What is Biosimilars Market Size?

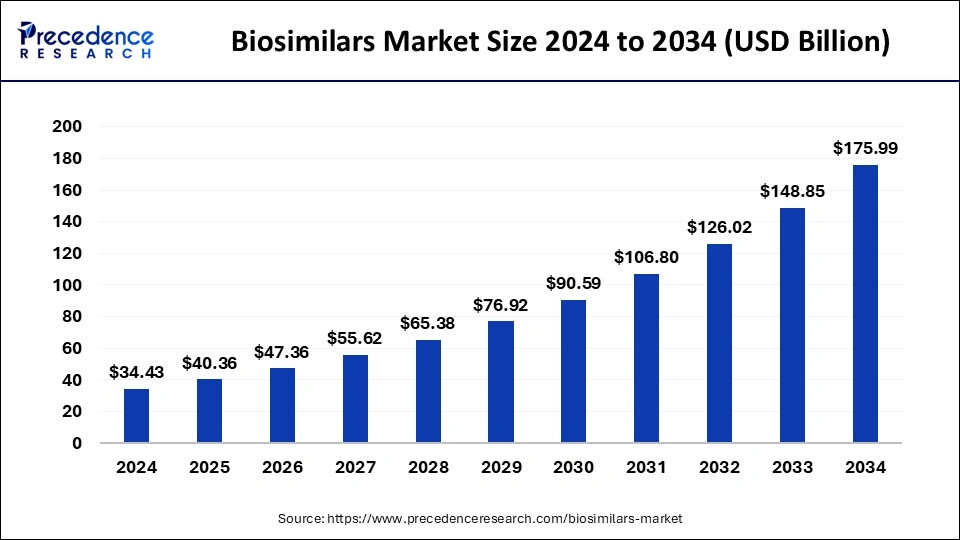

The global biosimilars market size accounted for USD 40.36billion in 2025 and is predicted to increase from USD 47.36 billion in 2026 to approximately USD 191.29 billion by 2035, expanding at a CAGR of 16.84% from 2026 to 2035. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advanced technology for manufacturing biosimilars.

Market Highlights

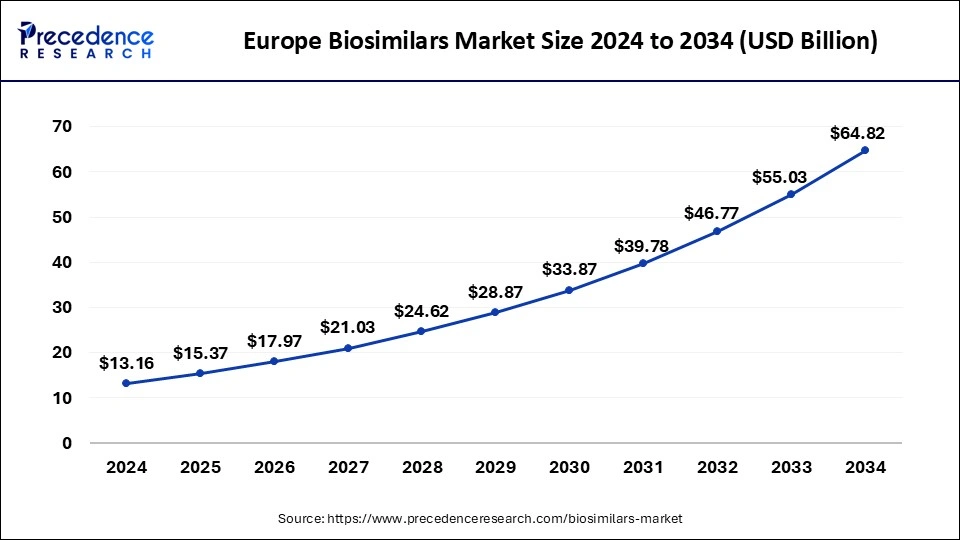

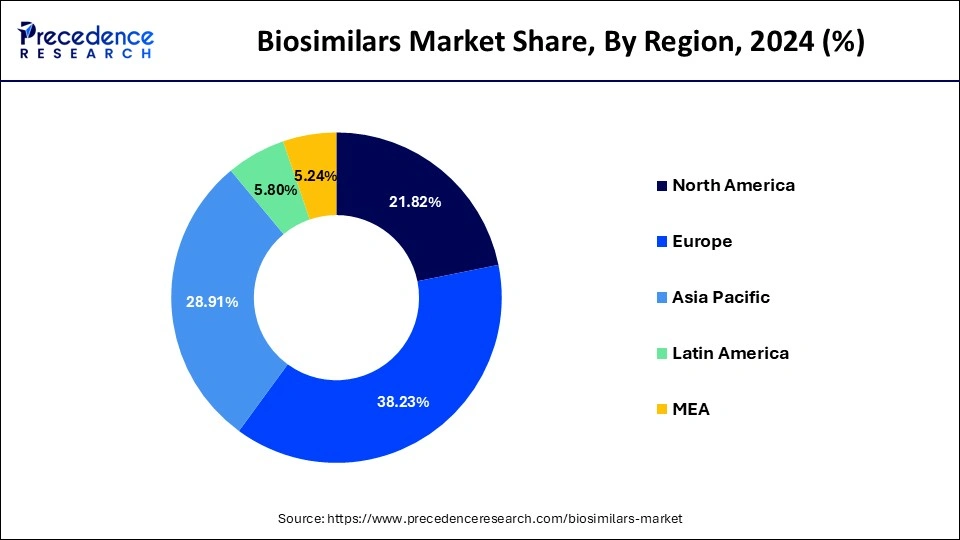

- Europe dominated the market with the largest market share of 38.23% in 2025.

- Asia Pacific is expected to expand at the fastest CAGR of 28.91% during the forecast period.

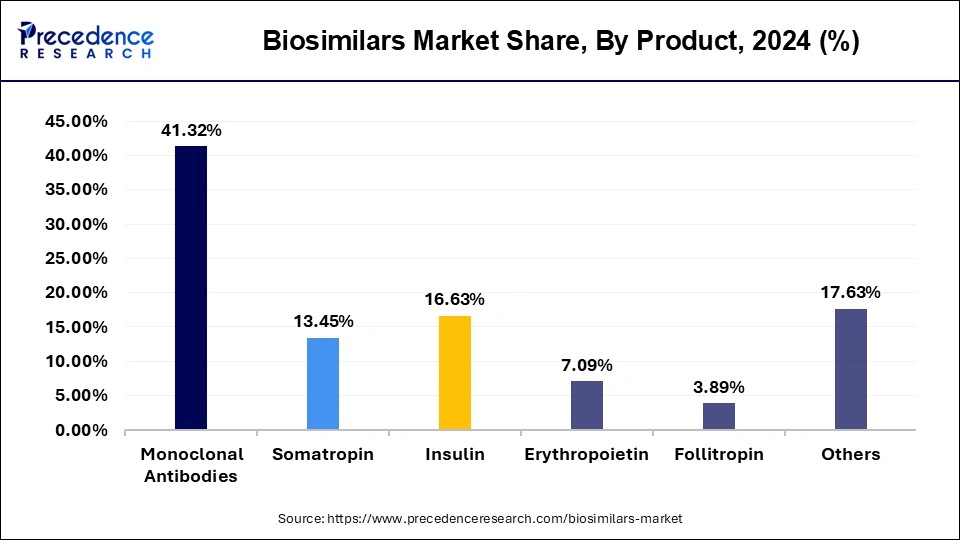

- By product, the monoclonal antibodies segment has captured around 41.32% of revenue share in 2025.

- By product, the insulin segment is projected to grow at a double-digit CAGR of 18.00% during the forecast period.

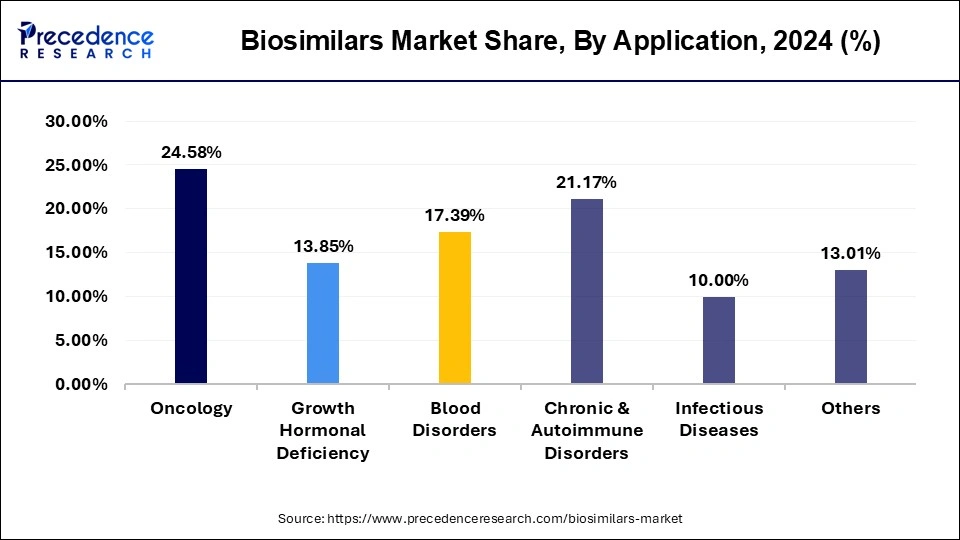

- By application, the oncology segment has contributed the largest market share of 24.58% in 2025.

- By application, the chronic and autoimmune disorders segment is growing at a CAGR of 18.10% during the forecast period.

- By manufacturer, the in-house segment accounted for the biggest market share of 84.62% in 2025.

- By manufacturer, the contract research and manufacturing services segment is poised to grow at a remarkable CAGR of 18.10% during the forecast period.

What is a biosimilar?

Biosimilars are biologic medical products that are highly similar to an already approved original ("reference") biologic drug. They are designed to have the same safety, efficacy, and quality as the reference product, but they are not identical due to the complexity of biologics, which are made from living organisms.

Biosimilars closely resemble the reference biologic in terms of function, structure, and clinical performance. They must demonstrate no clinically meaningful differences in terms of effectiveness and safety compared to the original drug. Typically, less expensive than the reference biologic, making them more accessible to patients. Subject to rigorous testing and evaluation by regulatory agencies like the FDA or EMA to ensure they meet the required standards.

Biosimilars are utilized to treat various conditions, such as cancers, autoimmune disorders, and chronic diseases like diabetes. Examples include biosimilar versions of insulin, monoclonal antibodies, and growth factors.

How is AI contributing to the Biosimilar Industry?

Artificial intelligence supports biosimilars through digital twins and advanced manufacturing optimization. The technology delivers multiple benefits, which include reduced environmental impact, enhanced process efficiency, decreased production expenses, and capacity for sustainable biologic manufacturing. The technologies enable worldwide access to their services while upholding high standards of quality and regulatory compliance.

Biosimilars Market Growth Factors

- The key players operating in the market are focused on geographic expansion and launching their biosimilar drug products in other countries which has increased the demand for biosimilars and is expected to drive the growth of the biosimilars market in the near future.

- Increasing focus on cost reduction and production efficiency can drive the specialty market growth further.

- Emerging markets and trends for biosimilars is expected to drive the growth of the global biosimilars market over the forecast period.

- Increasing regulatory support is estimated to drive the growth of the market over the forecast period.

- Increasing in adoption of the advanced technology for the production of biosimilars is estimated to drive the growth of the global biosimilars market in the near future.

- As patents for major biologic drugs expire, biosimilar manufacturers can enter the market with lower-cost alternatives, driving growth.

- Growing cases of chronic diseases like cancer, diabetes, and autoimmune disorders create higher demand for biologic treatments, including biosimilars.

- Regulatory bodies like the FDA and EMA have streamlined approval processes for biosimilars, encouraging innovation and market entry.

- Rising Healthcare Expenditure, has estimated to drive the growth of the global biosimilar market. Increasing global healthcare spending, particularly in emerging markets, is boosting access to biosimilars.

- Strategic alliances between pharmaceutical companies, contract manufacturing organizations (CMOs), and research organizations are accelerating biosimilar development and commercialization.

Global Biosimilars Market Trends

- The biosimilars market is currently witnessing a leading opportunity as nearly 85 patents for essential biologics will be expiring between 2025 and 2028. Such patent expiration creates strategic grounds for manufacturers, healthcare systems, and patients looking for effective yet reasonable healthcare treatment.

- Biosimilars are transforming healthcare segments to a significant level and are being adopted by many professionals as a preferred treatment choice. For example, in the United Kingdom, biosimilars and generics are now adopted by four in every five NHS-prescribed medicines, highlighting their evolving nature from optional medicine to the therapeutic preference by healthcare providers across the globe.

Market Outlook

- Industry Growth Overview: The biosimilar market experiences worldwide growth because of both patent expirations and increasing chronic disease cases.

- Sustainability Trends: Manufacturers use digital twins together with AI-based systems to achieve sustainability goals and decrease production expenses.

- Major investors: Sandoz, Pfizer, Amgen, Samsung Bioepis, Biocon Biologics, Alvotech, Dr. Reddy's, and Boehringer Ingelheim all invest their resources through aggressive financial commitments.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 40.36 Billion |

| Market Size in 2026 | USD 47.36 Billion |

| Market Size by 2035 | USD 191.29 Billion |

| Growth Rate from 2026 to 2035 | CAGR 16.84% |

| Largest Market | Europe |

| Fastest Growing Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Recent biosimilar product approvals in many countries:

Biosimilars and generics are both versions of previously FDA-approved medications and may offer more affordable treatment options to patients. A biosimilar is a biologic medicine that is approved based on a demonstration that it is highly similar to an FDA-approved biological medicine. These therapies are a commonsense solution to rising prescription drug costs and a lower-cost alternative to the most expensive drugs in our healthcare system. The primary benefit of biosimilars is their cost-effectiveness, with drug prices generally about a third lower than the brand-name biologic products.

Restraint

Regulatory uncertainties:

The regulatory expectations are that the biosimilar manufacturer applies contemporary technologies in their product development and must also adhere to current industry standards and regulatory expectations, which may also have evolved from the time that the reference product was developed and approved. Regulatory needs for biosimilars include rigorous, comprehensive, and evolving. Demonstrating bio-similarity needs rigorous evolution of the proposed biosimilar, including side-by-side comparison with the reference product. As compared to traditional generic drugs, biosimilars must navigate a particularly complex approval process that needs substantial resources, expertise, and time.

Opportunity

Technological advancements in bioprocessing

Bioprocess technology is a vital part of biotechnology that deals with processes combining the complete living matter or its components with nutrients to make specialty chemicals, reagents, and biotherapeutics. The processes form the backbone of translating discoveries of life sciences into useful industrial products. The major benefits of bioprocesses over traditional chemical processes are that they require mild reaction conditions, are more specific and efficient, and produce renewable by-products. The development of recombinant DNA technology expanded and extended the potential of bioprocesses. Implementing robotic technology into the manufacturing process translates to savings on labor costs, which increases productivity. It enables manufacturers to grow without paying additional salaries.

Segment Insights

Product Insights

The monoclonal antibodies segment held a dominant presence in the biosimilars market in 2025. Monoclonal antibodies will constitute the largest group for biosimilars in 2024 because of their long-term use in chronic diseases like cancer, autoimmune disorders, and inflammatory disorders. The expiry dates of the patents belonging to many first-generation blockbuster biologics opened up the entry for their biosimilar versions in the market, ensuring that the product could be offered at a cheaper rate and hence enjoy wider market reach.

- In March 2025, infliximab biosimilar will be marketed in Canada under the new brand name Remdantry, starting April 1, 2025, following approval of the product name change by Health Canada was announced by Celltrion, Inc., a leading global biopharmaceutical company.

The erythropoietin segment is expected to grow at the fastest rate in the market during the forecast period of 2026 to 2035, owing to the increasing prevalence of anemia in chronic kidney disease, cancer treatment, and other indications. Market growth would further be supported by mounting arrears for biosimilar erythropoietin adoption and increasing demands for targeted therapy and supportive treatment, rendering it the major plight for manufacturers throughout the coming decade.

- In April 2025, regulatory and commercial rights in the United States for TOFIDENCE, a biosimilar to ACTEMRA, from intravenous infusion from Biogen, were acquired by Organon. TOFIDENCE, the first approved tocilizumab biosimilar entrant in the U.S. market, was launched in May 2024 and is indicated in certain patients for the treatment of moderately to severely active rheumatoid arthritis, giant cell arteritis, polyarticular juvenile idiopathic arthritis, systemic juvenile idiopathic arthritis, and COVID-19.

Application Insights

The oncology segment accounted for a considerable share of the biosimilars market in 2024. In 2025 registered a sizeable share because of oncology, with cancer seeing highest prevalence and demand for cheaper biologics. Oncology biosimilars, mainly monoclonal antibodies and supportive therapies, have tremendously helped in offering life-saving medicines to more patients and alleviating the costs borne by healthcare systems for the said medicines. This promise, owing to R&D activity and favorable regulatory frameworks in the major market regions, shall eventually seep out to the segment.

- In August 2025, Samsung Bioepis' bone cancer biosimilar with storage edge over Amgen's Xgeva was launched by Boryung. Xbryk is a biosimilar to Amgen's Xgeva and is approved to prevent skeletal-related events in patients with bone metastases and to treat giant cell tumor of bone.

On the other hand, the growth hormonal deficiency segment is expected to be the fastest-growing segment during forecast period. The rising chances of kids getting affected with rare growth hormone deficiency during pregnancy is expected to drive the market. According to the National Organization for Rare Disorders, there are 50% chances of getting growth hormone deficiency to the child during pregnancy.

The growth hormonal efficiency segment is projected to experience the highest growth rate in the market between 2026 to 2035 due to growth hormone deficiency. Such a growing rate is contributed to by rising diagnosis-to-lowers treatment rates for both pediatric and adult patients, advances in recombinant DNA technologies, and the availability of biosimilar growth hormones. Greater awareness and clamping down on high costs will, therefore, drive adoption in this segment, making it one of the major growth sectors in the biosimilars market.

Biosimilars Market Revenue, by Application, 2022-2024 (USD Million)

| Application | 2022 | 2023 | 2024 |

| Oncology | 6,102.66 | 7,183.57 | 8,463.88 |

| Growth Hormonal Deficiency | 3,471.72 | 4,066.32 | 4,767.24 |

| Blood Disorders | 4,386.88 | 5,122.82 | 5,987.84 |

| Chronic & Autoimmune Disorders | 5,287.81 | 6,205.83 | 7,290.07 |

| Infectious Diseases | 2,537.22 | 2,953.96 | 3,442.38 |

| Others | 3,339.07 | 3,866.68 | 4,480.91 |

Manufacturer Insights

The contract research and manufacturing services segment led the market. The CRAMS segment held dominance in the biosimilars market in the year 2024, being an end-to-end solution provider for development up to production and regulatory compliance. Most pharmaceutical companies tend to outsource to CRAMS providers in order to save capital investment, speed up launch schedules, and assure quality compliance at the world markets. With increasing difficulties in biologics manufacturing, this segment is further gaining dominance.

- In April 2025, a new dedicated peptide research center, which is housed on its integrated R&D campus in Hyderabad, India, was launched by Sai Life Sciences, a contract research, development, and manufacturing organization (CRDMO). The center will offer specialized services across peptide synthesis, discovery, and advanced modalities, including complex conjugates, to support innovator pharmaceutical and biotech companies.

The in-house segment is set to experience the fastest rate of market growth from 2026 to 2035. As the number of big biopharma players investing in the development of in-house manufacturing capabilities grows, these players want to retain complete control over quality, intellectual property, and supply-chain operations. Increasing profit margins with the ability to scale production quickly in response to market demand or regulatory changes is another explanation} behind this trend.

- In January 2025, the U.S. Food and Drug Administration (FDA) has accepted for review Biologics License Applications (BLA) for AVT05, Alvotech's proposed biosimilar to Simponi and Simponi Aria (golimumab), which are prescribed to treat a variety of inflammatory conditions was announced by Alvotech, a global biotech company specializing in the development and manufacture of biosimilar medicines for patients worldwide and Teva Pharmaceuticals, a U.S. affiliate of Teva Pharmaceuticals Industries, Ltd.

Biosimilars Market Revenue, byManufacturer, 2022-2024 (USD Million)

| Manufacturer | 2022 | 2023 | 2024 |

| Contract Research and Manufacturing Services | 3,842.00 | 4,509.02 | 5,296.80 |

| In-House | 21,283.36 | 24,890.17 | 29,135.53 |

Regional Insights

What is the Europe Biosimilars Market Size?

The Europe biosimilars market size is exhibited at USD 15.37 billion in 2025 and is projected to be worth around USD 73.59 billion by 2035, growing at a CAGR of 16.95% from 2026 to 2035.

Europe dominated the global biosimilars market in 2025, in terms of revenue, and is estimated to sustain its dominance during the forecast period. The increased adoption of the biosimilars in Europe has boosted the market growth. Moreover, the regulatory authorities have played a crucial role in the adoption of biosimilars by making appropriate and favorable changes towards the approval of biosimilar drugs.

Germany Biosimilar Market Trends

Germany is characterized by high biosimilar penetration because of provider confidence and regulatory maturity. Pharmacy-level substitution policies are in line with the adoption of oncology and autoimmune care. The sustained high-value launches are indicative of a mature market, innovation, and high institutional acceptability in both hospital and outpatient care settings.

On the other hand, North America is estimated to witness a significant growth rate during the forecast period. The growing popularity of the biosimilars in North America and the presence of numerous market players in the region are investing heavily in the research of the biosimilars, which arew expected to drive the growth of the market in this region. The FDA in US approved around 20 biosimilars in the year 2020. In 2020, Pfizer obtained the FDA approval for its Nyvepria, which is used for lowering the infection incidences. All these factors are anticipated to drive the growth of the biosimilars market in North America, during the forecast period.

The U.S. biosimilars market is significantly expanding, and one of its examples is that, till the date August 2024, nearly 10 different molecules have their biosimilars, and 43 biosimilars have been launched in the U.S., and the U.S. market has witnessed nearly USD 7 billion annual revenue from biosimilars manufacturing. Supportive regulations have also played a key role in the market's expansion in the U.S. For instance, in June 2024, the FDA proposed a guideline about biosimilars that expects an interchangeable designation will no longer require conducting to conduct switching studies as was recommended before.

- North America biosimilars market size accounted for USD 7.51 billion in 2024 and is expected to reach around USD 37.64 billion by 2034, growing at a CAGR of 17.50% from 2026 to 2035

- Asia Pacific biosimilars market size was valued at USD 9.95 billion in 2024 and is projected to surpass around USD 55.09 billion by 2032, expanding at a CAGR of 18.70% from 2026 to 2035

Market trends in India

The biosimilar market in India is expanding due to many factors, like growing demand for cost-effective treatment solutions and increasing incidences of fatal chronic diseases, which need long-term treatment. Biosimilars provide a more reliable and reasonable option for their related biologics, promoting patients' options for critical healthcare treatments. Also, regulatory support plays a key role in market expansion. The accelerated adoption of biosimilars as a cost-effective solution positions them as a strategic response to the increasing prevalence of chronic diseases resulting from a significant demographic shift. This is achievable by advanced research in biotechnology and increased manufacturing capabilities in India.

Asia Pacific Biosimilars Market Trends

- The expanding pharma sector in APAC is driving investments in biotechnology and biosimilar research. Countries like China, India, and South Korea are becoming global hubs for biosimilar development due to their cost-effective research environments and skilled workforce.

- Asia Pacific governments are improving regulatory frameworks for biosimilars to streamline approvals and ensure safety and efficacy. Harmonization of guidelines with global standards (e.g., EMA and FDA) enhances market confidence. Low production and operational costs in Asia Pacific enable competitive pricing of biosimilars. Established manufacturing infrastructure in countries like India and China reduces production barriers.

- Rising healthcare expenditures and insurance coverage in APAC drive demand for affordable biologic treatments. Biosimilars offer cost-effective alternatives to high-priced biologics, meeting the needs of a growing patient population.

- In India major biosimilars hub with regulatory initiatives like the "Make in India" program, the biosimilars market is estimated to grow. The significant investment in biotech company and improving regulatory pathways through the National Medical Products Administration (NMPA) in China, drive the growth of the biosimilars market. A leader in biosimilar innovation with companies like Celltrion and Samsung Bioepis in South Korea, supports the growth of the biosimilars market in South Korea region.

Value Cain Analysis

- Research and Development: These activities pertain to the research and development phase, in which the aim is to gain an understanding of the reference biologic and to derive a highly similar biosimilar product.

Key Players: Sandoz (a Novartis division), Pfizer, Viatris (formerly Mylan), Teva Pharmaceutical Industries, Amgen - Clinical Trials and Regulatory Approvals: These compasses within the spectrum of comparative clinical trials to demonstrate biosimilarity about safety, purity, and potency, followed by a regulatory approval from agencies like the FDA or the EMA.

Key Players: IQVIA, ICON, Parexel - Formulation and Preparation of Final Dosage: This includes establishing the exact formulation and physical form of the biosimilar, the selection of excipients, and the determination of the final dosage form and route of administration.

Key Players: Sandoz, Pfizer, Biocon Biologics, Celltrion - Packaging and Serialization: These processes consist of designing and manufacturing the final packaging for the biosimilar product and installing serialization for tracking and tracing through the supply chain.

Key Players: West Pharmaceutical Services, Gerresheimer AG, Berry Global, AptarGroup - Distribution to Hospitals, Pharmacies: This pertains to warehousing, logistics, and delivery of terminated products to various points of care like hospitals and pharmacies.

Key Players: McKesson Corporation, AmerisourceBergen, Cardinal Health - Patient Support and Services: This consists of after-sales support, education, and possible programs to improve adherence to biosimilar treatments.

Key Players: Amgen SupportPlus, Sandoz One Source, Pfizer Oncology Together

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

- In May 2020, Fresenius Kabi acquired approval for its MSB11455, a pegfilgrastim biosimilar, from both the FDA and EMA.

The various developmental strategies like acquisition, partnerships, mergers, and government policies fosters market growth and offers lucrative growth opportunities to the market players.

Biosimilars Market Companies

- Novartis: Provides biosimilar hormones and biologics, such as epoetin and filgrastim, around the world.

- Synthon Pharmaceuticals, Inc.: Invents complex generic drugs and biological similars through sophisticated biologic technologies.

- TevaPharmaceutical Industries Ltd.: Research and develop markets for biosimilars of hormonal, cytokine, and enzyme therapies.

Other Major Key Players

- LG Life Sciences

- Celltrion

- Biocon

- Hospira

- Merck Serono

- Biogen idec, Inc.

- Genentech

Recent Developments

- On 1st Dec 2024, Biocon Biologics gets US nod to launch Stelara biosimilar. Biocon Biologics will soon launch the drug in the US as per the settlement and licensing agreement with Janssen. The biosimilar will be marketed under the brand name Yesintek.

- On 24th Feb 2025, Two More Stelara Biosimilars launched, Including One that is 90% Off Stelara. Pyzchiva (ustekinumab-ttwe), developed by Samsung Bioepis, seems to be interchangeable. Both Pyzchiva and Biocon Biologics's Yesintek have similar curing treatments.

- On 28th Jan 2025, Amgen settled the Prolia patent suit with Celltrion, teeing up a potential biosimilar launch in June. The new agreement between Amgen and Celltrion has cleared the settlement and disputes.

- In July 2025, Nepexto, a biosimilar to the reference product Enbrel (Etanercept), in Australia was launched by India's Biocon Biologics Ltd (BBL), a fully integrated global biosimilars company and subsidiary of Biocon Ltd. Nepexto will be promoted by Generic Health, a local partner and a leading provider of high-quality generic prescription, injectable, and over the counter medicines, to expand access to patients in Australia.

- In May 2025, Pyzchivz autoinjector, first commercially available in Europe for Ustekinumab biosimilars, was launched by Sandoz, the global leader in generic and biosimilar medicines.

Segments Covered in the Report

By Product

- Monoclonal Antibodies

- Infliximab

- Trastuzumab

- Rituximab

- Adalimumab

- Other monoclonal antibodies

- Insulin

- Granulocyte Colony-Stimulating Factor

- Erythropoietin

- Recombinant Human Growth Hormone

- Etanercept

- Follitropin

- Teriparatide

- Interferons

- Anticoagulants

- Other

By Application

- Oncology

- Growth Hormonal Deficiency

- Blood Disorders

- Chronic & Autoimmune Disorders

- Infectious Disease

- Others

By Manufacturer

- Contract Research and Manufacturing Services

- In-house

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting