Cell and Gene Therapy CDMO Market Size and Forecast 2025 to 2034

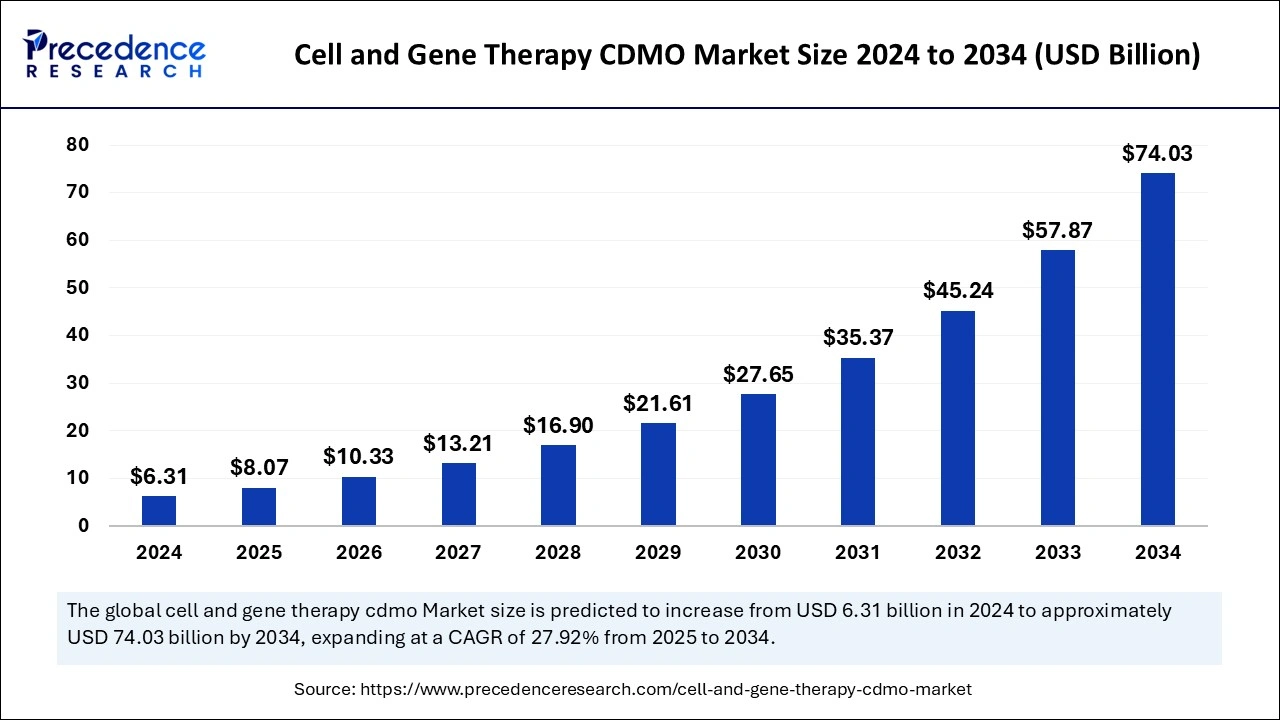

The global cell and gene therapy CDMO market size was estimated at USD 6.31 billion in 2024 and is predicted to increase from USD 8.07 billion in 2025 to approximately USD 74.03 billion by 2034, expanding at a CAGR of 27.92% from 2025 to 2034. The rising demand to put specialized expertise, facilities, and regulatory knowledge into developing and manufacturing cell and gene therapy is fueling the CDMO market for cell and gene therapy.

Cell and Gene Therapy CDMO Market Key Takeaways

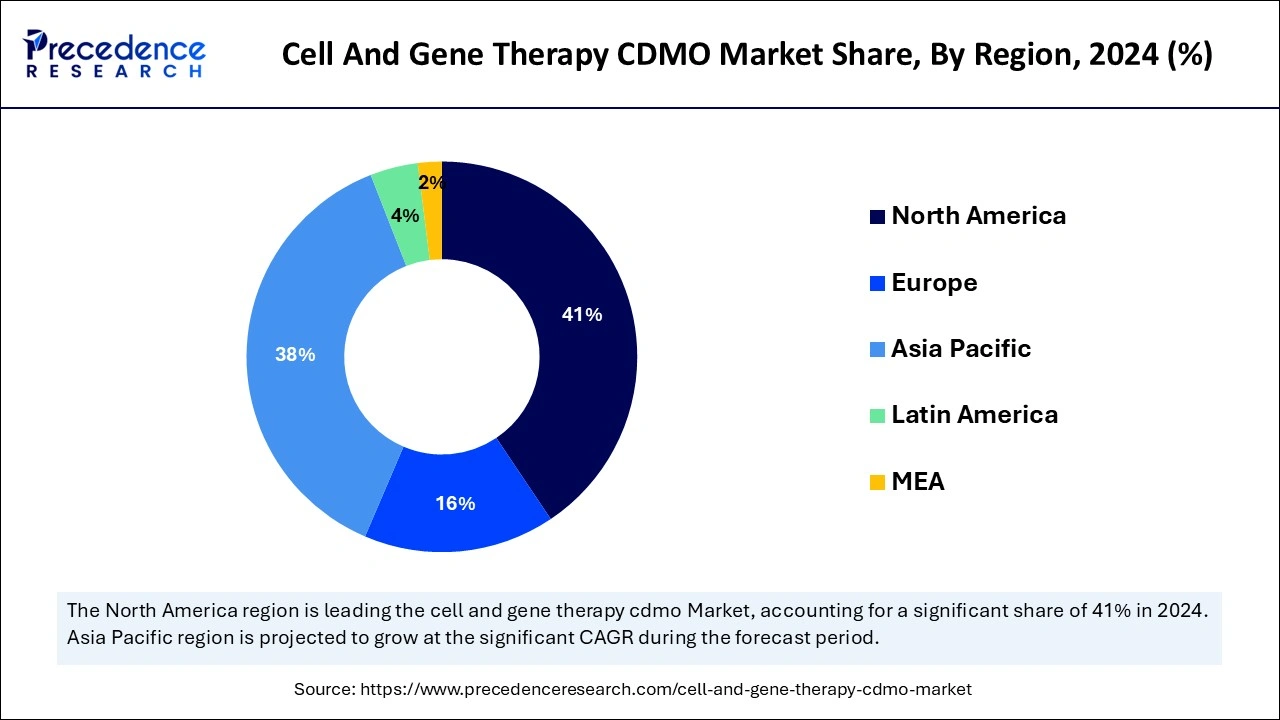

- North America dominated the global market with the largest share of 67% in 2024.

- Asia Pacific is expected to grow at a notable CAGR of 29.03% over the projected period.

- By phase, the pre-clinical segment has held a major market share of 67% in 2024.

- By phase, the clinical segment is projected to grow at a solid CAGR of 27.8% over the forecast period.

- By product type, the cell therapy segment accounted for a considerable market share of 42% in 2024.

- By product type, the gene-modified cell therapy segment is anticipated to grow at a healthy CAGR of 29% during the studied years.

- By indication, the oncology segment contributed the highest market share of 50% in 2024.

- By indication, the rare diseases segment is projected to expand rapidly in the coming years.

How is Artificial Intelligence (AI) Changing the Cell and Gene Therapy CDMO Market?

Integration of artificial intelligence into the cell and gene therapy CDMO market has significantly enhanced the development and manufacturing process by optimizing cell selection, predicting treatment results, analyzing large datasets to identify potential issues, and improving overall efficiency with the help of automated decision-making. AI delivers a great level of efficiency in cell and gene therapy manufacturing and offers more patients to benefit from vital treatments. Furthermore, AI facilitates the development of novel therapies throughout the research and development value chain in various stages, including target identification, payload design, and many more.

- In October 2024, OmniaBio, a CDMO focused on cell and gene therapies, introduced a new manufacturing facility that claims to be the largest in Canada. The 120,000-square-foot site is designed to meet the needs of cold chain logistics as well as the production of cell and gene therapies with the help of artificial intelligence.

U.S. Cell and Gene Therapy CDMO Market Size and Growth 2025 to 2034

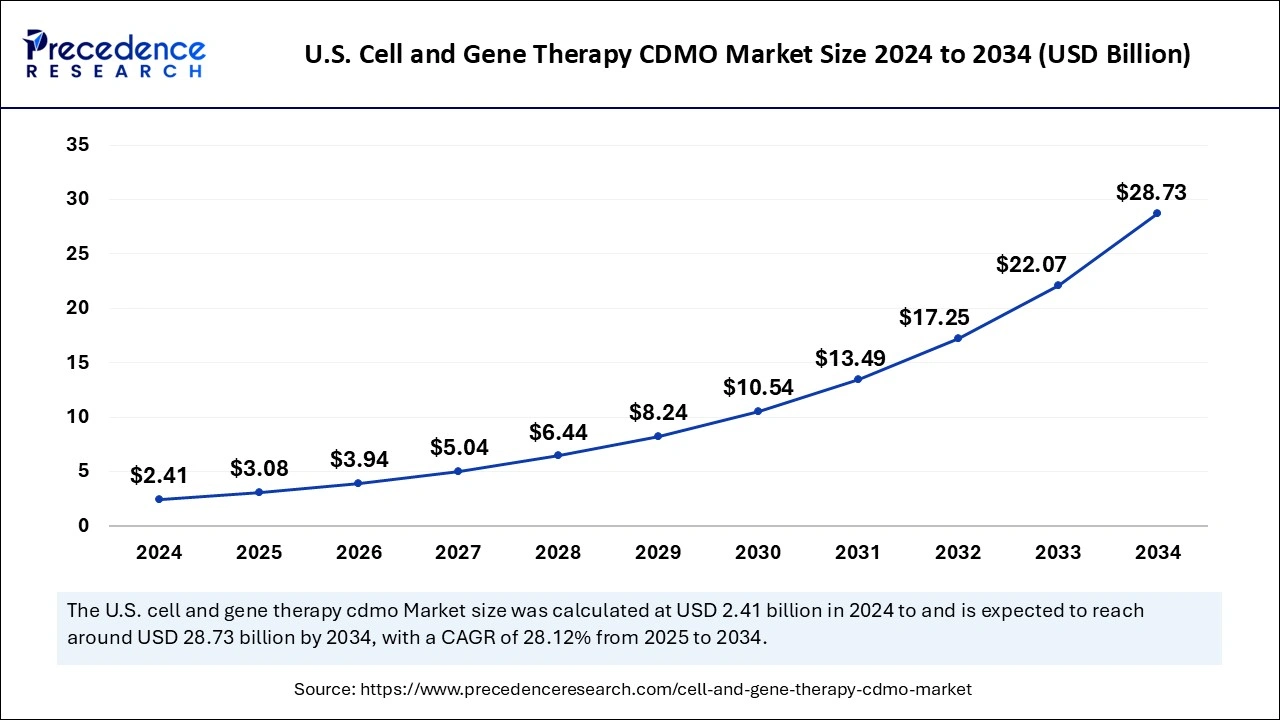

The U.S. cell and gene therapy CDMO market size was exhibited at USD 2.41 billion in 2024 and is projected to be worth around USD 28.73 billion by 2034, growing at a CAGR of 28.12% from 2025 to 2034.

North America accounted for the largest cell and gene therapy CDMO market share in 2024. The dominance of this region is experienced due to several factors, one of them is the expanding geographical reach. North America holds the largest market share due to its established healthcare infrastructure, high research and development investment, and supportive regulatory landscapes.

The region also has high adoption of cell and gene therapies, credited to its advanced technologies. The support from the regulatory environment in North America encourages innovation and development in cell and gene therapies.

Asia Pacific is projected to host the fastest-growing cell and gene therapy CDMO market in the coming years due to the rise in clinical trials for cell and gene therapies, driven by increasing patient needs for advanced treatment, growing government support, and an ascending ecosystem of innovation. This expansion is particularly observed in countries such as China with high cancer incidence, which leads to a strong push towards new treatment approaches. The government and regulatory support for CGT trials, in conjunction with increasing investment in products to get into the market.

Market Overview

Cell and gene therapy is a treatment that utilizes cells or genetic material to treat disease. CGT has the potential to treat the underlying cause of the disease, treat symptoms, and stop the progression of the disease. CDMO assists in providing specialized expertise and facilities to manufacture therapeutic products, which includes process development, clinical trial products, and scaling up to commercial manufacturing. This ensures high quality and adheres to strict regulatory compliance. 90% of biotech companies rely on contract development and manufacturer organization in the early stage and commercial launch of the product.

Cell and Gene Therapy CDMO Market Growth Factors

- Innovative technology: CDMOs are widely investing in cell and gene therapy technologies, with a large number of small- and medium-sized companies. The investment is largely observed for continuous manufacturing and artificial intelligence, which aids in improving the efficiency and scalability of the process. As cell and gene therapy is a complex technique, technological advancement is an essential need.

- Consolidation in the market: This trend is streamlining as larger players are acquiring smaller companies to expand their capabilities and geographic reach. This results in a more concentrated market with fewer major players, which allows for greater scale, wide service offerings, and improved efficiency.

- Geographical reach:The cell and gene therapy CDMO market is focused on territorial expansion, which will help meet the growing demand for cell and gene therapies. This is emerging in regions where the market is expected to grow significantly. Expansion refers to establishing healthcare infrastructure, high research and development investment, and supporting regulatory bodies.

- Regulatory landscape: The legal framework is evolving in cell and gene therapies, which ensures working closely with regulators to certify that the processes run by meeting the latest requirements.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 74.03 Billion |

| Market Size in 2025 | USD 8.07 Billion |

| Market Size in 2024 | USD 6.31 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 27.92% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered and Regions | Phase, Product Type, Indication, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Clinical trial for innovative Therapies

Cell and gene therapy (CGT) is rapidly expanding and evolving in healthcare through using living cells and genetic modification to treat disease. The cell and gene therapy CDMO market helps drug developers to successfully prepare for the execution of clinical trials in numerous ways. Presently, there are over 5,000 gene therapy trials listed in the National Institute of Health. The CDMO produces material for clinical trials, and if successful, it also assists in commercial manufacturing. Furthermore, CDMOs provide continuous monitoring and optimization of the manufacturing process, which ensures consistent product quality and meets the demands.

Restraint

High manufacturing complexities

The cell and gene therapy CDMO market faces a challenge with manufacturing complexities due to the inherent nature of therapies, which involve live cells, viral vectors, and individual treatment plans. The successful achievement of all this requires specialized expertise, stringent quality control, and adequate equipment. Manufacturing complexities contribute to increasing the production cost of approved gene therapy for patients.

Opportunity

Access to specialized facilities and technologies

The cell and gene therapy CDMO market is expected to receive hefty investment in the coming years for specialized facilities and technologies, which will be essential tools for the development and manufacturing of the therapies. Partnering with a CDMO can give access to several resources. The next five years are anticipated to be a critical period for the adoption of a combination of technological advances, strategic partnerships, and a major shift toward drug discovery. There will be noticeable capacity constraints, but despite that, the executives are expecting a lot more potential application for cell and gene therapies for relatively common conditions such as Parkinson's disease, where CDMO creates larger development and manufacturing facilities.

Type of Therapy Insights

The cell therapy segment dominated the market with 38.50% market share in 2024. The dominance of the segment can be attributed to the ongoing technological advancements, rising demand for outsourced services, and increasing incidence of chronic and rare diseases. The surge in personalized treatments such as autologous CAR-T therapies is boosting the need for customized production processes.

The CAR-T therapy segment is expected to grow at the highest CAGR of 20.80% in 2024. The dominance of the segment can be credited to the rising number of clinical trials, surge in incidence of cancer and other targeted diseases, along with the technological advancements. Also, mergers and acquisitions among CDMOs are driving the segment growth further.

Type of Manufacturing Service Insights

The manufacturing services segment led the market by holding 62.70% market share in 2024. The dominance of the segment can be linked to the surge in R&D investments, rising incidence of chronic and genetic diseases, and technological advancements in gene editing and cell processing. Moreover, the pharmaceutical and biotechnology market players are rapidly outsourcing their manufacturing requirements to CDMOs to reduce costs.

The development services segment is expected to grow at the highest CAGR of 17.20% in 2024. The dominance of the segment can be driven by growing R&D funding and supportive regulatory settings, especially for regenerative medicine and an increasing number of clinical trials across emerging economies in the world.

Cell & Gene Therapy Modality Insights

The viral vectors segment held a 64.10% market share in 2024. The dominance of the segment is owed to the growing demand for advanced therapies and technological innovations in gene therapy. Viral vectors play an essential role in optimising the treatment of various diseases by incorporating therapeutic genes into target cells.AAV vectors are extensively used in gene therapy and are witnessing significant growth due to their low immunogenicity.

The CRISPR/Cas9 and other tools segment is expected to grow at the highest CAGR of 21.40% in 2024. The dominance of the segment is due to growing investments in research and development coupled with the surging pipeline of cell and gene therapies. Furthermore, the application of CRISPR/Cas9 and other gene editing technologies is transforming cell and gene therapies.

Therapeutic Area Insights

The oncology segment dominated the market with 48.30% share in 2024. The dominance is credited to the innovative program focusing on clinical evaluation to help expedite the development of transformative cancer therapies with modern technologies and curative potential. The therapeutic approach includes CAR-T cells, TCR-T cells, Tumor-Infiltrating lymphocytes, and Oncolytic virus therapy.

The neurology segment is expected to grow at the highest CAGR of 18.70% in 2024. The dominance of the segment can be attributed to the surge in incidence of neurological disorders, innovations in gene editing technologies, and growing investments in cell and gene therapy research and development. The increasing number of clinical trials for neurological cells can impact overall segment growth positively.

End-User Insights

The biopharmaceutical companies segment led the market by holding 57.60% market share in 2024. The dominance of the segment can be driven by a growing number of clinical trials for cell and gene therapies, especially in oncology, along with the supportive regulatory pathways from venture capitalists, which are further boosting the growth of the market.

The academic and research institutions segment is expected to grow at the highest CAGR of 15.90% in 2024. The dominance of the segment can be linked to the growing complexity of cell and gene therapies coupled with the substantial investments in biopharmaceutical R&D, especially in advanced therapies, which are boosting the demand for specialized CDMO services to promote R&D efforts.

Cell and Gene Therapy CDMO Market Top Market Companies

- Avid Bioservices

- Catalent

- Charles River Lobaoraties

- Curia

- Emergent BioSolutions

- Eurofins

- FUJIFILM Diosynth Biotechnologies

- Genscript

- Lonza

- Pfizer CentreOne

- Recipharm

- Syngene

- Thermo Fisher Scientific

- Wacker

- WuXi Biologics

Latest Announcements by Industry Leaders

- In September 2024, Dr. Frank Mathias, Chief Executive Officer of OXB, said, “The launch of our new brand identity reinforces OXB's significant transformation into a leading pure-play cell and gene therapy CDMO. This rebranding is more than just a new look – it reflects the global nature of our operations and our deep commitment to the success of our client's drug development programs.”

Recent Developments

- In September 2024, Oxford Biomedical, a quality and innovation-led cell and gene therapy CDMO, launched its new corporate brand. The company is unveiling a more modern and recognizable visual identity that reinforces its transformation into a global-pure-play cell and gene therapy CDMO.

- In October 2024, Teijin Limited and Hilleman Laboratories, a biotechnology company based in Singapore, launched a signing of a memorandum of Understanding (MoU) for establishing a strategic international business partnership. This collaboration aims to expand contract development and manufacturing organization business in the field of cell and gene therapy.

Segments Covered in the Report

By Type of Therapy:

- Gene Therapy

- Viral Vector-based Gene Therapy

- Non-viral Gene Therapy

- Gene Editing Therapies

- Cell Therapy

- Autologous Cell Therapy

- Allogeneic Cell Therapy

- Stem Cell Therapy

- CAR-T Therapy

- Other Cell Therapies

By Type of Manufacturing Service

- Development Services

- Cell Line Development

- Process Development

- Analytical Testing

- Regulatory Support

- Manufacturing Services

- Clinical Manufacturing

- Commercial Manufacturing

- Fill & Finish

- Other Services

- Supply Chain Management

- Packaging and Labeling

By Cell and Gene Therapy Modality

- Viral Vectors

- Adeno-associated Virus (AAV)

- Lentivirus

- Adenovirus

- Retrovirus

- Other Viral Vectors

- Non-Viral Vectors

- Plasmid DNA

- mRNA-based Therapies

- CRISPR/Cas9 and Other Gene Editing Tools

By Therapeutic Area

- Oncology

- CAR-T Therapies for Cancer

- Cancer Vaccines

- Neurology

- Gene Therapies for Neurological Disorders

- Gene Editing for Neurological Conditions

- Cardiovascular

- Gene Therapy for Heart Diseases

- Metabolic Disorders

- Gene Therapy for Rare Diseases

- Other Therapeutic Areas

- Musculoskeletal

- Ophthalmology

- Infectious Diseases

By End-User

- Biopharmaceutical Companies

- Large pharma companies outsourcing manufacturing

- Small and medium-sized biotech companies

- Academic and Research Institutions

- Contract Development & Manufacturing Organizations (CDMOs)

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content