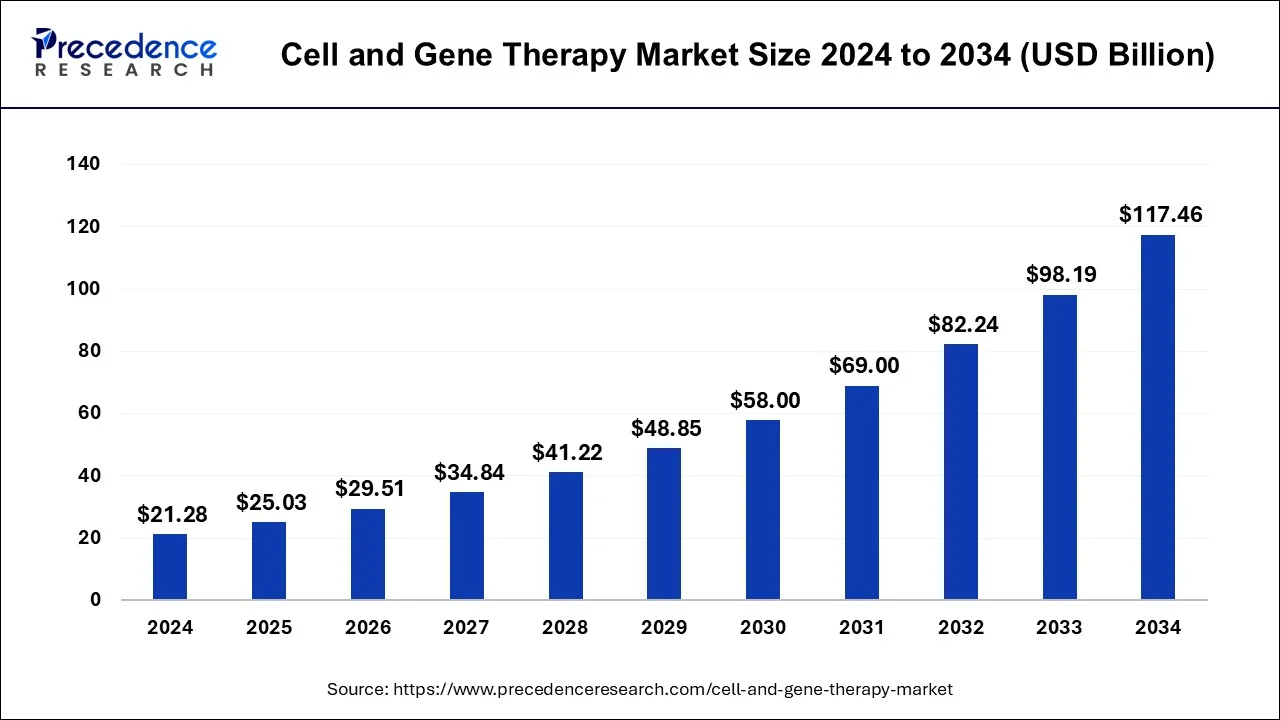

What is the Cell and Gene Therapy Market Size?

The global cell and gene therapy market size was estimated at USD 8.94billion in 2025 and is predicted to increase from USD10.44 billion in 2026 to approximately USD 45.24 billion by 2035, expanding at a CAGR of 17.60% from 2026 to 2035.

Cell and Gene Therapy Market Key Takeaways

- In terms of revenue, the global cell and gene therapy market was valued at USD 8.94billion in 2025.

- It is projected to reach USD 45.24billion by 2035.

- The market is expected to grow at a CAGR of 17.60% from 2026 to 2035.

