What is the Bioprocessing Market Size?

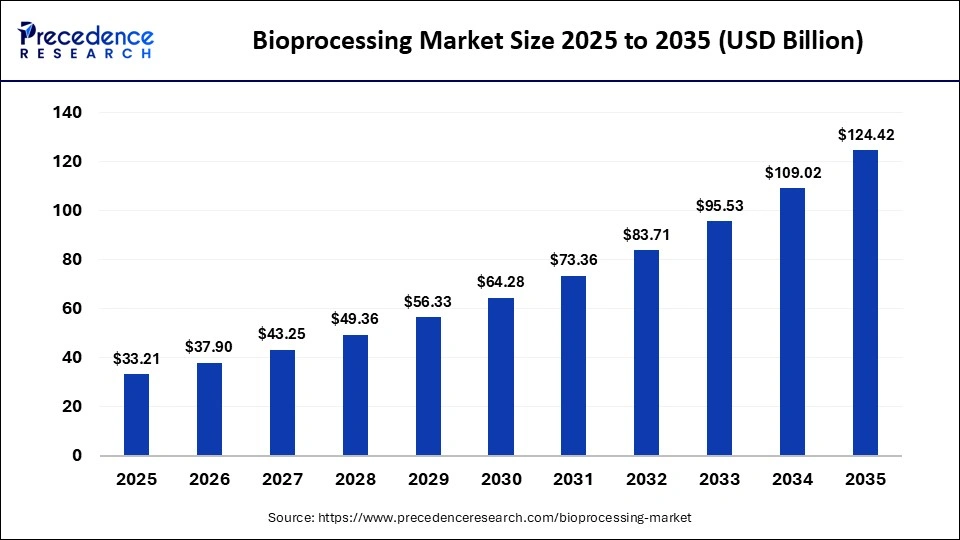

The global bioprocessing market size is calculated at USD 33.21 billion in 2025 and is predicted to increase from USD 37.90 billion in 2026 to approximately USD 124.42 billion by 2035, expanding at a CAGR of 14.12% from 2026 to 2035. The bioprocessing market is experiencing steady expansion, driven by rapid biologics production, rising demand for advanced therapies, and continuous innovation in upstream and downstream processing technologies.

Market Highlights

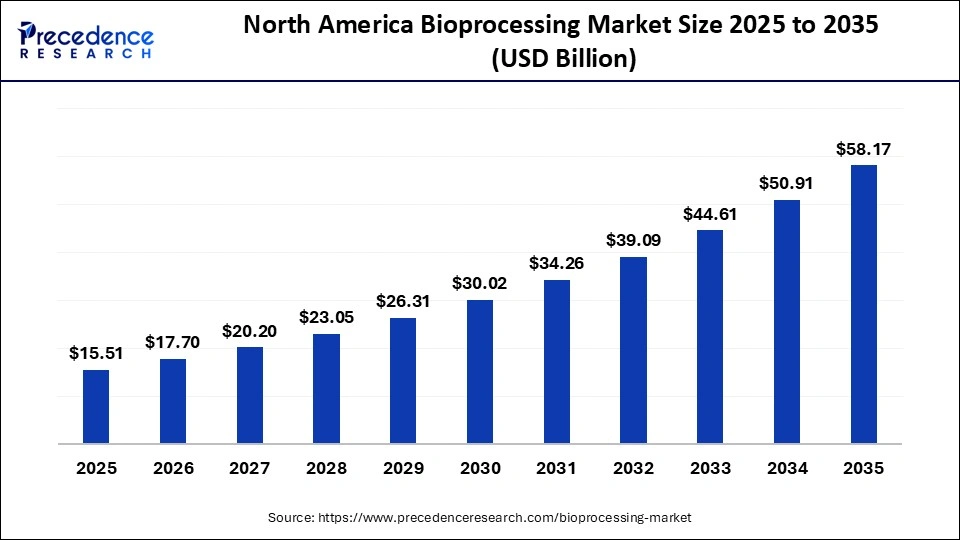

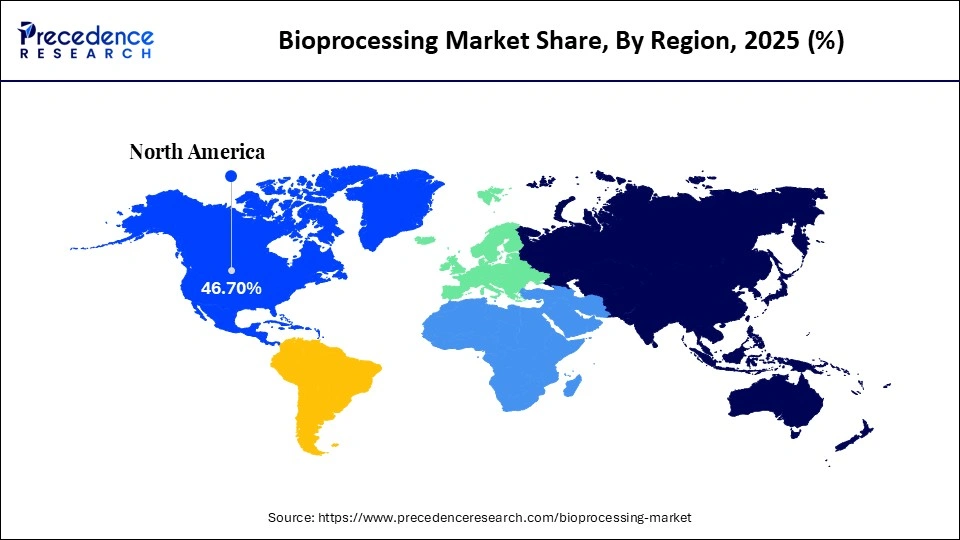

- North America led the bioprocessing market with a 46.7% market share in 2035.

- Asia Pacific is expected to expand at the fastest CAGR of 12.5% between 2026 and 2035.

- By product, the upstream bioprocessing products segment captured around 58.9% of the market share in 2025.

- By product, the single-use bioprocessing products segment is growing at a strong CAGR of 10.8% from 2026 to 2035.

- By type, the bioreactors segment contributed the highest market share of 34.8% share in 2025, with single-use bioreactors segment expected to expand fastest CAGR of 11% over the projected period 2026 and 2035.

- By application, the monoclonal antibody production segment captured 38.6% of market share in 2025.

- By application, the cell & gene therapy segment is expanding at the highest CAGR of 11.4% between 2026 and 2035.

- By capacity, the large-scale bioprocessing segment led with a 56.8% share in 2025.

- By capacity, the small-scale bioprocessing segment is set to grow at the highest CAGR of 11.3% between 2026 and 2035.

- By end-user, the pharmaceutical & biotechnology companies segment held more than 43.4% of the market share in 2024.

- By end-user, the contract development & manufacturing organizations (CDMOs) segment is expected to expand at the fastest CAGR of 11.5% between 2026 and 2035

Processes in Bioprocessing Are Changing the Way Healthcare Is Delivered

Living cells, enzymes, or biologicals are used in bioprocessing to create drugs such as vaccines, biologics, cell therapies, and recombinant proteins. Bioprocessing is responsible for producing complex biological molecules in large quantities using controlled methods. As the demand for advanced biologics and cell and gene therapy increases, and the demand for precision medicine continues to increase, the bioprocessing industry is growing faster than any other area of the medical devices and pharmaceuticals industry. To maximise throughput while minimising contamination risk, companies are moving toward using continuous processing, single-use technologies, and more efficient upstream production methods.

The use of automation, digital twin technology, and AI-based process optimisation has improved batch-to-batch consistency and reduced the time required for product development, creating a positive growth environment for bioprocessing. Increased investment in expanding biologics and viral vector production capacity will continue to create a favourable climate for future growth within the industry. The increasing collaboration between biopharmaceutical companies and contract development and manufacturing organisations (CDMOs) is another factor driving the growth of bioprocessing to meet the growing need for global manufacturing capabilities.

AI-Driven Innovation for the Modern Bioprocessing Market

Artificial intelligence (AI) has become the primary catalyst for the evolution of bioprocessing technology and for changing how the biologics industry is developed, tracked, and scaled. For example, in July 2025, the Canada-UK research consortium announced its first AI-biotech coordinated experiment with a cutting-edge AI-integrated bioreactor.

Researchers and biopharmaceutical companies can now use the latest machine learning technology to optimise cell line growth conditions and predict their behaviour based on real-time data. Overall, these examples indicate a growing trend toward a digitally twin-based approach to production, predictive analytics, and autonomous upstream management. As AI products are developed and improved over time, they continue to help reduce process variability, shorten the overall development cycle, and improve batch-to-batch consistency, enabling bioprocessing to become an increasingly precise, efficient, and data-centric manufacturing environment.

What are the Major Advances Changing the Bioprocessing Market Today?

- Single-Use Systems: Increasing use of single-use bioreactor systems and filtering systems as they are more flexible, lower risk of contamination, and allow for quicker selection of different setups. A major advantage of single-use systems is their ability to produce biologics in smaller quantities than ever before, thereby minimizing the costs of building and maintaining a bioprocess facility and of cleaning.

- Continuously Operating Systems: Implementing continuous bioprocessing enables manufacturers to increase their output while offering consistent product quality and reduced footprint. In addition, continuous processing enables real-time monitoring, higher yields, and more efficient scaling of complex biologics and advanced therapies.

- Increase in the Use of Automation and AI: The impact of advanced digital technologies combined with artificial intelligence (AI) has allowed for improved process visibility, predicting process failures, and eliminating the need for manual intervention, which enhances the efficiency of the process and ultimately leading to increased reliability, optimizing the workflows, and greater consistency across both upstream and downstream stages of the process.

- Increase demand for cell and gene therapies: The current growth in demand for viral vectors and personalized medicines is driving innovation in closed-system and scalable bioprocessing systems. This trend promotes better purification techniques, improved cell management, and more robust manufacturing of next-generation therapeutics.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 33.21 Billion |

| Market Size in 2026 | USD 37.90 Billion |

| Market Size by 2035 | USD 124.42 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 14.12% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Type, Application, Capacity, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Bioprocessing Market Segment Insights

Product Insights

Upstream Bioprocessing Products: The upstream bioprocessing products segment remains dominant in 2025 with a 58.9% share, reflecting the critical influence of upstream operations on final yield, cell-growth kinetics, and overall process efficiency. Upstream steps such as cell-line development, media optimization, nutrient-feed strategies, and bioreactor control determine biologics manufacturing productivity more than any other stage. As global biologics output continues to rise, manufacturers are prioritizing upstream systems that support higher cell densities, more predictable growth profiles, and consistent product quality across batches.

Single-Use Bioprocessing Products: The single-use bioprocessing products segment is experiencing rapid growth, with an expected CAGR of 10.8%, as biomanufacturers transition to flexible, contamination-free operations. As a result, biomanufacturers are shifting to disposable products, thereby accelerating the adoption of single-use products, which reduce cleaning and validation requirements, enable faster turnaround times, and enable the production of small-batch personalized therapies. The emergence of modular biomanufacturing facilities and decentralized production methods will continue to enhance the attractiveness of disposable systems, which are now the fastest-growing product segment in contemporary bioprocessing environments.

Type Insights

Bioreactors: This segment dominated the bioprocessing market in 2025 with a 34.8% share, as biopharmaceutical companies will produce and sell more biologic products in the future and will also rely on the increased use of high-density cultures and the adoption of advanced automated modular production lines. The bioreactor solution is necessary for biopharmaceutical companies to manage their production operations effectively, achieve product consistency, enable scalability, and provide real-time data to accept, reject, and manage production processes, thereby improving efficiency across mammalian, microbial, and cell-based manufacturing.

The single-use bioreactors biopharmaceutical companies are the fastest-growing segment, using more single-use bioreactors in response to growing demand for flexible manufacturing and to minimize production downtime. Because single-use bioreactors can be easily changed and reused immediately, manufacturers are less likely to cross-contaminate or require a separate cleaning process. They can respond to the increased demand for smaller- to medium-scale single-use bioreactors for gene and cellular therapies.

Application Insights

Monoclonal Antibody Production: Monoclonal antibody production is the dominant application in the bioprocessing market in 2025 with a 38.6% share. The strong demand for monoclonal antibody products in oncology, autoimmune disease treatments, and chronic disease management has kept the monoclonal antibody segment growing. The mAb segment is aided by mature manufacturing processes, high yields from batch production, and standardized regulations governing monoclonal antibody production across all countries. Additionally, due to the heavy concentration of mAbs in biopharmaceutical companies' pipelines, monoclonal antibody production manufacturers are continually increasing their capacity and optimizing their production processes to support the production of large, cost-effective quantities of mAbs.

Cell & Gene Therapy: This segment is the fastest-growing, with a CAGR of 11.4%, driven by the rise of personalized regenerative medicine. These therapies are produced using specialized systems in the upstream manufacturing area, use viral vectors as delivery methods, and employ closed, single-use manufacturing processes, all of which have led to significant technology adoption. The rapid growth in cell and gene therapy and the trend toward decentralised production have resulted in continued rapid growth of this segment, as new companies develop flexible bioprocessing solutions that reduce the risk of contamination.

Capacity Insights

Large-scale Bioprocessing: This segment has emerged as the dominant capacity due to the demand for large-scale production of biologics such as monoclonal antibodies (mAbs), vaccines, and recombinant proteins. Established biopharmaceutical companies use large fermenters (up to 200,000 liters), extensive purification pipelines, and efficient bulk manufacturing techniques to meet this high demand. Furthermore, the combined weight of established infrastructure and economies of scale in large bioprocessing facilities has helped maintain this lead. The increasing global demand for biologics in both emerging and developed markets will continue to provide a means to expand the current capacity segment in the near future.

Small-Scale Bioprocessing: This segment is expected to be the fastest-growing, with a CAGR of 11.3%, driven by the trend towards personalization and low-volume production, as well as increasing interest in manufacturing for clinical trials. Small-scale bioprocessing enables rapid production of multiple batches, a low-cost process-development approach, and flexible manufacturing of therapy products, including gene and cell therapies and rare-disease products. Companies are using smaller, single-use systems and modular cleanrooms to accelerate research and development, as well as early-stage clinical trials, thereby enabling faster transfer from concept to clinical evaluation.

End-User Insights

Pharmaceutical & Biotechnology Companies: This segment maintained its dominance in the bioprocessing space, with a 43.4% share, leveraging their manufacturing capabilities to build out their pipeline of therapeutic products, their ability to produce biologics in-house, and their ongoing commitment to improving biologics production processes. Pharmaceutical and biotechnology industries have large fleets of bioreactors, along with significant quantities of upstream and downstream technologies. These industries have also experienced an unprecedented increase in the number of biologics that have received FDA marketing approval, the development of next-generation biologics, and the utilization of increasingly diverse global manufacturing capabilities.

Contract Development & Manufacturing Organizations (CDMOs): As the fastest-growing end-user, with an 11.5% CAGR, contract development and manufacturing organizations (CDMOs) are significantly impacted as companies turn to them for flexibility, risk mitigation, and scalable, cost-effective manufacturing services. CDMOs are in demand for biomanufacturing services because emerging biotech companies rely on CDMOs to assist with developing their manufacturing processes, producing their final product for clinical trials, and ensuring regulatory compliance. CDMOs are also adopting module, single-use, and multi-disciplinary production systems, which further promote the rapid development of biomanufacturing.

Bioprocessing Market Regional Insights

The North America bioprocessing market size is estimated at USD 15.51 billion in 2025 and is projected to reach approximately USD 58.17 billion by 2035, with a 14.13% CAGR from 2026 to 2035.

Why did North America Dominate the Bioprocessing Market in 2025?

North America dominated the bioprocessing market with a 46.7% share, supported by a highly developed biomanufacturing ecosystem and long-standing investment in advanced production technologies. The region was among the first to adopt next-generation bioprocessing tools, including high-throughput single-use bioreactors, automated perfusion systems, and real-time process analytical technology. This early adoption continues to position North America as a global leader, particularly as biopharmaceutical manufacturers prioritize scale, flexibility, and regulatory compliance in biologics and cell-therapy production.

The region's growth is strengthened by a dense concentration of biotechnology companies developing monoclonal antibodies, recombinant proteins, mRNA therapeutics, and viral vectors for gene and cell therapies. According to NIH-funded biotechnology statistics for 2023, the United States maintains one of the world's largest active pipelines of biologic drug candidates, which drives continuous reinvestment in upstream and downstream bioprocessing upgrades. Companies across the region are integrating automation technologies, digital twins for process simulation, and advanced single-use platforms that reduce cleaning requirements, increase changeover speed, and support modular facility design.

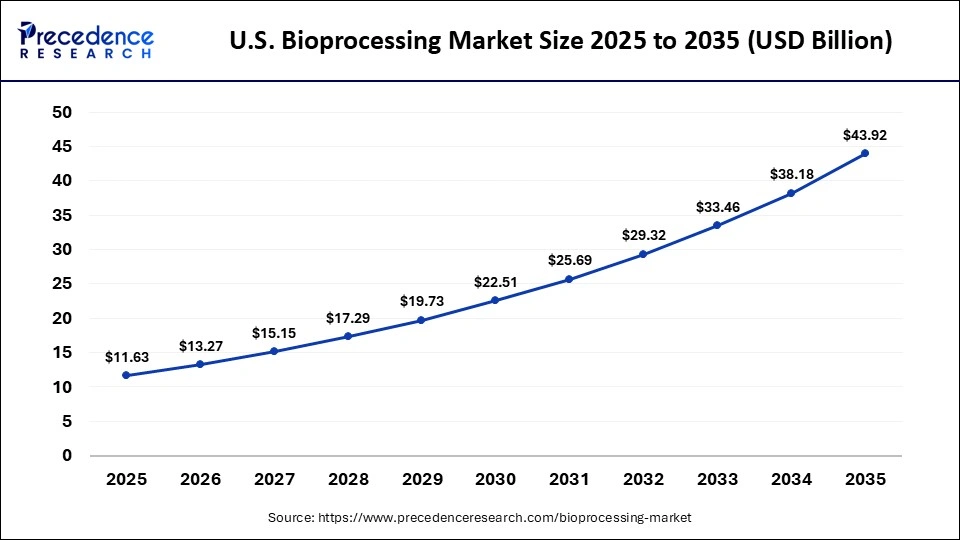

The U.S. bioprocessing market size is calculated at USD 11.63 billion in 2025 and is expected to reach nearly USD 43.92 billion in 2035, accelerating at a strong CAGR of 14.21% between 2026 and 2035.

U.S. Bioprocessing Market Trends

The United States is the leader in bioprocessing growth in North America. It has the world's most advanced bioprocessing infrastructure, is home to many innovation hubs, and is an early adopter of AI-enabled manufacturing. The large biotech clusters in multiple U.S. cities are continuing to develop new capacity for biologic and cell therapy production. In February 2025, Cellevate AB announced the U.S. launch of its lead product, Cellevat3d nanofiber microcarriers, at the third viral vector process development & manufacturing summit, aimed at accelerating bioprocessing. In addition, collaboration and partnership with other biotech companies and universities create a system of ecosystem collaboration that strengthens the entire bioprocessing industry and reinforces the U.S. role as the engine of development for bioprocessing technologies.

The Asia Pacific market for bioprocessing is on track to become the industry's predominant growth area, with a 12.5% expected growth rate, as countries across the region continue to invest heavily in biologics production through government-sponsored incentives and the rapid advancement of modern manufacturing systems. National programs are accelerating this shift. China's 14th Five-Year Plan (2021–2025) prioritizes large-scale biomanufacturing and supports facility expansion through grants administered by the Ministry of Science and Technology. Japan's AMED Regenerative Medicine Program funds continuous bioprocessing innovation and cell-therapy scale-up, while South Korea's Bioeconomy 2025 Strategy invests in GMP infrastructure dedicated to monoclonal antibodies, viral vectors, and mRNA therapeutics.

Asia-Pacific countries are aggressively developing large-scale manufacturing capacity by widely adopting single-use bioreactors, continuous perfusion systems, and modular, flexible facility configurations that enable rapid adjustment of production volumes. These systems help manufacturers accelerate technology transfer, reduce contamination risk, and shorten the timeline between clinical-scale and commercial-scale production. India and Singapore, for example, have expanded biopharma industrial parks that integrate single-use workflows and real-time process analytics tools to support high-throughput manufacturing.

China Bioprocessing Market Trends

China is leading the Asia-Pacific in bioprocessing growth, making significant investments in the development of biologics and biosimilars, largely due to large State-backed financial support and a rapid pace of installing modern, flexible bioprocessing systems. By cooperating with global manufacturers, China can improve its processes and increase efficiency, while also developing a large R&D pipeline and constructing world-class biomanufacturing facilities. China has quickly become the driving force behind the Asia-Pacific bioprocessing industry's accelerated growth.

In June 2024, WuXi Biologics revealed plans to manufacture drug substance and products for Virogen Biotechnology at its new Chengdu microbial-production facility, and to produce a growth-hormone therapy for VISEN Pharmaceuticals, boosting microbial-manufacturing capacity in China.

With a strong emphasis on quality as mandated by the European Union and its vast pharmaceutical manufacturing facilities, Europe's bioprocessing market is growing rapidly. Europe is gradually implementing continuous processes, increasing efficiency through purification systems, and has begun utilizing digitalization to improve both productivity and sustainability. Europe has numerous innovation hubs across regions, including the UK, Germany, and Switzerland, where businesses partner closely with universities to develop biologics, cell therapies, and vaccines. Moreover, eco-friendly bioprocessing is a priority in European countries, and millions of euros are being invested to establish systems that generate less waste while maximizing energy use. Together with an experienced workforce and centralized regulatory processes, Europe has emerged as a technical advanced and stable bioprocessing centre.

Germany Bioprocessing Market Trends

Germany benefits from some of the world's best engineers and engineers of high-tech bioprocessing facilities, which are at the forefront of automation and machine learning. As a result, Germany has the most complete infrastructure and capability to classify and monitor the quality of bioprocessing facilities in Europe. Biotechnological production processes are being rapidly innovated through the integration of industry and universities, placing Germany as Europe's leading centre for bioprocessing.

The MEA is rapidly growing in its involvement in the bioprocessing market, as many of the country's governments are focused on developing a foundational biomanufacturing infrastructure. These governments are prioritising bioeconomy self-sufficiency, and investment will be made in innovation hubs, pilot-supported bioprocessing systems, and training for qualified personnel to prepare for the demand for bioprocessing innovation. Collaboration with global biomanufacturing companies is creating a knowledge platform to enhance technology transfer and ensure early adoption of modular, flexible production capabilities suited for transitioning into the local market. The demand for locally produced biologics and the establishment of fill/finish plants for vaccines and other cell-based therapies will help strengthen the position of MEA in a global landscape.

UAE Bioprocessing Market Trends

The United Arab Emirates (UAE) is actively leading the MEA region in the creation of biotechnology zones, innovative laboratory infrastructure, and partnerships to support new biomanufacturing technologies. The UAE is experiencing rapid growth in its innovation economy and has strong government backing, along with a growing number of innovation-focused facilities. The development of qualified scientific talent in biotechnology positions the UAE as the most robust innovator in bioprocessing across the MEA region.

In November 2025, Emirates Biotech unveiled its Embio product range, a new line of PLA (polylactic acid) biopolymers made in the UAE, offering recyclable, compostable alternatives to traditional plastics for packaging, fibers, paperboard, and 3D printing, to support a circular-economy transition.

Top Players in the Bioprocessing Market and Their Offerings

- Thermo Fisher Scientific

- Sartorius AG

- Merck KGaA

- Danaher Corporation

- GE Healthcare

- Lonza Group

- Eppendorf AG

- Boehringer Ingelheim BioXcellence

- Corning Incorporated

- Repligen Corporation

- Fujifilm Diosynth Biotechnologies

- PBS Biotech

- Novasep

- Getinge AB

- Agilent Technologies

Recent Developments

- In December 2025, Ami Polymer launched IMAFLEXELL Film, a new 5-layer multi-layer barrier film for single-use bioprocessing systems, offering superior gas barrier, mechanical strength, chemical compatibility, and sterility for various biopharma applications.(Source: https://microbiozindia.com)

- In January 2025, Repligen introduced its CTech SoloVPE PLUS System, a UV-Vis variable-pathlength analyser delivering accurate protein, DNA/RNA, or mRNA concentration measurements in under 30 seconds, streamlining bioprocess analytics workflows.(Source: https://www.globenewswire.com)

- In May 2025, Asahi Kasei Bioprocess America and PeptiSystems announced an exclusive global partnership to supply AKBA's THESYS ACS Ergo synthesis columns to PeptiSystems' peptide synthesis platforms, aiming to streamline and scale up peptide and oligonucleotide drug manufacturing.(Source: https://www.businesswire.com)

- In June 2025, Ecolab Life Sciences launched Purolite AP+50, a new affinity chromatography resin with high dynamic binding capacity and durability, designed to improve cost-efficiency and throughput in large-scale monoclonal-antibody manufacturing.(Source: https://www.biopharminternational.com)

Bioprocessing MarketSegments Covered in the Report

By Product

- Upstream Bioprocessing Products

- Downstream Bioprocessing Products

- Single-use Bioprocessing Products

By Type

- Bioreactors

- Filtration Systems

- Chromatography Systems

- Consumables & Accessories

- Cell Culture Media & Reagents

- Mixing Systems

- Control & Monitoring Systems

- Centrifuges

By Application

- Monoclonal Antibody Production

- Vaccine Production

- Cell & Gene Therapy

- Recombinant Protein Production

- Stem Cell Research

- Enzyme Production

By Capacity

- Small-scale Bioprocessing

- Mid-scale Bioprocessing

- Large-scale Bioprocessing

By End-User

- Pharmaceutical & Biotechnology Companies

- Contract Development & Manufacturing Organizations

- Academic & Research Institutes

- CROs

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content