Insulin Delivery Devices Market Size and Growth 2026 to 2035

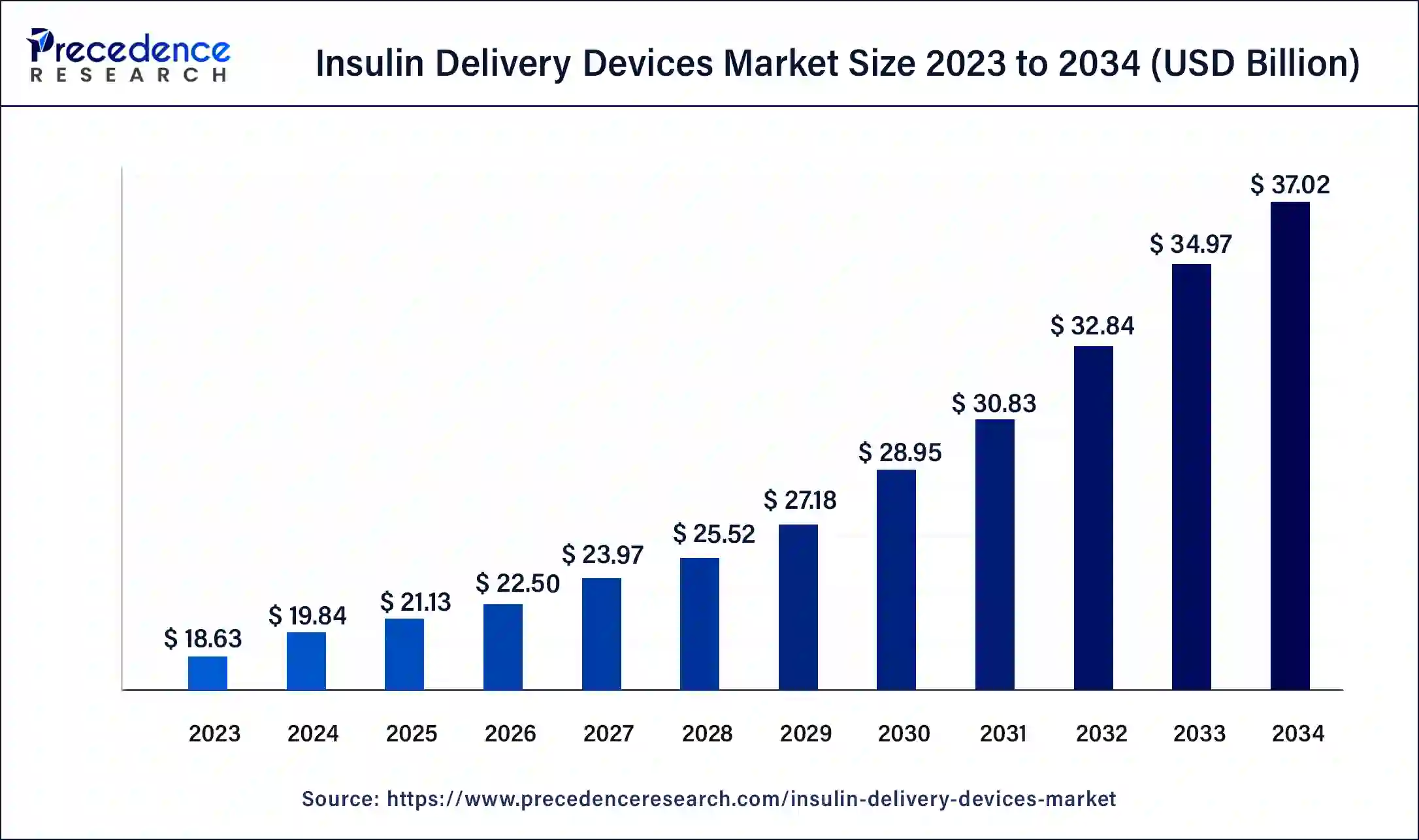

The global insulin delivery devices market size is valued at USD 21.13 billion in 2025 and is predicted to increase from USD 22.50 billion in 2026 to approximately USD 39.12 billion by 2035, expanding at a CAGR of 6.35% from 2026 to 2035.

Key Takeaways

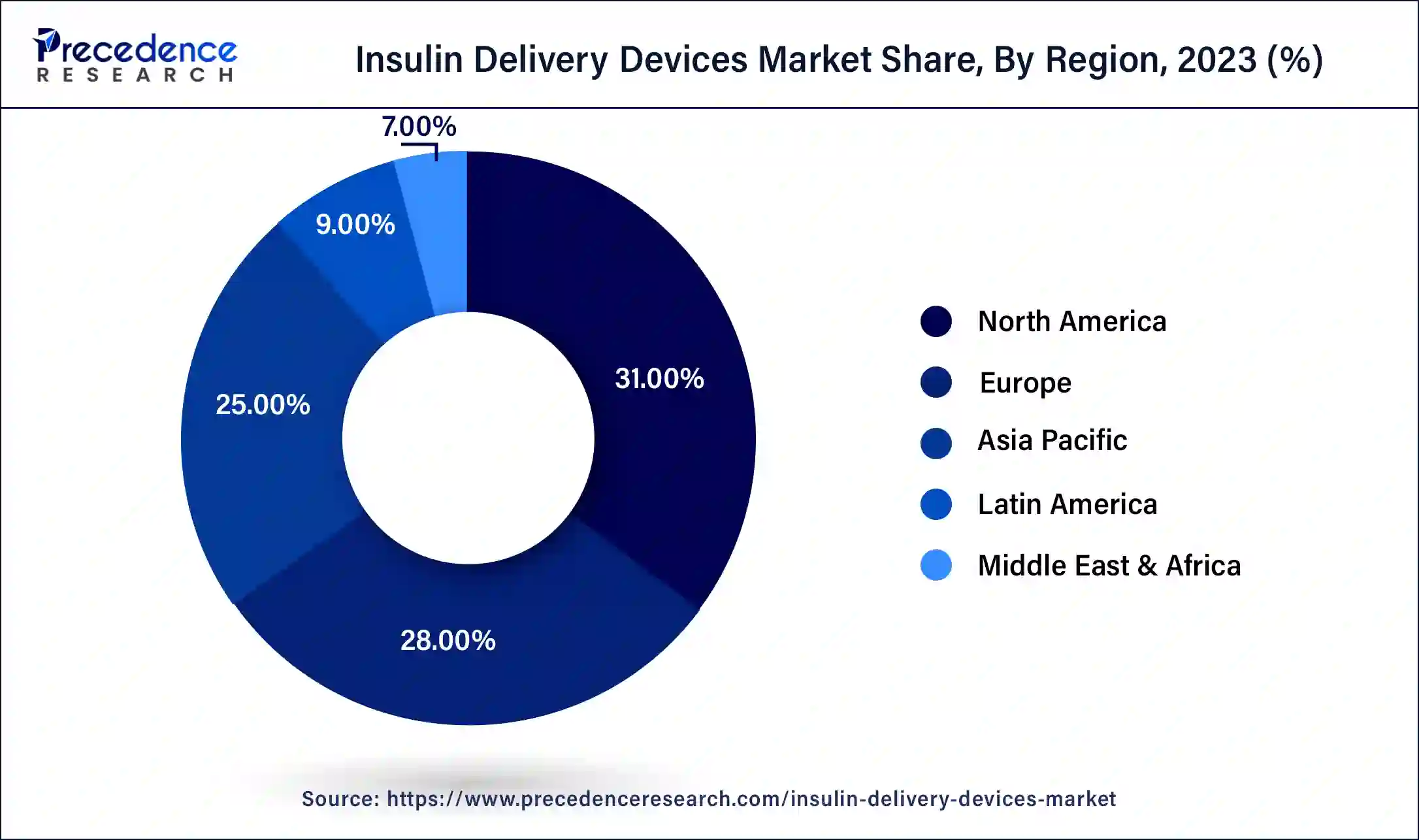

- North America led the global market with the highest market share of 31% in 2025.

- By product, the insulin pen segment has held the largest market share of 38% in 2025.

- By end user, the home care segment captured the biggest revenue share of 50% in 2025.

- By distribution channel, the incident delivery devices segment registered the maximum market share in 2025.

What are Insulin Delivery Devices?

The continuing rapid growth of the global insulin delivery devices market is attributed to the increasing number of people diagnosed with diabetes globally, greater education surrounding early intervention in disease progression, and continual technological advancements that are being developed rapidly. The development of insulin pen devices, pumps, or continuous subcutaneous insulin infusion (CSII), as well as smart insulin delivery system technology, is significantly improving patient convenience and therefore enhancing the rate at which patients adhere to their insulin therapy regimen.

The increasing demand for efficient, easy-to-use devices that provide accurate and reliable delivery of insulin via a minimally invasive method in the patient's home has led to the acceleration of the growth of this emerging market segment, which is becoming an integral part of modern-day diabetes management.

There are many ways in order to administer insulin to a patient. It is a hormone that helps in regulating the blood sugar levels of the diabetic patients. This hormone can be administered by the way of pens, pumps, jet sprays and syringes. The growing prevalence of diabetes is an important factor for the growth of the market. It also happens to be a major reason for surging mortality rate. It's about 1.5 million deaths due to diabetes in 2019 according to the report of the World Health Organization. The diabetic patients use the available insulin delivery devices in order to access the insulin dose which helps in regulating the hormone by maintaining the blood sugar of the patient. Administering insulin in the form of up tablet is also not possible as it gets degenerated by the digestive enzymes. Therefore there are a wide range of devices that are used in order to deliver the insulin at the correct location.

During the pandemic the patients with comorbidity contracted the disease earlier. About 40% of the hospitals has diabetic patients suffering with COVID-19. There were disruptions in the supply chain, shipping delays and shut down of various manufacturing units.

Growth Factors

The increasing prevalence of diabetes which is mainly due to obesity, aging or unhealthy lifestyle is expected to help in the growth of the market. Obesity happens to be the major factor causing diabetes. The number of diabetic patients across the world is increasing mainly in the obese or overweight patients. The diabetes off lifted population in the nations is driving the market for the insulin delivery devices. There's an increased demand for these devices due to various innovations. As an increasing expenditure on diabetes care the market for the insulin delivery devices is expected to grow. Due to the favorable reimbursement policies another option of other facilitative initiatives are helping in the growth of the market. The progressive and the chronic nature of diabetes inflicts the use of insulin over a long period of time. The pandemic has also proven to be a great factor in the expansion of insulin delivery devices market. As the population afflicted with diabetes across the globe is increasing it is driving the market for the Insulin delivery devices.

Insulin Delivery Devices Market Outlook

- Industry Growth Overview: The growth of the industry has been fueled by an increased incidence of diabetes, technological advancements, and an increased preference for using self-administered devices to administer insulin. The emergence and continuing improvement of smart connected insulin delivery systems will play a significant role in future growth opportunities.

- Sustainability Trends: Companies that manufacture insulin delivery devices have begun to focus on using sustainable materials, creating reusable insulin delivery pens, and reducing their plastic footprint. Products that use sustainable packaging and extend the lifespan of the devices are expected to be valued by consumers more than those that do not.

- Global Expansion: The emerging economies will be a focus for the continued growth of the insulin delivery device industry as manufacturers expand their manufacturing, distribution, and pricing strategies to take advantage of the growing populations of people with diabetes not being served.

- Startup Ecosystem: Startups are driving innovative ideas in the area of insulin delivery devices with the introduction of artificial intelligence-powered insulin pumps, digital tracking of doses, and designs that are focused on the needs of patients. Collaborations between established companies and startups are accelerating the commercialization and entry into the marketplace of new insulin delivery devices.

MarketScope

| Report Coverage | Details |

| Market Size in 2025 | USD 21.13 Billion |

| Market Size in 2026 | USD 22.50 Billion |

| Market Size by 2035 | USD 39.12 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.35% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, By Application, By End User, and By Distribution Channels |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Insulin Delivery Devices Market Segment Insights

Product Insights

The insulin pen segment accounted for the largest market share 38% in 2023. The insulin pens segment shall have the highest market share as there's an increasing preference due to the various benefits that it offers. These insulin pens are available at affordable cost and they are technologically advanced among all the other devices. Many people across the globe prefer insulin pen as it is easy to use and it also limits the financial burden of the patient as it is pocket friendly.

In the future the development of smart pen is also expected to drive the market of the insulin pen. The increasing number of diabetic patients are using insulin pen due to the convenience in usage. Other products like the insulin pump or the hand syringes are also used to administer insulin. All of these delivery devices also share a good market growth during the forecast.

End User Insights

The home care segment accounted for a market share of 50% in 2023. As does an increasing adoption of the delivery devices by the diabetic patients in the home care settings the market is expected to grow well during the forecast period across all the nations. As diabetes is a chronic disease which keeps on growing with every passing year it poses a great health care expenditure. The increasing pressure to reduce these expenses helps in adopting the devices which are easy to use in the homecare settings.

Significant advancements in these devices and the availability helps in driving the market beaded does a higher option rate of the smart insulin pen in the home care settings. It has a supporting smartphone application and a reusable injector pen which is extremely efficient in managing the delivery of insulin. As there is an increased awareness amongst the patient regarding the insulin delivery devices for home use the market shall grow during the forecast period.

Distribution Channel Insights

On the basis of the distribution channel, the incident delivery devices have maximum sales through the ecommerce segment. Due to advanced features provided by the ecommerce industry and as there is an increased use of the online services by the patients, this distribution segment is expected to grow well during the forecast. Ordering the devices online and getting it delivered to the house provides convenience. Apart from the E commerce segment the hospital pharmacies and the retail pharmacies segments are also expected to have a good crowd during the forecast period.

Insulin Delivery Devices Market Regional Insights

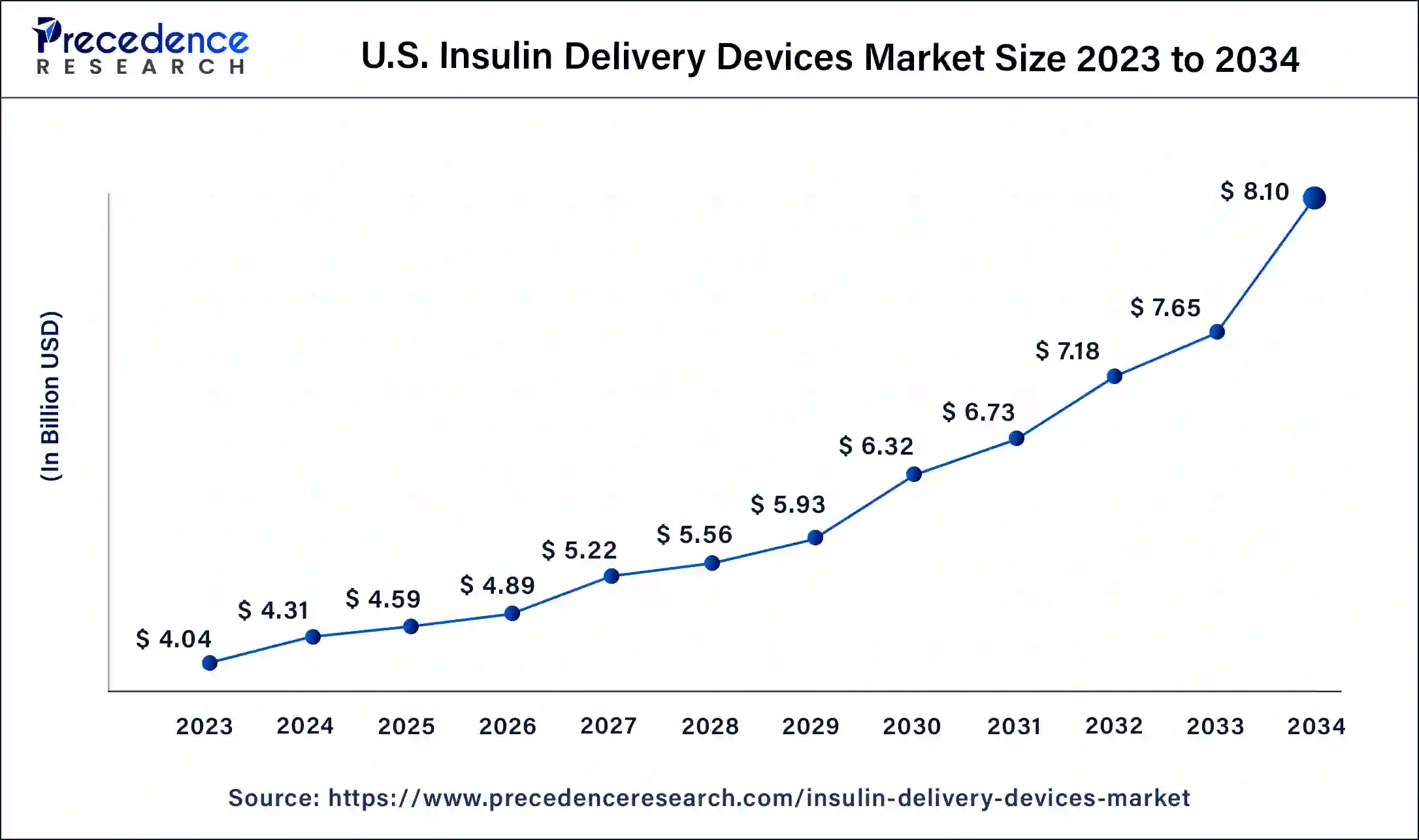

The U.S. insulin delivery devices market size is estimated at USD 4.59 billion in 2025 and is predicted to be worth around USD 8.56 billion by 2035, at a CAGR of 6.43% from 2026 to 2035.

The North American region has dominated the market of insulin delivery devices in 2025 and has garnered a market share of 30.14%.An increasing diabetic population and availability of technologically advanced devices across the North American region is helping in the growth of the market. The increasing patient base of diabetes is expected to boost the growth of the market in this region.

Why is the Market in Asia Pacific Growing at the Fastest Rate?

The market for insulin delivery devices in the Asia Pacific region is also expected to grow fast during the forecast period. In many developing economies like India and China there shall be the highest growth other than increasing population based suffering from diabetes and the awareness about the treatments for the same. Another major factor contributing to the growth in the Asia Pacific region is the high end products that are available in the market in order to treat diabetes.

China has the largest number of individuals who need insulin regularly. This has increased the demand for more advanced methods of delivering the drug. Rising use of insulin pens and patch pumps, along with greater insurer reimbursement support, is driving rapid market growth in China. Additionally, domestic companies are forming partnerships with global firms to improve access to minimally invasive delivery devices, thereby contributing to market expansion.

The market in Europe is driven by a well-structured national health system and the increasing adoption of wearable technologies. The growth of wearables, particularly those designed to monitor glucose levels and deliver insulin, is contributing to a rise in the number of individuals using diabetes care technologies. A growing awareness of diabetes management across various age groups also drives market growth.

Europe Injects Innovation: Notable Growth in the Insulin Delivery Devices Industry

Europe has an established market for insulin delivery devices; however, Europe's innovative development path continues to be fueled by the region's established reimbursement systems and high level of development in healthcare technology.

Countries such as Germany, France, and the U.K. continue to invest heavily in Insulin pumps and smart pens, while the region has a growing number of elderly persons and a growing number of persons diagnosed with diabetes. Europe is set to take the lead in the integration of digital health technologies, with connected insulin delivery devices, data-driven monitoring platforms, and long-term sustainable disease management.

Germany boasts a robust healthcare infrastructure, which has rapidly advanced with the integration of cutting-edge technologies in insulin delivery. The country is investing significantly in research and development in the diabetes care sector, with the government offering financial incentives to companies developing digital solutions to improve treatment management. This commitment to innovation is accelerating the development of advanced diabetes care technologies, making it easier for individuals to manage their condition effectively.

With an increasing number of users worldwide, Latin America is a developing region for insulin delivery devices due to a growing population suffering from diabetes, the urbanization of lifestyle habits, and enhanced access to healthcare. As Brazil, Mexico, and Argentina are investing in raising awareness about diabetes and creating better public health systems for controlling and managing the disease, there has been an increase in the ability of users to afford the use of insulin pens and other reusable devices.

The ability for users to get access to advanced methods of delivering insulin has also been aided by the expansion of international manufacturers' distribution networks, enabling them to provide their products at a wider range of locations throughout Latin America.

The Middle East & Africa (MEA) is experiencing significant growth in the market due to the rising number of people with diabetes, greater access to insulin devices, and greater investment in modernizing healthcare systems. Additionally, government initiatives and improved access to healthcare services are facilitating greater availability and affordability of these devices, driving market growth across the region. The UAE leads the market in the region due to rising investments in healthcare infrastructure and growing rates of diabetes.

Insulin Delivery Devices Market Value Chain Analysis

This stage involves the conceptualization of new devices, clinical validation, human factors studies, and the development of regulatory strategies to ensure that products are safe, effective, and user-friendly for the target patients.

Key components such as cartridges, pumps, electronics, and sterile disposables are sourced, and precision manufacturing processes are applied to ensure quality, traceability, and compliance with regulatory standards before assembly.

Devices are assembled in cleanroom environments, integrating all components, loading software, calibrating systems, and conducting thorough bench and clinical testing to ensure reliability and performance before commercial release.

This stage covers regulatory submissions, sterile and retail packaging, labelling, and cold-chain logistics to ensure that products meet all standards and reach hospitals, pharmacies, and patients safely and predictably.

After commercial release, companies provide customer training, digital health support, product warranties, patient safety monitoring, service support, and programs for recycling and responsible disposal, ensuring ongoing product reliability and patient safety.

At this stage, manufacturers are focused on R&D, engineering, and quality manufacturing of insulin delivery devices. Innovation, usability, and regulatory approval are three critical success factors at this stage.

Manufacturers partner with distributors, hospitals, and pharmacies to facilitate an efficient channel for distributing their products into the market.

Healthcare providers (i.e., physicians), healthcare facilities (i.e., clinics), and home care consumers all contribute to driving demand for insulin delivery devices.

Insulin Delivery Devices Market Companies

- Novo Nordisk A/S

- Wockhardt Ltd.

- Medtronic

- F. Hoffmann-La Roche, Ltd.

- Abbott Laboratories

- Sanofi

- Eli Lilly and Company

- Biocon Ltd.

- Ypsomed AG

- Becton, Dickinson and Company

Recent Developments

- In March 2022, Novo Nordisk announced the launch of its smart insulin in the UK. This novel product launch will offer competitive advantage and strengthen its industrial position in the UK region.

- Medtronic launched the InPen smart insulin pen that is integrated with real-time Guardian Connect CGM data which offers real-time glucose readings coupled with insulin dose data and makes it easier to make smarter dosing decisions. This product launch assisted the company in driving the sales & revenue generation in insulin delivery devices market.

Insulin Delivery Devices Market Segment Covered in Report

By Type

- Insulin Pumps

- Tubed/Tethered

- Tubeless

- Insulin Pens

- Reusable

- Disposable

- Insulin Pen needles

- Standard

- Safety

- Insulin Jet Injectors

- Insulin Syringes

- Others

By Application

- Type I Diabetes

- Type II Diabetes

By End User

- Home Care

- Hospitals & clinics

- Others

By Distribution Channels

- Online Sales

- Hospital Pharmacies

- Retail Pharmacies

- Other Clinics

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting