What is Cell Therapy Market Size?

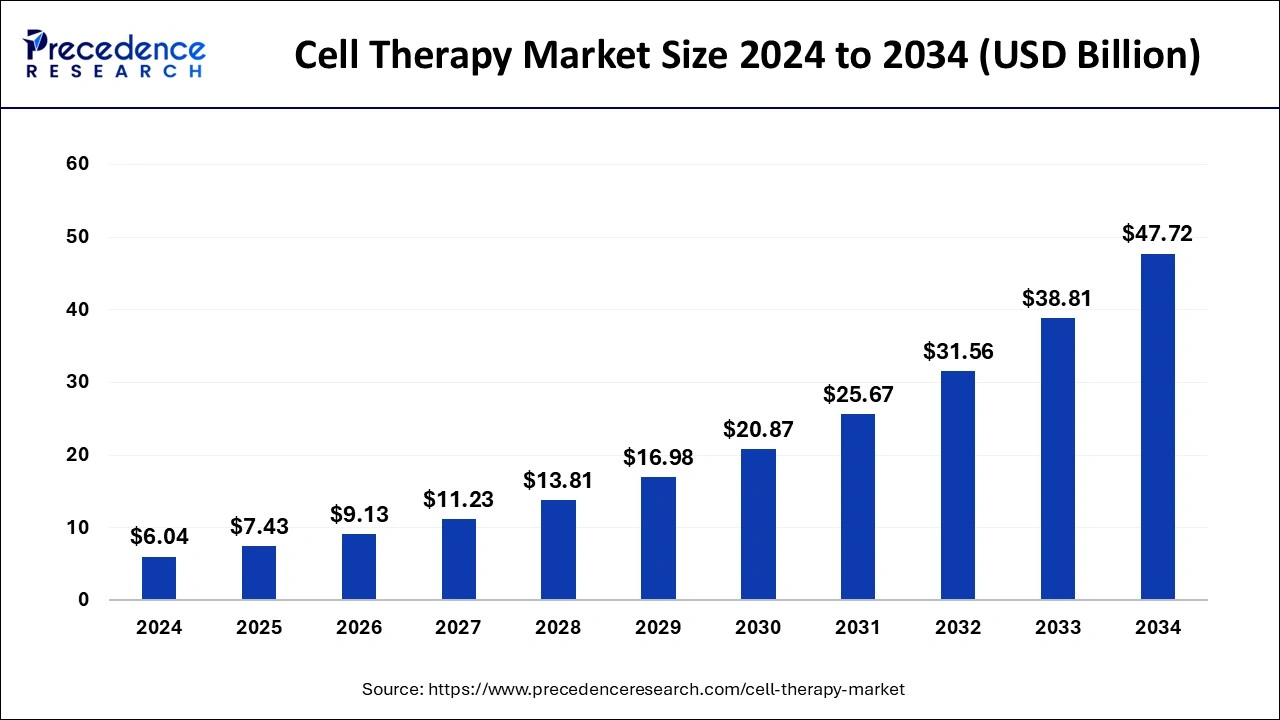

The global cell therapy market size is accounted for USD 7.43 billion in 2025 and is anticipated to reach around USD 47.72 billion by 2034, growing at a CAGR of 22.96% from 2025 to 2034.

Market Highlights

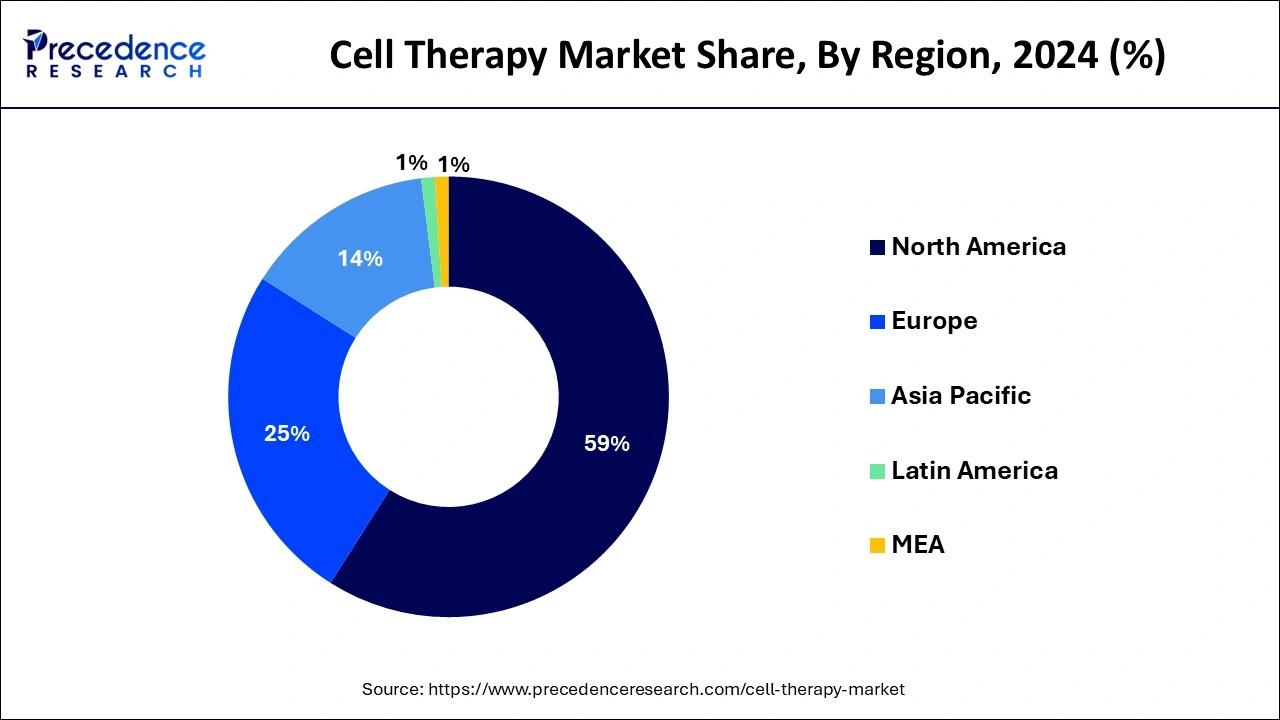

- North America dominated the global cell therapy market with the largest market share of 59% in 2024.

- Asia Pacific is expected to expand at a solid CAGR during the forecast period.

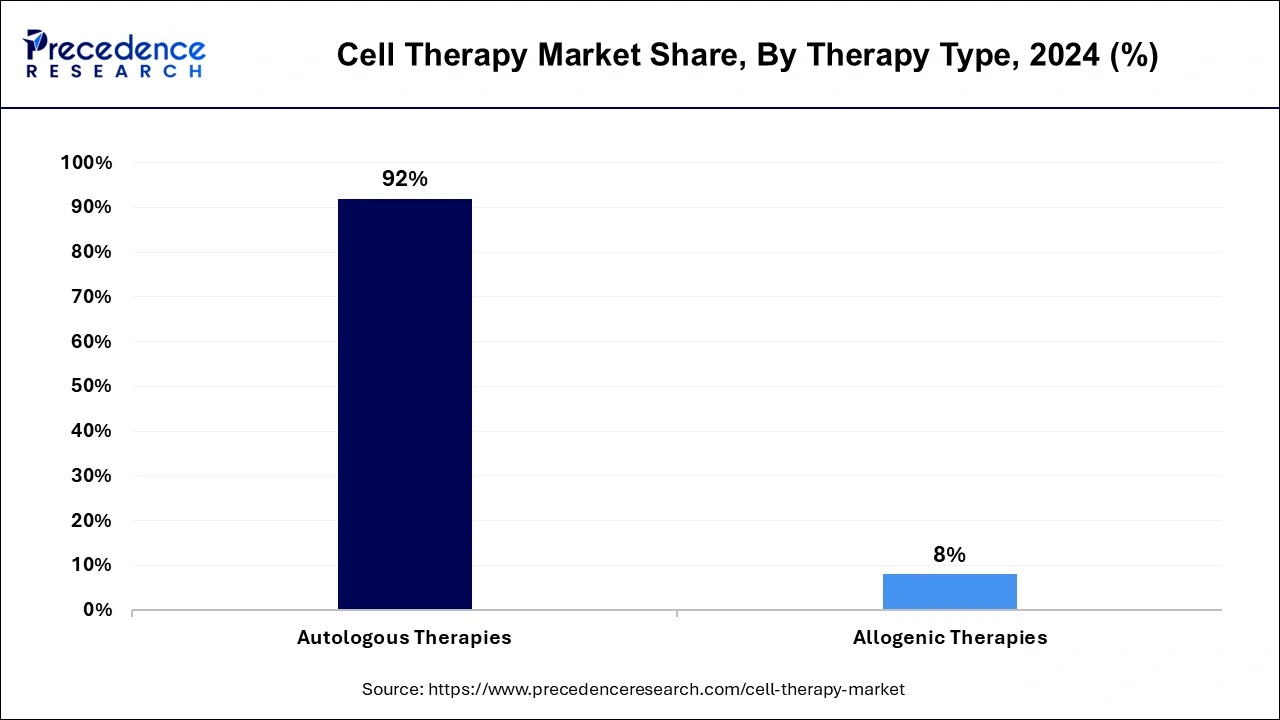

- By therapy type, the autologous therapies segment contributed the highest market share of 92% in 2024.

- By therapy type, the allogenic therapies segment is projected to grow at a solid CAGR during the forecast period.

- By user type, the research use segment led the global market in 2024.

- By user type, the clinical use segment is expected to grow at a notable CAGR during the forecast period.

Market Size and Forecast

- Market Size in 2025: USD 7.43 Billion

- Market Size in 2026: USD 9.13 Billion

- Forecasted Market Size by 2034: USD 47.72 Billion

- CAGR (2025-2034): 22.96%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What is the Cell Therapy Market?

What are the Latest Trends in Cell Therapy Market?

- Technological developments in cell therapy have gained the attention of various pharmaceutical companies, research institutes, and hospitals. Bone marrow transplantation, stem cell therapy are the most important reasons for the growth of the cell therapy market.

- The rising use of cell therapy has led to the development of various new therapies, out of which cellular regenerative therapy is the driver of the cell therapy market. Cellular regenerative therapy involves restoring the function of cells, tissues, or organs.

- AI plays a major role in gene therapy, as it can make target identification easy and accurate. AI and ML can be used to aim at specific targets that are responsible for causing the cancer, tumor, or any cytotoxic effect.

- The biotechnology sector growth, sector is rapidly growing due to rising awareness about the field and its importance.

How is AI Contributing to the Cell Therapy Market?

AI is a great asset to the cell therapy market in different areas, like making drugs faster; it expands the field, and the patient gets a better quality of life. It narrows down the differentiation of the cells and then predicts the best approach for the patient. AI also ensures the whole process of making the product is smooth through various methods, such as intelligent automation, quality control, and predictive maintenance.

Cell Therapy Market Growth Factors

The growth of global cell therapy market is attributed to the rising incidents of chronic disorders and infections. In addition, the growing cases of diabetes are also boosting the market growth. As per the International Diabetes Federation Diabetes Altas, almost 573 million persons globally had diabetes in 2022, with the number anticipated to grow by 643 million by 2033 and 783 million by 2045. Moreover, the growing number of research studies and clinical trials are also boosting the growth of global cell therapy market.

The global cell therapy market is also expanding due to stringent government regulations and guidelines. In addition, the growing investments for expansion of cell therapy market are paving way for the development of global cell therapy market. In July 2019, Bayer invested $215 million in Century Therapeutics, a biotechnology business established in the U.S. that aims to develop medicines for solid tumors and blood cancer. A $35 million donation from Versant Ventures and Fujifilm Cellular Dynamics boosted funding to $250 billion which is expected to help the sector to develop even more.

The government all around the world is constantly investing for the development of biopharmaceutical industry. This is directly impacting the growth of global cell therapy market. The key market players are collaborating with government agencies for the introduction of new cell therapies in the global market. In addition, market players are targeting developed and developing regions for the growth and development of global cell therapy market.On the other hand, the high cost of cell therapies is a major challenge for the expansion of global cell therapy market. Moreover, lack of skilled professionals also acts as restraint for the cell therapy market growth. However, the growth of global cell therapy market is expected in near future due to wide applications of cell therapy.

Market Outlook

- Industry Growth Overview: Chronic diseases and research and development have been the major contributors to the market's rapid growth (CAGR ~20%), together with the introduction of new technology.

- Sustainability Trends: Cost and environmental impact reduction through efficiency, automation, and closed systems setup in manufacturing are the focus areas.

- Global Expansion: North America is the leading market player at present, while Asia-Pacific, due to factors such as investments and improvements in healthcare infrastructure, is the region with the highest growth rate.

- Major Investors: The investment pool consists of large venture capital firms as well as pharmaceuticals, with OrbiMed, Bristol Myers Squibb, and Novartis AG being some of the key players.

- Startup Ecosystem: The environment for startups is characterized by innovation at very high levels, funding that keeps increasing, and collaborations that are strategic among biotech companies, research institutions, and investors.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 7.43 Billion |

| Market Size in 2026 | USD 9.13 Billion |

| Market Size by 2034 | USD 47.72 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 22.96% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | User Type, Therapy Type, End User,Cell type,Cell Source,Technology/manufacturing platform,Applicationand Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

User Type Insights

The research use segment led the global market in 2024. Cell therapy is widely used for research purposes. The growing research and development initiatives are driving the growth of the segment. In addition, key market players are highly investing in research projects. Not only market players are investing in research projects but also government agencies are collaborating for cell-based research projects. All of these factors are driving the growth of the segment.

The clinical use segment is expected to grow at a notable CAGR during the forecast period. Cell therapy is largely used for the treatment and diagnostics in some therapeutic areas such as malignancies, musculoskeletal therapies, autoimmune disorders, and dermatology. Thus, the growing number of clinical trials is boosting the segment's growth.

Therapy Type Insights

The autologous cell therapy segment held the largest share of 58.30% in the 2024 global cell therapy market. In the autologous cell therapy patient's own cells are used for treatment, controlling immune rejection and promoting personalized medicine. The segment is essential for burns, bone repair, cartilage damage, and blood cancers (CAR-T) conditions. The development in this therapy type is steered by regulatory approvals and rising demands. The segment also faces challenges, but the advancement in continuous production techniques and scaled-out manufacturing is developing rapidly to reach the massive number of treatments and clinical trials.

The allogenic therapies segment is projected to grow at a solid CAGR during the forecast period. The segment is growing due to increasing research and development activities. Moreover, market players are adopting unique strategies for segment growth. For example, SpringWorks and Allogene Therapeutics Inc. signed a clinical trial partnership agreement in January 2020 for the investigation of ALLO-715 in patients with multiple myeloma who are also taking Nirogacestat.

Cell type Insights

The stem cells segment held the largest share of 65.70% in the 2024 global cell therapy market. The stem cells' potency to differentiate and self-renew into a mature cell is steering the global cell therapy. The segment provides treatments for degenerative disease via regenerative medicine that repairs tissue and also introduces tools for drug discovery. The major developments mainly focus on advancing the ability to provide stem cells effectively. Apart from this, the use of nanotechnology and the production of induced pluripotent stem cells (iPSCs) improve safety and precision. Other productions are mesenchymal, embryonic, and hematopoietic stem cells.

The non-stem cells segment is expected to grow at a CAGR of 12.40% during the forecast period. The non-stem cells segment is also emerging with its immune modulation for numerous diseases and the targeted cellular replacement. The global cell therapy includes immune cells like NK, dendritic, and T cells, and other somatic cells, such as chondrocytes are established from the isolated human cells, extended, and later provided to patients for the treatment. Beta cells are essential, acting as an epicenter for recovery from diabetes, and fibroblasts are crucial as a significant cell source for cell therapy.

Cell Source Insights

The bone marrow segment held the largest share of 34.60% in the 2024 global cell therapy market. The bone marrow cells, mesenchymal stem cells (MSCs), and hematopoietic stem cells (HSCs) are a complex source for cell therapy. MSCs have the capability in regenerative medicine with their differentiation into numerous cell types, and HSCs help in the restoration of the immune and blood systems after transplantation, especially for blood cancers. The development in bone-marrow-based cell therapies has accelerated, with its early transplantation shifting to critical regenerative treatments with the rapid contribution of the global infrastructure.

The engineered/genetically modified cells segment is expected to rise at a CAGR of 14.20% during the forecast period. The segment in cell therapy is gaining traction with its genetic material from a donor cell. With viral or non-viral vector method, the modification takes place to provide therapeutic genes and enable potential roles in major diseases such s cancer, by monitoring the immune system and introducing regeneration. The development of genetically modified cells in global cell therapy is encompassed by the approved treatments, such as CAR-T cells for blood cancer, and their continuous research in regenerative medicine applications, like tissue repair.

Technology/manufacturing platform Insights

The viral vector technology segment held the largest share of 36.90% in the 2024 global cell therapy market. The viral vector technology plays a crucial role in global cell therapy by serving as a delivery source to make genetic material reachable from one end to specific cells, providing treatments for numerous cancers, genetic disorders, and other diseases. The ongoing development of this technology has enhanced vector efficiency, potency, and safety to focus on specific cells that will lead to an increase in approved therapies. The major vectors, such as lentivirus (LV) and adeno-associated virus (AAV), have been introduced to overcome certain challenges.

The gene editing tools segment is expected to grow at a CAGR of 15.10% during the forecast period. The gene editing tools, such as ZFNs, CRISPR-Cas9, and TALENs, are crucial in cell therapy for implementing accurate and important changes to DNA, delivering the development of advanced treatments for cancer and genetic disorders. The tools enable modification of patient cells to set accurate mutations that improve immune responses against the cancer or introduce universal cell therapies by editing donor cells to avoid rejection. The technological development, mainly in CRISPR-Cas9, has leveraged the segment.

Application Insights

The oncology segment held the largest share of 43.80% in the 2024 global cell therapy market. In oncology, cell therapy uses modified immune cells, such as stem cells and CAR-T cells, to fight and end cancer cells. The rising hematologic cancers (eg, Lymphoma, myeloma, leukemia) and solid tumors (eg, melanoma, lung cancer, glioblastoma) have largely contributed to the growth of the global cell therapy. Additionally, the development aims to discover more effective and personalized treatments for solid and blood tumors by designing cells for specific scenarios and discovering new types of cells, such as NK cells.

The neurological disorders segment is expected to rise at a CAGR of 13.50% during the forecast period. The cell therapy carries a transitioning ability for neurological disorders such as stroke, spinal cord injury, parkinson's, and Alzheimer's disease, with its replacement potency of the damaged cells and revealing the protective factors. The developed mesenchymal stem cells (MSCs) and induced pluripotent stem cells (IPSCs) are major cell types enabling different cell sourcing and scalability. These pave the way for cell therapy's advancement concerning the rising neurological disorders.

End user Insights

The hospitals and clinics segment held the largest share of 40.20% in the 2024 global cell therapy market. The hospitals and clinics are largely adopting cell therapy to their portfolio to meet the advanced needs of treatment and the demand for precision therapy. The segment is an epicenter of global cell therapy development. The patient enrollment in clinical trials needs clinics, and the storage/receiving of finished cell products requires hospital space. Wherein the academic medical centers have potentially pioneered these therapies. The vast infrastructure development is essential in all medical centers for endless processes like shipment, storage, collection, infusion, and preservation to further succeed in covering use and patient reach.

The biopharmaceutical and biotechnology company segment is expected to grow at a CAGR of 12.80% during the forecast period. The biopharmaceutical and biotechnology companies are at the center of the evolution of cell therapy, empowering innovation via advancements such as engineered cell production and CRISPR gene editing. The segment has targeted personalized treatment of diseases and accelerated scaling and manufacturing of the critical therapies. The key role of these companies involves significant investment in R&D, collaboration with emerging firms, and addressing challenges related to accessibility and cost to broaden the availability of effective treatments for patients worldwide.

Regional Insights

U.S. Cell Therapy Market Size and Growth 2025 to 2034

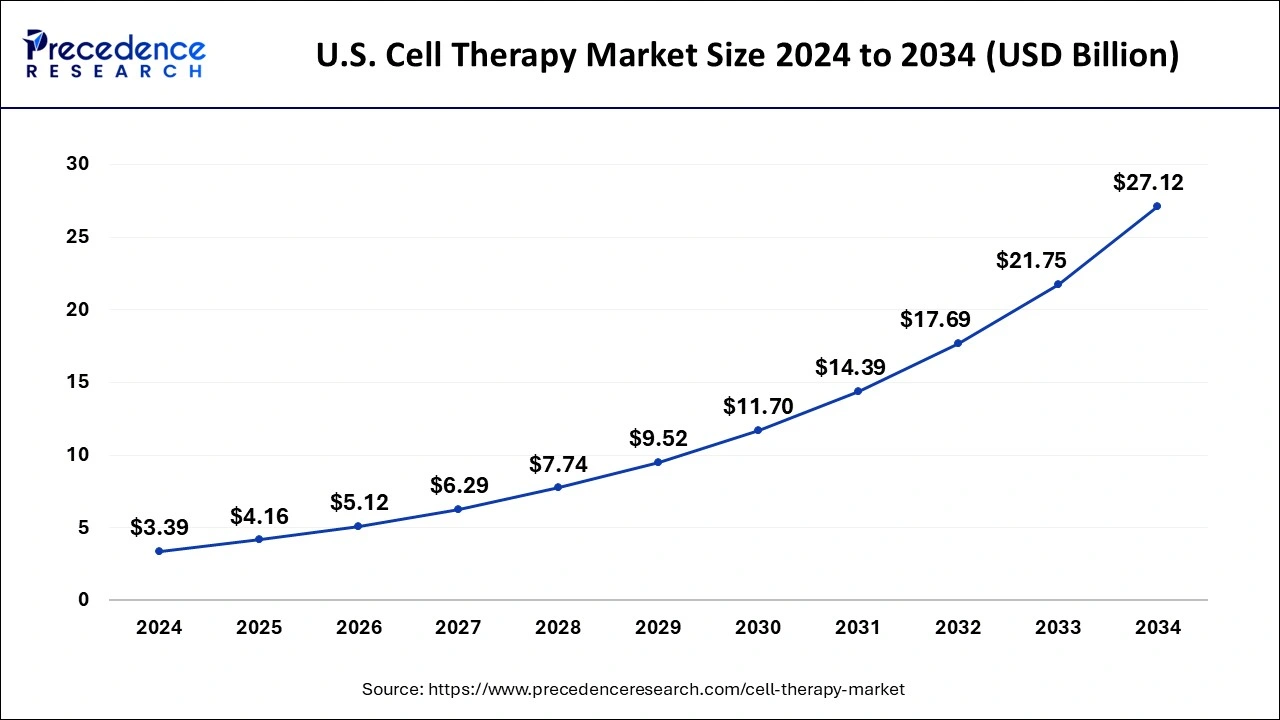

The U.S. cell therapy market size is evaluated at USD 4.16 billion in 2025 and is predicted to be worth around USD 27.12 billion by 2034, rising at a CAGR of 23.11% from 2025 to 2034.

United States Cell Therapy Market Trends:

The United States remains the main player in the field of cell therapy with its well-developed R&D capabilities, active academic collaborations, and large venture investments. The ecosystem encourages translational research, making it easier for clinics to adopt practices and for products to be innovated. Growing patient awareness and digital adoption are making advanced treatments more accessible; therefore, the U.S. is setting the standard for the world in terms of these therapies.

How is North America Leading in the Cell Therapy Market?

North America dominates the world cell therapy market by a wide margin with its excellent technology integration and medical infrastructure. The presence of a lot of research activities, quick adoption of innovations, and good partnerships between the biotech industry and research labs are the main reasons for the market being in this position. Besides, the supportive government policies and the amazing investment environment are factors that contribute even more to the region's clinical development and commercialization leadership.

North America dominated the global cell therapy market with the largest market share of 59% in 2024. Factors such as rising incidents of chronic disorders and growing investments for the development of cell therapy market in the U.S. Cellino Biotech, an autonomous cell treatment manufacturing firm obtained a first investment round of $80 million in January 2022. Cellino wants to make stem cell-based medicines more accessible with the goal of building the first self-contained human cell foundry by 2025. In addition, the cell therapy market in North America region is also being driven by growing applications of stem cell technologies for the treatment of various diseases. Moreover, the growing research and development activities are boosting the growth of North America cell therapy market.

How is Asia-Pacific Performing in the Cell Therapy Market?

Asia-Pacific is experiencing an enormous turnover mainly due to the increasing biomanufacturing capacity, supportive policies, and huge patient populations. The sector is getting more and more funding, clinical trial diversity, and public-private collaborations, which are speeding up the process of innovation. Local governments in the region put a lot of emphasis on production, affordability, and regulatory harmonization, which in turn lead to the adoption of cell therapy and the region being recognized as a future hegemon in the development of regenerative healthcare.

Asia-Pacific is expected to develop at the fastest growth rate 16% during the forecast period. China dominates the cell therapy market in Asia-Pacific region. The favorable government regulations are contributing towards the growth of cell therapy market in this region. Asia-Pacific has a great potential for market expansion, as it accounted for roughly 4.6 billion of the world human population in 2019, which might act as a prospective patient base. Furthermore, emerging nations such as China and India are predicted to grow as a result of improved healthcare facilities, low cost, and increased knowledge of cell therapy.

China Cell Therapy Market Trends:

The cell therapy market in China is going through a transformation due to its involvement in research, production, and regulatory reforms. Partnership between the university, the ministry, and the company is a catalyst for both innovation and market penetration. The growth of clinical infrastructure with the necessary human resources and the development of communications between countries will strengthen China's global position in the field of cell-based treatments and enable patients to get access to the very latest in regenerative therapies.

India Cell Therapy Market Trends

The growing medical sector and improvements and innovations in the country boost the growth of the market. Rising ethical considerations and regulatory guidelines in the country promote the focus on cell therapy technology with advances by technological advancement in the field, like integration of artificial intelligence (AI) and machine learning, as they help in accuracy and precision. These applications boost the growth of the market and help in the expansion of the country.

What are the Driving factors of the Cell Therapy Market in Europe?

Europe's rapid growth is mainly through the collaboration between research organizations, academic networks, and biopharma companies. The combination of supportive regulations, technological maturity, and increasing activity in clinical trials leads to innovation. Europe's investments in the areas of automation, sustainability, and digital manufacturing reinforce its position as a major global center for cell-based therapies covering both regenerative medicine and chronic disease management.

Germany Cell Therapy Market Trends:

Germany's market growth is mainly supported by innovations in precision medicine and improved manufacturing systems. There is a very strong collaboration between academia and industry, which leads to the development of stem cell treatments and the production on an industrial scale. Local and international biotech companies are forming strategic alliances, which in turn promote innovation. Besides that, the initiatives in healthcare modernization are opening up new markets for regenerative and therapeutic technologies, turning the country into a more competitive player globally.

Value Chain Analysis

- R&D: Derived from preclinical investigations and exploration of cellular mechanisms, the discovery of possible therapies.

Key Players: Novartis, Gilead Sciences (Kite Pharma), Takeda Pharmaceutical

- Clinical Trials and Regulatory Approvals: The phases of testing in humans to determine safety and efficacy, plus getting legal permission.

Key players: IQVIA and Parexel

- Formulation and Final Dosage Preparation: Medicinal formulations made of active cells were turned into stable and patient-ready ones.

Key Players: Lonza, Thermo Fisher Scientific (Patheon)

- Packaging and Serialization: The packaging and the tracing were made ultra-secure for quality assurance and regulatory compliance.

Key Players: Cryoport, Peli BioThermal, and Marken

- Distribution to Hospitals, Pharmacies of Cell Therapy: Timely, safe delivery of temperature-sensitive therapies through specialized logistics that ensure their quality over time.

Key Players: McKesson, AmerisourceBergen, and Cardinal Health

Cell Therapy Market Companies

- Kolon TissueGene Inc.

- JCR Pharmaceuticals Co. Ltd

- Castle Creek Biosciences Inc.

- Anterogen Co. Ltd

- The Future of Biotechnology

- Celgene Corporation

- Tameika Cell Technologies Inc.

- Cells for Cells

- MEDIPOST

- NuVasive Inc.

Recent Developments

- In November 2025, Bharat Biotech International Ltd entered the cell and gene therapy sector by launching Nucelion Therapeutics Pvt Ltd, a wholly owned CRDMO dedicated to research, development, and manufacturing in this field. (source: https://scanx.trade)

- In November 2025,StemCyte International launched its Public Bank Matching Protection Service in Taiwan, partnering with Taishin Life to connect life insurance with public cord blood resources, enhancing transplant protection for families. (Source:https://www.prnewswire.com)

Segments Covered in the Report

By Therapy Type

- Autologous Cell Therapy

- Allogeneic Cell Therapy

By Cell Type

- Stem Cells

- Hematopoietic Stem Cells (HSCs)

- Mesenchymal Stem Cells (MSCs)

- Embryonic Stem Cells (ESCs)

- Induced Pluripotent Stem Cells (iPSCs)

- Non-Stem Cells

- Immune Cells

- T cells

- NK cells

- Dendritic cells

- Fibroblasts

- Chondrocytes

- Beta cells

- Immune Cells

By Cell Source

- Bone Marrow

- Adipose Tissue

- Peripheral Blood

- Umbilical Cord Blood

- Placental Tissue

- Embryonic Cells

- Engineered/Genetically Modified Cells

By Technology / Manufacturing Platform

- Viral Vector Technology

- Non-Viral Methods

- Gene Editing Tools

(e.g., CRISPR, TALENs, ZFNs) - 3D Cell Culture

- Cell Expansion & Isolation Technologies

- Automated Cell Processing Systems

By Application

- Oncology

- Hematologic cancers (e.g., leukemia, lymphoma, myeloma)

- Solid tumors (e.g., glioblastoma, melanoma, lung cancer)

- Cardiovascular Diseases

- Neurological Disorders

(e.g., Parkinson's, spinal cord injury, stroke) - Orthopedic Disorders

(e.g., cartilage regeneration, osteoarthritis) - Autoimmune Diseases

(e.g., Type 1 diabetes, Crohn's disease, multiple sclerosis) - Infectious Diseases

- Metabolic Disorders

- Wound Healing & Dermatology

- Others

(e.g., liver diseases, ophthalmology, renal disorders)

By End User

- Hospitals & Clinics

- Academic & Research Institutes

- Cell Therapy Manufacturing & Processing Centers

- Biopharmaceutical & Biotechnology Companies

- Specialty Care Centers / Regenerative Medicine Clinics

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting