What is the Continuous Bioprocessing Market Size?

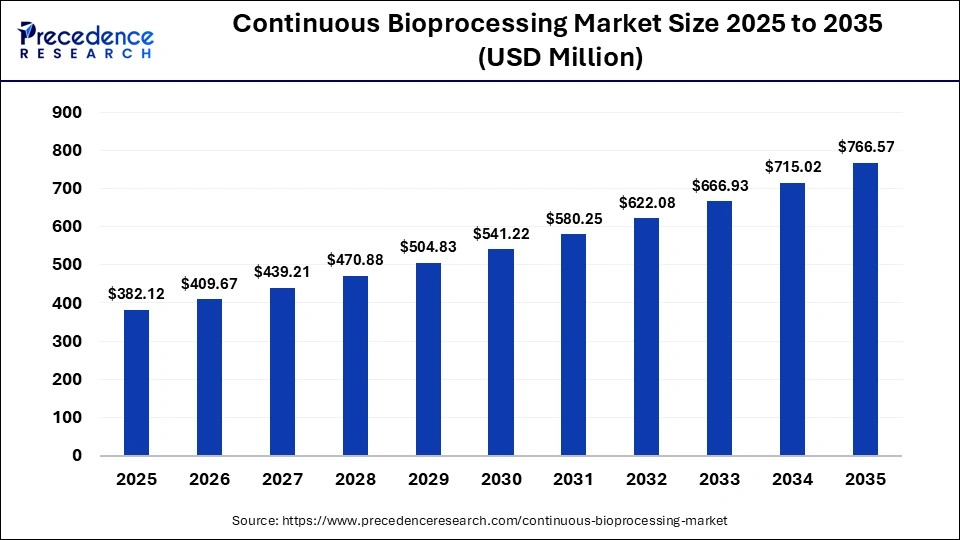

The global continuous bioprocessing market size was calculated at USD 382.12 million in 2025 and is predicted to increase from USD 409.67 million in 2026 to approximately USD 766.57 million by 2035, expanding at a CAGR of 19.12% from 2026 to 2035. The need for efficient, scalable, and cost-effective biologics manufacturing drives the continuous bioprocessing market.

Market Highlights

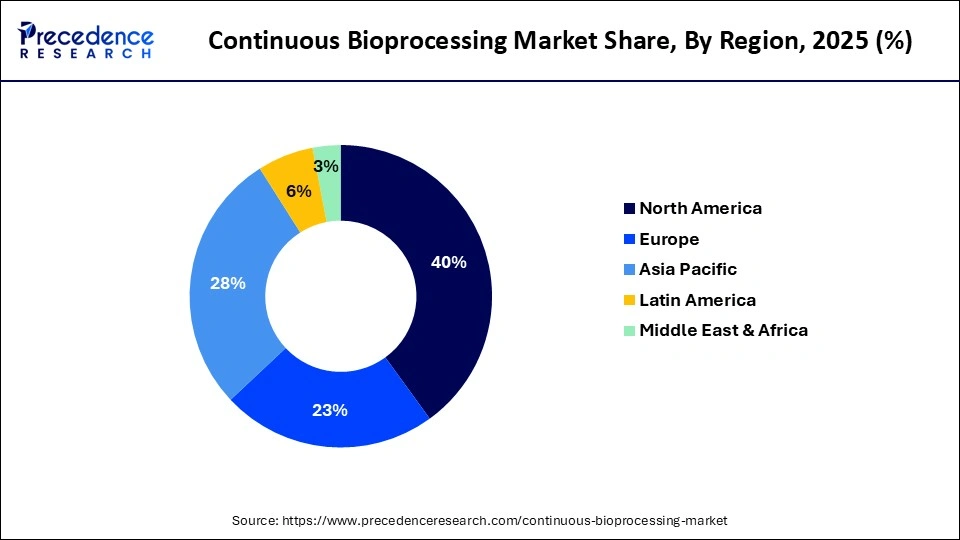

- By region, North America dominated the market, holding the largest market share of 40% in 2025.

- By region, Asia Pacific is expected to expand at the highest CAGR of 20% from 2026 to 2035.

- By product, the bioreactors segment held the largest market share, approximately 58% in 2025.

- By product, the chromatography systems & consumables segment is expected to grow at the fastest rate of 18.2% between 2026 and 2035.

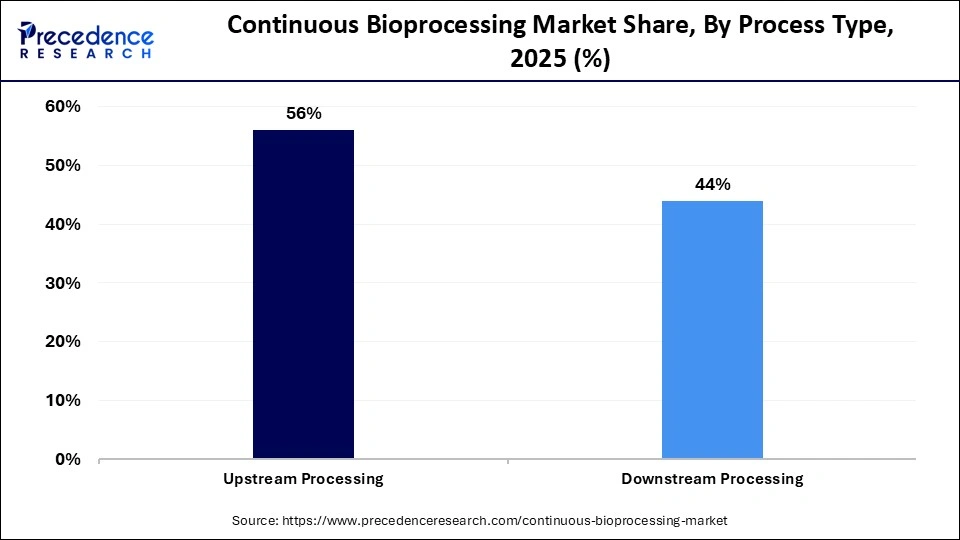

- By process type, the upstream processing segment held the largest market share of 56% in 2025.

- By process type, the downstream processing segment is set to grow at the highest rate of 17.9% from 2026 to 2035.

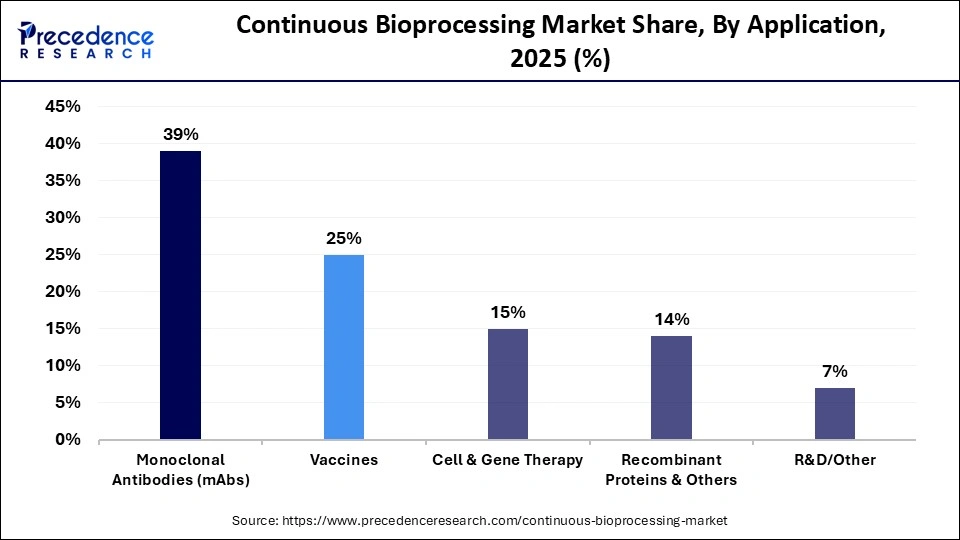

- By application, the monoclonal antibodies segment held the largest market share of 39% in 2025.

- By application, the vaccines segment is expected to see the highest rate of growth of 17.2% between 2026 and 2035.

- By end user, the pharmaceutical & biotechnology companies segment held the largest share of 46% in 2025.

- By end user, the CDMOs / CMOs segment is expected to reach a market share of 17.6% by 2035.

Transforming Biologics Manufacturing: How Innovation Is Reshaping the Continuous Bioprocessing Market

The continuous bioprocessing market comprises various technologies, systems, instruments, consumables, and services that are meant to provide continuous production of upstream and downstream production biologics, vaccines, monoclonal antibodies, and high-end therapies. Continuous bioprocessing through the combination of automation, single-use systems, perfusion bioreactors, and real-time monitoring guarantees the consistent quality of products, increased yield, and minimized variability of production over traditional batch-based methods.

There is a swift growth witnessed in the market of increased global demand for biologics and advanced therapeutics with the rising prevalence of chronic diseases, oncology treatment, and personalized medicine. In North America, Europe, and the Asia Pacific, regulatory bodies are promoting the employment of intensified and continuous manufacturing processes in order to improve efficiency and quality compliance in a supply chain.

Key AI Integration in the Continuous Bioprocessing Market

The integration of AI is transforming the development of the continuous bioprocessing market since it allows producing biologics more intelligently, stably, and efficiently. Predictive maintenance involves the use of AI in order to reduce equipment downtime, which identifies mechanical failure at an earlier stage and carries out routine maintenance. These are complex algorithms designed to assist in the adaptive control of processes, and consequently, important parameters such as temperature, pH, and nutrient feed rates are automatically controlled to maximize the yields.

Continuous Bioprocessing Market Trends

- Increased adoption of process analytical technology (PAT) and real-time control devices to improve the control of processes, maintain regulatory controls, and help achieve optimization of processes at different manufacturing phases based on data.

- Increased adoption of single-use systems and modular bioprocessing equipment in an effort to reduce capital investment, reduce the risk of contamination, and allow them to create flexible, codable manufacturing facilities.

- The growing adoption of automation and digital twins to replicate the conditions of production, minimize downtime, and make decisions in operations across continuous manufacturing processes.

- The reinforcement of regulatory assistance to the continuous manufacturing strategies in the industry, with the authorities promoting the development of advanced production technologies that enhance the reliability of supplies, consistency of quality, and sustainability of the manufacturing industry.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 382.12 Million |

| Market Size in 2026 | USD 409.67 Million |

| Market Size by 2035 | USD 766.57 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 19.12% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Process Type, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Insights

Why Did the Bioreactors Segment Hold a 58% Share in 2025?

In 2025, the bioreactors segment commanded a 58% market share in the continuous bioprocessing market. With bioreactors, the growth of cells is made under controlled conditions, which guarantee high yields, high productivity, and reproducible quality of a product. The adoption rates of single-use bioreactors have also increased the segment because of decreased cleaning needs, decreased risk of contamination, and rapid turnaround. Such systems are favored by big pharmaceutical and biotechnology companies in monoclonal antibody, vaccine, and cell therapy production because they are scalable, flexible, and can be used with process analytical technologies.

The chromatography systems & consumables segment are set to be the fastest growing with a 18.2% CAGR, and proved to be the most dynamic segment because the downstream purification needs of complex biologics are rising. The high-resolution separation could be achieved with chromatography and ensures purity, yield, and regulatory requirements. The need to develop more advanced chromatography platforms, including continuous chromatography and high-throughput chromatography, has risen as a result of the rising demand for monoclonal antibodies, cell and gene therapies, and vaccines. The high products are consumables, resin, columns, and membranes, which have a short life cycle and are very reliable in the process.

Process Type Insights

Why Did the Upstream Processing Segment Hold a 56% Share in 2025?

In 2025, the upstream processing segment took up 56% of the continuous bioprocessing market share because of the importance of the segment in the cultivation of cells and the generation of biologic intermediates. The use of continuous upstream technologies, such as perfusion and chemostat technologies, increases cell density, product yield, and process reproducibility as compared to conventional batch processes. Upstream processing is continually being innovated by the growing demand for monoclonal antibodies, vaccines, and recombinant proteins. Moreover, the encouragement of continuous manufacturing by regulating bodies and the need to minimize the cost of operations have encouraged manufacturers to optimize the upstream operations.

The downstream processing segment is set to grow at the highest CAGR of 17.9% in the period between 2026 and 2035, owing to the rising demand for purification, formulation, and quality assurance. Constant chromatography, filtration, and other separation methods allow high purity of products and yield and less time and waste of materials involved in the process. The explosion of complex biologics and cell and gene therapies requires state-of-the-art downstream platforms required to handle delicate biomolecules. Flexibility and quicker deployment are increasingly being adopted by single-use and modular downstream systems. An increasing number of investments in biosimilars, vaccines, and recombinant protein production are also contributing to the downstream processes being the most rapidly expanding in continuous bioprocessing.

Application Insights

Why Did Monoclonal Antibodies Lead the Continuous Bioprocessing Market in 2025?

The monoclonal antibodies segment dominated the market, occupying 39% in 2025, as a result of its extensive usage in the market as therapeutic agents against cancer, autoimmune diseases, and infections. Bio continuous processing also increases the efficiency of mAb production, enhances batch-to-batch consistency, and also reduces production costs. Perfusion bioreactors and integrated downstream purification systems are becoming key tools in the biopharmaceutical business to achieve high demand in the world market. The expansion of biosimilars is another expansion of the segment because companies are using continuous platforms to scale up more cheaply and rapidly.

The vaccines segment, which has an expected CAGR of 17.2% during the forecasted period, will increase substantially owing to the rising global demand for immunizations and new preparedness to face new infectious diseases. Bio-processing can be continuously scaled, versatile, and cost-efficiently produce vaccines with enhanced productivity and stability. The single-use systems, perfusion culture, and automated purification methodology are adopted to minimize the risks of contamination and hasten the time to market. Due to the activities of government support, pandemic preparedness programs, and increased vaccination campaigns, investments in continuous vaccine production are on the rise.

End User Insights

Why Did the Pharmaceutical & Biotechnology Companies Segment Hold a 46% Share in 2025?

The pharmaceutical & biotechnology companies took up 46% of the market in 2025 because they are the most dominant players, as they have long biologics pipelines and they can afford to invest in the advanced manufacturing technologies. Big biopharma players deploy continuous bioprocessing to achieve the optimal operation efficiency, lowering costs and aligning with the quality requirements of the regulations. This enables rapid time-to-market and reliable product quality because of the adoption of single-use bioreactors, integrated platforms of purification, and AI-enabled process monitoring. Monoclonal antibodies, vaccines, and cell and gene therapies have strong R&D pipelines to further industry dominance.

The CDMOs/CMOs segment, with an expected 17.6% CAGR, is being sustained as CDMOs/CMOs offer high-quality and affordable services to numerous clients in a shorter time of manufacturing and use of less space. The outsourcing of manufacturing of monoclonal antibodies, vaccines, and cell therapies through contract-based production is propelling investments in single-use bioreactors, automation of purification, and AI-based control of the process. The growth in this segment is strategic alliances with drug makers, and thus, CDMOs/CMOs represent a rapidly growing end-user market in the continuous bioprocessing industry.

Region Insights

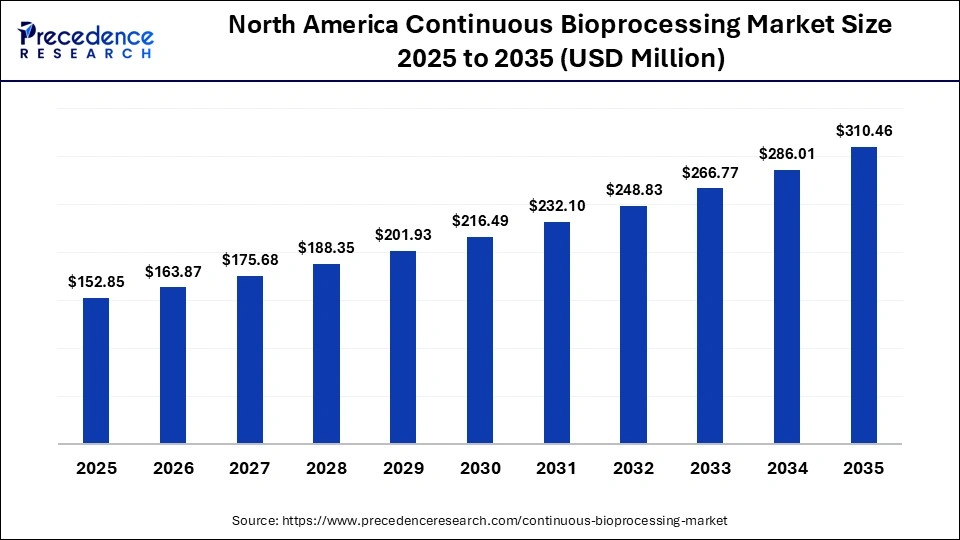

How Big is the North America Continuous Bioprocessing Market Size?

The North America continuous bioprocessing market size is estimated at USD 152.85 million in 2025 and is projected to reach approximately USD 310.46 million by 2035, with a 7.34% CAGR from 2026 to 2035.

Why Did North America Lead the Global Continuous Bioprocessing Market in 2025?

- In 2025, North America was the largest market with a 40% share of the continuous bioprocessing market because it has a good biologics manufacturing industry and adoption of the latest production technology. There are several prominent biopharmaceutical firms and contract development and manufacturing organizations in the region that are involved in continuous manufacturing.

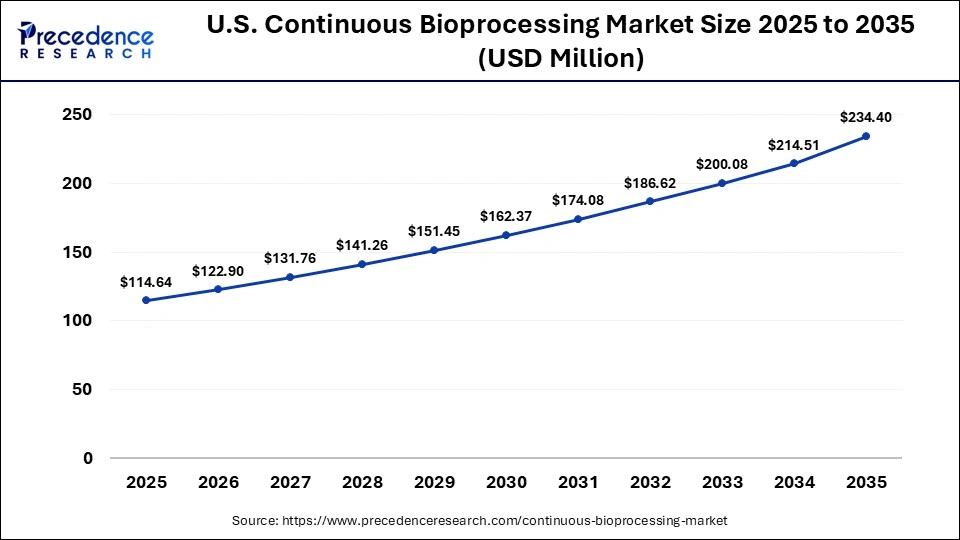

What is the Size of the U.S. Continuous Bioprocessing Market?

The U.S. continuous bioprocessing market size is calculated at USD 114.62 million in 2025 and is expected to reach nearly USD 234.40 million in 2035, accelerating at a strong CAGR of 7.41% between 2026 and 2035.

U.S. Continuous Bioprocessing Trends

The U.S. FDA has supported it with initiatives that favor contemporary methods of manufacturing, further boosting adoption. Moreover, the industry and academic research institutions have worked closely, and their spending on R&D is high, venture funding is robust, and technological innovation is fast. The automation, process analytical technologies, and AI-based monitoring systems have been commonly used to increase the reliability of processes and the quality of the products.

Why Is Asia Pacific Undergoing the Fastest Growth in the Continuous Bioprocessing Market?

The Asia Pacific region is experiencing the most rapid growth in the world continuous bioprocessing market, which has expected CAGR of 20% during the period between 2026 and 2035, due to the high rate of biopharmaceutical manufacturing in countries like China, India, South Korea, and Singapore. The governments in the region are working hard to promote biologics production in the country by providing finances, tax incentives, and infrastructural support. Increase in investments by international pharmaceutical firms to build cost-effective manufacturing centers has also led to faster. Moreover, the growing incidence of chronic conditions and the need to produce low-cost biologics and biosimilars are positive signs that manufacturers are moving towards continuous production.

Why Is the European Continuous Bioprocessing Market Experiencing Notable Growth?

The European continuous bioprocessing market is recording notable growth as continuous processes are being embraced by many European biopharmaceutical companies in managing energy usage, minimizing wastage, and adhering to the strict environmental guidelines. The existence of developed research centers and joint ventures between the government and industries has enhanced the creation of the next-generation bioprocessing technologies. The increasing needs of individualized medicines, biosimilars, and high-tech therapies are causing manufacturers to pursue general and effective production systems.

Who are the Major Players in the Global Continuous Bioprocessing Market?

The major players in the continuous bioprocessing market include Thermo Fisher Scientific Inc., Danaher Corporation (incl. Pall & Cytiva), Sartorius AG, Merck KGaA, WuXi Biologics, Repligen Corporation, GE Healthcare / Cytiva, Eppendorf AG, 3M Company, Bionet, Getinge AB, Corning Incorporated, Entegris, Inc., Fujifilm Holdings Corporation, Meissner Corporation

Recent Developments

- In May 2025, Tozaro, a technology supplier in the manufacture of cell and gene therapies, established a Technical Advisory Board (TAB) to steer commercialization and development of the innovation applications. The board will assist in the enhancement of the Smart Polymer platform of the company to enhance the bioseparation of the company and chromatography in the production of cell and gene therapy.(Source: https://tozaro.com)

- In April 2025, Head of UCL Biochemical Engineering Professor Suzanne (Suzy) Farid was awarded the 2025 Elmer Gaden Award of the journal Biotechnology & Bioengineering due to the groundbreaking work in the field of the economic potential of continuous bioprocessing. Her work emphasized the application of continuous bioprocessing as a major decision-making tool to manufacturers in comparing the cost and profitability with the traditional batch processes.(Source: https://www.ucl.ac.uk)

Segement Covered in the Report

By Product

- Bioreactors

- Chromatography Systems & Consumables

- Filtration Systems & Consumables

- Cell Culture Media, Buffers & Reagents

- Other Instruments & Consumables

By Process Type

- Upstream Processing

- Downstream Processing

By Application

- Monoclonal Antibodies (mAbs)

- Vaccines

- Cell & Gene Therapy

- Recombinant Proteins & Others

- R&D/Other

By End User

- Pharmaceutical & Biotechnology Companies

- CDMOs / CMOs

- Academic & Research Institutes

- Other Users

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting