What is the Continuous Renal Replacement Therapy Market Size?

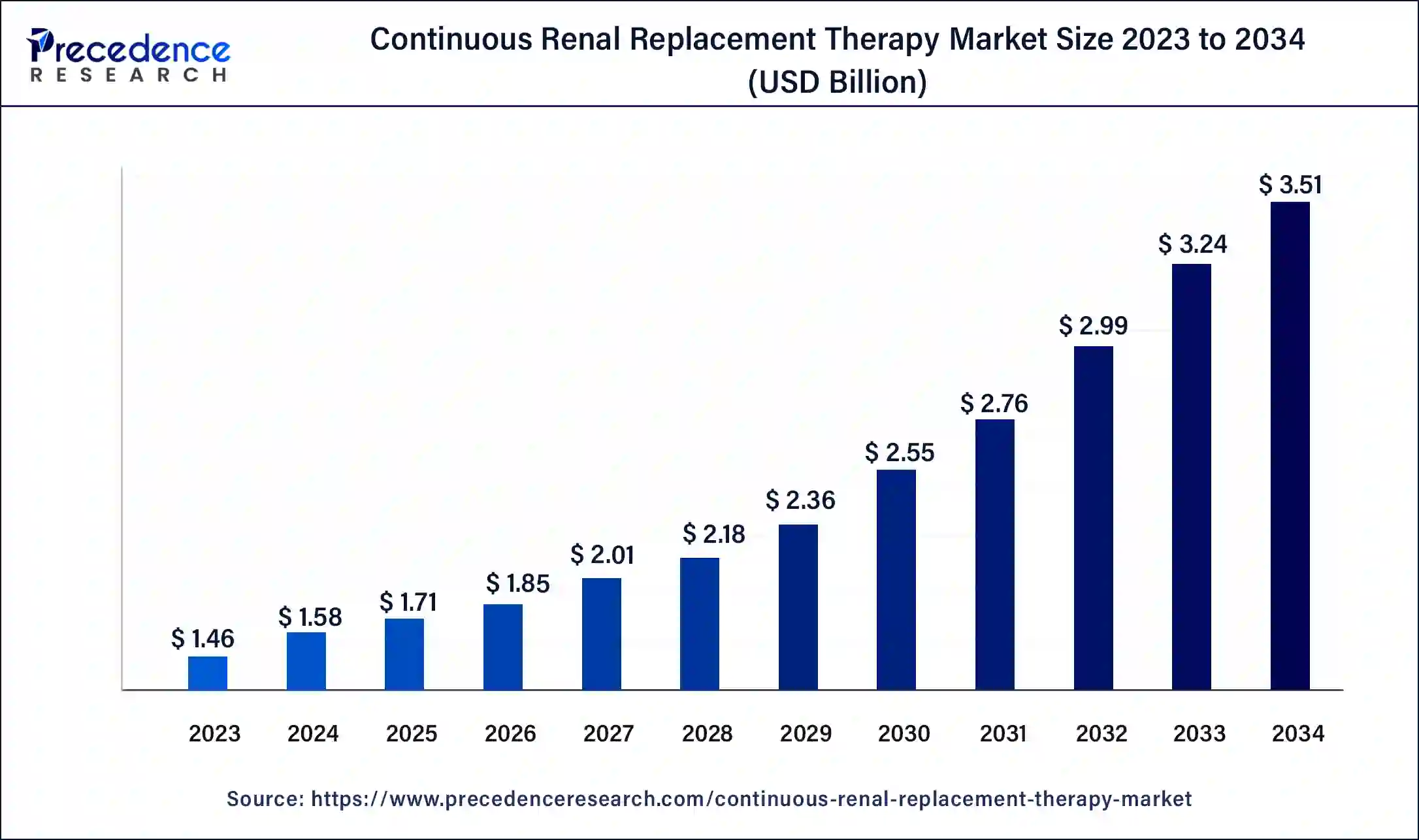

The global continuous renal replacement therapy market size is valued at USD 1.71 billion in 2025 and is predicted to increase from USD 1.85 billion in 2026 to approximately USD 3.51 billion by 2034, and expand at a CAGR of 8.3% from 2025 to 2034.

Continuous Renal Replacement Therapy Market Key Takeaways

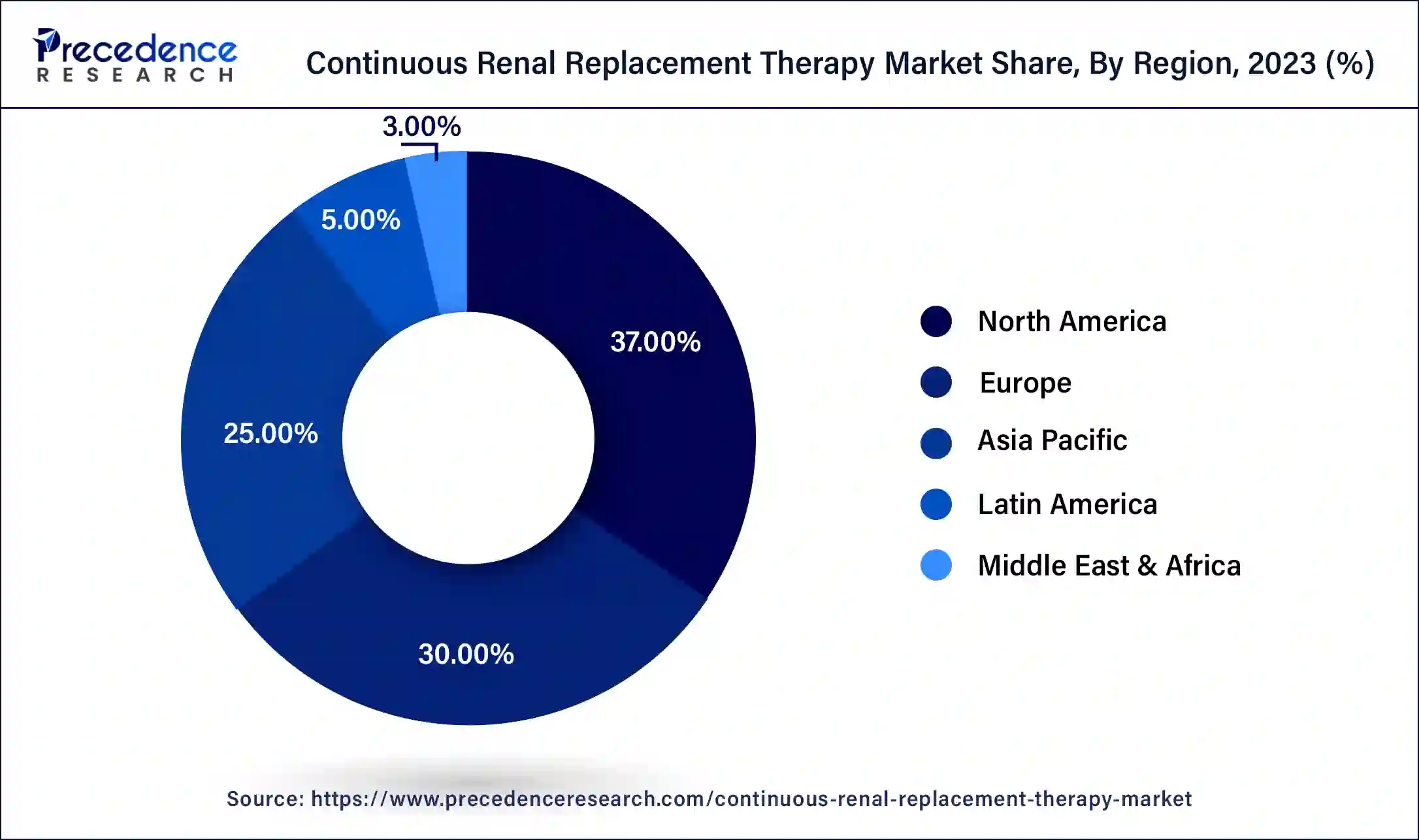

- North America contributed more than 37% of revenue share in 2024.

- Asia-Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

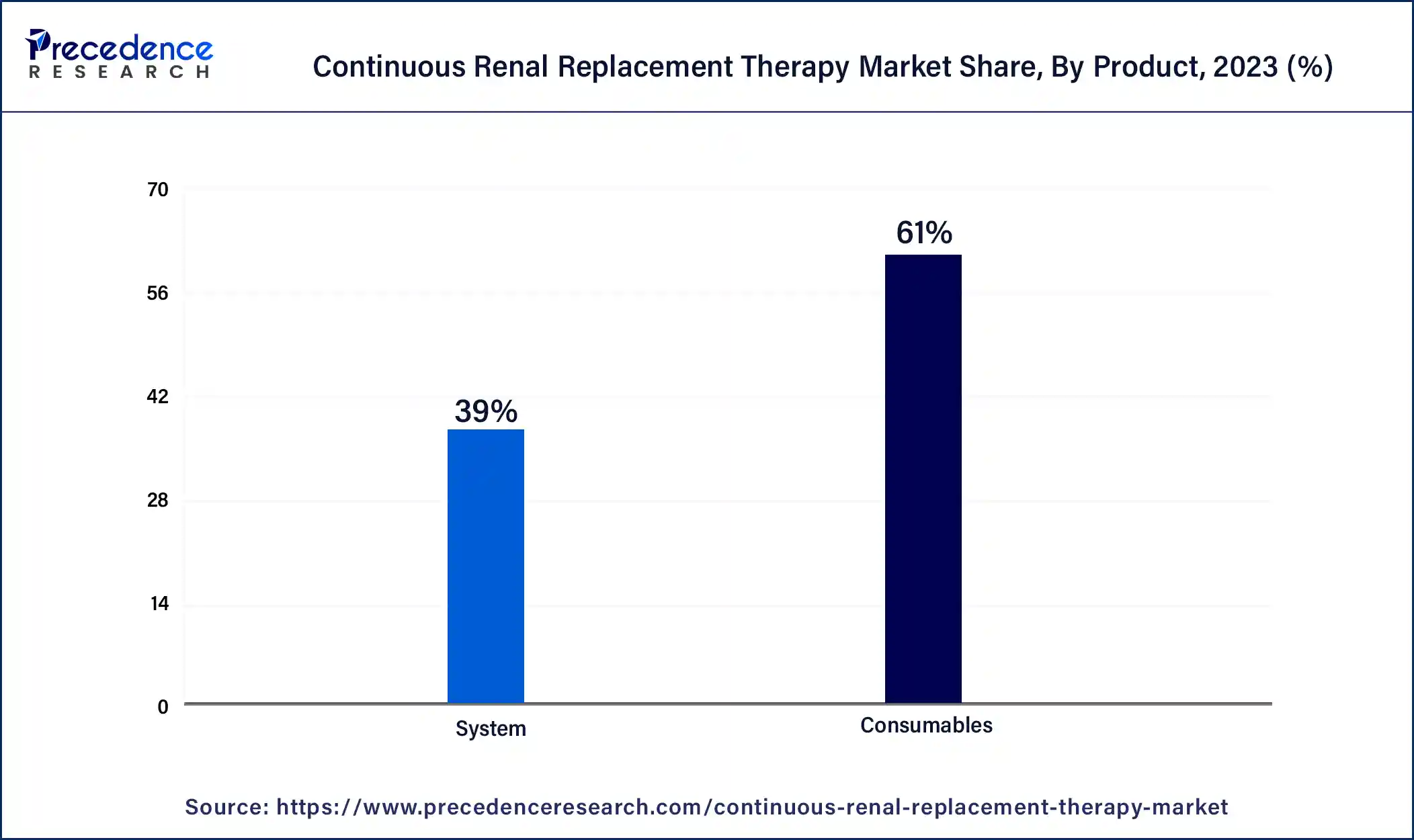

- By product, the consumables segment has held the largest market share of 61% in 2024.

- By product, the system segment is anticipated to grow at a remarkable CAGR of 9.1% between 2025 and 2034.

- By modality, the continuous venovenous hemofiltration (CVVH) segment generated over 32% of revenue share in 2024.

- By modality, the continuous venovenous hemodiafiltration (CVVHDF) segment is expected to expand at the fastest CAGR over the projected period.

How is the Continuous Renal Replacement Therapy Transforming?

Continuous renal replacement therapy (CRRT) is an advanced medical procedure designed for critically ill patients dealing with acute kidney issues. Unlike standard intermittent hemodialysis, CRRT offers a continuous and gradual elimination of waste products, extra fluids, and electrolytes from the patient's bloodstream. This therapy is particularly beneficial for individuals who may not tolerate the rapid fluid shifts associated with conventional dialysis.

CRRT involves the use of a machine that continuously circulates a patient's blood through a specialized filter, known as a hemofilter or dialyzer. This filter allows for the removal of toxins and fluid in a gradual and controlled manner, mimicking the natural functioning of the kidneys. CRRT is commonly employed in intensive care units for patients who are hemodynamically unstable or critically ill, requiring a gentler and more sustained approach to renal replacement therapy. This method helps maintain fluid balance and electrolyte levels, contributing to the overall stabilization of the patient's condition while allowing time for the kidneys to recover.

According to the data published by the International Society of Nephrology (ISP), more than 850 million people worldwide have some form of kidney disease, which is roughly double the number of people who live with diabetes (422 million) and 20 times more than the prevalence of cancer worldwide (42 million) or people living with AIDS/HIV (36.7 million).

Continuous Renal Replacement Therapy Market Growth Factors

- Increasing Incidence of Acute Kidney Injury (AKI): The rising prevalence of AKI globally is a significant growth factor, driving the demand for Continuous Renal Replacement Therapy (CRRT) as a crucial treatment option.

- Aging Population: The aging demographic contributes to a higher incidence of renal issues, creating a sustained market growth for CRRT solutions to address the specific needs of elderly patients.

- Technological Advancements: Ongoing innovations in CRRT technologies enhance efficiency, safety, and patient outcomes, stimulating market growth as healthcare providers seek state-of-the-art solutions.

- Growing Intensive Care Unit (ICU) Admissions: The increasing number of patients admitted to ICUs, where CRRT is often employed, fuels the demand for continuous renal replacement therapy.

- Rising Prevalence of Sepsis: Sepsis-related kidney complications drive the adoption of CRRT, as it proves effective in managing fluid balance and mitigating renal challenges associated with sepsis.

- Expanding Chronic Kidney Disease (CKD) Cases: The global surge in CKD cases contributes to a sustained demand for CRRT as a vital intervention in managing advanced renal conditions.

- Awareness and Education Initiatives: Growing awareness about CRRT benefits and educational efforts among healthcare professionals amplify its adoption, fostering market expansion.

- Increased Healthcare Expenditure: Higher healthcare spending globally enables healthcare facilities to invest in advanced renal replacement therapies like CRRT, propelling market growth.

- Government Initiatives Supporting Renal Care: Supportive policies and government initiatives focusing on renal care infrastructure and treatment accessibility contribute to the CRRT market's growth.

- Rising Demand for Home-based Healthcare Solutions: The increasing preference for home-based healthcare solutions drives the development of portable and user-friendly CRRT devices, expanding market reach.

- Collaborations and Partnerships: Strategic collaborations between medical institutions, research organizations, and industry players drive research and development, fostering CRRT market expansion.

- Global Pandemic Impact: The COVID-19 pandemic underscores the importance of CRRT in managing severe cases with renal complications, leading to increased adoption in emergency settings.

- Advancements in Filter Technology: Ongoing advancements in filter technology enhance the efficacy of CRRT, contributing to its adoption in diverse clinical scenarios.

- Rising Investments in Healthcare Infrastructure: Increased investments in healthcare infrastructure, especially in developing regions, support the integration of CRRT into medical facilities.

- Growing Patient Preference for Non-Invasive Therapies: Patient preference for less invasive and more comfortable treatment options drives the adoption of CRRT as a well-tolerated renal replacement therapy.

- Increasing Number of Dialysis Centers: The establishment of more dialysis centers worldwide expands the accessibility of CRRT services, positively impacting market growth.

- Expanding Applications in Pediatric Care: The widening applications of CRRT in pediatric cases, where traditional dialysis may be challenging, contribute to market expansion.

- Continuous Research and Development: Ongoing research efforts to enhance CRRT modalities and outcomes propel market growth by introducing improved and innovative solutions.

- High Prevalence of Co-morbidities: The presence of multiple co-morbidities in patient populations necessitates advanced renal care solutions like CRRT, supporting market growth.

- Globalization of Renal Care Services: The globalization of renal care services encourages the standardization of CRRT practices, fostering a broader market presence and acceptance.

Continuous Renal Replacement Therapy Market Outlook

- Global Expansion: The prominent growth is propelled by a rise in patient population with kidney disorders and acute kidney injuries, a growing geriatric population, and technological advancements.

- Major Investors: Companies, like Baxter International Inc., Medtronic plc, are widely investing in research, development, and strategic acquisitions.

- Startup Ecosystem: Hemotune, a Swiss startup that develops a blood purification platform based on magnetic beads to remove pathogens and toxins from the blood to treat concerns like septic shock.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.51 Billion |

| Market Size in 2025 | USD 1.71 Billion |

| Market Size in 2026 | USD 1.85 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.3% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Modality, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing incidence of acute kidney injury (AKI) and aging population

The increasing incidence of Acute Kidney Injury (AKI) and the aging population collectively drive a surge in demand for continuous renal replacement therapy (CRRT). AKI, often a consequence of critical illnesses or medical interventions, has witnessed a global uptick, necessitating advanced renal care solutions. CRRT proves instrumental in managing AKI by providing a continuous and controlled removal of waste products and fluids from the bloodstream, catering to patients who may not tolerate the rapid fluid shifts associated with conventional dialysis. Simultaneously, the aging demographic contributes significantly to the demand for CRRT.

As individuals age, the likelihood of encountering renal issues rises, necessitating specialized renal interventions. CRRT, with its ability to provide a gentle and sustained approach to renal replacement therapy, aligns with the specific needs of elderly patients, further fueling its adoption in healthcare settings. The combination of these factors underscores CRRT's pivotal role in addressing the evolving healthcare needs of a population grappling with an increased prevalence of acute kidney injuries and age-related renal challenges.

Restraint

High treatment costs and preference for conventional dialysis

The high treatment costs associated with continuous renal replacement therapy (CRRT) stand as a significant restraint on market demand. The expenses linked to CRRT procedures, equipment, and ongoing maintenance can be prohibitive for both healthcare facilities and patients. This financial burden limits the accessibility of CRRT, particularly in regions with budget constraints and healthcare systems facing economic challenges. As a result, cost considerations may lead healthcare providers and institutions to opt for more cost-effective alternatives, thereby impeding the widespread adoption of CRRT.

Additionally, the preference for conventional dialysis methods over CRRT acts as a notable restraint. Despite the advantages offered by CRRT, established practices and familiarity with traditional intermittent hemodialysis may create resistance to change among healthcare professionals and facilities. This preference for conventional methods, driven by historical practices and comfort levels, can hinder the broader acceptance and integration of CRRT into routine renal care protocols, impacting its market demand and adoption.

Opportunity

Home-based CRRT solutions and pediatric applications

Home-Based continuous renal replacement therapy (CRRT) solutions represent a significant opportunity in the market by addressing the demand for more accessible and patient-friendly renal care. The development of portable and user-friendly CRRT devices for home use allows patients to receive continuous renal therapy in the comfort of their homes, reducing the need for frequent hospital visits. This not only enhances patient convenience but also opens a new market segment, especially for individuals who may prefer or require home-based care.

Furthermore, the expansion of CRRT applications into pediatrics offers another avenue for market growth. Pediatric applications of CRRT cater to the specific needs of young patients with acute kidney injury or other renal conditions. The adaptation of CRRT systems to meet the unique requirements of pediatric care not only addresses a critical medical need but also creates opportunities for specialized solutions in the pediatric renal care segment. These developments align with a broader trend towards personalized and home-based healthcare, shaping the future landscape of the continuous renal replacement therapy market.

Product Insights

In 2024, the consumables segment had the highest market share of 61% on the basis of the product. In the continuous renal replacement therapy (CRRT) market, the consumables segment includes essential components regularly replaced during therapy, such as filters, tubing, and solutions. The consumables segment is witnessing a trend toward the development of more efficient and durable materials, ensuring prolonged use and cost-effectiveness.

Manufacturers are focusing on innovations to enhance the performance and lifespan of consumables, aligning with the growing demand for sustainable and economically viable solutions in the CRRT market, ultimately improving the overall efficiency and accessibility of continuous renal replacement therapy.

The system segment is anticipated to expand at a significant CAGR of 9.1% during the projected period. The system segment in the continuous renal replacement therapy (CRRT) market refers to the comprehensive machines or devices used to perform the therapy. These systems typically include components such as pumps, filters, and monitors, working together to facilitate the continuous removal of waste products and excess fluids from the patient's bloodstream.

A notable trend in this segment involves continuous technological advancements, with an emphasis on creating more efficient, user-friendly, and integrated CRRT systems. Ongoing innovations aim to enhance treatment outcomes, improve patient experiences, and streamline the operational aspects of delivering continuous renal replacement therapy.

Modality Insights

According to the modality, the continuous venovenous hemofiltration (CVVH) segment held a 32% revenue share in 2023. Continuous Venovenous Hemofiltration (CVVH) is a modality within continuous renal replacement therapy that involves the continuous removal of waste products and excess fluids from the blood. It utilizes a combination of convective and diffusive mechanisms to achieve a more gradual and continuous filtration process.

A trend in the CVVH segment involves the increasing adoption of precision technologies, enhancing therapy customization. The integration of advanced monitoring and control features improves the precision and efficiency of fluid removal, contributing to better patient outcomes and driving the evolution of CVVH within the broader CRRT market.

The continuous venovenous hemodiafiltration (CVVHDF) segment is anticipated to expand fastest over the projected period. Continuous Venovenous Hemodiafiltration (CVVHDF) is a modality in continuous renal replacement therapy that combines hemodialysis and hemofiltration. It involves the continuous removal of waste products, excess fluids, and electrolytes from the blood using a combination of diffusion and convection. The CVVHDF segment in the CRRT market is witnessing a trend towards increased adoption due to its ability to provide comprehensive solute clearance and effective fluid management. This modality offers a more holistic approach to renal replacement therapy, contributing to its growing prominence in critical care settings.

Regional Insights

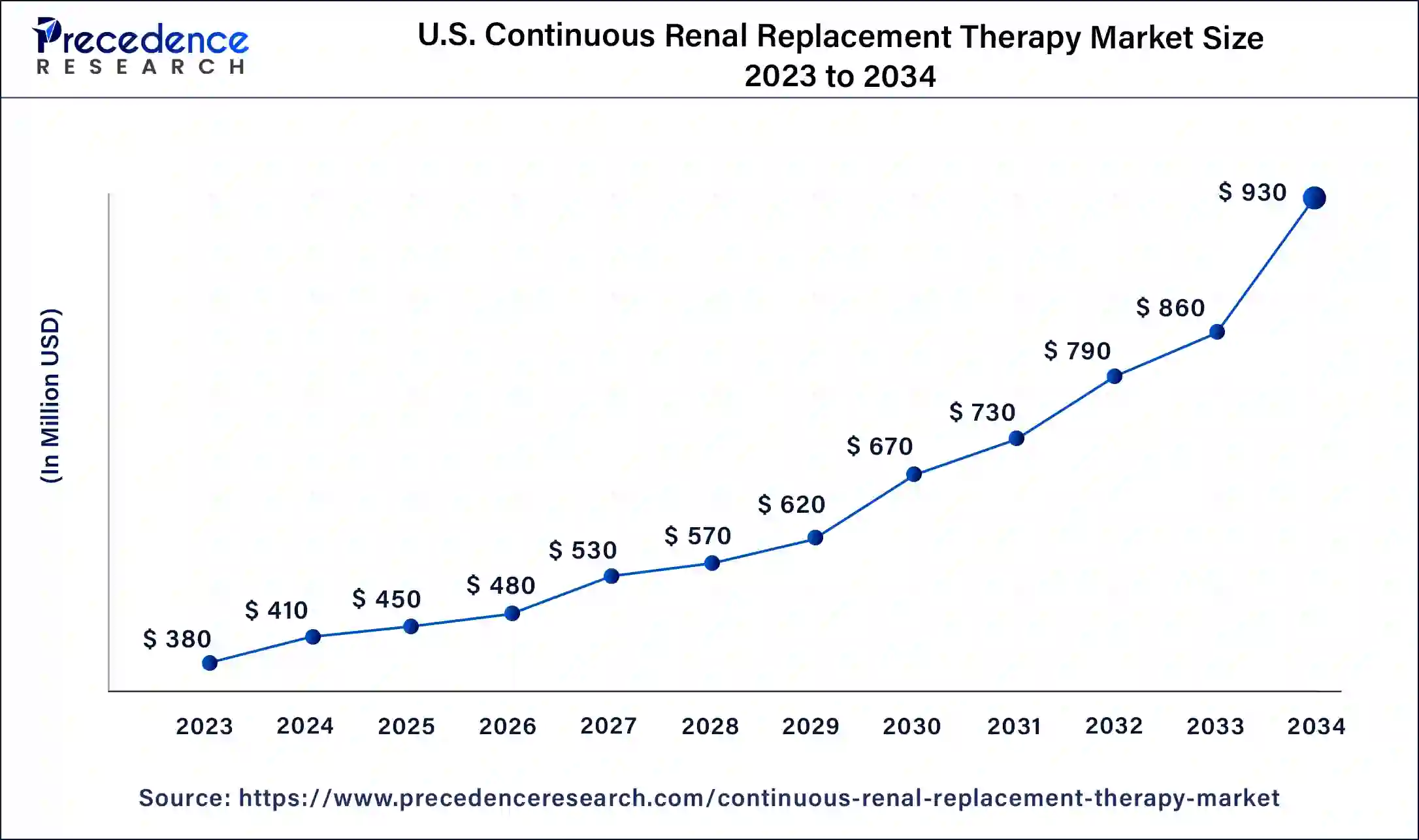

U.S. Continuous Renal Replacement Therapy Market Size and Growth 2025 to 2034

The U.S. continuous renal replacement therapy market size is estimated at USD 450 million in 2025 and is predicted to be worth around USD 930 million by 2034, at a CAGR of 8.5% from 2025 to 2034.

What Made North America Dominant in the Market in 2024?

North America held the largest revenue share of 37% in 2024. North America dominates the continuous renal replacement therapy (CRRT) market due to factors such as a high prevalence of renal diseases, well-established healthcare infrastructure, and substantial investments in advanced medical technologies. The region benefits from a robust research and development environment, fostering technological innovations in CRRT. Additionally, a proactive regulatory framework and increasing awareness among healthcare professionals contribute to the widespread adoption of CRRT in North America, consolidating its major share in the global market.

Numerous prominent market players are widely adopting various business strategies, such as collaborations, acquisitions, partnerships, and new product launches, to expand and strengthen their position in the industry. For instance, in May 2024, Thermo Fisher Scientific announced the launch of the CXCL10 testing service, which will assist in the management of kidney transplant patients. The testing service is intended to make post-transplant care more convenient and less invasive for the nearly 250,000 people in the United States living with a kidney transplant.

Progression of the Healthcare System is Bolstering the Asia Pacific

Asia-Pacific is estimated to observe the fastest expansion. The Asia-Pacific region dominates the continuous renal replacement therapy market due to factors such as a high prevalence of kidney diseases, an aging population, and increasing awareness of advanced renal care. Growing healthcare infrastructure, rising healthcare expenditure, and the adoption of innovative CRRT technologies further contribute to the market's prominence. Additionally, strategic initiatives by key market players to expand their presence in Asia-Pacific and collaborations with local healthcare providers drive the region's major share in the CRRT market.

- Furthermore, strategic initiatives by key market players to expand their presence in Asia-Pacific and collaborations with local healthcare providers drive the region's major share in the CRRT market.

Spurring Government Initiatives: Assists the Indian Market

In addition, the supportive Government initiative is expected to boost the regional market's growth in the coming years. For instance, in India, under the Pradhan Mantri National Dialysis Program (PMNDP), every year, about 2.2 lakh new patients of End-Stage Renal Disease (ESRD) get added, resulting in additional demand for 3.4 Crore dialysis. In May 2025, the Delhi government, in collaboration with the Centre's PM National Dialysis Program, installed 300 dialysis machines across 16 government hospitals to expand free and subsidised care for kidney patients.

Integration of Monitoring and Automation: Promotes the U.S. Market

The upcoming expansion of the U.S. market will be leveraged by the emergence of modern machines that contribute advanced sensors and automation for real-time patient monitoring. As well as the U.S. is assisting the development of novel machines, which encompass optical sensors to track blood volume, hematocrit, and oxygen saturation in real-time, supporting clinicians in maintaining patient stability.

Expanded Anticoagulation Protocols are Fueling Europe

A notable growth of the market in Europe is extensively fostered by European studies that have evaluated and refined anticoagulation plans to enhance circuit life, with recent research promising optimized circuit survival using particular regional citrate anticoagulation (RCA) protocols.

Promising Technological Breakthroughs: Explores the German Market

Involvement of robust medical device manufacturers, such as Fresenius Medical Care and B. Braun, who have established united, user-friendly CRRT machines that enable a variety of techniques and enhanced fluid balance control. Also, they possess automated priming and advanced interfaces, streamlining complex procedures for intensive care unit (ICU) staff.

Continuous Renal Replacement Therapy Market: Value Chain Analysis

- R&D

This consists of a structured medical device development process, uniting engineering, clinical expertise, and stringent regulatory compliance.

Key Players: B. Braun Melsungen AG, Medtronic, Asahi Kasei Corporation, etc. - Clinical Trials & Regulatory Approvals

Trials are emphasizing improvements in its use in critically ill patients, mainly concerning treatment intensity (dose), timing of initiation, and patient outcomes.

Key Players: IRCCS Azienda Ospedaliero-Universitaria di Bologna, Chulalongkorn University, C. Storm, etc. - Patient Support & Services

Healthcare providers facilitate a comprehensive, multidisciplinary healthcare team within an intensive care unit (ICU) setting.

Key Players: Vantive, Nikkiso Co., Ltd., Medtronic, etc.

Key Players Offerings:

- Baxter International Inc.- It introduced PrisMax and PrisMax 2 Systems, the next-generation platforms created to simplify the delivery of CRRT.

- Fresenius Medical Care AG & Co. KGaA- A vital company facilitated multiFiltratePRO, and NxStage System One S with NxView.

- B. Braun Melsungen AG- They offered numerous solutions through the OMNI acute blood purification system and the Diapact CRRT machine.

- NxStage Medical, Inc. (a subsidiary of Fresenius Medical Care)- A leader offers NxStage System One with NxView, a versatile system developed for both acute and chronic care facilities.

- Nikkiso Co., Ltd.- It unveiled Aquarius System, a machine for use in intensive care units (ICU) for patients with acute kidney injury (AKI).

Continuous Renal Replacement Therapy Market Companies

- Baxter International Inc.

- Fresenius Medical Care AG & Co. KGaA

- B. Braun Melsungen AG

- NxStage Medical, Inc. (a subsidiary of Fresenius Medical Care)

- Nikkiso Co., Ltd.

- Asahi Kasei Corporation

- Infomed SA

- Toray Medical Co., Ltd.

- Medtronic plc

- Medica S.p.A.

- Biolight Co., Ltd.

- SWS Hemodialysis Care Co., Ltd.

- Nipro Corporation

- Bellco S.r.l.

- Asahi Biomed Co., Ltd.

Recent Developments

- In January 2023, Peconic Bay Medical Center (PBMC) launched a renal therapy option for dialysis patients. The hospital announced that it offers continuous renal replacement therapy (CRRT), a blood purification process much slower than typical dialysis, for patients experiencing a kidney injury.?

- In April 2025, the Blood Purification Professional Committee (BPPC) of the China Medical Device Industry Association (CMDIA) gathered in Liuyang, Hunan, for its annual conference, themed "Synergy and Endless Innovation." This event united regulatory leaders, academic experts, and pioneering medical device companies to propel advancements in blood purification technologies, integral to treating kidney disease, poisoning, multi-organ failure, and immune disorders.

- In August 2024, Mohandai Oswal Hospital, Ludhiana, announced the launch of new state-of-the-art medical equipment for continuous renal replacement therapy.

- In April 2022, Baxter International revealed the FDA (510k) clearance for its ST set, utilized in continuous renal replacement therapy. This system is pre-connected, extracorporeal, employs a semipermeable membrane for blood purification, and is compatible with PrisMax or Prismaflex.

- In March 2022, Nipro, a prominent manufacturer of renal products, announced the full-scale commercial launch of SURDIAL DX. This advanced hemodialysis system is meticulously designed to deliver optimal dialysis treatment.

Segments Covered in the Report

By Product

- System

- Consumables

By Modality

- Slow Continuous Ultra-Filtration (SCUF)

- Continuous Venovenous Hemofiltration (CVVH)

- Continuous Venovenous Hemodialysis (CVVHD)

- Continuous Venovenous Hemodiafiltration (CVVHDF)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting