What is the Continuous Glucose Monitoring (CGM) Device Market ?

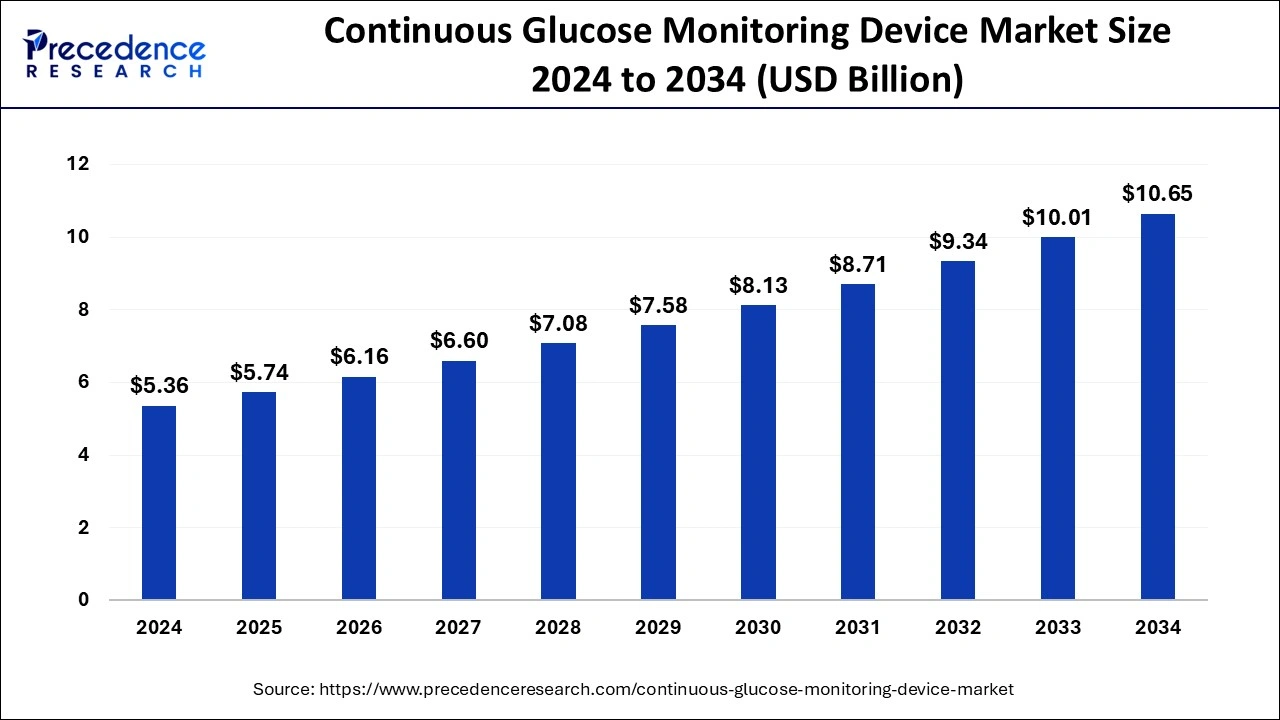

The continuous glucose monitoring device market size is accounted at USD 5.74 billion in 2025 and predicted to increase from USD 6.16 billion in 2026 to approximately USD 10.65 billion by 2034, representing a CAGR of 7.11% from 2025 to 2034.

Continuous Glucose Monitoring (CGM) Device Market Key Takeaways

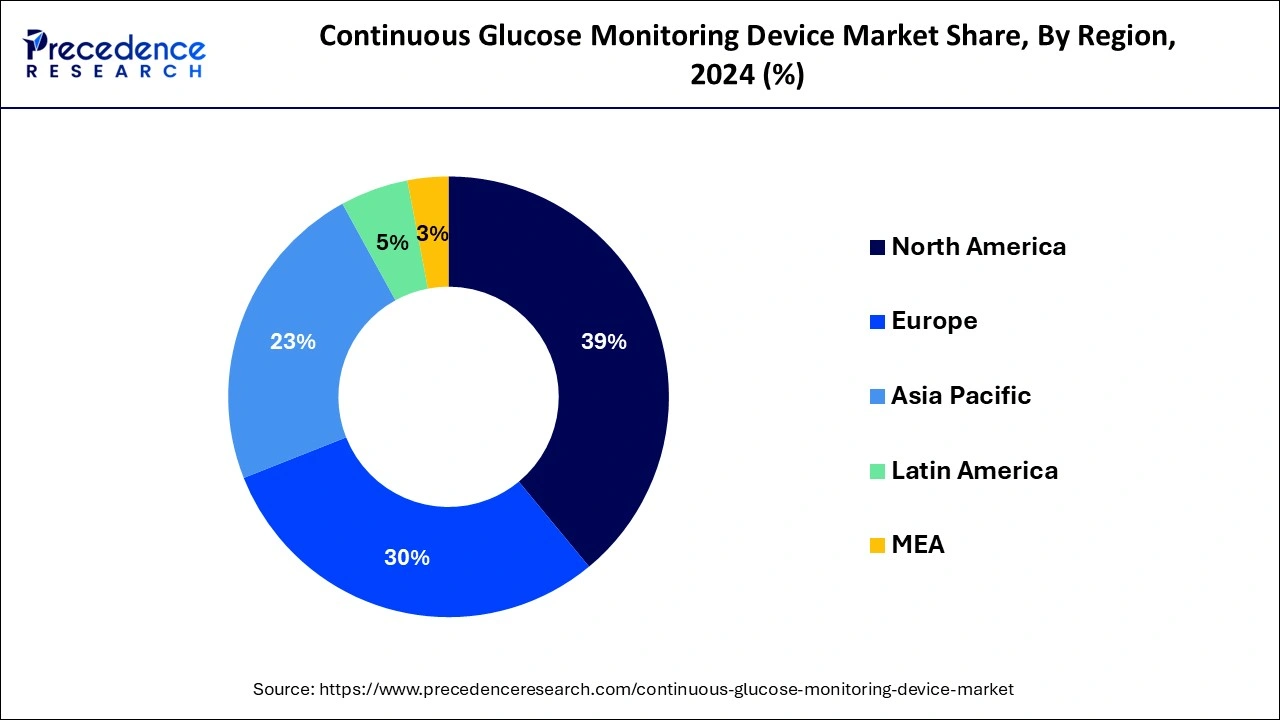

- North America dominated the market with share of 39% in 2024.

- By component, the sensors segment is register a CAGR of 10.2% from 2025 to 2034.

- By end use, the hospital segment is growing at a CAGR of 9.7% from 2025 to 2034.

AI in the Market

AI is doing wonders in the CGM device market by boosting accuracy, personalization, and predicting abilities. AI algorithms are being used to analyze glucose data for pattern detection, fluctuation forecasting, and timely alerts for hypoglycemic events, among others. Thus, the healthcare professionals as well as the users get the chance to make dietary, activity, or medication-related adjustments proactively. Besides, AI contributes to sensor calibration and decreases measurement errors by getting through the user's specific physical responses. It also enables monitoring from a distance, and it helps in optimizing the device. Data interpretation is done by AI, and user engagement is improved through tailored recommendations and virtual coaching.

Continuous Glucose Monitoring (CGM) Device Market Growth Factors

The global continuous glucose monitoring device market is primarily driven by the rising prevalence of diabetes and increasing demand for the treatment and preventive measures across the globe. According to the World Health Organization, around 1.5 million deaths were directly linked to the diabetes in 2019 and around 2.2 million deaths were linked to high blood glucose in 2012. According to the International Diabetes Federation, around 700 million people will have diabetes around the globe, by 2045. Therefore, the alarming rise in the diabetic population globally is expected to drive the demand for the CGM device in the forthcoming years. Furthermore, the growing geriatric population is a significant factor that will augment the demand for the CGM device. Geriatric people are prone to high blood glucose levels and diabetes. The rising awareness regarding the diabetes, availability of CGM devices, increasing disposable income, and increasing expenditure in the healthcare are the significant factors that are estimated to augment the global CGM device market in the foreseeable future.

Overweight and obesity are the two major causes of diabetes. Moreover, the unhealthy food habits among the population have contributed in the growth of the number of obese people. According to the World Health Organization, more than 1.9 billion global populations were overweight, out of which around 650 million adults were obese in 2016. The CGM device tracks the glucose levels and continuously monitors it using latest technologies like sensors and wireless connectivity, which helps in the proper management of the blood glucose levels. The aggressive marketing by the prominent players in the developed and developing markets had augmented the demand for CGM devices by spreading the awareness regarding the glucose monitoring. All these factors are expected to have a positive impact on the global continuous blood glucose monitoring device market.

- Diabetes occurrence has been rapidly growing worldwide, thereby driving the continuous glucose monitoring devices market with the cloud: the more the number of individuals who need effective alternatives to managing glucose aggregates, the more the demand for CGM devices.

- The older population aged 65 years and above, much prone to diabetes and hyperglycemic conditions, drives the demand for continuous glucose monitoring devices globally.

- Greater awareness about diabetes management, increased disposable income, and increased government health expenditure all operate as supporting factors towards CGM technology adoption.

- Unhealthy eating habits lead to overweight and burning to obesity levels among people, both significant contributors to diabetes, an increasingly privileged stage for demand for state-of-the-art continuous glucose monitoring support.

- The CGM was highly appreciated and matured into a new program through the CGM technologies, which coupled sensors with wireless connectivity in providing cutting-edge support.

- The increasing frequency of diabetes patients prompts the adoption of CGM devices.

- The aging population's vulnerability to hyperglycemia necessitates precise monitoring.

- The market for advanced glucose monitoring technologies is supported by rising awareness and disposable incomes.

- The wireless connectivity and real-time tracking are some technological advancements that have made CGM devices more accessible.

- The focus on obesity and lifestyle-related disorders continues to strengthen the market outlook.

Market Scope

| Report Highlights | Details |

| Market Size by 2034 | USD 10.65 Billion |

| Market Size in 2025 | USD 5.74 Billion |

| Market Size in 2026 | USD 6.16 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.11% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | End User, Component, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Diabetes Prevalence

The increasing global prevalence of diabetes-Because it is an aging population, has led to obesity and sedentary lifestyles an apt drivers for propagating and proliferating the CGM market. As diabetes patients increases, especially those suffering from type 2 diabetes and in need of management, the installation of glucose management tools has increased. Continuous glucose monitoring devices provide 24 h monitoring with real-time data serving as an aid in disease management and prevention of serious complications. The demand for convenient monitoring solutions is fomenting the adoption and subsequent boom of the CGM market in various parts of the world.

Restraint

Limited Accessibility

Access to continuous glucose monitoring technology remains limited in rural and underserved areas, and that stands to be a major roadblock for market growth. Many populations face barriers: poor healthcare infrastructure, lack of specialist care, affordability, and the like. These restrict the availability and use of the CGM devices, and many diabetics go untreated with advanced monitoring solutions. It is an issue that shakes the accessibility landscape of these devices, and focused efforts towards improvements in distribution, healthcare delivery, and education are never cheap and slow down the rapid adoption of CGM technology in certain parts.

Opportunity

Digital Health Integration

There are big opportunities for probable growth in remote health monitoring purposes and treatment through the integration of continuous glucose monitoring (CGM) systems with smartphones, smartwatches, and telemedicine platforms. Because of thepresence of such integration, it would basically mean seamless connectivity to enhance a user's experience with real-time monitoring, easy sharing of data, and ultimately, personalized feedback. The end-goal view is that the full-scale remote monitoring of patients helps doctors keep track of their patients' health continuously so that interventions can be made at the right time, leading to better care management. Hence, the integration of digital health promotes patient engagement with their treatment and enables self-care. As digital health technologies progress and get accepted, the integration of these technologies with CGM devices will be porous and penetrate even more into delivering diabetes care in the market.

Component Insights

The sensors segment accounted for around 40.5% of the market share in 2024. This is attributed to the accuracy and efficiency of the sensors in analyzing the blood glucose levels. Moreover, higher preference for the sensors has augmented the growth of this segment. It efficiently reads the fluctuations in the blood glucose levels which makes sensor the dominating segment in the CGM device market. The technological advancements in the sensors technology has improved the performance of the sensors. The advancements in the sensor technology has resulted in increasing the affordability of the sensor CGM devices, thereby opening growth prospects in the developing and the underdeveloped economies across the globe.

End User Insights

The home healthcare segment accounted for around 45% of the market share in 2024. This can be attributed to the rising prevalence of diabetes, increased awareness regarding the availability of CGM devices, increasing disposable income, and increased demand for the preventive measures among the consumers. The increasing health consciousness and rising awareness regarding the management of blood glucose levels on regular basis has augmented the demand for the CGM device at home healthcare segment. Moreover, aggressive marketing strategies adopted by the top market players have exponentially contributed towards the growth of this segment.

The other segment is estimated to be the most opportunistic segment during the forecast period. The rising penetration of clinics and diagnostic labs across the globe is a major factor that boosts the demand for the CGM devices. Moreover, low literacy in the low and middle income countries makes the diabetic population dependent on the clinics and diagnostic labs for the continuous blood glucose monitoring, which is a major factor for the growth of the others segment.

Regional Insights

U.S. Continuous Glucose Monitoring (CGM) Device Market Size 2025 To 2034

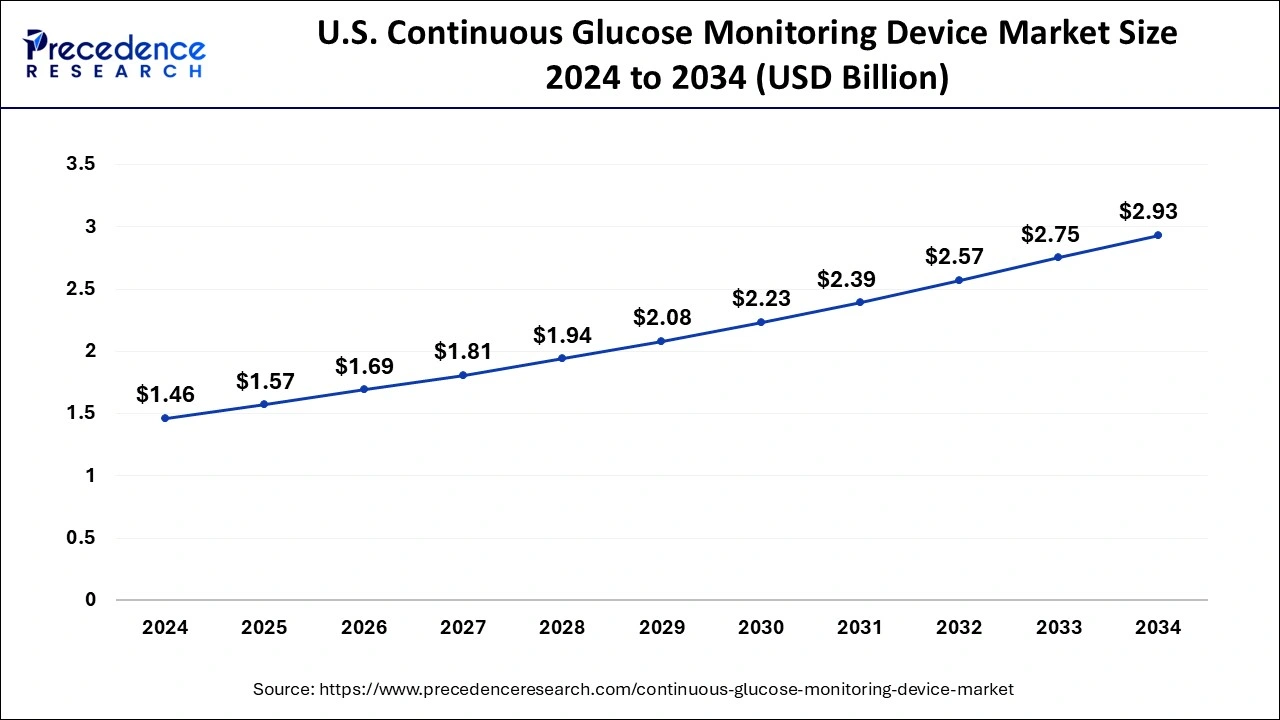

The U.S. continuous glucose monitoring device market is valued at USD 1.57 billion in 2025 and is projected to grow around USD 2.93 billion by 2034, growing at a CAGR of 7.19% between 2025 to 2034.

Based on region, North America accounted for around 39% of the market share in 2024. This is simply attributed to the high literacy rate, increased disposable income, increased healthcare expenditure, increased adoption rate of latest technologies, increased awareness regarding diabetes, growing geriatric population, and higher demand for the diabetes preventive measures in the major markets like US and Canada. In North America, Canada is the fastest-growing market, owing to the rising cases of diabetes. According to the Diabetes Canada, around 11 million people were suffering from diabetes in 2020, and this number is expected to rise in the future.

North America dominated the continuous glucose monitoring (CGM) devices market due to technological advancements in healthcare infrastructure and awareness regarding optimization of government and private insurance policies. The advanced infrastructure provides individuals with the topmost clinical facility that helps prevent diseases like diabetes and cancer.

Early detection assists in identifying and prescribing medication for rare diseases, and CGM devices significantly improve the prevention of diseases, as they provide real-time tracking of blood sugar levels and continuously measure glucose levels in the interstitial fluid. In addition, Canada also plays a crucial role as it provides patients with government initiatives and promotes awareness regarding the advantages of glucose monitoring.

What to Expect in U.S. Glucose Monitoring Device Market?

The growing prevalence of diabetes in the country increases demand for continuous glucose monitoring devices. For instance, according to the National Diabetes Statistics Report in 2021 total of 38.4 million people had diabetes. The presence of robust infrastructure for managing diabetes and a well-established healthcare system helps in the market growth. The growing adoption of innovative healthcare technologies and favorable reimbursement policies drives the market growth. The growing awareness about continuous glucose monitoring among healthcare providers and patients drives the overall growth of the market.

- In May 2025, Roche announced a $550 M investment to expand its continuous glucose monitoring systems manufacturing hub in the United States. The project aims to provide innovative monitoring solutions for diabetes. (Source: https://www.biospectrumindia.com)

The Asia Pacific is estimated to be the most opportunistic market during the forecast period. Asia Pacific presets a lucrative growth opportunity to the market players. The presence of huge population, rising urban population, rising healthcare expenditure, rising awareness regarding diabetes, and unhealthy food habits are the major factors that are altogether augmenting the growth of the continuous blood glucose monitoring device market.

In Asia Pacific, the continuous glucose monitoring (CGM) devices market is also experiencing rapid growth, fueled by a combination of factors including a diverse and growing patient population base of diabetes patients, the presence of real-time tracking devices, smart handheld devices, and an increasing emphasis on an automated insulin delivery system. These dynamics contribute to the region's elevated demand for insulin delivery devices, particularly among patients with glucose levels that drop too low (hypoglycemia) or rise too high (hyperglycemia).

Asia Pacific consumers exhibit a wide range of preferences, from those seeking affordable insulin devices to those desiring personalized smart devices that provide 24/7 monitoring, such as implantable CGMs and intermittently scanned CGMs. Moreover, India is home to numerous digital healthcare solutions and government initiatives, which reinforce a strong presence in the market for high-quality CGM devices.

China Continuous Glucose Monitoring (CGM) Device Market Trends:

China is a major contributor to the continuous glucose monitoring device market. The growing diabetic population in the nation increases demand for an efficient tool like a continuous glucose monitoring device. The growing awareness about diabetes through various programs like community outreach and health campaigns, and educational programs helps in the market growth. The growing geriatric population and technological advancements in CGM devices drive the overall growth of the market.

- According to Volza's India Export data, China exported 5402 shipments of Glucose monitoring. (Source: https://www.volza.com)

India Continuous Glucose Monitoring (CGM) Device Market Trends:

India is significantly growing in the continuous glucose monitoring market. The growing adult diabetes population in the nation increases demand for CGM devices. The high prevalence of diabetes 2 helps in the market growth. The growing awareness about the advantages of CGM devices increases the adoption of CGM devices. The growing prevalence of diabetes and the rising trend of preventive healthcare fuel demand for CGM devices. The aging population and the growing diabetes in older people drive the overall growth of the market.

- For instance, according to the International Diabetes Federation, in 2024 number of adults (20-79) suffering from diabetes was 89.8 million.

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

- In February 2020, Abbott and Insulet entered into a partnership to develop CGM device by integrating automatic insulin deliver and glucose sensing technologies that can provide enhanced CGM solutions.

- In November 2020, Medtronic acquire FDA approval for InPen, a smart insulin pen that can serve those diabetic patients who are on daily insulin injections.

The various developmental strategies like mergers, acquisitions, and partnerships foster market growth and offers lucrative growth opportunities to the market players.

Continuous Glucose Monitoring (CGM) Device Market Companies

- Abbott Laboratories

- Dexcom, Inc.

- A. Menarini Diagnostics

- Echo Therapeutics, Inc.

- GlySens Incorporated

- Johnson & Johnson

- Medtronic plc

- Senseonics Holdings, Inc.

- F. Hoffmann-La Roche Ltd

- Ypsomed

Recent Developments

- In June 2025, Tracky, a Thane-based healthtech startup, launched India's first Bluetooth-enabled Continuous Glucose Monitor (CGM), aiming to revolutionize diabetes care and preventive health management. (Source:https://www.biospectrumindia.com/)

- In April 2025, Ambrosia, a global leader in real-time health monitoring, has launched India's first 24x7 glucose and stress monitoring service, integrating wearable sensor technology, AI, and remote monitoring. (Source: https://www.business-standard.com)

Roche

- In September 2024, Roche launched its first continuous glucose monitor (CGM), authorized for Type 1 or Type 2 diabetes.

Eversense

- In October 2024, Eversense launched the 365 CGM system, which is specifically designed to reduce device frustrations.

Abbott

- In September 2024, Abbot announced its new launch, Lingo, its continuous glucose monitoring (CGM) technology.

Value Chain Analysis

- R&D: The process includes the creation and implementation of cutting-edge CGM sensors, algorithms, and analytical technologies for the purpose of continuous and precise glucose tracking.

Key Players: Dexcom, Medtronic, and Abbott Laboratories - Clinical Trials and Regulatory Approvals: This stage of the process is focused on conducting human trials to determine safety and efficacy, which is then followed by the attainment of licenses from medical regulatory agencies for the purpose of selling the product.

Key Players: Dexcom, Medtronic, and Abbott Laboratories - Packaging and Serialization: Devices are packed in protective packaging for shipment, and serial codes are assigned for traceability and quality assurance.

Key players: Dexcom, Medtronic, and Abbott Laboratories - Distribution to Hospitals, Pharmacies: The process of finished devices' logistics to medical facilities, retail pharmacies, and authorized distributors is managed by this department.

Key Players: Cardinal Health, Medline, and McKesson Corporation - Patient Support and Services: This is a part of the whole thing that gives training, maintenance, warranty support, and technical assistance to the customers after the sale to keep them satisfied and loyal.

Key Players: Dexcom, Medtronic, and Abbott Laboratories

Segments Covered in the Report

By Component

- Transmitters

- Receivers

- Sensors

- Integrated Insulin Pumps

By End User

- Hospitals

- Home Healthcare

- Others

By Demographics

- Child Population (≤14 years)

- Adult Population (>14 years)

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting