What is the Dialysis Market Size?

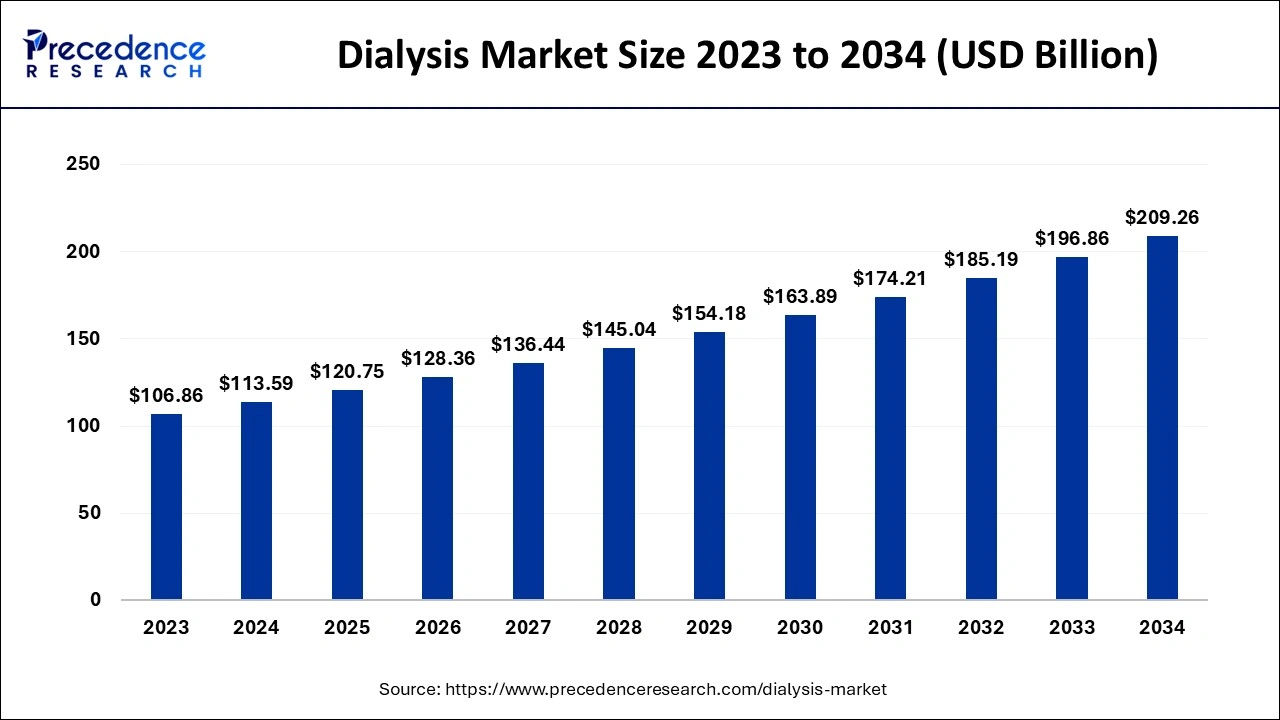

The global dialysis market size is valued at USD 120.75 billion in 2025 and is predicted to increase from USD 128.36 billion in 2026 to approximately USD 209.26 billion by 2034, expanding at a CAGR of 6.30% from 2025 to 2034.

Dialysis Market Key Takeaways

- In 2024, services segment accounted largest market share 79%.

- In 2024, product segment has contributed largest share 22%.

- In 2024, hemodialysis dialysis segment has registered 56% market share.

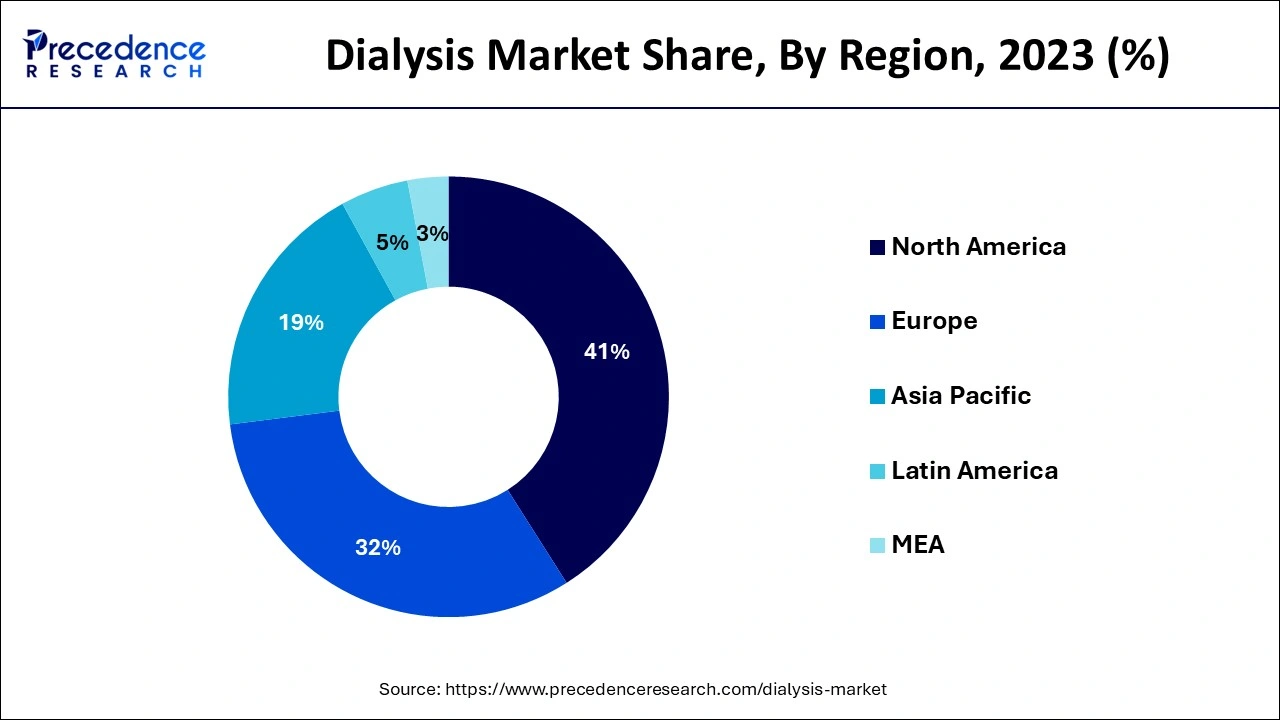

- North America has garnered highest revenue share 41% in 2024.

- Asia Pacific region is expected to grow at a CAGR of 6% from 2025 to 2034.

What Is Expanding the Global Dialysis Market at the End of 2025?

Dialysis is a treatment used to eliminate waste products from the blood, such as urea and creatinine, caused by faulty kidney function, and is frequently necessary for persons suffering from chronic renal failure. End-stage renal disease (ESRD) and kidney transplantation are both treated with this surgery. Throughout the procedure, the blood is cleaned, excess fluid and toxins are removed, and electrolyte balance is restored.

There are two types of dialysis: hemodialysis and peritoneal dialysis. Waste materials such as urea are extracted extracorporeally from the patient's blood during hemodialysis. The peritoneum in the abdomen is utilised for dialysis in peritoneal dialysis. The increase in the number of diabetic and hypertensive patients, the spike in financing for the development of new medicines, and the rise in the number of end stage renal disease (ESRD) patients are all contributing to market expansion. Furthermore, dialysis is favoured over kidney transplantation, which is projected to drive dialysis market expansion even further. Moreover, an increase in the senior population, an increase in healthcare spending, and an increase in disposable income are likely to fuel market expansion.

According to the National Kidney Foundation, chronic kidney disorders impact 10% of the worldwide population, with over a million people dying each year owing to a lack of cheap therapies. This scenario has increased dialysis treatment penetration throughout the years, contributing to the growth of the global dialysis market. However, the dangers and problems connected with dialysis, as well as product recalls, may hinder the dialysis market's development.

Also, increased occurrences of kidney failure, a scarcity of kidney donors for transplants, time-consuming kidney transplant procedures, and rising demand for home peritoneal dialysis treatment will generate new chances for the global dialysis market to develop in the future.

The global dialysis market is expanding rapidly due to the rise in chronic kidney diseases (CKD), diabetes, and hypertension prevalence, along with an increase in demand for home dialysis therapies and advancements in hemodialysis and peritoneal dialysis technology. Increased awareness of renal health, improved reimbursement policies, and the steadily increasing aging population around the world also support continued growth in the market, originating in both developed and developing countries.