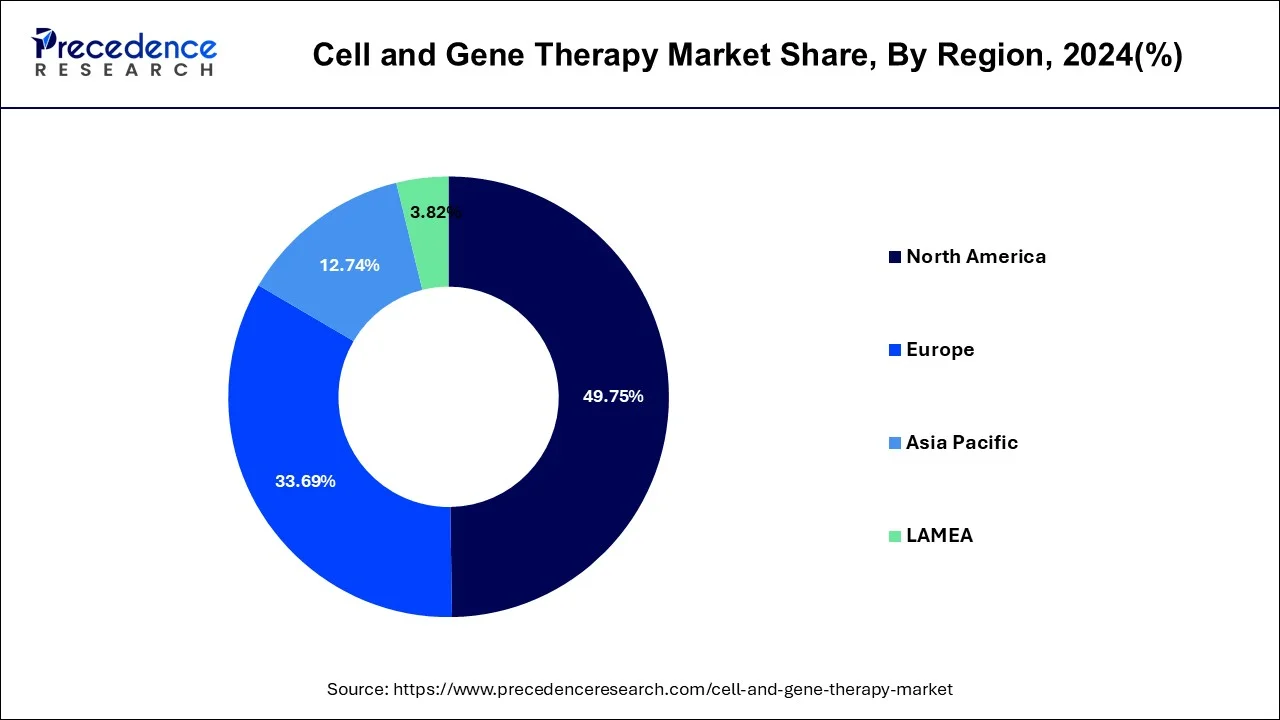

- North America region generated a revenue share of around 50.26% in 2025.

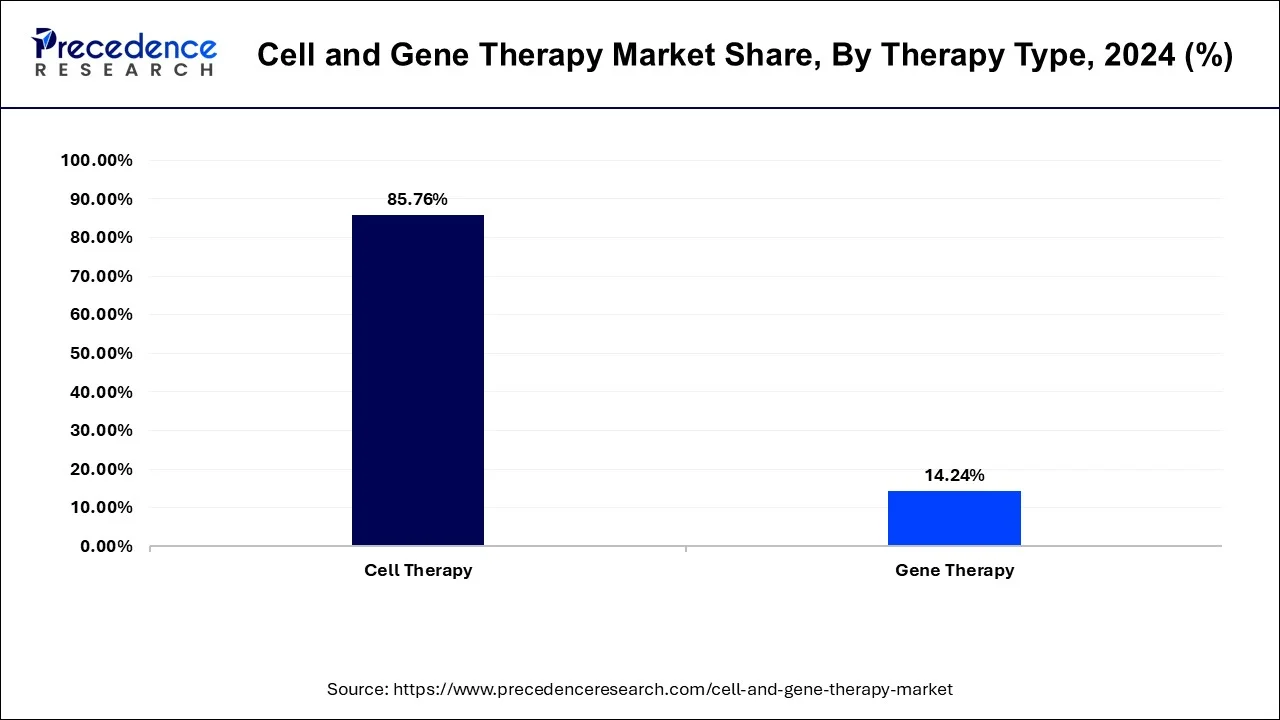

- By therapy type, the cell therapy segment held a revenue share in 2025.

- By therapeutic class, the infectious disease segment is expected to hold the largest market share in 2025.

- By delivery method, the In vivo segment captured the biggest revenue share in 2025.

- By end-users, the cancer care centers segment generateed the major market share in 2025.

What is Cell and Gene Therapy Manufacturing?

Cell and gene therapies (CGTs) provide substantial advancements in patient care by treating or perhaps curing a variety of illnesses that have previously been untreatable by small molecule and biological medicines. The FDA in the United States has approved more than 20 CGTs during the past 20 years, and many of these one-time therapies range in price from US$37,500 to US$2 million per shot. Given the high financial outlay and patient expectations of these life-saving pharmaceuticals, it is essential that manufacturers provide integrated services across the whole supply chain to enable efficient biomanufacturing processes and smooth logistics and minimize uptake barriers.

High-profile mergers and acquisitions, such as those involving bluebird bio/BioMarin, Celgene/Juno Therapeutics, Gilead Sciences/Kite, Novartis/AveXis and the CDMO CELLforCURE, Roche/Spark Therapeutics, and Smith & Nephew/Osiris Therapeutics, have been made recently as a result of the CGT market's expansion.

Many bio/pharma businesses have re-invested in R&D, In order to standardize vector manufacturing and purification, utilize forward engineering approaches in cell therapies, improve cryopreservation of cellular samples, and explore the development of off-the-shelf allogeneic cell solutions.

In order to increase their manufacturing capabilities, pharmaceutical companies are now closely examining their internal capabilities and either investing in their own manufacturing facilities or outsourcing to contract development and manufacturing organizations (CDMOs) or contract manufacturing organizations (CMOs).

Lack of money, infrastructure, and capacity forces small biotech companies developing cell and gene therapies to form strategic collaborations with contract manufacturers. This has fueled cell and gene therapies (CGTs) market expansion. Additionally, investments in this area are growing enormously, which further fuels the market.

How is AI contributing to the Cell and Gene Therapy Manufacturing Industry?

To improve the manufacturing of cell and gene therapy, AI enhances the speed of the development process and stabilizes the complex production conditions. It optimizes the condition of processes with real-time manufacturing information and enhances uniformity with anticipatory learning. AI is also able to anticipate equipment failures long before they happen, as well as facilitate smooth production changes on a large scale.

Market Outlook

- Industry Growth Overview: Clinical momentum keeps the industry growing. Automation enhances effectiveness throughout manufacturing settings.

- Global Expansion: Infrastructure is being expanded in Germany, the UK, and Canada to supply regional manufacturing requirements.

- Major investors: Thermo Fisher Scientific, Lonza Group, Catalent, WuXi AppTec, Fujifilm Holdings, increase capacity and technologies.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 45.24Billion |

| Market Size in 2025 | USD 8.94 Billion |

| Market Size in 2026 | USD 10.44 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 17.60% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Therapy Type, Therapeutic class, End User, Delivery Method, Region |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

Market Dynamics

Drivers

The COVID-19 impact, which had earlier resulted in restrictive containment measures involving social estrangement, remote work, and the closure of commercial activities that resulted in operational challenges, is largely to blame for the growth. The companies are now resuming their operations and adjusting to the new normal while recovering from the impact.

The market has been primarily driven by an exponential increase in the clinical pipeline and an increase in the number of regulatory approvals for innovative medicines.

Market participants are working hard to increase their market presence as they take into account the significant growth opportunities in the contract development of cellular and gene-modified medicines. Additionally, bio producers are forming strategic partnerships with contract producers to quicken the R&D of their candidate programs. The emergence of several new competitors and the expansion of product development capabilities as a result of the growing demand for CMO/CDMO services have had a favorable impact on market revenue.

In order to advance the production of cell and gene therapies, several novel techniques are being introduced. For instance, the potential of single-use technology in production workflows is being investigated by the makers. This method is becoming more popular in this field since it can expedite development while also cutting costs and production times. In the upcoming years, market growth is predicted to be supported by such technological developments in space.

The growing demand for cutting-edge treatments has increased market competition among participants. Companies that manufacture cell therapies and CDMOs are inking agreements in order to hasten the development of their products and acquire a competitive edge. Additionally, ongoing clinical research projects have driven the contract manufacturing segment's revenue growth. Additionally, increase in outsourcing of the manufacturing process for cell and gene therapy also supports segment growth.

Restraints

There are many difficulties in the development, including safety and efficacy problems, drawn-out clinical study protocols, strict regulatory frameworks, and high prices of cell and gene therapy. Some of the key elements include the capacity to simultaneously treat heterogeneous systems with a variety of cells, high gene transfer efficiency, low cell toxicity, single cell specificity to the intended target, and single cell specificity.

Several CAR T-cell therapies have been approved, but according to data from the World Health Organization (WHO), one in five cancer patients who are qualified for them die as they wait for a production facility. In contrast to the past, when many of these autologous products took about a month to generate, some of them may now be made in less than two weeks.

The development of more sophisticated gene-transfer tools with CARs (such as transposon, CRISPR (Clustered Regularly Interspaced Short Palindromic Repeats), among others) and the use of centralized organization with standardized apheresis centers are two approaches being investigated by the health sector (collection and reinfusion).

Opportunities

A number of gene treatments have received approval, mostly for the treatment of rare diseases Numerous businesses, including Astellas Gene Therapies, Bayer, ArrowHead Pharmaceuticals, Bluebird Bio, Intellia Therapeutics, Krystal Biotech, MeiraGTx, Regenxbio, Roche, Rocket Pharmaceuticals, Sangamo Therapeutics, Vertex Pharmaceuticals, Verve Therapeutics, and Voyager Therapeutics, are researching novel gene therapy vectors to boost levels of gene expression/protein production, decrease immunogenicity, and improve durability.

Segment Insights

Therapy Type Insights

How did the Cell Therapy Segment Dominate the Cell and Gene Therapy Market in 2025?

The cell therapy segment held the largest share of the market in 2025, due to the increased need for faster and visible results of the disorders testing globally. Moreover, the individuals are actively shifting towards cell therapies as awareness of early diagnosis is growing, specifically in chronic disease conditions such as cancer and others. Furthermore, therapies such as the CAR T and others have gained immense industry attention and public trust in the past few years.

The gene therapy segment is expected to grow at a notable rate during the predicted timeframe, akin to its unique characteristics, such as the gene therapy can focus on correcting the root cause of genetic diseases, which is contributing to the segment growth in the current period. Furthermore, by offering a one-time and potentially permanent solution, gene therapy is expected to gain major industry share in the upcoming years.

The cell therapy segment held a dominant presence in the cell and gene therapy market in 2025. The segment includes autologous cell therapy, allogeneic cell therapy, stem cell therapy, immune cell therapy, dendritic cell therapy, and others. The growth of the segment is attributed to the significant investments in research and development activities, increasing awareness regarding the benefits of CAR-T cell therapies, and the growing demand for personalized medicine. The increasing prevalence of chronic diseases such as cancers, rheumatoid arthritis, and Type 1 diabetes has led to an increasing adoption of cell therapies to improve the treatment effectiveness by using living cells to target the disease. The market is experiencing increasing funding for cell therapy clinical studies and investment from pharmaceutical and biotech companies in research and development activities.

Cell and Gene Therapy Market By Therapy Type, 2022-2024 (USD Million)

| Therapy Type | 2022 | 2023 | 2024 |

| Cell Therapy | 3,766.3 | 4,271.5 | 4,854.2 |

| Autologous Cell Therapy | 1,587.6 | 1,785.0 | 2,010.8 |

| Allogeneic Cell Therapy | 745.4 | 859.5 | 992.8 |

| Stem Cell Therapy | 574.7 | 654.9 | 747.7 |

| Hematopoietic Stem Cells (HSC) | 240.8 | 270.9 | 305.3 |

| Mesenchymal Stem Cells (MSC) | 225.5 | 260.0 | 300.3 |

| Induced Pluripotent Stem Cells (iPSC) | 108.4 | 124.0 | 142.2 |

| Immune Cell Therapy | 376.9 | 432.2 | 496.7 |

| CAR-T Cell Therapy | 167.9 | 193.4 | 223.2 |

| TCR (T-cell Receptor) Therapy – targets intracellular antigens | 82.3 | 95.5 | 111.1 |

| TIL (Tumor Infiltrating Lymphocyte) Therapy | 44.2 | 50.2 | 57.0 |

| NK (Natural Killer) Cell Therapy | 59.0 | 67.2 | 76.6 |

| Macrophage Therapies | 23.5 | 26.0 | 28.8 |

| Dendritic Cell Therapy | 139.4 | 157.7 | 178.7 |

| Others | 342.4 | 382.2 | 427.5 |

| Gene Therapy | 2,244.0 | 2,564.2 | 2,936.0 |

| In-vivo Gene Therapy | 1,025.5 | 1,178.1 | 1,356.1 |

| Ex-vivo Gene Therapy | 599.4 | 681.2 | 775.7 |

| Gene Editing Therapies | 269.1 | 313.7 | 366.3 |

| RNA-Based Therapies | 217.4 | 242.3 | 270.4 |

| Others | 132.6 | 148.9 | 167.5 |

Therapeutic Class Insights

Based on application, the market is divided into cardiovascular disease, cancer, genetic disorders, rare diseases, oncology, hematology, ophthalmology , infectious disease, neurological disorders. Among these, the infectious disease segment dominates the market in 2025. The oncology segment held a revenue share in 2024. Research and treatment in the biomedical domains of cell therapy and gene therapy. Both treatments have the ability to lessen the underlying cause of hereditary disorders and acquired diseases. Both therapies aim to treat, prevent, or perhaps cure diseases. By repairing or changing specific cell types, or by employing cells to transport a medication across the body, cell therapy tries to treat diseases. Cell therapy involves growing or modifying cells outside of the body before injecting them into the patient. The cells may come from a donor (allogeneic cells) or the patient (autologous cells)6. By replacing, deactivating, or introducing genes into cells, either inside the body (in vivo) or outside the body, gene therapy seeks to treat disorders (ex vivo).

The market for genetic disorders is expanding as a result of factors like the high prevalence of genetic and chronic disease cases and the growing government initiatives to raise public knowledge of genetic testing and diagnosis. Researchers are developing novel techniques for screening, diagnosing, and treating patients for a variety of cardiac diseases as they investigate the genetic roots of heart and vascular illness. Some researchers are looking for new ways to size patients who are at risk for sudden cardiac death. Others are examining how medicines that could postpone or obviate the need for cardiac surgery could benefit patients with uncommon illnesses.

The intricacy of mitochondrial genetics and the diverse clinical and biochemical symptoms of primary mitochondrial disorders (PMDs) have shown to be a significant obstacle to the development of effective disease-modifying medications. A successful clinical transition of genetic medicines for PMDs is possible, according to encouraging evidence from gene therapy trials in patients with Leber hereditary optic neuropathy and improvements in DNA editing tools.

The oncology segment contributed the highest revenue share in 2024. The segment includes hematologic malignancies, solid tumors (glioblastoma, pancreatic cancer, melanoma, prostate, breast, lung cancer), and others (head and neck cancer, sarcomas, and ovarian cancer (with experimental CGT trials). The growth of the segment is driven by the increasing prevalence of cancer around the world. Cancer represents a leading segment for cell and gene therapy applications. The expanding clinical trial pipelines, significant advancements in gene delivery technologies, such as CRISPR-Cas9, and growing demand for patient-specific therapies for cancers fuel the segment's expansion during the forecast period. Increasing investment in biopharmaceutical research and supportive regulatory support for the advancement and approval of novel cell and gene-based treatments, driving the expansion of the market during the forecast period.

Indication Type Insights

Why does the Oncology Segment Dominate the Cell and Gene Therapy Market by Indication Type?

The oncology segment held the largest share of the cell and gene therapy market in 2025, owing to these cell and gene therapies having gained the most success in the detection and treatment of the various types of cancers in recent years. Moreover, cancers such as leukemia and lymphoma have provided immense industry attention to cell and gene therapy in recent times, as per the current market survey.

On the other hand, the genetic disorders segment is expected to grow at a notable rate due to the increased need for a permanent fix for the diseases inherited globally in recent years. Moreover, health professionals are seen under the heavy recommendation of cell and gene therapy for rare diseases such as spinal muscular atrophy and others in recent times. Furthermore, individuals are more aware of advanced therapies, which can lead to the segment's growth in the upcoming years.

Vector Type Insights

The viral vector segment dominated the market with the largest share in 2025, due to its being considered the most effective segment for delivering therapeutic genes in the cells. Moreover, having unique properties such as targeting specific tissues and long-lasting effects, the viral vectors have gained immense industry attention in recent years, as per the current market survey.

The non-viral vector segment is expected to grow at a significant rate because it is considered safer, easier to produce at scale compared to viral ones. Also, by avoiding the risk of immunogenic reactions and insertional mutations, the non-viral vector is likely to get an immense industry share during the forecast period. Moreover, the rising need for low-risk delivery can contribute immediately to the future segment growth as per the future industry expectations.

The viral vectors segment held the majority of the market share in 2024. The segment includes Adeno-Associated Virus (AAV), lentivirus, retrovirus, herpes simplex virus (HSV), adenovirus, and others. The segment's growth is mainly driven by the rapid advancements in biotechnology, the increasing prevalence of chronic and genetic disorders, and the rapid advancement in viral vector delivery systems. Viral vectors play a crucial role in gene therapy and vaccine development by effectively delivering genetic material into target cells. Moreover, an increasing number of people with target diseases and the proven effectiveness of viral vectors like adeno-associated virus (AAV), retrovirus, herpes simplex virus (HSV), and lentivirus (LV) are anticipated to accelerate the segment expansion in the coming year.

Manufacturing Type Insights

The in-house (biotech/pharma-owned facilities) segment held the largest share of the cell and gene therapy market in 2025, because large pharmaceutical and biotech companies prefer to maintain full control over quality, process, and intellectual property during production. These therapies are highly complex, so in-house operations ensure better management, security, and speed during trials and commercial production.

On the other hand, the contract development and manufacturing organizations segment is expected to grow at a notable rate because many startups and small biotech firms lack the resources to build their own facilities. As more cell and gene therapies enter trials and the market, outsourcing manufacturing to specialized CDMOS helps companies reduce costs, save time, and ensure regulatory compliance.

The in-house (biotech/pharma-owned facilities) segment held the largest share in 2025. Biotech and pharma firms are increasingly building and expanding their in-house manufacturing capabilities to efficiently manage specialized processes and navigate complex regulatory pathways for innovative therapies. Cell and gene therapy manufacturing requires highly sterile environments, specialized expertise, and labour-intensive processes. In-house facilities allow companies to protect intellectual property and assist in ensuring a reliable and timely supply chain for personalized and high-value cell and gene therapy.

End Use Insights

The hospitals and specialty clinics segment held the largest share of the cell and gene therapy market in 2025, because they are the primary sites where advanced therapies are administered. These treatments require close patient monitoring, skilled staff, and special handling, which general clinics often lack. Major hospitals also participate in clinical trials and have direct access to patients who need such therapies. With specialized infrastructure and support from pharma companies, these settings are best suited for early-stage and complex therapy delivery.

The government and public bodies segment is expected to grow at a significant rate, as they ramp up investments in universal access and rare disease treatment. To make therapies more affordable and widespread, governments are establishing national funding programs, research grants, and collaborations with manufacturers.

The biopharma and biotech companies segment registered its dominance in the cell and gene therapy market in 2024. Several leading biopharma and biotech companies, such as Gilead Sciences, Novartis, Vertex Pharmaceuticals, Intellia Therapeutics, Sarepta Therapeutics, and others, are increasingly focusing on developing transformative treatments for genetic, rare, and chronic diseases to enhance better healthcare outcomes using gene editing and cellular manipulation technologies. These companies are actively involved in addressing critical healthcare gaps in rare, genetic, and chronic conditions. The strategic collaborations or partnerships and acquisitions between biopharma and biotech giants are significantly accelerating research and commercialization efforts.

Cell and Gene Therapy Market By End Use, 2022-2024 (USD Million)

| By End Use | 2022 | 2023 | 2024 |

| Hospitals and Specialty Clinics (administering therapies) | 4,676.4 | 5,295.5 | 6,008.5 |

| Government/Public Health Bodies (NIH, EMA programs) | 817.5 | 945.6 | 1,095.7 |

| Others | 516.4 | 594.6 | 686.0 |

Regional Insights

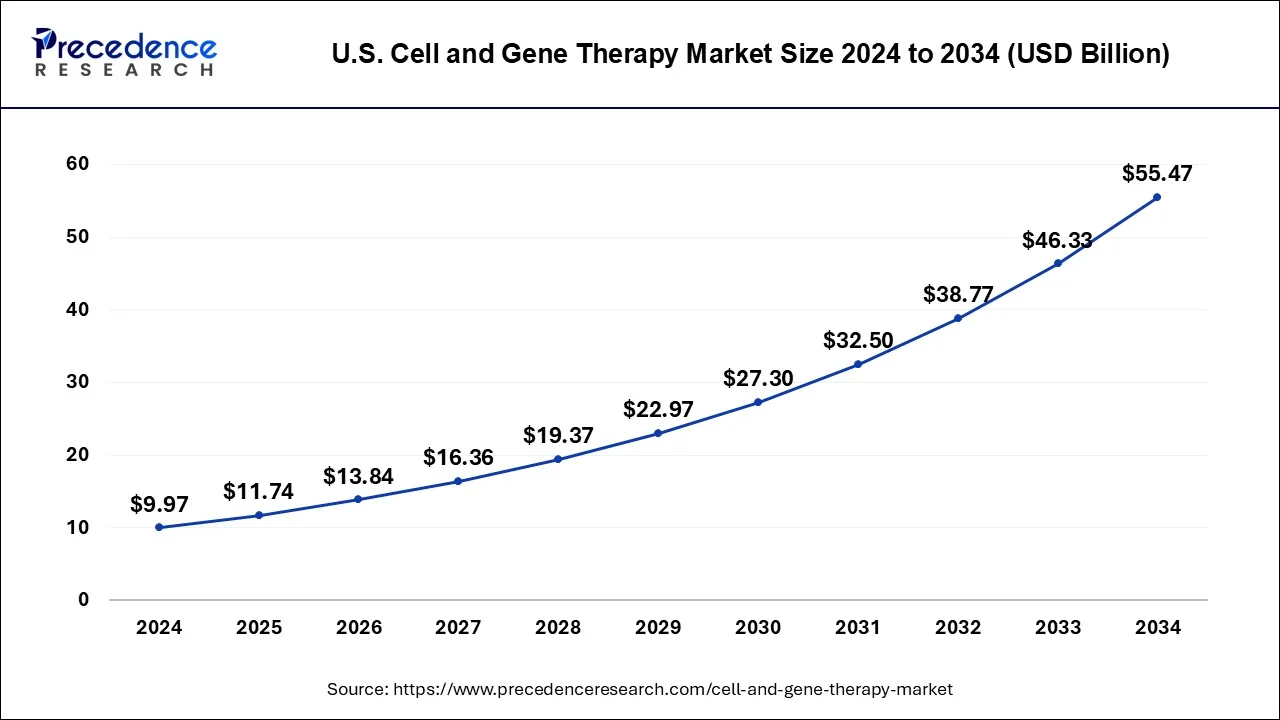

What is the U.S. Cell and Gene Therapy Market Size?

The U.S. cell and gene therapy market size was estimated at USD 4.09 billion in 2025 and is predicted to be worth around USD 19.25 billion by 2035, at a CAGR of16.75% from 2026 to 2035.

A significant number of ongoing clinical trials and a rise in corporate involvement in gene and cell therapy R&D are the primary drivers of regional market expansion. The North America region accounted for more than 50.26% of revenue share in 2024.

North America scored first for having the greatest number of gene therapy clinical trials , with more than 400 enterprises in the region actively engaged in the development of cell and gene therapy products for a variety of disorders.

Numerous brand-new collaborative research and innovation initiatives have been launched across Europe under the Horizon 2021 initiative. One of these endeavors is testing gene therapy utilizing viral vectors. This is expected to accelerate the growth of cell and gene therapy manufacturing services across Europe. The rise of the market is anticipated to be aided by the developed infrastructure and skilled labor force in European countries.

Value Chain Analysis of the Cell and Gene Therapy Manufacturing Market

- R&D: The effective identification of therapeutic targets and the development of viral vectors or cellular modification targeting a particular genetic disorder.

Key players: Novartis, Gilead (Kite Pharma), CRISPR Therapeutics - Clinical Trials and Regulatory Approvals: Therapies that are tested in humans and are shown to be safe and gain approval from authorities such as the FDA or EMA.

Key players: IQVIA, Charles River Laboratories - Packaging and Serialization: To make sure that items are kept in temperature-controlled packaging marked with labels that do not allow counterfeiting but allow tracking of items in supply chains.

Key players: Marken (UPS), Cryoport Systems, Almac

Cell and Gene Therapy Market Companies

- Merck KGaA: Provides bioprocessing equipment, specialized culture media, and viral vectors services that assist in the stable production of therapies in a variety of manufacturing settings.

- Novartis AG: Global manufacturing system for manufacturing CAR-T products and gene therapies based on automated bioreactor systems to supply in large quantities on a commercial basis.

Other Major Key Players

- Alnylam Pharmaceuticals Inc.

- Amgen Inc.

- Biogen Inc.

- CORESTEM Inc.

- Dendreon Pharmaceuticals LLC.

- Helixmith Co. Ltd.

- JCR Pharmaceuticals Co. Ltd.

- Kolon TissueGene Inc.

- Novartis AG

- Pfizer Inc.

Recent Developments

- In November 2025, BRIC-THSTI, in partnership with Miltenyi Biotec and BIRAC, launched India's inaugural hands-on training program on Cell and Gene Therapy Manufacturing. The program emphasizes CAR-T cell therapy techniques. ( https://www.expresspharma.in )

- In November 2025, Bharat Biotech launched "Nucelion Therapeutics," a subsidiary in Hyderabad's Genome Valley. The subsidiary serves as a CRDMO for advanced cell and gene therapies, offering comprehensive solutions for global life science innovators. ( https://www.gktoday.in )

- McKinsey will launch a new Digital Capability Center to quicken the development of cell and gene therapies (CGT). The Digital Capability Center will focus on accelerating operational excellence and digital transformations in biopharmaceutical manufacturing. The Digital Capability Center will join McKinsey's rapidly growing global network of Digital Capability Centers, immersive learning environments that inspire and prepare organizations to deliver sustainable performance improvement from operational-excellence and tech-enabled transformations.

- on october 3, 2022, Alexion's genomic medicines annuoced the acquisition of LogicBio's technology, by this acquiestuion they are looking to incorpate knowledgeable team for preclinical development, and team for research and development on rare diseases. LogicBio has developed a number of technical systems for the delivery and insertion of genes to address genetic disorders. Additionally, they will built a platform to improve the creation of viral vectors.

- On October 12, 2022, Moderna disclosed that Merck(MSD) has decided to exercise its $250 million option to co-develop and commercialize PCV mRNA-4157/V940. The vaccine is now being tested in a phase II clinical trial as adjuvant therapy for patients with high-risk melanoma in combination with pembrolizumab, Merck's programmed cell death protein 1 (PD-1) antibody.

- On October 3, 2022, Pfizer announced that they have successfully purchased Biohaven Pharmaceuticals which is a migraine drug manufacturing company. They recently manufactured NURTEC ODT (rimegepant) which is approved for both acute therapy and episodic migraine prevention in adults. With Pfizer's global reach and this acquisition, they will be able to provide migraine patients with more treatment alternatives.

Segments Covered in the Report

By Therapy Type

- Cell Therapy

- Autologous Cell Therapy

- Allogeneic Cell Therapy

- Stem Cell Therapy

- Hematopoietic Stem Cells (HSC)

- Mesenchymal Stem Cells (MSC)

- Induced Pluripotent Stem Cells (iPSC)

- Immune Cell Therapy

- CAR-T Cell Therapy

- TCR (T-cell Receptor) Therapy - targets intracellular antigens

- TIL (Tumor Infiltrating Lymphocyte) Therapy

- NK (Natural Killer) Cell Therapy

- Macrophage Therapies

- Dendritic Cell Therapy

- Others

- Gene Therapy

- In-vivGene Therapy

- Ex-vivGene Therapy

- Gene Editing Therapies

- RNA-Based Therapies

- Others

By Indication / Therapeutic Area

- Oncology

- Hematologic Malignancies

- Acute Lymphoblastic Leukemia (ALL)

- Non-Hodgkin Lymphoma (NHL)

- Chronic Lymphocytic Leukemia (CLL)

- Hematologic Malignancies

- Solid Tumors

- Glioblastoma

- Pancreatic Cancer

- Melanoma

- Prostate, Breast, Lung Cancer

- Others

- Head and Neck Cancer

- Sarcomas

- Ovarian cancer (with experimental CGT trials)

- Genetic Disorders

- Hemophilia A and B

- Spinal Muscular Atrophy (SMA)

- Duchenne Muscular Dystrophy (DMD)

- Beta-thalassemia

- Sickle Cell Disease

- X-linked Adrenoleukodystrophy (X-ALD)

- Others

- Neurological Disorders

- Parkinson's Disease

- Alzheimer's Disease

- Batten Disease

- Huntington's Disease

- ALS (Amyotrophic Lateral Sclerosis)

- Others

- Cardiovascular Diseases

- Heart Failure

- Myocardial Infarction

- Peripheral Artery Disease

- Critical Limb Ischemia

- Others

- Ophthalmology

- Musculoskeletal / Orthopedic Disorders

- Infectious Diseases

- Metabolic Disorders

- Others

By Vector Type (Gene Delivery Method)

- Viral Vectors

- Adeno-Associated Virus (AAV)

- Lentivirus

- Retrovirus

- Herpes Simplex Virus (HSV)

- Adenovirus

- Others

- Non-Viral Vectors

- Lipid Nanoparticles (LNPs)

- Naked DNA/RNA Plasmids

- Electroporation

- Gene gun / microinjection

- CRISPR-Cas Delivery Systems (non-viral)

- Others

By Manufacturing Type

- In-house (Biotech/Pharma-Owned Facilities)

- Contract Development & Manufacturing Organizations (CDMOs)

- Hybrid Models (e.g., early stage in-house, scale-up outsourced)

- Others

By End User

- Hospitals and Specialty Clinics (administering therapies)

- Academic and Research Institutes (preclinical development)

- Biopharma and Biotech Companies

- CDMOs and CROS

- Government/Public Health Bodies (NIH, EMA programs)

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting