What is Process Analytical Technology Market Size?

The global process analytical technology market size is calculated at USD 4.00 billion in 2025 and is projected to surpass around USD 11.01 billion by 2035, growing at a CAGR of 10.66% from 2026 to 2035.

Market Highlights

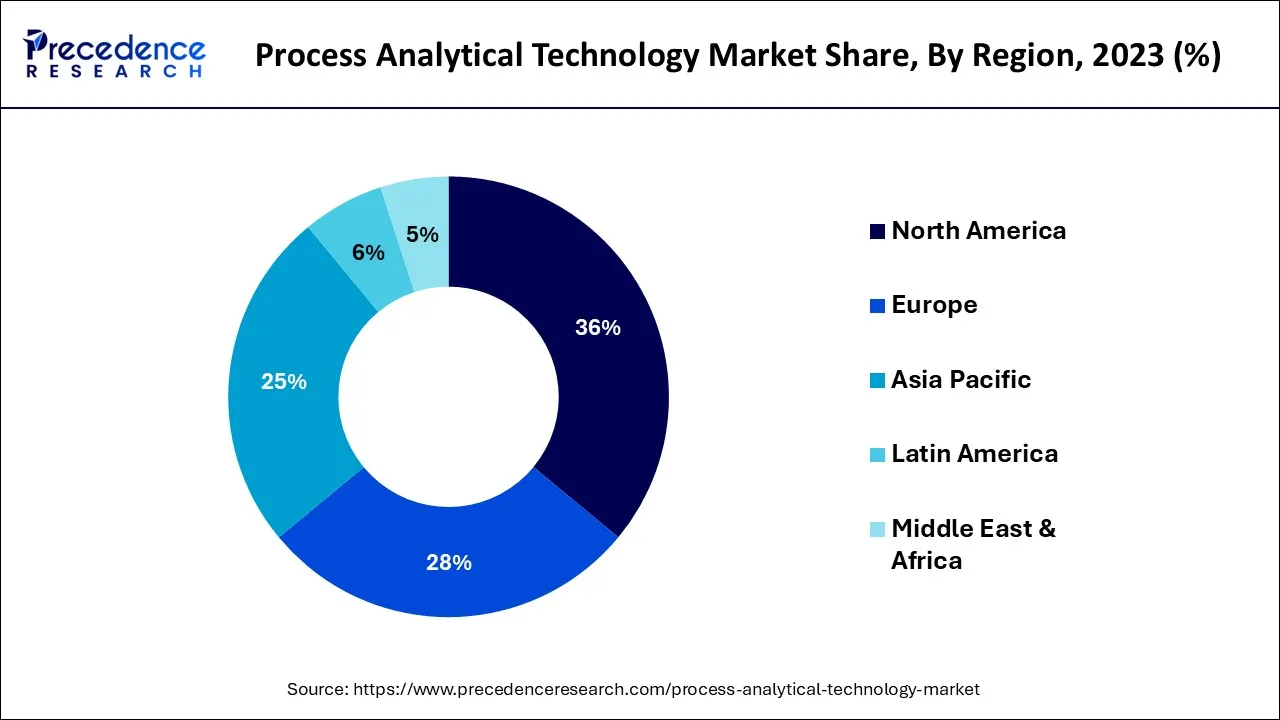

- North America led the global market with the highest market share of 36% in 2025.

- By Product, the analyzers segment is expected to generate the maximum market share between 2026 and 2035.

- By Technique, the spectroscopy segment is projected to capture the largest market share between 2026 and 2035.

- By Monitoring Method, the on-line segment is expected to record the highest market share between 2026 and 2035.

- By End-user, the pharmaceutical manufacturer segment is predicted to contribute the highest market share between 2026 and 2035.

Market Overview

Process analytical technology (PAT) is an advanced analytical system that monitors and controls manufacturing processes. The process analytical technology market refers to the industry developing, manufacturing, and commercializing analytical instruments and systems used for real-time process monitoring and control. These technologies help ensure the quality and consistency of products, improve production efficiency, and reduce manufacturing costs. PAT can be applied in various industries, such as pharmaceuticals, food and beverage, and chemicals.The process analytical technology market is driven by the increasing demand for high-quality products, the need to reduce production costs, and the growing regulatory pressure to ensure product safety and efficacy.

Furthermore, implementing PAT can help manufacturers improve product quality, reduce costs, increase efficiency, and comply with regulatory requirements, making it a valuable investment for many companies. Additionally, PAT helps to ensure that products meet the required quality standards. By monitoring and controlling the manufacturing process in real-time, manufacturers can identify issues and make adjustments to prevent product defects.

PAT can help manufacturers reduce costs by optimizing the production process and reducing waste. By monitoring the process in real time, manufacturers can identify and correct issues before they result in product defects, which can be costly to rectify. PAT can improve manufacturing efficiency by reducing production downtime and minimizing the need for manual interventions. This can lead to faster production times and increased overall output, which has fueled the growth of the global process analytical technology market over the last few decades.However, high development costs and a lack of skilled personnel are anticipated to impede the market growth. The high cost associated with implementing this technology. The equipment, software, and training required to implement PAT can be expensive and a barrier for some companies.

How is AI Impacting the Process Analytical Technology Market?

Artificial Intelligence is significantly transforming the market by enabling real-time data analysis, predictive monitoring, and process optimization. Machine learning algorithms can detect subtle patterns in production data, allowing manufacturers to anticipate deviations in critical quality attributes and adjust processes proactively. AI-driven analytics also improve integration with manufacturing execution systems (MES) and reduce manual intervention, enhancing efficiency and compliance. Overall, AI accelerates decision-making, increases process reliability, and drives the shift toward fully data-driven, smart manufacturing.

Process Analytical Technology Market Growth Factors

The demand for improved product quality and consistency by providing real-time monitoring and control of production processes is the factor that propelled the market demand. The various factors are helping to drive the market are the growing demand for quality control, industry 4.0 and the digitalization of manufacturing and increasing regulatory requirements.

Process Analytical Technology Market Outlook

- Industry Growth Overview: The process analytical technology market is expected to grow significantly between 2025 and 2034, driven by the increasing adoption of continuous manufacturing and Quality-by-Design (QbD) principles in the pharmaceutical and biotechnology sectors. Regulatory emphasis on real-time monitoring of critical quality attributes (CQAs) and process parameters (CPPs) is compelling manufacturers to implement PAT solutions on production lines. Additionally, the convergence of regulatory support, technological advancements, and industry modernization is creating a strong and sustainable growth trajectory for the market.

- Technological Innovation: The market is driven by innovations in spectroscopy, chromatography, chemometrics, and process sensors, enabling real-time observation and control of manufacturing processes. Companies like Thermo Fisher Scientific and Agilent Technologies are rapidly advancing AI-powered analytics and cloud-based PAT systems. The convergence of advanced hardware with intelligent software is transforming PAT from a compliance-focused tool into a strategic driver of manufacturing efficiency and quality.

- Global Expansion: Major PAT providers are expanding their presence in high-growth regions such as Asia-Pacific, Latin America, and the Middle East to capitalize on rising demand. The rapid expansion of biopharmaceutical manufacturing and contract development and manufacturing organizations (CDMOs) is driving strong PAT adoption in Asia-Pacific. Europe remains a key market, with Germany, Switzerland, and the UK hosting major manufacturing and research hubs that support sustained PAT deployment.

- Major Investors: The market is attracting significant attention from private equity and strategic investors due to its high margins, recurring service revenues, and regulation-driven demand. Investment activity is focused on analytics software, sensor technologies, and bioprocess monitoring solutions, with firms like KKR, Carlyle Group, and Warburg Pincus targeting companies offering integrated PAT platforms and advanced instrumentation. Additionally, startups introducing AI- and IoT-enabled process monitoring innovations are drawing growing venture capital, fueling R&D, international expansion, and commercialization of next-generation PAT technologies.