Dialysis Market Growth Factors

One of the major drivers of the dialysis industry is the increasing prevalence of chronic kidney disease and renal failure. Regarding the price and healthcare facilities services, the overall burden of ESRD and CKD is one of the greatest. ESRD is a condition in which one or both kidneys cease to function correctly and the patient requires long-term renal infusion treatment or a kidney transplant. As a result, the rising frequency of ESRD is increasing the global cost burden of renal illnesses and is one of the important causes for boosting revenue generation from services.

In addition, the advent of the COVID-19 pandemic is expected to boost the expansion of the dialysis business in the coming years. This is mostly due to active instructions published by government agencies to perform the surgery for critical COVID-19 patients. For example, the Government of India recently issued guidelines regarding the dialysis procedure for coronavirus patients, which includes, the state must allocate and recognize one facility with a suitable amount of skilled staff, a dialysis machine, proper system for treatment of water, and additional support equipment.

Market expansion is anticipated to be fueled by additional regulatory authorities giving the go-ahead for the introduction of new goods and consumables, government involvement in the prevention and control of renal diseases, and joint efforts by a number of organisations to deliver such effective renal services in underserved parts of developing nations.

One of the significant developments in the sector recently has been the increasing desire of patients for obtaining treatment at home, particularly in developed and emerging nations. Furthermore, governments in places such as North America are developing new financing mechanisms for treating renal illness, with a preference for lower-cost care at home. Furthermore, the number of patients opting for treatment in home care settings is expected to rise in the future years.

Market Key Trends: Embracing a Healthier Future

The dialysis market is undergoing a dynamic transformation, driven by the rising prevalence of chronic kidney diseases, growing geriatric populations, and technological breakthroughs in renal care. One of the most prominent trends includes the increasing shift towards home dialysis and portable hemodialysis machines, enabling patients to undergo treatment in the comfort of their homes. Moreover, there is a rising interest in personalized dialysis protocols that match individual patient needs, thanks to advancements in data-driven healthcare and AI integration. Another significant trend is the growing emphasis on biocompatible dialysis membranes that minimize side effects and improve the longevity of patients undergoing long-term dialysis.

Market Outlook

- Industry Growth Overview: The global dialysis market is expected to experience a strong growth trajectory, driven by innovative new solutions, growing prevalence of chronic kidney disease (CKD), and demand for home-based options. Leading companies are expanding via mergers and clinical partnerships, and new markets are emerging in developing economies, while investments in healthcare continue to rise and awareness grows among patients.

- Sustainability Trends: The dialysis industry is undergoing substantial changes with respect to eco-efficient solutions, including recyclable products, water-saving dialysis machines, low-energy options, and enhancing green production processes to reduce waste and carbon emissions. Additionally, healthcare providers are leveraging sustainable procurement and digitalization to maximize resource utilization, positioning the dialysis sector to operate under social responsibility and global environmental frameworks.

- Global Expansion: Leading dialysis companies are increasing rapid expansions globally, especially in Asia-Pacific, the Middle East, and Latin America, which includes partnership opportunities with local healthcare providers and tech centered clinics. Launching new products aligned with local healthcare approaches helps solidify a footprint while new treatment modalities create cost-effective dialysis solutions, fully establishing a pathway for high-quality dialysis globally.

Market Scope

| Report Coverage | Details |

| Market Size in 2026 | USD 128.36 Billion |

| Market Size in 2025 | USD 120.75 Billion |

| Market Size by 2034 | USD 209.26 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.30% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Dialysis Type, End User, Geography |

Dialysis Type Insights

Dialysis Market is divided into two categories i.e Hemodialysis and Peritoneal Dialysis's. Hemodialysis is further classified into two types: conventional and everyday (short daily and nocturnal hemodialysis). Hemodialysis produced the most revenue of the two in 2024 and is predicted to continue to dominate revenue throughout the projection period. Waste materials like as urea are removed extracorporeally from the inmate's blood during haemodialysis. The peritoneum in the stomach is used in dialysis in peritoneal dialysis. During the foreseeable years, haemodialysis is likely to stay dominant. Inadequate peritoneal treatment training in both developed and developing nations has reduced peritoneal treatment preference. Aside from the therapeutic benefits linked with this treatment, such as the reduced time required to operate and adopt arteriovenous fistula (AV Fistula), the demand for haemodialysis is increasing.

Peritoneal Dialysis (PD) is one of the most rapidly developing treatment choices for kidney failure and is a superior alternative, particularly for patients with residual kidney function and sensitivity to the rapid fluid balance changes associated with hemodialys. PD allows for more treatment options and minimises the number of visits to dialysis clinics. Choosing PD home dialysis has advantages such as improved outcomes, less drugs, and fewer food restrictions. Patients may use PD at home without assistance and simply monitor themselves 24 hours a day, seven days a week. These benefits have made peritoneal dialysis more popular among renal patients today, and will continue to fuel the home care segment development of the peritoneal dialysis market over the projection period. The majority of end-stage renal disease patients receiving PD therapy are older, and their degree of accessibility, experience, and technical knowledge varies greatly. Many senior cycler patients' technophobia and unwillingness to utilise cyclers are seen as market limitations.

Currently, the coronavirus pandemic is posing a number of difficulties for patients and clinical healthcare professionals all around the world. A possible upsurge in the incidence of kidney injury is predicted to result from the surge in COVID patients and its severity rate. The epidemic has greatly boosted the need for renal replacement fluids on a global scale. Comparing COVID-19 patients to historical US populations, the need for RRT has risen fivefold (4.9 percent as of 2020 VS. 0.9 percent earlier). Prior to the pandemic, there had been a progressive trend toward home hemodialysis treatment, and concerns about the spread of the COVID-19 virus have significantly increased patient interest in HD therapy. This issue is probably going to increase the use of home hemodialysis equipment during the pandemic.

Although the majority of patients choose hemodialysis, peritoneal dialysis is predicted to be the fastest expanding category throughout the projection period due to effective elimination of harmful chemicals and increased desire for homecare among dialysis patients.

Type Insights

The market is divided into two types: Services and Products. In 2024, services made up the greatest portion, mostly due to the expansion of renal care centres with modern equipment for both chronic and urgent treatment throughout the world, as well as a growing emphasis on quality-care delivery to patients by service providers. Additionally, increasingly patient-focused and profit-driven business models among care providers are raising service demand. The product sector is predicted to develop steadily in the coming years as the number of local and regional companies in this market increases to meet the increased demand for innovative goods and consumables.

End User Insights

End consumers in the worldwide market are classified as centres and hospitals, as well as home care. In terms of value, dialysis treatment centres accounted for the largest market share in 2024, owing to favourable reimbursement offered by renal facilities and hospitals for renal treatments, an expanding patient population with CKD and ESRD, and increasing population healthcare spending. Homecare, on the other hand, is expected to be the fastest-growing category over the projected period, with a significantly higher CAGR. The hospital segment is expected to develop in the near future because to an increase in the number of COVID-19.

