What is the Insulin Market Size?

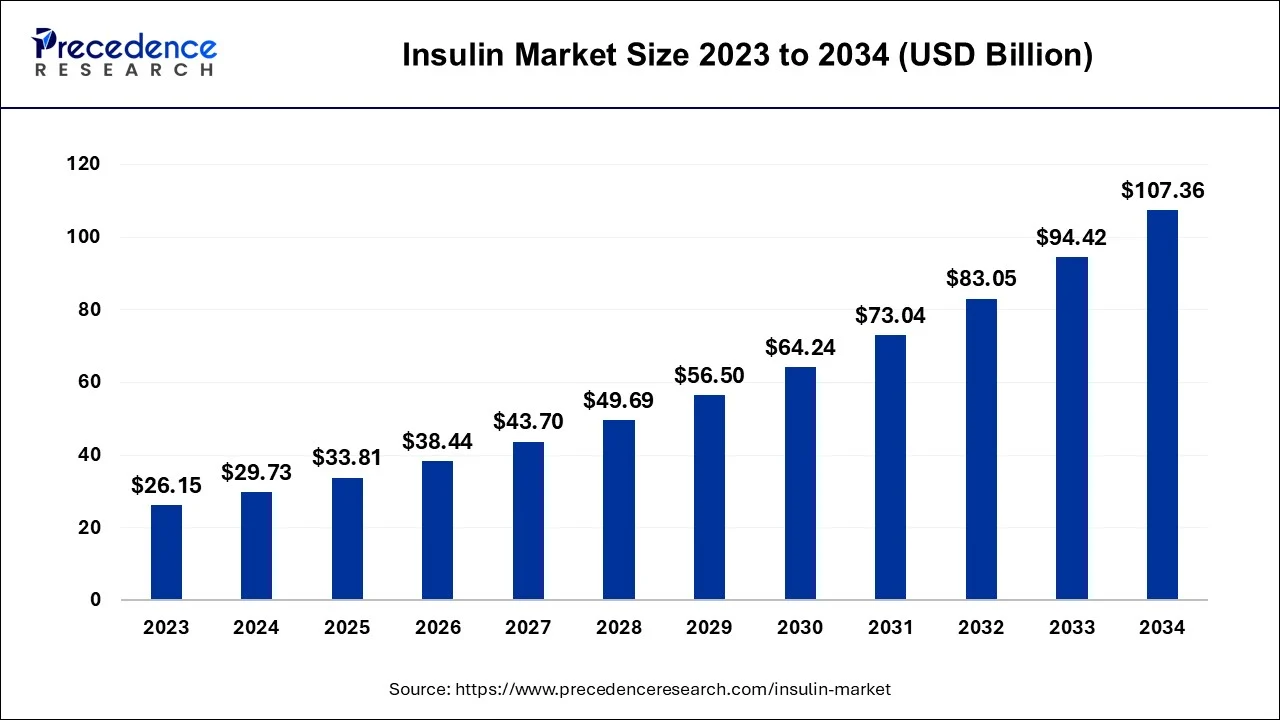

The global insulin market size is valued at USD 33.81 billion in 2025 and is predicted to increase from USD 38.44 billion in 2026 to approximately USD 119.25 billion by 2035, expanding at a CAGR of 13.43% from 2026 to 2035.

Insulin Market Key Takeaways

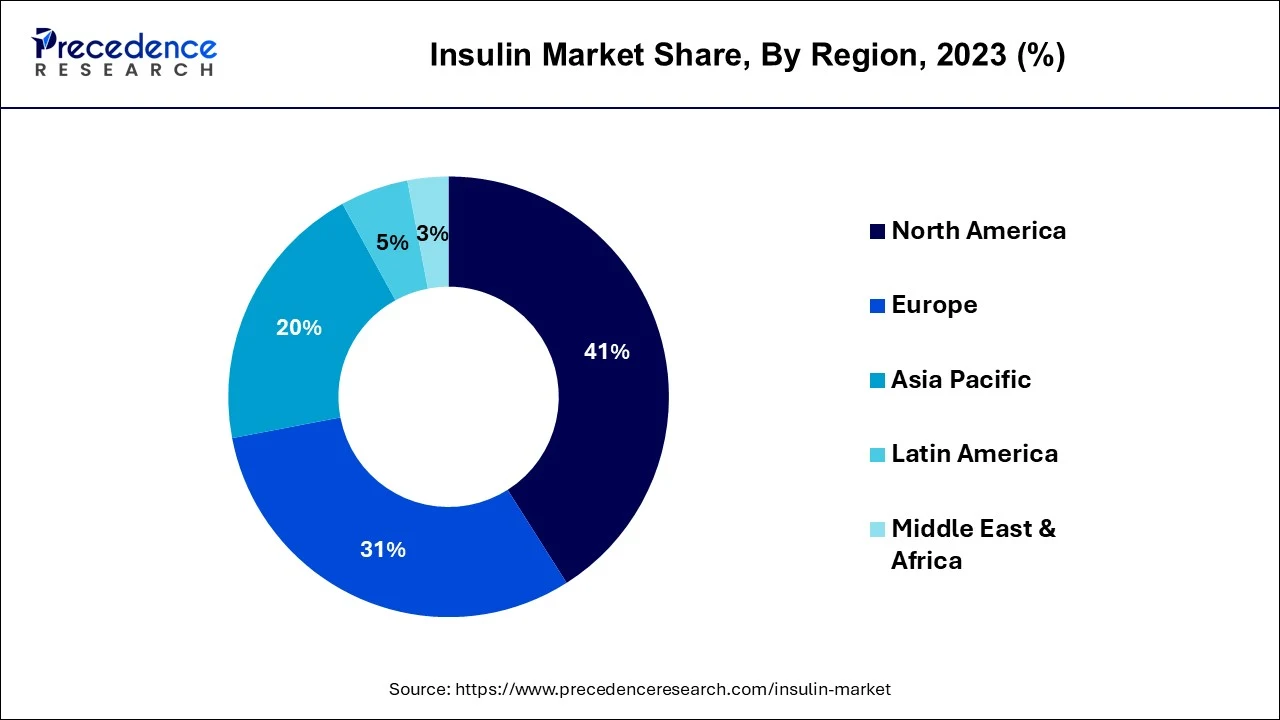

- North America contributed more than 41% of the revenue share in 2025.

- Asia Pacific is estimated to expand the fastest CAGR between 2026 and 2035.

- By product, the long-acting Insulin segment has held the largest market share of 48% in 2025.

- By product, the rapid-acting insulin segment is anticipated to grow at a remarkable CAGR of 21.4% between 2026 and 2035.

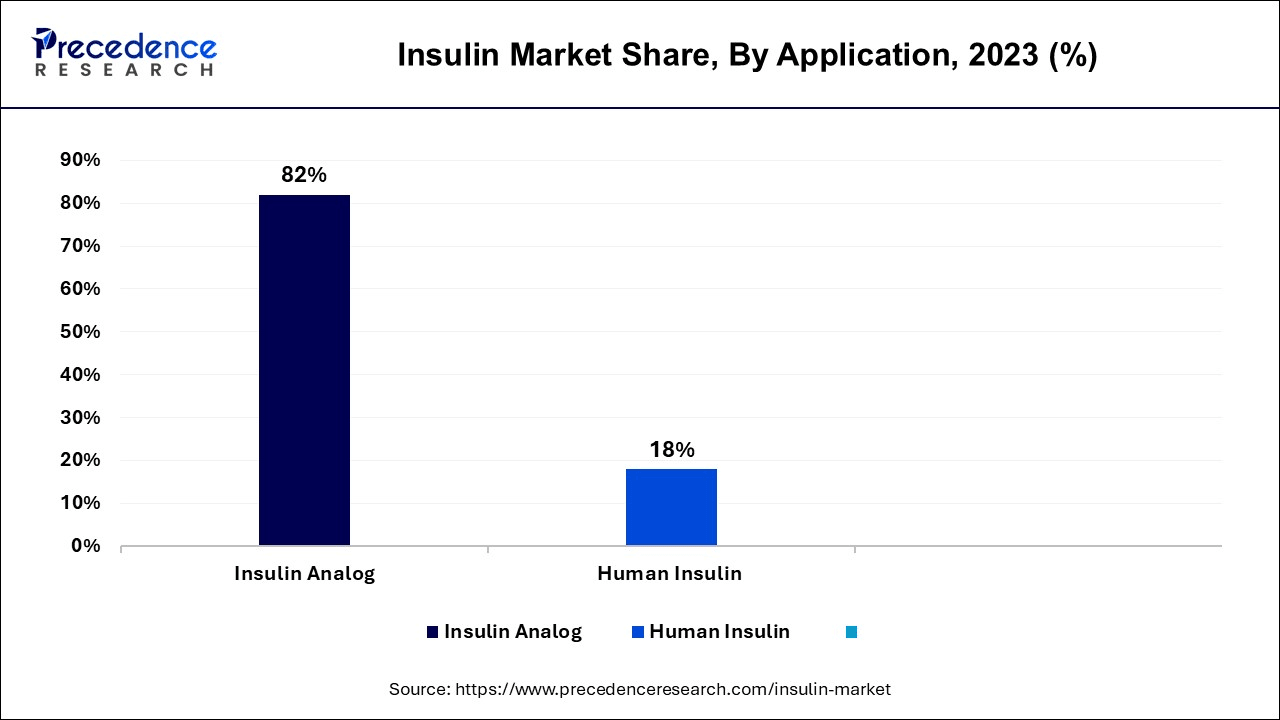

- By type, the insulin analog segment generated over 82% of revenue share in 2025.

- By type, the human insulin segment is expected to expand at the fastest CAGR over the projected period.

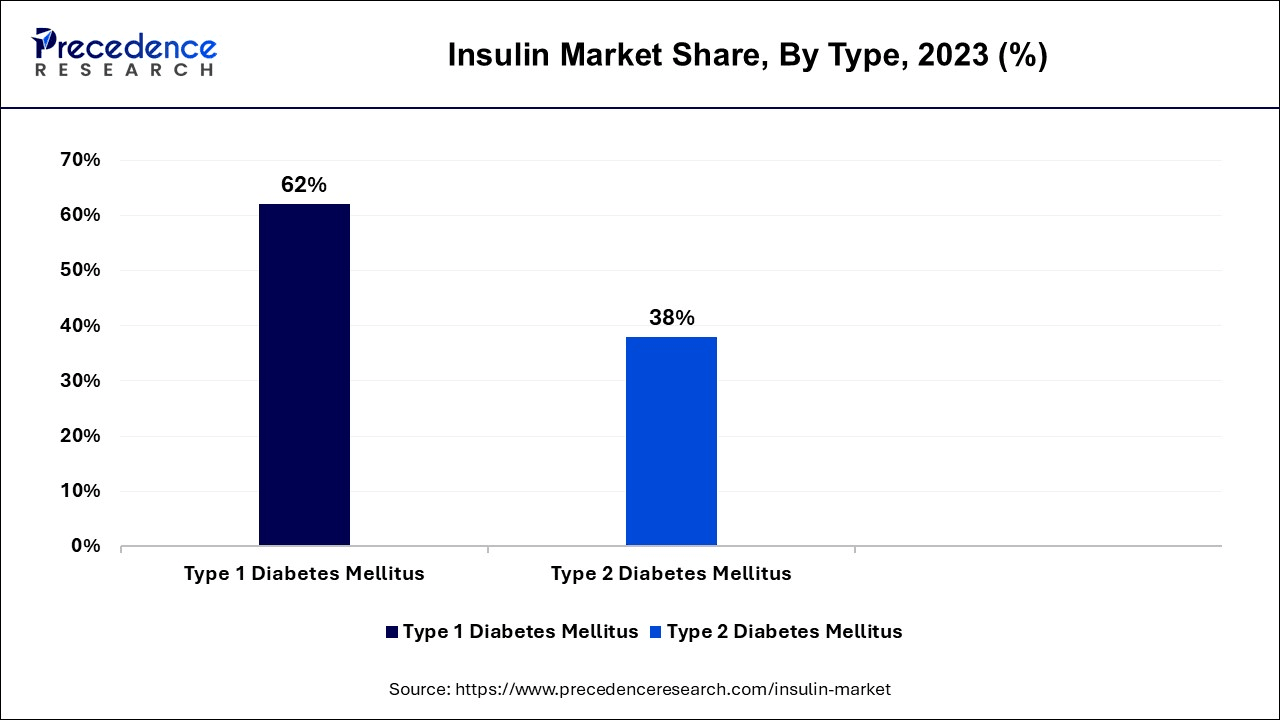

- By application, the Type 1 diabetes mellitus segment had the largest market share of 62% in 2025.

- By application, the Type 2 diabetes mellitus segment is expected to expand at the fastest CAGR over the projected period.

- By distribution channel, the hospital segment generated over 76% of revenue share in 2025.

- By distribution channel, the retail pharmacies segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

The insulin market plays a vital role in the pharmaceutical sector by producing and supplying insulin, a hormone essential for managing diabetes. It comprises diverse insulin types, such as fast-acting, long-acting, and intermediate-acting formulations. Key factors propelling this market are the escalating global diabetes prevalence and the expanding elderly population. These demographics drive insulin demand, making it a pivotal component of healthcare.

With various insulin delivery innovations and the development of biosimilar products, the market continues to evolve, but it also faces challenges in ensuring equitable access to insulin and navigating regulatory complexities. This process helps maintain the body's blood sugar balance, preventing it from reaching dangerous levels. Insulin deficiency, often associated with conditions like diabetes, can lead to high blood sugar and various health complications, necessitating external insulin supplementation for management.

Insulin Market Outlook

- Industry Growth Overview: The insulin market is expected to grow steadily from 2026 to 2035, driven by rising global rates of diabetes, particularly Type 2, and demand for effective glucose management. The rising demand for long-acting insulin analogs, biosimilars, and advanced delivery systems, such as smart insulin pens and automated insulin delivery (AID) pumps, further supports market growth.

- Technological Advancements: Technological advancements in the market are focusing on improving patient accessibility and adherence, with the expansion of biosimilar insulins helping to lower costs and the development of once-weekly insulin formulations enhancing convenience. Additionally, the integration of digital health solutions is streamlining treatment optimization, while growing environmental concerns are driving the shift toward reusable insulin pens and sustainable packaging solutions.

- Global Expansion:Leading companies are strategically growing into high-growth emerging markets, particularly in the Asia-Pacific region, Latin America, and the Middle East and Africa, where diabetes rates are increasing quickly and healthcare systems are developing by increasing local production and ensuring affordable insulin access.

- Major Investors:The market is dominated by a few major pharmaceutical giants, including Novo Nordisk, Sanofi, and Eli Lilly, which hold the majority of the market share and heavily invest in R&D. These companies, along with venture capital and strategic investors, are drawn by the sustained demand for chronic disease management and the potential for innovative, high-impact solutions.

- Startup Ecosystem: The startup ecosystem is dynamic, with innovators focusing on next-generation delivery technologies and digital health integration. Emerging firms are developing non-invasive delivery methods like oral or inhaled insulin in clinical trials and AI-powered platforms that link continuous glucose monitors (CGMs) with smart pens and pumps.

Insulin Market Growth Factors

- The insulin market experiences remarkable growth due to the escalating global prevalence of diabetes, primarily attributed to changing lifestyles, increasing obesity rates, and genetic factors. This surge fuels the ever-growing demand for insulin, making it an indispensable component of diabetes management.

- The demographic shift towards an older population, which is more prone to diabetes, contributes significantly to the insulin market's expansion. The increasing elderly demographic requires access to a reliable and consistent supply of insulin, amplifying market demand.

- Continuous advancements in insulin delivery methods, such as insulin pumps, smart pens, and patch pumps, enhance patient convenience and adherence. These innovations not only improve the patient experience but also offer opportunities for market growth and diversification.

- The development and adoption of biosimilar insulin products provides cost-effective alternatives to branded insulins. This trend is driven by cost-conscious healthcare systems and the need to reduce the financial burden on patients, thus expanding market accessibility.

- The global effort to improve healthcare access in emerging markets broadens the reach of the insulin market. This includes awareness campaigns, affordable insulin supply initiatives, and collaborations with healthcare providers to ensure more patients can access and afford insulin treatment.

- The trend towards personalized medicine is impacting the insulin market. Tailored insulin regimens based on patients' specific needs, lifestyle, and health status are gaining prominence. This individualized approach enhances treatment effectiveness and patient outcomes.

- Ongoing research focuses on the development of ultra-rapid and ultra-long-acting insulins. These formulations aim to improve the precision and convenience of insulin therapy, offering patients greater control over their diabetes management.

- The integration of the Internet of Things (IoT) and smart technologies into insulin delivery systems is a notable trend. These connected devices enable real-time monitoring, data analysis, and precise insulin dosing, enhancing patient care and management.

Insulin Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2025 | CAGR of 13.43% |

| Market Size in 2025 | USD 33.81 Billion |

| Market Size in 2026 | USD 38.44 Billion |

| Market Size by 2035 | USD 119.25 Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, Type, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising diabetes prevalence and innovative insulin delivery

The relentless surge in diabetes prevalence serves as a potent force propelling the insulin market to unprecedented heights. With changing lifestyles, poor dietary choices, and increasing rates of obesity, diabetes has become a global health crisis. As more people require insulin to control their blood sugar levels, the demand for this life-saving hormone has reached new levels. This trend is not limited to developed regions; emerging economies are also grappling with rising diabetes cases, creating a vast global market. The insulin market responds to this demand by continually expanding production and research to meet the varied needs of diabetes patients.

The insulin market witnesses a surge in demand due to continuous innovations in insulin delivery methods. Smart insulin pens, wearable insulin pumps, and advanced monitoring systems are transforming how patients manage their diabetes. These innovations enhance the convenience, precision, and overall patient experience of insulin therapy, leading to increased market demand. Moreover, these modern delivery solutions address longstanding challenges related to patient adherence and insulin dosing accuracy.

The convergence of technology and healthcare is making insulin therapy more accessible and manageable, resulting in a heightened demand for insulin products. The insulin market, driven by these innovative delivery methods, is at the forefront of providing patients with effective and convenient tools for diabetes management.

Restraint

Patient adherence, affordability and accessibility

Patient adherence, or the consistent and proper use of prescribed insulin regimens, remains a significant challenge within the insulin market. Non-adherence to treatment plans can lead to inadequate glycemic control, complications, and increased healthcare costs. Patients may skip doses, use insulin improperly, or discontinue treatment due to factors like injection discomfort or fear of hypoglycemia. Addressing patient education, support, and reducing barriers to adherence is crucial to enhancing treatment effectiveness and overall market demand.

The affordability of insulin is a pressing concern that restrains market demand. The rising costs of insulin production and pricing disparities between different regions can limit access for patients, particularly those without adequate insurance coverage. Many individuals face financial burdens when purchasing insulin, leading to medication rationing, suboptimal diabetes control, and adverse health outcomes. Affordable insulin alternatives, such as biosimilars and government initiatives, are essential to alleviate these affordability challenges and ensure equitable access to this life-saving medication.

Moreover, limited access to insulin is a critical constraint affecting market demand, particularly in low-income regions and underserved communities. Access to healthcare facilities, diagnostic tools, and insulin delivery options can be limited, hindering timely and appropriate diabetes management. Expanding healthcare infrastructure, increasing insulin affordability, and fostering telemedicine and remote healthcare services are strategies that can address accessibility issues, enhancing market demand while improving the quality of care for people with diabetes.

Opportunity

Biosimilar production and telemedicine integration

The surge in biosimilar insulin production significantly boosts the demand for insulin in the market. Biosimilar insulins offer cost-effective alternatives to branded counterparts, making diabetes management more affordable and accessible. As healthcare systems and patients seek to control the rising costs of diabetes treatment, biosimilars address these concerns while maintaining quality and efficacy. This cost-efficiency drives patient adoption, supporting market growth. Furthermore, biosimilar production diversifies insulin options, providing a broader range of choices for healthcare providers and patients, thereby expanding the insulin market.

The integration of telemedicine into diabetes care is reshaping the insulin market. Telemedicine enhances patient care by enabling remote consultations and monitoring. It promotes adherence to insulin regimens and provides real-time support for patients. By incorporating telehealth solutions, the market expands its reach to underserved areas, making diabetes management more convenient and accessible.

Telemedicine complements insulin treatment by offering patient education, data-driven diabetes management, and regular follow-ups, ultimately improving patient outcomes. This integration not only improves patient care but also fuels market demand as it meets the evolving needs of both patients and healthcare providers in the dynamic healthcare landscape.

Segmental Insights

Product Insights

According to the product, the long-acting insulin segment held a 48% revenue share in 2024. Long-acting insulin, also known as basal insulin, provides a slow, steady release of insulin over an extended period. This type of insulin helps maintain consistent blood sugar levels between meals and overnight. In the insulin market, there is a growing interest in more convenient, once-daily, and ultra-long-acting formulations to simplify diabetes management and enhance patient compliance.

The rapid-acting insulin segment is anticipated to expand at a significant CAGR of 21.4% during the projected period. A rapid-acting insulin is a type of insulin designed for quick absorption into the bloodstream. It is typically administered just before or after meals to manage post-meal blood sugar spikes. Current trends in the insulin market indicate a rising demand for faster-acting formulations, facilitating better glycemic control for individuals with diabetes.

Application Insights

Based on the application, the insulin analog segment held the largest market share of 82% in 2024. An insulin analog is a synthetic form of insulin engineered to have specific properties tailored for individual patient needs. In the insulin market, there's a growing trend towards personalized diabetes management. Insulin analogs offer greater flexibility in dosing and are becoming increasingly popular for their ability to mimic natural insulin release. This trend reflects the pursuit of improved glycemic control and enhanced quality of life for diabetes patients.

On the other hand, the human Insulin segment is projected to grow at the fastest rate over the projected period. Human insulin, a biologically derived hormone, is a cornerstone in diabetes management. It is a replica of the insulin naturally produced by the human body. In the insulin market, the trend is shifting towards the adoption of recombinant DNA technology to produce human insulin, enhancing its availability and affordability. This technological advancement aligns with the demand for more cost-effective and accessible insulin treatments, particularly in developing regions.

Type Insights

In 2025, the Type 1 diabetes mellitus segment had the highest market share of 62% based on the type. In the insulin market, Type 1 diabetes mellitus requires a continuous and dependable supply of insulin. Recent trends in this segment focus on the development of advanced delivery systems like insulin pumps and smart insulin pens. There is also a growing emphasis on enhancing the insulin's stability and duration of action. Personalized insulin regimens and telemedicine solutions are gaining traction to better manage insulin dosages and monitor glucose levels in this segment.

The type 2 diabetes mellitus segment is anticipated to expand at the fastest rate over the projected period. Type 2 diabetes mellitus in the Insulin market is witnessing an upsurge in demand, primarily due to the increasing prevalence of this form of diabetes. Current trends include the development of long-acting insulins, convenient pre-filled insulin pens, and more user-friendly injection devices. The market is moving towards more patient-centric approaches, focusing on self-management, education, and combination therapies to address the multifaceted nature of Type 2 diabetes.

Distribution Channel Insights

Based on the distribution channel, the hospitals segment is anticipated to hold the largest market share of 76% in 2024. Hospitals play a pivotal role in the Insulin market by serving as a key distribution channel for this life-saving medication. Insulin, used to manage diabetes, is primarily dispensed in hospital settings for inpatients and individuals requiring immediate medical attention. Recent trends indicate a shift towards digitalization in hospitals, with electronic health records and automated medication dispensing systems streamlining the distribution process. Additionally, hospitals are increasingly emphasizing patient education on insulin administration and management, further enhancing patient care and outcomes.

On the other hand, the retail pharmacies segment is projected to grow at the fastest rate over the projected period. Retail pharmacies, both brick-and-mortar and online, are essential in ensuring convenient access to insulin for patients managing diabetes. These pharmacies provide insulin products for outpatient use, offering a wide range of insulin formulations and injection devices.

Current trends in the insulin market within retail pharmacies include expanded accessibility through online platforms, home delivery services, and the introduction of biosimilar insulins to address cost concerns. Patient-centric care models and personalized insulin management support are also on the rise, enhancing the overall patient experience in these settings.

Technological Advancement

- Technological advancement in the insulin market features continuous glucose monitoring (CGM) systems, smart insulin pens, automated insulin delivery wearable technology, novel drug delivery systems (NDDS), digital health integration, and artificial pancreas systems (APS). The new insulin analogs help develop ultra-long-acting and ultra-rapid insulin analogs. It reduces the risk of hypoglycemia and optimizes the insulin action profile. The smart insulin pens feature reminders, dose tracking, and connection to the mobile app. Wearable technology develops automated insulin pumps and wearable CGM devices supporting diabetes management. The digital health integration connects diabetes devices to several online platforms and mobile apps to provide quick data analysis and remote support.

- Artificial pancreas systems (APS) are a combination of insulin pumps, algorithms, and CGM. Novel drug delivery system (NDDS) consists of oral insulin to make insulin more convenient and accessible. The new technology in the insulin market is the automation process. The automated insulin delivery system (AID) features continuous glucose monitoring (CGM) integration. The advancement in healthcare provides a secure solution for health safety.

Regional Insights

U.S. Insulin Market Size and Growth 2025 to 2034

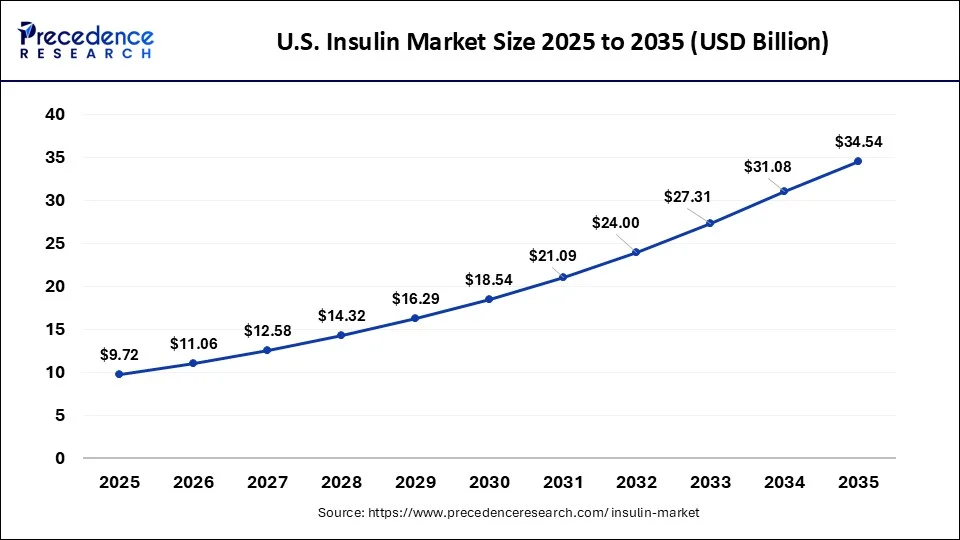

The U.S. insulin market size is estimated at USD 9.72 billion in 2025 and is expected to be worth around USD 31.08 billion by 2034, growing at a CAGR of 13.79% from 2025 to 2034

North America Leads the Way: Advancing Insulin Therapies and Personalized Diabetes Care.

North America has held largest revenue share of 41% in 2024. The North American insulin market is characterized by a robust demand for diabetes management solutions. Insulin, a life-saving hormone for individuals with diabetes, is witnessing a trend towards advanced delivery mechanisms such as insulin pens and pumps. Moreover, there is a growing preference for long-acting and ultra-rapid-acting insulin analogs, emphasizing improved convenience and efficacy. The region is also witnessing a rising focus on personalized insulin therapies, with an emphasis onprecision medicine approaches.

U.S. Insulin Market Trends

The U.S. dominates the North American insulin market due to its large diabetic population and advanced healthcare infrastructure, which ensures widespread access to insulin therapies. The country's high adoption of innovative insulin delivery methods, including insulin pumps and smart pens, along with a robust pipeline of new treatments and biosimilars, further solidifies its regional dominance. In response to rising costs, recent policy measures, such as the Inflation Reduction Act's Medicare copay caps and initiatives to promote biosimilar competition, aim to enhance affordability. At the same time, U.S.-based pharmaceutical companies are prioritizing R&D on newer, more profitable medications for diabetes and obesity.

Asia-Pacific Insulin Market Soars: Driving Affordable Care and Digital Diabetes Solutions

Asia Pacific is estimated to observe the fastest expansion.In Asia Pacific, the insulin market is defined by its rapidly expanding diabetic population. This trend has led to a surge in demand for affordable and accessible insulin products. Biosimilar insulins have gained traction, aiming to provide cost-effective alternatives. Additionally, Asia Pacific is witnessing a shift towards telemedicine and digital solutions for diabetes management, enabling better patient care and access to insulin therapies in remote and underserved areas. Regulatory reforms and increasing awareness about diabetes care are further shaping the insulin market in this region.

India Insulin Market Trends

India is emerging as a key global supplier of affordable biosimilar insulins, leveraging its strong pharmaceutical manufacturing sector. Known as the pharmacy of the world, India offers high-quality, low-cost generics and biosimilars. Indian companies like Biocon have obtained U.S. FDA approvals for interchangeable biosimilar insulins, directly increasing competition and reducing prices in high-value markets.

Europe Advanced Diabetes Care: Personalized Insulin and Innovative Delivery Lead the Market

In Europe, the insulin market is marked by a growing emphasis on personalized medicine and innovative delivery systems. The region's healthcare systems support a wide range of insulin options, including biosimilars and cutting-edge therapies. Stricter regulations on insulin pricing and accessibility continue to shape the market landscape while promoting affordability and quality care.

Germany Insulin Market Trends

Germany holds a significant position in the global insulin market due to its advanced healthcare system, strong pharmaceutical sector, and well-established infrastructure for diabetes care. The country's high level of patient awareness, favorable reimbursement policies, and adoption of innovative insulin therapies, including biosimilars, enable it to maintain a competitive edge in managing healthcare costs while improving patient outcomes.

Latin America: Tackling Diabetes with Innovative Therapies and Expanded Access

Latin America is experiencing an opportunistic rise in the insulin market due to increasing diabetes rates, driven by factors such as urbanization, unhealthy diets, and a growing aging population. The market is supported by global companies like Novo Nordisk, Sanofi, and Eli Lilly, who mainly supply insulin analogs that are preferred for their improved effectiveness and convenience for patients. While the high cost of treatment remains a barrier to access for many patients, government initiatives and public health programs in countries like Brazil and Mexico are working to improve access and raise awareness of diabetes management.

Brazil Insulin Market Trends

Brazil is a major player in the Latin American market, with a large number of diabetic patients and a growing demand for insulin therapies. There is a rapid shift toward advanced insulin analogs and biosimilars, driven by the need for affordable options and better patient outcomes. Government programs, such as the public health system, offer free access to essential medicines, including insulin, and initiatives are in place to promote the adoption of biosimilars through clearer regulations and price competition.

MEA Insulin Market Expands: Rising Diabetes Drives Innovation And Local Market Development

The MEA region is vital for the growth of the insulin market because of its high and rising diabetes rates linked to lifestyle and genetics. Challenges include affordability and differences in healthcare infrastructure, with wealthier Gulf countries having better access to advanced treatments than some lower-income African nations. The market is mainly controlled by major global companies, but local players are beginning to emerge. Additionally, governments are adopting national health strategies to fight the epidemic.

Saudi Arabia Insulin Market Trends

Saudi Arabia is a major contributor to the MEA insulin market, characterized by one of the world's highest diabetes prevalence rates. The market is strongly influenced by the government's initiatives, prioritizing healthcare modernization, sustainability, and the localization of pharmaceutical manufacturing to reduce reliance on imports. There is a growing demand for advanced therapies like long-acting insulin analogs and biosimilars, and public-private partnerships are being formed to establish local production facilities to ensure a stable and affordable supply of insulin.

Value Chain Analysis

- Research and Development (R&D)

This stage focuses on discovering new insulin formulations and delivery technologies using biotechnology and clinical research.

Key Players: Eli Lilly, Novo Nordisk, Sanofi, Biocon, Medtronic. - Clinical Trials and Regulatory Approval

In this stage, rigorous testing of new products is conducted to demonstrate safety and efficacy and secure regulatory clearance from bodies such as the FDA.

Key Players: Eli Lilly, Novo Nordisk, Sanofi, and regulatory bodies. - Manufacturing and Production

This stage involves the large-scale biological manufacturing of insulin active ingredients, drug products, and delivery devices.

Key Players: Eli Lilly, Novo Nordisk, Sanofi, Biocon, Medtronic, BD. - Distribution and Supply Chain Management

Ensuring secure delivery of insulin to pharmacies and hospitals, heavily influenced by PBMs who manage formularies and prices.

Key Players: Cardinal Health, McKesson, CVS, Walgreens, CVS Caremark, OptumRx. - Service Delivery and Prescription

Healthcare professionals diagnose diabetes, prescribe the appropriate insulin, and provide ongoing care management.

Key Players: physicians, nurses, hospitals, and clinics. - Patient Support, Adherence, and Payment

Focuses on patient education, managing insurance claims, and handling financial transactions, often impacted by government policies.

Key Players: UnitedHealth Group, Humana, CMS, patient advocacy groups, and digital health tech companies.

Top Companies in the Insulin Market

- Merck & Co., Inc.:Headquartered in Kenilworth, New Jersey, U.S., Merck develops insulin analogs and diabetes management therapies, focusing on innovative formulations and patient-friendly delivery systems to improve glycemic control.

- Pfizer Inc.: Headquartered in New York, U.S., Pfizer offers insulin therapies and combination treatments, along with digital health solutions for diabetes management, aiming to enhance efficacy and patient adherence.

- Johnson & Johnson: Headquartered in New Brunswick, New Jersey, U.S., through its diabetes care segment, J&J provides insulin pumps, delivery devices, and supportive therapies, emphasizing integrated solutions for type 1 and type 2 diabetes.

- Roche Holding AG:Headquartered in Basel, Switzerland, Roche delivers insulin analogs, pens, and digital monitoring tools, focusing on personalized diabetes care and advanced treatment options for improved patient outcomes.

- AstraZeneca PLC:Headquartered in Cambridge, UK, AstraZeneca develops adjunct therapies for diabetes, supports insulin combination treatments, and invests in patient-centric solutions, enhancing overall metabolic disease management and treatment adherence.

- Novo Nordisk A/S:Offers a wide range of insulins (NovoLog, Tresiba, Levemir) and major GLP-1 diabetes/obesity drugs (Ozempic, Wegovy).

- Eli Lilly and Company: Offers an extensive insulin portfolio (Humalog, Humulin, Basaglar) and prominent GLP-1 drugs (Mounjaro, Zepbound).

- Sanofi S.A.: Offers long-acting insulin products (Lantus, Toujeo) and other insulin formulations.

- Biocon Limited:Focus on biosimilar insulins, including recombinant human insulin (INSUGEN) and insulin glargine (BASALOG).

- Gan & Lee Pharmaceuticals:Chinese-based firm offering various insulin products, including long-acting (Basalin) and rapid-acting (Prandilin).

Other Key Players

- Boehringer Ingelheim International GmbH

- Tonghua Dongbao Pharmaceutical Co., Ltd.

- Wockhardt Ltd.

- Adocia S.A.

- Oramed Pharmaceuticals Inc.

Recent Developments

- In April 2025, Novo Nordisk phased out the country's largest insulin brand. The company recently confirmed the discontinuation of the country's largest-selling insulin, Human Mixtard, among other older insulin brands in India.

- In May 2025, Sequel Med Tech and Senseonics Holdings announced a commercial development agreement to integrate Sequel's Twiist Automated Insulin Delivery (AID) System, powered by Tidepool, with Senseonics' Eversense 365 CGM. This innovation provides individuals with type 1 diabetes enhanced flexibility and personalization in managing their condition.

- In 2022, Novo Nordisk's acquisition of Dicerna Pharmaceuticals, incorporating their RNAi technology platform, bolsters Novo Nordisk's research capabilities. This addition aligns with their strategy of utilizing diverse technology platforms across their therapeutic focus areas for innovative solutions.

- In 2022, Biocon secured a 3-year, $90 million contract from the Ministry of Health Malaysia for supplying Insugen, recombinant human insulin. This deal reinforces Biocon's presence and commitment to emerging markets like Malaysia.

- In 2022, Biocon collaborated with Viatris Inc. to acquire their biosimilar business, enhancing Biocon's R&D and manufacturing capabilities. This strategic move positions them for effective commercialization in the biosimilar market.

- In 2021,Eli Lilly and Company lowered the cost of Lispro injection in the U.S., easing the financial burden on patients and making it more accessible at an affordable price, thereby improving affordability and access to this critical medication.

Segments Covered in the Report

By Product

- Rapid-Acting Insulin

- Long-Acting Insulin

- Combination Insulin

- Biosimilar

- Others

By Application

- Human Insulin

- Insulin Analog

By Type

- Type 1 Diabetes Mellitus

- Type 2 Diabetes Mellitus

By Distribution Channel

- Hospitals

- Retail Pharmacies

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content