- Startup Ecosystem: The PAT startup ecosystem is rapidly maturing, focusing on high-precision sensors, AI-driven analytics, and miniaturized in-line monitoring technologies. Emerging companies are developing solutions to reduce sample preparation time, enhance predictive capabilities, and seamlessly integrate with manufacturing execution systems (MES). Innovators like Repligen Corporation and Sensirion AG are attracting venture capital to scale production and expand into new geographies. Collaborations between startups, established PAT vendors, and contract manufacturers are accelerating technology adoption and speeding up knowledge transfer across the industry.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.00 Billion |

| Market Size in 2026 | USD 4.43 Billion |

| Market Size by 2035 | USD 11.01 Billion |

| Growth Rate from 2025to 2034 | CAGR of 10.66% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Technique, Monitoring Method, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Key Market Drivers

Increasing use of process analytical technology for healthcare applications to brighten the market prospect:

Adopting PAT technologies helps improve product quality and consistency by providing real-time monitoring and control of production processes. This is particularly important in the pharmaceuticals, biotechnology, and chemicals industries, where product quality is critical to success. For instance, in the pharmaceutical industry, the quality of drugs is a major concern, and the industry is heavily regulated to ensure that drugs meet high safety and efficacy standards. PAT technologies can help to improve drug quality by providing real-time monitoring and control of production processes, ensuring that drugs are produced consistently and meet the required standards. For example, PAT can monitor critical quality attributes (CQAs) such as particle size, polymorphism, and purity and make real-time adjustments to the process to ensure that the desired CQAs are achieved.

Similarly, in the biotechnology industry, PAT technologies are used to improve the quality of biologics, such as vaccines and monoclonal antibodies. Biologics are complex molecules that require precise control over the production process to ensure they are safe and effective. PAT technologies can help optimize production and achieve the desired product quality. For instance, PAT can monitor critical process parameters (CPPs) such as pH, temperature, and agitation speed and make real-time adjustments to the process to ensure the desired product quality.

Increased regulatory requirements:

Increasing regulatory requirements in pharmaceuticals, biotechnology, and chemicals drive the process analytical technology (PAT) market. Regulatory bodies are imposing strict guidelines for product quality, safety, and efficacy, and companies must demonstrate compliance with these guidelines through rigorous testing and monitoring.

For instance, in Food and Drug Administration (FDA) requires pharmaceutical manufacturers to provide evidence that their products meet quality standards. PAT can help manufacturers meet these standards by providing real-time monitoring and control of manufacturing processes. The NIR spectroscopy can be used to monitor the chemical composition of pharmaceutical products during production. This can help manufacturers identify and correct quality problems before they become more serious.

Similarly, Food Safety Modernization Act (FSMA) requires food manufacturers to implement preventive control measures to ensure the safety of their products. PAT can help manufacturers meet these requirements by monitoring critical process parameters such as temperature, pH, and moisture content. For instance, a baby food manufacturer could use PAT to monitor the temperature during the cooking process to ensure that the food is cooked to the proper temperature and is safe for consumption. This has led to increased adoption of PAT technologies, which enable real-time monitoring and control of production processes, ensuring that products meet the required standards.

Key Market Challenges

The implementation cost of process analytical technology is causing hindrances to the market:

The high cost of implementing the PAT technology is a major challenge for many manufacturers. The need for specialized instrumentation and software is one of the major causes of the high cost of PAT. PAT requires sophisticated analytical instruments such as near-infrared spectroscopy, Raman spectroscopy, and mass spectrometry to monitor critical quality attributes in real-time. These instruments can be expensive to purchase and maintain, and the cost can be prohibitive for smaller manufacturers.

Another factor backing the high cost of PAT implementation is the need for specialized training and expertise. PAT requires skilled personnel to design, implement, and maintain the technology. In addition, this person must be trained in using specialized software and analytical instruments. The cost of hiring and training these personnel can be significant.

Key Market Opportunities

Development of advanced analytics

The development of advanced analytics is a key growth factor for the process analytical technology market, as it offers several opportunities for businesses to optimize their manufacturing processes. In addition, the development of advanced analytics is a key growth factor for the process analytical technology market. Real-time monitoring and control, predictive analytics, big data analytics, automation and machine learning, and cost savings are all opportunities that are driving growth in the market. As businesses continue to adopt these technologies, the process analytical technology market is likely to experience continued growth and innovation.

Expansion into new industries

The rise in the demand for process analytics technology is expected to generate extensive growth opportunities over the forecast period. As process analytics technology becomes more widely recognized as a valuable tool for optimizing manufacturing processes, demand is increasing across a variety of industries. This includes industries such as pharmaceuticals, food and beverage, chemicals, and oil and gas, among others.

Additionally, as businesses expand into new markets, the demand for process analytics technology is also increasing. This is particularly true in emerging markets, where businesses are seeking to optimize their manufacturing processes to remain competitive in the global marketplace. Furthermore, the development of new applications, technological advancements, cost effectivity and globalization are other factors responsible for generating prominent growth opportunities.

Development of portable and handheld devices

The development of portable and handheld devices is a significant opportunity driving growth in the process analytical technology market. Increased mobility, cost savings, ease of use, real-time data analysis, and market expansion are all factors contributing to the growth of the market. As portable and handheld devices become more advanced and affordable, their use in a variety of industries is likely to continue to increase, driving further innovation and growth in the process analytical technology market.

Segment Insights

Product Insights

On the basis of product, the process analytical technology market is divided into analyzers, sensors & probes, samplers, and software & services, with the analyzers accounting for most of the market because it measures the chemical or physical properties of materials being produced. They are used to monitor the process and ensure that it is under control. The analyzer market includes several types of devices, such as gas, liquid, and solid analyzers.

The sensor and probe segment is also significant, with temperature sensors being the most widely used type of sensor, followed by pressure sensors and pH probes. They ensure that the process remains in control and that deviations from the desired parameters are detected and corrected immediately.

Technique Insights

On the basis of technique, the process analytical technology market is divided into spectroscopy, chromatography, particle size analysis, electrophoresis, and others, with spectroscopy accounting for most of the market because it provides real-time data on the chemical and physical properties of pharmaceutical products. Near-infrared (NIR) spectroscopy is the most commonly used spectroscopic technique in PAT, followed by Raman spectroscopy and Fourier transform infrared (FTIR) spectroscopy. Chromatography is another important technology in PAT used for separating, purifying, and identifying components in pharmaceutical products.

In addition, spectroscopy allows manufacturers to analyze samples and monitor processes in real-time, providing a wealth of information about the chemical and physical properties of the produced materials. This information can be used to optimize production processes and ensure that the final product meets the desired quality specifications.

Monitoring Method Insights

On the basis of the monitoring method, the process analytical technology market is divided into on-line, in-line, at-line, and off-line, with the on-line accounting for most of the market because it provides continuous measurement of process parameters in real-time during the production process.

The data is collected using sensors and probes, and the information is analyzed to control and optimize the production process. On-line monitoring is essential in ensuring that the process remains in control and that deviations from the desired parameters are detected and corrected immediately. On-line monitoring is primarily used in the pharmaceutical and chemical industries, where strict regulations require continuous monitoring of the production process.

End-User Insights

On the basis of end-user, the process analytical technology market is divided among pharmaceutical manufacturers, biopharmaceutical manufacturers, and contract research & manufacturing organizations, with the pharmaceutical manufacturer accounting for most of the market.

Pharmaceutical manufacturers are the largest end-users of PAT tools and technologies, seeking to ensure that their products meet strict quality standards and regulatory requirements. Chemical manufacturers are also significant end-users seeking to optimize their production processes and reduce costs.

Regional Insights

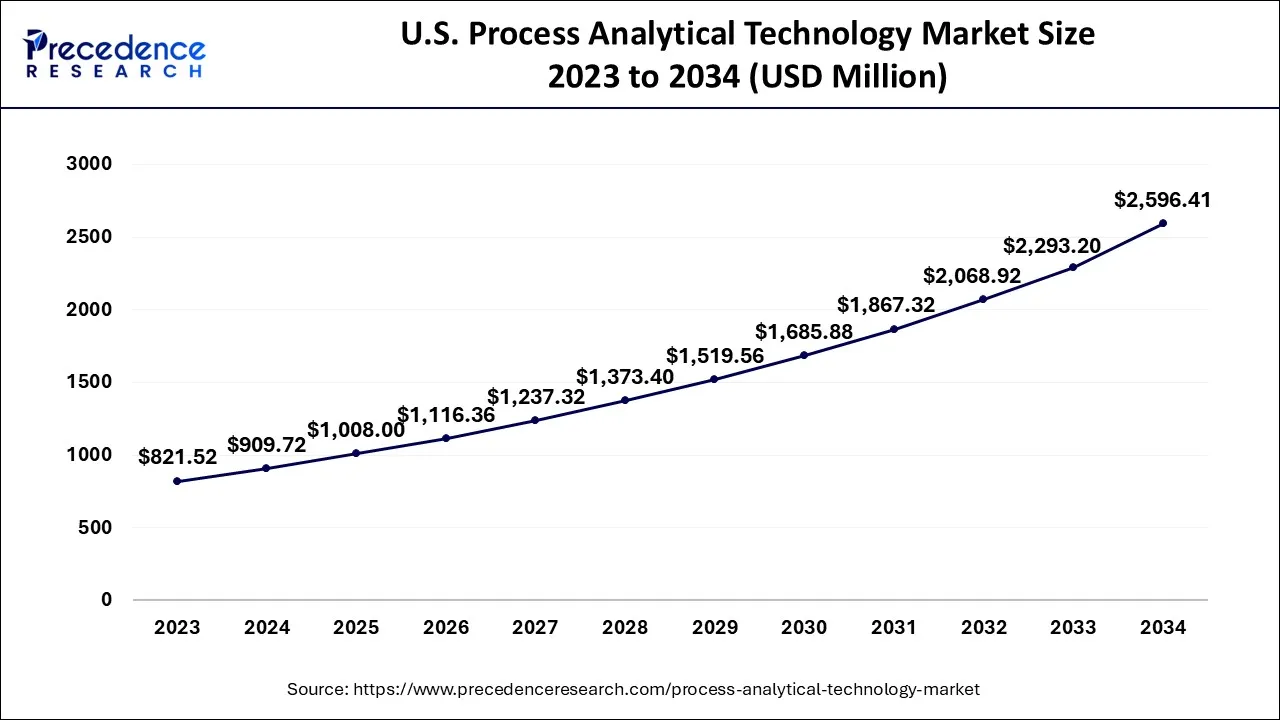

What is the U.S. Process Analytical Technology Market Size?

The U.S. process analytical technology market size is exhibited at USD 1,008 million in 2025 and is projected to be worth around USD 2,847.00 million by 2035, growing at a CAGR of 10.94% from 2026 to 2035.

What Made North America the Dominant Region in the Process Analytical Technology Market?

On the basis of geography, North America dominates the market, driven by the presence of several key players in the region and the growing adoption of PAT by pharmaceutical and biotech companies. The increasing focus on quality control and assurance, as well as the need for process optimization, are driving the growth of the PAT market in North America. The PAT market in North America is also driven by the stringent regulatory environment in the region, with the FDA mandating the adoption of PAT in pharmaceutical and biotech manufacturing.

The increasing focus on data integrity and traceability is also driving the adoption of PAT in the region. Thus, the PAT market in North America is anticipated to grow considerably, driven by the increasing demand for real-time process monitoring and control in the manufacturing industry. The region's well-established pharmaceutical and biotech industry, along with the presence of key players, is expected to continue driving the growth of the PAT market in North America.

What Makes Europe a Significant Market for Process Analytical Technology?

Europe is a significant market for Process Analytical Technology (PAT), with Germany, the United Kingdom, and France being the major contributors to the market's growth. The growth in this market is driven by the increasing focus on process optimization and the growing demand for quality products. The pharmaceutical and biotech industries in Europe are highly regulated, and PAT is increasingly being adopted to comply with the regulatory requirements.

The presence of several key players, such as Roche Diagnostics, Siemens AG, and Sartorius AG, among others, is also driving the growth of the PAT market in Europe. These companies are investing heavily in R&D to introduce innovative solutions that cater to the evolving needs of the end-users.

What Makes Asia Pacific the Fastest-Growing Region in the Process Analytical Technology Market?

The region in Asia-Pacific is anticipated to have the greatest CAGR driven by the increasing adoption of PAT by pharmaceutical and biotech companies, the growing emphasis on regulatory compliance, and the presence of a large number of contract manufacturing organizations (CMOs) in the region. Countries such as China, Japan, and India are the key contributors to the development of the PAT market in the Asia-Pacific region.

The growth in these countries is driven by the increasing demand for quality products and the need for process optimization in the manufacturing industry. The presence of key players such as Shimadzu Corporation, Hitachi High-Technologies Corporation, and Yokogawa Electric Corporation, among others, is also driving the growth of the PAT market in the region. These companies are investing heavily in R&D to introduce innovative solutions that cater to the evolving needs of the end-users.

What Factors are Driving the Growth of the Process Analytical Technology Market in the MEA?

The market in the Middle East & Africa (MEA) is growing due to increased investment in the pharmaceutical, oil and gas, chemicals, and food and beverage manufacturing industries. Government initiatives promoting local manufacturing and industrial diversification are driving demand for real-time process monitoring and quality assurance systems. The development of petrochemical complexes, refineries, and biopharmaceutical plants in countries like Saudi Arabia, the UAE, and South Africa is further fueling PAT adoption. Additionally, stricter regulatory compliance requirements are encouraging manufacturers to implement advanced analytical tools to ensure process efficiency and product quality.

What Is Fueling the Rapid Expansion of the Latin American Process Analytical Technology Market?

Latin America offers significant opportunities in the process analytical technology market. These opportunities arise from the expanding adoption within the pharmaceutical and biotechnology sectors as companies seek greater process efficiency, quality control, and regulatory compliance. Growth in food and beverage, chemical, mining, and energy industries also creates demand for advanced analytical solutions to ensure product consistency and operational excellence. Additionally, rising investment in automation, smart manufacturing, and digitalization supports broader PAT deployment, while government initiatives and industry modernization programs further accelerate market uptake across the region.

The Latin American process analytical technology market is growing at an alarming rate, given the fact that manufacturers are aiming at increasing the operational efficiency, compliance with regulatory standards, and the consistency of their products. Brazil, Mexico, and Argentina are steadily increasing their pharmaceutical and biotechnology industries, which are provoking an increase in the demand for the in-line and at-line analytical solutions. Increased food and beverage and chemical industry, mining, and energy industry are also increasing the adoption of PAT. Moreover, the increased investment in automation, intelligent manufacturing, and digitalization is enabling the expansion of the use of PAT systems.

What Factors Are Driving Growth in the MEA Process Analytical Technology Market?

The MEA process analytical technology market is also recording a high growth rate with the rise in the number of investments in the pharmaceutical, oil and gas, chemicals, and food and beverage manufacturing industries. The governments in the region are encouraging local manufacturing and industrial diversification, and this is increasing the demand for real-time process monitoring and quality assurance systems. The growth of petrochemical complexes, refineries, and biopharmaceutical plants in other countries like Saudi Arabia, the UAE, and South Africa is also contributing to the adoption of PAT. It is also motivating manufacturers to adopt powerful analytic tools, as a result of more stringent regulatory and compliance demands.

Value Chain Analysis of the Process Analytical Technology Market

- R&D: The specialization of PAT R&D is the creation of new analytical devices, sensors, spectroscopy applications, and real-time monitoring and quality-by-design implementation software platforms.

Key Players: Thermo Fisher Scientific, Sartorius, Danaher, Agilent Technologies, Bruker. - Clinical Trials and Regulatory Approvals

PAT tools are approved and compliant with FDA, EMA, and ICH standards to support clinical manufacturing, process validation, and regulatory submissions.

Key Players: FDA, EMA, Sartorius, Merck KGaA, Thermo Fisher Scientific. - Formulation and Final Dosage Preparation: In formulation and drug product manufacturing, PAT can be used to monitor the key quality characteristics of the product, including the concentration, the size of the particles, and their homogeneity in real-time.

Key Players: Sartorius, Malvern Panalytical, Mettler-Toledo, Bruker, Agilent Technologies

Process Analytical Technology Market Companies

- Thermo Fisher Scientific Inc.

- Agilent Technologies, Inc.

- Danaher Corporation (Ab Sciex LLC)

- Bruker Corporation

- PerkinElmer, Inc.

- ABB Ltd.

- Carl Zeiss AG (Zeiss Group)

- Emerson Electric Co.

- Mettler-Toledo

- Shimadzu Corporation

- Sartorius AG

- Hamilton Company

- Repligen Corporation

Recent Developments

- In March 2025, Repligen Corporation purchased the desktop analytical instrument portfolio of 908 Devices to enhance its Process Analytical Technology (PAT) to be used in bioprocessing. After the deal, 908 Devices changed its strategic focus to handheld and field-based safety and detection devices.(Source: https://investors.repligen.com )

- In March 2025, HORIBA introduced four new analysis tools, such as a molecular-fingerprinting system or a screening tool based on Raman that assists in vaccine development and characterizing proteins. The launches increase the portfolio of PAT offered by HORIBA through the ability to analyze at high speeds and without destroying the samples in any biopharmaceutical process.(Source: https://www.spectroscopyonline.com )

- In February 2025, Thermo Fisher Scientific achieved the USD 4.1 billion purchase of the purification and filtration enterprise of Solventum to increase its bioprocessing and PAT solutions. The company has an anticipated cost and revenue synergies of about USD 125 million to be achieved after 5 years to be in a position in advanced manufacturing solutions.(Source: https://www.reuters.com )

- In March 2025, Repligen Corporation acquired 908 Devices' desktop analytical instrument portfolio to enhance its Process Analytical Technology (PAT) for bioprocessing. Following the deal, 908 Devices shifted its strategic focus to handheld and field-based safety and detection devices.(Source: https://investors.repligen.com )

- In March 2025, HORIBA introduced four new analysis tools, including a molecular-fingerprinting system and a Raman-based screening tool that support vaccine development and protein characterization. The launches expand HORIBA's PAT portfolio by enabling high-speed analysis without sample destruction across biopharmaceutical processes.(Source: https://www.spectroscopyonline.com )

- In February 2025, Thermo Fisher Scientific completed the USD 4.1 billion acquisition of Solventum's purification and filtration business to expand its bioprocessing and PAT solutions. The company expects to achieve about USD 125 million in cost and revenue synergies over 5 years, positioning it for advanced manufacturing solutions.(Source: https://www.reuters.com )

Segments Covered in the Report

By Product

- Analyzers

- Sensors & Probes

- Samplers

- Software & Services

By Technique

- Spectroscopy

- Chromatography

- Particle Size Analysis

- Electrophoresis

- Others

By Monitoring Method

- On-line

- In-line

- At-line

- Off-line

By End-User

- Pharmaceutical manufacturers

- Biopharmaceutical manufacturers

- Contract research and manufacturing organization

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting