What is the Insulin Pump Market Size?

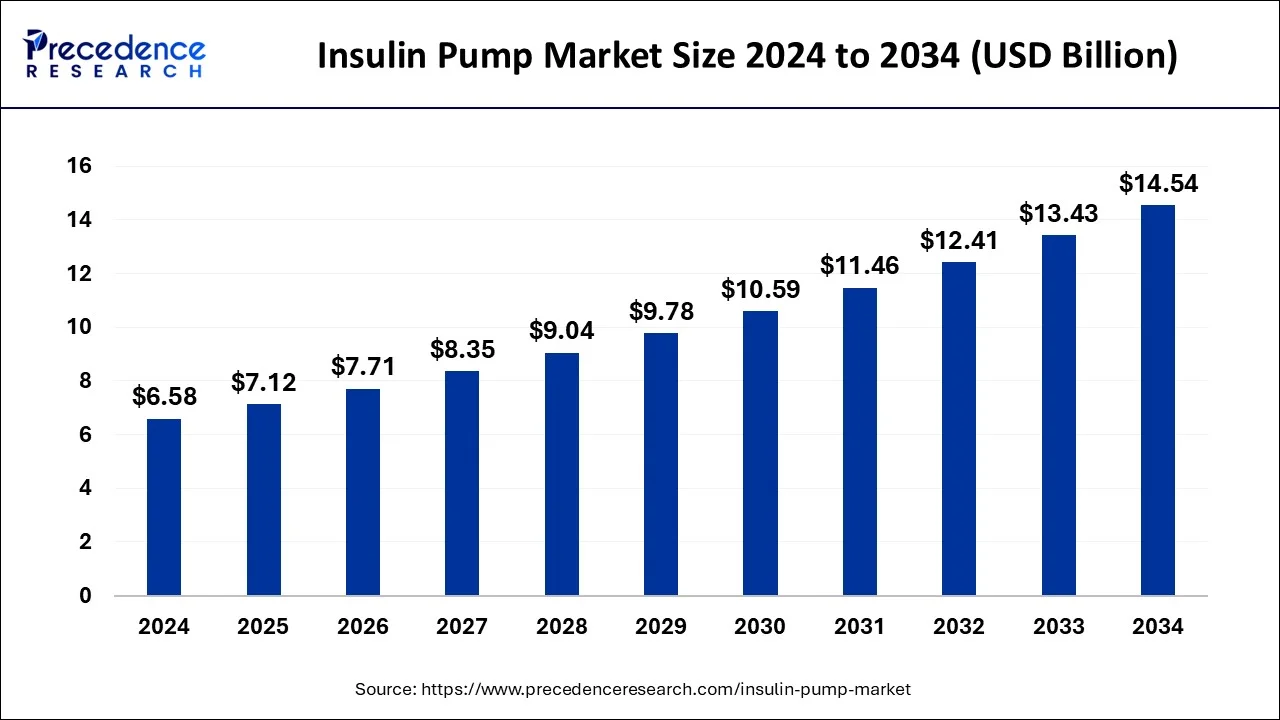

The global insulin pump market size is calculated at USD 7.12 billion in 2025 and is predicted to increase from USD 7.71 billion in 2026 to approximately USD 15.59 billion by 2035, expanding at a CAGR of 8.15% from 2026 to 2035.

Market Highlights

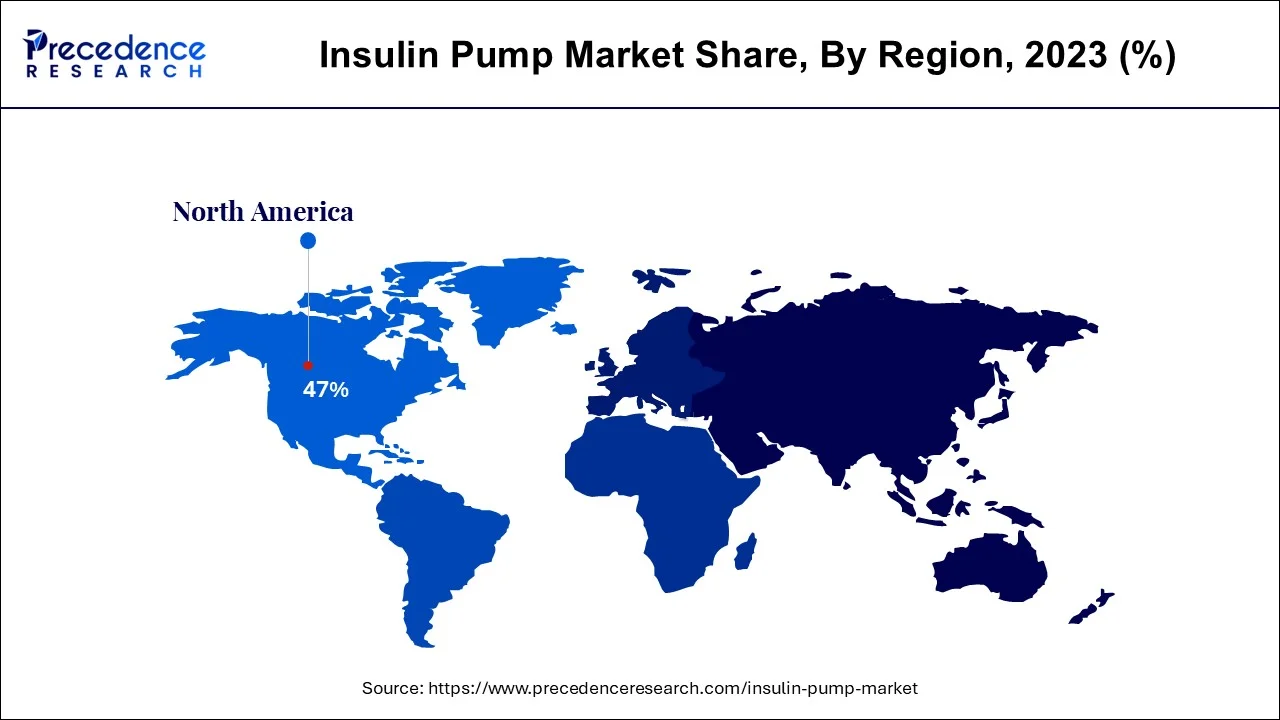

- North America accounted revenue share of over 47% in 2025.

- By pump type, the tethered pump segment accounted market share of over 62% in 2025.

- By accessories, the insulin set insertion devices segment accounted largest revenue share in 2025.

- By end user, the hospitals segment dominated the market in 2025.

- By product, the MiniMed segment held a significant share in 2025.

- By product, the tandem segment is anticipated to show considerable growth in the market over the forecast period.

- By disease indication, the type 1 diabetes segment held a significant share in 2025.

- By disease indication, the type 2 diabetes segment is anticipated to show considerable growth in the market over the forecast period.

AI in the Market

Artificial intelligence is changing the face of the insulin pump market as it automates, predicts, and individualizes diabetes management. The AI algorithms interface with a continuous glucose monitor so that they forecast the glucose changes and proactively initiate insulin delivery, trying to maintain the patients' levels with minimal intervention. These closed-loop systems lessen the burden of constant monitoring and increase the accuracy in comparison to manual treatment; therefore, these systems are also called artificial pancreas solutions. Insulin delivery gets so personal through AI because these systems learn the unique influences of diet, activity, and life patterns of each individual. AI continues to fast-track the adoption of advanced insulin pumps amidst regulatory hurdles and data security concerns.

Smarter Insulin: The Next Generation of Diabetes Tech

The insulin pump market offers devices that provide an alternative to daily insulin injections for people with diabetes. This market includes wearable devices like tubeless patch pumps and traditional pumps connected by tubing. It is driven by the increasing number of diabetes cases, particularly Type 1, and advances in technology that make pumps smarter and easier to operate. Patients are choosing these advanced devices for greater convenience, lifestyle flexibility, and more accurate blood sugar management, while improved insurance coverage in some regions also encourages adoption. Leading companies are continuously innovating to remain competitive in this growing market.

Insulin Pump Market Growth Factors

Insulin pumps are compact computerized drug delivery devices that enable the delivery of the insulin doses in required amount into a diabetic patient. The increased efficiency of the insulin pumps in managing and controlling the diabetes regularly by providing consistent and timely delivery of the insulin doses to the patients has fostered the adoption of the insulin pumps across the globe.

The demand for the insulin pumps is primarily driven by the growing prevalence of diabetes among the population. As per the data revealed by the International Diabetes Federation, around 552 million people across the globe are estimated to have diabetes by the year 2030. According to the World Health Organization, diabetes is a major cause of blindness, stroke, and kidney failure. The changing lifestyle of the consumers, shifting consumption pattern, and unhealthy food habits of the people is surging the cases of diabetes among the global population.

The rising awareness regarding the availability of the advanced innovative pumps and its easy availability are the major factors that drives the growth of the global insulin pump market. The rising investments by the market players in the research and innovation of the drug delivery devices has encouraged the development of the insulin pumps that primarily focuses on the convenience of the patients is fueling the market growth.

Furthermore, the integration of smart technologies like artificial intelligence in the healthcare sector is propelling the adoption of the automated insulin pumps among the patients. Moreover, rising number of product approvals and various developmental strategies such as partnerships, distribution agreements, and collaborations adopted by the market players is positively influencing the growth of the global insulin pump market.

- Adoption of insulin pumps is driven mainly by a rise in the incidence of diabetes worldwide, as people look for efficient and reliable means to manage their condition.

- Increasing inclination toward advanced drug delivery systems, along with easy availability of innovative pumps, is heightening market demand.

- Continuous research and a thrust toward technological advancements are continually resulting in new patient-friendly designs and smart functionalities-to-day usability and outcome.

- Strategic initiatives taken by manufacturers encompassing partnerships, approvals, and collaborations are henceforth raising their product portfolios and avenues for expansion.

- The integration of digital health solutions with insulin pumps, combined with dedicated healthcare infrastructure, is strengthening the asserted outlook of how much patients wish to rely on conventional methods of insulin delivery toward automated methods.

Insulin Pump Market Outlook

- Industry Growth Overview: The market is expected to experience rapid growth from 2026 to 2035, driven by the increasing global prevalence of diabetes and the growing patient preference for less invasive, more convenient insulin delivery options. Growth will mainly focus on advanced wearable devices, such as patch pumps and integrated systems that connect with continuous glucose monitors.

- Sustainability Trends: The healthcare industry is adopting sustainable practices through the circular economy, focusing on reusable and rechargeable medical devices to reduce waste and lessen environmental impact. This eco-friendly innovation is further supported by AI and IoT, which optimize manufacturing and supply chains for better efficiency and improved patient outcomes.

- Global Expansion: While North America remains the leading market, major players are strategically expanding into high-growth regions, especially Asia-Pacific, Latin America, Eastern Europe, and the Middle East and Africa (MEA). This expansion is driven by increasing diabetes rates in these areas, improving healthcare infrastructure, and strategic partnerships with local health systems and distributors.

- Major investors: Venture capital, private equity, and strategic corporate investors are actively funding companies in the insulin pump and diabetes technology sectors. These investments are attracted by the high growth potential, strong clinical demand, and the trend toward automated and integrated diabetes management solutions. Recent examples include funding rounds for Beta Bionics and acquisitions by Medtronic and Tandem Diabetes Care.

- Startup Ecosystem: The startup ecosystem is thriving, with innovators focusing on creating advanced hardware, software, and delivery models like Robotics-as-a-Service (RaaS) for diabetes care. New companies are attracting funding by specializing in areas such as tubeless patch pumps, AI-powered dosing algorithms, and improved integration with digital health platforms.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 7.12 Billion |

| Market Size in 2026 | USD 7.71 Billion |

| Market Size by 2035 | USD 15.59 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.15% |

| Leading Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Pump Type, Accessories, End User, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Prevalence of Diabetes

One of the major factors that has stimulated the insulin pump market is the increasing diabetes across the entire world. Both Type 1 and Type 2 diabetes are on the rise owing to various factors, which include the aging of populations, poor dietary patterns, obesity, and highly sedentary lifestyles. Since diabetes is becoming ranked by a lot of persons, the need to have efficient and effective delivery of insulin becomes higher. These devices are especially beneficial to Type 1 diabetics and to insulin-dependent Type 2 patients. Moreover, the insulin pump is becoming more appealing and accessible due to technological changes, such as its integration with continuous glucose monitors (CGMs) and the emergence of closed-loop systems.

- According to the latest 11th edition of the International Diabetes Federation (IDF) Diabetes Atlas, released in April 2025, an estimated 589 million adults aged 20 to 79 were living with diabetes in 2024.

Restraint

High Cost of Insulin Pumps to Limit Their Adoption

One of the inhibitory factors of the widespread usage of insulin pumps is that their cost is high. Although these smart devices are transforming the way diabetes is managed in a way that provides much more control and flexibility, they remain unaffordable in many ways. The high cost of an insulin pump to purchase, with additional costs associated with regular consumable equipment such as infusion sets, reservoirs, and batteries. This hinders affordability by major proportions of the diabetes population, particularly in the developing world, where medical facilities and reimbursement strategies are not that fine-tuned.

Opportunity

Rise in Demand for User-Friendly Devices

Patients are demanding less invasive, simple-to-use, and convenient solutions that manage diabetes. Real-time data visualization, smartphone connection, and touchscreen interface embedded on insulin pumps raise convenience and connectivity for patients. Also, smaller and wearable solutions make patients more comfortable, and their limited size promotes long-term compliance. With increased consciousness concerning diabetes management and lifestyle demands, manufacturers stand a good chance of gaining a market share on individualized insulin pump solutions that are easy to use.

Segment Insights

Product Insights

The MiniMed segment led the Insulin pump market and accounted for the largest revenue share in 2025. Mainly because of its wide usage and high technological functionalities. The manufacturer of MiniMed insulin pump, Medtronic, has gained a firm regional presence and brand loyalty, especially with the introduction of the MiniMed 670G system, which has received accreditation as the world very first hybrid closed-loop insulin delivery system. These pumps have built-in continuous glucose monitoring that allows the tracking of blood glucose levels in real time, and automatically adjust the amount of insulin. This automation is found to improve glycemic control as well as reduce the risk and manual interventions. The system can function 24/7, so in addition to patients having enhanced control over their condition, it also enables healthcare providers to base their clinical decisions on data.

- In January 2024, Medtronic Diabetes claimed the first-ever approval of the MiniMed 780G System with Simplera Sync disposable, all-in-one sensor in the world. It incorporates modern technology, which improves the management of diabetes, and facilitates the experience of users is facilitated. These product portfolio innovations are to spur the segment's market growth.

The tandem segment is expected to grow at a significant CAGR over the forecast period. Associating itself with its user-friendliness assured, the big color touchscreen interface of the t: slim X2 is especially useful to patients with less dexterity and enhances the overall usability. This artificial intelligence-enabled closed-loop system automatically adjusts insulin delivery according to the insulin delivery. The personalized insulin management and smart connectivity of Tandem make it a competitive insulin pump. As the awareness and the patient preference to use more technologically advanced and easy-to-operate devices continue to rise, the Tandem segment will proliferate at a high rate.

- In February 2025, Tandem Diabetes Care announced that its next-generation automated insulin delivery (AID) algorithm, Control-IQ+ technology (Control-IQ+), received U.S. Food and Drug Administration (FDA) approval to be used in people with type 2 diabetes aged 18 and older to support the entry of extended weight and total daily insulin range inputs.

Pump Type Insights

The tethered pump segment held a 62% share of the market in 2025. This is because of its proven reliability, customization options, and precision. These traditional devices, connected to the body with flexible tubing, deliver highly accurate, continuous subcutaneous insulin infusion (CSII). Their longer presence in the market has also established a strong reputation for dependability among patients and healthcare providers. Tethered pumps were the first to integrate with continuous CGM and AID systems, reinforcing their leadership position in advanced diabetes management through consistent performance.

The patch pump segment is expected to grow at a CAGR of 10% during the forecast period. This growth is driven by improved convenience, increased discretion, and integration with advanced digital and AID systems. These wearable, tubeless devices represent a significant improvement over traditional pumps by eliminating the hassle and social stigma linked to tubing, providing a more flexible and comfortable experience for users. Innovations include simplified, disposable options to meet the needs of the expanding Type 2 diabetes population, along with sophisticated models that offer closed-loop integration with CGM systems to automate insulin delivery.

Disease Indication Insights

Type 1 diabetes segment dominated the market in 2024. Autoimmune type 1 diabetes is a response as the immune system of the body accidentally destroys and kills the insulin-producing beta cells in the pancreas. Due to the inability of the body to produce insulin, patients with this condition are treated with lifelong insulin therapy, which is generally given in various daily insulin injections or using insulin pumps. The advantage of insulin pumps is the level of accuracy in delivering and receiving insulin dosages when compared to the release of insulin in the body. The potential increase in the popularity of insulin pumps as a treatment for Type 1 diabetes is due to the rising consciousness of patients and health specialists, and insurance benefits in most developed areas.

The type 2 diabetes segment is expected to grow substantially in the Insulin pump market. The increased worldwide incidence of Type 2 diabetes (caused by ageing populations, inactive living, and poor diet) has led to increased interest in the more sophisticated diabetes associated instruments. The recent studies reveal that automated insulin delivery systems can improve glycemic control in Type 2 diabetes patients, bringing both the level of clinical outcomes improvement as well as the quality of life in general. Besides, the continuous R&D is reciprocating products in the form of various models of pumps that are targeted to suit the demands of diabetics with Type 2.

Accessories Insights

The insulin set insertion devices segment accounted for the largest revenue share in 2025. This is primarily because they are essential, high-turnover consumables. Unlike durable pump hardware, infusion sets need to be replaced every two to three days to ensure proper insulin delivery and prevent infection or blockage, creating a steady, predictable revenue stream for manufacturers. Additionally, recent advancements in insertion devices directly address key user pain points, such as needle anxiety and insertion pain, with features like automatic insertion mechanisms and improved cannula design.

The insulin reservoir segment is expected to grow at a 9% CAGR during the period. This growth is mainly driven by innovations in design, capacity, and materials that directly tackle common patient concerns such as inconvenience and waste. As traditional and patch-style pumps become more widely used, the demand for easy-to-use, high-capacity cartridges and reservoirs has increased, especially among the growing number of people with Type 2 diabetes and those using AID systems. This makes it a dynamic and rapidly expanding part of the overall market.

End User Insights

The hospitals segment dominated the market in 2025. This is simply attributed to the increased penetration of hospitals across the globe. The skilled healthcare professionals that can provide assistance to the diabetic patients in effectively curing diabetes has fueled the growth of the segment. The rising government and corporate investments in the advancements of the hospitals is expected to further fuel the growth of the hospitals segment in the near future.

The homecare segment is expected to grow at a CAGR of 9.2% during the forecast period. This growth is driven by a strong combination of technological progress, a growing preference for self-management, and rising economic affordability. Innovations have made insulin pumps smaller, easier to use, and more connected, shifting diabetes care from clinical settings to the convenience of patients' homes.

Region Insights

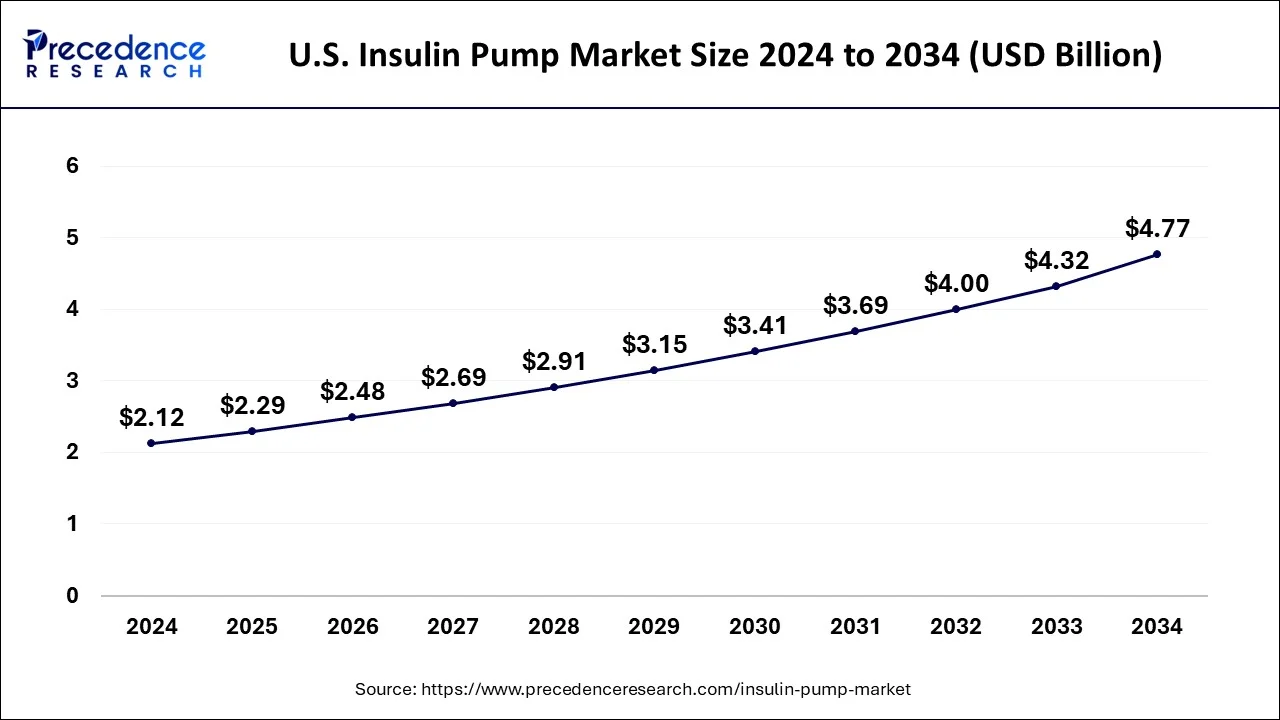

U.S. Insulin Pump Market Size and Growth 2026 to 2035

The U.S. insulin pump market size is evaluated at USD 2.29 billion in 2025 and is predicted to be worth around USD 5.13 billion by 2035, rising at a CAGR of 8.4% from 2026 to 2035

U.S. Insulin Pump Market Trends

The U.S. is a key player in the North American market, fueled by its advanced healthcare infrastructure, high diabetes rates, and a tech-focused approach to patient care. Major companies like Medtronic, Insulet, and Tandem Diabetes Care dominate the market, emphasizing technological innovation. They are creating automated closed-loop systems and smart wearable devices that provide greater convenience and better glucose management.

What Makes North America the Dominant Region in the Insulin Pump Market?

North America accounted revenue share of over 47% in 2024. The presence of numerous top market players in the region coupled with the increased prevalence of diabetes and increased demand for the innovative drug delivery devices among the population has fostered the growth of the insulin pump market in North America. The increased disposable income and increased health consciousness has triggered the adoption of the insulin pumps among the population and the region is projected to retain its dominant position throughout the forecast period.

India Insulin Pump Market Trends

India plays a key role in the market in Asia Pacific, presenting significant opportunities with the second-largest diabetic population worldwide. The country has a vast, largely underserved patient base, driving demand for advanced solutions like insulin pumps. Market growth is fueled by rising disposable incomes in urban areas, a focus on effective diabetes management, and technological innovations, including the launch of integrated patch pumps and automated systems.

How is the opportunistic Rise of Asia Pacific in the Market?

On the other hand, Asia Pacific is estimated to be the most opportunistic segment during the forecast period. Asia Pacific is home to around 4.4 billion people and the changing consumption pattern and unhealthy food habits of the consumers is resulting in a surge in the diabetic population. Moreover, growing health awareness, rising penetration of the retail pharmacies, and rising consumer expenditure on the healthcare in the region is expected to drive the growth of the insulin pump market in Asia Pacific in the foreseeable future.

European Insulin Pump Market: Advanced Care, Varied Access

The European insulin pump market is expected to grow significantly in the coming years. This growth is driven by advanced healthcare facilities, increased healthcare spending, and investments in R&D. Countries such as Germany, France, and the UK are leading in the region due to their well-developed healthcare systems and reimbursement policies. The rise in diabetes, particularly among elderly patients, is increasing demand for technologically advanced insulin pumps. Government initiatives focused on rapid market expansion aim to promote early diabetes diagnosis, improve access to care, and support digital health tools.

UK Insulin Pump Market Trends

The insulin pump market in the UK is also growing quickly, mainly because of the increasing number of patients with type 1 diabetes, and the government supports diabetes care in this country. Under strict clinical criteria, insulin pumps are offered to eligible patients, especially children and adults with poorly controlled type 1 diabetes, through the National Health Service (NHS).

South America's Insulin Pump Market Boom

South America is gaining a more significant role in the global market, mainly due to the high rates of diabetes and a growing elderly population. This trend becomes clearer as healthcare systems modernize in key countries like Brazil and Mexico. The gradual increase in health insurance coverage, rising healthcare costs, and greater awareness are driving the demand for advanced technologies. Furthermore, the spread of telemedicine is improving access to diabetes management through the use of newer, more advanced devices.

Brazil Insulin Pump Market Trends

Brazil is the main driver of growth in this market, fueled by its large and growing diabetic population and a shift toward more advanced diabetes management solutions. However, there is a significant gap in market adoption: smart and wireless insulin pumps are increasingly used in urban areas like São Paulo and Rio de Janeiro, where healthcare infrastructure and disposable incomes are higher. This urban adoption helps close accessibility gaps and improves patient management.

Diabetes Tech in the MEA

The Middle East and Africa (MEA) are expected to experience significant growth, offering unique opportunities for rapid expansion along with notable challenges to widespread adoption. The wealthy Gulf Cooperation Council (GCC) countries are a high-growth market because of their increasing diabetic populations, rising healthcare expenditures, and substantial investments in modern healthcare infrastructure. These factors have driven the adoption of advanced, connected insulin pump systems in urban hospitals and clinics.

UAE Market Trends

The UAE plays a significant role in this market, with a high rate of diabetes, strong healthcare investments, and a tech-savvy patient community. Government initiatives and strategic partnerships between healthcare providers and device manufacturers are encouraging the use of advanced insulin delivery solutions and fostering trends like remote patient monitoring and patient empowerment in managing health.

Key Government Initiatives for the Insulin Pump Market

| Country | Key Government Initiative |

| U.S. | Favorable federal reimbursement policies (Medicare) and accelerated regulatory approvals for advanced devices by the FDA. |

| UK | The National Institute for Health and Care Excellence (NICE) approved funding for hybrid closed-loop systems for a wide range of patients via the NHS. |

| Australia | Proposed federal subsidies for all Australians with type 1 diabetes from 2025. A long-standing program subsidizes pumps for eligible individuals under 21. |

| China | National volume-based procurement (NVBP) policies for insulin to reduce prices. Increased funding for diabetes management technology under the Healthy China 2030 plan. |

| Brazil | Resumed domestic insulin production and facilitated partnerships with global pharmaceutical firms to increase local manufacturing capacity. |

Value Chain Analysis

- R&D: This stage involves all the research and development activities required to innovate new insulin pump technologies or improve upon existing products in terms of design, function, and patient needs.

Key Players: Insulet Corporation, Bigfoot Biomedical

- Clinical Trials and Regulatory Approvals: This phase covers pre-clinical and clinical testing on human subjects to document and prove the efficacy and safety of the insulin pump, followed by obtaining the necessary regulatory approvals (e.g., FDA approval in the US) to market the device.

Key Players: Medtronic, Tandem, and Insulet

- Formulation and Final Dosage Preparation: This stage pertains to all engineering activities of fine machining all components of the insulin pump, as well as the processes related to correct insulin dosage and reliable delivery mechanisms within the device.

Key Players: Phillips-Medisize, Novo Nordisk, Eli Lilly, and Sanofi

- Packaging and Serialization: This stage includes packaging the final insulin pump device, ensuring sterility and protection of the product, as well as serialization-assigning unique IDs that could be used for tracking and fighting counterfeits.

Key Players: Medtronic, Insulet, and Tandem

- Distribution to Hospitals, Pharmacies: This stage includes the logistical activities for transporting and delivering insulin pumps that have been packaged into various healthcare facilities and pharmacies, ensuring timely and efficient availability to patients.

Key Players: Medtronic, Insulet, Tandem, Roche Diabetes Care, and Ypsomed

Top Companies Operating in the Insulin Pump Market

Medtronic

Corporate Information

- Headquarters: Operational headquarters at 710?Medtronic?Parkway, Minneapolis, MN 55432 5604, U.S.

- Year Founded:1949

- Legal/International Structure:Although founded in the U.S., Medtronic has its legal domicile in Ireland (after the 2015 acquisition of Covidien) and is listed on the NYSE under ticker “MDT”.

Business Overview

Medtronic is a global leader in medical technology, services, and solutions, providing devices and therapies across multiple therapeutic areas, including cardiovascular, neurological, surgical, and diabetes care.

In the context of the insulin pump market:

- Medtronic's diabetes business includes insulin delivery devices, continuous glucose monitoring integration, hybrid closed loop systems, and related services.

- In the global insulin pump market, Medtronic's “MiniMed” product line holds a dominant position. For example, in 2024, it was reported that the MiniMed segment held ~52.9% share of the insulin pump market, driven by its technology and installed base.

Business Segments / Divisions

- Cardiac & Vascular Group – devices and therapies for heart rhythm, vascular diseases.

- Minimally Invasive Therapies Group – surgical technologies, minimally invasive tools.

- Restorative Therapies Group – neuromodulation, spine, brain therapies.

- Diabetes Group – management solutions for diabetes, including insulin pumps, CGM, and services.

Within the Diabetes Group, divisions include non-intensive diabetes therapies, intensive insulin management, diabetes services, and solutions.

Geographic Presence

- Medtronic operates in 150+ countries worldwide and has more than 95,000 employees (source: “global locations” page).

- Major manufacturing, R&D, and commercial operations span North America, Europe, Asia Pacific, Latin America, and the Middle East/Africa.

- In India, for example, Medtronic India Pvt. Ltd has business across many major cities and R&D facilities in Bangalore and Hyderabad.

Key Offerings (with respect to Insulin Pump Market)

- The MiniMed™ system: Medtronic's flagship insulin pump product line. It integrates continuous glucose monitoring, automatic basal insulin adjustment (hybrid closed loop), and advanced algorithms.

- End-to-end diabetes management solutions: Pump hardware, infusion sets, sensors, software, and services for patients and healthcare providers.

- Global manufacturing and service infrastructure enabling broad scale and support.

SWOT Analysis

Strengths:

- Market leader in insulin pumps (dominant share in “MiniMed” product line) – gives scale, installed base, and brand recognition.

- Strong global footprint: extensive distribution, manufacturing, and service capabilities across many geographies.

- Broad med tech portfolio beyond diabetes (cardio, neuromodulation, surgical) allows leverage of infrastructure, cross therapy innovation.

- Ongoing product innovation: hybrid closed loop systems, CGM integration, automation in insulin delivery.

Weaknesses:

- The diabetes segment is smaller relative to some of its other major segments (cardio, neuroscience), which may receive less corporate attention.

- Complexity of devices (pump + CGM + algorithms) increases regulatory, integration, and support burdens (hardware, software, services).

- Medtronic has faced product-specific issues (e.g., recalls in insulin pump series), which can affect reputation and trust.

Opportunities:

- Rising global prevalence of diabetes (type?1 & type?2), increasing adoption of insulin pumps in emerging markets.

- Advances in closed-loop/automated insulin delivery offer differentiation and growth potential.

- Expansion into tethered/patch pump markets and integration with digital health platforms.

- Potential spin-off or strategic focus of diabetes business (which could unlock value and dedicated resources).

Threats:

- Intensifying competition from other pump manufacturers (e.g., patch pump players, wireless systems), which may erode share or pressure pricing.

- Regulatory and cybersecurity risks (e.g., device vulnerabilities, recalls) can impact adoption and cost.

- Reimbursement pressures and healthcare cost containment globally may affect growth or margins in diabetes care.

- Technological shifts: if insulin delivery paradigm changes (e.g., non-invasive delivery, oral insulin), this could challenge pump growth.

Recent Developments

- In September 025, Medtronic received FDA approval for its MiniMed 780G insulin pump, enabling it to connect with a new Abbott-specific continuous glucose sensor for Type 2 diabetes patients in the U.S.(Source: https://www.fiercebiotech.com)

- In July 2025, Mattel introduces its first Barbie doll with type 1 diabetes, promoting inclusivity and medical reality through a continuous glucose monitor, insulin pump, and emergency snack bag.( Source:https://www.moneycontrol.com)

Recent News & Updates

- On September 23, 2025, Medtronic Diabetes launched the Instinct CGM in the U.S., made by Abbott, expanding options for MiniMed?780G pump users.

- In February 2025, Medtronic issued an urgent device correction warning that insulin pump delivery may be inaccurate during air pressure changes, such as on flights.

| Company | Key Offerings |

| Medtronic | Industry-leading insulin pumps with wide installed base, advanced hybrid closed-loop systems, and strong global distribution. |

| Insulet Corporation | Omnipod patch pump systems, user-friendly design, and strong support for pediatric and adult diabetes care. |

| Tandem Diabetes Care | T: slim X2 insulin pumps with interoperable technology and continuous updates; focus on connected diabetes management. |

| Roche (Accu-Chek) | Integrated pump systems with glucose monitoring, focusing on both clinical and home settings. |

| Ypsomed AG | Modular insulin pump systems and customizable therapy solutions, strong presence in Europe. |

Other Key Players in the Insulin Pump Market

- Medzer

- Eoflow

- Debiotech S.A.

- Lenomed Medical

- Microtech Medical

- Cequr SA

- Zealand Pharma

- Terumo Corporation

- Vicentra B.V.

Segments Covered in the Report

By Pump Type

- Tethered Pump

- Patch Pump

- Implanted Insulin Pump

- Closed Loop Insulin Pump

By Product

- MiniMed (630G, 670G, and VEO)

- Accu-Chek (Combo, Insight, and Solo)

- Tandem (T: slim X2, G4, T: flex Delivery System)

- Omnipod

- My life omnipod

- Others

By Accessories

- Battery

- Insulin Set Insertion Devices

- Insulin Reservoir

By Disease Indication

- Type 1 Diabetes

- Type 2 Diabetes

By End User

- Hospitals

- Clinics

- Homecare

- Laboratories

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

- GCC Countries

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting