What is the Bioprocess Technology Market Size?

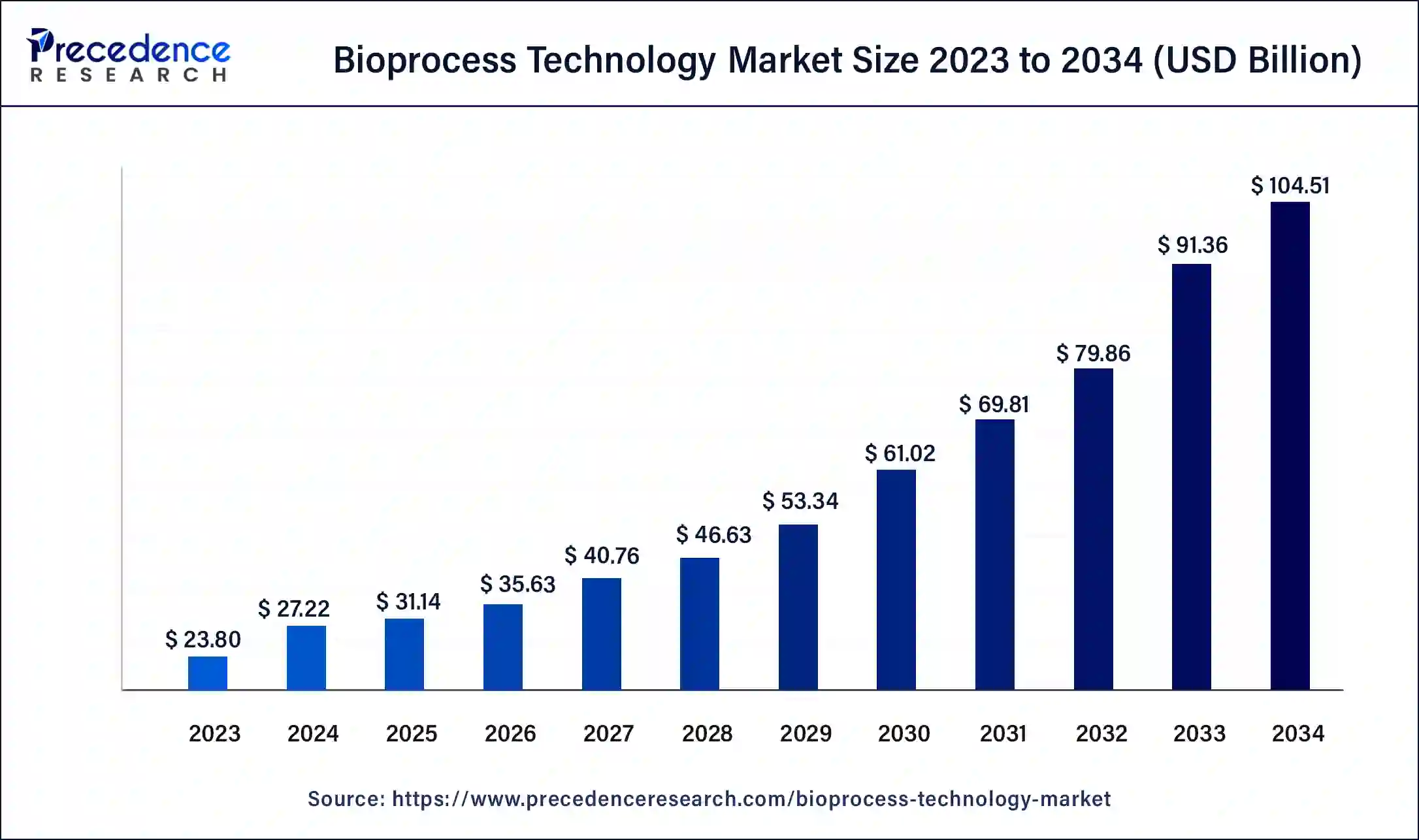

The global beverage packaging market size is accounted at USD 31.14 billion in 2025 and predicted to increase from USD 35.63 billion in 2026 to approximately USD 117.66 billion by 2035, representing a CAGR of 14.22% from 2026 to 2035.

Bioprocess Technology Market Key Takeaways

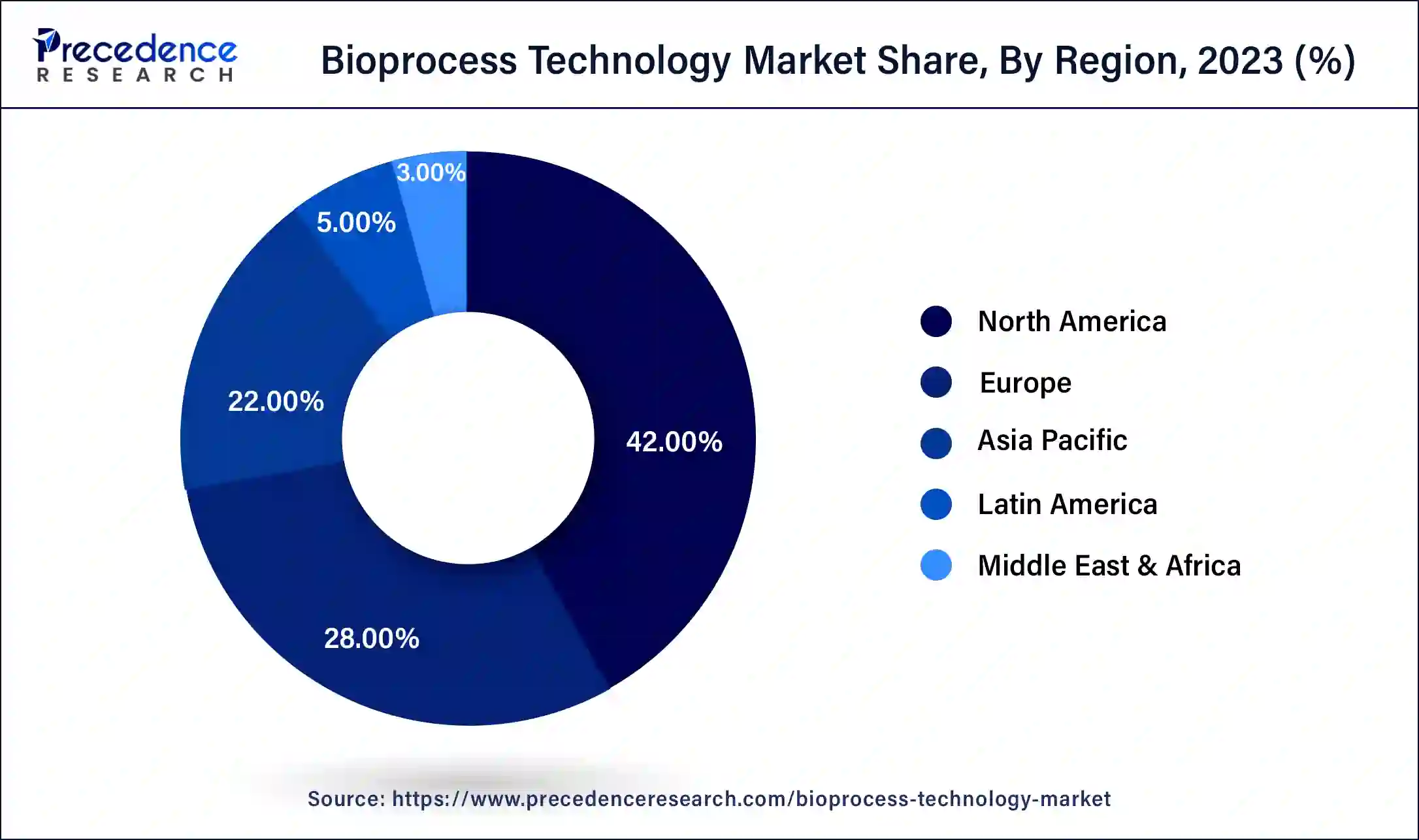

- By geography, North America is anticipated to lead the market from 2026 to 2035 and account for more than 42% of revenue share in 2025.

- By product type, the biologics safety testing segment is anticipated to expand quickly from 2026 to 2035.

- By application, the recombinant proteins are expected to have a rapid increase from 2026 to 2035.

- By end-use, the biopharmaceutical companies are expected to hold the greatest market share from 2026 to 2035.

What is Bioprocess Technology?

Bioprocess technology describes the industries that utilize living cells or their individual parts to convert desired substrates. The key advantages of the ado-trial application of biological Bioprocesses over traditional chemical ones include the production of renewable by-products, the need for mild reaction conditions, and their increased focus and efficiency (biomass).

The development of Recombinant DNA technology has boosted and broadened the possibilities of Bioprocesses. Bioprocess technology, which deals with methods that mix the entire live organism or its component parts with nutrients to make specialized chemicals, reagents, and biotherapeutics, is a crucial part of biotechnology. The techniques serve as the cornerstone for translating advances in the life sciences into useful industrial goods.

Among the many processes related to Bioprocess technology are substrates and media, biocatalysts, volume production, downstream processing, purification, and final processing. Over the past few years, the Bioprocess technology industry has seen a rise in the development of numerous next-generation biopharmaceutical products.

Bioprocess Technology Market GrowthFactors

- Development in the Biopharmaceutical Industry

- Increasing Investments in R&D by Biotechnology and Pharmaceutical Companies

The market of Bioprocess technology is being driven by an increasing emphasis on preventative measures as well as alternative medications for certain needs. Key elements affecting overall market growth include the opening of new production facilities and the expansion of existing ones in emerging regions. The development of new technologies to address performance and quality challenges related to the production of Bioprocess products has resulted in increased investments over the past five years, which has led to a significant advancement in the field of Bioprocess technology.

Additionally, the pharmaceutical industry is projected to have a sizable demand for Bioprocess technology due to the rise in infectious and chronic diseases such as cancer. Outsourcing biopharmaceuticals is becoming a successful method of addressing patients' unmet medical requirements. It has caused a growth in Bioprocessing systems with greater throughput and process efficiency.

The procedures of legal compliance benefit due to Bioprocess technology. Since single-use systems offer cost-efficiency and technological breakthroughs due to expanding capacities and capabilities, many bio-pharmaceutical businesses are choosing to adopt them. However, the market expansion for Bioprocess technologies is constrained by tight supervision regulations and costly technology costs.

Market Outlook

- Industry Growth Overview:

The market gets bigger due to the increased demand for biologics, the developing manufacturing technologies, and the rising interest in innovative therapeutic development. - Sustainability Trends:

Bioprocessing moves towards more eco-friendly methods with less consumption of resources, minimal waste, and the use of non-polluting practices. - Global Expansion:

North America is still on top while the Asia-Pacific region is catching up fast due to the growing biopharma capacity and the spreading acceptance of cutting-edge bioprocess technologies. - Major Investors:

Flagship Pioneering, ARCH Venture Partners, OrbiMed, RA Capital Management, and Third Rock Ventures are the main players in the innovation-driven bioprocess advances market by continuously injecting funds.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 31.14 Billion |

| Market Size in 2026 | USD 35.63 Billion |

| Market Size by 2035 | USD 117.66 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 14.22% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Largest Market | North America |

| Segments Covered | By Product Type, By Application, By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Market Dynamics

Key Market Drivers

With the rise in chronic diseases, biopharmaceutical companies are increasing their R&D efforts. The desire for advancements in Bioprocess technology is being fueled by the rising frequency of cancer and other chronic disorders. Market participants in the worldwide Bioprocess technology market is seeing increased revenue prospects because of the pharmaceutical industry's ongoing expansion. Pharmaceutical and biotechnology businesses have increased the manufacturing of treatments and supported research studies and other investigations as a result of the growth in demand for proteins and vaccines.

Outsourcing of biopharmaceuticals is becoming more popular as a technique to meet patients' unmet medical requirements. This has increased the use of Bioprocessing systems with higher throughput and process efficiency. These solutions provide a benefit for following legal compliance procedures. Single-use systems are becoming more popular among biopharmaceutical businesses since they offer cost-efficiency and technological breakthroughs owing to expanding capacities and capabilities.

Continuous R&D activities are improving bioprocess technology. The market for Bioprocess technology is expanding because of ongoing technological advancements. The assembly of biomaterials such as catalysts, anti-microbial drugs, food and farming products, antibodies, and drug supplements finds value in Bioprocess technology. Additionally, this technology identifies applications to produce biodegradable and environmentally friendly chemicals, the development of alternative treatments for diseases, and facilitation of the production and evaluation of more secure food products.

Bioprocesses may find applications in various fields where substance processes are currently used as methods and instruments become more advanced. The creation of media, the development of biocatalysts, and the design of substrates for bioreactors are examples of Bioprocessing activities that combine biological, engineering, and mathematical processes. Companies in the Bioprocess technology market are diversifying towards the use of hybrid systems in their facilities as they become more aware of the advantages of single-use Bioprocessing technologies.

Key Market Challenges

Strict regulations - The market players in the Bioprocess technology sector find it difficult to advance at the growth pace. Many governments around the world have already taken action, and some of them are choosing to impose severe regulation policies backed by the high cost of the market instruments that are preventing the market from expanding during the projected period.

COVID-19 challenges - The unexpected onset of the COVID-19 pandemic in late 2019 and early 2020 has been one of the primary problems encountered by the leading industry players in the Bioprocess technology market size. Concerns and tensions to protect the world's population from the sickness arose because of the sudden and rapid spread of the coronavirus disease. Global governments were forced to enforce tight rules in the form of standards such as social distancing and the implementation of temporary and permanent lockdowns because there was no vaccine or appropriate medicine.

The government is playing a significant part in assisting the Bioprocess technology market to recover from everything that has been disrupted because of the pandemic's entrance and acceleration of various trends in 2020. The market players anticipated a rebound in demand patterns as the lockdown restrictions are lifted, which will let them concentrate on new innovations before launching those products internationally to satisfy the active wants of the worldwide target audience during the forecast period.

Key Market Opportunities

Technological advancement - Increased financing and investment from the government, the public sector, and major market participants aid in the growth of the market's size during the current forecast period. By using the right investment policies to assist the Bioprocess technology market to grow and serve the needs of a wider audience, biotechnology and pharmaceutical firms are improving their operations.

Product Type Insights

Based on the product category, the biologics safety testing market is anticipated to expand quickly over the next few years. Manufacturers assess the safety of biologics for impurities such as viruses, bacteria, and mycoplasma. The validation and process control of finished goods, as well as the quality control of raw materials, depend on this procedure the most. The market expansion is attributed to factors including rising pharmaceutical outsourcing and increasing government backing for the biotechnology and pharmaceutical industries.

Application Insights

Recombinant proteins are expected to have a rapid increase over the forecast period based on application. The market is expanding because of an increase in demand for recombinant proteins in medicinal applications. The most effective treatments for a variety of illnesses, including cancer, diabetes, infectious infections, anemia, and hemophilia, are provided by recombinant therapeutic proteins. Antibodies, interleukin, hormones, anticoagulants, enzymes, and FC fusion proteins are examples of frequently used therapeutic proteins. As a result, the segment is expanding as the incidence of chronic diseases like cancer and diabetes rises.

End Use Insights

The category of biopharmaceutical firms is expected to hold the greatest market share during the projection period by end-use. The production of a variety of next-generation or highly innovative biopharmaceutical products using Bioprocess technology has grown in popularity in the market for Bioprocess technology over the past few years.

Due to continual technological advancements in Bioprocessing techniques, the range of their applications has further enlarged. Further fostering the segment's growth is the constantly expanding interest in fields of life science such as biotechnology, pharmacology, and toxicology as well as the rising need for improved Bioprocess technology for the creation of innovative pharmaceuticals and vaccines.

Regional Insights

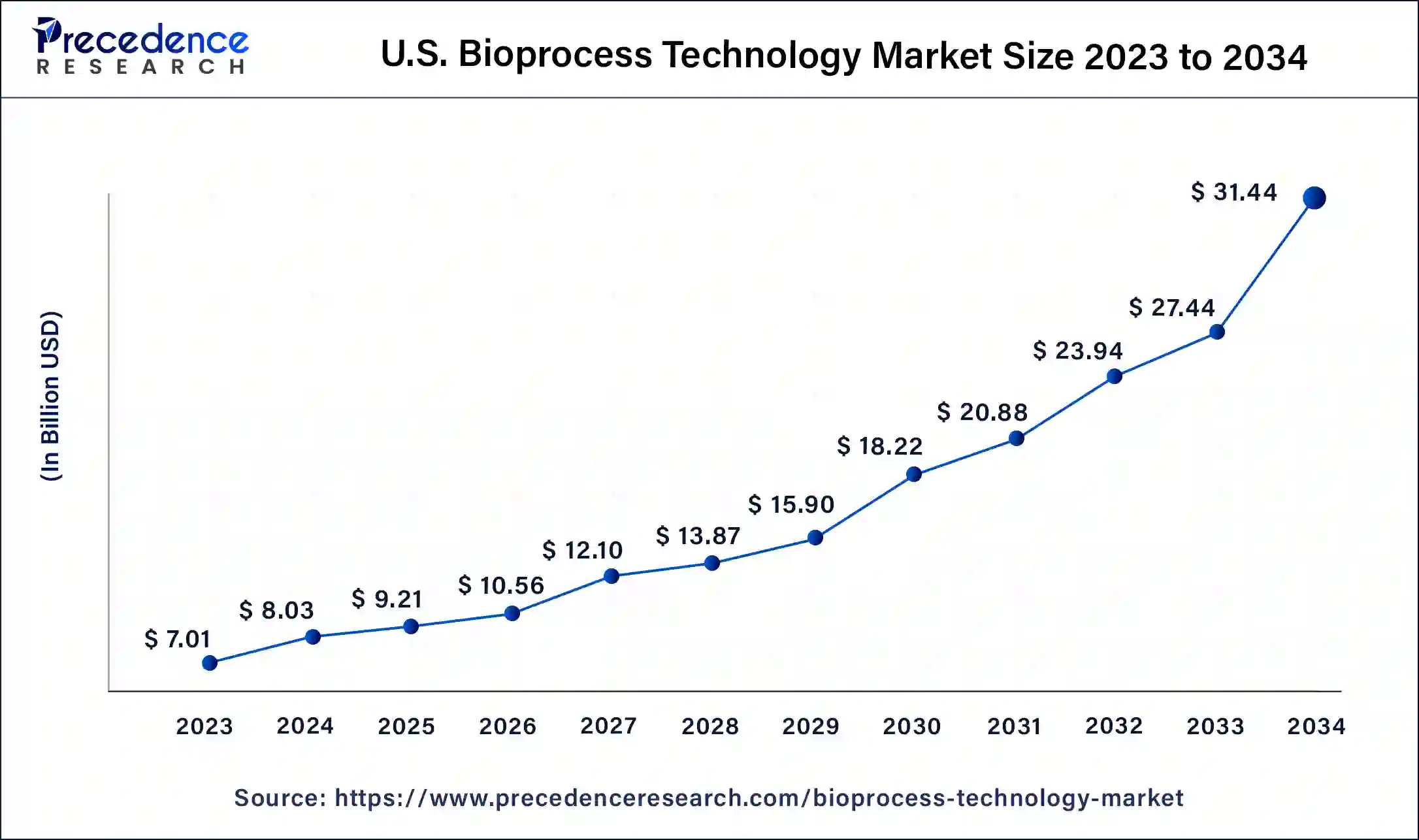

U.S. Bioprocess Technology Market Size and Growth 2026 to 2035

The U.S. beverage packaging market size is estimated at USD 9.21 billion in 2025 and is predicted to be worth around USD 35.44 billion by 2035, at a CAGR of 14.43% from 2026 to 2035.

North America is anticipated to lead the market during the forecast period and account for more than 40% of revenue share in 2025.The existence of large companies, the high frequency of chronic diseases treated mostly with biopharmaceuticals in the area, and the developed healthcare infrastructure all contribute to the market's growth. In addition, favorable government efforts and a rise in research partnership numbers are among the factors anticipated to fuel market expansion. Due to its pro-healthcare legislation, large patient population, and developed healthcare market, the U.S. has the largest share in this region.

How is North America leading in the Bioprocess Technology Market?

North America has the leading position in the global market because of its robust biopharmaceutical ecosystem, advanced research skills, and faster acceptance of modern manufacturing technologies. Opportunities related to the development of cell and gene therapy in the U.S. are supported by the growing number of facilities and continued innovation in biologics production, which is one of the main drivers for the country's biopharmaceutical market.

The market is expanding because of rising biotechnology and pharmaceutical companies' spending on research and development. India Brand Equity Foundation estimates that India's biotech sector accounts for 2% of the global market. About 800 companies make up India's biotechnology sector, which was projected to be worth $11.6 billion by the end of 2021. In order to grow this sector into an industry that will be USD 100 billion by 2025, the government invested USD 5 billion to create human resources, infrastructure, and research efforts.

Furthermore, biopharma is one of the largest sectors across the globe. Several international businesses have aggressively partnered with Indian businesses because of India's promising generic biotechnology future. The Telangana government biotech and pharma Flagship event named BioAsia 2017 was able to attract investment of about 507.3 million USD. For biotechnology, sector agreements were signed by 37 companies at the Global Summit of Gujarat which took place in the same year. The high cost of the instruments and the rigorous regulatory laws, however, are the downsides of the market expansion.

U.S. Bioprocess Technology Market Trends:

The grants handed out by the state to biologics manufacturing and the opening of plants using next-generation technologies at a rapid pace are the factors that lead to the USA's advantage. Major opportunities are building up in cell and gene therapy development.

What are the driving factors of the Bioprocess Technology Market in Europe?

The biotech and pharmaceutical industries in Europe are the main players, along with the demand for biosimilars and the large-scale production, which is being driven by the region's steady growth. The region has a regulatory framework that is well-developed to support high-quality biologics.

Germany Bioprocess Technology Market Trends:

Germany is the front-runner in Europe thanks to its huge biopharmaceuticals sector, government programs that promote biosimilar use, and a constant rise in the demand for new technologies. The opportunities include increased use of automation, fed-batch systems, and single-use solutions, all of which are supported by the partnership of the industry and academia that upholds quality and innovation in manufacturing.

How is Asia-Pacific performing in the Bioprocess Technology Market?

Asia-Pacific is the fastest-growing region when it comes to the biopharmaceutical industry; government support and investment in biologics production are also factors that contribute to its growth. This area attracts outsourcing services because it is already equipped with advanced bioprocessing and modern manufacturing technologies that allow diverse therapeutic applications to be produced efficiently, quickly, and at a lower cost.

China Bioprocess Technology Market Trends:

China is the dominant player in the region due to its advanced biologics and vaccine manufacturing capabilities, comprehensive government backing, and fast adoption of continuous bioprocess lines. The use of single-use bioreactors and the creation of GMP-compliant facilities that boost efficiency, lower costs, and fortify the entire manufacturing infrastructure are among the factors that will increase the opportunities.

Bioprocess Technology Market-Value Chain Analysis

- R&D: The whole process starts with the discovery of drug targets in foundational research and the invention of new compounds or enhanced formulations that will eventually lead to the development of more advanced bioprocessing techniques.

Key Players: Pfizer, Novartis, Roche, Thermo Fisher Scientific - Clinical Trials and Regulatory Approvals: The generation of studies that produce safety and efficacy data, which are then submitted to authorities for the approval of essential market authorizations, is the main purpose of clinical trials and regulatory approvals.

Key Players: IQVIA, PPD (part of Thermo Fisher Scientific), Syneos Health - Formulation and Final Dosage Preparation: The active pharmaceutical ingredients are being transformed into stable, effective, and patient-acceptable forms, ensuring the therapeutic performance is consistently delivered.

Key players: Catalent, Lonza, WuXi AppTec - Also, Packaging and Serialization: the last product is separated into portions, and tracking measures are put in place to secure it, safeguard against counterfeiting, and facilitate effective management of secure inventory.

Key players: Catalent, Sharp Packaging Solutions, Körber - Distribution to Hospitals, Pharmacies: The efficient movement and storage of finished goods so that healthcare providers and patients in different markets can have their needs met and their treatments provided when necessary and where necessary.

Key Players: McKesson Corporation, Cardinal Health, AmerisourceBergen

Top Companies in the Bioprocess Technology Market & Their Offerings:

- Philips Healthcare: Concentrates on medical devices, imaging diagnostics, and patient monitoring solutions rather than producing bioprocess technology equipment for industrial applications.

- Hoffmann-La Roche Ltd.: Works on producing and licensing cancer treatments and diagnostics, making use of the in-house bioprocessing to support advanced product and research pipelines.

- Thermo Fisher Scientific Inc.: Has the bioprocessing solutions that range from single-use systems, bioreactors, to chromatography, and that are all capable of supporting efficient biologics manufacturing workflows across modern production environments.

Bioprocess Technology Market Companies

- Philips Healthcare

- Hoffmann-La Roche Ltd.

- Thermo Fisher Scientific Inc.

- Becton, Dickinson, and Company

- Sartorius Group

- Abbott Laboratories

- Danaher

- Alere Inc.

Recent Developments

- In March 2019 – The BioContinuum, which is a Buffer Delivery service or Platform was introduced by Merck, a new component of the BioContinuum for next-generation of Bioprocessing. The Merck BioContinuum Platform includes the BioContinuum platform for Buffer Delivery for delivering "contiGuous" Bioprocessing.

- In order to improve access to medical supplies throughout the nations like Africa, International

- Finance Corporation (IFC) and Getinge teamed together.

- In March 2018 –A perfusion bioreactor ambr 250 HT was introduced by Sartorius AGan.

- This is a system that deals with the cell culture process of development for optimizing the generation of therapy-related antibodies. A computerized system in the parallel bioreactor is provided, and this system was created specifically for the rapid development of cell culture perfusion processes.

- In November 2025, Thermo Fisher Scientific launched two facilities in Hyderabad's Genome Valley, including the Bioprocess Design Centre. The launch was in collaboration with the Telangana government and the Ministry of Science & Technology under the Biotech Park Project. (https://www.biospectrumindia.com)

- In July 2025, Debut launched a plant cell biotechnology platform to create fragrance ingredients by replicating key molecules from cultivated extracts. This eliminates the need for cultivation and significantly shortens the lengthy development process, typically lasting up to five years. (https://www.prnewswire.com)

Segments Covered in the Report

By Product Type

- Biologics Safety Testing

- Cell Culture

- Cell Expansion

- Cell Line Development

- Flow Cytometry

- Tangential Flow Filtration

- Flow Cytometry

By Application

- Antibiotics

- Biosimilars

- Recombinant Proteins

- Others

By End-Use

- Biopharmaceutical Companies

- Contract Manufacturing Organization

- Academic Research Institutes

- Food and Feed Industry

- Contract Research Organization

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content