What is the Continuous Renal Replacement Therapy Consumables Market Size?

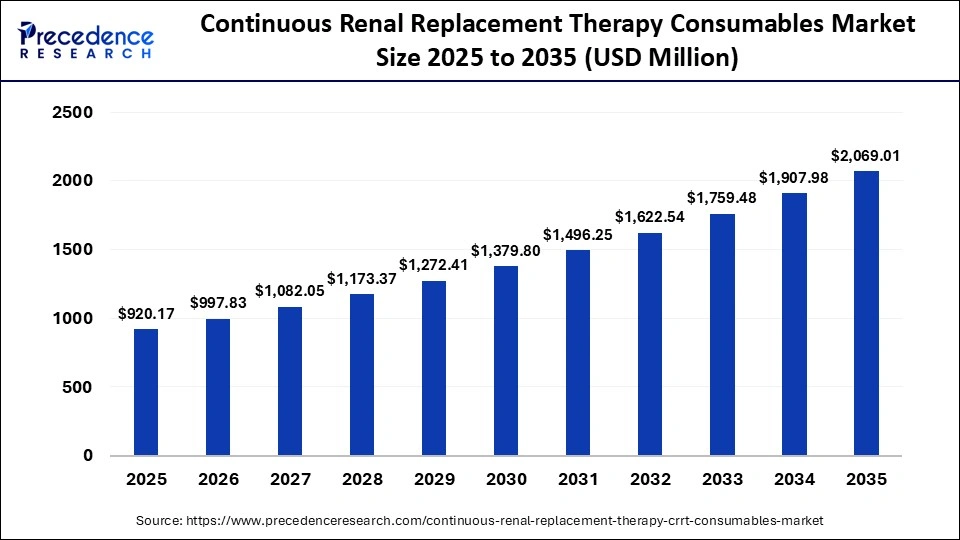

The global continuous renal replacement therapy consumables market size accounted for USD 920.17 million in 2025 and is predicted to increase from USD 997.83 million in 2026 to approximately USD 2,069.01 million by 2035, expanding at a CAGR of 8.44% from 2026 to 2035. This market is growing due to the rising incidence of acute kidney injuries in critically ill patients and the increasing use of CRRT in intensive care units.

Market Highlights

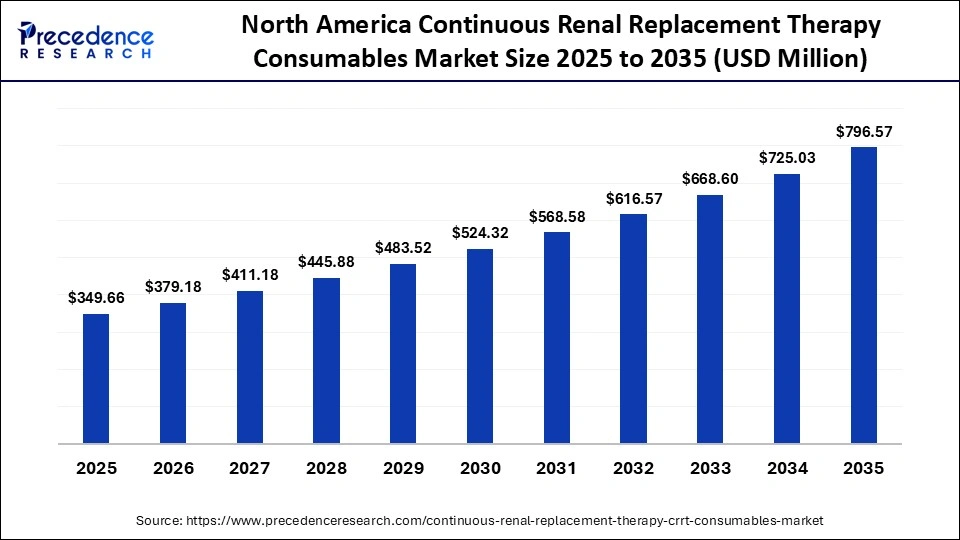

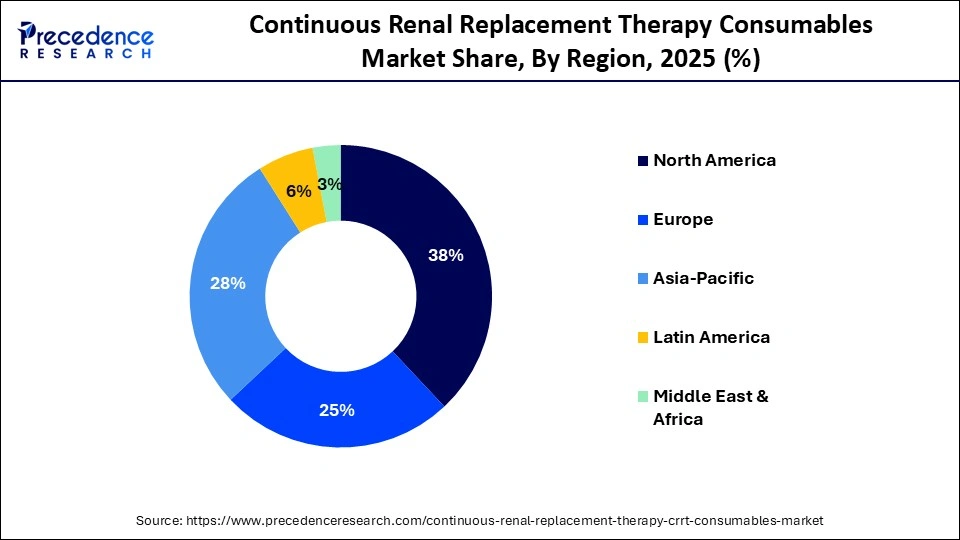

- North America dominated the global continuous renal replacement therapy consumables market with a revenue share of 38% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

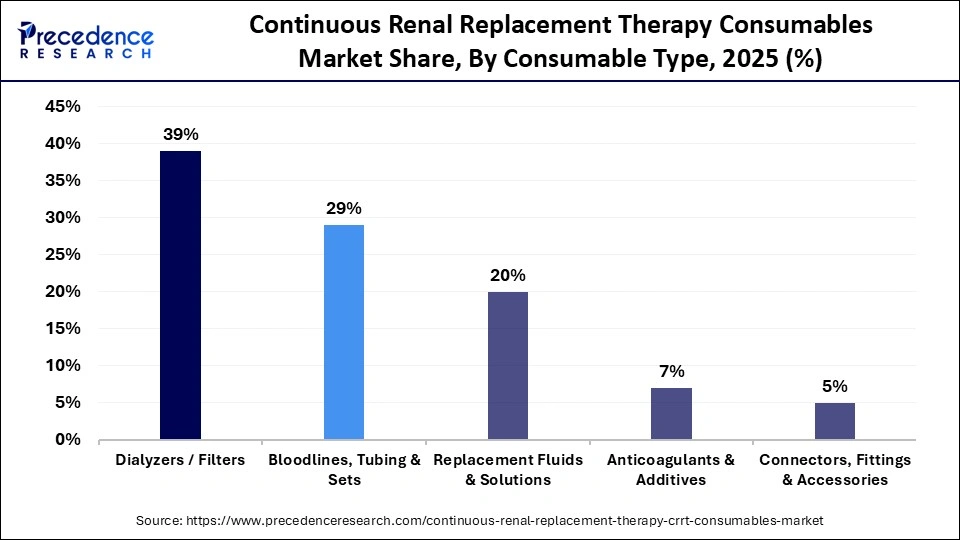

- By consumable type, the dialyzers/filters segment held the biggest market share of approximately 39% in 2025.

- By consumable type, the replacement fluids & solutions segment is expected to expand at the fastest CAGR between 2026 and 2035.

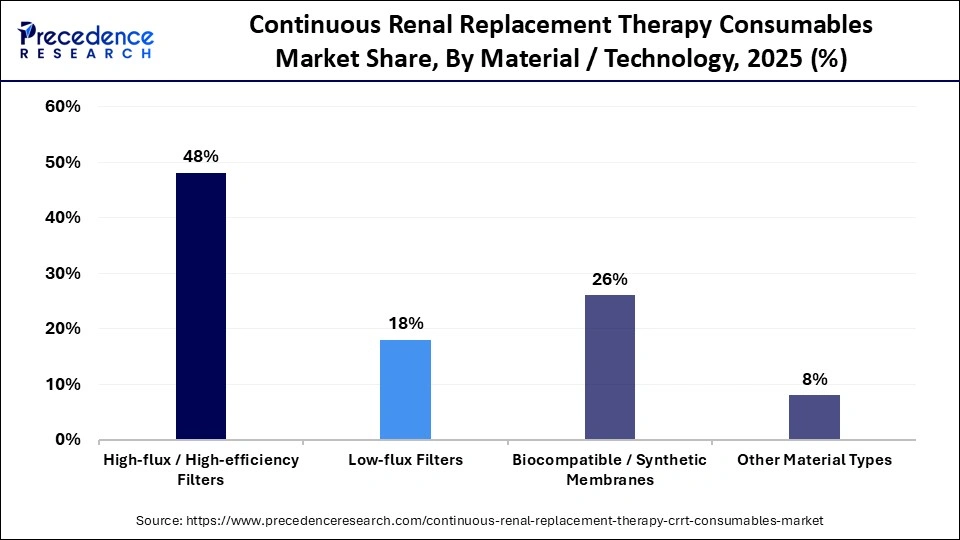

- By material/technology, the high-flux/high-efficiency filters segment held the highest market share of approximately 48% in 2025.

- By material/technology, the biocompatible/synthetic membranes segment is expected to grow at a strong CAGR between 2026 and 2035.

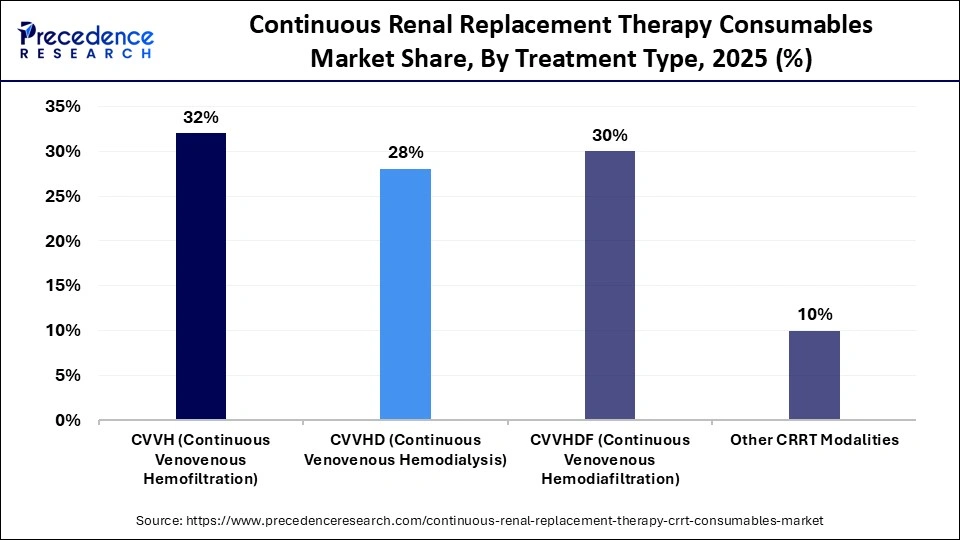

- By treatment type, the CVVH segment held a major market share of approximately 32% in 2025.

- By treatment type, the CVVHDF segment is expected to expand at the fastest CAGR from 2026 to 2035.

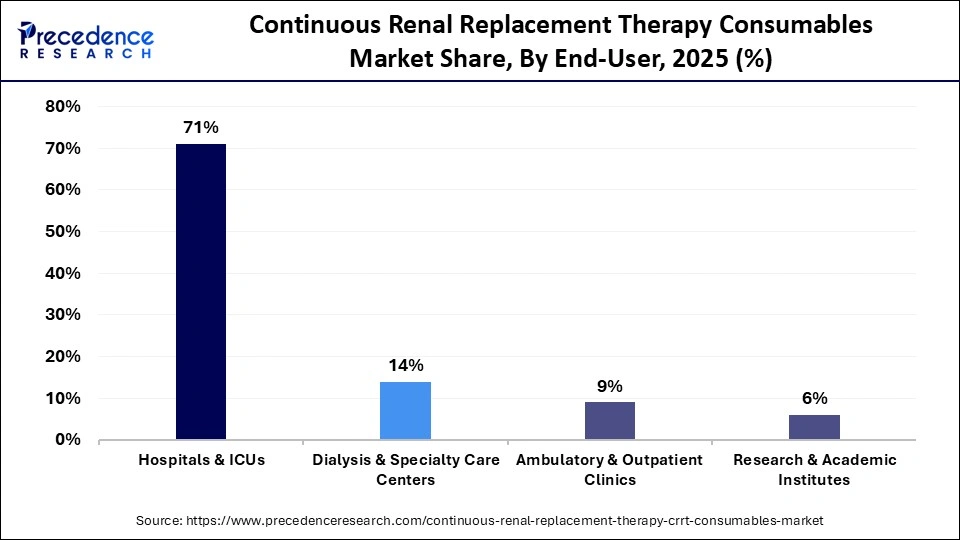

- By end user, the hospitals & ICUs segment generated the biggest market share of approximately 71% in 2025.

- By end user, the dialysis & specialty care centers segment is expected to expand at the fastest CAGR between 2026 and 2035.

What are the Major Factors Driving the Continuous Renal Replacement Therapy Consumables Market?

The market is experiencing steady growth due to the rising number of critically ill patients with acute kidney injury who require continuous renal replacement therapy (CRRT), along with increasing ICU admissions. Every treatment cycle necessitates the use of consumables like filters, tubing sets, and dialysate solutions, which results in steady repeat demand. CRRT adoption in critical care settings is further supported by the rising incidence of sepsis, heart problems, and multi-organ failure. Long-term market growth is also being supported by improvements in CRRT machine technology and the expansion of critical care infrastructure in hospitals.

How is AI Impacting the Continuous Renal Replacement Therapy Consumables Market?

Artificial Intelligence (AI) positively impacts the market by enhancing the accuracy of continuous renal replacement therapy and treatment monitoring in critical care units. Real-time analysis of patient data by AI-enabled CRRT systems can optimize fluid balance dosage accuracy and filter usage, minimizing therapy interruptions and wasteful use of consumables. The overall effectiveness of treatment is increased when clinicians use predictive analytics to foresee filter clotting and therapy downtime. AI integration is anticipated to increase demand for cutting-edge CRRT consumables that work with intelligent therapy platforms, as smart ICUs and data-driven critical care models grow.

What are the Major Trends Influencing the Market?

- Rising adoption of CRRT in intensive care units for managing acute kidney injury and hemodynamically unstable patients.

- Increasing demand for high-performance hemofilters with longer life and improved biocompatibility.

- Growing use of single-use and disposable consumables to reduce infection risk and cross-contamination.

- Technological advancements in CRRT machines are driving demand for compatible and specialized consumables.

- Expansion of critical care infrastructure and ICU capacity across hospitals worldwide.

- Increasing focus on early intervention and continuous therapy in sepsis and multi-organ failure cases.

- Integration of digital monitoring and smart ICU systems influences consumable design and usage patterns.

- Future Growth Outlook of the Continuous Renal Replacement Therapy Consumables Market:

- The rising incidence of acute kidney injury and sepsis in critically ill patients creates sustained demand for CRRT consumables.

- Expansion of ICU facilities and critical care services in emerging economies offers strong market growth potential.

- Development of advanced hemofilters with longer lifespans and better clot resistance enables product differentiation.

- Increasing adoption of AI-enabled and automated CRRT systems opens opportunities for smart-compatible consumers.

- Growing awareness among clinicians about early CRRT initiation supports higher utilization of consumables.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 920.17 Million |

| Market Size in 2026 | USD 997.83 Million |

| Market Size by 2035 | USD 2,069.01 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.44% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Consumable Type, Material/Technology, Treatment Type, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Consumable Type Insights

What made dialyzers/filters the dominant segment in the market?

The dialyzers/filters segment dominated the continuous renal replacement therapy consumables market with a 39% share in 2025, driven by the fact that they are essential to the ongoing purification of blood in all CRRT techniques. Their high replacement frequency, driven by infection control protocols and the risk of clotting, creates strong, recurring demand. The segment's leadership is further reinforced by ICU CRRT guidelines that emphasize standardized and routine filter usage. Additionally, ongoing product innovations aimed at improving filter durability and clearance efficiency continue to strengthen adoption and sustain market dominance.

The replacement fluids & solutions segment is expected to grow at the fastest CAGR in the coming years due to their critical role in maintaining fluid balance, electrolyte stability, and acid–base equilibrium in critically ill patients. Each CRRT session requires large volumes of these fluids, resulting in consistent and repeat demand, especially with longer therapy durations in ICUs. The rising incidence of acute kidney injury, sepsis, and multi-organ failure is increasing CRRT utilization, further driving fluid consumption. In addition, advancements in balanced and bicarbonate-based solutions, along with a shift toward ready-to-use and pre-mixed formulations, are improving safety and ease of use, supporting the segment's growth.

Material/Technology

Why did the high-flux/high-efficiency filters segment dominate the market?

The high-flux/high-efficiency filters segment dominated the continuous renal replacement therapy consumables market with a major share of 48% in 2025. This is because these filters provide superior clearance of middle- and large-molecule toxins while maintaining effective fluid removal, which is critical for managing severely ill ICU patients. These filters improve the course of treatment for inflammatory diseases and sepsis. Clinician confidence in these filters is strengthened by robust clinical validation and long-term usage data. Widespread adoption is further fueled by compatibility with the majority of CRRT machines. Their capacity to shorten treatment duration also enhances intensive care unit operational effectiveness.

The biocompatible/synthetic membranes segment is expected to grow at the fastest CAGR in the coming years due to their better hemocompatibility and decreased inflammatory reactions. Polymer science developments are improving the performance consistency and durability of membranes. Preference for safer materials is increasing as therapy-related complications become more widely recognized. Longer therapy sessions with fewer side effects are also supported by these membranes. Growing regulatory attention to patient safety promotes segmental expansion even more.

Treatment Type Insights

What made CVVH the leading segment in the market?

The CVVH (continuous venovenous hemofiltration) segment led the continuous renal replacement therapy consumables market with 32% market share in 2025 because it permits continuous fluid removal and efficient convective clearance. In critical care, it is especially favored for hemodynamically unstable patients. CVVH is easier to implement across ICUs when operational protocols are simpler. Long-term use is supported by strong physician familiarity and training availability. Its supremacy is further reinforced by consistent clinical results.

The CVVHDF (continuous venovenous hemodiafiltration) segment is expected to grow at the fastest CAGR in the coming years because it combines the benefits of both diffusion and convection, enabling more efficient removal of small and middle-molecular-weight toxins. This treatment type is especially effective for critically ill patients with sepsis, multi-organ failure, or severe metabolic imbalances, where comprehensive solute clearance is required.

CVVHDF also allows greater flexibility in fluid and electrolyte management, making it a preferred choice in intensive care settings. Additionally, increasing clinician familiarity, standardized ICU protocols, and compatibility with advanced CRRT machines are accelerating the adoption of CVVHDF, driving higher consumption of associated consumables.

End User Insights

Why did the hospitals & ICUs segment dominate the market?

The hospitals & ICUs segment dominated the continuous renal replacement therapy consumables market with the highest share of 71% in 2025. This is because CRRT is primarily performed in intensive care settings for critically ill patients with acute kidney injury, sepsis, and multi-organ failure. Hospitals and ICUs have the necessary infrastructure, trained nephrology and critical care staff, and advanced CRRT machines to safely deliver continuous therapy.

The high volume of ICU admissions and the need for prolonged treatment cycles result in frequent and repeated use of consumables such as filters, tubing sets, and replacement fluids. Additionally, standardized clinical protocols and 24/7 monitoring capabilities in hospital settings further reinforce the dominance of this segment.

The dialysis & specialty care centers segment is expected to grow at the fastest CAGR in the coming years, driven by the extension of critical care services outside of hospitals. These facilities are expanding their capabilities to treat patients with acute kidney injury, sepsis, and post-surgical complications, driving demand for CRRT consumables such as filters, tubing sets, and replacement fluids.

Improved access to trained nephrology specialists and advanced CRRT equipment in specialty centers is supporting wider adoption. Additionally, the shift toward decentralized critical care, shorter hospital stays, and coordinated care models is encouraging the use of CRRT in dialysis and specialty care settings, fueling market growth.

Regional Insights

How Big is the North America Continuous Renal Replacement Therapy Consumables Market Size?

The North America continuous renal replacement therapy consumables market size is estimated at USD 349.66 million in 2025 and is projected to reach approximately USD 796.57 million by 2035, with a 8.58% CAGR from 2026 to 2035.

What made North America the dominant region in the market?

North America dominated the continuous renal replacement therapy consumables market with a 38% share in 2025, backed by high CRRT utilization rates and sophisticated healthcare infrastructure. Early adoption of advanced consumables is encouraged by robust reimbursement frameworks. The demand for CRRT consumables is consistently driven by a high level of awareness of AKI management procedures. Supply availability is strengthened by the presence of top CRRT manufacturers. Long-term R&D investments also strengthen regional leadership even more.

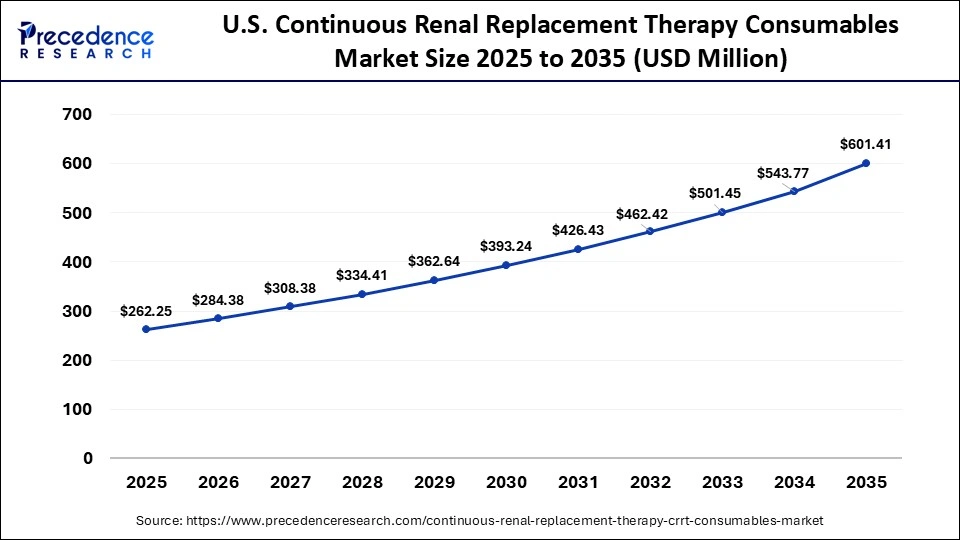

What is the Size of the U.S. Continuous Renal Replacement Therapy Consumables Market?

The U.S. continuous renal replacement therapy consumables market size is calculated at USD 262.25 million in 2025 and is expected to reach nearly USD 601.41 million in 2035, accelerating at a strong CAGR of 8.65% between 2026 and 2035.

U.S. Continuous Renal Replacement Therapy Consumables Market Trends

The U.S. is a key market for CRRT consumables due to its high ICU admission rates, advanced critical care infrastructure, and widespread use of continuous renal replacement therapy for managing acute kidney injury. Market growth is further supported by favorable reimbursement frameworks, the availability of skilled nephrology specialists, and the early adoption of innovative filters, dialyzers, and replacement fluids. Additionally, the presence of leading global manufacturers and continuous product innovations helps strengthen the adoption of CRRT consumables across hospitals and specialty care facilities.

How is the opportunistic rise of Asia Pacific in the market?

Asia Pacific is expected to grow at the fastest CAGR in the coming years, driven by the rising incidence of acute kidney injury and the rapid expansion of ICU capacities across the region. Increased healthcare spending is improving access to advanced renal therapies, while greater clinician awareness is accelerating the adoption of CRRT. The growing number of private hospitals and specialty care facilities further supports the demand for consumables like filters, dialyzers, and replacement fluids. Additionally, government investments in critical care infrastructure are creating a favorable environment for market expansion.

India Continuous Renal Replacement Therapy Consumables Market Trends

India is one of the major contributors to the market within Asia Pacific because of improved access to advanced critical care services, increased rates of sepsis and acute kidney injury, and growing intensive care unit capacity. Adoption of CRRT consumables is being driven by rising investments in hospital infrastructure, the expansion of private and multispecialty hospitals, and raising clinician awareness. There is a rising demand for low-cost consumables, along with the growing domestic production and the gradual adoption of CRRT procedures, which is expected to drive the market in India.

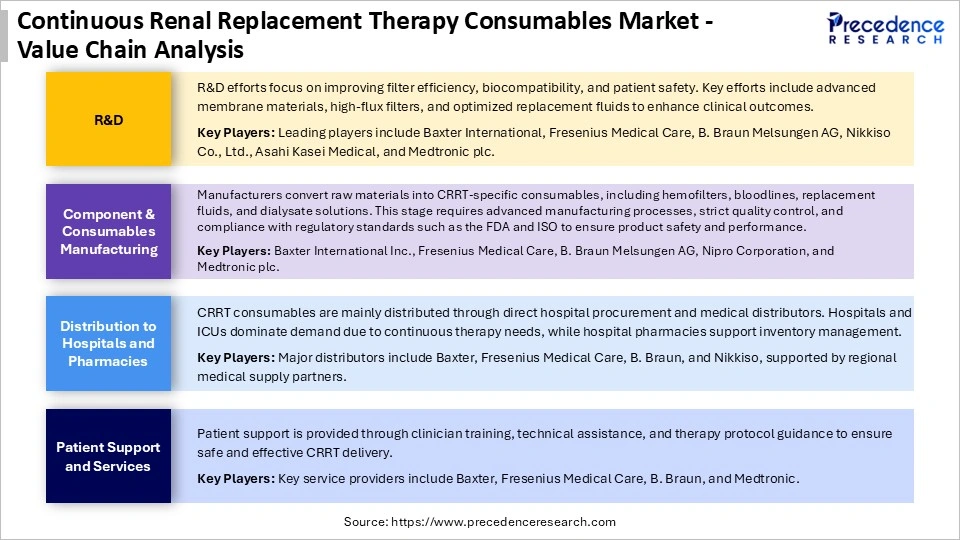

Continuous Renal Replacement Therapy Consumables Market Value Chain Analysis

Who are the Major Players in the Global Continuous Renal Replacement Therapy Consumables Market?

The major players in the continuous renal replacement therapy consumables market include Baxter International Inc., Fresenius Medical Care AG & Co. KGaA, B. Braun SE, Medtronic plc, Nipro Corporation, Asahi Kasei Medical Co., Ltd., Nikkiso Co., Ltd., Toray Medical Co., Ltd., Infomed SA, Medica S.p.A., SWS Hemodialysis Care Co., Ltd., Rockwell Medical, Inc., Medical Components, Inc. (MedComp), Ningbo Tianyi Medical Devices Co., Ltd., Medites Pharma spol. s.r.o., and Jafron Biomedical Co., Ltd.

Recent Developments

- In September 2025, Quanta Dialysis Technologies and Innovative Renal Care announced a multi-year partnership to expand the Quanta Dialysis System across the U.S. The agreement allows for nationwide delivery of three dialysis modalities using a single portable device, following a successful pilot program. This collaboration aims to enhance operational efficiency and patient care with innovative dialysis solutions in various settings.(Source: https://www.prnewswire.com)

- In February 2025, U.S. Renal Care announced a new nursing scholarship and support program for team members interested in becoming nephrology nurses. The program includes financial aid, tuition discounts, and mentorship to help employees earn nursing degrees. This initiative aims to combat the nursing shortage and improve specialized care for kidney disease patients.(Source: https://www.prnewswire.com)

Segments Covered in the Report

By Consumable Type

- Dialyzers/Filters

- Bloodlines, Tubing & Sets

- Replacement Fluids & Solutions

- Anticoagulants & Additives

- Connectors, Fittings & Accessories

By Material/Technology

- High-flux/High-efficiency Filters

- Low-flux Filters

- Biocompatible/Synthetic Membranes

- Other Material Types

By Treatment Type

- CVVH (Continuous Venovenous Hemofiltration)

- CVVHD (Continuous Venovenous Hemodialysis)

- CVVHDF (Continuous Venovenous Hemodiafiltration)

- Other CRRT Modalities

By End-User

- Hospitals & ICUs

- Dialysis & Specialty Care Centers

- Ambulatory & Outpatient Clinics

- Research & Academic Institutes

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting