market in North America. Along with this, the rising participation of major key players in the research and development activities for the invention of new diabetes cures has accelerated the growth of the type 1 diabetes market in North America. Asia Pacific is the fastest growing region in the global type 1 diabetes market owing to the reduced cost of treatment for diabetes.

U.S. Type 1 Diabetes Market Trends

The U.S. enables regional supremacy through the strong fusion of digital health platforms and state-of-the-art diabetes technologies. The focus on personalized treatment techniques and the constant development of new drugs for the disease coming along with the already strong strength that disease management and the support of the modern monitoring and delivery solutions are becoming faster in getting ubiquitous.

The rise in consumer spending on healthcare and technological advancements in the healthcare sector has fuelled the growth of the type 1 diabetes market in Europe. Germany is the fastest-growing country in Europe for the type 1 diabetes market due to increasing early checkups for diabetes. The technological advancements in insulin delivery options for type 1 and type 2 diabetic patients have boosted the growth of the type 1 diabetes market in Latin America. Moreover, the developing healthcare infrastructure will likely increase the market's growth during the forecasted period of 2023-2032.

What are the Driving Factors of the Type 1 Diabetes Market in Europe?

Europe is still one of the main markets that is affected by a lot of research activities and by a greater number of early screening practices. The emphasis on the understanding of both the genetic and the environmental factors helps to support the lifting of the bar in the therapeutic area. The growing interest in the development of advanced cell-based approaches is a great booster of the regional advancements in Type 1 diabetes care.

Germany Type 1 Diabetes Market Trends

Germany's market increases gradually with more early screening initiatives and a great deal of health technology awareness. The spotlight on research-driven progress and coordinated care ups the ante in the adoption of innovative diabetes management tools while simultaneously supporting the broad improvement of long-term patient outcomes.

How is Asia-Pacific performing in the Type 1 Diabetes Market?

Asia-Pacific is on the fast lane in terms of market expansion due to the rising awareness of diabetes, different healthcare needs, and the changing digital health adoption. The building up of manufacturing capacity and the investment in technology-driven diabetes solutions help to develop the market further. The use of personalized and economical approaches in diabetes treatment is benefiting the whole region by educating more people and thus indirectly boosting innovation in the care models.

India Type 1 Diabetes Market Trends

India is witnessing rapid expansion in its market for health care and diabetes-related products due to various government initiatives, better access to health care services, and the growing acceptance of home-based diabetes care solutions. One of the main strengths of digital health is that it significantly facilitates monitoring practices and creates demands for tailored, technology-enhanced management approaches across various patient populations.

Countries in the Middle East and Africa are experiencing increased type 1 diabetes patients. The oral anti-diabetic drug segment holds the largest revenue share of the type 1 diabetes market in Middle East countries. Along with this, the developing healthcare infrastructure will likely boost the growth of the type 1 diabetes market in Africa.

Value Chain Analysis of the Type 1 Diabetes Market

- R&D: R&D reveals new treatments for type 1 diabetes and lays down research that demonstrates the initial therapeutic viability.

Key Players: Eli Lilly, Novo Nordisk, Sanofi - Clinical Trials and Regulatory Approvals: Clinical trials mean that the drugs are safe and effective through organized studies and the subsequent approval by regulatory agencies for market entry.

Key Players: IQVIA, PPD - Formulation and Final Dosage Preparation: Formulation transforms the active substances into stable, practical dosage forms that are compatible with the patient-oriented diabetes care delivery methods.

Key Players: Eli Lilly, Novo Nordisk, Sanofi - Packaging and Serialization: Packaging and serialization maintain the integrity of the products, and additionally, they apply identifiers that guarantee their traceability and compliance with safety regulations.

Key players: West Pharmaceutical Services, SCHOTT, TraceLink - Distribution to Hospitals, Pharmacies of Electronic Health Record Software: Distribution brings the finished diabetes products to hospitals, pharmacies, and other essential healthcare providers via logistics networks.

Key Players: McKesson, AmerisourceBergen

Type 1 Diabetes Market Companies

- Eli Lilly: Eli Lilly has a comprehensive range of insulin products and delivery technology that are effective in managing type 1 diabetes through the use of innovative treatments and monitoring devices.

- Pfizer: Pfizer has a wide range of pharmaceuticals in its portfolio and does not have a specific product for type 1 diabetes, but rather supplies the healthcare industry to a large extent through its medicines for various diseases.

- Abbott Laboratories: Abbott Laboratories offers FreeStyle Libre continuous glucose monitoring systems that provide an economical, easy, and dependable way of controlling diabetes for the niceties of daily life.

Other Major Key Players

- DiaVasc, Inc.

- Biodel, Inc.

- Sanofi

- Merck

- Astellas Pharma

- Mannkind Corporation

Recent Developments

- In August 2025, A new drug, Teplizumab, was licensed in the UK to slow down type 1 diabetes progression, enabling patients to live normally without insulin injections. Experts call it a “breakthrough moment” in treatment. (Source: https://www.independent.co.uk )

- In July 2025, Mattel introduced its first Barbie doll with type 1 diabetes (T1D) to promote inclusion and empathy. Developed with Breakthrough T1D, this initiative highlights the company's dedication to representation. Krista Berger, senior vice president of Barbie, emphasized the significance of this step towards inclusivity in children's toys. (Source: https://www.thehindu.com/ )

- In January 2022, a Danish drug maker, Novo Nordisk, launched oral semaglutide to treat diabetes.

- In November 2022, Gandhi Hospital, based in Secunderabad, India, launched a specialized center 'Center of Excellence' for type 1 diabetic children. This CoE will allow diabetic children to get proper and advanced treatment for diabetes.

- In November 2022, the national research team led by researchers at the University of Birmingham launched a trial program to screen 20,000 children for type 1 diabetes.

- In December 2022, a global company in inulin delivery technology, Tandem Diabetes, announced that it had agreed to acquire AMF Medical. AMF Medical is a prominent name in patch pump development for diabetes patients.

- In December 2022, aprominent manufacturer of glucose monitoring systems, Dexcom, announced that the company is going to launch Dexcom's G7 continuous glucose monitor early next year. The continuous glucose monitoring system designed and developed by Dexcom can be used for type 1 & type 2 diabetes.

- In August 2022, a leading manufacturer of wearable health devices, LifeScan, launched OneTouch Solutions. It is an e-commerce site that offers convenient and personalized programs for diabetic people.

- In June 2022, a leading pharmaceutical company, Vertex Pharmaceuticals, released new data from the first two participants to receive a stem-cell-based therapy as a cure for type 1 diabetes. The company released this data at the American Diabetes Association's 82nd annual scientific session in New Orleans.

- In November 2022, the U.S. Food & Drug Administration (FDA) approved the world's first immunotherapy 'Teplizumab' for type 1 diabetes. Teplizumab, also known as Tzield can now be prescribed in the United States for patients with a high risk of developing type 1 diabetes.

- In September 2020, Medtronic announced the U.S. Food & Drug Administration (FDA) clearance for their MiniMedTM 770G hybrid closed-loop system. MiniMedTM 770G is an insulin administration system that can be used for young ones as two years old. The system is equipped with SmartGuard technology.

Segments Covered in the Report

By Insulin Analog

- Rapid-Acting Insulin

- Short-Acting Insulin

- Long-Acting Insulin

By Devices

- Insulin Pump

- Insulin Pen

- Blood Glucose Meter

- Others

By End-User

- Hospital

- Research Institutes

- Home Care

ByGeography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content