Regional Insights

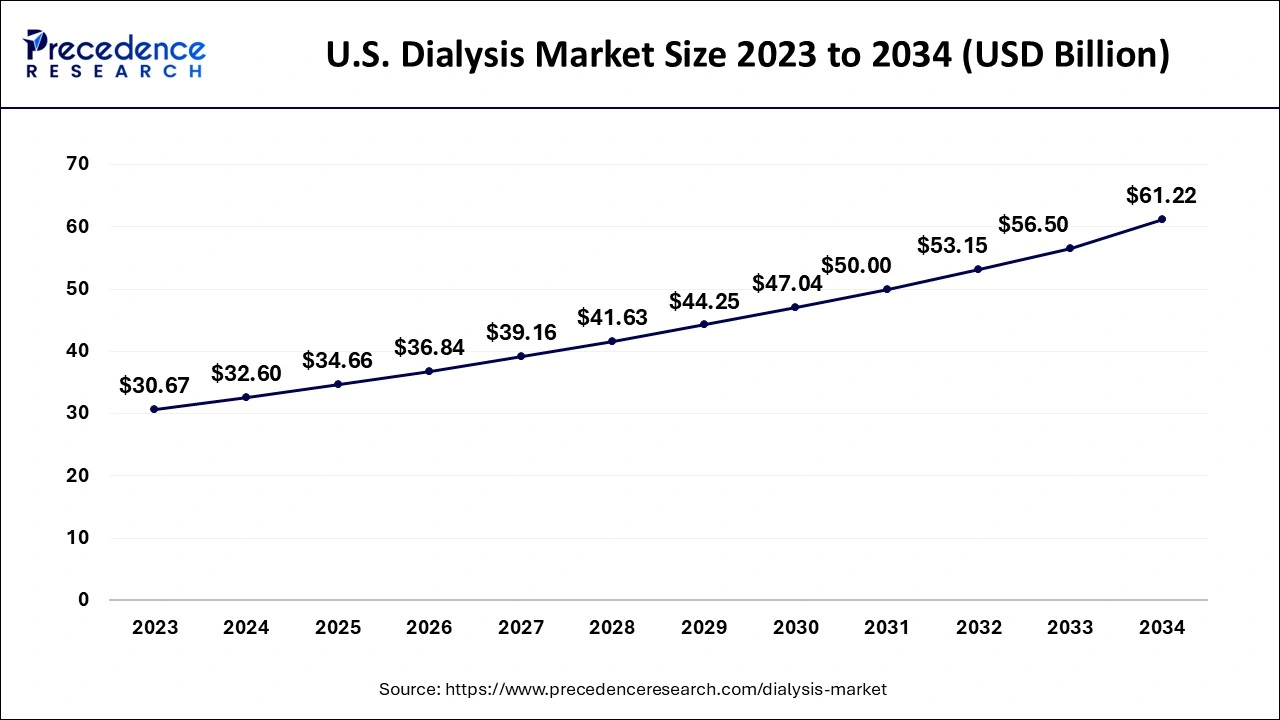

U.S. Dialysis Market Size and Growth 2025 to 2034

The U.S. dialysis market size is evaluated at USD 34.66 billion in 2025 and is predicted to be worth around USD 61.22 billion by 2034, rising at a CAGR of 6.49% from 2025 to 2034.

North America dominated the market with revenue share of 41% in 2024. The high incidence of CKD and ESRD in the United States and Canada, together with greater treatment rates in these countries, are expected to drive market growth over the projected period. The United States is also expected to see an increase in demand for services and products as a result of the rising prevalence of coronavirus infections and associated renal failures. Europe is predicted to be the second biggest region in this market in terms of size, with moderate long-term growth. The region's rapid expansion is mostly owing to a rising senior population suffering from renal problems.

North America Leads the Way: The Powerhouse of Dialysis Innovation

North America continues to dominate the global dialysis market, supported by strong healthcare infrastructure, high disease awareness, and robust reimbursement systems. The United States stands at the forefront, contributing significantly due to the high incidence of end-stage renal disease (ESRD), technological adoption, and government-backed initiatives like the Advancing American Kidney Health program. This program aims to improve patient outcomes by encouraging home dialysis and kidney transplantation. Canada and Mexico follow as key contributors due to increasing healthcare investments and the expansion of private dialysis chains. The U.S. is leading due to strong federal support and private sector innovation; it is rising investment in public-private partnerships for home dialysis.

Furthermore, Asia-Pacific is predicted to see comparatively large value development in this market. Funding from public players to enhance access to renal care is expected to boost market growth throughout the projected period. The National Health and Family Planning Commission of China established regulations for the fundamental standard and administration of haemodialysis facilities in December 2016, with the goal of standardising the growth of autonomous such centres across the nation. Such a well-established regulatory framework for renal treatment facilities is expected to drive market growth in Asia Pacific throughout the forecast period.

Asia-Pacific: The Rising Tide of Renal Treatment

Emerging Economies, Expanding Opportunities Asia-Pacific is poised to become the fastest-growing region in the dialysis market, fuelled by rapidly growing populations, rising lifestyle-related disorders, and the expansion of healthcare access. Countries such as China, India, and Japan are investing heavily in dialysis infrastructure and innovation. There is a notable push toward building indigenous dialysis equipment and low-cost consumables to address the massive patient base. Moreover, the region is witnessing government support in the form of insurance schemes and public-private partnerships, making treatment more affordable and accessible.

In Brazil, the increased prevalence of CKD among the senior population is fueling the expansion of the market for services and goods. Due to the delayed diagnosis of chronic CKD and ESRD, the Middle East and Africa region is anticipated to develop slowly to moderately over the forecast period. Though, increased urbanisation in the area and rising awareness regarding the seriousness of renal illnesses are expected to drive revenue in this region throughout the projection period.

What Impacts the Growth Rate of the Dialysis Market in Latin America?

The dialysis market is expanding in Latin America because of the increasing number of individuals with chronic kidney disease (CKD), along with improved access to healthcare. Countries such as Brazil, Mexico, and Argentina are improving dialysis infrastructure and the availability of advanced treatment technologies. Additionally, government programs in healthcare support and increase dialysis access in more remote areas of their countries.

The increasing partnerships with private healthcare entities, coverage from larger dialysis service corporations, and collaboration with such service chains are increasing accessibility, improving patient treatment outcomes, and ensuring that steady growth is sustained in the dialysis market across Latin America.

How Is the European Dialysis Market Making Progress Towards Shaping the Future of Renal Care?

Europe is a dominant center for innovation, has excellent healthcare systems, and expertise in medical device manufacturing. Out of the entire world, Europe continues to lead in its aging population, affecting dialysis demand, the growing incidence of diabetes and hypertension, and mortality related to these diseases. Germany, the UK, and France are leaders in home haemodialysis. Favourable reimbursement contracts are proving to be a good way to increase market share while maintaining a focus on leading research initiatives that position the region towards more patient-centered care.

Value Chain Analysis:

How may the dialysis market value chain improve efficiency and foster innovation?

- Raw Material & Components Suppliers: Deliver high-quality supplies of materials for dialysis machines, sterilization methods, renal replacement filters, and other disposable consumable goods that are compliant with medical standards and maintain consistency of supply for manufactures across the globe.

- Manufacturers & Technology Innovators: Incorporate emerging technologies such as artificial intelligence (AI), IoT, and automation into the dialysis machinery, improving the precision, ease of use, and real-time monitoring and notification capabilities for patients.

- Distributors & Service Providers: Guarantee to the right supply channel from product distribution, installation, and after sales service. In addition, they provide patient education and staff training that increase accessibility and reliability of treatment.

- Healthcare Institutions & Digital Partners: Participation with digital companies / hospitals, as digital patient monitoring systems and predictive maintenance lead to previously unthought-of solutions to improve dialysis management.

- Sustainability & Continuous Improvement: OEM, eco-efficient water less systems, recyclable components, and lower energy dialysis systems to reduce the carbon footprint / and lower operation cost and minimize environmental impact, as sustainability leads to improvement.

Dialysis Market Companies

- Fresenius Se and Co. Kgaa

- Asahi Kasei Corporation

- B. Braun Melsungen Ag

- Baxter International Inc.

- Becton, Dickinson And Company (C. R. Bard, Inc.)

- Davita

- Angiodynamics Inc.

- Diaverum Deutschland Gmbh.

- Nikkiso Co. Ltd.

- Nipro Corporation

- Medtronic

- Asahi Kasei Corporation

Key market developments

- In May 2025, Meditech Renal Solutions, a Canada-based healthcare company, launched its “NephroFlow Portable Dialyzer”, aimed at transforming home-based hemodialysis with wireless monitoring and AI-integrated health tracking.

- In May 2021, Davita Inc. enhanced its home renal care programme by incorporating Baxter International Inc.'s HomeChoice Claria automated peritoneal dialysis (APD) equipment. This innovative technology improved the company's home dialysis programme and is a key step toward promoting home dialysis.

- In May 2021, Fresenius Medical Care AG and Co. KGa launched the Kinexus treatment management platform, a cloud-based solution. This system was developed to improve workflows, productivity, and patient outcomes while managing peritoneal dialysis using the Liberty Select cycler.

Segments Covered in the Report

By Type

- Product

- EQUIPMENT

- Dialysis Machines

- Water Treatment Systems

- Others dialysis equipment

- Consumables

- Dialyzers

- Catheters

- Other dialysis consumables

- Dialysis Drugs

- Services

By Dialysis Type

- Hemodialysis (HD)

- Conventional Hemodialysis

- Short daily hemodialysis

- Nocturnal hemodialysis

- Peritoneal dialysis (PD)

- Continuous Ambulatory Peritoneal Dialysis (CAPD)

- Automated Peritoneal Dialysis (APD)

By End User

- Dialysis Center and Hospitals

- Home Care

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting