Immunology Biosimilars Market Size and Forecast 2025 to 2034

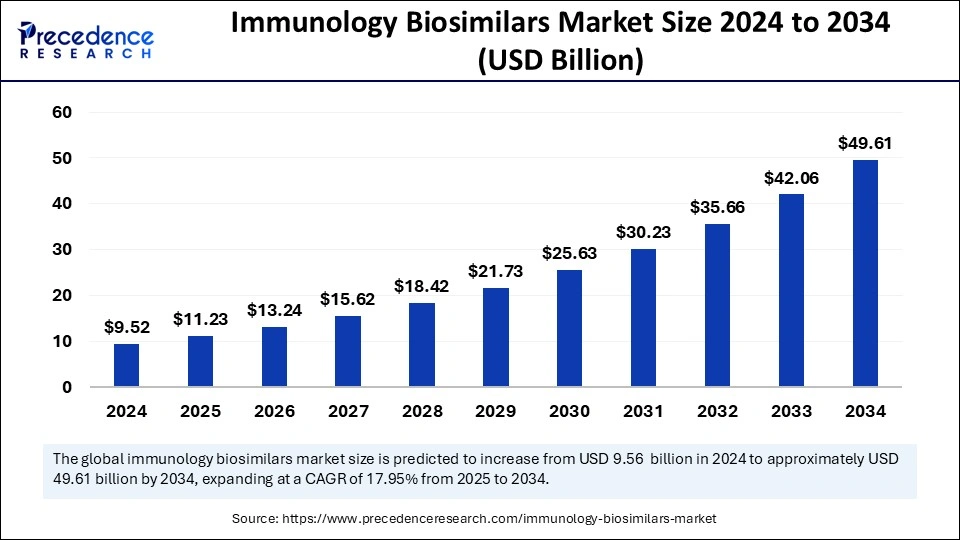

The global immunology biosimilars market size was calculated at USD 9.52 billion in 2024 and is predicted to increase from USD 11.23 billion in 2025 to approximately USD 49.61 billion by 2034, expanding at a CAGR of 17.95% from 2025 to 2034. The market is experiencing growth due to the increasing prevalence of chronic immunological diseases requiring immunotherapies, the increasing demand for cost-effective treatments, and the need for more accessible therapies by propelling the demand for immunology biosimilars.

Immunology Biosimilars Market Key Takeaways

- North America dominated the immunology biosimilars market in 2024.

- Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period.

- Europe is emerging as a notable region in the market.

- By disease, the inflammatory bowel disease segment held a dominant presence in 2024.

- By disease, the arthritis segment is expected to witness the fastest growth during the predicted timeframe.

- By distribution channel, the hospital pharmacies segment contributed the biggest market share in 2024.

- By distribution channel, the retail pharmacies segment is projected to expand rapidly in the coming years.

Emergence of Artificial Intelligence in Immunology Biosimilars Development

Artificial intelligence (AI) is transforming the immunology biosimilars market by enhancing research, development, production, and clinical acceptance. Significant contributions ofAI include accelerating biosimilar development through in silico modeling and machine learning to forecast biological activity, boosting manufacturing efficiency by refining workflows and automating procedures, and advancing pharmacovigilance by identifying rare adverse events and estimating safety profiles. Moreover, AI assists in personalized treatment choices for patients and enhances research efficiency by analyzing unstructured data to improve biosimilar development strategies.

- In September 2024, Biomedicines formed a partnership with Novartis, possibly exceeding USD 1 billion to grasp its generative AI platform for the development of protein therapeutics, highlighting the dedication of the market to the incorporation of AI in biologic drug development.

Market Overview

The immunology biosimilars market is a sector dedicated to biosimilar medications aimed at directing immunological conditions. These biotherapeutic products closely resemble approved biologics with no significant differences in safety, efficacy, and quality. They are for ailments such as rheumatoid arthritis, Crohn's disease, psoriasis, and various autoimmune and inflammatory disorders. The market is experiencing substantial growth due to the increasing prevalence of autoimmune disorders, the demand for budget-friendly therapies, and the expiration of biological patents and thus providing more economical options for treating chronic immunological conditions.

Immunology Biosimilars Market Growth Factors

- Increasing prevalence of chronic immunological conditions: A significant increase in the prevalence of Chronic Immunological conditions such as rheumatoid arthritis, Crohn's disease, psoriasis, ankylosing spondylitis, and inflammatory bowel disease has augmented the demand for effective and affordable treatments.

- Patent expiration: The expiration of patents on major biologic drugs has opened up the market for biosimilars by providing cost-effective alternatives with comparable therapeutic efficacy and thereby reducing the demand for expensive branded Therapies.

- Cost efficiency: Significantly, biosimilars provide equivalent clinical results to branded biologics, increasing their accessibility and reducing the financial strain on healthcare systems.

- Technological advancements: Advancements in manufacturing technologies improved production efficiency and reduced manufacturing costs by making them more accessible with wider scalability of immunology biosimilars production.

- Increased healthcare expenditure: A significant increase in healthcare expenditure of developing countries or economies, along with rising access to innovative therapies and improved insurance coverage for biosimilar therapies, supports the adoption of the market.

- Government initiatives and regulatory support: Different Regulatory agencies like the FDA, EMA, and WHO are actively promoting the development and approval of biosimilars to improve healthcare accessibility through suitable policies focused on reducing healthcare costs.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 49.61 Billion |

| Market Size in 2025 | USD 11.23 Billion |

| Market Size in 2024 | USD 9.52 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 17.95% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Disease, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Patent expirations of leading biologic drugs

The main key driver for growth in the immunology biosimilars market is the patent expirations of leading biologic drugs such as Humira, Stelara, and Enbrel. This allows biosimilar producers to develop affordable options, lowering healthcare expenditure while safeguarding therapeutic effectiveness. This advancement enhances competition and accessibility by driving the expansion of the market.

- In February 2025, Biocon Biologics introduced YESINTEK™, a biosimilar to Stelara, in the U.S., providing an affordable alternative with comparable safety, efficacy, and immunogenicity profiles by providing access to advanced chronic conditions.

Restraint

Complex manufacturing process

The immunology biosimilars market encounters substantial restraints due to the complex manufacturing process demands, advanced technology, and specialized knowledge to accurately reproduce the precise molecular structure and biological function of the original biologic. This method requires thorough investigations, validation, and clinical testing, enhances development expenses, and establishes obstacles for newcomers. The main limitation is the unclear contracting methods of brand-name biologic makers, who frequently provide significant discounts to pharmacy benefit managers and sponsors, leading to a commanding market presence.

Opportunity

Developing and marketing immunology biosimilars for complex biologics

The immunology biosimilars market holds considerable future prospective in developing and marketing immunology biosimilars for complex biologics, extending beyond TNF inhibitors such as adalimumab by pointing on interleukins and other immune pathways that can meet disappointed medical requirements and enhance patient access to advanced treatments.

- In May 2024, the European Commission authorized Omlyclo, the initial biosimilar of Celltrion Healthcare, to Xolair for managing severe allergic asthma, rhinosinusitis, and urticaria, revealing the possibilities of biosimilars in directing new therapeutic fields.

Disease Insights

The inflammatory bowel disease segment held a dominant presence in the immunology biosimilars market because of the increasing prevalence of Inflammatory Bowel Disease, the highly expensive biologic therapies, and the prospectus of biosimilars to reduce costs while maintaining efficacy and safety. However, interchangeability of biosimilars with original biologics ensures that patients can switch to a biosimilar without compromising their treatment outcomes by revealing real-world evidence to support their use.

- In October 2023, ZYMFENTRA, an FDA-approved subcutaneous form of infliximab, serves as a new therapeutic option for adult individuals suffering from moderate to severe active Inflammatory Bowel Disease.

The arthritis segment is expected to witness the fastest growth during the predicted timeframe because of the high prevalence of arthritis, the effectuality of biologic treatments, and the potential for biosimilars to reduce costs and increase access to these treatments. Recent advancements include biosimilar approvals for rheumatoid arthritis treatments and collaborations rationalized biosimilar development and improved patient access.

Distribution Channel Insights

The hospital pharmacies segment dominated the immunology biosimilars market with the highest share in 2024, owing to their large patient volume, unique requirements, direct purchasing capabilities, quicker acceptance of biosimilars, proficiency in handling intricate treatments, and involvement in the Group Purchasing organizations. These Pharmacies also hold the required infrastructure for handling complex therapies and secure bulk pricing for biosimilars by prioritizing affordability and emphasizing patient care.

The retail pharmacies segment is projected to expand rapidly in the coming years due to increased patient access and affordability by offering less expensive alternatives to original biologics and making immunology treatments more accessible to a wider range of patients. Also, its widespread network is useful for the convenience of dispensing these medications at retail locations and is further strengthened by strategic partnerships and collaborations. However, online pharmacies are also experiencing notable growth due to convenience, accessibility, and cost-effectiveness, particularly for patients with chronic conditions who often require long-term therapies.

Regional Insights

North America Dominates with Well-Established Pharmaceutical Sector

North America dominated the immunology biosimilars market in 2024 because of its strong regulatory structure, the presence of major pharmaceutical firms such as Pfizer, Amgen, and AbbVie, significant demand for cost-effective healthcare, and straightforward access to biosimilars. The approval process of the U.S. FDA, along with efforts such as the biosimilars Action plan, facilitates the creation and marketing of biosimilars, guaranteeing safety and efficacy standards. The expiration of patents for key biologics such as Humira has created chances for biosimilar producers to penetrate the market by increasing market and broadening the treatment alternatives.

- In June 2024, the FDA proposed removing the requirement for switching studies for biosimilars seeking interchangeable status to simplify approval processes, reduce development expenses, and enhance market entry.

The U.S. Immunology Biosimilars Market Trends

The U.S. plays a crucial role in the immunology biosimilars market due to its solid regulatory infrastructure, competitive pricing strategies, and strong research and development capabilities. The BBCIA of 2009 and BAP from the FDA facilitates approval processes while the loss of patent protection for biologics like Humira, Remicade, and Embrel created opportunities for biosimilar rivals while high healthcare spending in the U.S. enables cost reduction by biosimilars and a venture capital backed biotech ecosystem to reach the biosimilar markets expansion.

Developed Healthcare Infrastructure of Asia Pacific Driving the Market

Asia Pacific is anticipated to grow at the fastest rate in the immunology biosimilars market during the forecast period, owing to factors like the increasing prevalence of chronic diseases, government programs and robust local production capabilities India has introduced the national biotechnology development strategy to establish itself as a worldwide biomanufacturing centre, whereas Japan has formed the Japan biosimilar association and enacted the honorable policy to encourage biosimilar creation. China is establishing multinational clinical centers and speeding up the approval processes for specialized medication. Developing nations are putting funds into healthcare infrastructure to increase the demand for biosimilars.

- In February 2024, Biocon and Sandoz have teamed up to market Ogivri and Abevmy biosimilars in Australia for cancer therapies with the aim of enhancing patient access to affordable treatments and highlighting biosimilars expansion in the region.

Biological Drug Development of India Propelling the Market

India has implemented guidelines and standards to accelerate the development and adoption of biosimilars, including initiatives to facilitate approval processes and enhance clinical data protection. The Indian government encourages biological drug development through initiatives like the Make in India campaign and the National Bio Pharma Mission. With a significant number of USFDA-approved manufacturing plants outside the U.S., India is a strong contender in the global market. Indian pharmaceutical companies are actively developing and commercializing biosimilars like Cetuxa for oncology, immunology, and diabetes.

Investments in Research and Development Tossing the Market

China is at the spearhead of immunology biosimilar development and adoption, supported by efforts like multinational clinical centers, global sharing of clinical data, and expedited approval procedures. The nation has made significant investment in research and development by establishing itself as the world leader in drug types and the companies engaged in them. With fifty-one authorized biosimilars, China is dedicated to enhancing the availability of therapeutic drugs.

Europe: A Notable Force in the Immunology Biosimilars Market

Europe is emerging as a notable region in the immunology biosimilars market because of the evolving biosimilar regulation and commercialization by the European Medicines Agency (EMA), the approval of the highest number of biosimilars worldwide and consequently has the most extensive experience of their use and safety. Also, it has a sophisticated, diverse healthcare system with experience in biosimilar evaluation and adoption, thus setting a template for other regions.

- In July 2024, STADA and Alvotech announced the launch of biosimilar ustekinumab Uzpruvo in Europe across many European countries. Uzpruvo is the second immunology biosimilar brought to market through the strategic partnership between STADA and Alvotech, following the 2022 launch of Hukyndra.

Immunology Biosimilars Market Companies

- Novartis AG

- Pfizer Inc.

- Mylan N.V.

- AbbVie Inc.

- STADA Arzneimittel AG

- Celltrion, Inc.

- KBI Biopharma, Inc.

- Amgen, Inc

Leaders' Announcements

- In June 2023, Samsung Biologics and Pfizer announced a strategic partnership for the long-term commercial manufacturing of multi-product portfolio of Pfizer. Under the terms of the new agreement, Samsung Biologics will supply Pfizer with additional capacity for large-scale manufacturing for a multi-product biosimilars portfolio covering oncology, inflammation, and immunology.

Recent Developments

- In February 2025, Biocon Biologics Ltd., a fully integrated global biosimilars company, announced that YESINTEK™ (ustekinumab-kfce) is available to patients in the United States and is a choice of first Stelara (ustekinumab) biosimilar market entrants in the country.

- In May 2024, the U.S. FDA approved Bkemv (eculizumab-aeeb) as the first interchangeable biosimilar to Soliris (eculizumab) for the treatment of paroxysmal nocturnal hemoglobinuria (PNH) to lessen hemolysis and atypical hemolytic uremic syndrome (aHUS) to inhibit complement-mediated thrombotic microangiopathy.

- In May 2023, Alkem Oncology reported the launch of Cetuxa, the first biosimilar of cetuximab used in the treatment of head and neck cancer. The cetuximab originator was developed by Merck and is sold under the brand name Erbitux.

Segments Covered in the Report

By Disease

- Inflammatory Bowel Disease

- Arthritis

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting