What is the Cell Cryopreservation Market Size?

The global cell cryopreservation market size is worth over USD 1,640.9 million in 2025 and is expected to grow from USD 1,818.3 million in 2026 to nearly USD 4,492.5million by 2034, growing at a CAGR of 11.8%from 2025 to 2034. The prolonged advantages in preserving fertility and cells for research and development, protecting cell quality and efficacy, and developing new biologics like vaccines accelerate the progress of the cell cryopreservation market.

Cell Cryopreservation Market Key Takeaways

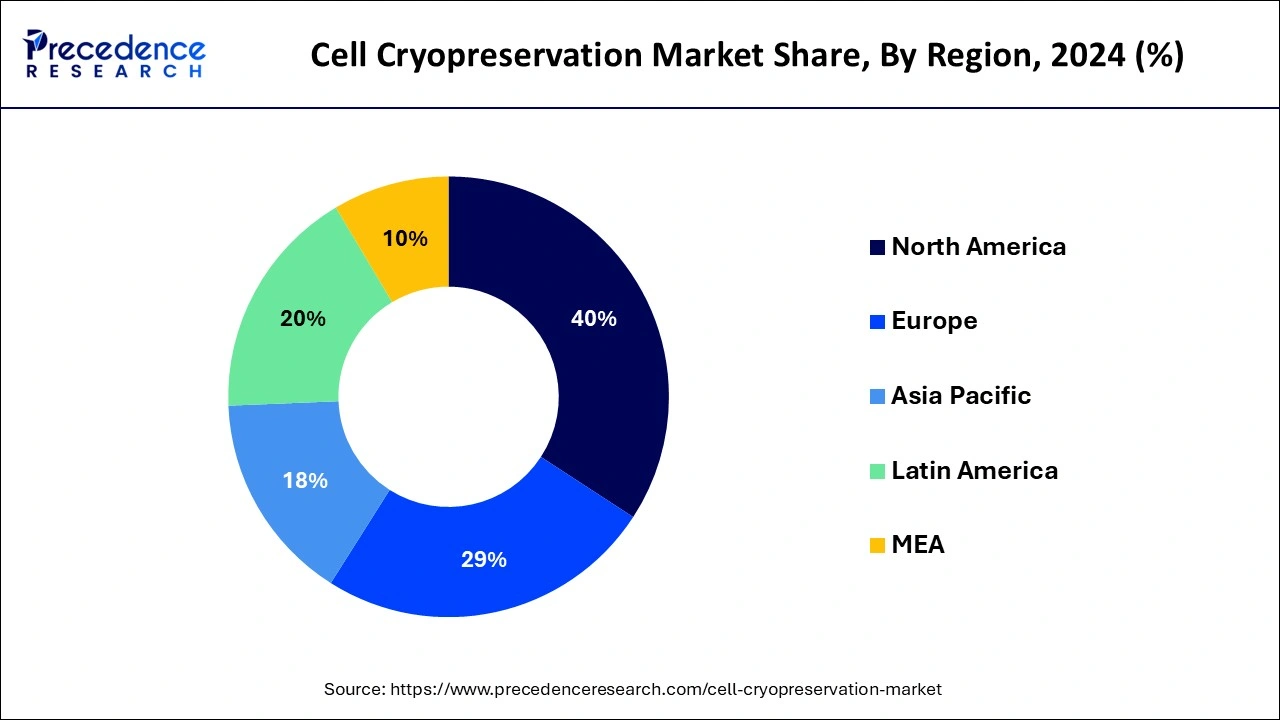

- North America dominated the global cell cryopreservation market with the largest market share of 45.8%in 2024..

- Asia Pacific is estimated to expand at the fastest CAGR of 13.7% from 2025 to 2034.

- By type, the consumables segment has held the largest market share of 43.2%in 2024.

- By type, the cell freezing media segment is anticipated to grow at a remarkable CAGR of 13.4%between 2025 and 2034.

- By application, the stem cells segment held the major market share of 43.0% in 2024.

- By application, the sperm cells segment is expected to expand at the fastest CAGR of 13.5% from 2025 to 2034.

- By end-user, the IVF clinics segment generated the biggest market share of 32.4%in 2024.

- By end-user, the biobanks segment is expected to grow at a double-digit CAGR of 12.0% from 2025 to 2034.

Market Size, Growth, and Forecast 2025 to 2034

- Market Size in 2025: USD 1,640.9Million

- Market Size in 2026: USD 1,818.3Million

- Forecasted Market Size by 2034: USD 4,492.5Million

- CAGR (2025-2034): 11.80%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Market Overview

The cell cryopreservation market involves the preservation of cells at extremely low temperatures, typically below -130°C, to maintain their viability for various applications, such as regenerative medicine, drug discovery, and biobanking. This process prevents cellular damage and allows for long-term storage.

Key players in the market provide cryopreservation solutions, including specialized freezing equipment, cryoprotectants, and services. The market's growth is driven by increasing applications in stem cell research, organ transplantation, and vaccine development, with a focus on preserving cells' functional integrity and enabling their use in diverse biomedical fields.

The cell cryopreservation refers to preserving cells, tissues, organelles, or any biological constructs in cool conditions or very low temperatures to maintain their viability and efficiency. This market is achieving high demand and success by the use of cryoprotective agents and temperature control equipment. Thermo Fisher Scientific Inc., GE Healthcare, BioLife Solutions Inc., Takara Bio Inc., Cardinal Health Inc., etc. are the prominent industries in this market. In October 2024, Nucleus Biologics announced the launch of a chemically defined cryomedia set named NB-KUL™ DF which is DMSO-free and aims to redefine cryopreservation standards.

Impact of Artificial Intelligence on the Cell Cryopreservation Market

Artificial intelligence, advanced sensors, machine learning algorithms, and other AI-driven systems allow the continuous and real-time monitoring of storage environments which can detect slight changes and optimal conditions. AI can predict threshold levels of liquid nitrogen and provide early warnings to staff members. The use of AI-enhanced cryopreservation monitoring systems reduces sample damage. A regulatory compliance and data management are offered by AI monitoring. AI technology offers reliability and safety in cryopreservation methods.

Cell Cryopreservation Market Growth Factors

- Increasing applications in stem cell research, organ transplantation, and vaccine development drive the demand for cell cryopreservation solutions.

- The rising importance of biobanks for storing cells for research and clinical purposes contributes to market growth.

- The expanding field of cellular therapies, including CAR-T cell therapies, propels the need for effective cell cryopreservation methods.

- The emphasis on precision medicine and personalized treatments creates opportunities for cell cryopreservation in preserving patient-specific cells.

- Ongoing developments in freezing equipment and cryoprotectants enhance the efficiency of cell cryopreservation methods.

- Rising Demand for Personalized Medicine: The focus on personalized medicine fuels the need for long-term cell storage and cryopreservation solutions.

- The industry witnesses a trend towards incorporating automation and robotics in cryopreservation processes for increased efficiency.

- The move towards serum-free cryopreservation methods addresses concerns related to cellular damage and introduces more sustainable practices.

- Opportunities exist for companies developing novel cryopreservation technologies and solutions.

- Providing specialized cryopreservation services for biobanking facilities presents a niche business opportunity.

- Companies can explore opportunities by expanding their cryopreservation services globally to meet the increasing international demand.

- Collaborating with research institutions for joint ventures and technology transfer initiatives opens avenues for market growth.

Market Scope

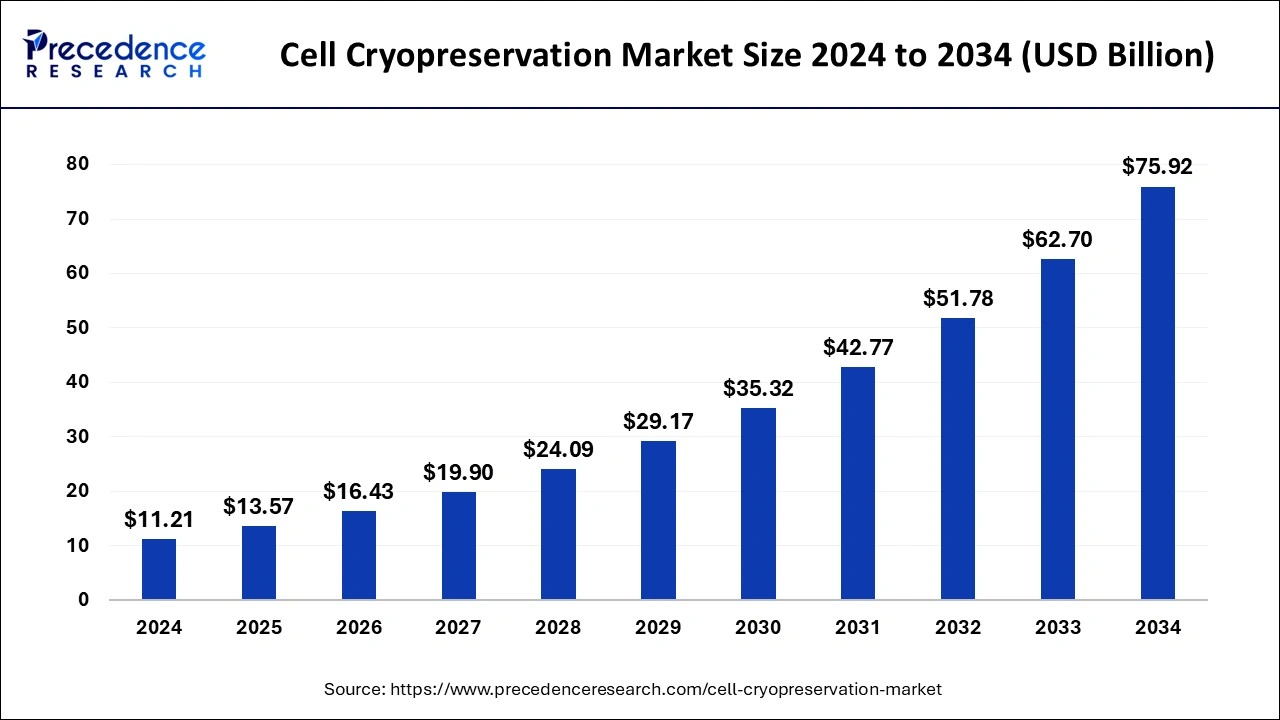

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 21.08% |

| Market Size in 2025 | USD 13.57 Billion |

| Market Size by 2034 | USD 75.92 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Application, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing biobanking activities and advancements in cellular therapies

Growing biobanking activities and advancements in cellular therapies are significant drivers surging the demand for the cell cryopreservation market. The expanding biobanking landscape, where biological samples are stored for research and clinical purposes, necessitates effective cell cryopreservation methods to maintain the viability and functionality of diverse cell types over extended periods. Biobanks serve as repositories for valuable cellular materials, including stem cells and tissues, driving the need for robust cryopreservation solutions to ensure the long-term integrity of stored specimens.

Advancements in cellular therapies, particularly in CAR-T cell therapies, further amplify the demand for cell cryopreservation. Cellular therapies involve the manipulation and infusion of patient-specific or donor-derived cells, requiring precise preservation methods to maintain their therapeutic efficacy. As cellular therapies expand, the reliance on cryopreservation for preserving these specialized cells grows, reflecting a symbiotic relationship between the cell cryopreservation market and the evolving landscape of biobanking and cellular-based therapeutic innovations.

Restraint

Cell damage concerns and technical complexity

Cell damage concerns pose a significant restraint for the cell cryopreservation market. The process of freezing and thawing cells inherently carries the risk of cellular damage, impacting their structural integrity and functionality. Cryoprotectants, while essential for preventing ice crystal formation, can introduce additional stress on cells. Ensuring minimal damage during cryopreservation is a complex challenge, particularly for delicate cell types crucial in biomedical applications. Addressing these concerns is pivotal for maintaining the viability and efficacy of preserved cells, as damaged cells may compromise the success of applications in regenerative medicine, drug development, and biobanking.

Technical complexity represents a formidable obstacle in the widespread adoption of cell cryopreservation methods. The intricacies involved in precisely controlling freezing and thawing rates, selecting optimal cryoprotectants, and customizing protocols for diverse cell types make the process technically challenging. Standardizing cryopreservation procedures across different cell lines and applications is intricate due to the diverse requirements of various cells. This complexity not only hinders uniform practices but also necessitates specialized expertise, limiting the accessibility and ease of implementation for researchers and organizations seeking to leverage cryopreservation technologies.

Opportunity

Advancements in cryoprotectants and freezing techniques

Advancements in cryoprotectants and freezing techniques are key drivers propelling the demand for the cell cryopreservation market. Continuous research and development efforts in cryoprotectant formulations and freezing methodologies are revolutionizing the field, ensuring enhanced cell viability and functionality post-thaw. Innovative cryoprotectants with improved properties, such as reduced cytotoxicity and increased permeability, contribute to minimizing cellular damage during the freezing and thawing process.

These advancements cater to the evolving needs of diverse applications, including regenerative medicine, stem cell research, and cellular therapies. The ability to preserve cells with greater efficiency and minimal damage not only expands the scope of cryopreservation across various biomedical disciplines but also aligns with the growing demand for precision medicine. As cellular-based therapies gain prominence, the market experiences a surge in demand for advanced cryopreservation techniques, reflecting the pivotal role these innovations play in ensuring the therapeutic efficacy of preserved cells in groundbreaking medical interventions.

Market Segmentation Insights

Type Insights

The consumables segment held 43.2% market share in 2024. Consumables in the cell cryopreservation market refer to the materials used in the cryopreservation process, including cryovials, cryobags, and labels. These consumables are designed to ensure the safe and efficient storage of cells during freezing and thawing. Trends in consumables involve the adoption of specialized containers with improved insulation properties and the development of eco-friendly, single-use options to address sustainability concerns in the cryopreservation workflow.

The cell freezing media segment is anticipated to expand at a significant CAGR of 13.4%during the projected period. Cell freezing media in the cell cryopreservation market are formulations designed to protect cells during the freezing process. These media typically contain cryoprotectants and other additives to minimize ice crystal formation and cellular damage.

Trends in cell freezing media include the use of serum-free formulations, allowing for more defined and controlled cryopreservation conditions. Additionally, there is a focus on optimizing media compositions to enhance post-thaw cell viability and functionality, catering to the evolving needs of various applications in biobanking and biomedical research.

Application Insights

The stem cells segment held the largest market share of 43.0%in 2024. In the cell cryopreservation market, the preservation of stem cells is a critical application. Cryopreservation of stem cells, renowned for their regenerative capabilities, is integral to applications in regenerative medicine and therapeutic interventions.

A notable trend encompasses the formulation of specialized cryopreservation protocols tailored to distinct types of stem cells. These protocols are designed to uphold the viability and functionality of stem cells throughout the freezing and thawing processes. This trend significantly contributes to the progression of regenerative therapies, ensuring that preserved stem cells retain their regenerative potential, thereby fostering advancements in the field of regenerative medicine.

On the other hand, the sperm cells segment is projected to grow at a significant CAGR of 13.5%from 2025 to 2034. Cell cryopreservation plays a vital role in preserving sperm cells, primarily utilized in reproductive medicine. The market trend focuses on optimizing cryopreservation techniques for sperm cells, addressing factors such as motility and DNA integrity. This aligns with the increasing demand for assisted reproductive technologies, offering solutions for fertility preservation and aiding in various reproductive interventions.

End-user Insights

The IVF clinics segment generated the biggest market share of 32.4%in 2024. In the cell cryopreservation market, IVF clinics are significant end-users, utilizing cryopreservation to store embryos, eggs, and sperm for assisted reproductive technologies. A notable trend involves the increasing adoption of vitrification, a rapid freezing technique, for improved cell survival rates during thawing. This trend aligns with the rising demand for fertility preservation and the broader acceptance of in vitro fertilization methods.

The biobanks segment is expected to grow at a double digit CAGR of 12.0% between 2025 and 2034. Biobanks play a crucial role by storing diverse cell types for research and therapeutic purposes. A trend in biobanking involves incorporating automated cryopreservation systems for streamlined and standardized cell storage, enhancing the efficiency of large-scale storage initiatives. This trend addresses the challenges related to manual processes and supports the growing demand for well-preserved cell samples in various research domains.

Regional Landscape

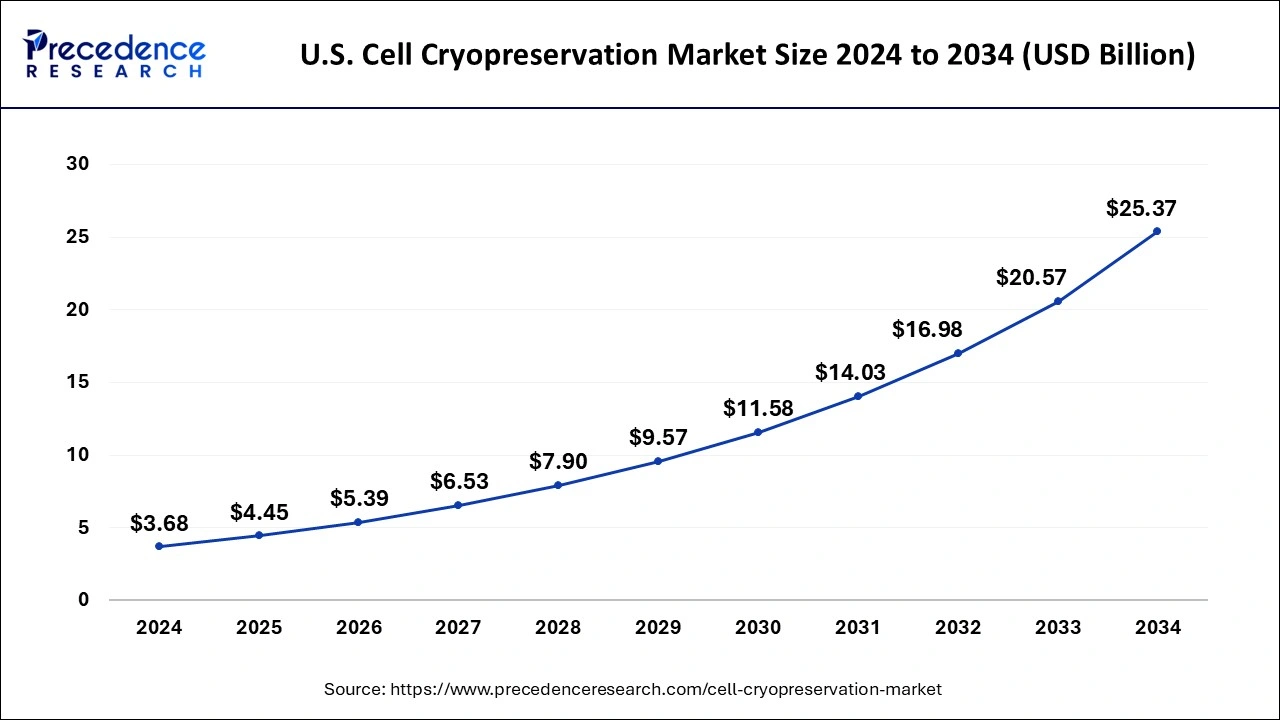

U.S. Cell Cryopreservation Market Size and Growth 2025 to 2034

The U.S. cell cryopreservation market size is projected to surpass over USD 1,998.7 million by 2034, increasing from USD 677.7 million in 2025, expanding at a notable CAGR of 11.3% from 2025 to 2034.

North America dominated the global cell cryopreservation market with the largest market share of 43.0%in 2024. In North America, the cell cryopreservation market is marked by a strong emphasis on technological innovation and extensive research in cryopreservation methods. The region witnesses a surge in demand for advanced freezing techniques and cryoprotectants, driven by a robust biomedical research sector and theincreasing adoption of personalized medicine. Strategic collaborations between industry players and research institutions contribute to the rapid evolution of cryopreservation technologies in North America.

The presence of several cryopreservation product manufacturers in the North American region is driving the market's growth remarkably. Moreover, advanced medical infrastructure, developed economies, and established supply channels propel the demand and need for cryopreservation solutions. The preservation of cells allows the design and development of innovative products in healthcare due to the rising incidence of diseases and the expansion of the elderly population in this region. The growing demand for personalized pharmaceuticals surges the need for efficient cell storage solutions.

Asia Pacific is estimated to expand the fastest CAGR of 13.7%during the forecast period. Asia-Pacific exhibits dynamic trends in the cell cryopreservation market, with a notable focus on expanding biobanking activities and thegrowing influence of regenerative medicine. The region experiences a rise in demand for cryopreservation solutions in emerging economies, driven by a flourishing healthcare sector and increasing awareness of stem cell applications. Asia Pacific showcases a trend towards the adoption of automated cryopreservation systems, reflecting a forward-looking approach to technological integration in the field of cell preservation.

The growing adoption of cell cryopreservation technologies, especially in China and Japan drives the market's growth in the Asia Pacific region. The large regional population, the rising incidence of chronic diseases, the growing elderly population, and the growth in fertility cases are the major rationales behind the success of the cell cryopreservation industries in this region. The wide applications of this technique in protecting stem cells, oocytes, embryonic cells, sperm cells, and hepatocytes accelerate this market significantly.

In Europe, the cell cryopreservation market reflects a progressive landscape with a strong emphasis on sustainable practices. The region sees a surge in research collaborations and investments, fostering advancements in cryopreservation technologies. Growing adoption of serum-free cryopreservation methods and adherence to stringent regulatory standards define Europe's approach. The market is characterized by a commitment to ethical and high-quality cell preservation practices, aligning with the region's focus on advancing biomedical sciences.

Advancements in cryoprotectants and freezing techniques significantly boost the cell cryopreservation market by enhancing cell viability during freezing processes. Improved formulations mitigate cellular damage, broaden the scope of applications, and foster the development of more effective cryopreservation solutions. This, in turn, stimulates market growth, meeting the increasing demands of diverse biomedical disciplines.

Cell Cryopreservation Market Companies

- Thermo Fisher Scientific Inc.

- Merck KGaA

- GE Healthcare

- Lonza Group Ltd.

- STEMCELL Technologies Inc.

- BioLife Solutions, Inc.

- Cryolife, Inc.

- Organ Recovery Systems Inc.

- Custom Biogenic Systems

- Sartorius AG

- Takara Bio Inc.

- Chart Industries, Inc.

- Biocision, LLC

- Cardinal Health, Inc.

- Helmer Scientific

Recent Developments

- In April 2024, Pluristyx announced the launch of cryopreservation media named PluriFreeze to accelerate stem cell therapy development which is manufactured under Good Manufacturing Practice (GMP) as an innovative formulation.

- In September 2024, Colder Products Company (CPC) announced the launch of a new aseptic product known as micro-connector for its utilization in cell and gene therapy cryopreservation.

Market Segmentation

By Product

- Consumables

- Cell Freezing Media

- Equipment

- Others

By Application

- Stem Cells

- Oocytes and Embryotic Cells

- Hepatocytes

- Sperm Cells

- Others

By End User

- IVF Clinics

- Biobanks

- Biopharmaceutical and Pharmaceutical Companies

- Research Institutes

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content